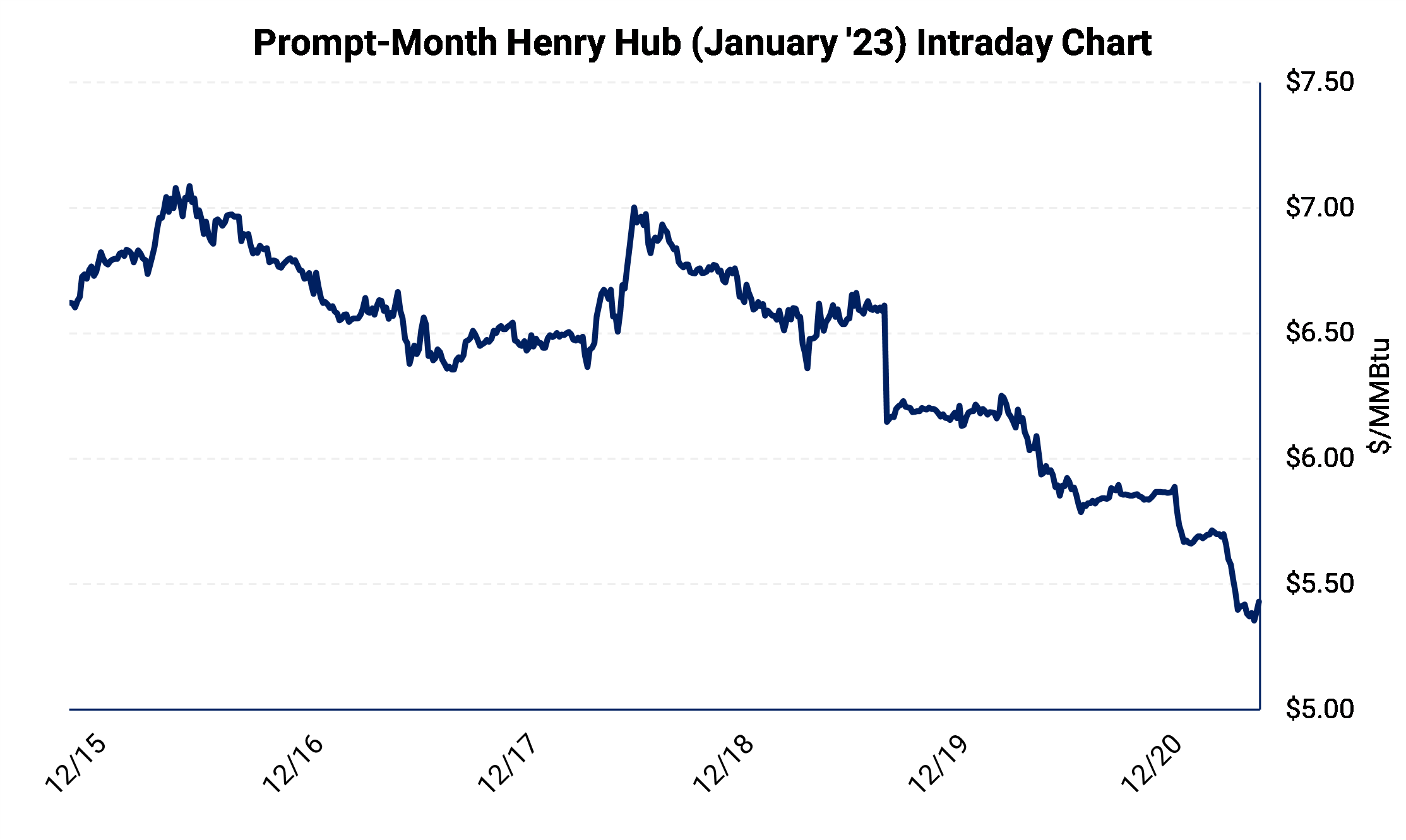

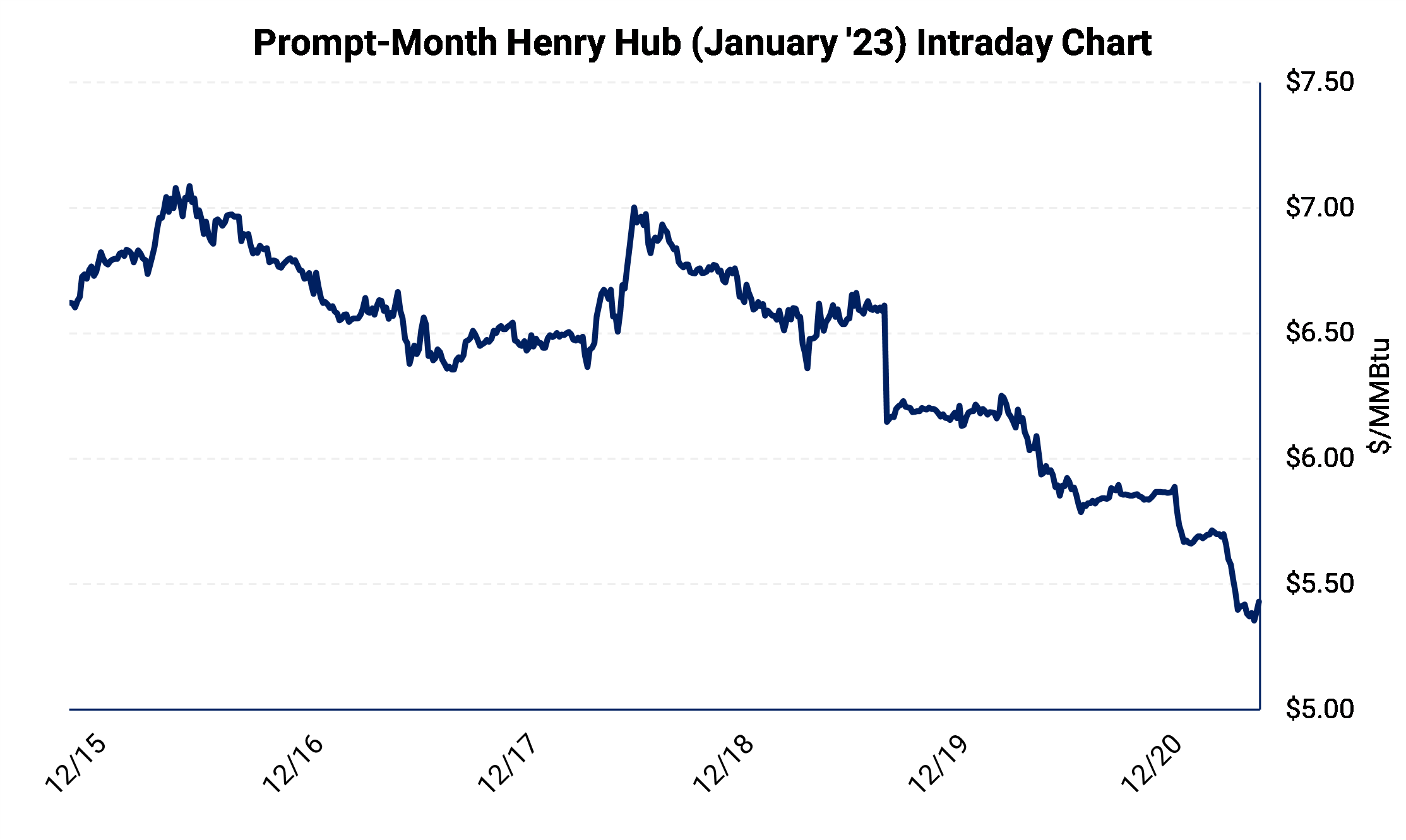

NYMEX natural gas was down $1.22 in two days, touching $5.32 this morning. Has it found support this morning, finally? Risk has changed; fundamentals are still bearish for 2023; there are hedging actions you should consider.

The January contract settled at $6.60/MMBtu on Friday. Yesterday, it dived $0.74, and then stepped down another $0.46 in early-morning trade today. It consolidated around $5.40. The Summer '23 price has slipped to $4.70. The weather traders were out in force this morning, reading a milder forecast and selling across the curve.

When prices move fast like this, there are some hedging actions to consider. Check the end of this article for a few ideas that could apply to the situation.

Major causes of this two-day deterioration in price:

- The cold-air mass that threatened to dip deep into the Midwest may not be as severe as first thought. Compared to yesterday’s forecasts, the Upper Midwest is now an average of 2.6 °F warmer for the next two weeks. But it’s not just the next two weeks; the pattern is also being interpreted as warmer and bearish for the middle of January.

- Since the peak of summer, gas production has been rising, and any storage deficit was erased by mild fall weather and higher production. This market was set up to be vulnerable to disappointing weather, especially near the typical January peak in gas demand.

- Summer has given up over $0.53 in two trading days, so this phenomenon is not isolated to the Winter tenors. Because fundamentals for Summer '23 are not supportive of higher gas prices, we believe there is little demand-side buying or speculative-trading support to hold up the back of the curve.

We have consistently reiterated a neutral winter point of view (price pathway depends on weather) and a bearish outlook for Summer 2023 through Winter 2023-2024. We continue to hold those views, even as prices have slipped lower, because the likelihood of S&D deterioration is great in 2023, barring major restrictions to supply output.

Actions to consider:

- Apply gains on long put options (including those originally part of “costless collars”) to uplift swap values.

- If you have previously sold call options (again, usually as a part of a “costless collar”), you may buy back short calls and either leave the upside open or resell a lower-strike call for income.

- Further on the call options, the monetary gain can be reapplied as an increased (higher than market) strike on a fixed-price swap.

- Sometimes, decreases in Henry Hub come with improvements in regional gas basis prices. Although we do not see this happening yet (except in the West, but that’s a different story), it is something to watch in the coming days.

If you aren't hedging natural gas - Get Started