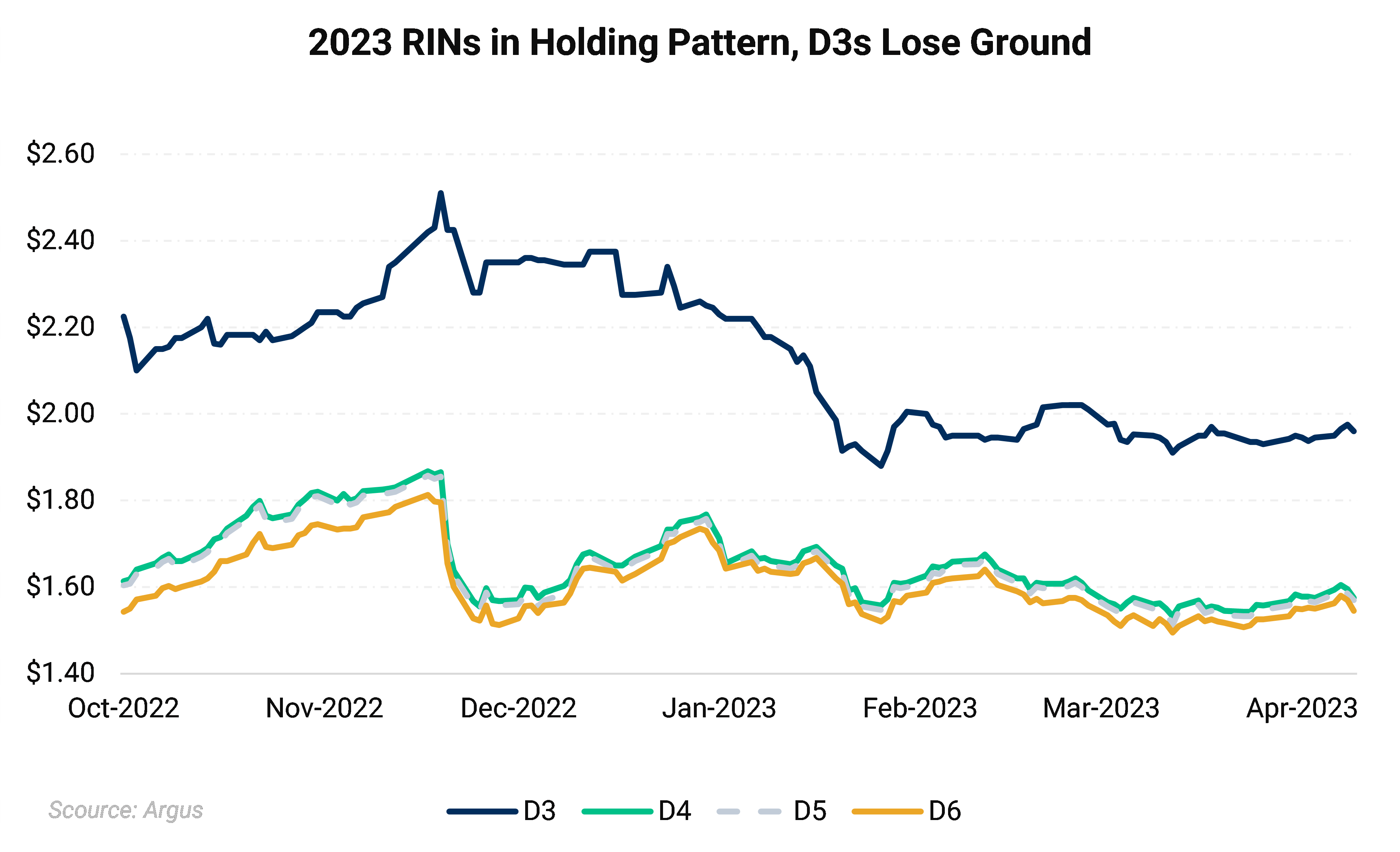

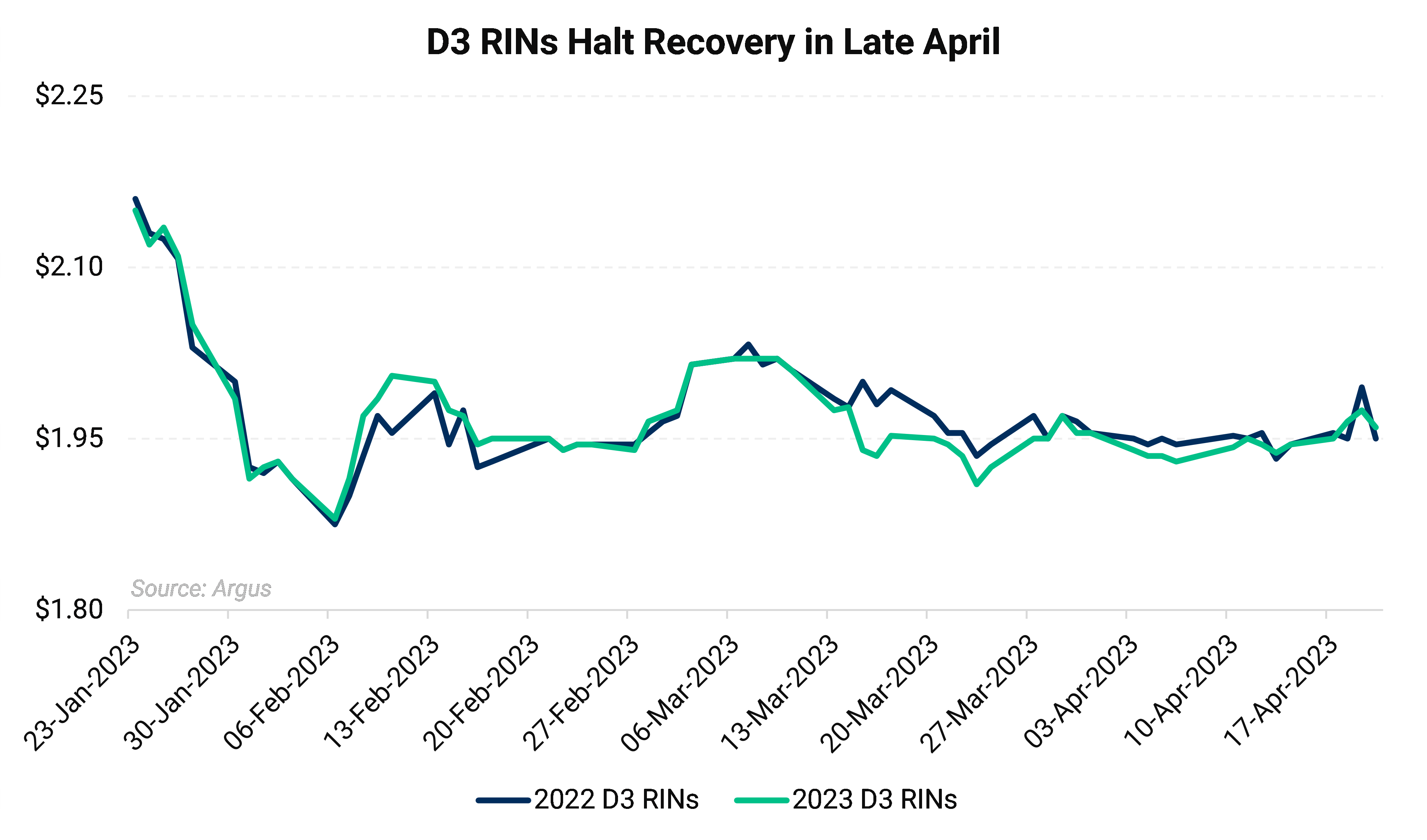

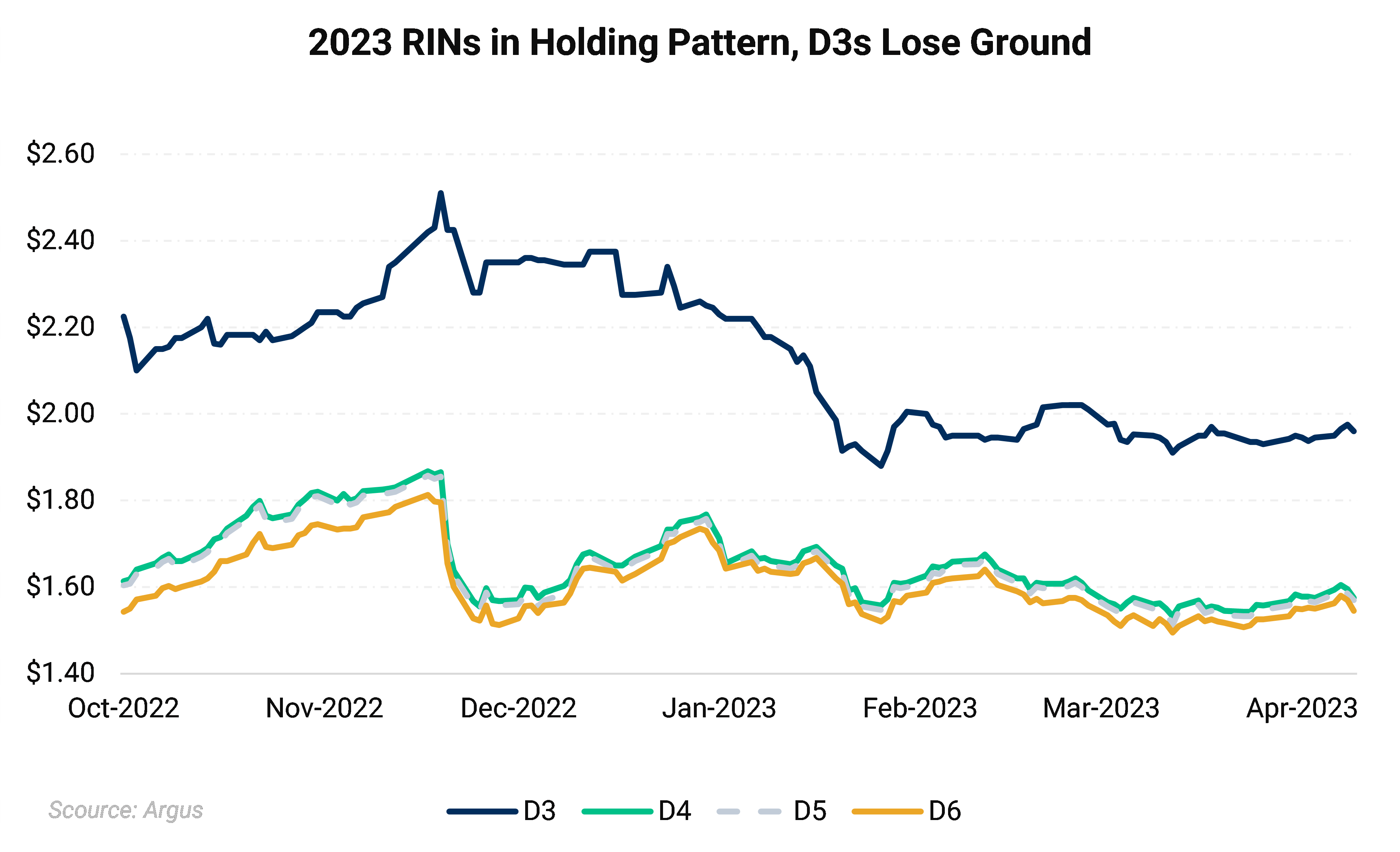

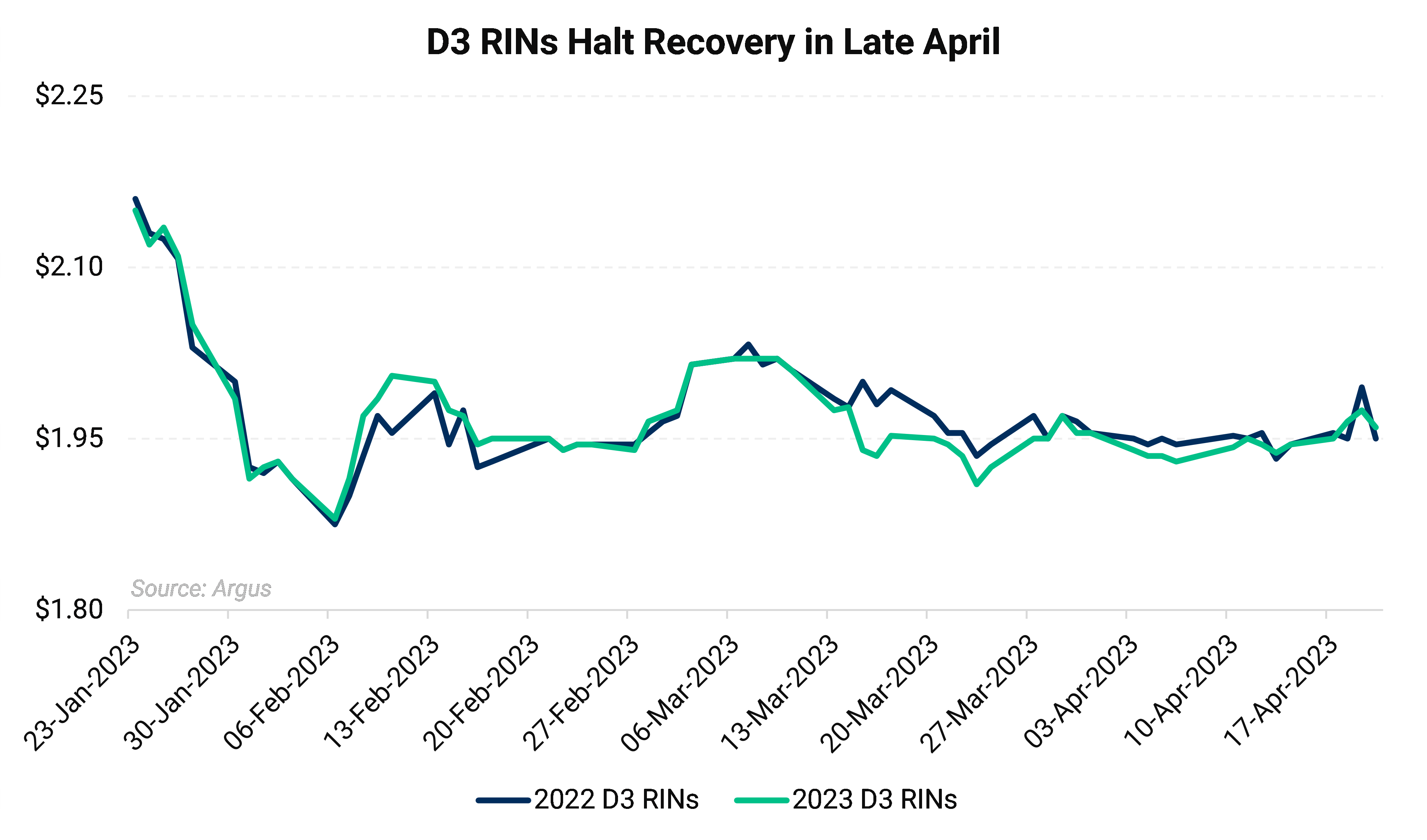

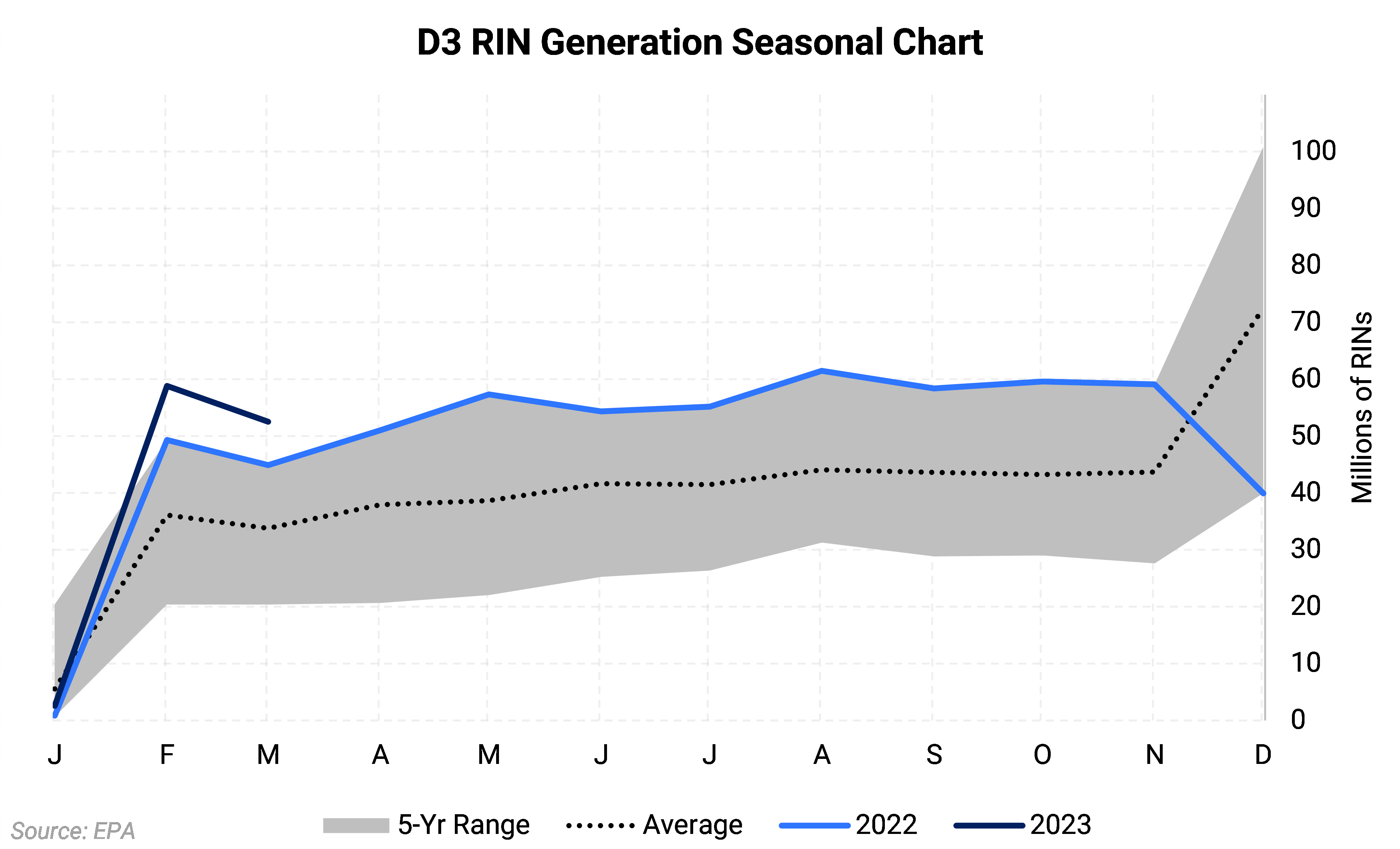

RIN prices kept to a holding pattern over the course of April, leaving prices nearly unchanged on a month-over-month average basis. Small movements in prior year credit pricing had outsized effects on inter-vintage RIN spreads. D3 credits remained the exception to a sideways market as current year vintage credits posted losses after creeping higher for two consecutive months. The market largely shrugged off bullish developments in the Small Refinery Exemption (SRE) sphere as March D4 RIN generation data came in at the highest on record. Talk among lobbyists hinted at higher advanced mandates in the EPA’s final set rule expected in mid-June, while the eRIN is anticipated to be watered-down or delayed.

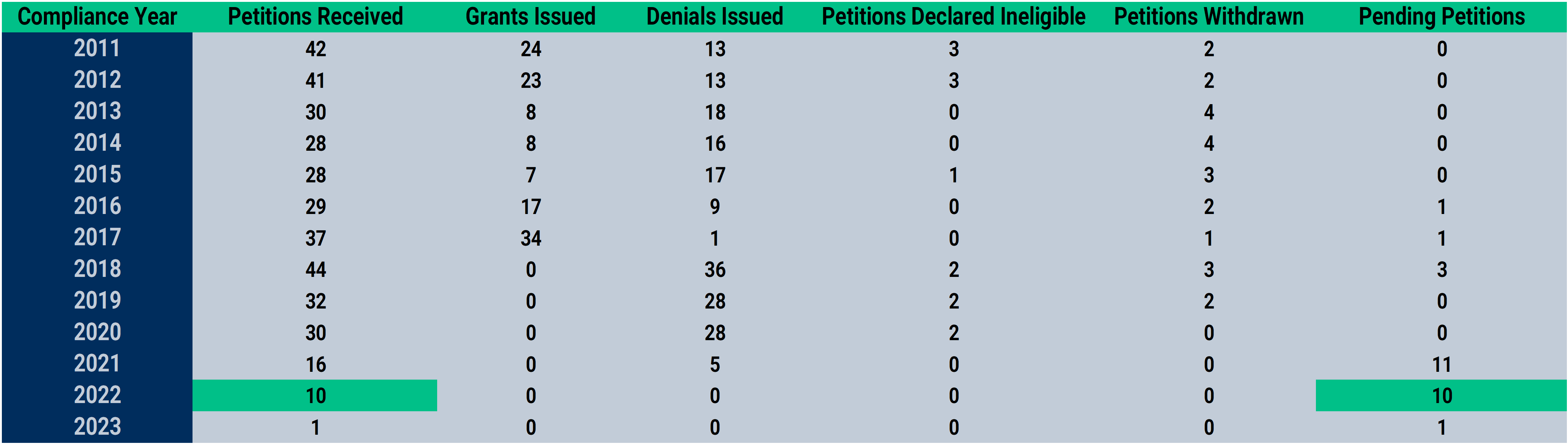

- News that United Refining was denied its SRE hardship waiver by the Third Circuit court proved moderately bullish to the overall RIN complex as the move adds additional demand to the marketplace.

- Trade organization Growth Energy entered comments in support of enforcing SREs in its case against the EPA. A full denial of all SREs would represent more than 1.6 billion RINs.

- Prior to the United Refining ruling, the approval by a federal court of a SRE for Calumet Special Products 30,000 b/d refinery in Montana provided bearish undertones to RIN markets.

- Two new SRE petitions for 2022 compliance year, bringing the total outstanding SREs to 27.

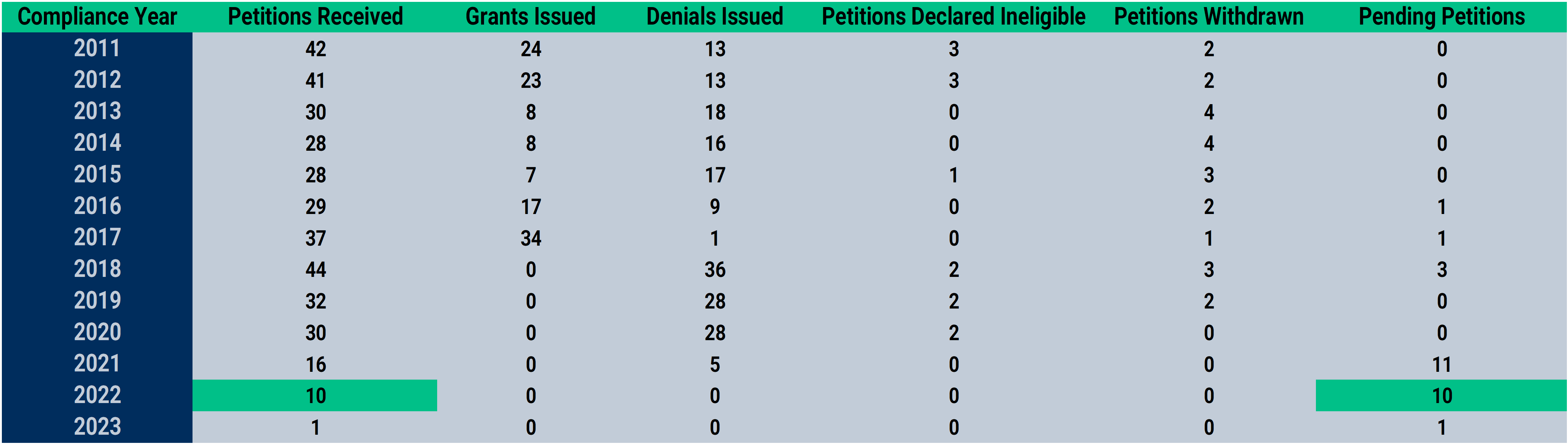

- Earlier this year, a court ruling halting compliance obligations for two refineries with SRE petitions signaled the chance for a pivot in the EPA’s approach on SREs.

- Notes from the court were strongly in favor of granting the SREs, as the court made it clear it intends to handle SREs as originally intended by the RFS—i.e. waive RFS compliance if undue hardship can be demonstrated—and to allow waivers which were issued in an “unlawful retroactive application.”

- The EPA retroactively overturned 69 Trump-Era SREs starting in April of last year by denying 31 SRE waivers for 2018 and then denying all SRE petitions for 2016 through 2020. Denying SREs is bullish for RINs markets as refiners must enter the marketplace to purchase RINs to cover compliance obligations which were originally waived.

- EPA Administrator Michael Regan issued comments at a House Agriculture Committee hearing that the request by eight Midwest states requesting year-round sales of E15 should be completed in time for the 2024 summer driving season. Regan noted concerns over “a significant disruption in consumer pricing” as the move would require a specific lower octane gasoline to be produced for consumption in those states. Creating a new boutique grade will be more expensive and leave gasoline markets more prone to shortages and volatility.

- Regan’s comments also indicated the EPA is likely to cave to both industry and lawmaker pressure to increase the advanced biofuel mandate in the final ruling.

Calendar:

Relevant News:

- Parkland Corp. announced its decision to halt its renewable diesel project in British Columbia, Canada. The company had been coprocessing at its Burnaby Refinery with plans to build a 273,000 gallons/yr RD facility, set to come online in 2026. The company cited rising feedstock costs and advantages to US producers afforded by new credits carved out in the Inflation Reduction Act (IRA). The move could be a harbinger of slowing momentum for the RD industry which has increasingly worried about rising feedstock costs, while the numerous advantages of the US market are likely to open export markets soon.

- The Washington State Senate passed a Sustainable Aviation Fuel (SAF) tax credit, following actions from the state of Illinois which issued its own SAF credit with additional tax advantages for the fuel. Washington aims to establish a $1/gallon credit with a $2/gallon cap as additional value can be earned for fuels with lower carbon emissions. The Illinois SAF credit is set at $1.50/gallon and will run from June 1, 2023, through June 1, 2033, making the state the highest returning market for SAF.

- Vertex expects to complete its 10,000 Bbl/d Mobile, Alabama renewable diesel facility by the end of this month, with production set for the second quarter. Vertex aims to boost capacity to 14,000 b/d in late 2023, an expansion originally planned for 2024.

- FutureFuel Corp. is considering halting biodiesel production citing rising feedstock prices, uncertainty on the permanency of certain federal tax credits and heavy competition from the renewable diesel industry. The company owns a multifeed, 59mn gallons/yr biodiesel plant in Batesville, Arkansas.

- The UK received its first renewable diesel import on March 30 to Valero Cardiff following a decision to lift import tariffs on US RD. The move presages growing export opportunities for competitive US RD product.

- Shell scrapped plans for a 550,000 t/yr RD and SAF facility in Singapore. While no rationale was put forth, feedstock supply and the lack of mandates throughout the Asia Pacific region are likely culprits. While feedstock prices have been falling, recession fears have also been weighing on diesel values, limiting margin growth.

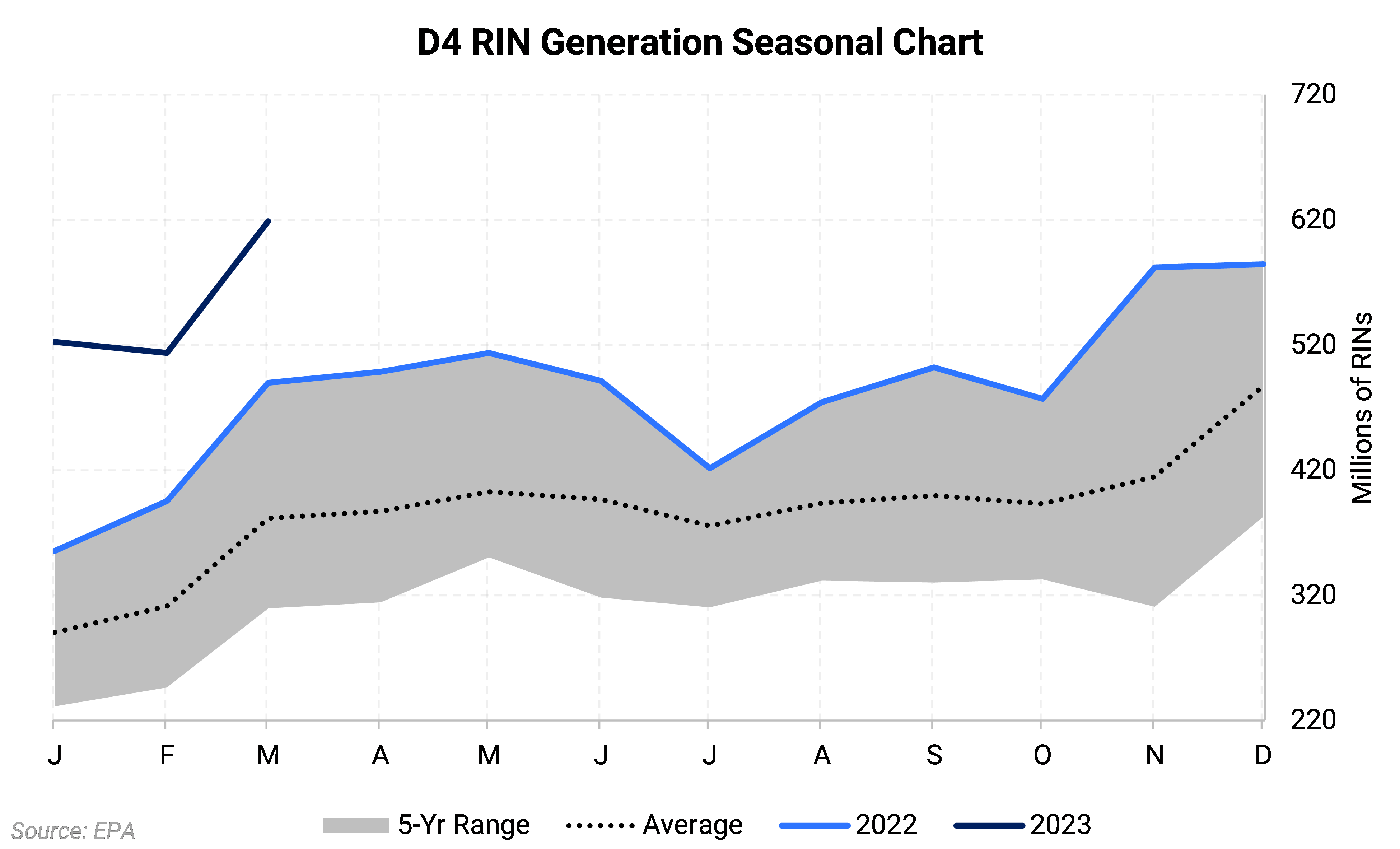

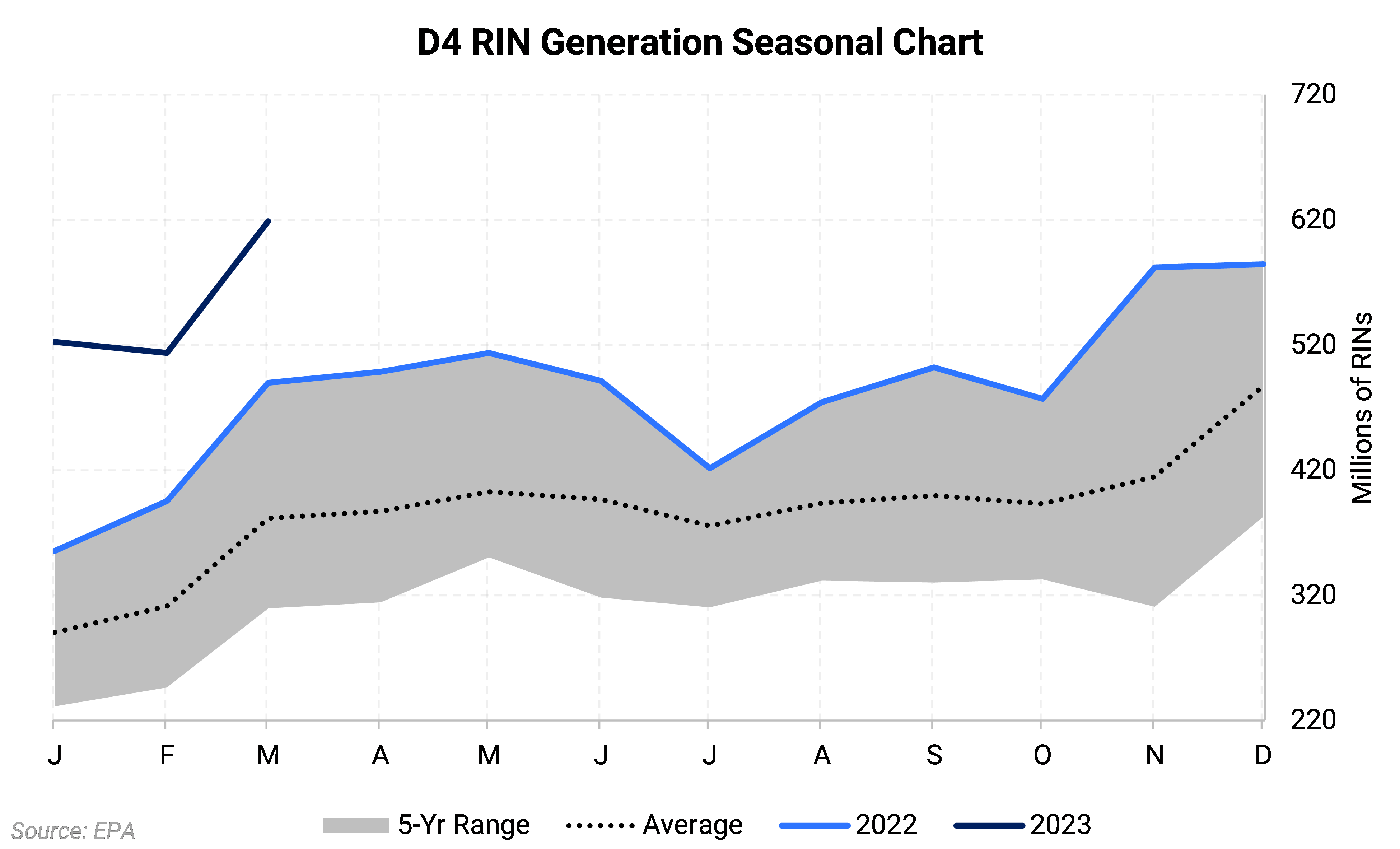

RIN markets settled into a holding pattern relative to April as the market stuck to the sidelines awaiting the final ruling. Headlines proved directionally mixed, hindering players from taking significant positions. D3 credits lost modest value on a month-over-month basis after inching upward for two consecutive months. Comments from EPA Administrator Regan hinting at a higher finalized advanced mandate were modestly bullish D4 credits yet were largely offset by record D4 RIN generation for the month of March.

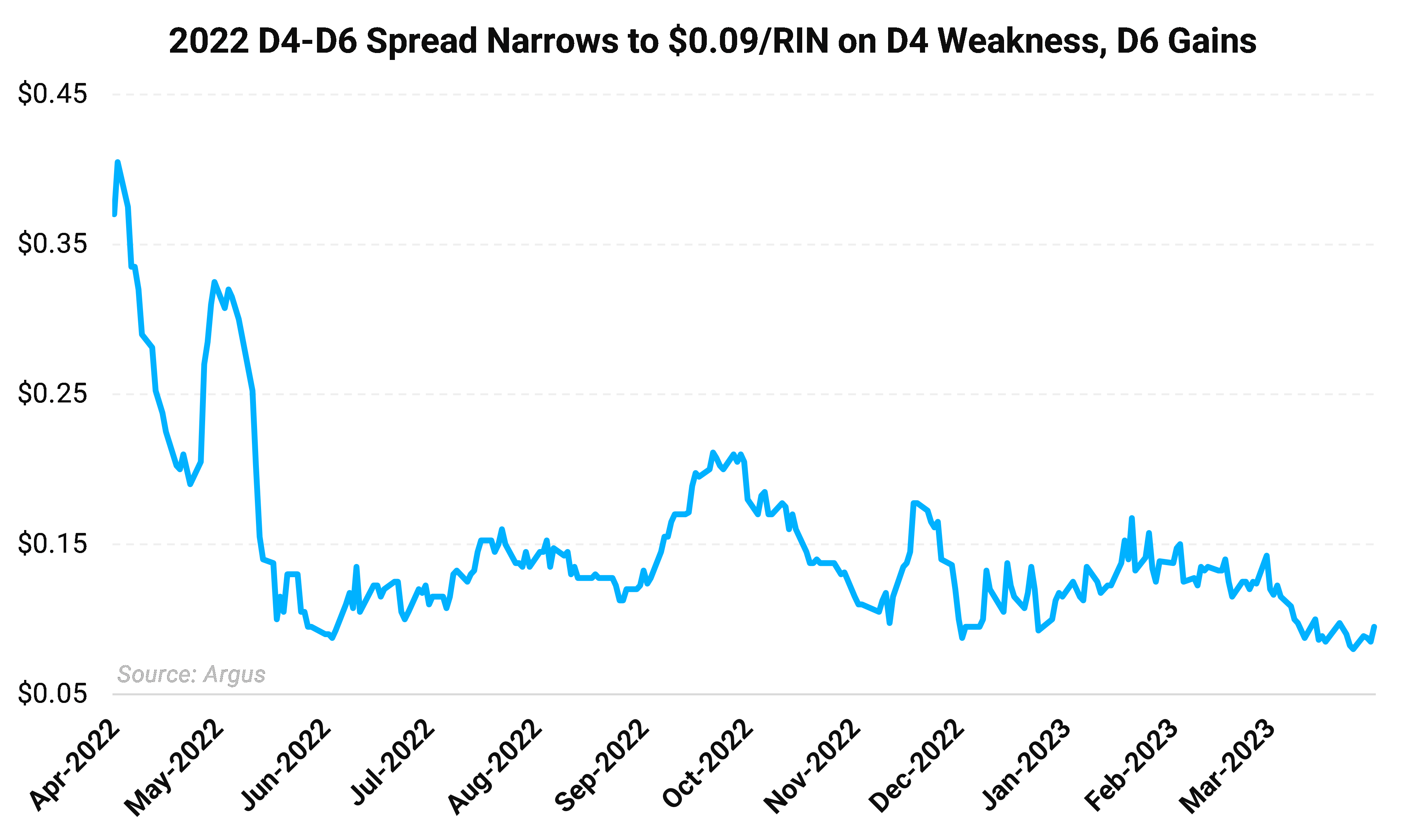

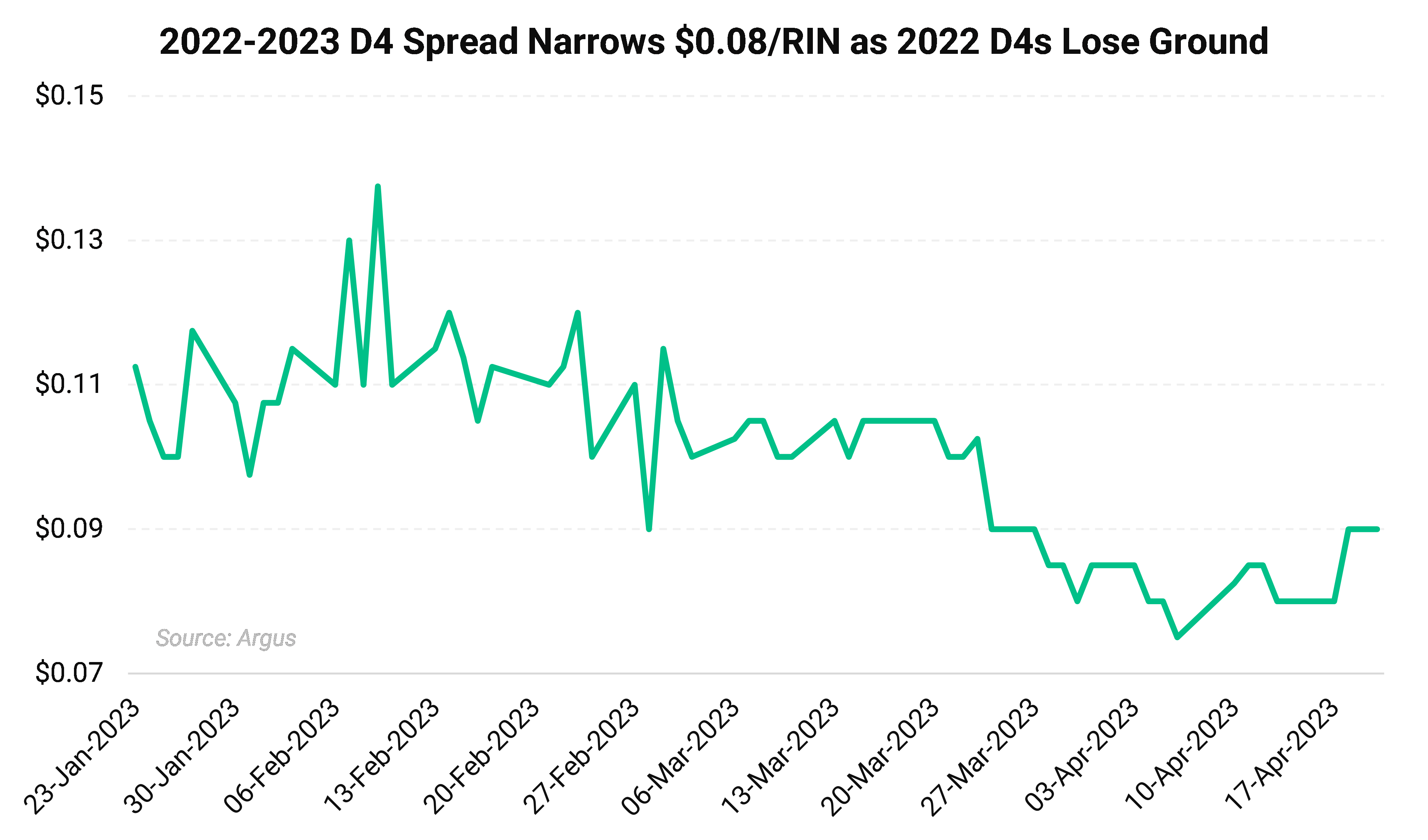

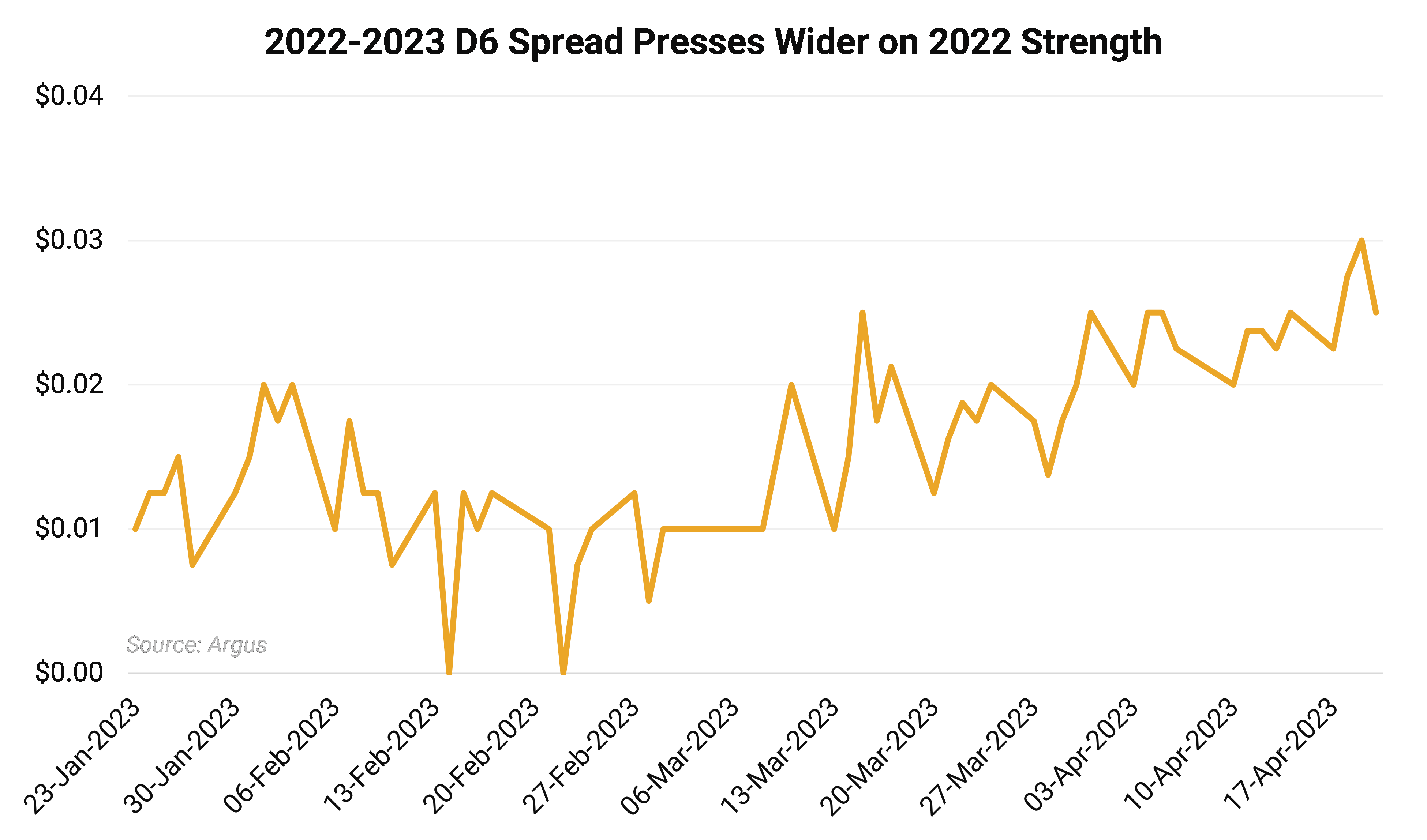

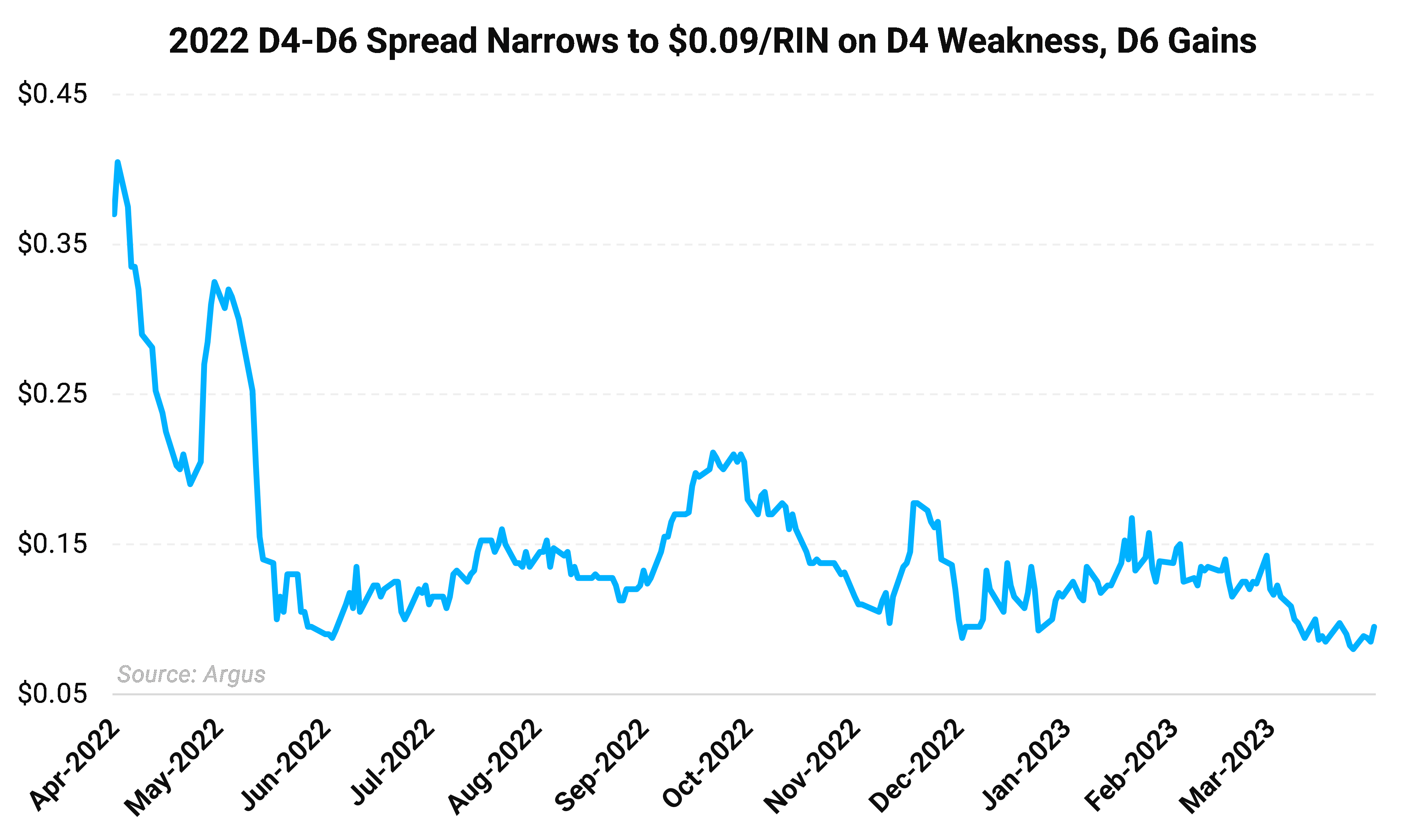

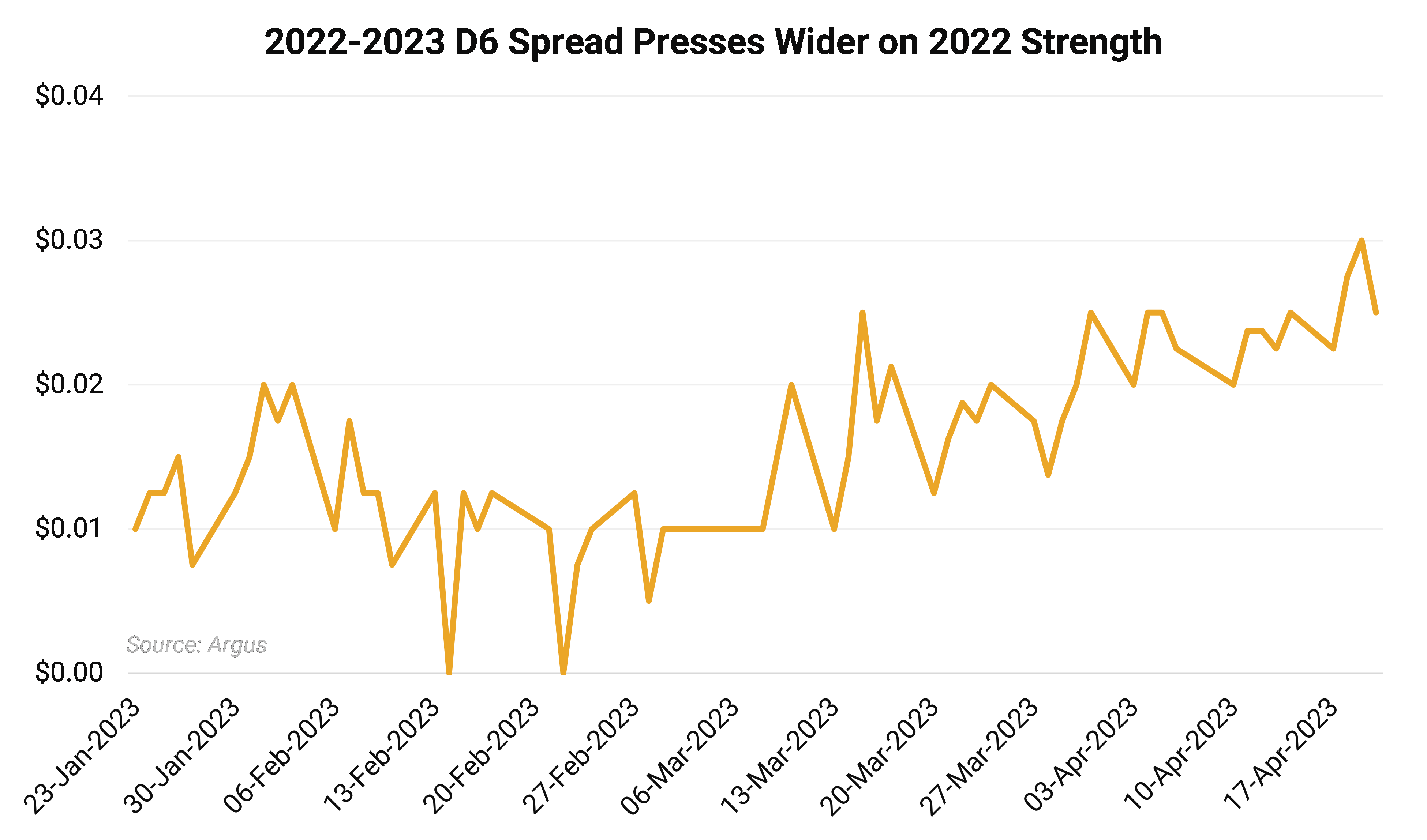

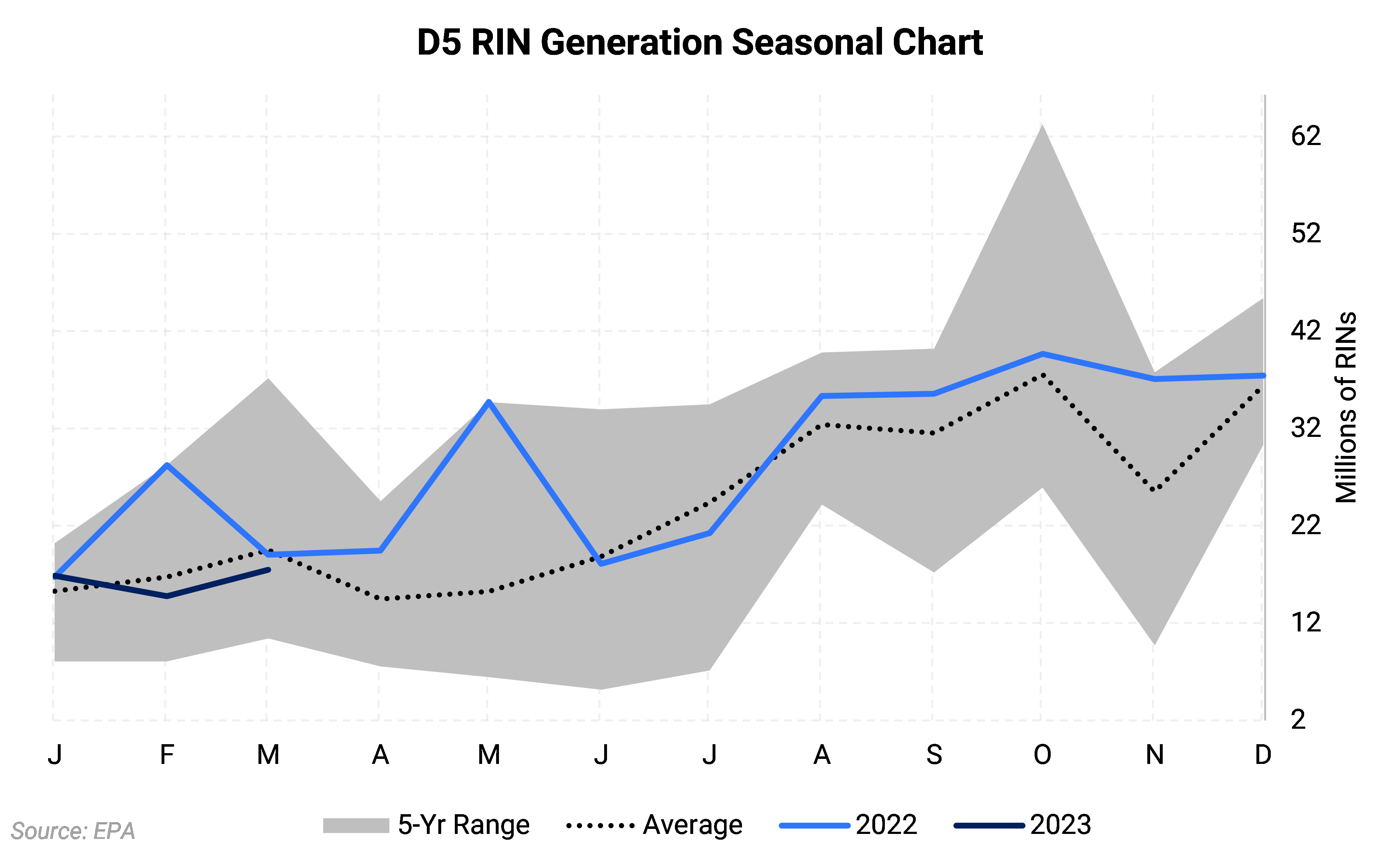

While 2023 vintage RINs were largely stagnant, 2022 credits saw weaker D4 and D5 credits against stronger D6 RINs, likely a result of the United Refining SRE denial. D4 RINs shed nearly $0.017/RIN on the month against D6 gains of $0.015/RIN. 2022 D3 credits shed almost $0.03/RIN. This made for outsized moves in inter-vintage and D-category spreads.

The 2022 D4-D6 spread spent the bulk of the month just under the $0.09/RIN mark as modest D4 losses were met with marginal D6 gains. The spread narrowed more than $0.03/RIN from March’s $0.12 level.

A wider D4-D6 spread implies a looser D6 supply as the D4 credit is the next vehicle of compliance in the absence of sufficient D6 RINs or the ability to use carryover credits. Conversely, a narrow D4-D6 spread implies a tight supply of D6 RINs. The theoretical cap on the spread is parity though D6s have traded at modest premiums to D4 credits in extreme circumstances.

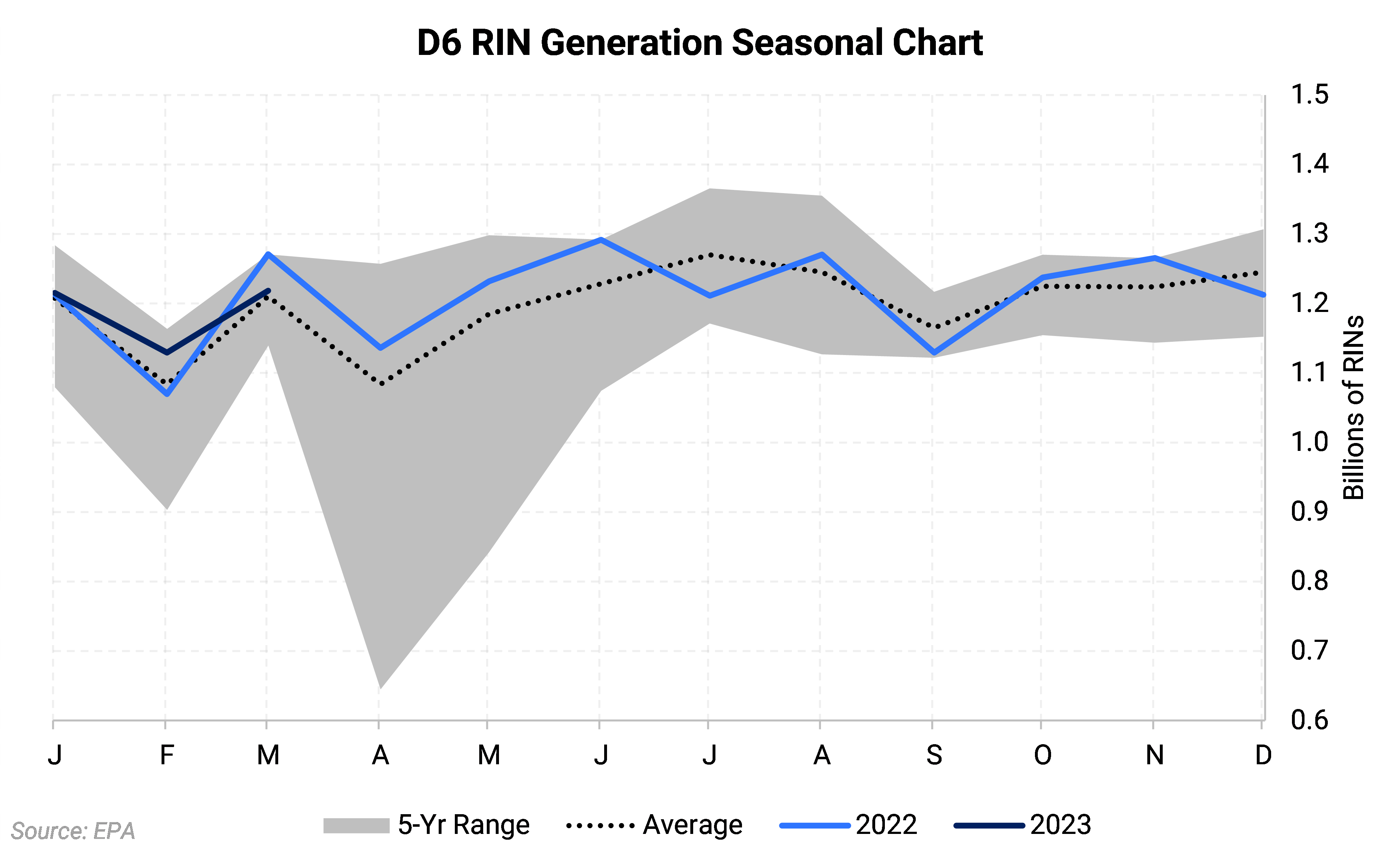

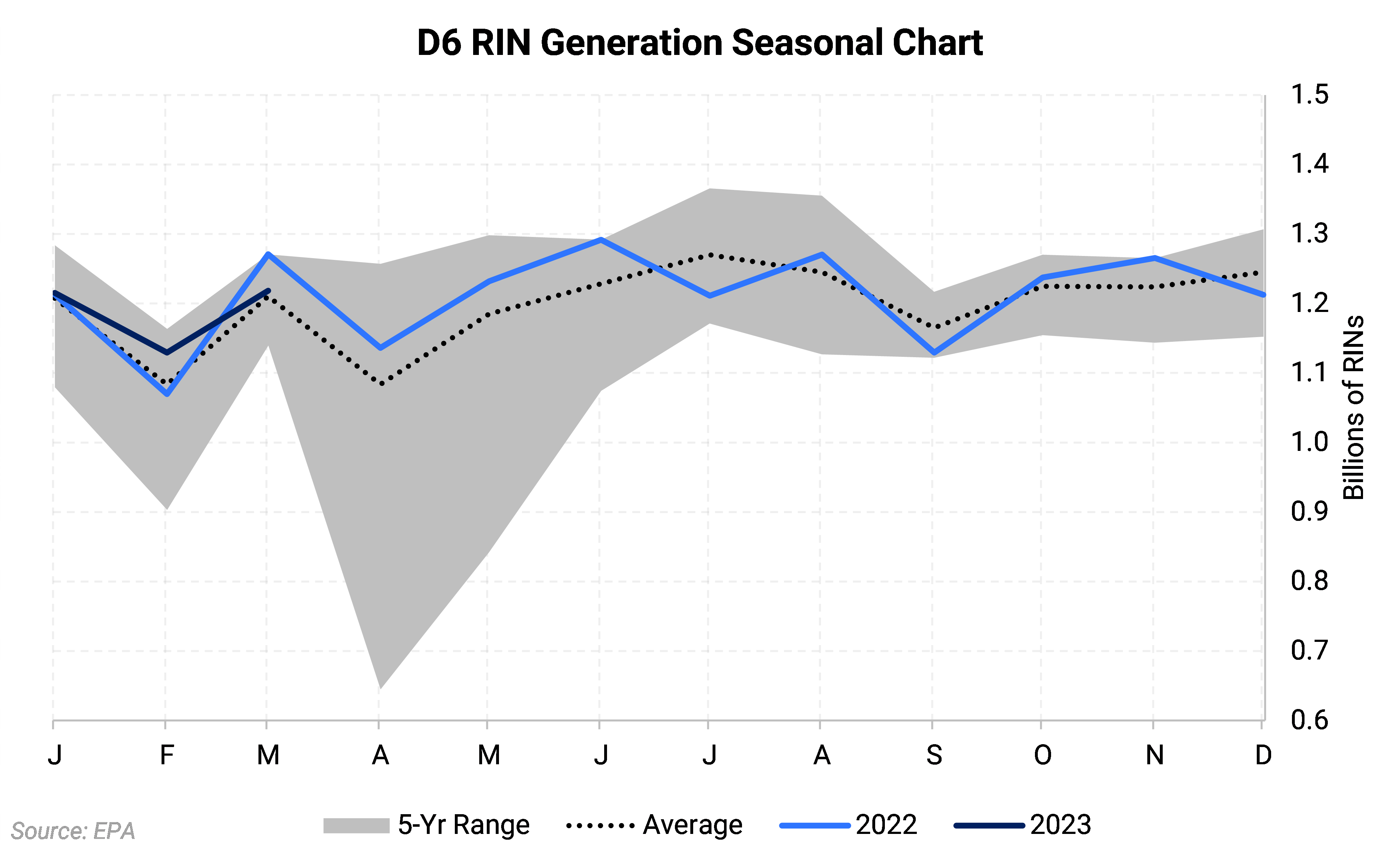

D6 RINs found support in a fresh SRE denial and as RIN generation data shows the US on pace to miss D6 compliance by approximately 1bn credits. Further gains were limited amid comments that year-round E15 blending in eight Midwest will likely be approved by summer 2024.

Amid state and regional petitions for year-round E15 usage, recent government data confirmed the US is consistently able to blend in excess of the 10% blendwall even during the summer season when ethanol blending is constrained by RVP.

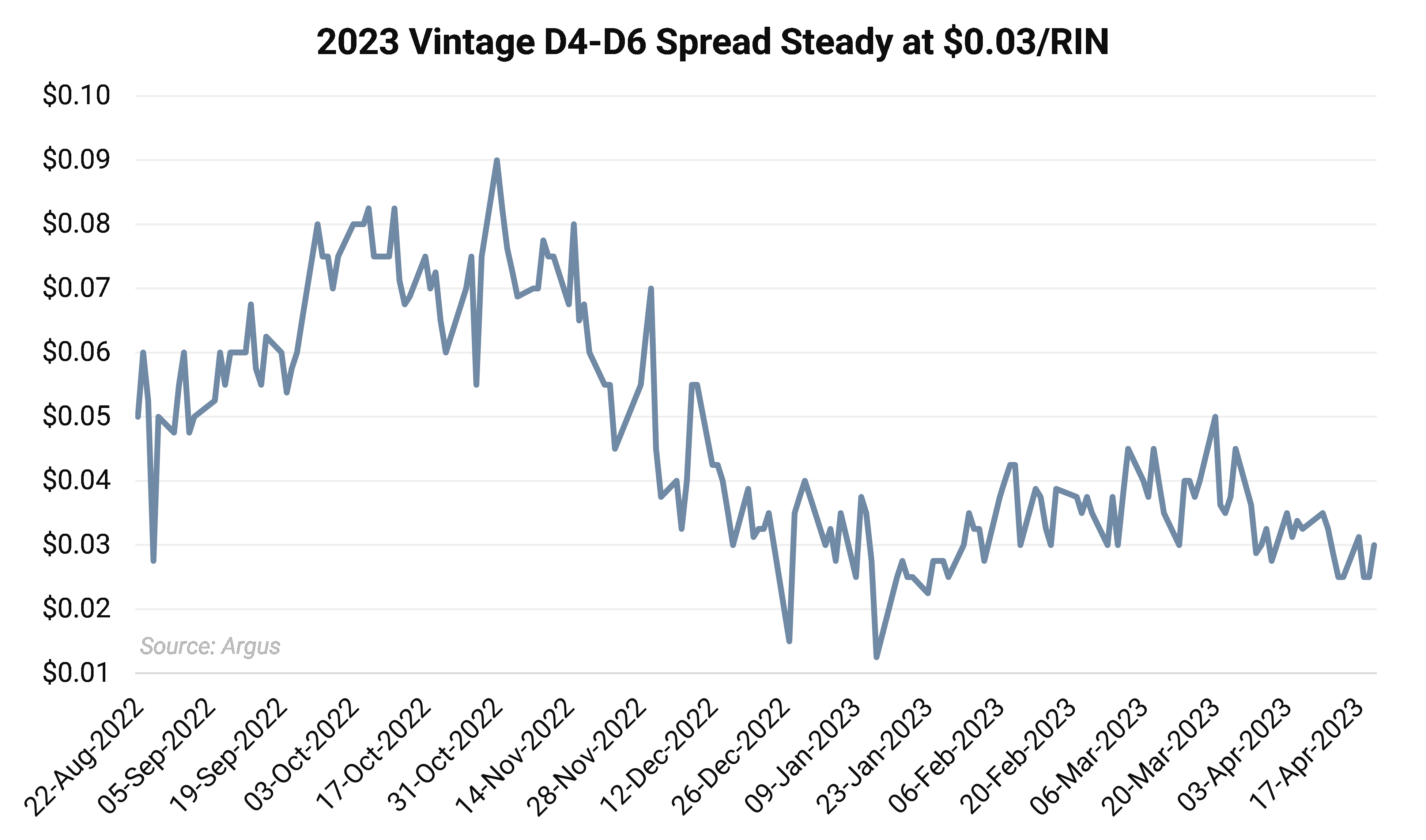

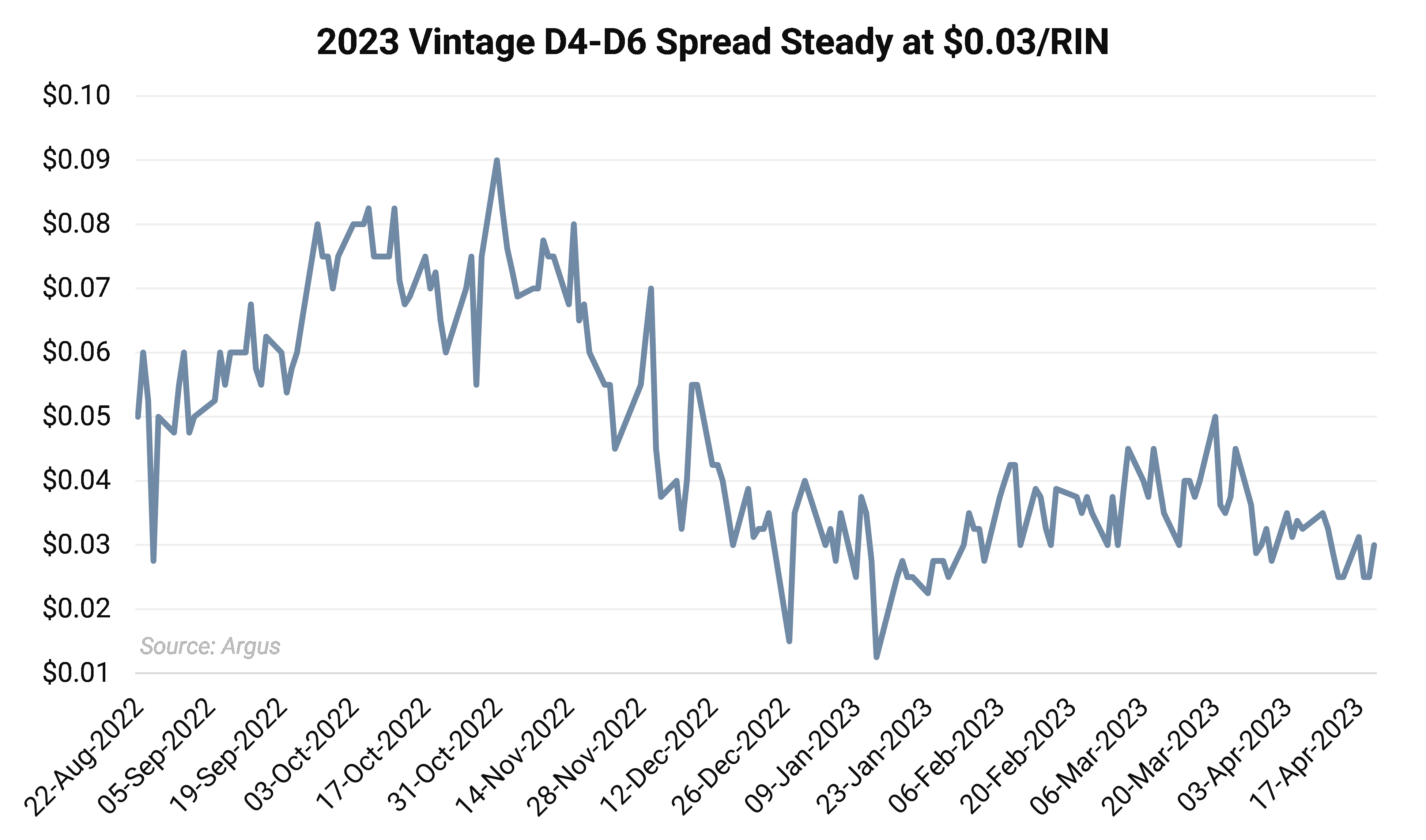

The 2023 D4-D6 spread narrowed marginally over the course of the month to average $0.03/RIN as the D6 market tightened up relative to D4 credits.

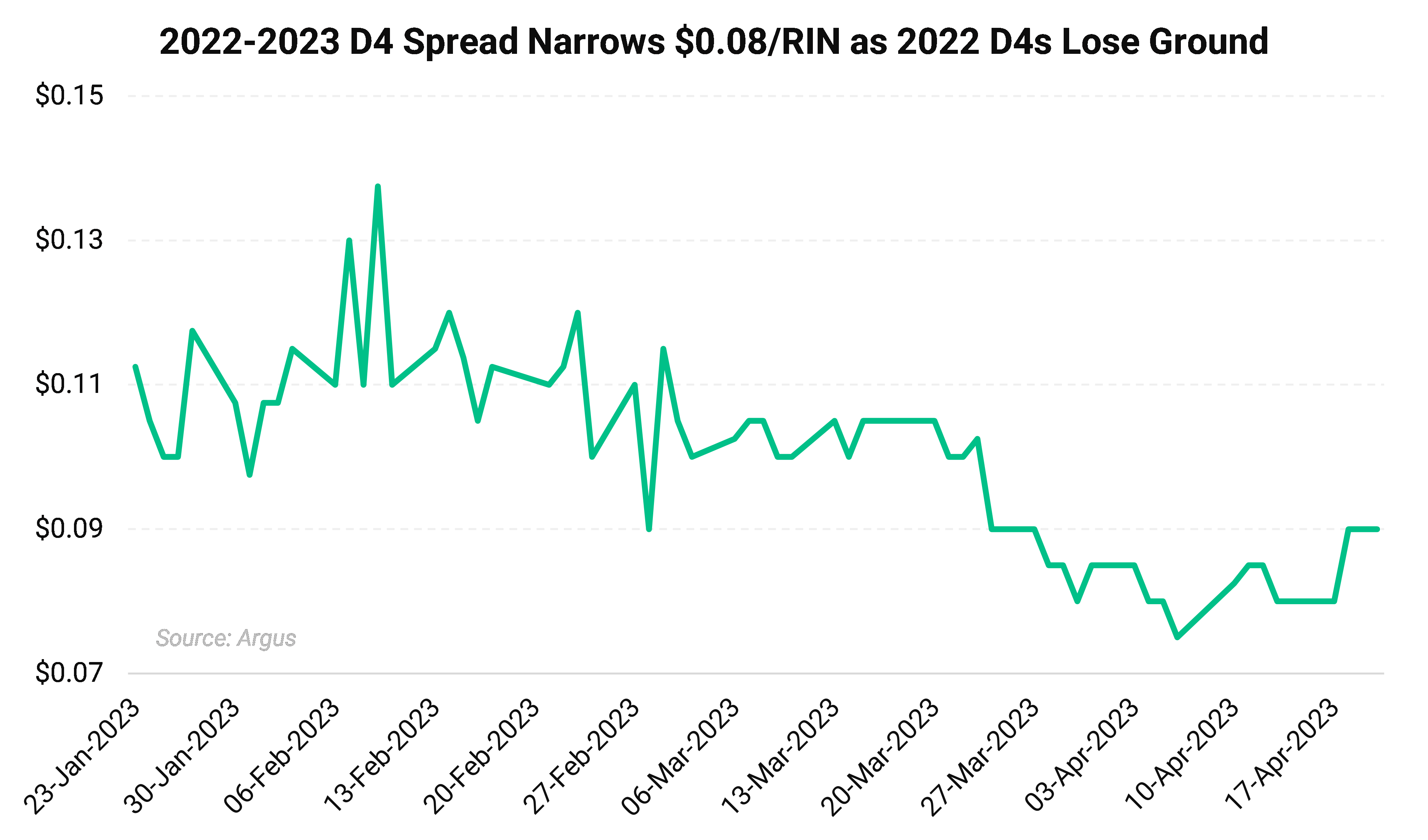

The inter-vintage D4 RIN spread narrowed to just over $0.0.8/RIN on average as losses in 2022 D4 credits were met by stable 2023 D4s. Expectations of a larger final advanced mandate were countered by record March D4 RIN generation and the opening of export markets for US renewable diesel.

The 2022-2023 D6 spread widened throughout April amid strength in the 2022 vintage against stable 2023 D6s. The spread only reached as narrow as $0.03/RIN late in the month.

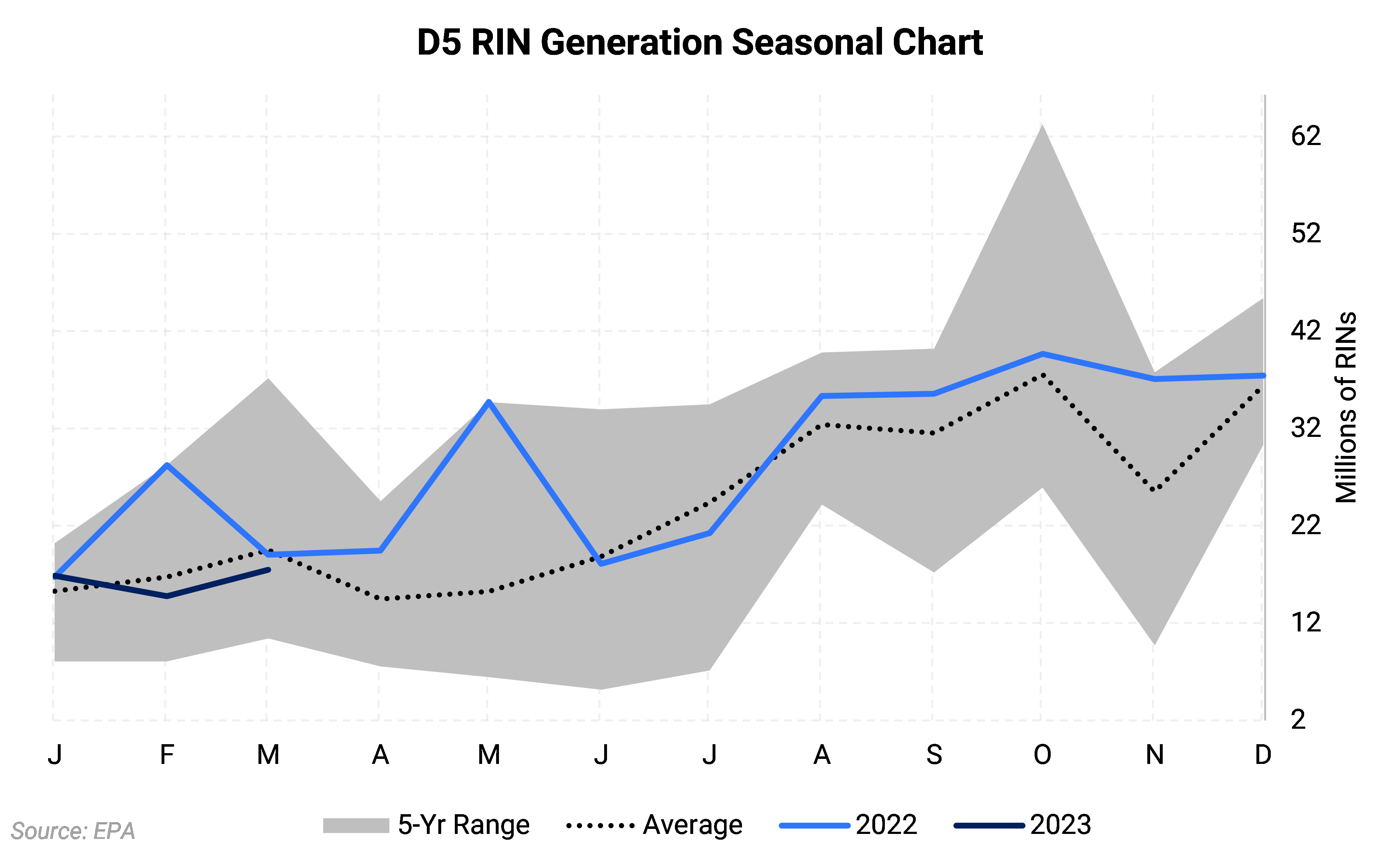

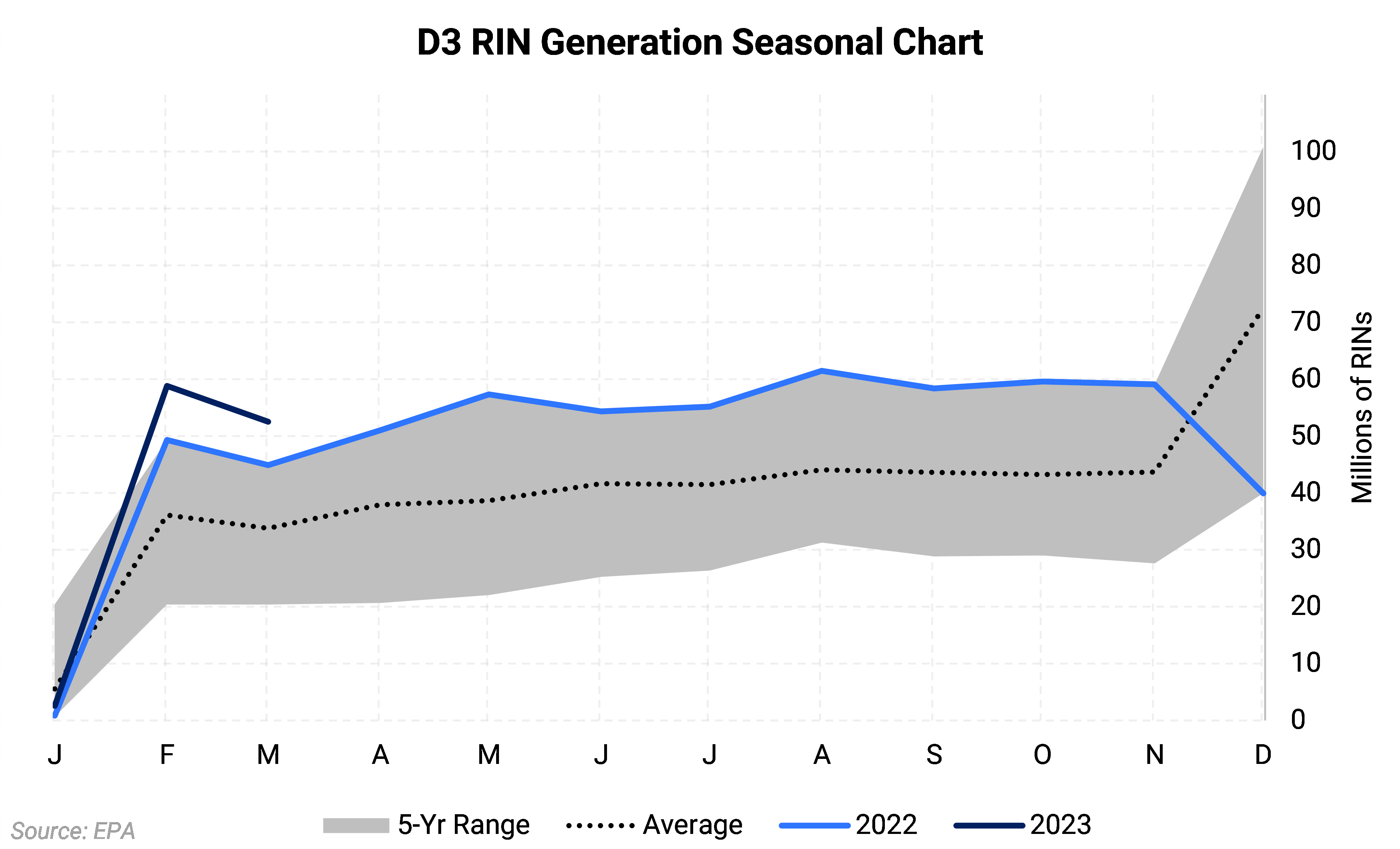

EPA RIN Generation Data as of April 20:

EPA Small Refinery Exemption (SRE) Data as of April 20:

Some of the price and regulatory risk in the development of the renewable fuels markets is controllable through hedging or pre-selling. Other risks require constant monitoring of pending changes to regulations and programs. AEGIS can help with both.

Interested in receiving these updates directly to your inbox?