Global gas prices have been wildly volatile this year as news headlines continue to paint a picture in which we run short of gas in the depths of winter.

With the increase in LNG movements, gas has become a much more global market in recent years, but regional basis markets can still make or break a producer’s earnings and warrant sharp attention.

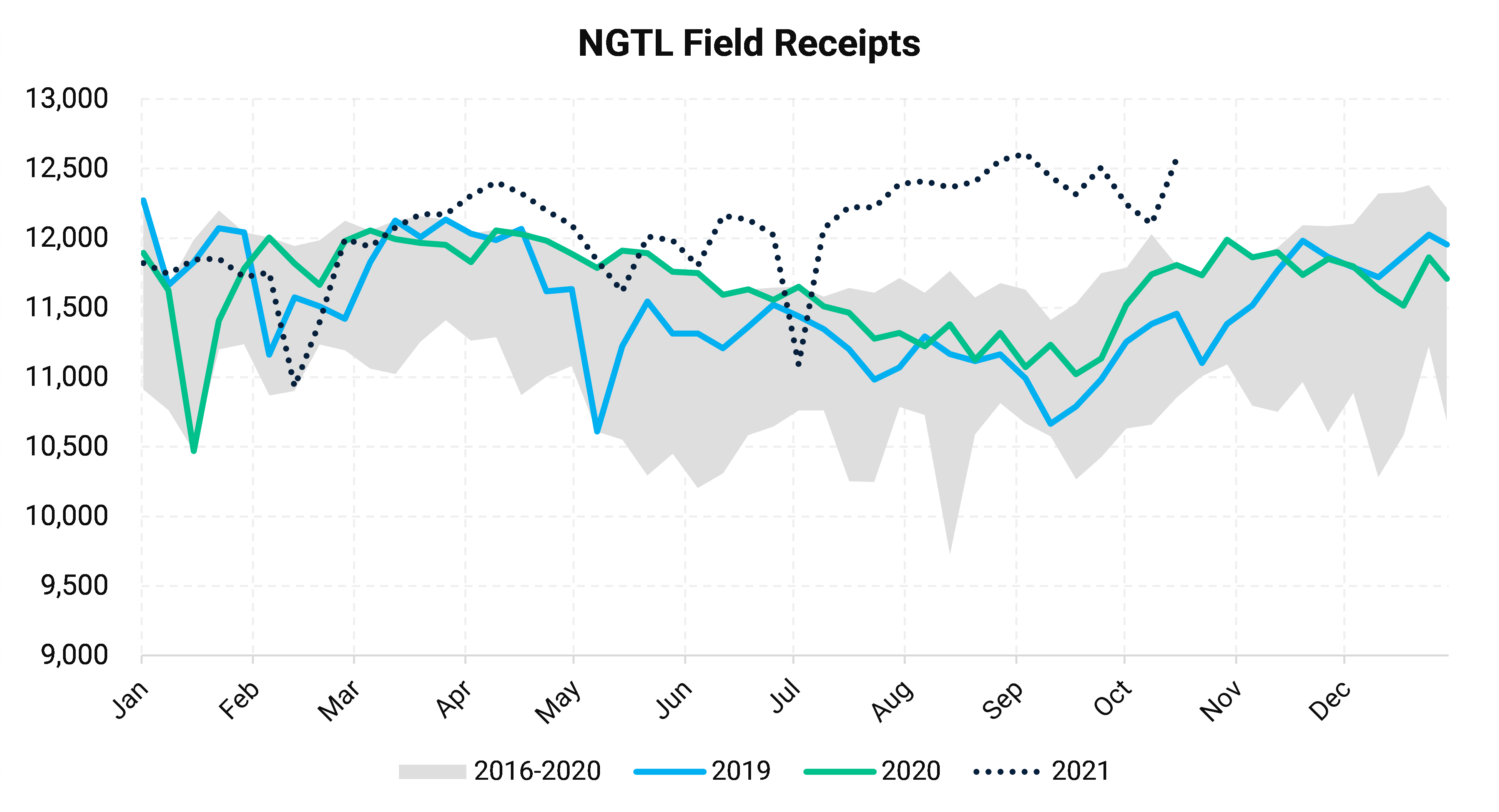

Western Canadian supply growth has been surprisingly resilient this year, particularly when considering the focus on capital discipline, but it seems Canadian producers can’t help but take advantage of higher outright prices and additional egress capacity that alleviates the bottlenecks that has tanked price in the past. The chart below is clear in showing the production growth in Alberta, but keep in mind that the NGTL maintenance restrictions have potentially masked additional growth that would/could have occurred in a non-constrained environment.

|

| Source: TC Energy, AEGIS Research |

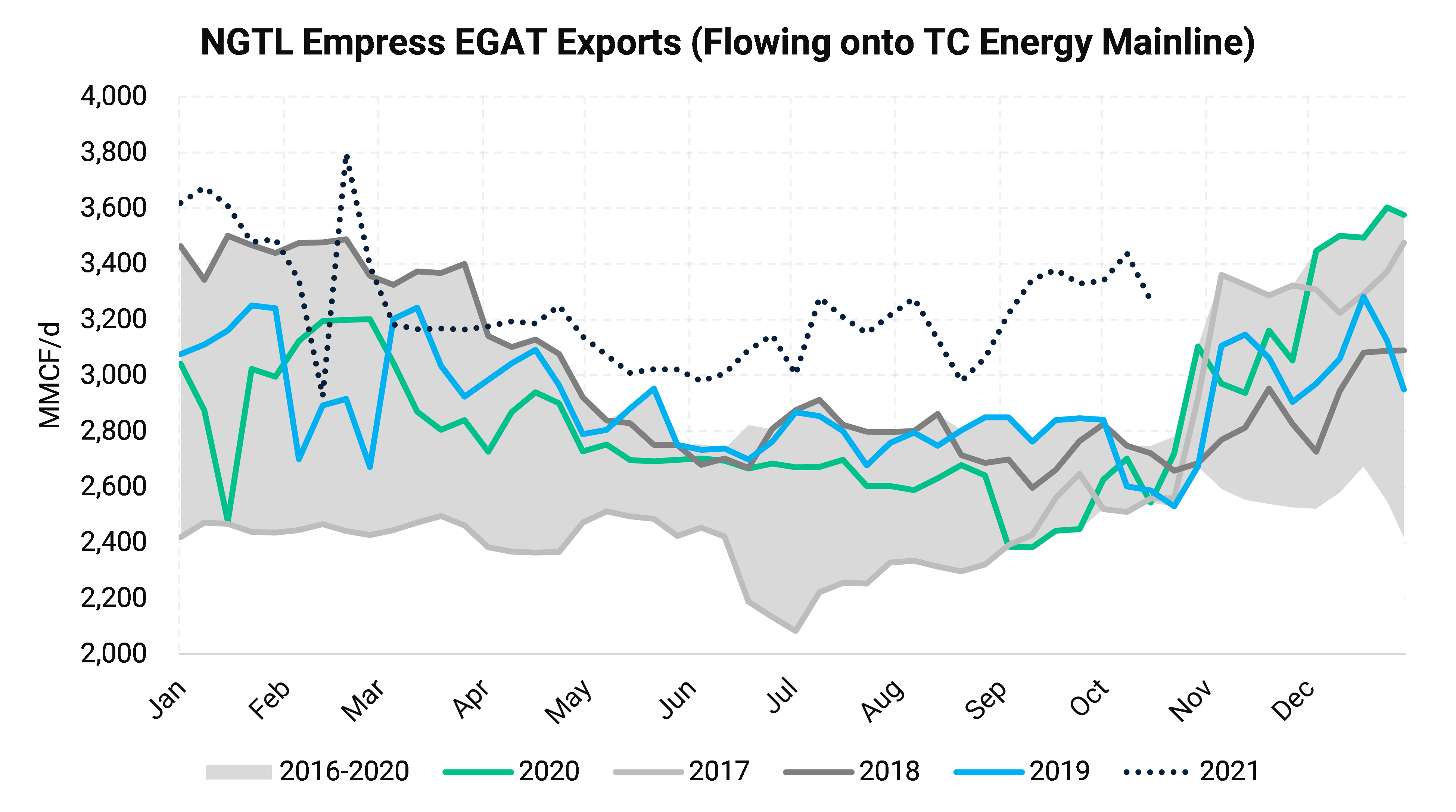

Demand for WCSB gas comes in two forms – intraprovincial demand and export demand. On both fronts, demand has outperformed expectations. Intraprovincial demand has benefitted tremendously from the growth in the oil sands as well as from the transition from coal to natural-gas-fired power generation. In fact, with (or perhaps even without) some cooperation from Mother Nature in the form of a normal to cold winter, we could set some intraprovincial demand records this winter. Export demand to both Eastern Canada and to US markets has been equally impressive.

|

| Source: TC Energy, AEGIS Research |

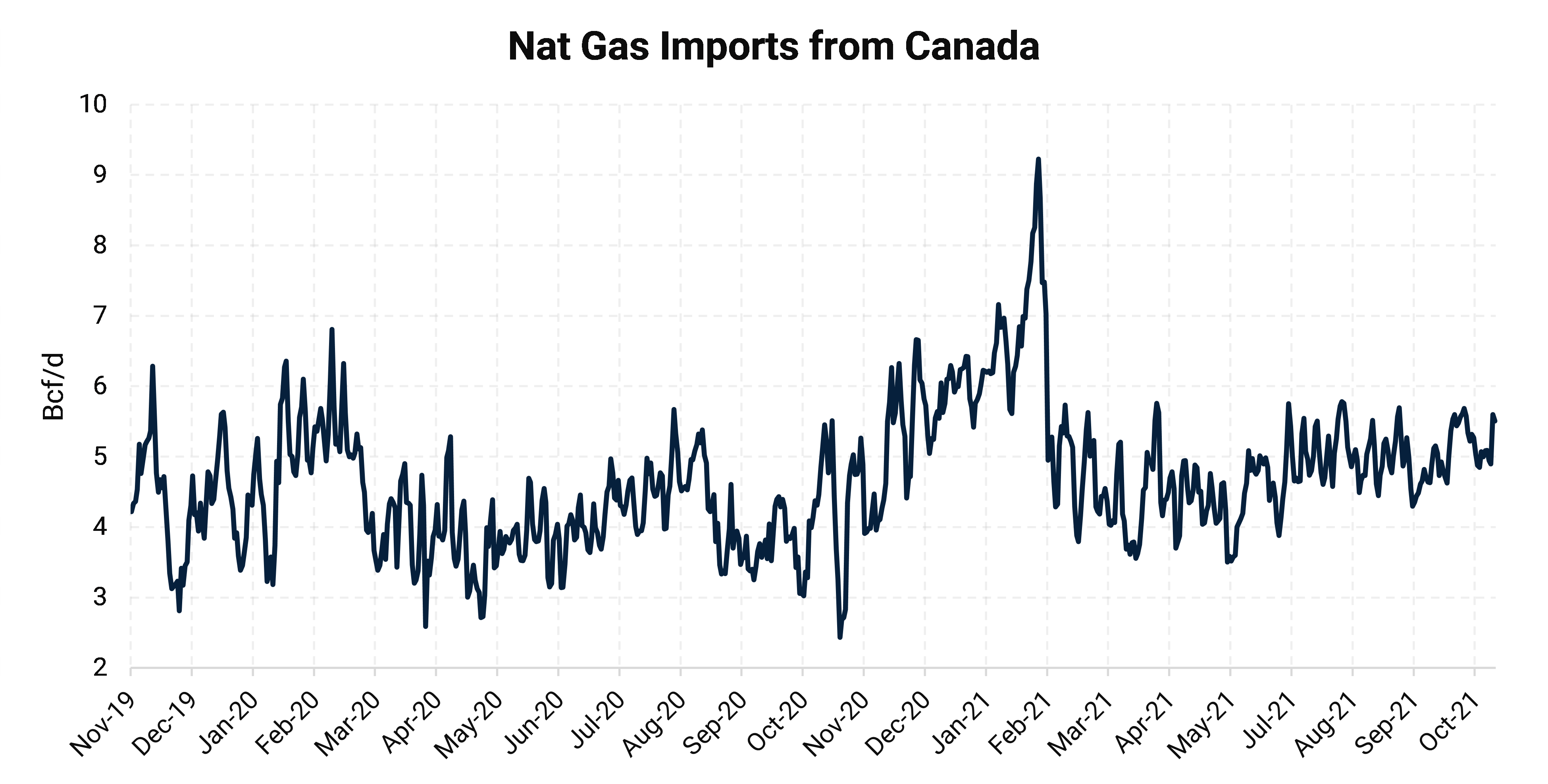

|

| Source: PointLogic, AEGIS Research |

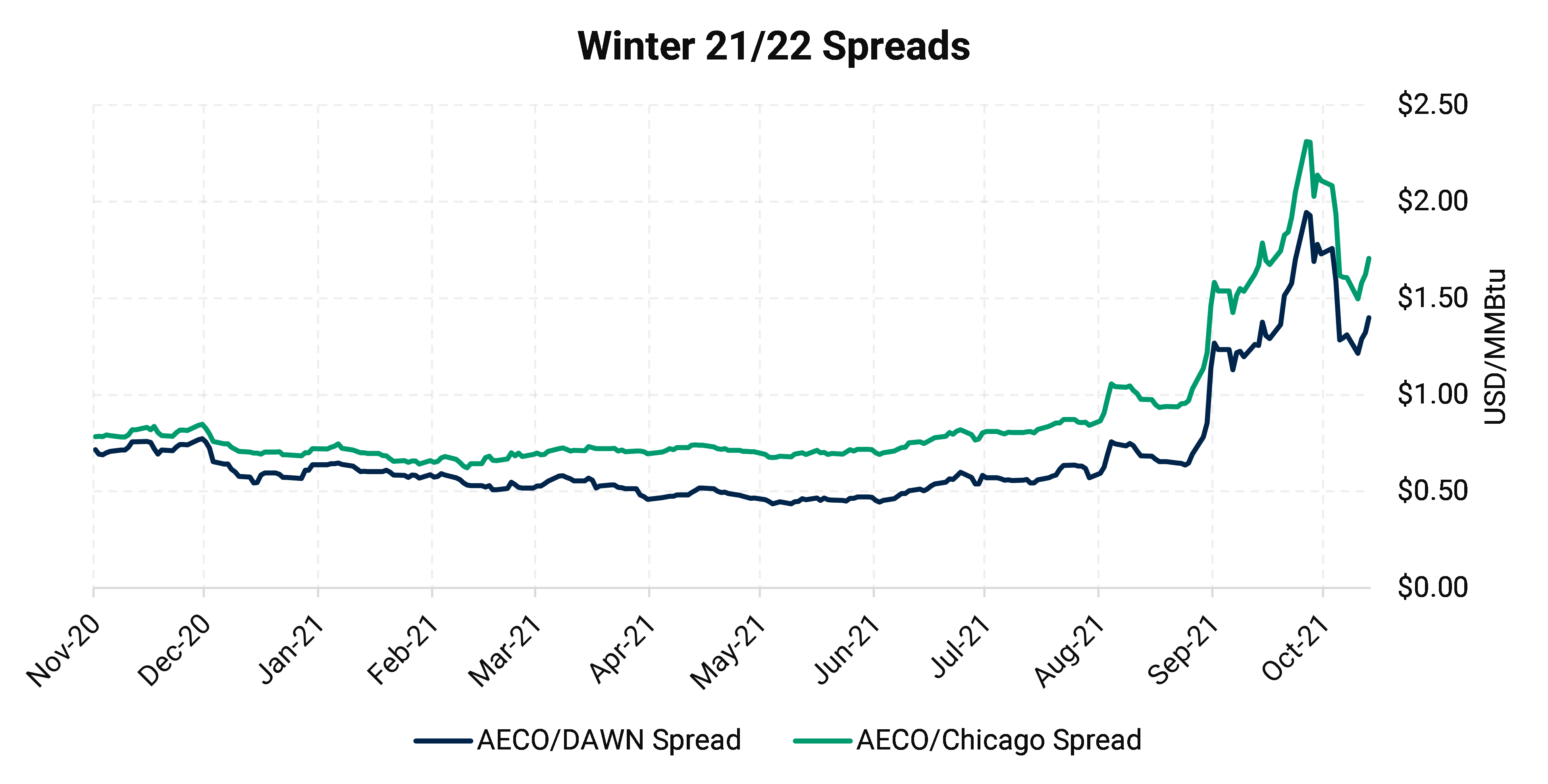

WCSB gas that isn’t consumed in the local market is primarily shipped to three markets – Eastern Canada, the US Midwest, or the Pacific Northwest. In an arbitrage-free world, the difference between AECO and the other basis points should be the all-in cost of transportation between the markets, but the world isn’t arbitrage free, and the price between points is and will always be dynamic.

The winter spread between AECO and Chicago, and AECO and Dawn has caught our attention recently, mostly because it shines a light on AECO’s relative weakness. At the beginning of September, the AECO-Chicago spread was trading just under the $1 USD/MMBtu mark (Chicago over AECO) while AECO-Dawn was in the neighborhood of $0.65 USD/MMBtu – both reasonable when considering transportation costs to the Chicago and Dawn markets. The price volatility has been really interesting since then. Reaching a peak of $2.31 US/MMBtu $1.95 US/MMBtu for winter AECO/Chicago and AECO/Dawn spreads respectively, shows that AECO continues to experience extreme disconnections to North American gas markets.

|

| Source: ICE, AEGIS Research |

We attribute the widening of these spreads to three factors:

The combination of these factors has kept AECO weak relative to other basins, but has incentivized additional transportation contracting of varying tenors on both Alliance and TC Mainline.

The wide spread between AECO and these downstream demand markets will keep exports flowing until (1)AECO prices become high enough to incentivize the borders to close, or (2) gas prices decrease in the US. For out producer clients' sakes, we hope it’s the former.