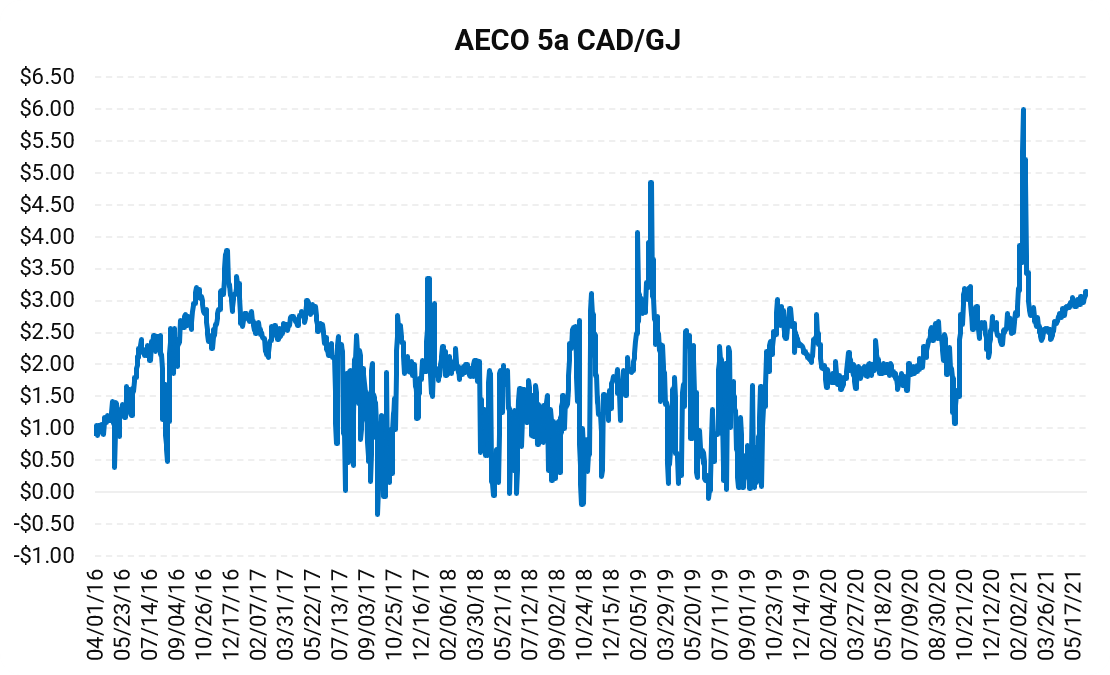

The conversation around the oversupply of WCSB natural gas in relation to existing pipeline infrastructure has been robust over the last decade. There have been countless high profile industry players, politicians, academics and research analysts taking aim at the underlying reasons for the lack of Alberta’s ability to increase capacity intra-Alberta capacity or add new capacity to reach new demand markets. The Government of Alberta even assembled a Natural Gas Advisory Panel to prepare a report for the Minister of Energy with recommendations to ensure Alberta is receiving maximum value for its natural gas resources. Meanwhile, producers have endured extreme volatility and painfully wide differentials in AECO pricing as regulatory delays and overall uncertainty stunted takeaway capacity growth in both the gathering system and export capacity while production growth soared.

Source: ICE

Source: ICE

Weak absolute prices have done little to dampen overall supply growth, instead a shift in drilling activity to crude oil and liquids-rich coupled with lower costs have served to contribute to the problem. The focus on drilling in wet gas wells for higher value liquids resulted in meaningful associated gas volumes in a geographical are where infrastructure was years away from being able to adequately handle the volumes. But the age-old adage that time heals everything applies to intra-provincial infrastructure and ultimately AECO prices in Alberta.

Source: TC Energy, AEGIS

Source: TC Energy, AEGIS

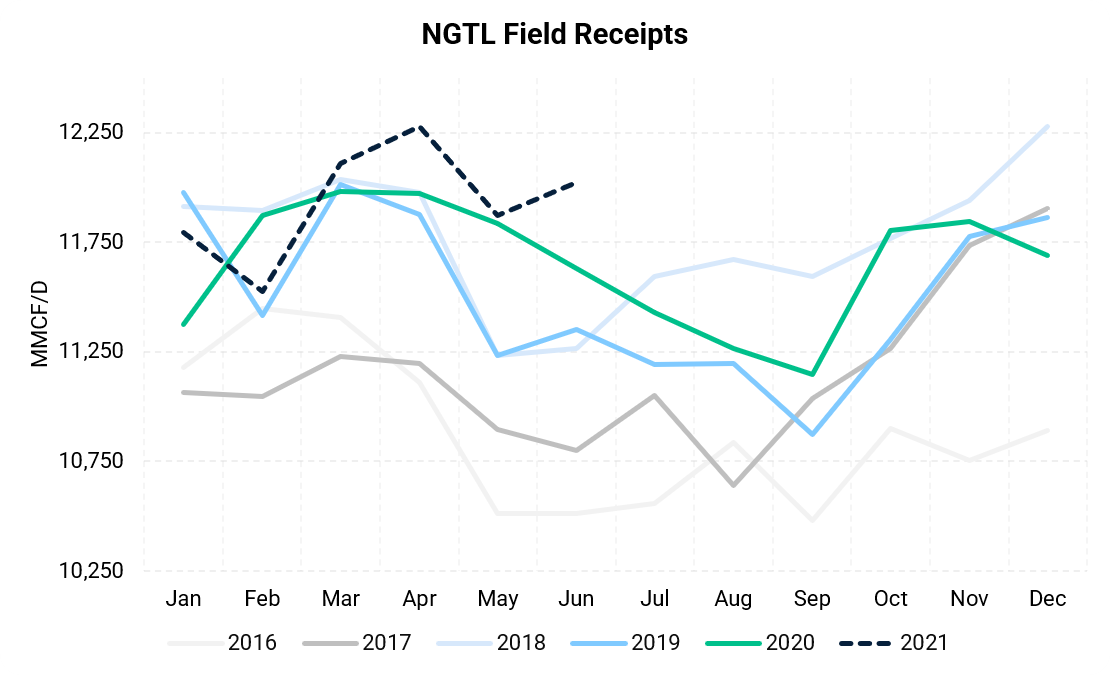

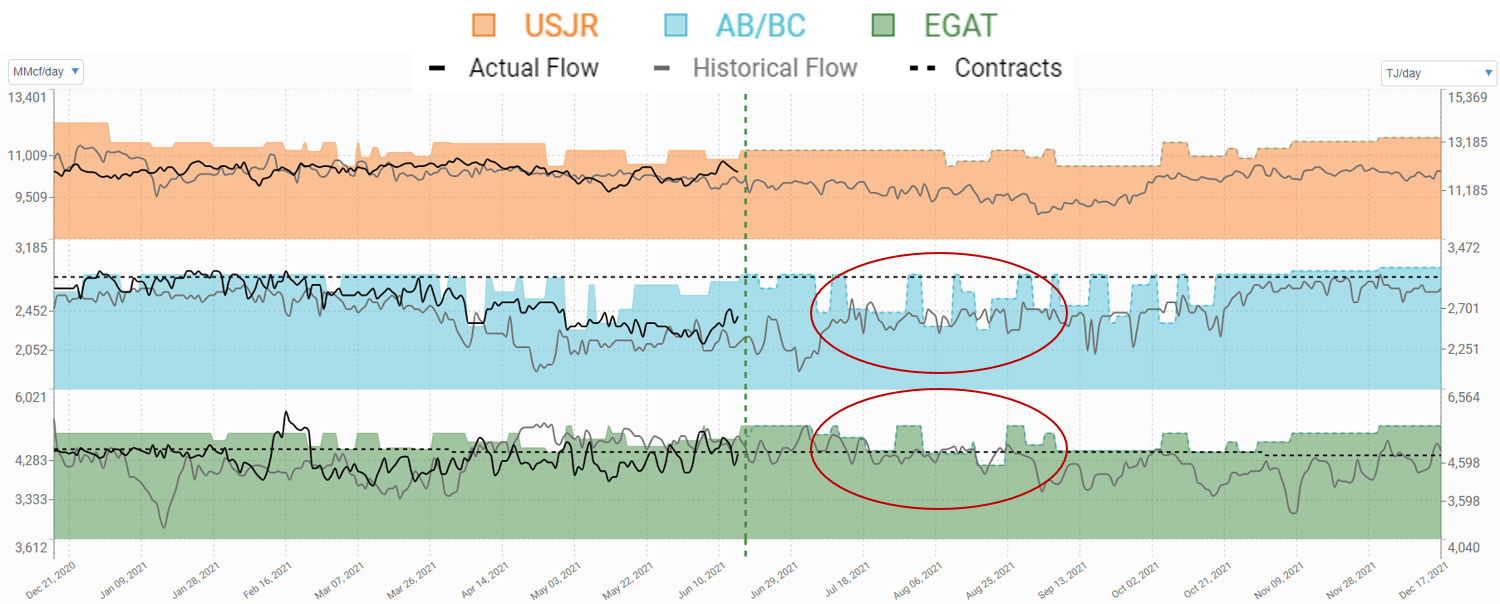

In 2014, TC Energy embarked on 2 major expansion projects – the first one (2017 NGTL System Expansion) was completed in 2017, and the second one (2021 NGTL System Expansion) will be completed in 2022. The latest expansion is expected to come online throughout 2021 with the last remaining project components to be fully completed by April 2022.

These two large scale expansion projects have turned the scales. While not the only factor in boosting AECO prices, the de-bottlenecking of the intra-Alberta pipeline system has helped to prevent severe discounting that occurs when molecules have nowhere to go. Exports have averaged over 6.1 Bcf/d so far in June, and some early summer heat has kept intra-provincial load strong. Field receipts have also recovered after the latest plant turnarounds wrapped up, averaging just over 12 Bcf/d summer-to-date.

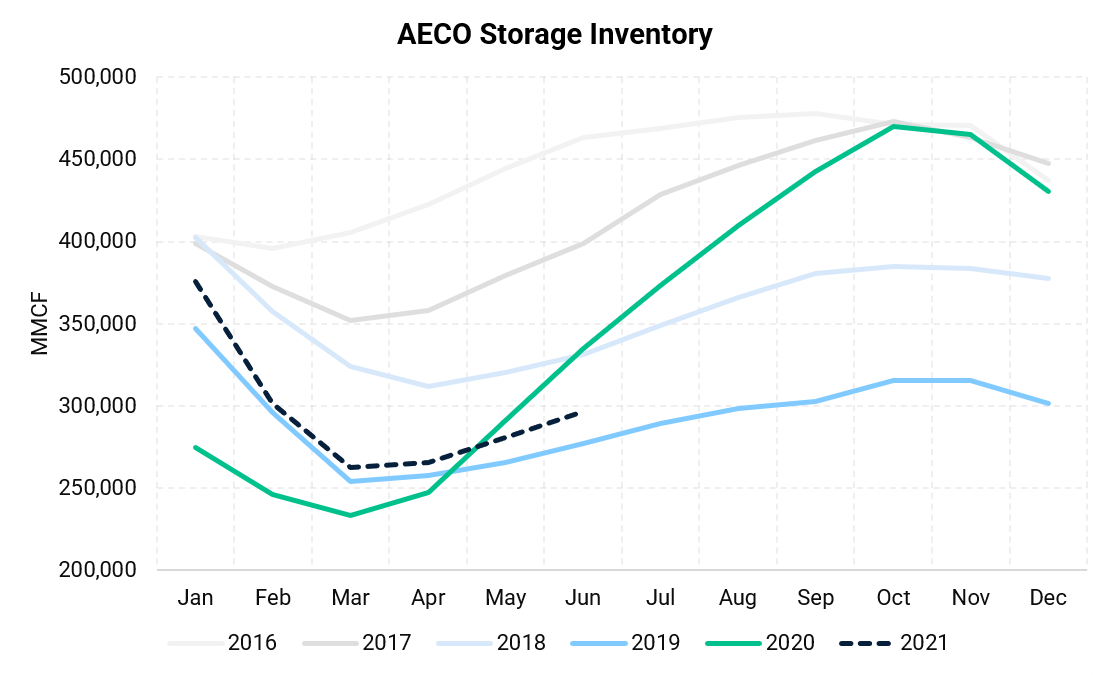

Cash to winter AECO spreads have yet to incentivize storage and we believe that this is not poised to change for the balance of June. Planned maintenance for July, August and September is forecast to be quite heavy potentially causing constraint driven price weakness but might also prevent storage players from taking advantage of the wider spread by limiting injections. With production on the rise on NGTL and the WCSB as a whole, flows are likely to exceed capacity as maintenance picks up.

Source: NGTL

AECO prices are averaging $2.85 $C/GJ so far for the Summer 2021 season, and $3.23 $C/GJ so far for June. Storage injections are noticeably weak relative to summer 2020 and on par with summer 2017, 2018, and 2019 when maintenance on the NGTL system limited flows into storage. Total injections since April 1 amount to about 0.6 Bcf in Alberta, well behind the 1.3 Bcf we saw 2020.

Source: NGTL, AEGIS

Source: NGTL, AEGIS

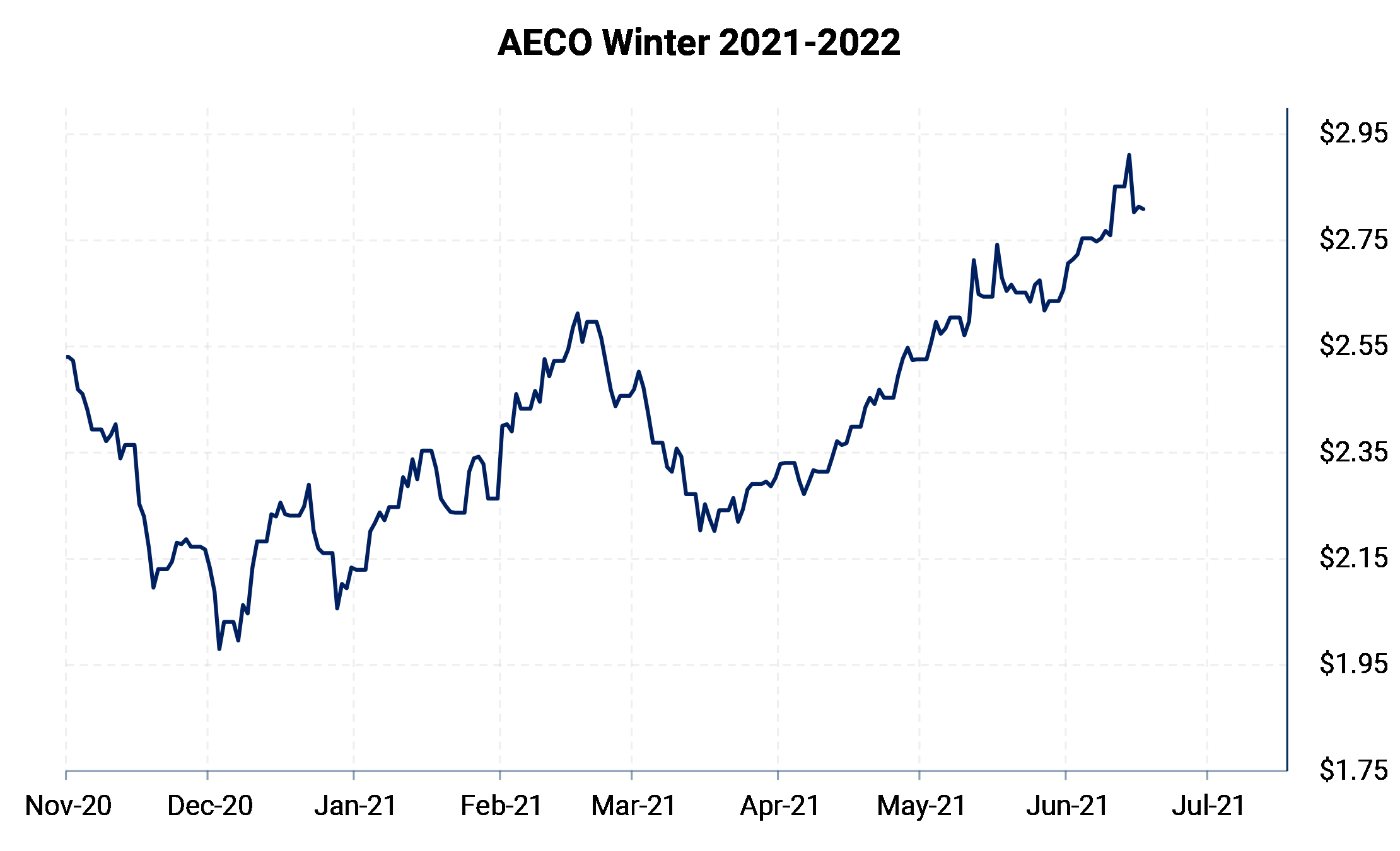

Winter 21/22 AECO basis is currently -$0.58 $US/MMBtu (-$0.68 $C/GJ) equating to $2.75 AECO FP $US/MMBtu ($3.21 AECO FP $C/GJ) which we don’t believe fully takes into account the likelihood that Alberta storage could be considerably low at the beginning of the withdrawal season. The caveat here is that we expect there will be more gas to go around as the US continues to recover to 94-95 Bcf/d (according to the EIA STEO).

Source: Bloomberg

Regional supply/demand data will be important to watch as we move through the balance of the summer. Stay tuned for future posts on the issues that we anticipate will affect prices for the balance of the summer and as we head into winter, particularly: