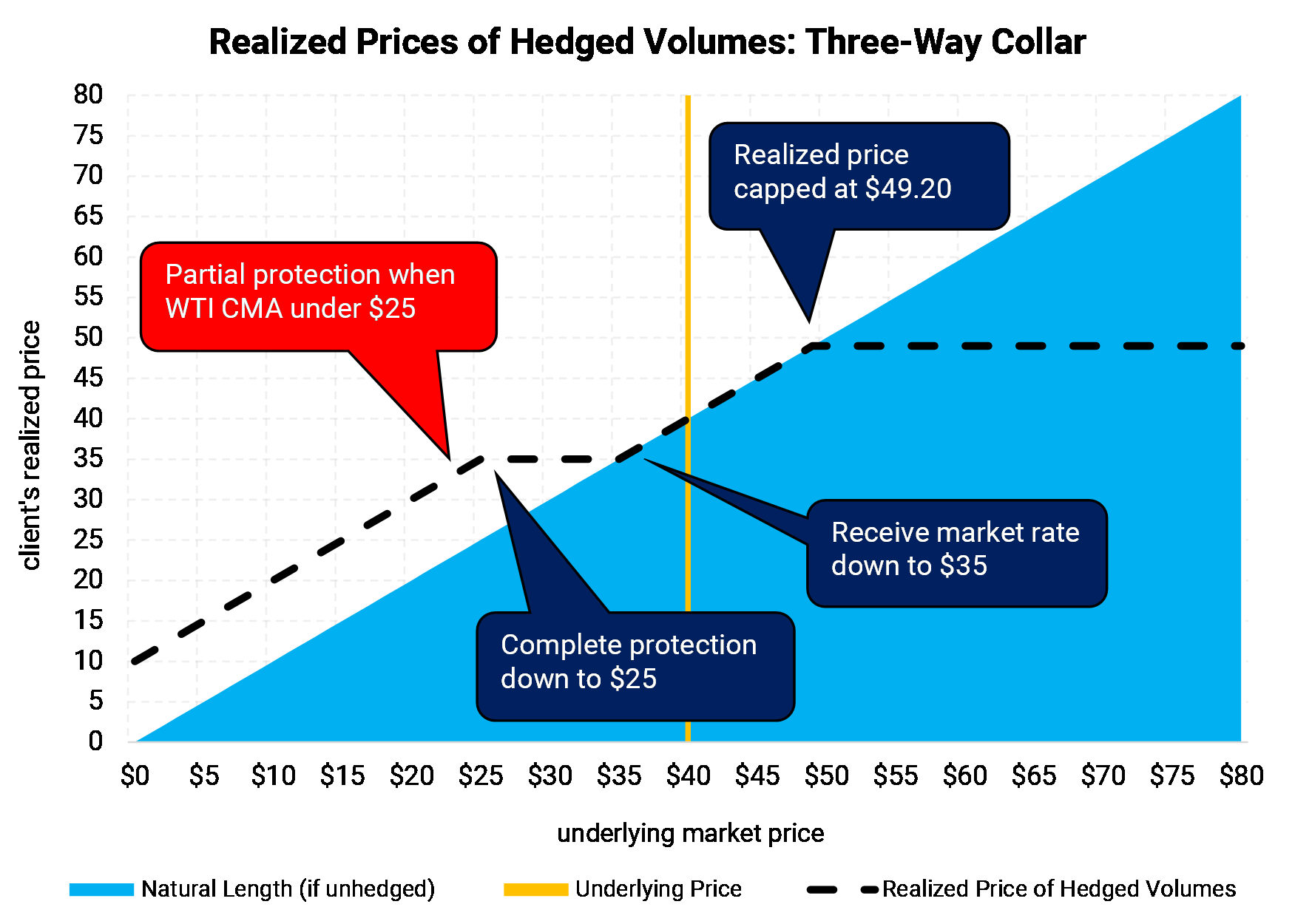

| The chart above shows what the realized price an E&P would achieve, net of the hedges, at a variety of prices for WTI. Note that the producer is fully protected if WTI were to settle between $25 and $35. The realized price would be capped at $49.20.

Why not simply use a more traditional costless collar? Because, for the same tenor and floor of $35, the producer would be capped at a lower ceiling price -- about $43.80/Bbl. But we're most concerned about what happens below $25, where the traditional costless collar would have provided absolute protection. That formula for the three-way is this: below a $25 settle in WTI, the holder of the three-way collar would receive market price (the settle) plus $10, which is the difference between the strike prices in bullets (1) and (2) above. |

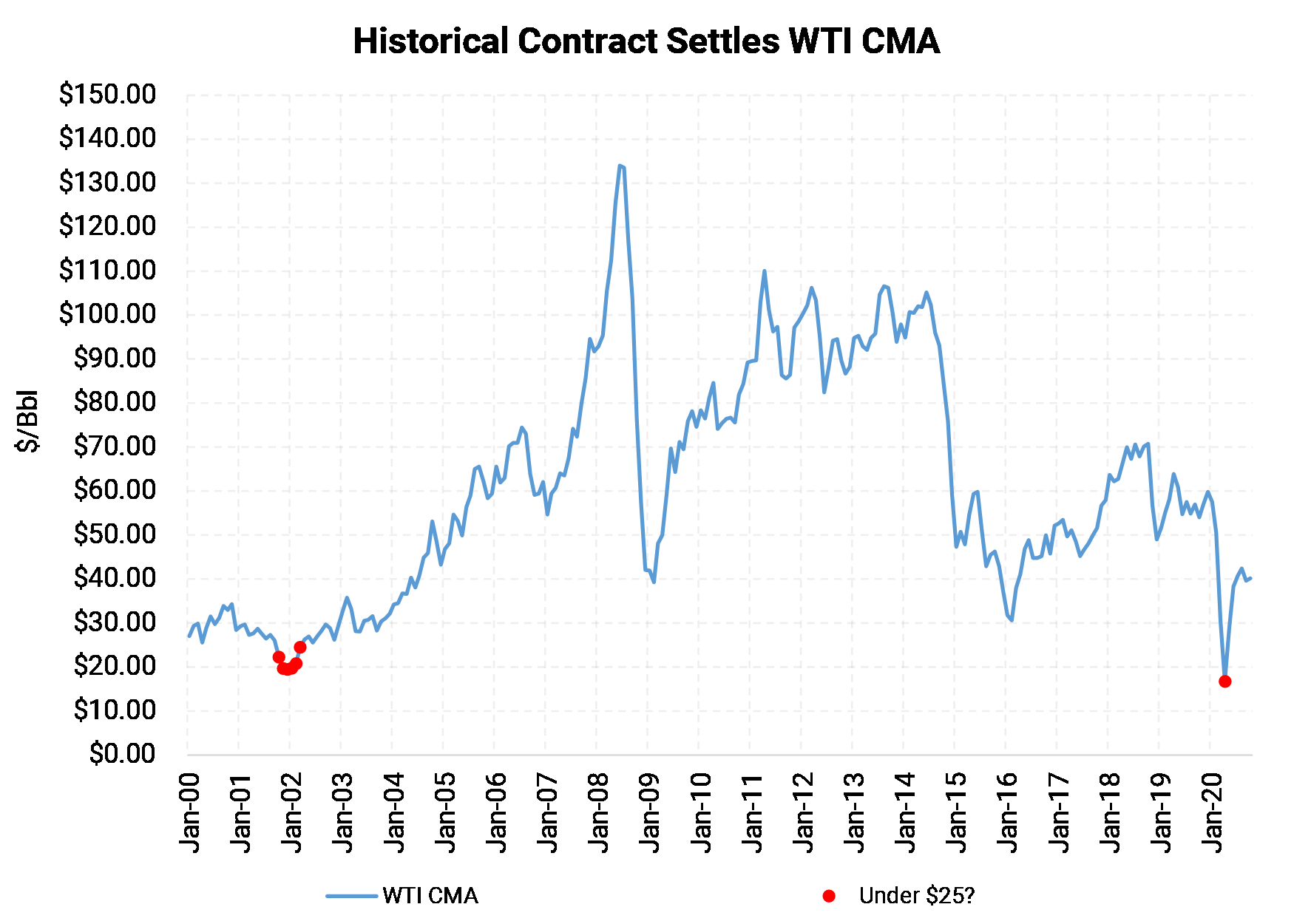

| How possible is it that WTI could settle below $25/Bbl? It's 100% possible, but in the past, has been uncommon.

The second chart (above) shows how many months of WTI CMA have actually settled below $25. It's rare. This year, it happened in April (WTI futures settled below $25 in March, too). You probably blacked out during those months and don't remember, and we aren't judging you. The previous sub-$25 settlements were in 2002. Therefore, even in the supply-rich, post-shale era, the U.S. producer-price benchmark of WTI CMA has remained over $25 except for one month this year. Further, the market has seen that prices near $25 encourage temporary shut-ins of oil wells. If shut-ins occur, the reduced supply can support prices. |

This hedging tactic is not appropriate for everyone. Contact the AEGIS strategy team to see how three-way collars would affect your risk and your portfolio.

Questions or comments, please contact us at view@aegis-energy.com