So-called "collars" or "costless collars" provide effective price protection, but they give up access to the best potential prices. These structures are used to hedge the extremes, while letting prices float inside a fixed range. Collars are many companies' favorite structure, because the collar can obtain additional price participation that swaps alone would not allow.

A collar is an effective hedge tool for both the producer or consumer who wants or expects better prices (high for the producer; low for the consumer) for their business in the future, while achieving protection that may be required by a bank covenant or by a minimum budgetary success metric.

But, sometimes, they're not a good choice. The metric described below can answer that question.

|

Cap-Floor Index = LIFT / PROTECTION The Cap-Floor Index (CFI) is a simple metric that describes the degree of benefit a collar provides, in the context of its historical benefits. CFI is a ratio of the potential price benefit compared to the amount protected. |

One way to objectively determine the positive or negative impact of a collar is to quantify (in the case of a producer) the upside lift versus the downside protection afforded by the market. As an example, if the forward price of WTI is $40 and a producer purchases the $35 floor (put option), a "neutral" level for a cap (the strike of a sold call option) would be $45, so that the lift of $5 ($45-$40) is nearly the same as where the protection kicks in $5 ($40-$35). This seems fair and equitable: the hedger did not have to give up more upside than they gained in downside protection.

In this example, since both LIFT and PROTECTION = $5, the Cap Floor Index = 1 (100%). To contrast, if a producer only received $4 of Lift, to $44, in a $35 X $44 Collar instead of a $35 X $45 Collar, that means the CFI would be $4/$5 or 0.8 (80%). So for producers, a CFI below 100% would be "uneconomic" because the upside gap would be less than the downside gap.

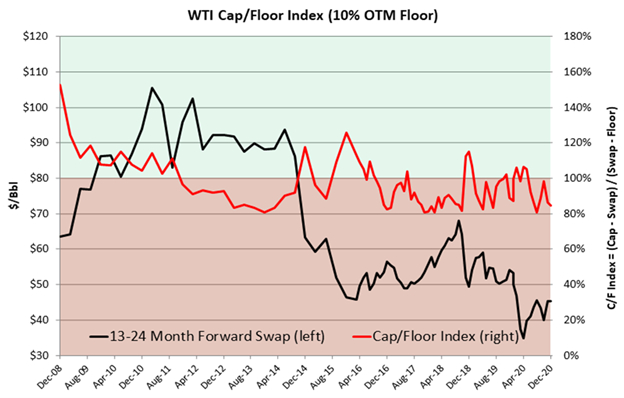

A way to add even more objectivity is to see what the market prices in historically to gain further insight into what is reasonable. The chart above tracks collar pricing back 12 years with the red line.Since 2017, WTI collars have mostly priced in a range between 80% and 100% on the CFI. At or above 100% (green shading) collars are a good "deal," in that they offer more benefit than cost. Below 100%, (red shading) the collar is less attractive.

That's why when the Cap/Floor Index is below 90% for oil, all else equal, we'd rather see the producer consider hedge by using a swap instead. Since swaps lock in prices immediately and remove any floating participation, the hedger can use a smaller amount of contracts to achieve similar price protection. For example, instead of hedging with 2 contracts per day of $40 X $49 collars, the effectiveness of a hedge with 1.5 contracts per day of $45 swaps may be functionally the same. Moreover, you avoid paying premia into the options market that may not be necessary.

Questions or comments, please contact us at research@aegis-hedging.com.