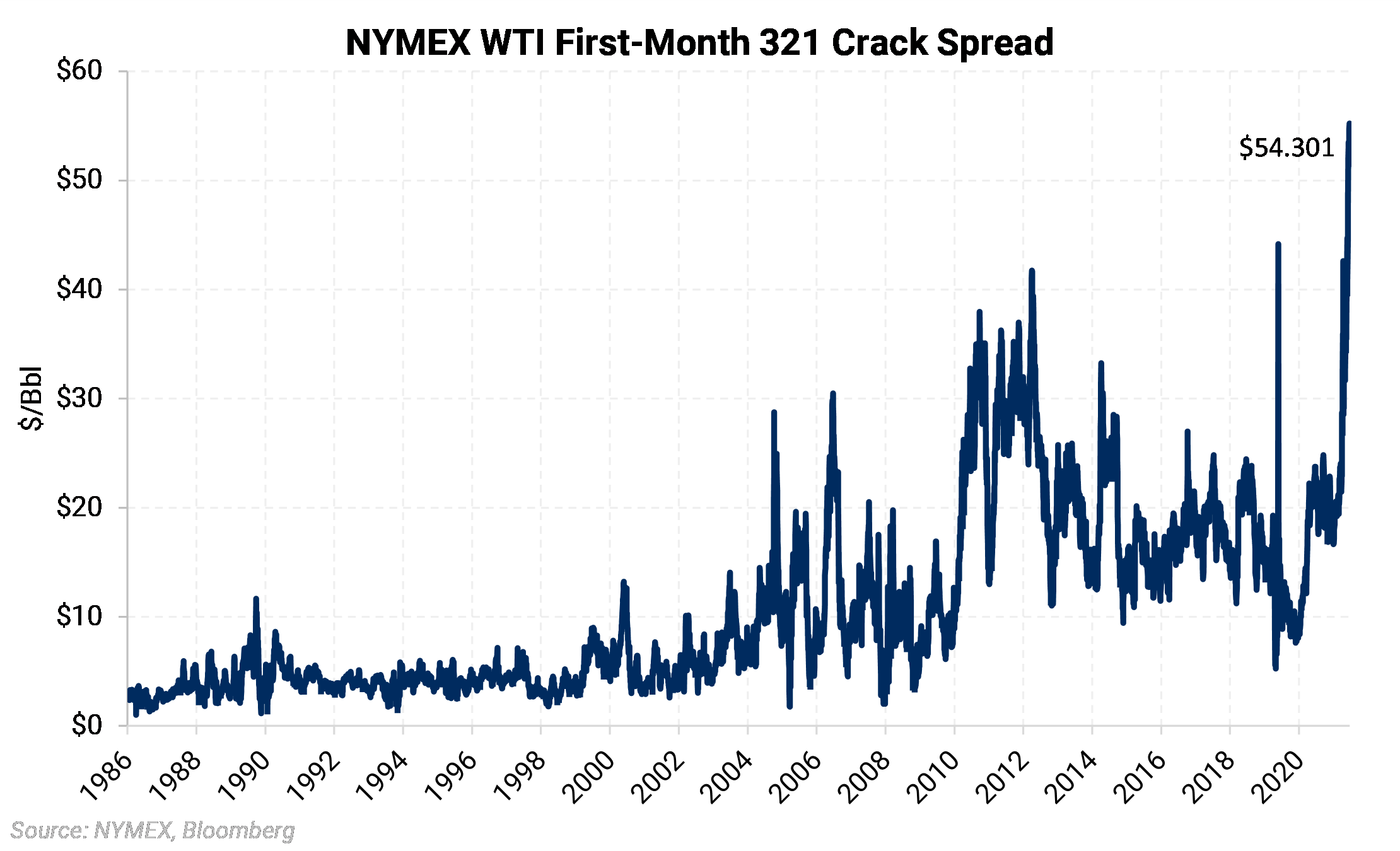

The 3:2:1 crack spread has set several fresh new record-highs over the last several weeks as several parts of the country are facing product shortages that have sent gasoline and diesel prices to record levels. In addition, the wave of refinery closures that COVID brought on is making it even more difficult for these local product markets to rebalance themselves via prices, and strong exports of U.S. products further complicate the situation.

The 3:2:1 crack spread measures the difference between the purchase price of crude oil and the selling price of finished products and is an indicator of short-term refining profits or just the refiner's appetite for crude in general. It can also serve as an indicator for crude prices and helps gauge the relationship between the NY ULSD, RBOB Gasoline, and WTI prices.

The crack spread approximates the yield from a barrel of crude oil as gasoline is produced at almost twice the rate of diesel. This relationship makes this spread the best short-term indicator for trends in the refining industry.

RBOB and ULSD futures intuitively have a strong correlation with crude oil since they are distilled from crude. That's why spreads are referenced when trying to look at trends with the price of products, net the price of crude. Spreads represent the margin to refine a barrel of crude into a product. Gasoline and diesel markets have their own supply and demand factors that drive those prices and may cause it, at times, to become dislocated from the price of crude. When one product spread is blowing out, the market is saying that there needs to be more output of said product. When all spreads are blowing out simultaneously, that may be the market's way of signaling it needs more refining capacity to satisfy growing product demand.

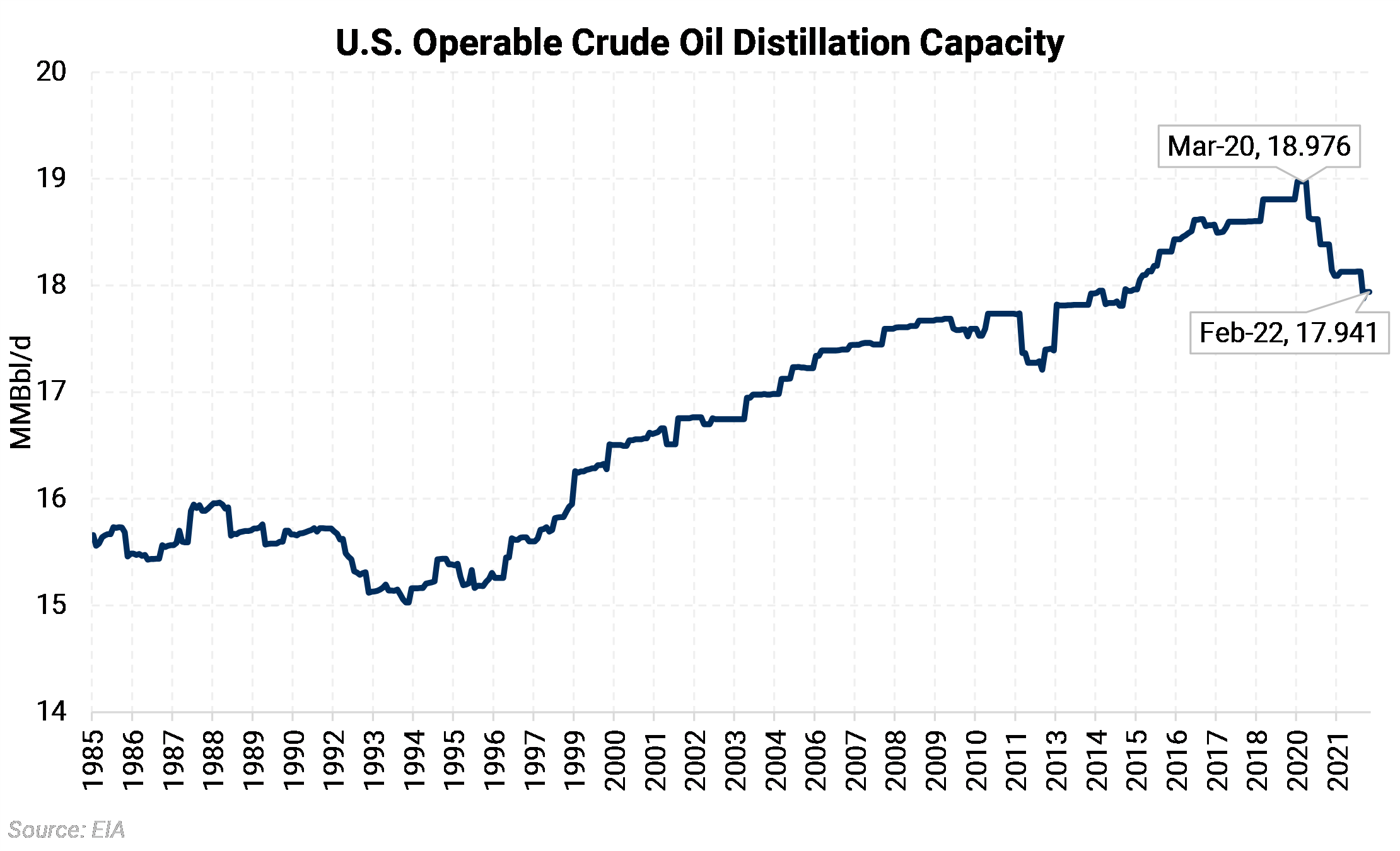

The U.S. has shuttered several refineries over the last several years, which has reduced the U.S.'s ability to ramp up to produce more gasoline and diesel. This reduction in refining capacity may explain the diesel and gasoline supply shortage present in the U.S.. Since the onset of the pandemic in February 2020, the U.S. has lost over 1 MMBbl/d of operable capacity because of retirements, EIA data shows.

If the U.S. lacks the refining capacity to meet demand, then refined product exports would likely be the first source of demand to come under threat. However, most of the world is in a shortage of transportation fuels, especially diesel. Prices in the U.S. would have to rise to where it is not economic to export diesel, loosening the domestic market. Still, that means that gasoline and diesel prices would have more upside risks from here before that happens.

Commodity Interest Trading involves risk and, therefore, is not appropriate for all persons; failure to manage commercial risk by engaging in some form of hedging also involves risk. Past performance is not necessarily indicative of future results. There is no guarantee that hedge program objectives will be achieved. Certain information contained in this research may constitute forward-looking terminology, such as "edge," "advantage," 'opportunity," "believe," or other variations thereon or comparable terminology. Such statements and opinions are not guarantees of future performance or activities. Neither this trading advisor nor any of its trading principals offer a trading program to clients, nor do they propose guiding or directing a commodity interest account for any client based on any such trading program.