Demand for liquid petroleum products, including gasoline and diesel, is expected to be restored more or less to normal by the end of this year, according to Shell CEO Ben van Beurden. Van Beurden believes, as do others, that jet fuel demand will not be so positive.

Jet fuel demand is not expected to return to 2019 levels until 2023, according to S&P Global. Moreover, In its Annual Energy Outlook 2021, the Energy Information Agency (EIA) does not forecast U.S. passenger air travel demand to return to 2019 levels until 2025. Jet fuel consumption will not return to 2019 levels until 2030. The EIA claims air travel efficiency means that increasing air travel does not result in similar jet fuel consumption changes.

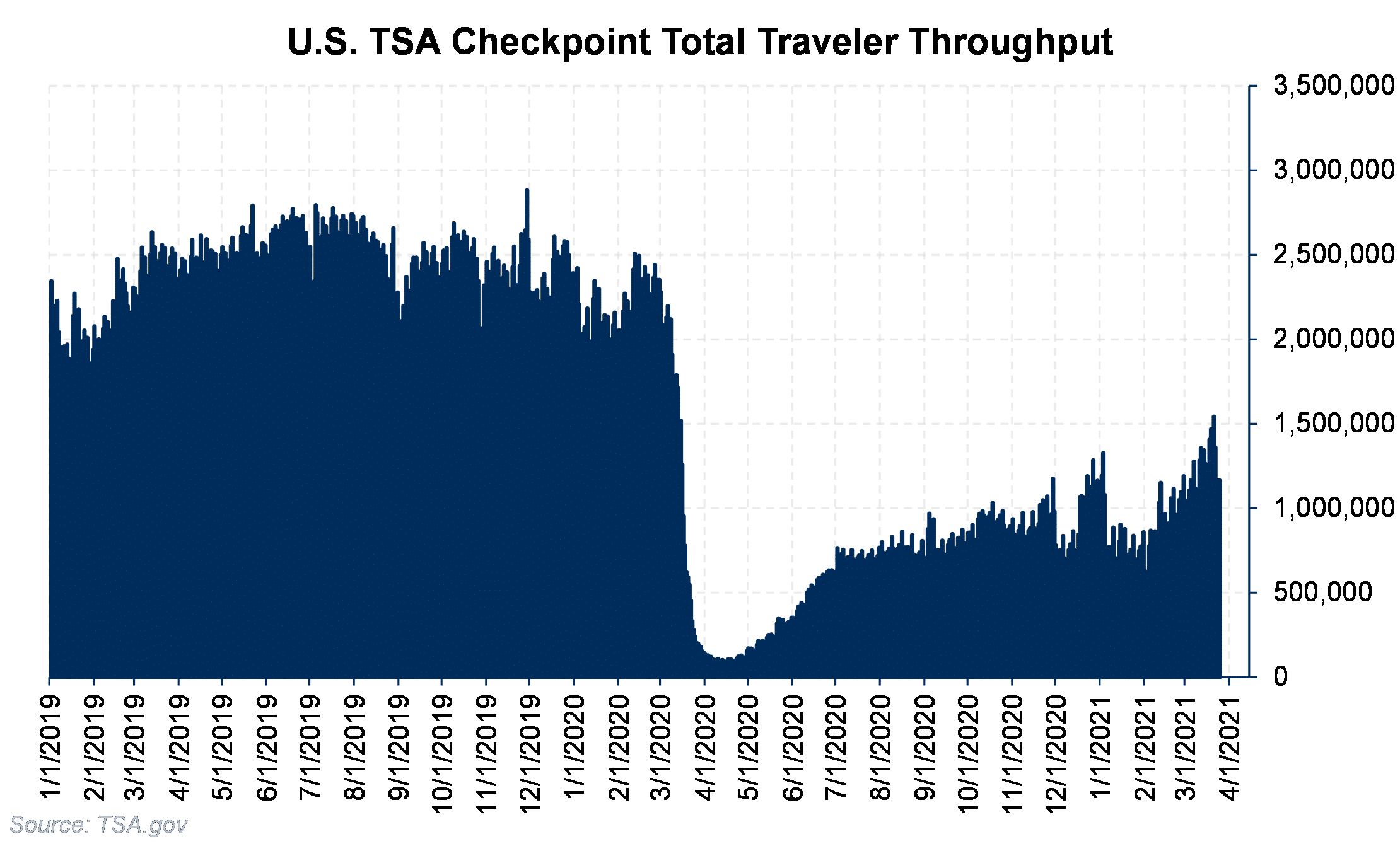

The number of U.S. passengers hitting the skies continues to increase, shown in the chart below. However, analysts say those long-haul, intercontinental flights that use a good portion of total jet fuel will take a long time to return to normal.

|

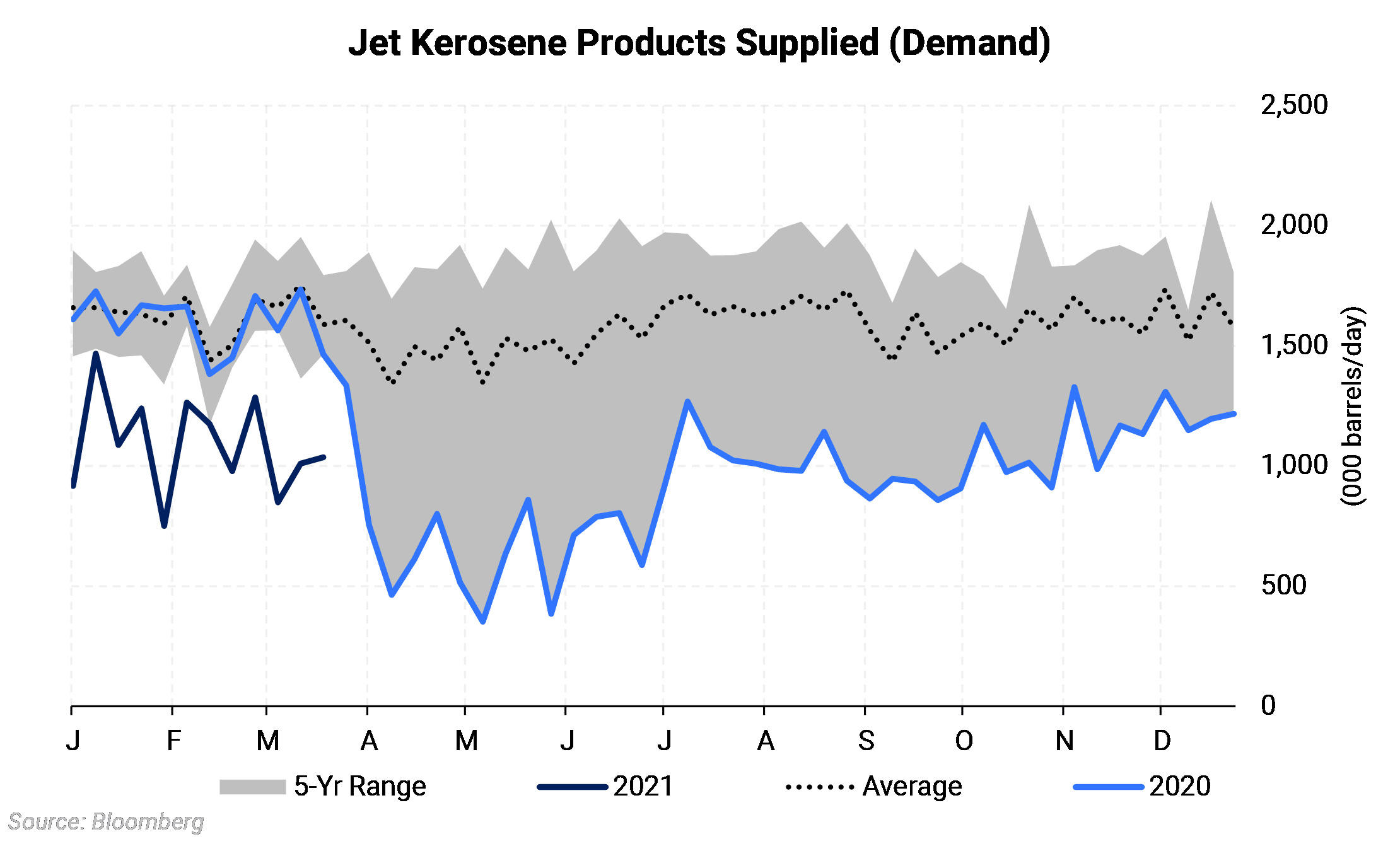

|

Last year, travel by air was down by 66 percent compared to 2019, the International Air Transport Association (IATA) says. According to Energy Aspects, aviation fuel consumption will likely remain at about 5.55 MMBbl/d in the first half of 2021, down from the average global consumption of 7.9 MMBbl/d in 2019.

Jet fuel accounted for about 10% of oil demand in OECD countries in 2019, dropping to 6% in 2020, according to the International Energy Agency (IEA). For comparison, gasoline demand stood for about 30% of oil demand in 2019 and 2020.

AEGIS notes that jet fuel demand does not need to recover for crude oil prices to rise. Global supply restrictions, primarily by OPEC, have helped balance the crude oil market. The expected slow return of jet fuel demand could mean OPEC+ nations may not return supply at the pace desired without sacrificing price.

Commodity Interest Trading involves risk and, therefore, is not appropriate for all persons; failure to manage commercial risk by engaging in some form of hedging also involves risk. Past performance is not necessarily indicative of future results. There is no guarantee that hedge program objectives will be achieved. Certain information contained in this research may constitute forward-looking terminology, such as "edge," "advantage," 'opportunity," "believe," or other variations thereon or comparable terminology. Such statements and opinions are not guarantees of future performance or activities. Neither this trading advisor nor any of its trading principals offer a trading program to clients, nor do they propose guiding or directing a commodity interest account for any client based on any such trading program.