New rules may affect copper hedgers who have a physical exposure to the cash market. Please contact AEGIS if you think this applies to you.

New Rules (as of 10/19/2021):

- First, the exchange placed limits in the “tomorrow-next” market, which is a one-day cost of rolling a financial position without physical delivery. A new rule limits backwardation in tomorrow-next copper contracts of no higher than 0.50% of the prior day’s cash price. Thus, if the cash price is $10,000/mt, then the maximum additional backwardation the tomorrow-next copper contract spread can go is $50/mt.

- Second, anyone with a position of higher than 50% of LME warrants or metal units available for trading on the exchange must lend metal at 0.25% daily rate. This is rule is to encourage traders to deliver and keep copper at LME warehouses.

- Third, short positions (i.e., sold contracts) who could neither deliver or borrow at a backwardation of no higher than 0.50% per day of the prior day’s cash price, can now roll their position for 0.50%. This rule stands only if the member contacts the exchange and proclaims they can and want to deliver.

Background:

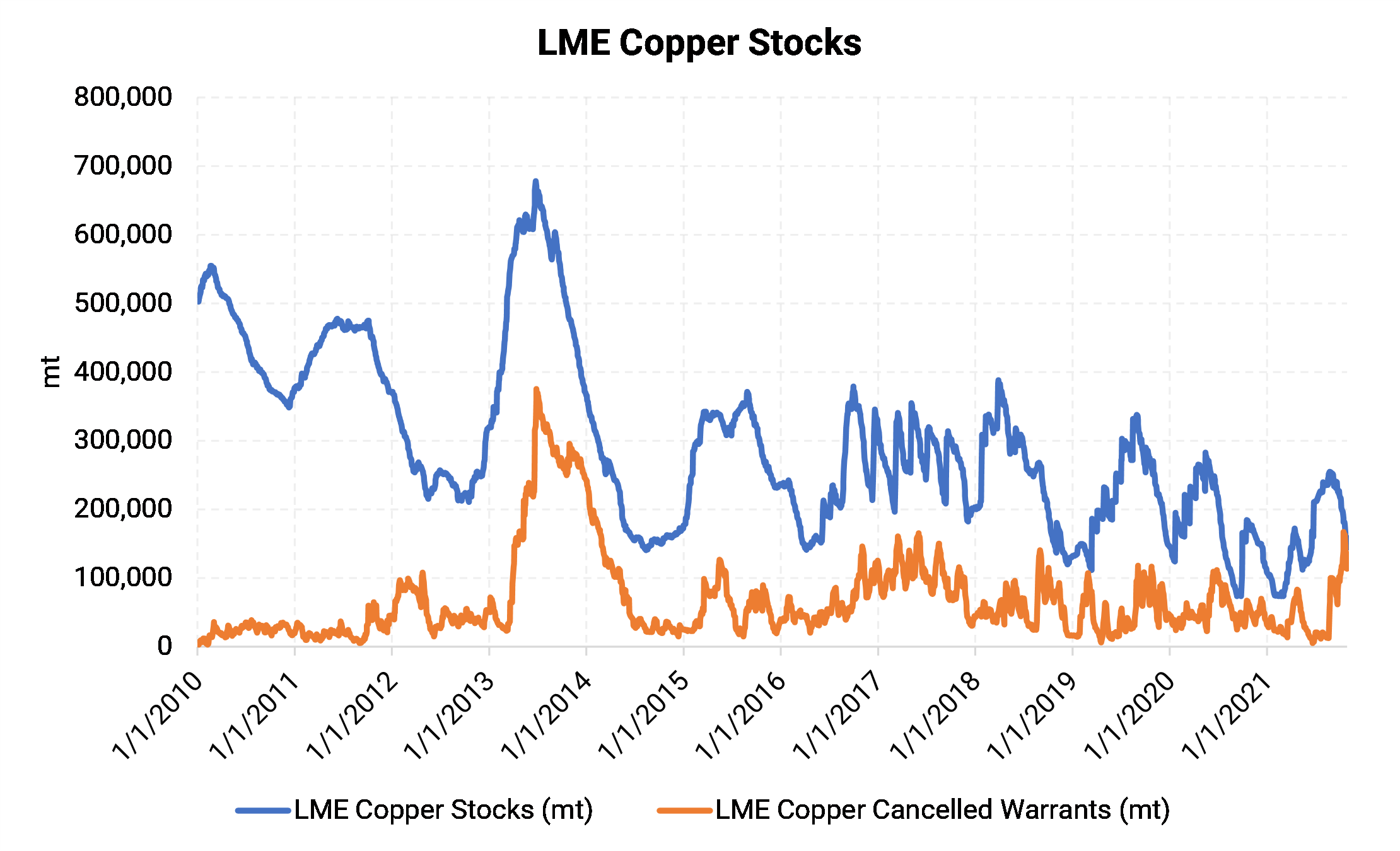

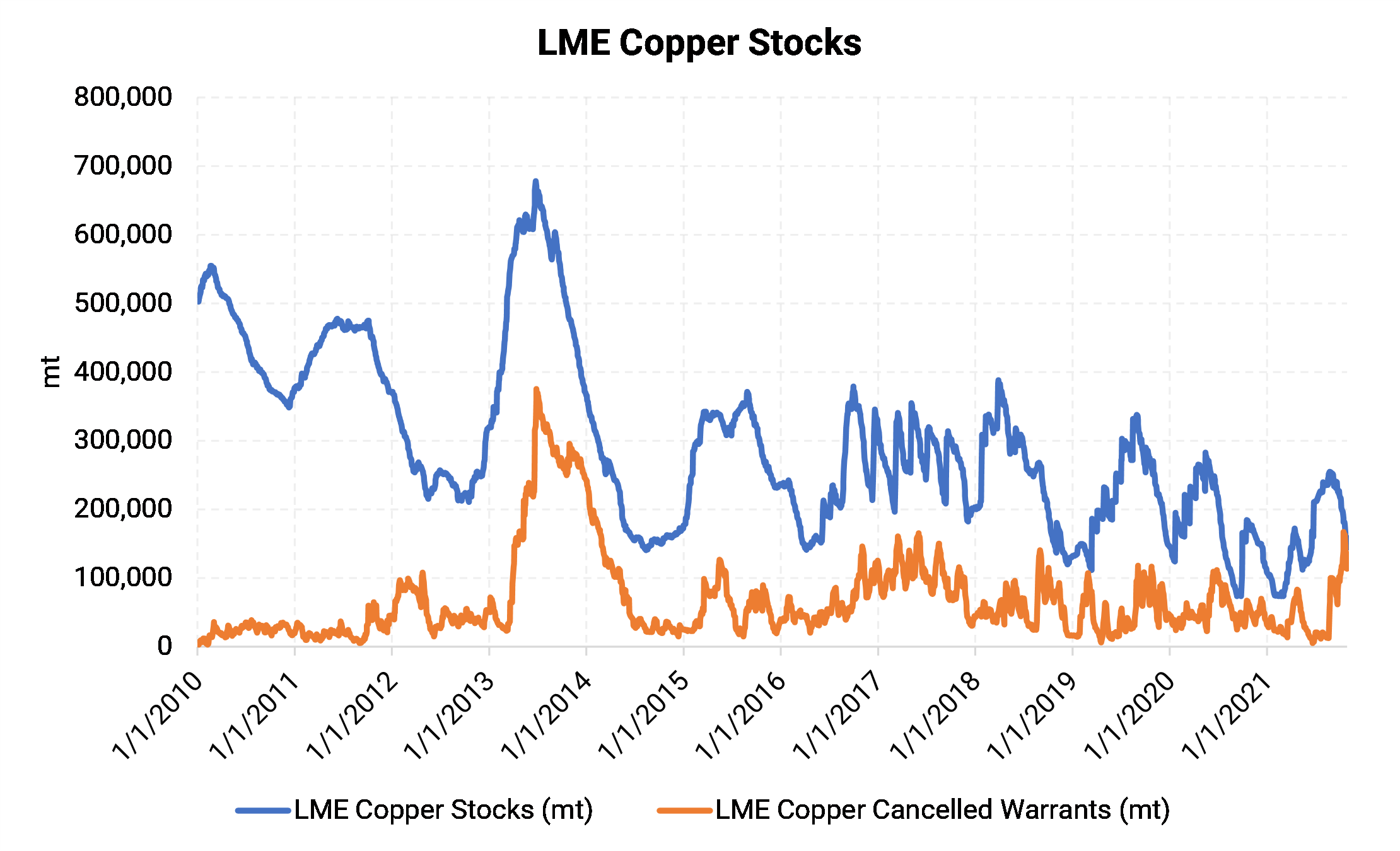

- In response to volatility in the cash market and an extreme drawdown in copper stocks in early- to mid-October 2021, the LME implemented new rules stem the outflow of copper stocks.

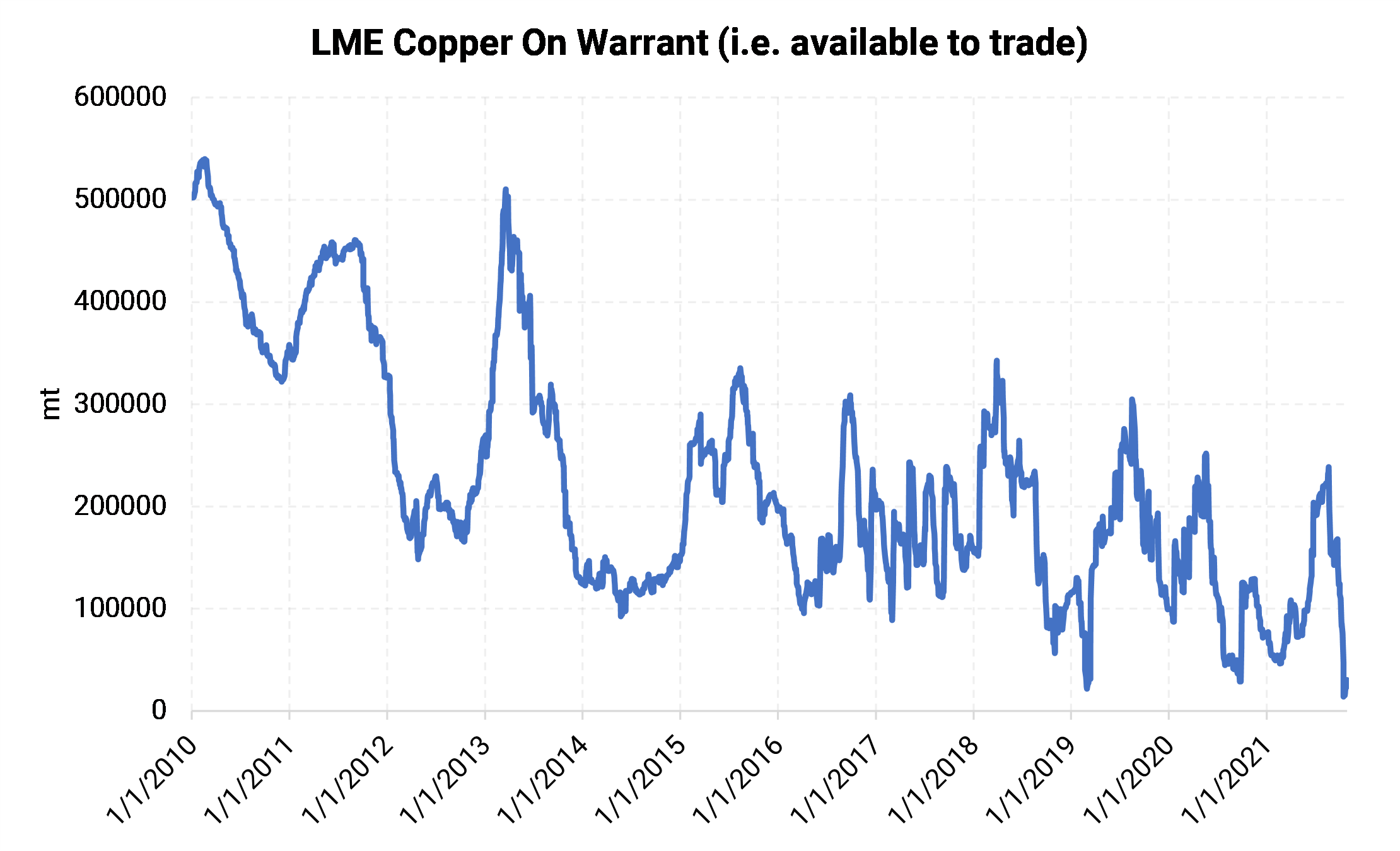

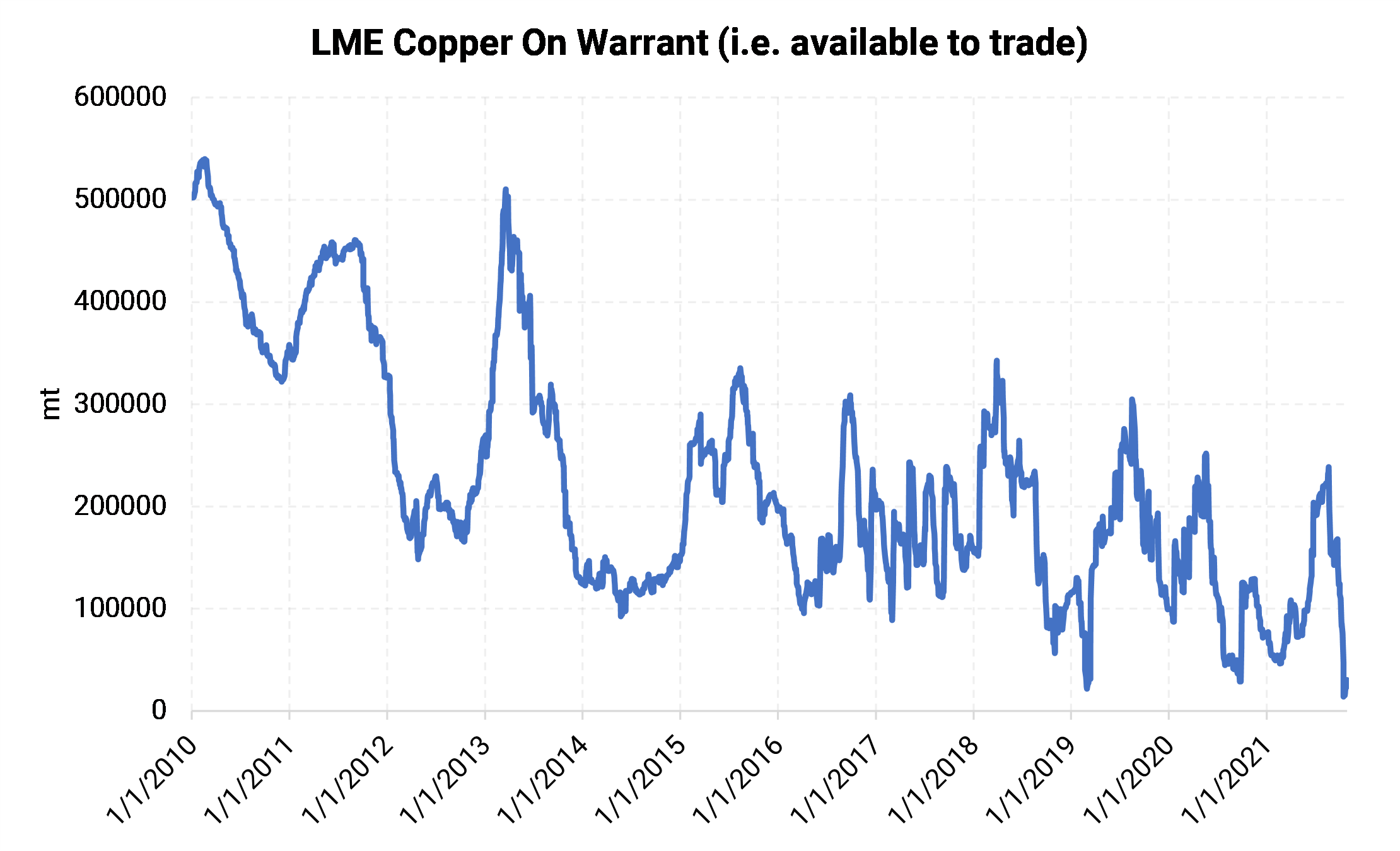

- On Friday, October 15, 2021, the LME warehouse system only had 14,150 mt of available copper for delivery, the lowest volume since 1974. On-warrant (i.e., available for delivery) stocks had been 114,200 mt on October 1. The minimum amount the LME needs to have on hand for members to make their delivery requirements is generally thought to be 6,000 mt.

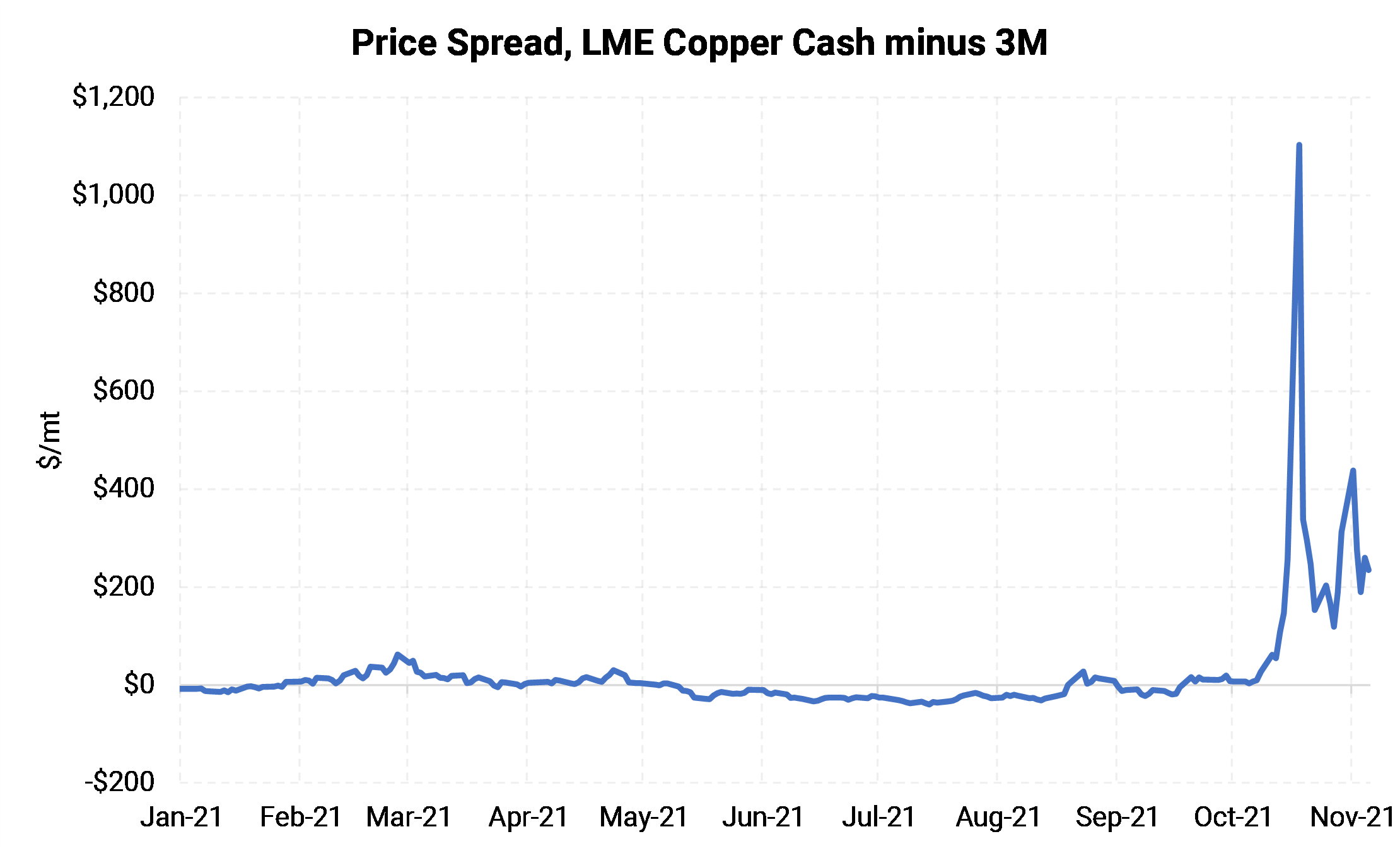

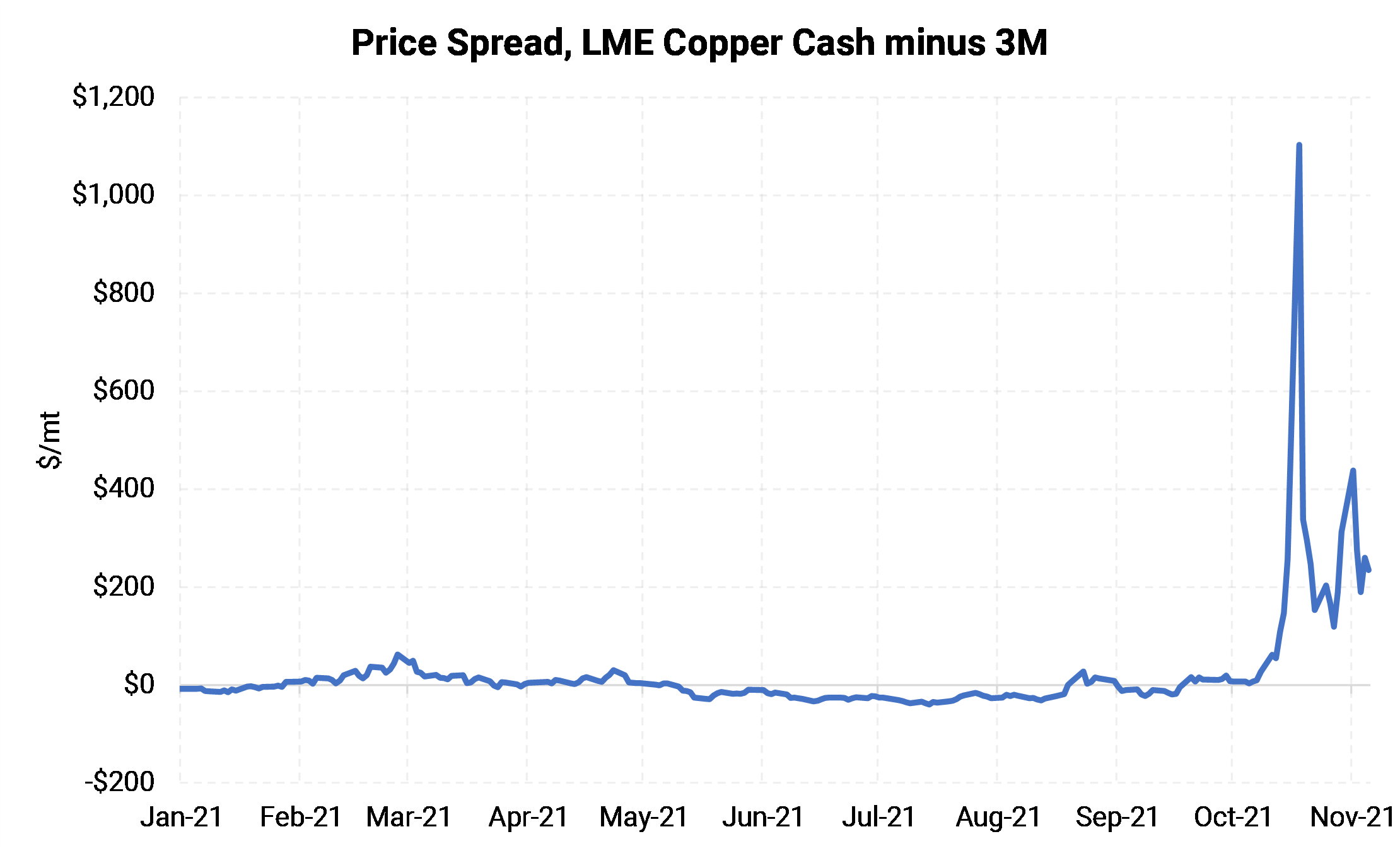

- The drawdown in stocks, along with continued firm demand for physical copper, led to a steep backwardation in the cash market versus the rest of the curve as the prompt-month (October) contract went into expiry. This backwardation created a squeeze for market participants who needed to roll their positions.

- On Monday, October 18, this backwardation reached over $1,000/mt.

- The new LME rules also aimed to lessen the chance of market manipulation by those holding a large amount of physical copper.

- According to a Trafigura spokesperson, the large trading house had been withdrawing LME stocks for delivery to customers.

- Also on Monday, October 18, one LME member owned 50-79% of all warrants. However, by Wednesday, October 20, this amount had dropped to nearly 50%.

- Copper futures on the LME are physically settled against the cash price, so these new rules reduce the chances of volatility in cash prices.

For AEGIS clients, these rules mainly affect hedgers who need to deliver a nearby cash position. Clients and non-clients alike are welcome to call us to find out if this affects you.

Definitions:

Warrant: Document of title, signifying ownership of a specific brand and lot of metal in a specific warehouse

On-Warrant: Metal that is in the warehouse and available to trade.

Cancelled Warrant: Metal that is requested for delivery.

Opening Stock: Equals the closing stock as of the prior day.

Delivered In: Quantity of metal for which LME warrants were issued during the reported period. May also consists of metal that was delivered to the warehouse earlier but had not been on warrant.

Delivered Out: Quantity of metal which was removed from the warehouse.

Closing stock: Equal to the opening stock plus delivered in, minus delivered out.

Open tonnage: Equal to the amount of warrants in free circulation (i.e. tradable, not cancelled). Can be calculated by taking the closing stock minus canceled tonnage.

Cancelled tonnage: Equal to the amount of warrants set for delivery. These warrants cannot be traded.

Cancelled Warrant Ratio: Equal to the percentage of cancelled tonnage divided by the total closing stock.

Tomorrow Next: A short-term transaction that allows traders to simultaneously buy and sell a commodity over two separate business days: tomorrow, and the next day. This way the trader does not have to take physical delivery of the commodity.

Important Disclosure: Indicative prices are provided for information purposes only, and do not represent a commitment from AEGIS Hedging Solutions LLC ("Aegis") to assist any client to transact at those prices, or at any price, in the future. Aegis makes no guarantee to the accuracy or completeness of such information. Aegis and/or its trading principals do not offer a trading program to clients, nor do they propose guiding or directing a commodity interest account for any client based on any such trading program.