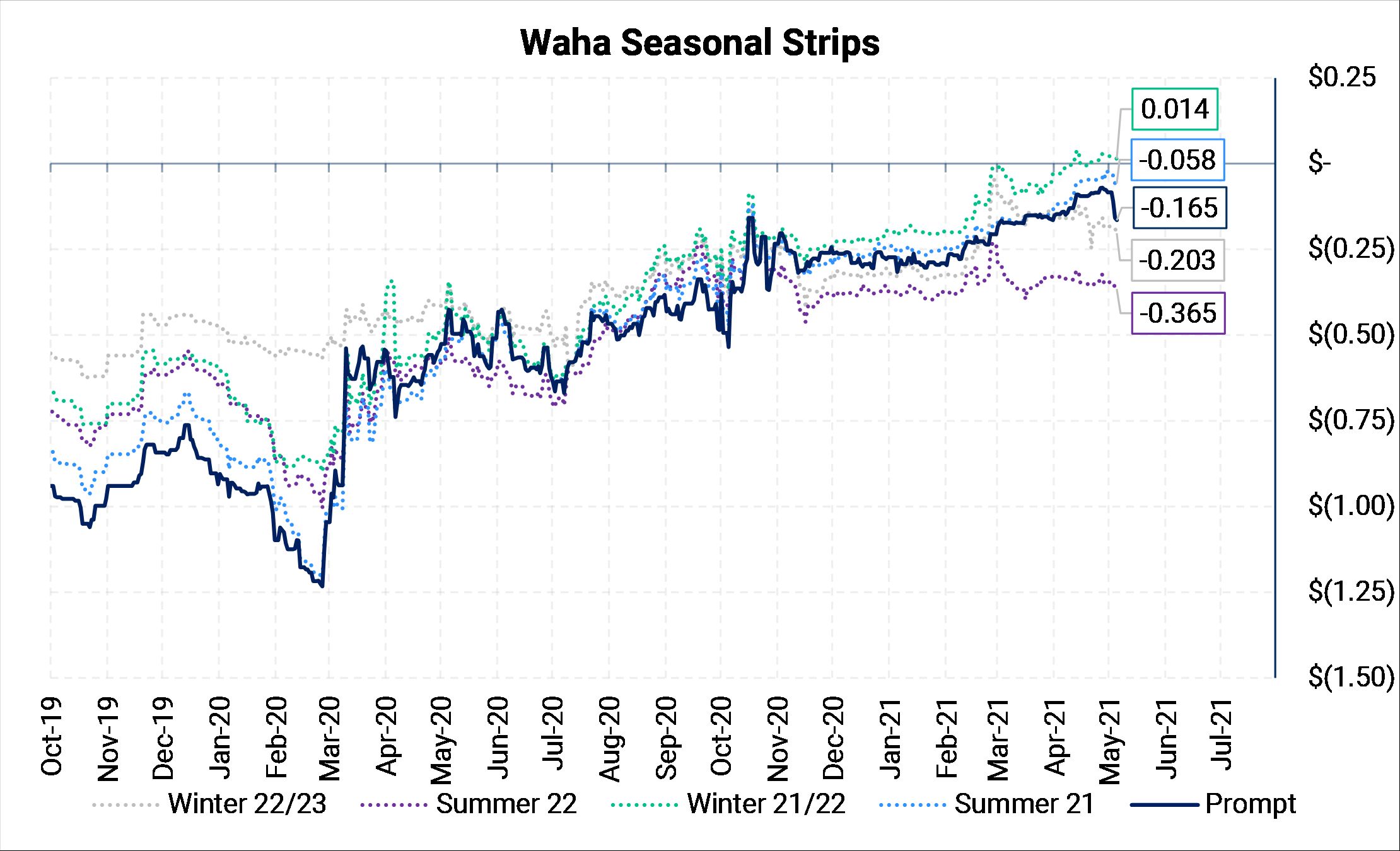

The Waha forward curve has dramatically improved over the past year, so much so that certain contract months and the Winter 2021-2022 strip has moved to a premium versus Henry Hub. In addition, another major Permian-to-Gulf Coast pipeline is due online in 3Q and could create an even greater draw on Permian gas to the Texas Coast. So the question becomes: With lower expected production growth in the near term, will Waha prices stay elevated?

|

|

As of May 5, the Aug '21 and Dec-Feb '21-'22 Waha contract months are all trading at a slight premium to Henry Hub. The Waha basis forward curve is close to its highest since 2017, when production in the region was only 7 Bcf/d, barely over half its current output. Excess takeaway capacity for the Permian is a new phenomenon and has created better in-basin pricing. |

|

Permian gas has been in high demand as surrounding demand locations compete for molecules. The Gulf Coast region has seen strong LNG and Mexico exports totaling over 18 Bcf/d at times this spring. Permian gas can flow west on El Paso and Transwestern pipelines to serve southern California and Arizona. West Coast basis like SoCal have risen to assure gas continues to flow west. It's not over: West Texas is slated to receive another 2 Bcf/d pipeline, named Whistler, to take gas from the Waha area to South Texas. The project is estimated to come online in 3Q 2021 and will add additional egress capacity, much like PHP did. |

|

|

|

Natural gas production growth in the Permian grew between 2015 to 2019 as oil producers created an abundance of gas as a byproduct. Gas had typically played such a low percentage of a Permian producer's revenue that even when Waha fixed-price gas went negative in April 2019, operators continued to grow their oil output. Lower oil prices due to COVID and external pressures from shareholders have reduced the region's output. Gas production leveled off just as new takeaway capacity arrived. The chart above illustrates the yearly growth rates (Jan-Dec) since 2015. Note that 2021 is a forecast using an Enverus Short-Term Outlook, based heavily on company guidance rather than economics. |

|

It's likely that without additional supply in the region or a drop in export demand, Waha basis will remain elevated. However, higher oil prices could lead to more associated gas production late this year or in 2022. Additional supply without matching growth in demand would reduce the need for Waha to remain at a premium to Henry Hub. However, that incremental production may take longer to appear in enough quantities as many public companies are emploring capital restraint and limiting supply growth. |

| Commodity Interest Trading involves risk and, therefore, is not appropriate for all persons; failure to manage commercial risk by engaging in some form of hedging also involves risk. Past performance is not necessarily indicative of future results. There is no guarantee that hedge program objectives will be achieved. Certain information contained in this research may constitute forward-looking terminology, such as “edge,” “advantage,” ‘opportunity,” “believe,” or other variations thereon or comparable terminology. Such statements and opinions are not guarantees of future performance or activities. Neither this trading advisor nor any of its trading principals offer a trading program to clients, nor do they propose guiding or directing a commodity interest account for any client based on any such trading program.

|