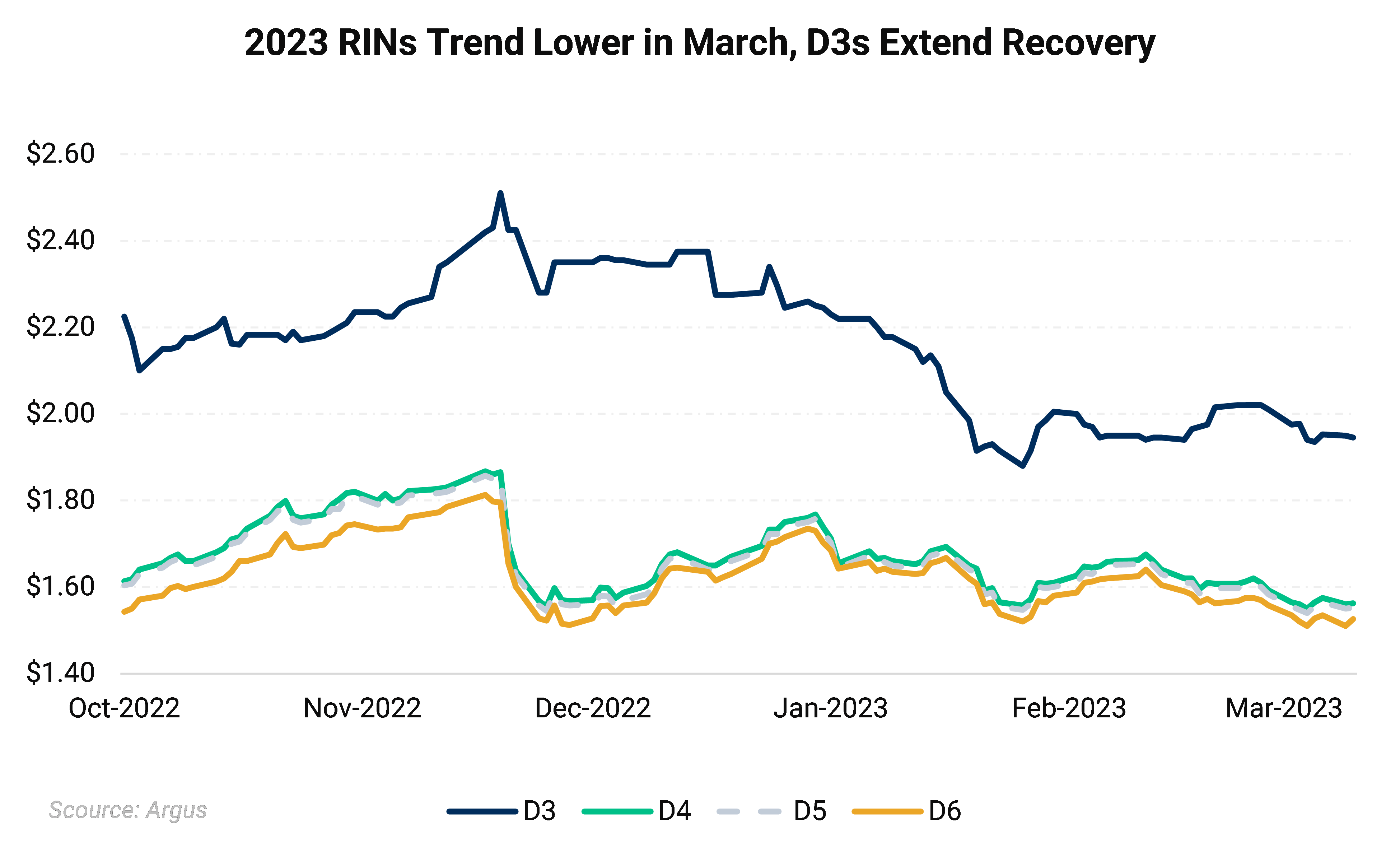

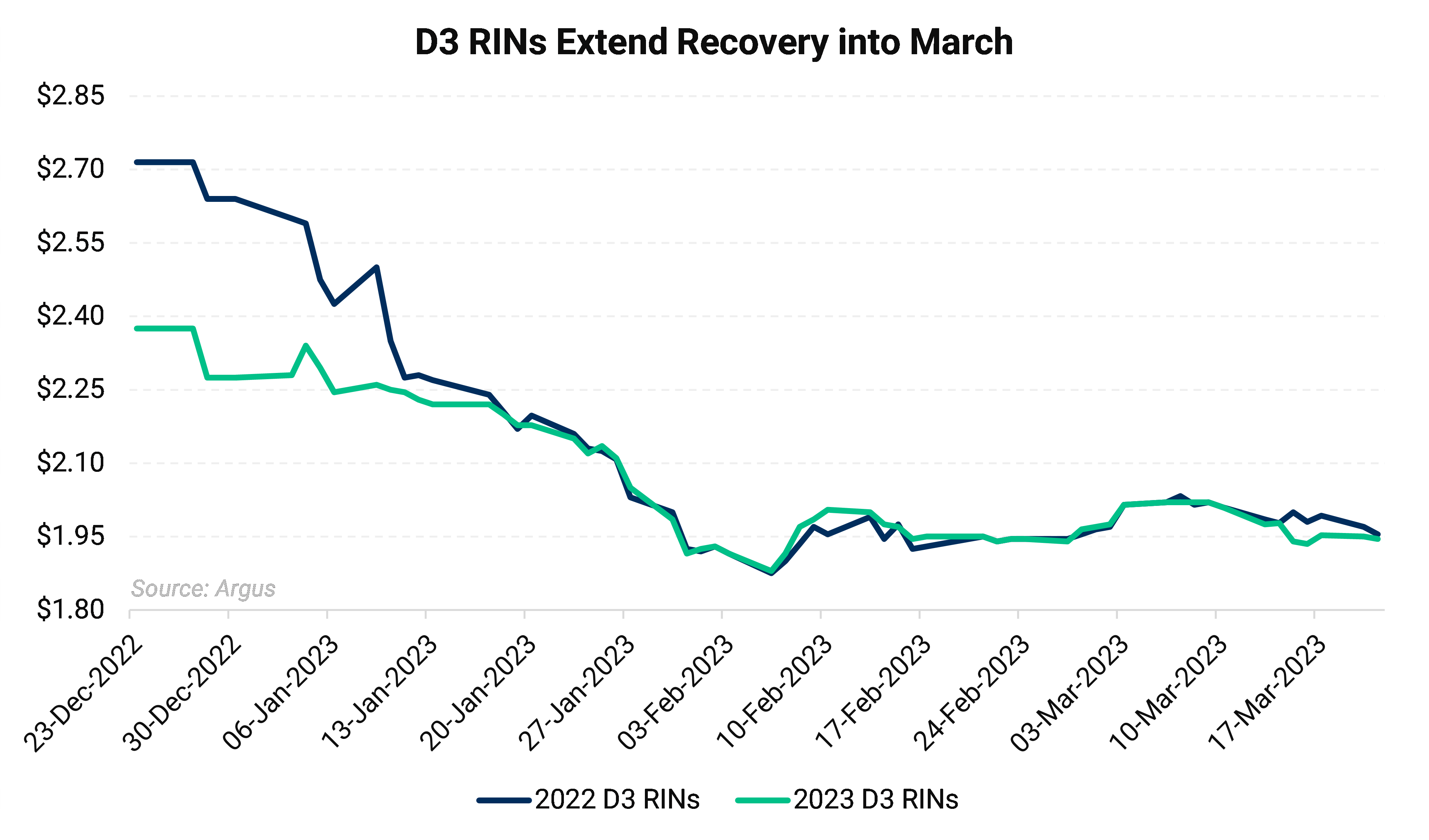

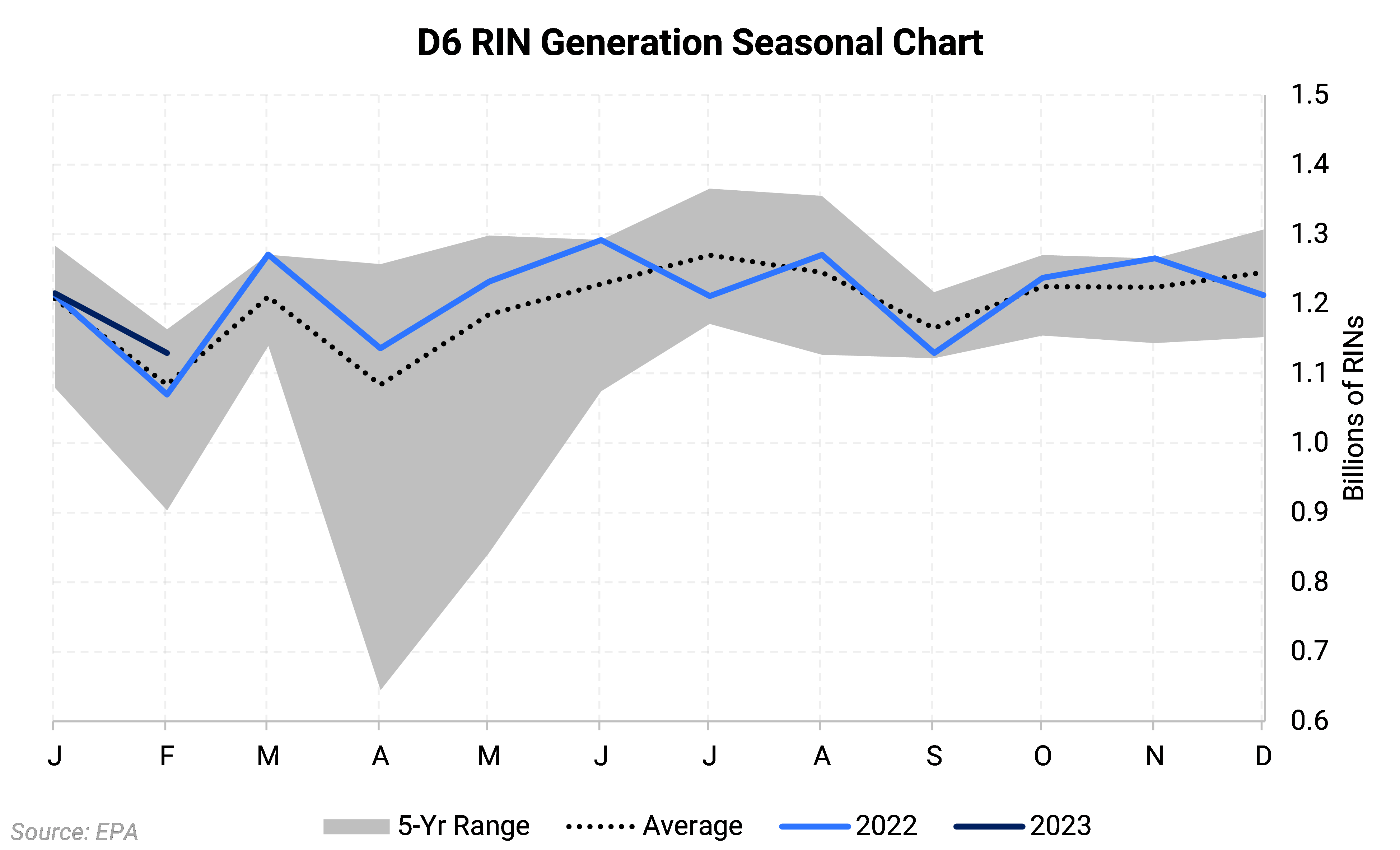

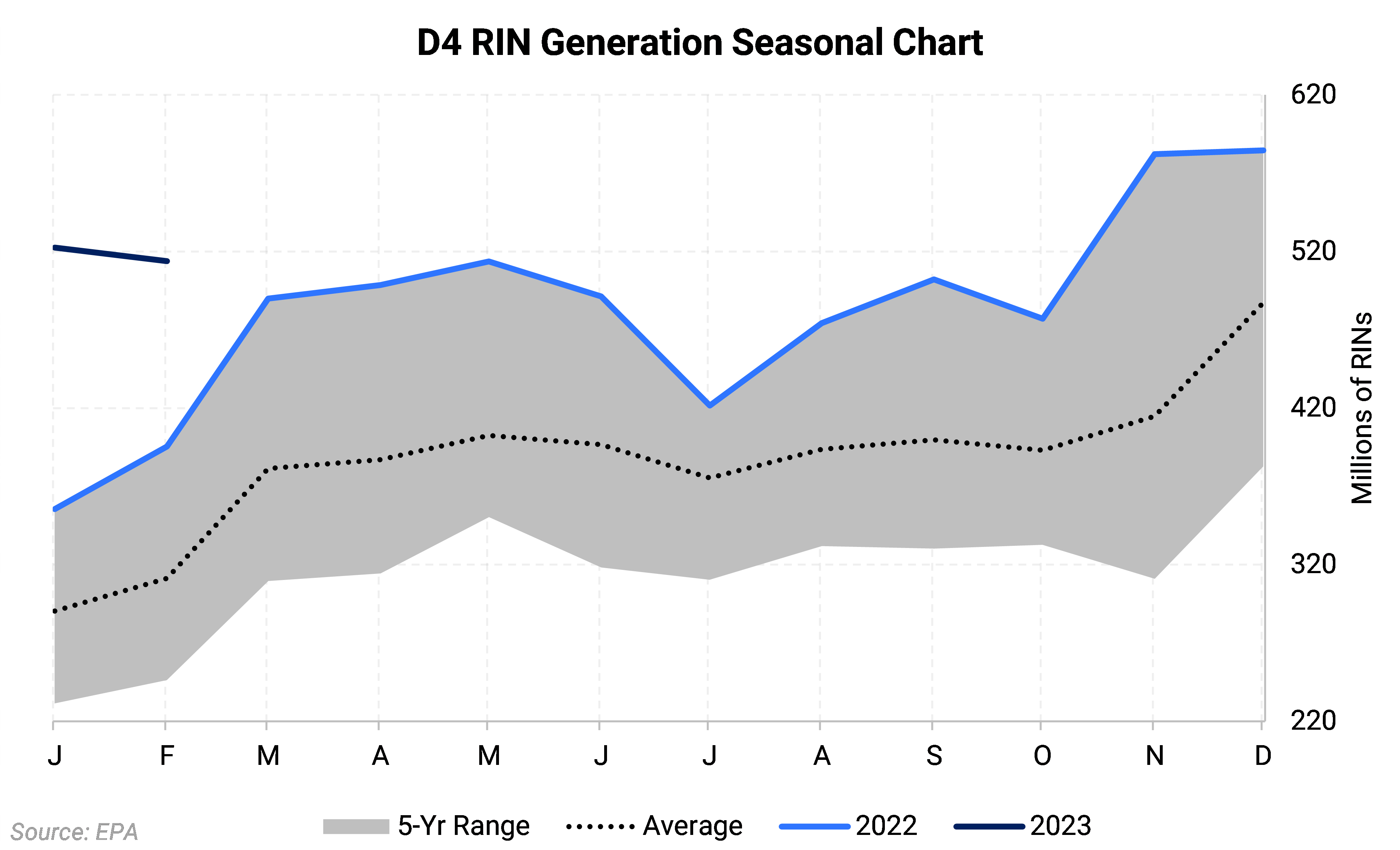

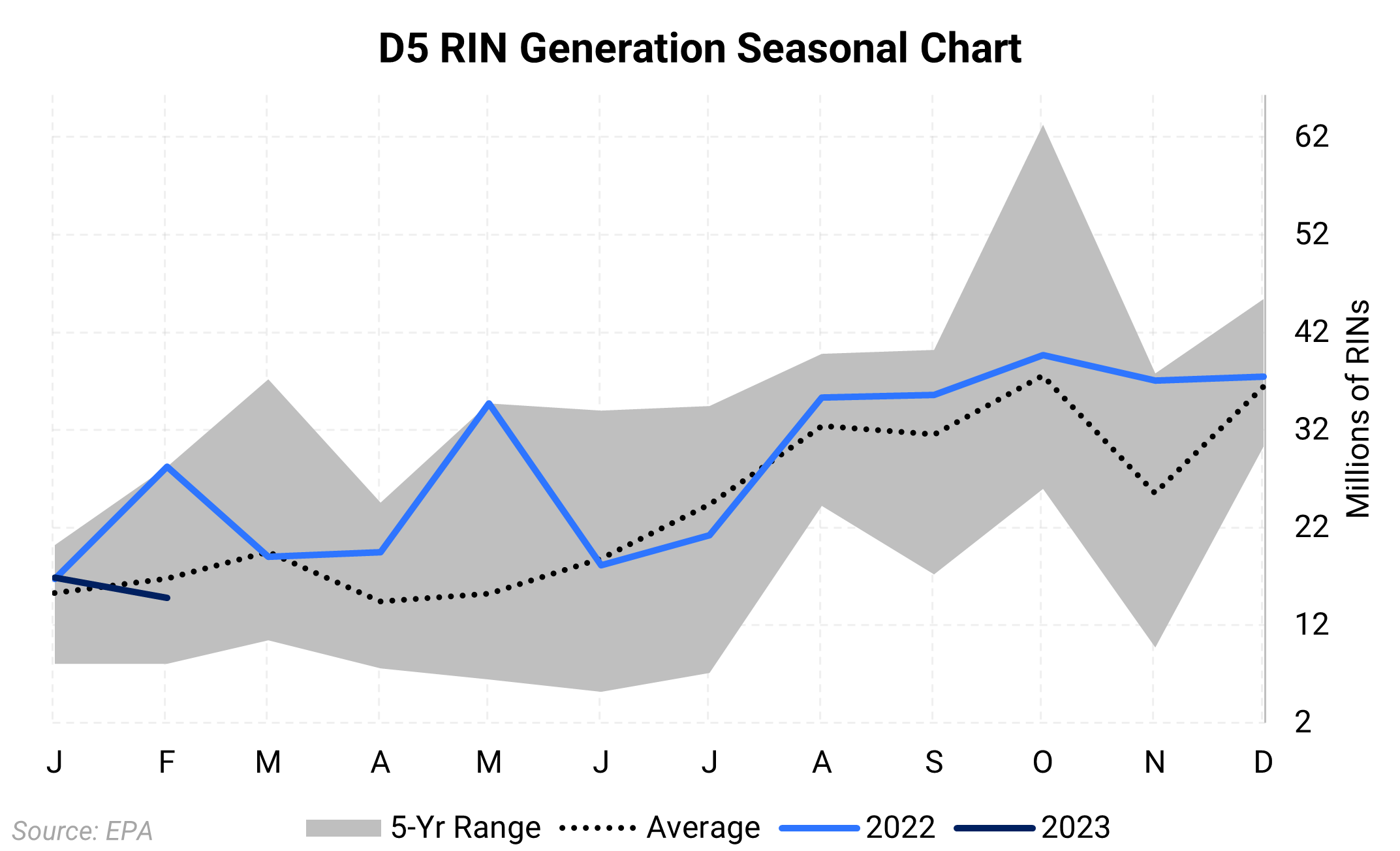

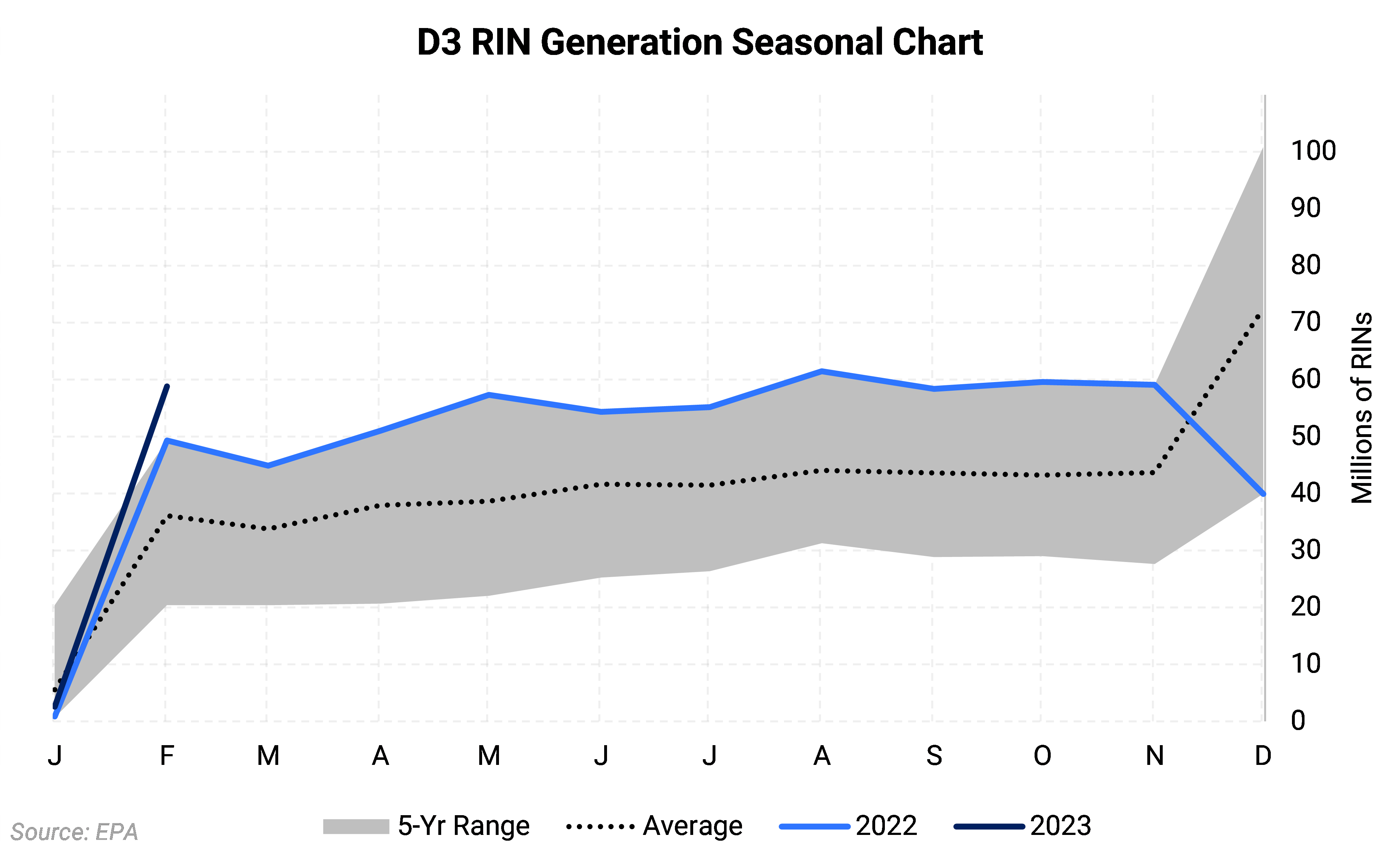

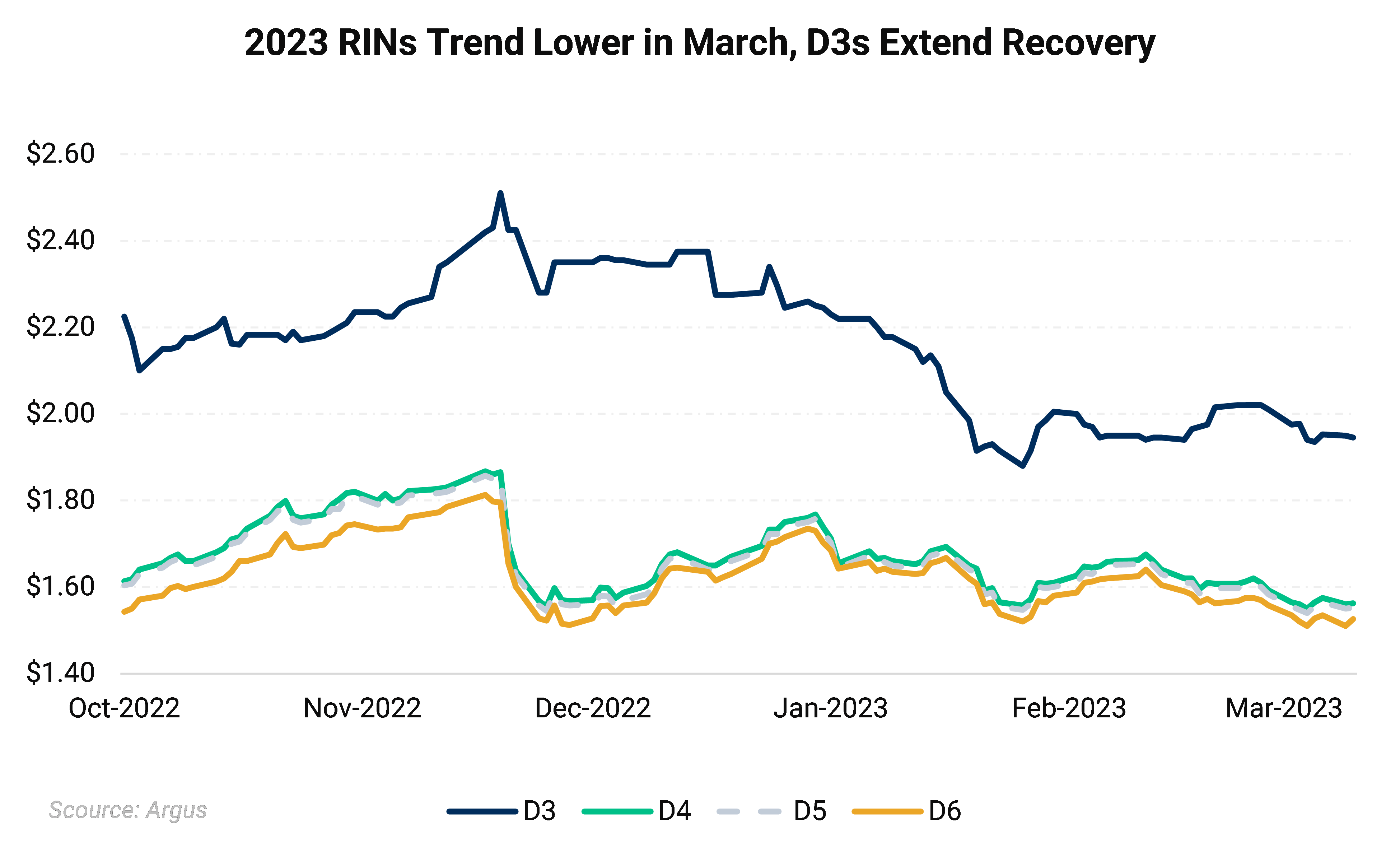

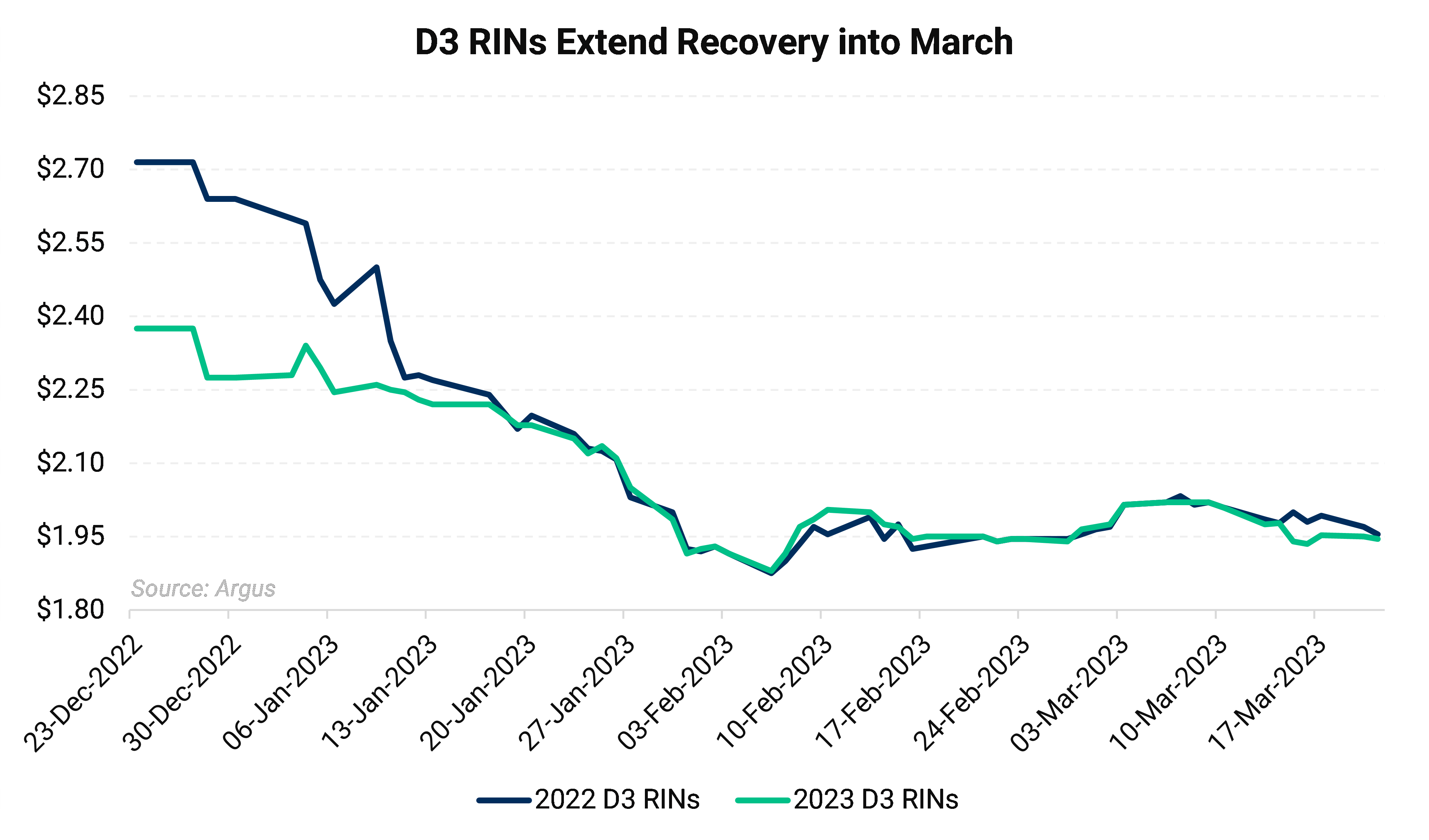

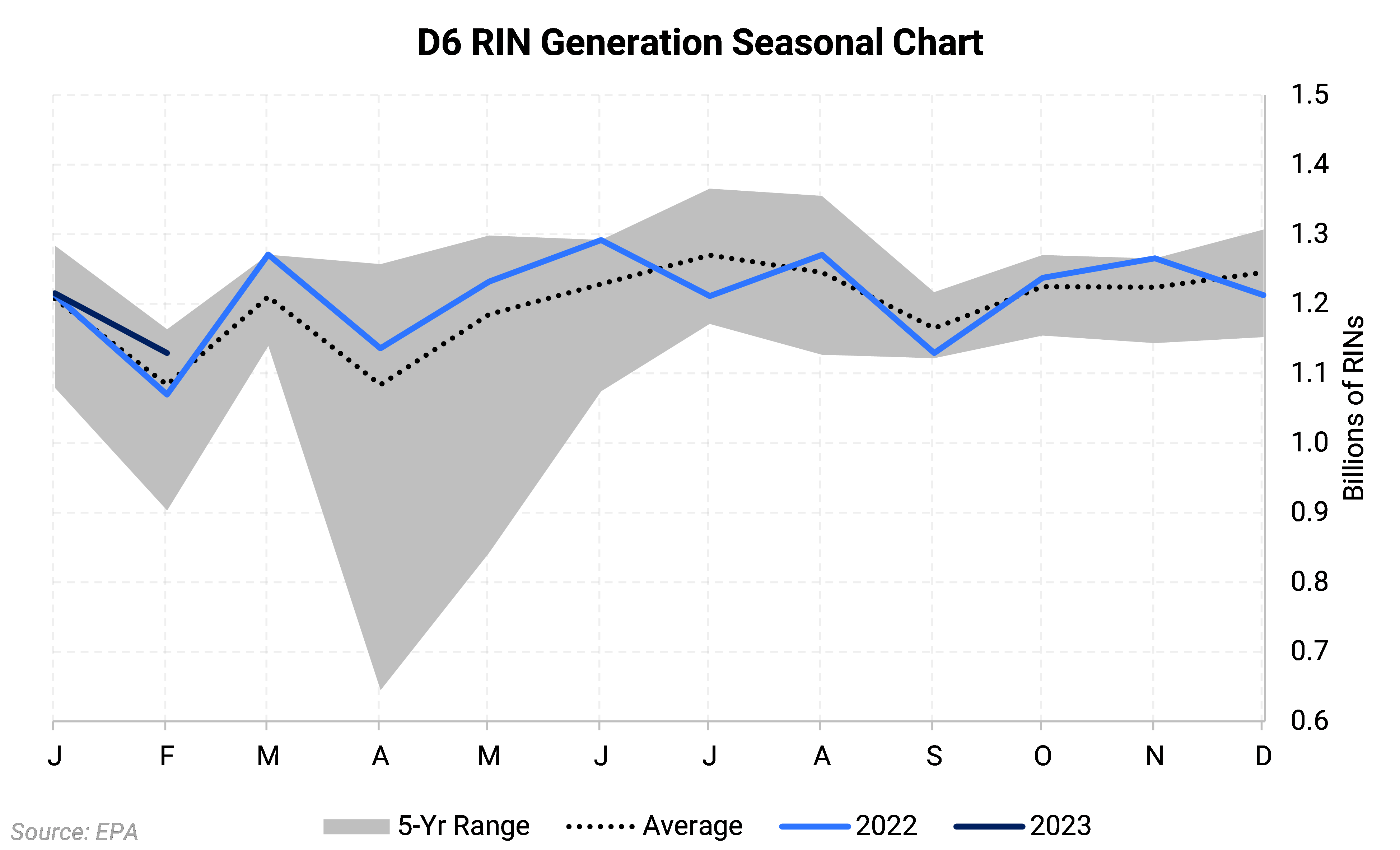

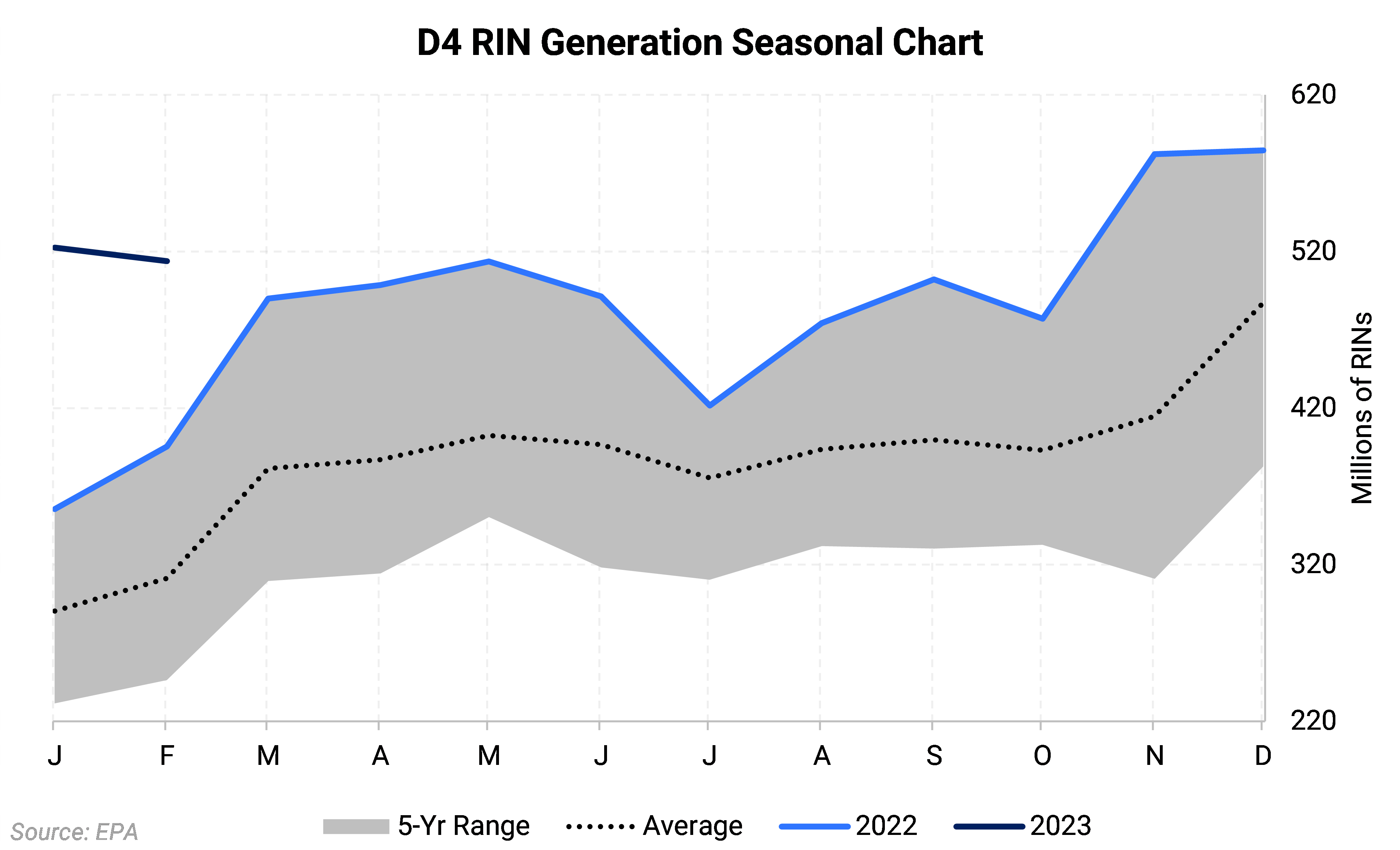

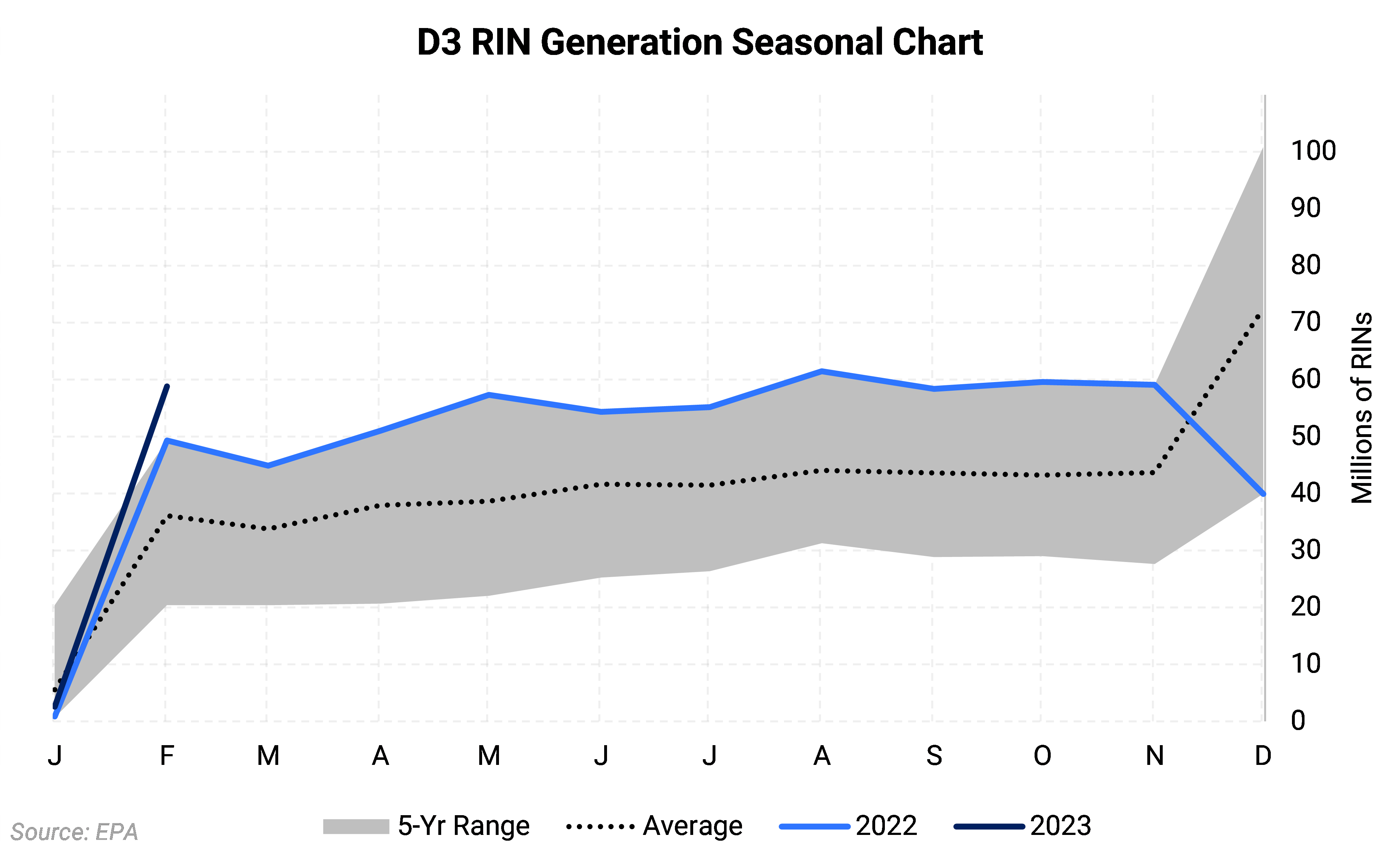

RIN prices lost ground over the course of March as ample RIN supply and thin demand weighed on the marketplace. D3 credits were the exception as cellulosic credits trended higher for a second consecutive month after posting steep losses in January. Uncertainty surrounding a final court ruling on Small Refinery Exemption (SRE) stays for 2021 and 2022 continued to add bearish sentiment to the marketplace, while speculation regarding the implementation of the eRIN dominated discussions. February D6 RIN generation pulled back from two-year highs, while D4 generation ran 30% over year-ago levels.

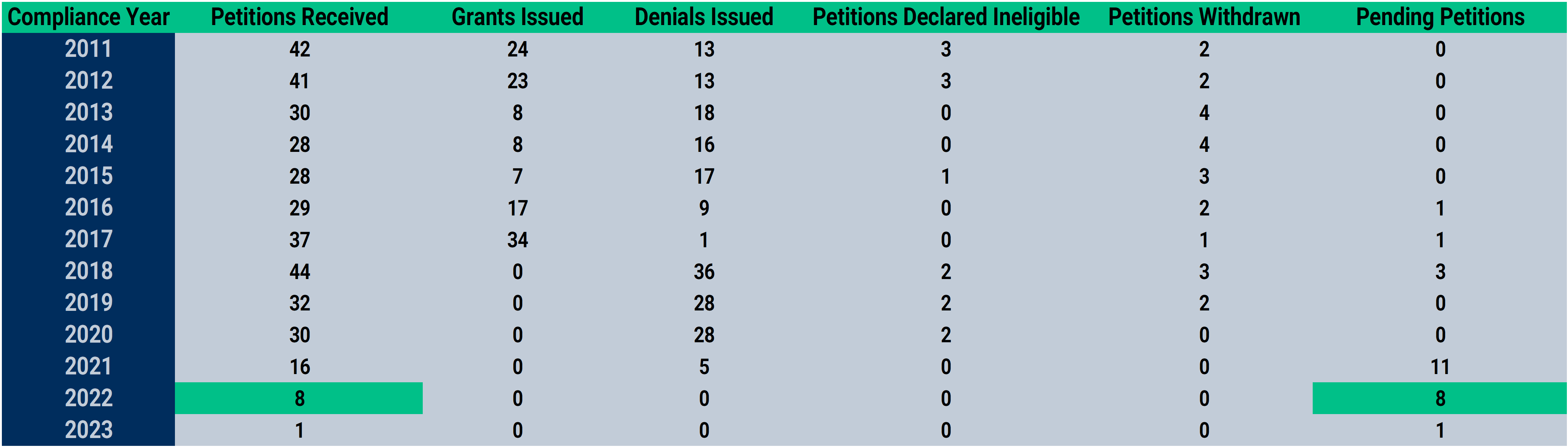

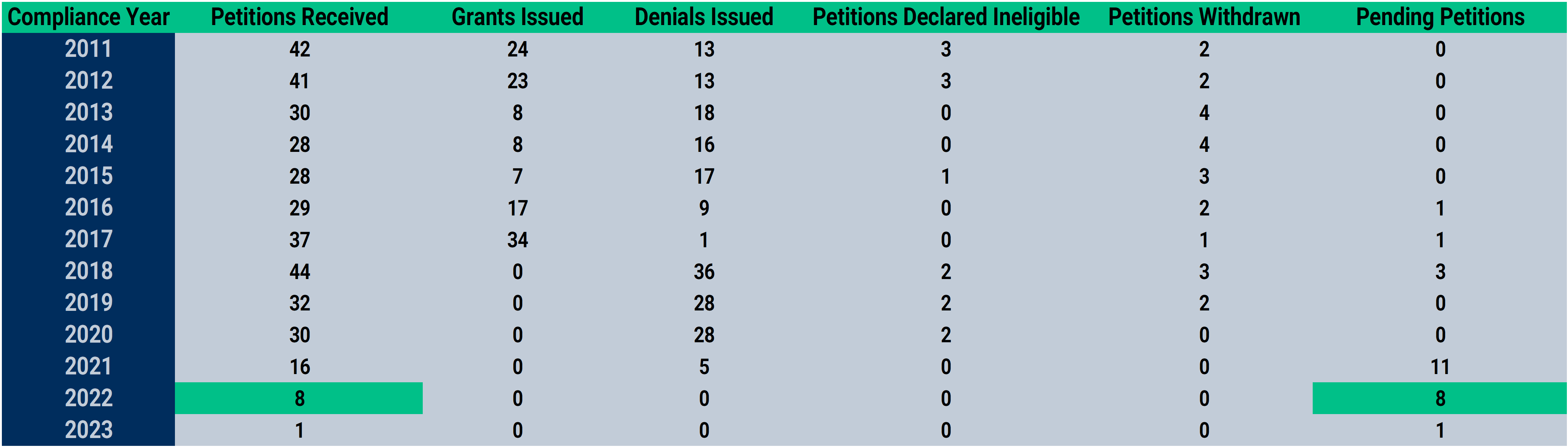

- A court ruling halting compliance obligations for two refineries with Small Refinery Exemption (SRE) petitions continued to pressure credit markets as the chance for a pivot in the EPA’s approach on SREs could prove materially bearish for RIN prices. Three new petitions have been submitted in the past two months.

- Notes from the court were strongly in favor of granting the SREs, as the court made it clear it intends to handle SREs as originally intended by the RFS—i.e. waive RFS compliance if undue hardship can be demonstrated—and to allow waivers which were issued in an “unlawful retroactive application.”

- The EPA retroactively overturned 69 Trump-Era SREs starting in April of last year by denying 31 SRE waivers for 2018 and then denying all SRE petitions for 2016 through 2020. Denying SREs is bullish for RINs markets as refiners must enter the marketplace to purchase RINs to cover compliance obligations which were originally waived.

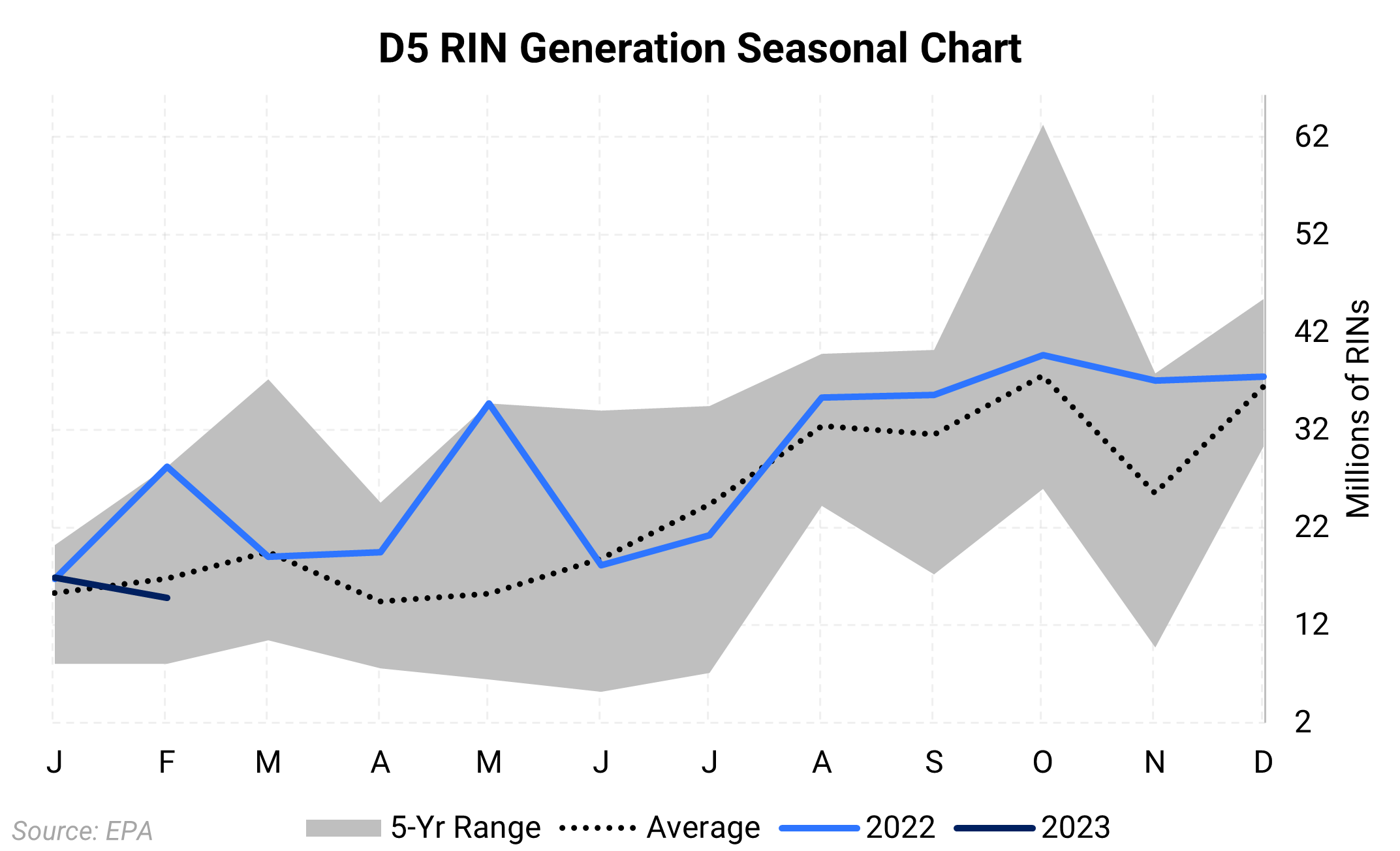

- D6 RINs came under pressure amid thin buying and ample supply, while the D4 market lost its upward momentum as bullish comments from the advanced biofuels industry faded from the headlines. D3 RINs continued to track higher for a second month after a heavy rout in January. The prospect of substantial RNG project development this year and uncertainty surrounding the final cellulosic carve out in the ‘Set Rule’ limited gains.

- The eRIN remained contested in market discourse with a consensus emerging that we will see eRINs at some point, but implementation may be delayed. At the center of the issue is who earns the credit. By allowing only auto manufacturers to earn the eRIN, the EPA is choosing to promote one technology which contravenes the statutory purpose of the Renewable Fuel Standard (RFS), which is to boost renewable fuel use and let the market determine the technology.

Calendar:

Relevant News:

- Parkland Corp. announced its decision to halt its renewable diesel project in British Columbia, Canada. The company had been coprocessing at its Burnaby Refinery with plans to build a 273,000 gallons/yr RD facility, set to come online in 2026. The company cited rising feedstock costs and advantages to US producers afforded by new credits carved out in the Inflation Reduction Act (IRA). The move could be a harbinger of slowing momentum for the RD industry which has increasingly worried about rising feedstock costs, while the numerous advantages of the US market is likely to open export markets soon.

- ExxonMobil has threatened to pull out of its offtake agreements with Global Clean Energy’s if the former Big West facility is unable to produce RD by the end of June. The major complained of delays and concerns over project costs. The 210mn gallon/yr facility is running a year behind schedule.

- The Washington State Senate passed a Sustainable Aviation Fuel (SAF) tax credit, following actions from the state of Illinois which issued its own SAF credit with additional tax advantages for the fuel. Washington aims to establish a $1/gallon credit with a $2/gallon cap as additional value can be earned for fuels with lower carbon emissions. The Illinois SAF credit is set at $1.50/gallon and will run from June 1, 2023, through June 1, 2033, making the state the highest returning market for SAF.

- Vertex expects to complete its 10,000 Bbl/d Mobile, Alabama renewable diesel facility by the end of this month, with production set for the second quarter. Vertex aims to boost capacity to 14,000 b/d in late 2023, an expansion originally planned for 2024.

- One new SRE petition was filed for the 2022 compliance year as of March 16, leaving a total of 25 pending petitions.

RIN markets shed value over the course of March on thin liquidity as market participation was limited by both spring break travel and conferences. The chance for a change in the EPA’s SRE policy continued to provide bearish undertones alongside growing RIN generation. The renewable diesel and SAF industries as well as RNG remain on a growth path despite a couple of minor hiccups, shoring up expectations of high advanced RIN production.

2023 D6 RINs shed nearly $0.04/RIN, or 2.5%, on a monthly basis to average $1.55/RIN so far this month, while D4 losses were more muted at $0.036/RIN, or 2.2%. Losses were more pronounced for the 2022 vintage D4 credits at $0.044/RIN. D3 RINs gained $0.03/RIN, or 1.6%, to average $1.98/RIN. The 2022 vintage D3 RINs gained $0.055/RIN to average $1.99/RIN.

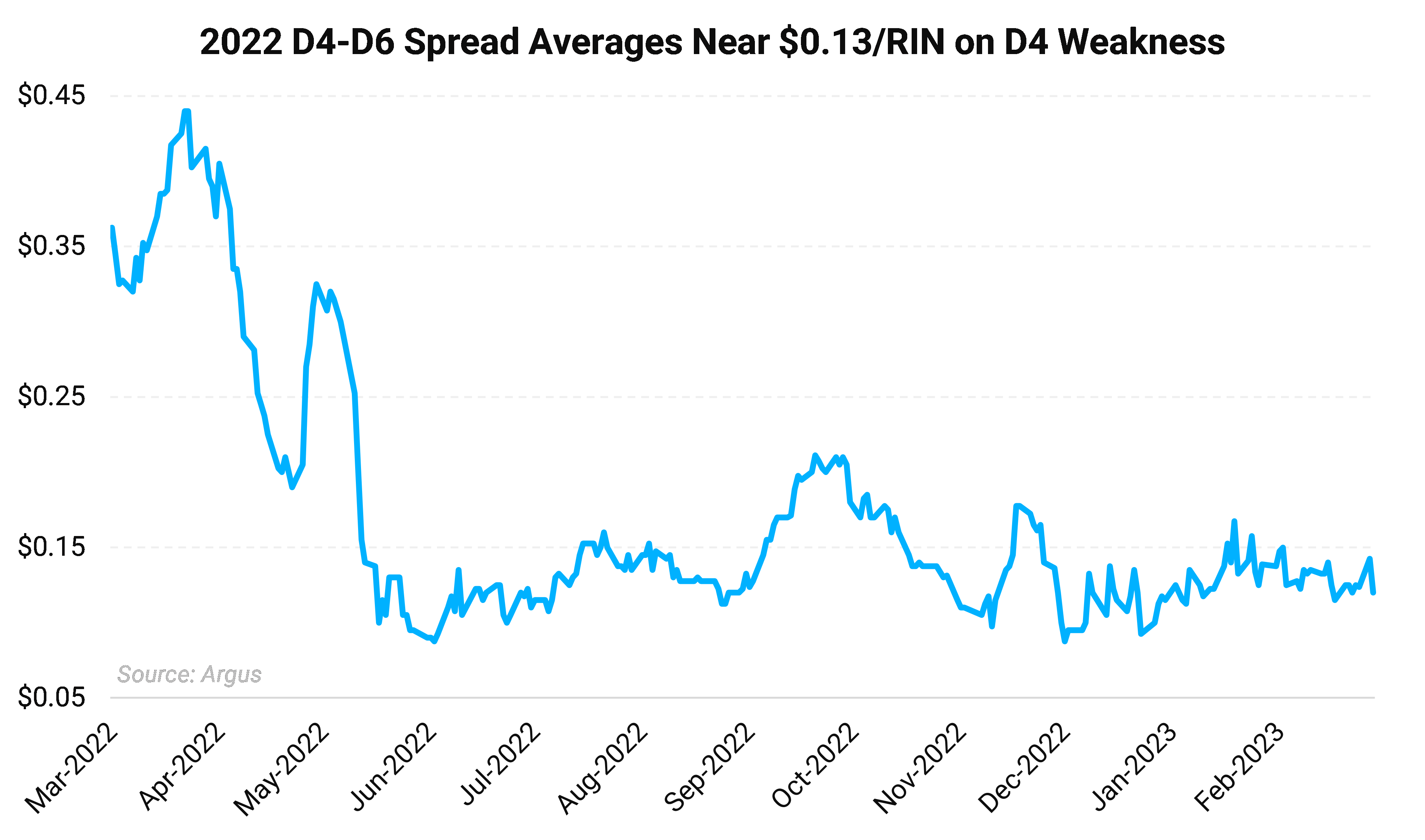

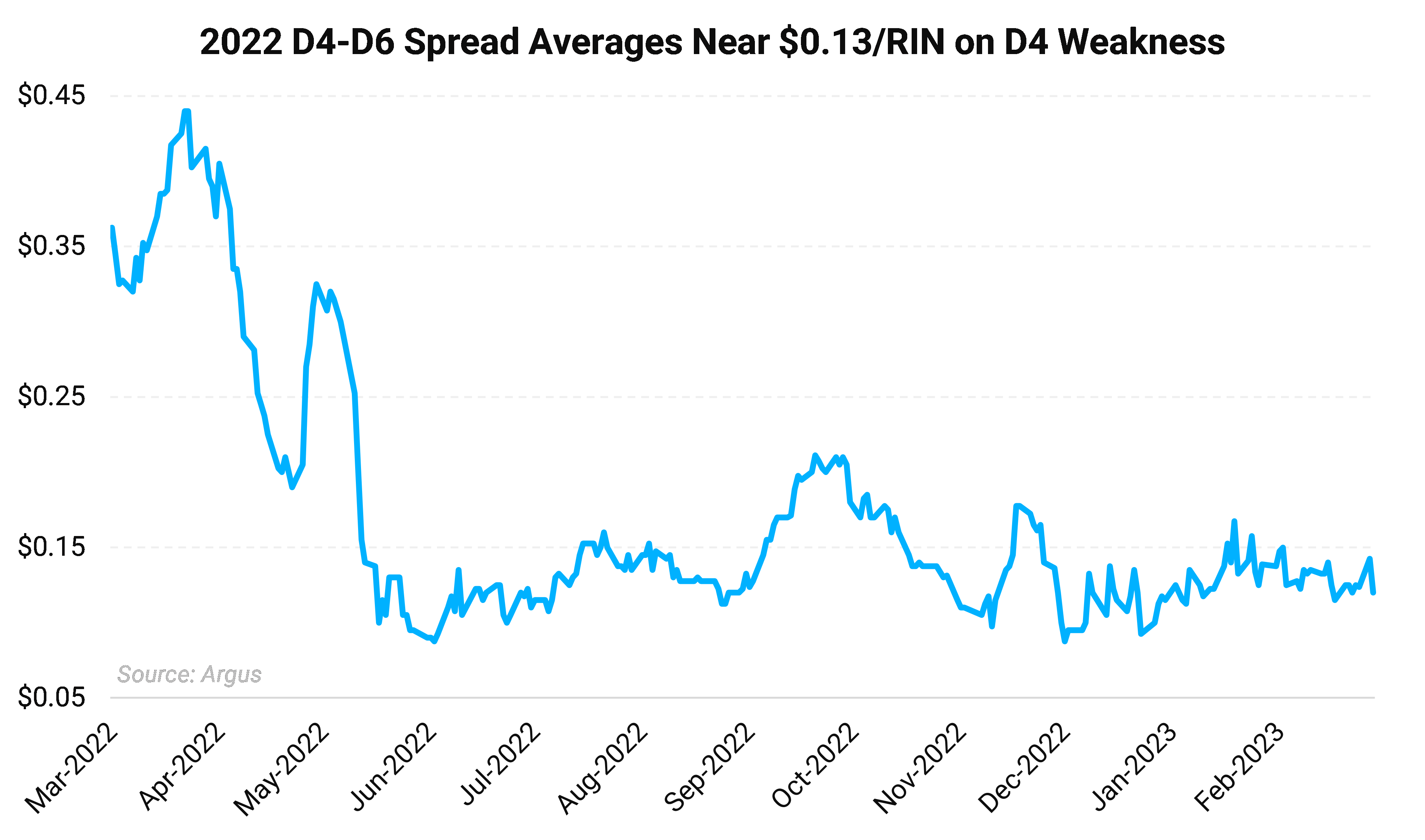

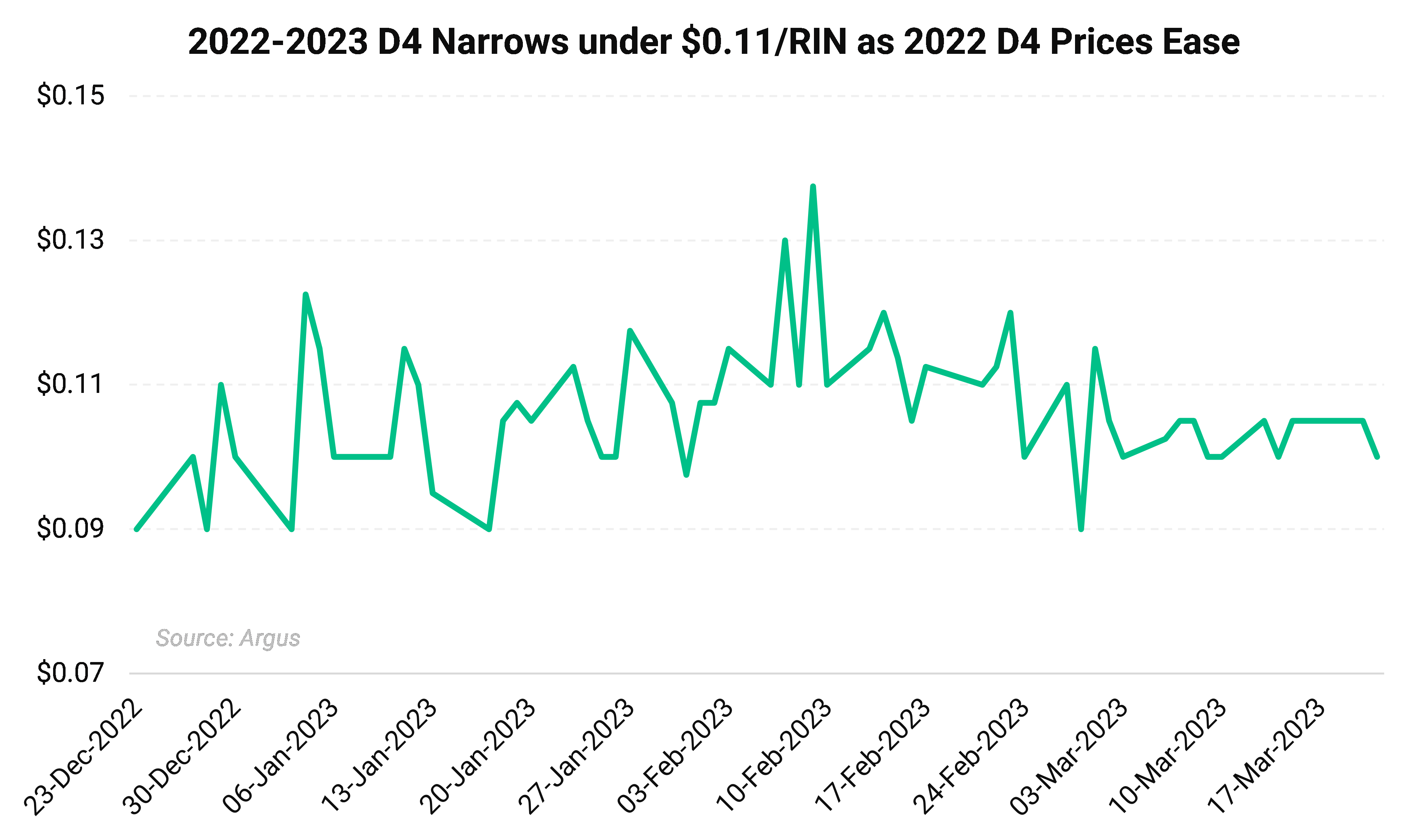

The 2022 D4-D6 spread spent the bulk of the month over the $0.13/RIN mark as D4 losses proved more pronounced for the prior year vintage. The spread narrowed less than a cent from February’s $0.137 level, a move likely spurred by generation data.

A wider D4-D6 spread implies a looser D6 supply as the D4 credit is the next vehicle of compliance in the absence of sufficient D6 RINs or the ability to use carryover credits. Conversely, a narrow D4-D6 spread implies a tight supply of D6 RINs. The theoretical cap on the spread is parity though D6s have traded at modest premiums to D4 credits in extreme circumstances.

D6 RINs remain under pressure from the chance for an SRE pivot as any granted SRE petitions will free up more D6 RINs than any other D-category.

Amid state and regional petitions for year-round E15 usage, recent government data confirmed the US is consistently able to blend in excess of the 10% blendwall even during the summer season when ethanol blending is constrained by RVP.

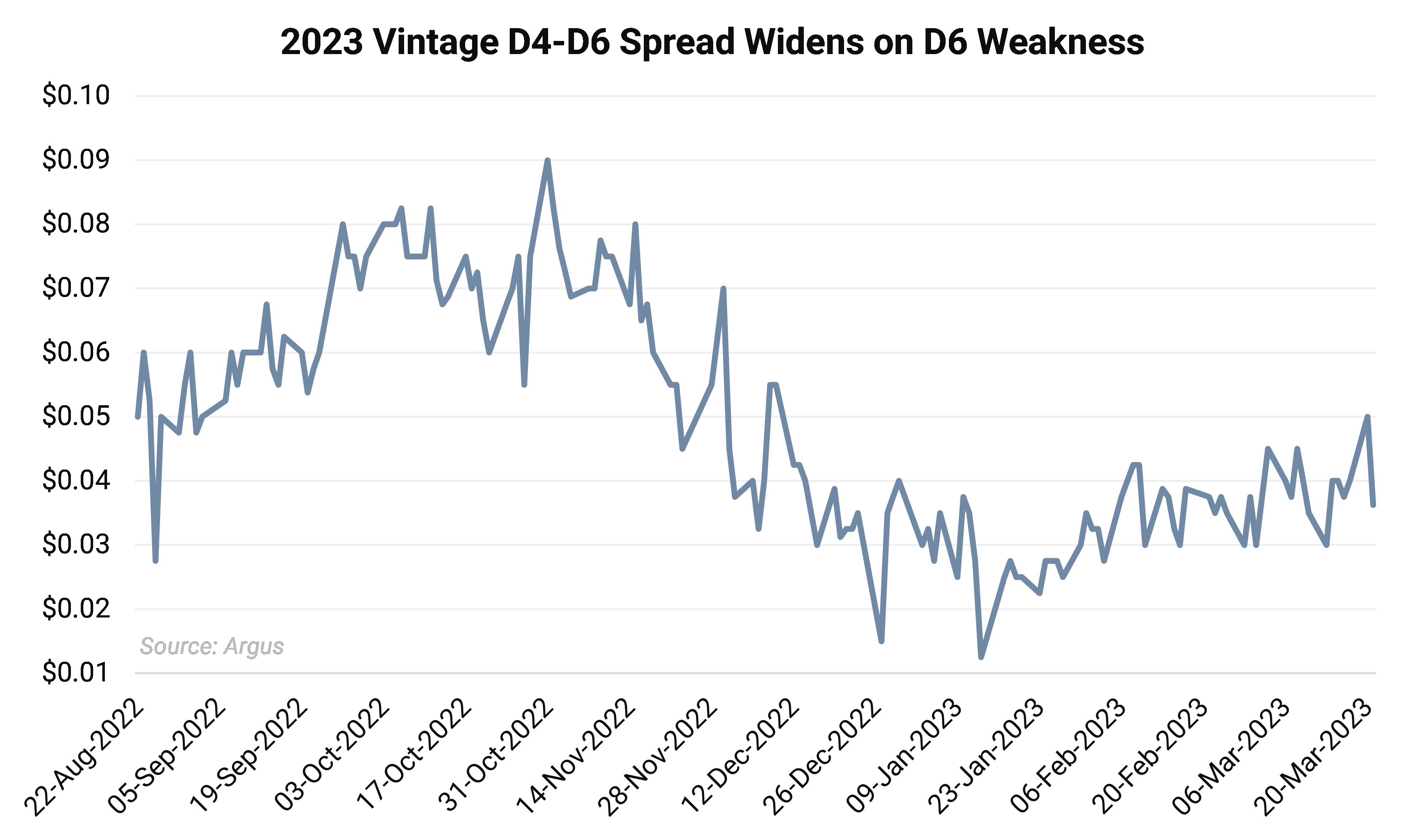

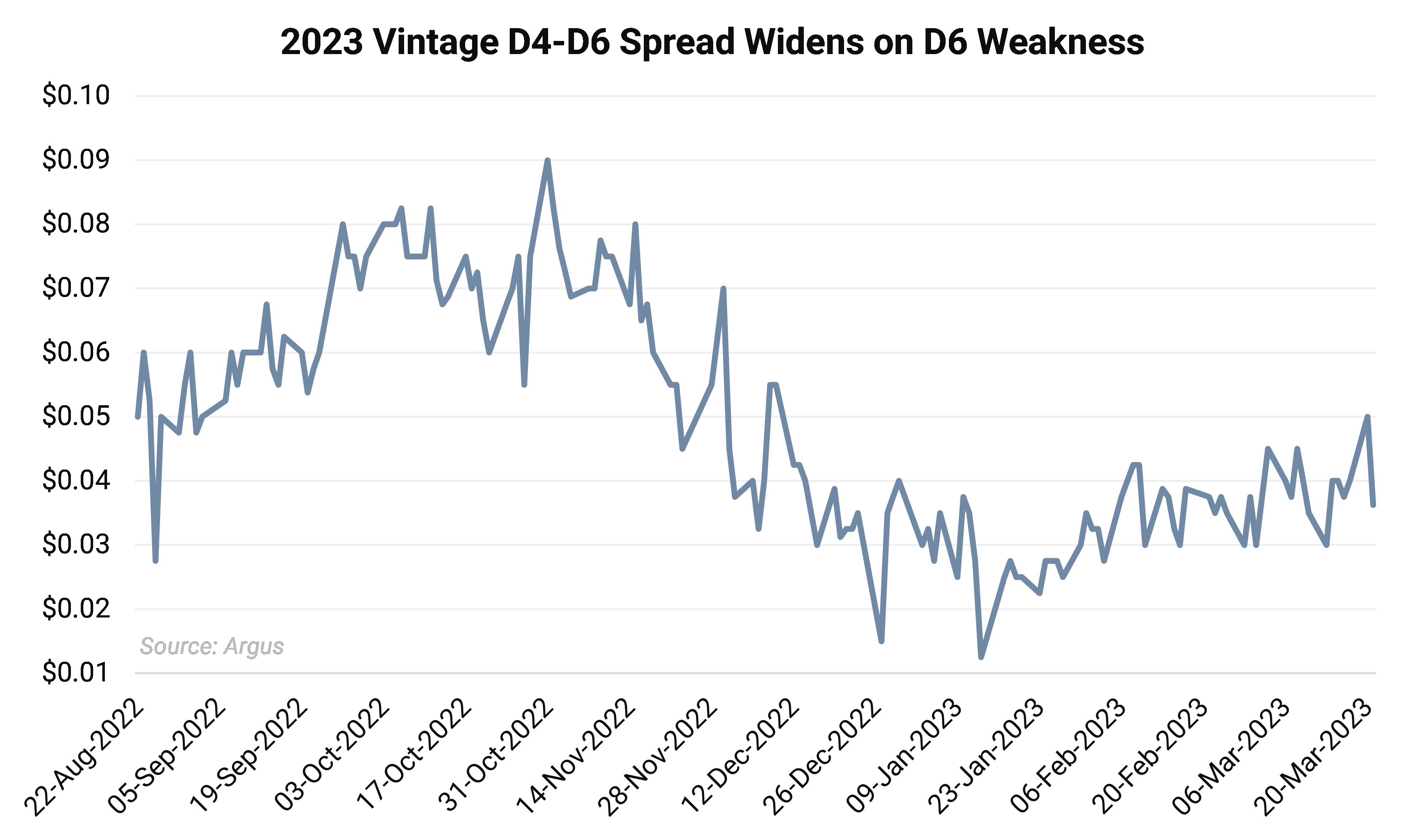

The 2023 D4-D6 spread widened over the course of the month averaging $0.039/RIN as the D6 market loosened up relative to D4 credits. The spread reached as wide as $0.05/RIN on March 20 as D6 losses outpaced D4s.

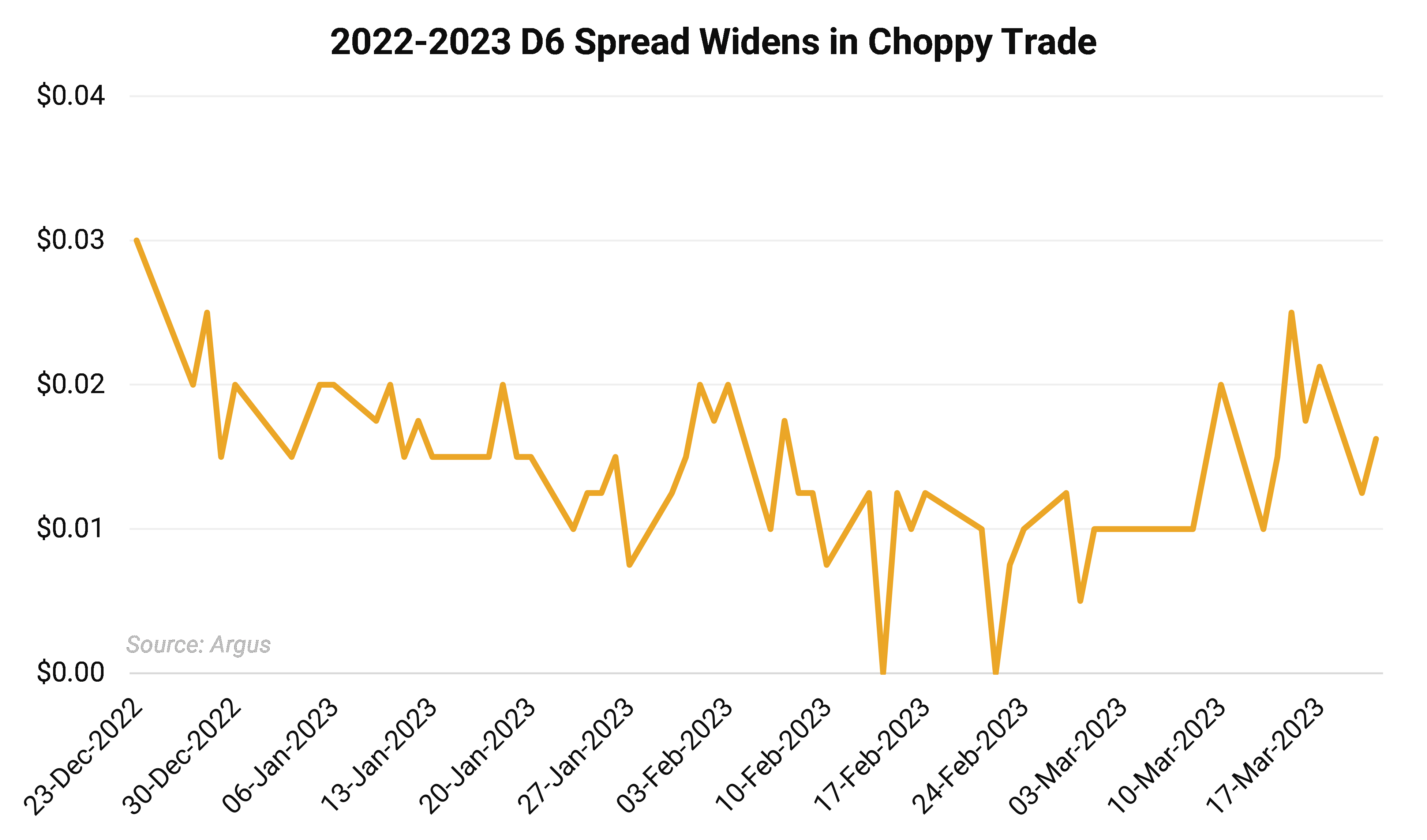

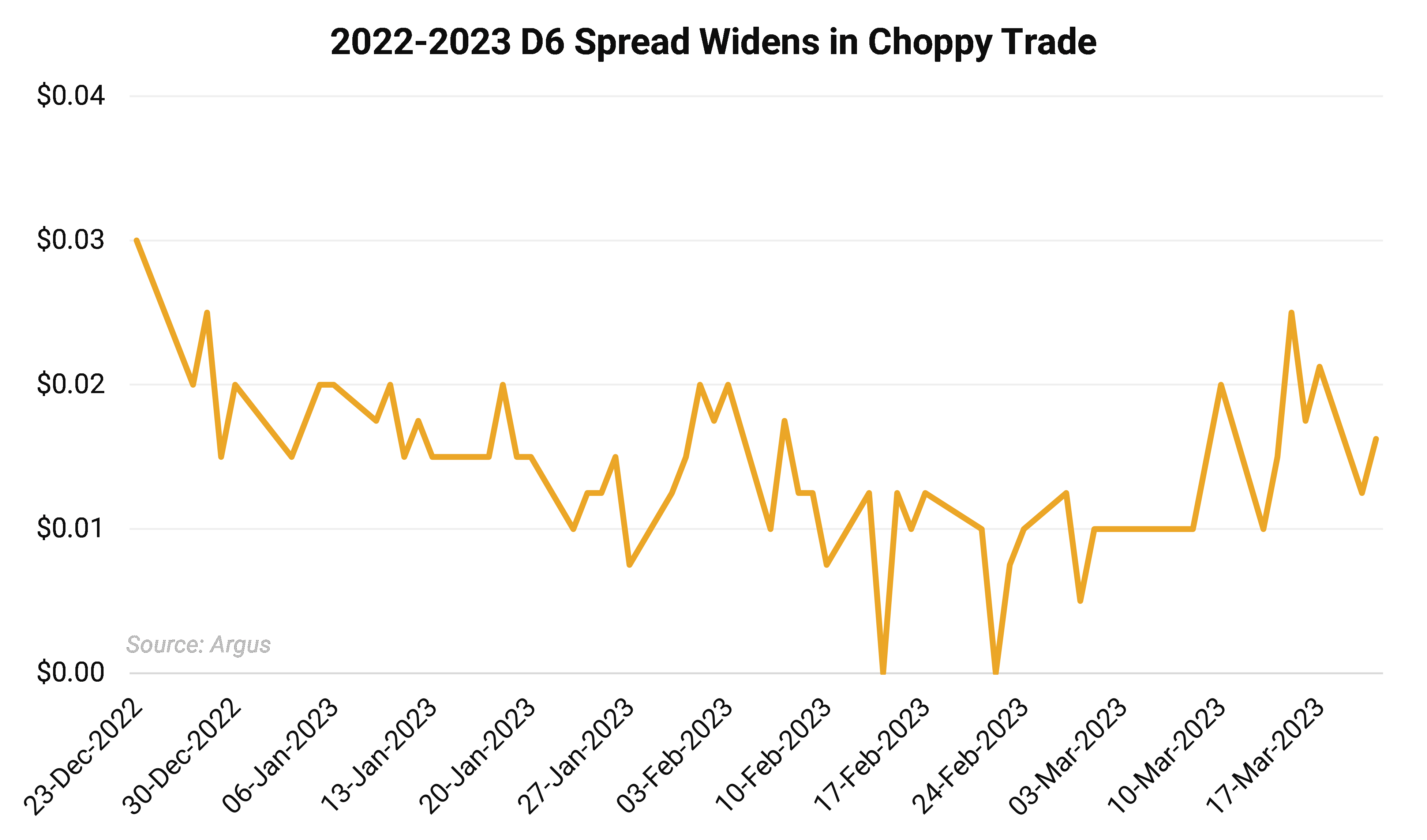

The remainder key RIN spreads corrected as the market took stock of higher 2023 RIN generation and revisions to 2022 data. The 2022-2023 D6 spread pulled off parity to trend higher throughout March. The spread only reached as wide as $0.025/RIN at mid-month. The wider spread was driven by more pronounced 2023 D6 losses relative to the prior year vintage.

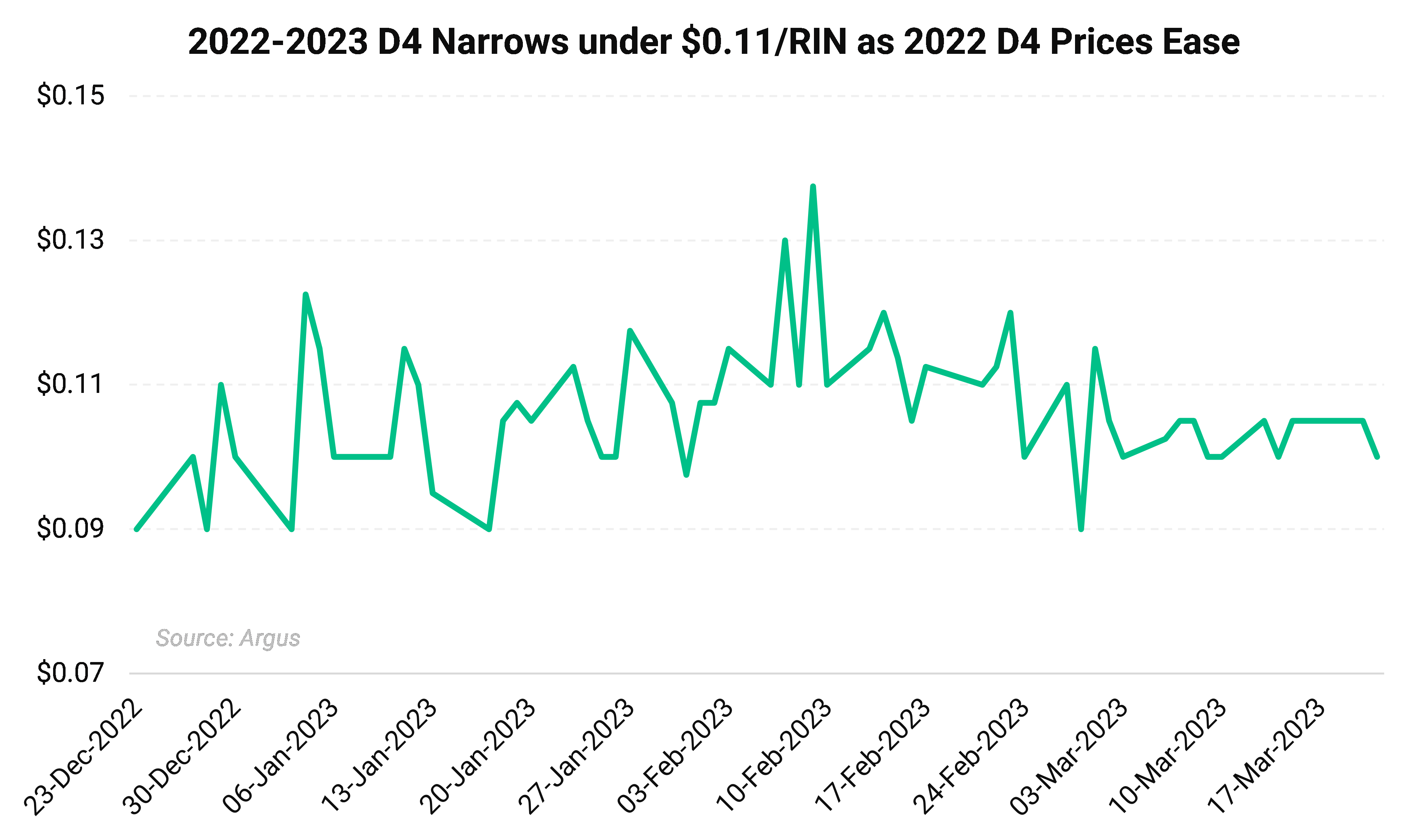

The inter-vintage D4 RIN spread narrowed to under $0.11/RIN over the course of the month, ranging between $0.10 and $0.105/RIN. Losses in 2022 D4 credits outpaced 2023 D4s on a month-over-month basis as the market shrugged of downward revisions in 2022 generation data and the need to draw on advanced credits to meet 2022 compliance.

EPA RIN Generation Data as of March 16:

EPA Small Refinery Exemption (SRE) Data as of March 16:

Some of the price and regulatory risk in the development of the renewable fuels markets is controllable through hedging or pre-selling. Other risks require constant monitoring of pending changes to regulations and programs. AEGIS can help with both.

Interested in receiving these updates directly to your inbox?