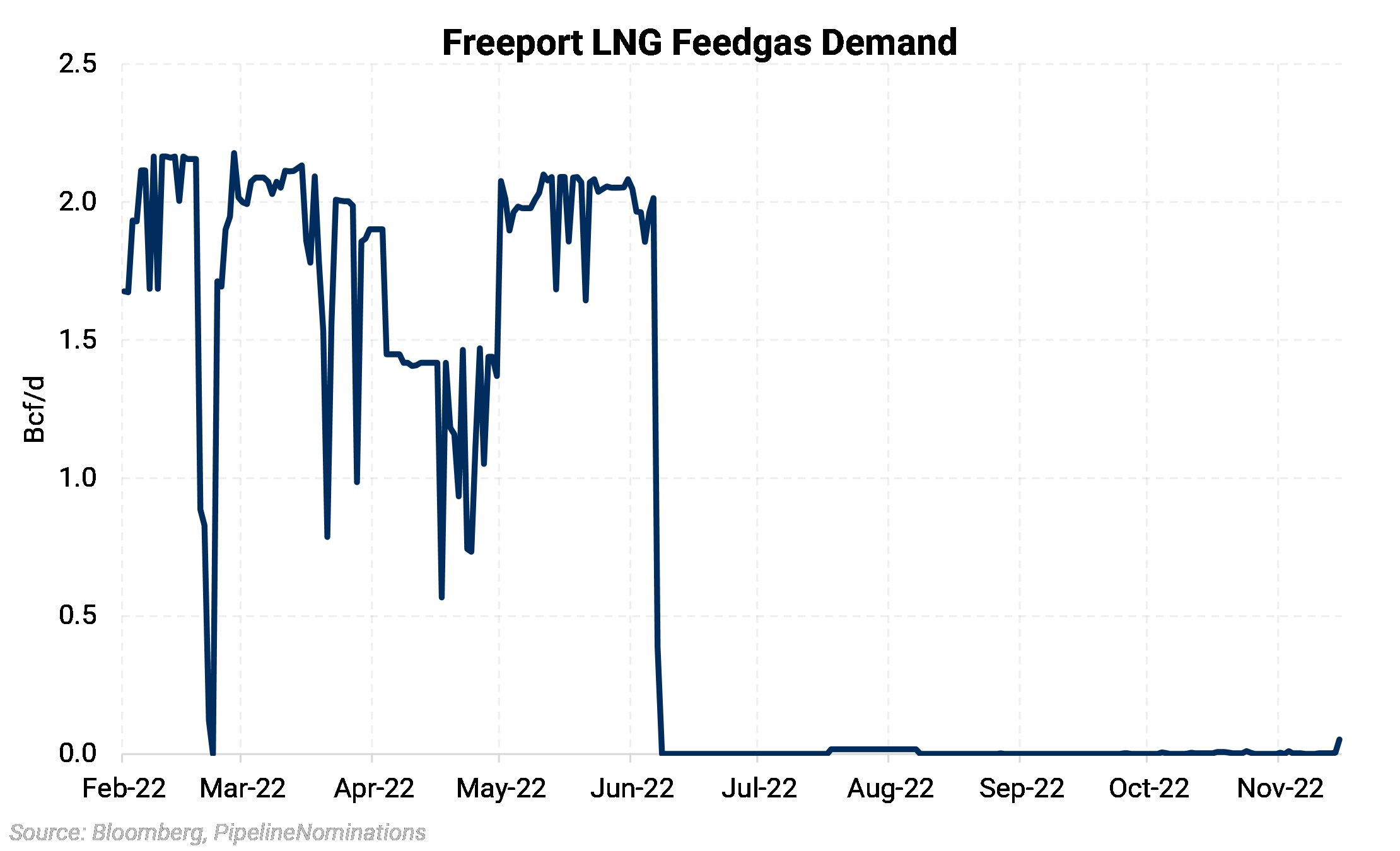

Freeport LNG is on track to resume exports in December, but it could be longer before the facility is consuming at its 2-Bcf/d demonstrated capacity rate. Due to delays, the increase in exports may coincide with the highest-stress time of the year for domestic storage facilities and pipeline systems because of peak heating demand.

November 16, 2022 - Since the June 8 explosion at the Freeport LNG facility, company officials have remained steadfast in their position that the facility would be operating at 85% of its export capacity by mid-November and 100% by March 2023. However, it is now mid-November, and we have not seen any signs that the facility has begun to restart. In fact, several liquefied natural gas (LNG) vessels have been rerouted from the facility on expectations the plant's restart could be delayed to December or later, according to Refinitiv.

Freeport LNG has been very quiet as it works to finish repairs at the facility, causing outsiders to speculate on when the facility will return to operations. Several reports from third-party sources have claimed that the facility will not come online until 2023, but the company has not issued any new timelines.

Gas sold off almost 7% last Thursday in response to a tweet claiming the restart would be delayed based on "internal sources" from a Twitter account with 300 followers. The tweet gained so much traction that Freeport LNG had to come out and refute the tweet, saying," Freeport LNG has not made any public statements today regarding the restart of our liquefaction facility. Any Tweets and/or posts on Freeport LNG branded letterhead that may have been obtained or published, are reporting false information and are not legitimate, official public information from Freeport LNG."

On Tuesday, November 15, Freeport LNG provided the results of an independent, third-party root cause failure analysis (RCFA) report on the June 8 explosion at its liquefaction facility and submitted the findings to the Pipeline and Hazardous Materials Safety Administration (PHMSA).

Freeport LNG did not comment on its timeline for a restart in the official release. Further, the company has not finalized its restart plan, which must be submitted to and approved by the PHMSA before the facility can restart. This has caused many analysts to speculate on when the facility will start re-introducing gas. On November 16, 2022, pipeline nominations showed 52,309 Mcf/d, its highest since the outage began in June, but it's still unlikely that the site would start receiving large gas volumes without obtaining necessary approval from the PHMSA.

But what does all of this mean for the gas market? First, if an unverified tweet can send the market limit down, traders must keep an eye out for announcements. Fundamentally, it means the market could remain artificially looser for a few more months, allowing storage to catch up even more.

When operations resume at the facility, this market will effectively tighten by 2 Bcf/d overnight in the middle of winter. This doesn't mean we are bullish once Freeport LNG comes online. On the contrary, we hold a very cautious outlook toward the gas market in 2023, barring new export demand from LNG facilities. Still, the downed facility, combined with bearish weather, could be partially concealing tightness in the gas market and be contributing to the selling pressure we have observed since August.

We have a more neutral outlook toward this winter's prices and think an early Freeport LNG restart and cooler temps could increase gas prices. Still, they could just as easily move lower if the weather disappoints. In conclusion, Freeport LNG does not look like it is coming online anytime soon at this time, meaning the market could be especially prone to downside price action if the weather disappoints. However, once it comes online, it could support prices, especially if the increased consumption leads to an undersupplied market and the deficit in U.S. inventories to the five-year average begins to widen again.

Stay tuned for more updates, and if you have any questions, please reach out to your market strategist/ trader.