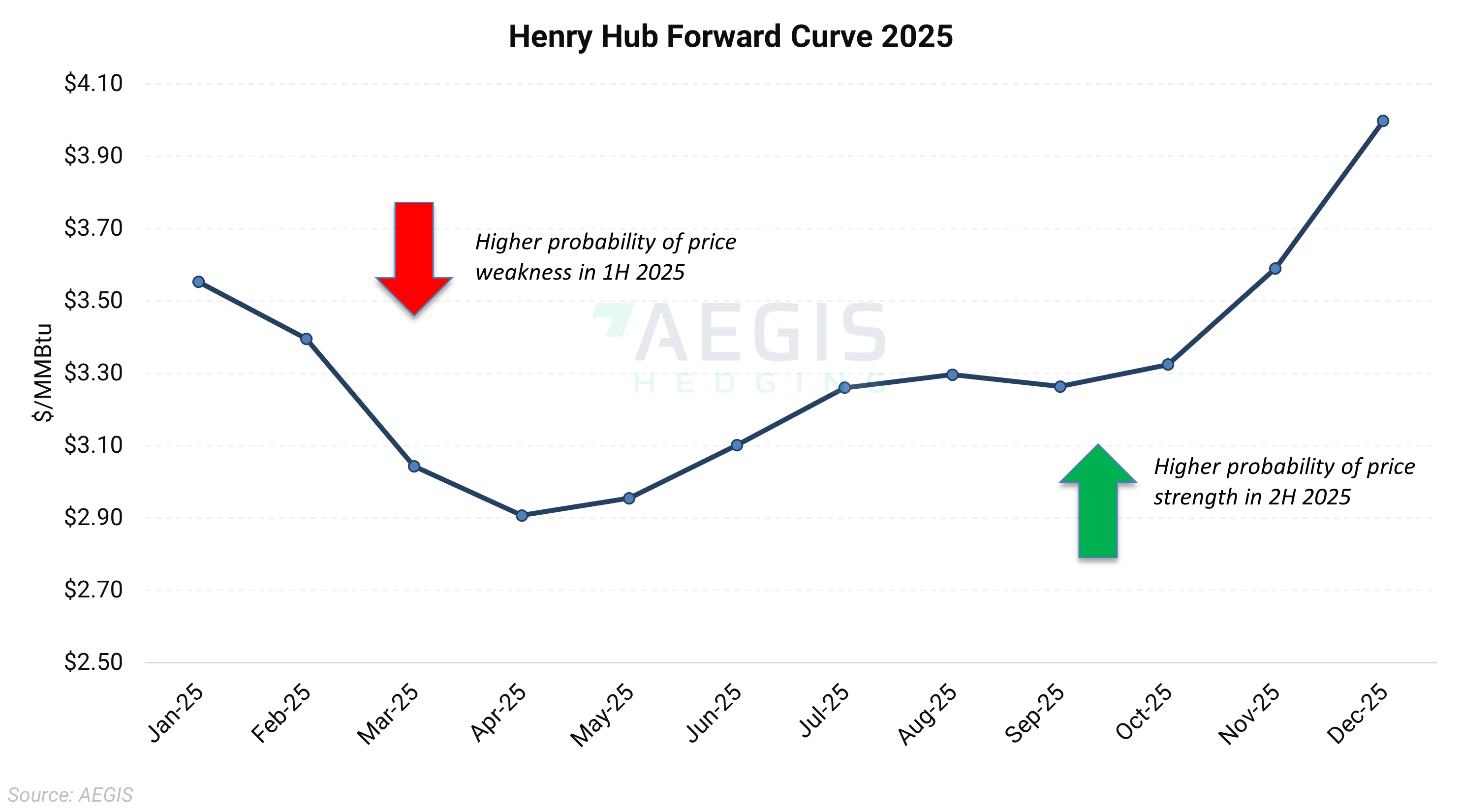

Significant changes to Lower 48 natural gas supply and demand are expected in 2025, potentially leading to large price impacts on Henry Hub. Next year has long been expected to be a turning point for gas prices and market balances, with a sizeable increase in LNG export demand arriving. However, continued delays to export projects and what could potentially be a decline in gas-fired power generation have pushed the anticipated bullishness toward the end of 2025. This has led us to maintain a bearish outlook for the first half of 2025 while taking a more optimistic view on the second half.

Do you think production can match the year-over-year demand growth in the second half of the year?

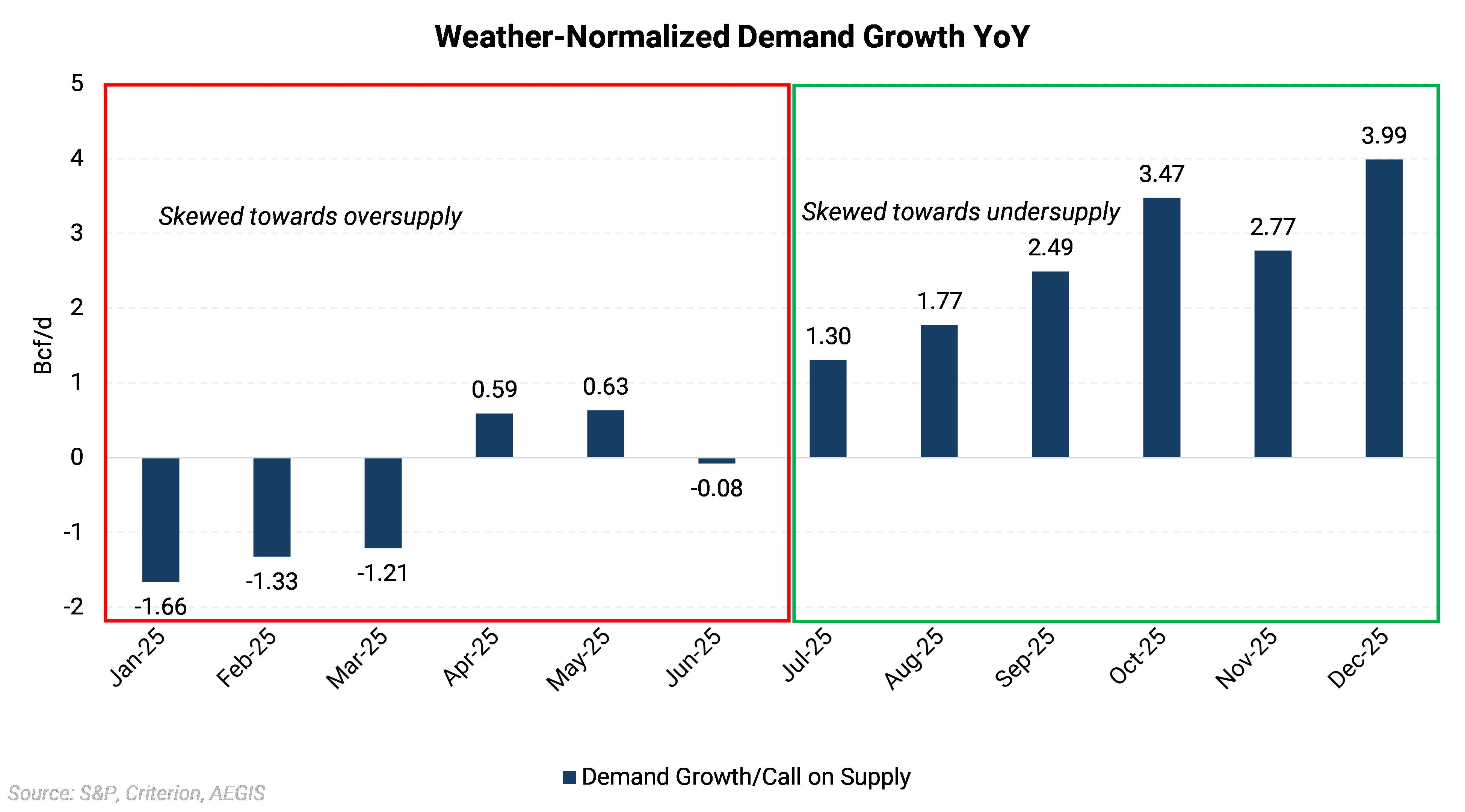

The chart above shows the projected demand changes in 2025 year over year or, to put it another way, the amount of supply growth needed to keep the market balanced compared to year-ago levels from each month. Historical weather-driven components such as residential, commercial, industrial, and power demand have been weather-normalized and forecasted forward using ten-year average temperatures. We applied a ramp schedule to the incoming LNG facilities to more accurately portray their startup process regarding their gas consumption.

Based on this, we find that year-over-year demand growth may be weak and even negative in the first half of the year, especially Q1, before rising into the second half. The lower year-over-year demand numbers in the first half are mainly due to a forecasted decline in power sector natural gas demand, which many people may be surprised by or disagree with. The decline in gas power demand is driven by the continued buildout of renewable assets such as wind, solar, and batteries. For this, we took the EIA’s numbers for renewables currently under construction, applied a capacity factor, and converted to Bcf/d. LNG feedgas demand growth eventually offsets the decline in gas power demand, resulting in strong demand growth numbers in 2H 2025.

The point where the weather-normalized supply-demand balance flips has been pushed back over the past few months by delays to incoming LNG projects, most recently being the delay of Golden Pass LNG to the end of 2025.

Based on our modeling of supply-demand balances in 2025, our outlook is for the first half of the year to settle lower than the forward curve currently shows or at least be exposed to a higher probability of price weakness. The second half of the year may see prices more supported, but weakness at the beginning of the year could drag all prices lower before fundamentals improve.