AECO Outlook

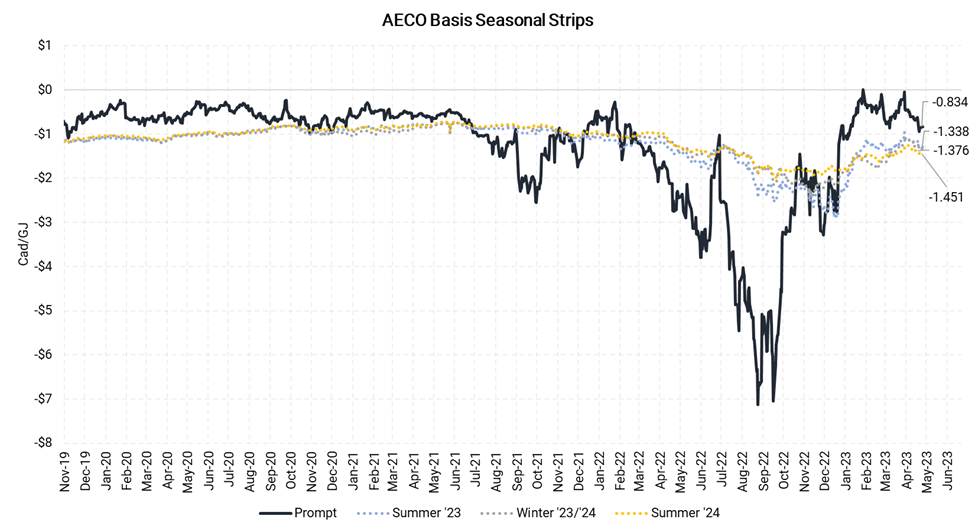

With AECO basis trading at one of the highest relative values in recent years, we view this as an attractive point to add basis hedges. Hedge the summer months more aggressively than winter months, given that much of the bullish potential is from the risk of Chicago Citygate moving higher, which generally occurs during periods of high weather-driven demand. With summer months prone to low demand, low egress capacity, and oftentimes low prices AEGIS sees AECO basis risk skewed to the downside.

AECO basis has tightened against Henry Hub and several other regional basis points

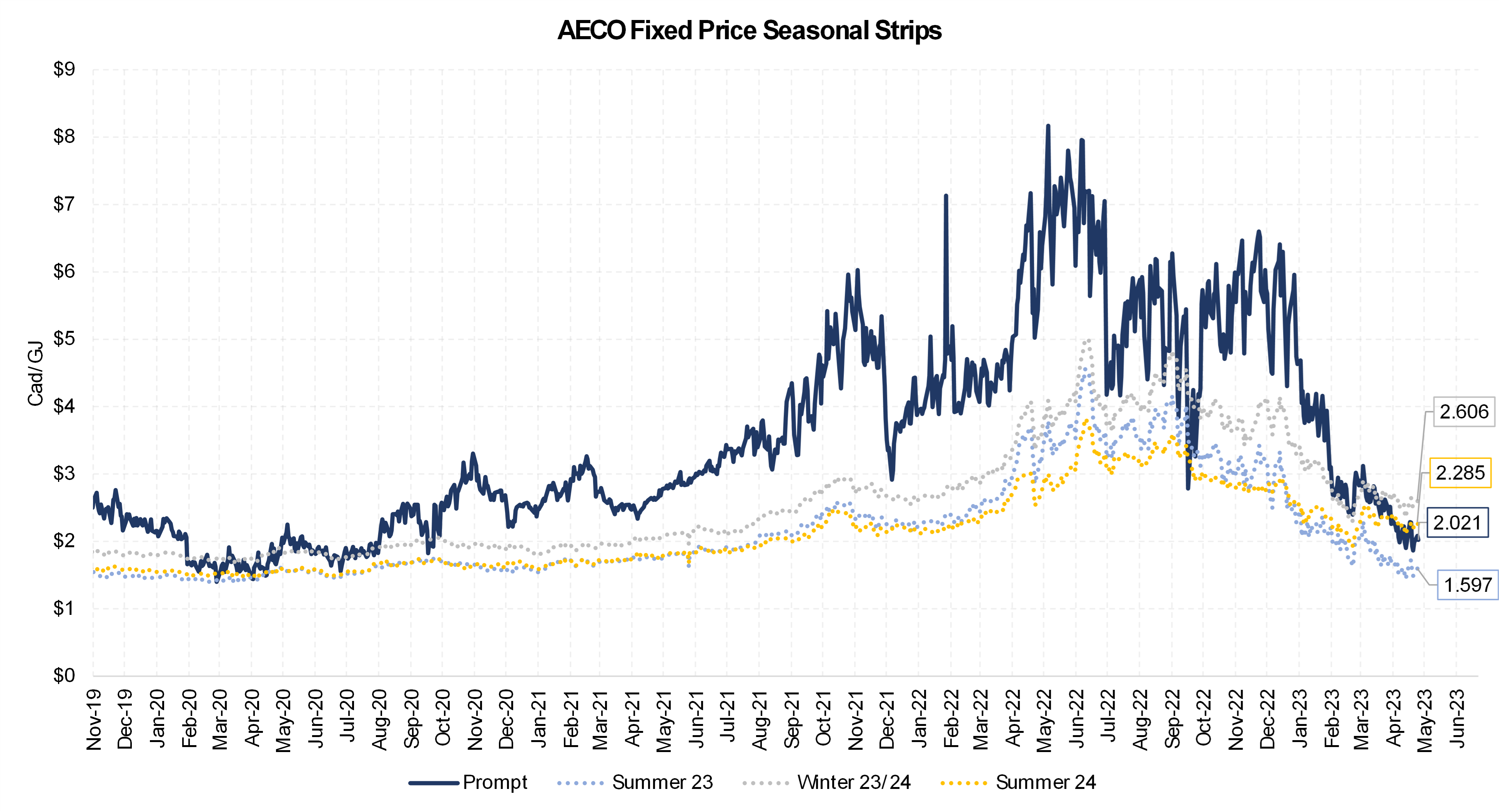

Prompt month AECO fixed price has fallen substantially from about $8/MMBtu to its current level of $2.61/MMBtu. This drop in prices mirrors the price action in other North American gas markets this year. While fixed price has fallen, AECO basis to Henry Hub has tightened along with many regional basis points, which presents a hedging opportunity for producers, especially ones with exposure to other pricing locations.

AECO basis has improved significantly

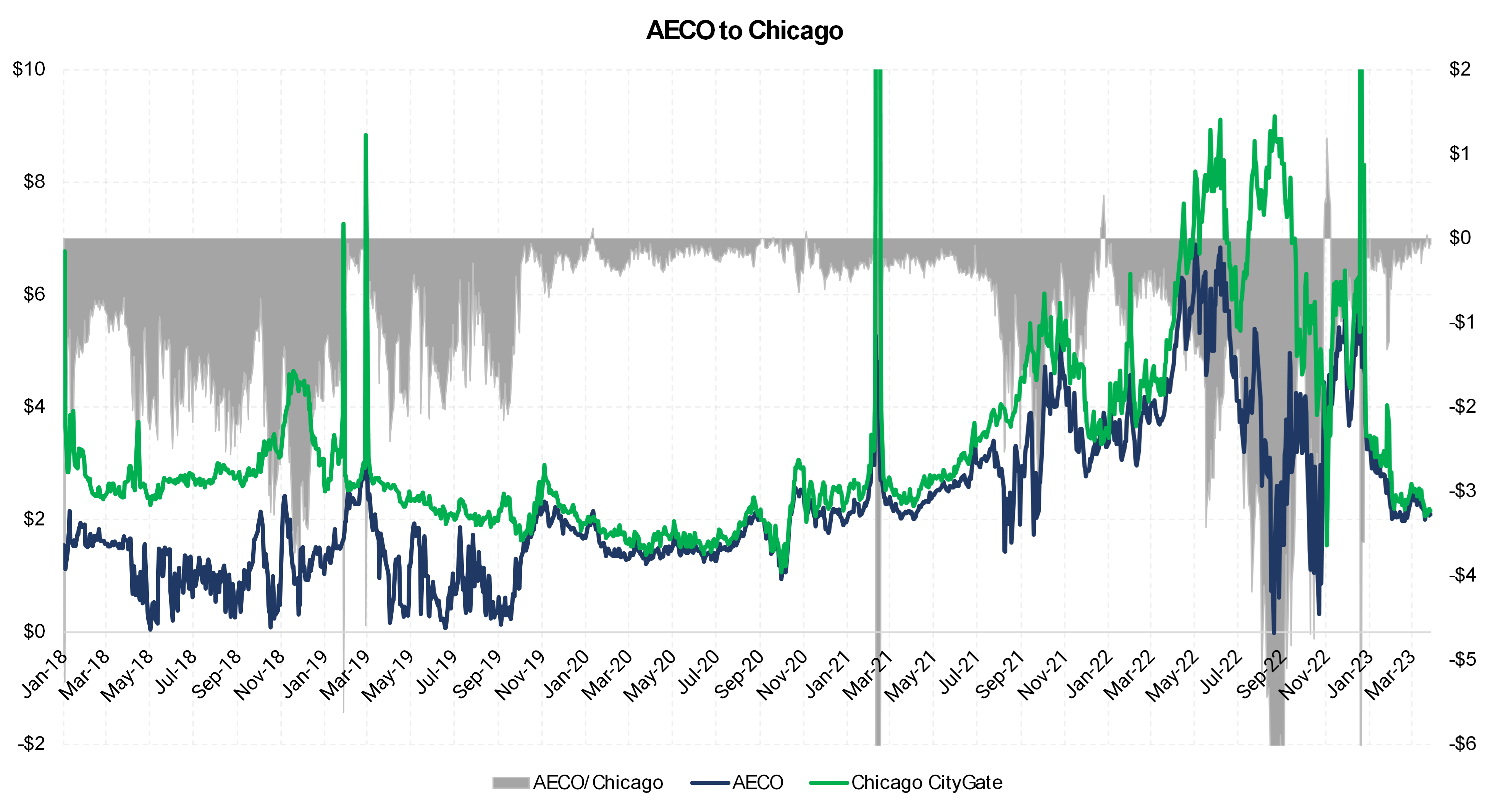

The AECO to Chicago Citygate spread is at one of the tightest levels in several years. This is important to note as Chicago is one of the primary destination markets for gas produced in Western Canada. AECO rarely trades above Chicago, and when it does, it is only for a brief period of time. This is because, without higher prices in a downstream market, there would be little incentive to supply it with gas. From Fall 2019 to late 2020, AECO traded very closely with Chicago and other US hubs due to a regulatory change in TC Energy’s Alberta pipeline system, prioritizing interruptible gas flows and allowing additional gas to move into storage. Following the 2020 injection season, AECO/Chicago prices diverged again and only briefly traded at or above parity. In addition to this, Chicago prices can drag AECO higher, especially during periods of high weather-driven demand.

The spread between AECO and Henry Hub tells a similar story: despite the collapse in fixed price, AECO basis is relatively high. With AECO and other regional basis prices trading very closely, we view this as an attractive point for adding basis hedges.

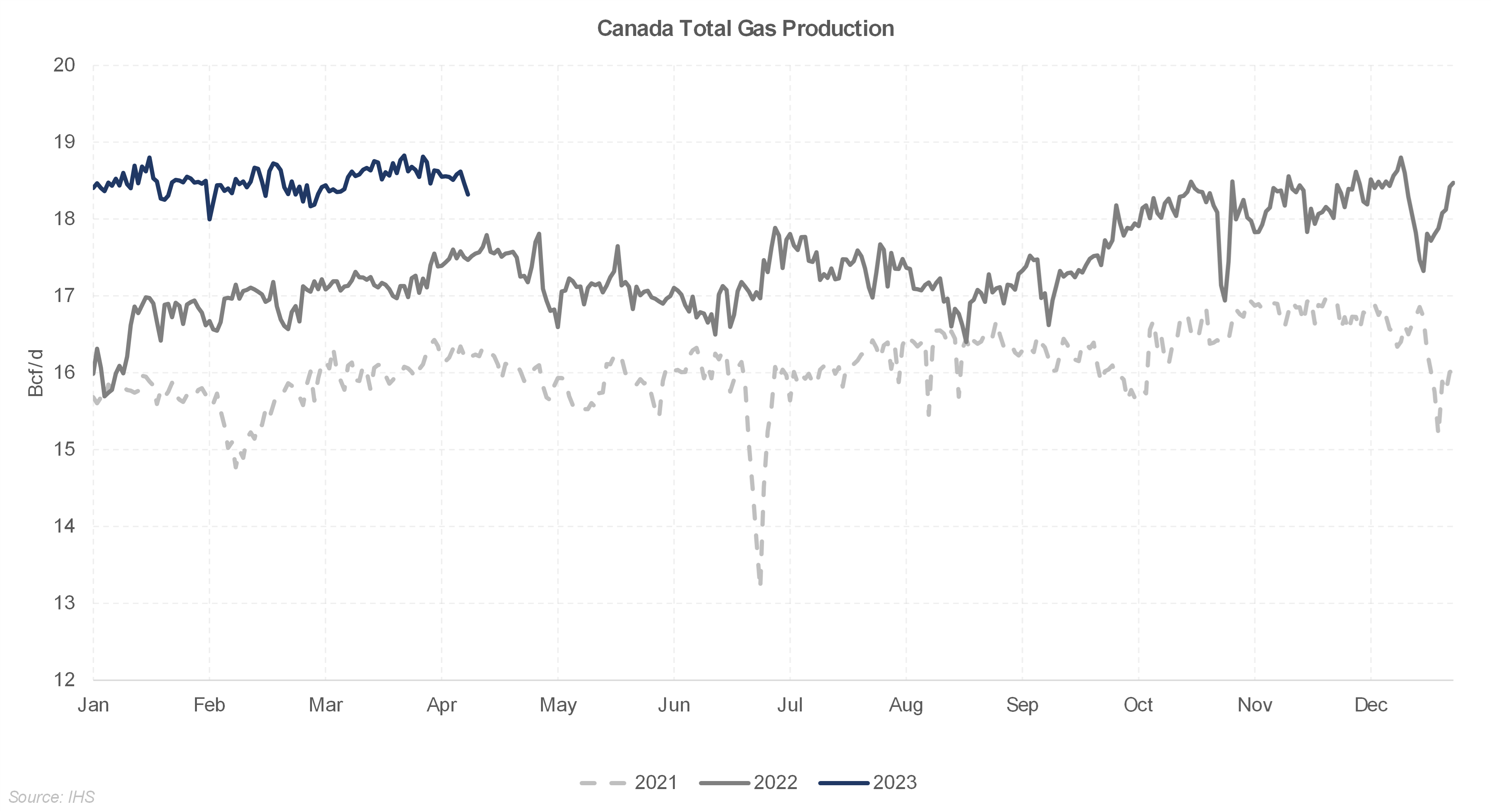

Production growth has been robust

Despite the fall in gas prices, Canadian gas production has remained strong. Production has averaged 18.5-Bcf/d in 2023, up from an average of 17.3-Bcf/d in 2022. Most of the Canadian production originates from the Montney shale, which is also where the largest year-over-year growth has been. However, pipelines out of Western Canada are often constrained, and any additional production growth creates a risk of price blowouts, especially around planned or unplanned maintenance outages, which have been seen on multiple occasions in the past.

Pipeline constraints could continue to plague prices

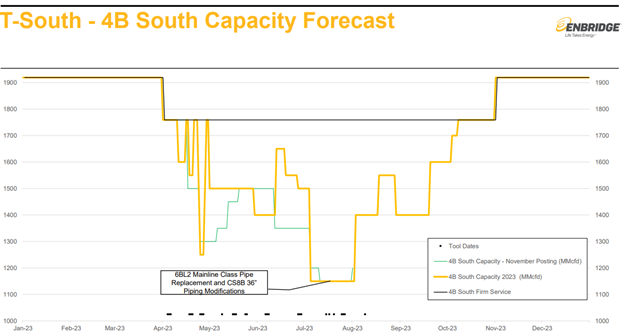

Several pipelines in Western Canada perform maintenance over the summer, such as Enbridge’s Westcoast pipeline and TC Energy’s massive NGTL system. These maintenance events often lead to pricing pressures with gas constrained and pipes flowing at full capacity. The effect on T-South capacity can be seen in the chart below, with volumes being significantly reduced throughout the summer. The NGTL 2021 expansion should alleviate some of the pressure by increasing eastbound capacity at the border of Alberta and Saskatchewan. The 2.1-Bcf/d Coastal Gaslink pipeline coming online in 2024 will move gas to the west coast of British Columbia to supply the planned LNG Canada export facility.