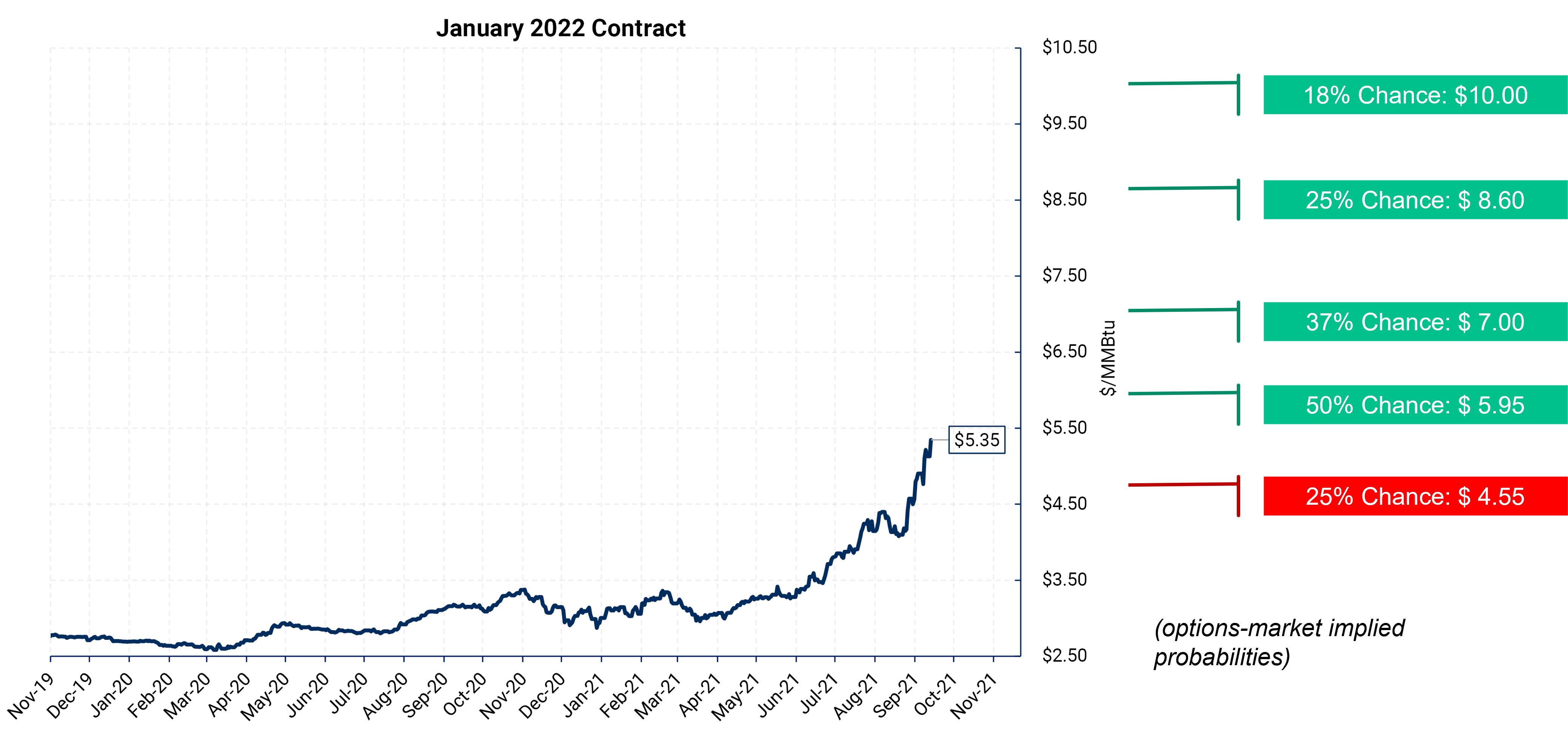

There is now* about a 20% chance that natural gas prices reach $10/MMBtu for the January contract, implied by the options market!

Gas prices have been on a tear this year, with the prompt month contract now at $5.29/MMBtu as of September 13, compared to $2.58 on January 1, 2021. The Winter 2021-2022 strip is up to $2.45 to $5.35 over the same time frame.

Warning: Exceptional volatility in natural gas prices guarantees these values are changing constantly. Check with your AEGIS strategist for current indications if it is part of a hedge decision.

Source: Bloomberg

"Deltas” are convenient approximations of price probabilities

The options market can be used to assess the probability that a specific strike will be in the money at maturity. Because options are traded by both “strike price” and tenor, every price and date combination can be studied specifically. And, because volatility is an input into the cost of an option, we can find the market’s implied range of price outcomes for each price/tenor combination. Further, we can find the market’s opinion of price skew, because call options give us information about price increases, while put options simultaneously tell us about price decreases.

Within the options price itself, a measurement called the "delta” of an option gives us our probability estimate. We use option delta as our probability percentages in the chart above. For example, a 50 delta would imply a 50% chance that prices could settle above that strike. A 25 delta implies a 25% of settling higher than that strike. When price increases far beyond the strike price, the delta approaches 1.0, meaning almost a 100% chance that prices remain above the strike price. As buyers and sellers of options bid those instruments’ premiums higher or lower, then delta (and other so-called “greeks” metrics) change with them. For more option delta explanation, read here.

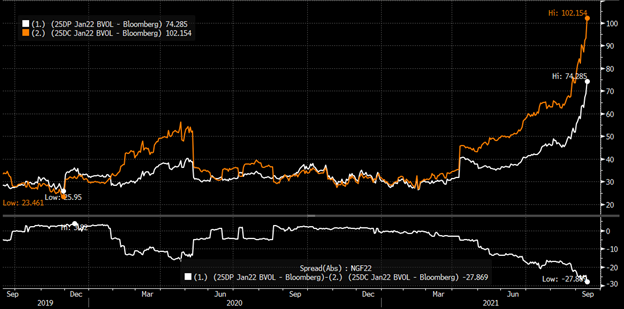

Skew shows more fear of price increases than price decreases

The amount of call-option skew present in the gas market right now is atypical for this time of year. Call skew is the discrepancy between the values of call options and put options. Call options reflect the probability that prices will rise further, while puts reflect the probability of price decreases. Winter strips for gas usually carry some degree of call skew due to weather risks in winter, but this year, call skew for the winter tenors has ballooned early, while we’re still in the heat of summer.

Source: Bloomberg

The chart above shows the Jan 2022 contract option volatility evolution for the 25-delta put and 25-delta call. If these values are even, then we would say there is no put or call skew. The 25-delta call (orange line) shows how the call value has separated from the offsetting 25-delta put. The bottom quarter of the chart shows the spread between the two options, representing the growing call-skew at 27 (25-delta put – 25-delta call). For perspective, the current call-skew is in the zero percentile or 4.6 standard deviations.

So why so much call skew? This winter, there is a real fear that natural gas inventories may be depleted to scarcity or shortage levels if winter is colder than average. Natural gas fundamentals have been tight versus previous years in 2021. This has led to below-average stocks in underground storage heading into North America’s colder months. Traders, and likely buy-side participants, may be laying in heavy on the call buying to protect against even higher gas prices this winter.

What could a hedger do?

Producers: Can capture the asymmetric risk in the market by utilizing costless collars to capture the high level of call-skew. Producers can also buy put options on the cheap, compared to what they cost just a few weeks ago. Later, you can add a call option to complete a collar, or raise your floor, at low cost, if prices rise.

Consumers: Will be more on the defensive as the options market is implying the possibility of higher prices. Consumers face the difficult decision of hedging with swaps after a large rally, or using options structures, which are expensive. We lean toward swaps for most consumers, we need to know your specific situation before making a firm recommendation.

* As of September 13, 2021, intraday

Commodity Interest Trading involves risk and, therefore, is not appropriate for all persons; failure to manage commercial risk by engaging in some form of hedging also involves risk. Past performance is not necessarily indicative of future results. There is no guarantee that hedge program objectives will be achieved. Certain information contained in this research may constitute forward-looking terminology, such as "edge," "advantage," 'opportunity," "believe," or other variations thereon or comparable terminology. Such statements and opinions are not guarantees of future performance or activities. Neither this trading advisor nor any of its trading principals offer a trading program to clients, nor do they propose guiding or directing a commodity interest account for any client based on any such trading program.