The Russia-Ukraine conflict caused LME aluminum prices to eclipse $4,000 in early March 2022. Prices have tumbled since then and are down about 45% from the highs and about 20% on the year. However, prices are still holding at a historically high level.

|

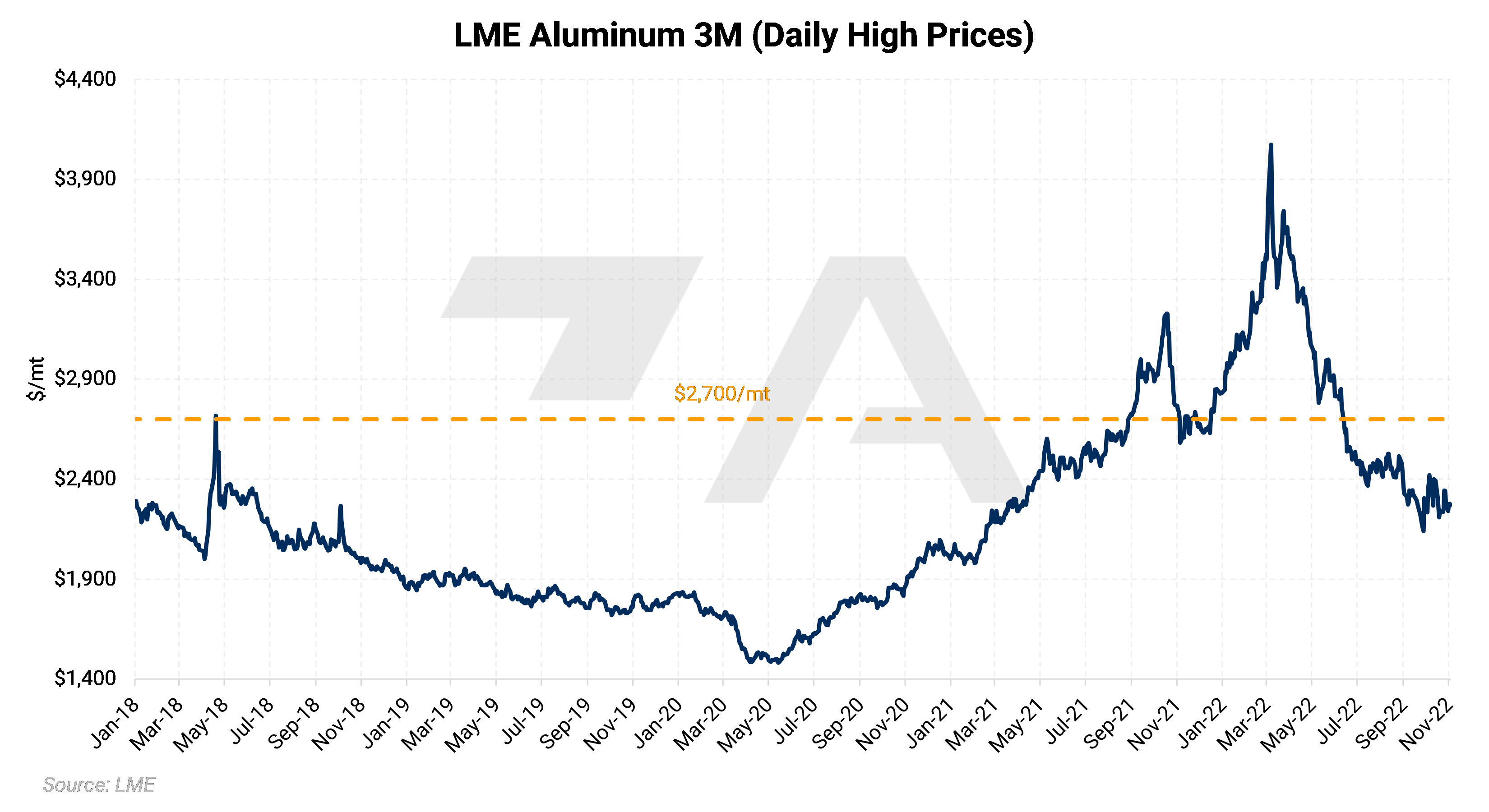

Before the pandemic, aluminum prices had been trending downward since the short-term high seen in April 2018. Prices bottomed in June 2020, and as the pandemic subsided, supply-chain issues and pent-up demand caused prices to rally through late 2021. Despite a brief pullback to approximately $2,700/mt, prices rallied to a high of $4,073/mt on March 7, just after the start of the Russia-Ukraine conflict. Since the peak, prices have tumbled due to the uninterrupted aluminum supply from that region. Moreover, demand has fallen as economies worldwide (mainly the US, China, Japan, and the Eurozone) have slowed. Decreasing the Eurozone supply has not been enough to offset falling global demand. The price rally in these early days of November is due to an expected pick-up in Chinese demand. Currently, 3M prices hover near $2,300/mt. (11/7/2022) |

|

|

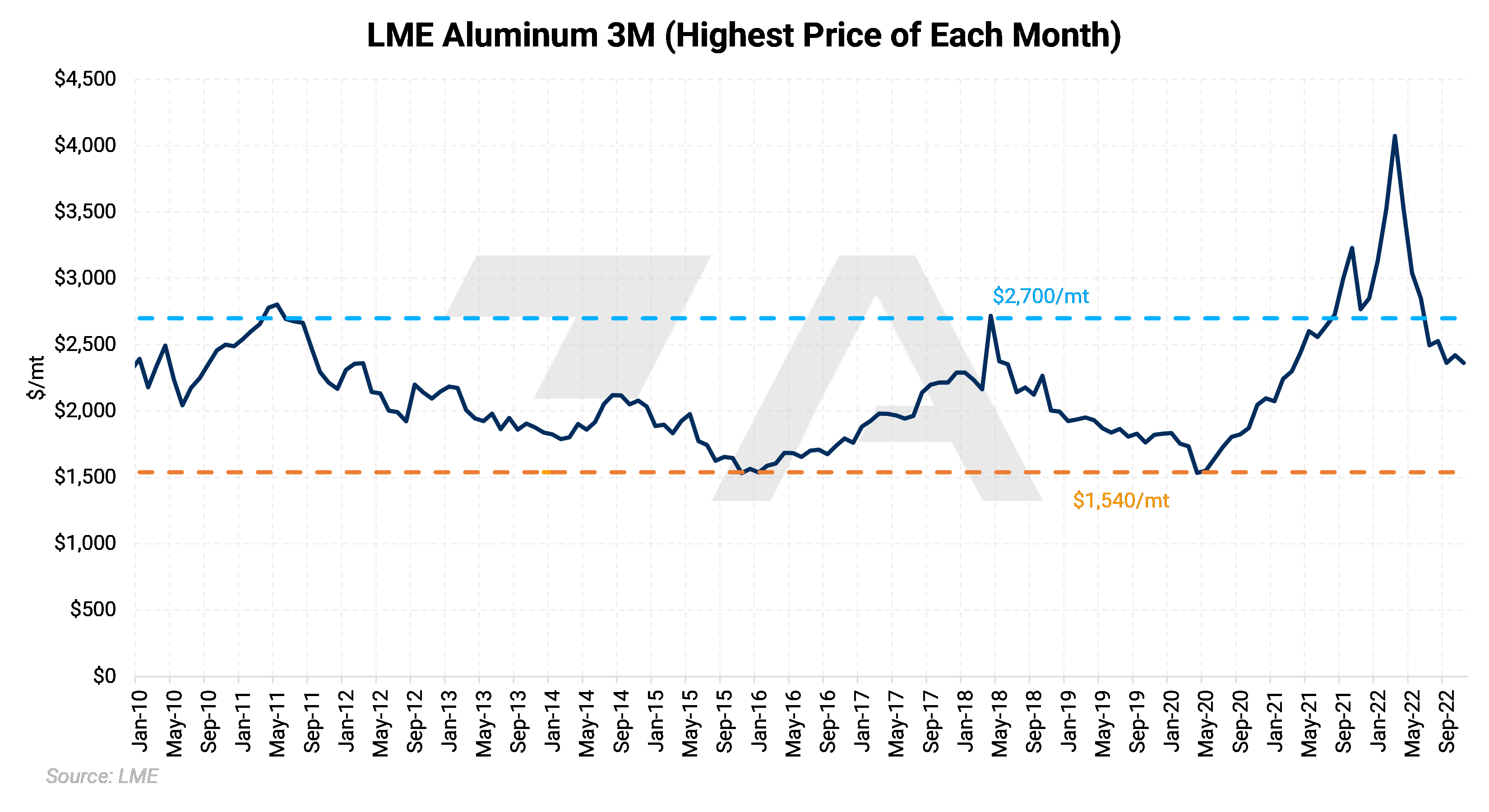

Since 2010, the $2,700/mt level has been a strong inflection point. Although the Russia-Ukraine conflict briefly pushed prices to over $4,000/mt, the market quickly and sharply rejected this price action, and prices moved lower. The market is well below prior inflection points, with prices hovering near $2,300/mt. Is the aluminum market trying to settle into the range seen between 2012 and 2020? Will the market retest the $1,540/mt level? |

|

|

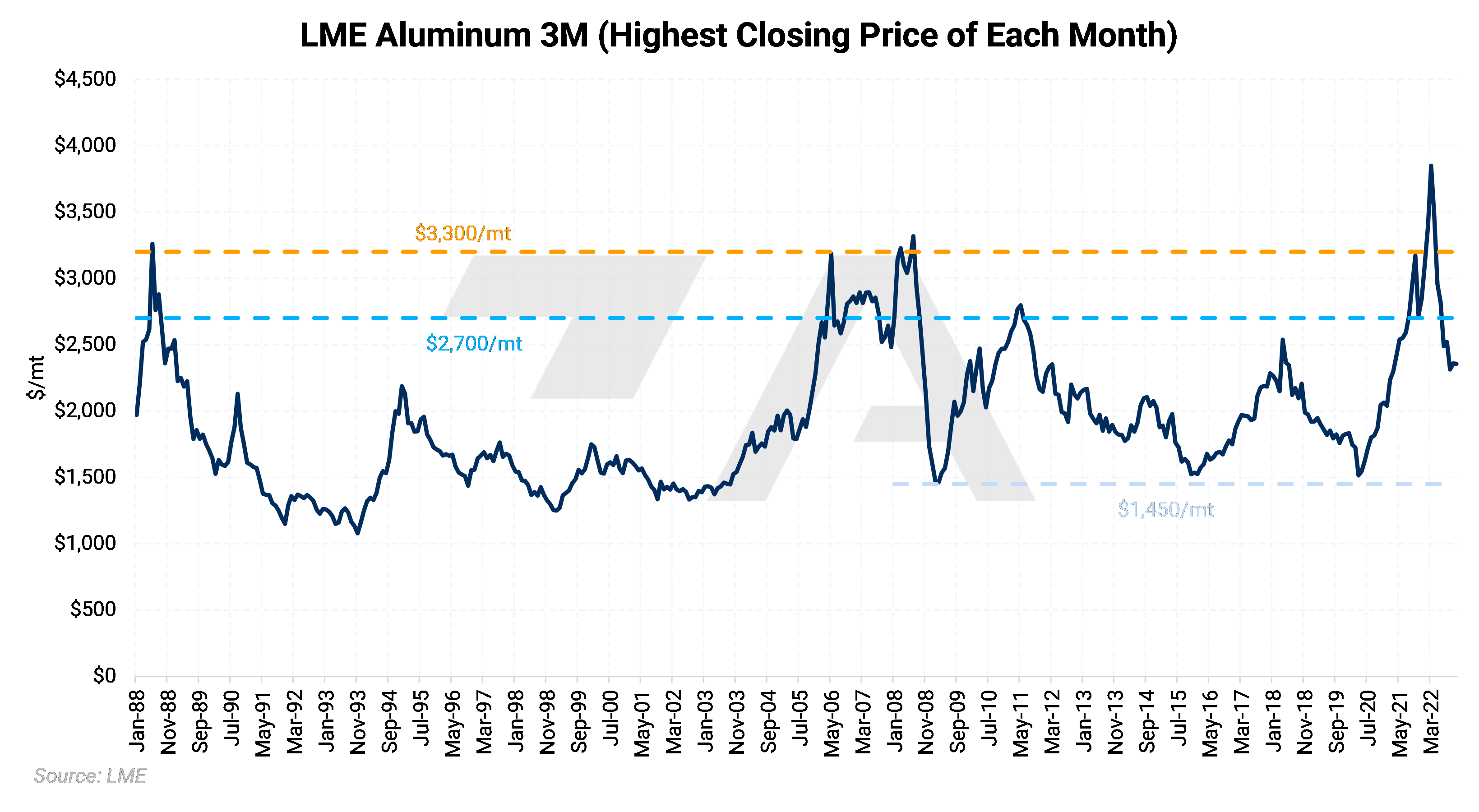

The following chart is more granular on support and resistance levels. All rallies since 2006 have peaked above $2,700/mt, with the rallies of 1988, 2006, and 2008 each eclipsing $3,200/mt. Since 2008, the $1,450/mt level has been strong support. Why do prices seem to run into resistance at $2,700/mt? Although the correlation isn't perfect, Chinese aluminum exports typically increase as prices rise. However, their exports usually peak approximately three to six months after prices peak. It appears or is highly likely that "rest-of-world" demand fizzles at prices higher than $2,700/mt. A lag in the economic data could account for the slight timing discrepancy. Similarly, $1,450/mt is a strong support level because Chinese aluminum imports tend to rise as prices dip. In 2009 and 2020, Chinese aluminum imports rose dramatically within a few months of the bottom of the market. Again, a lag in the economic data could account for the slight timing discrepancy. (We'll cover Chinese imports and exports in an upcoming post, so please stay tuned!) |

|

|

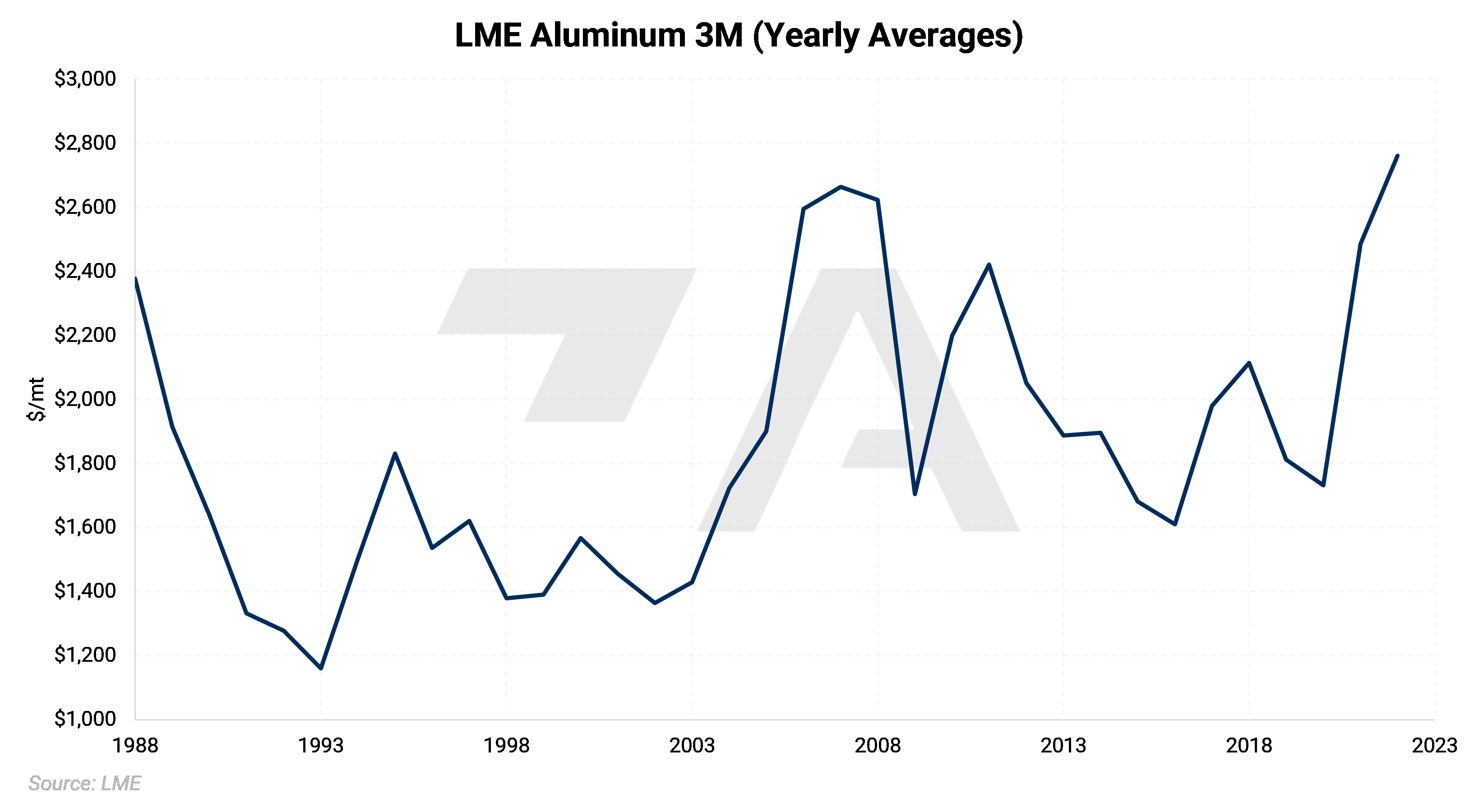

For those who like to think about long-term averages, the $2,664/mt level of 2008 is currently the high-water mark. However, the average price for 2022 is approximately $2,770/mt. So, will we set a new benchmark this year? |

|

|

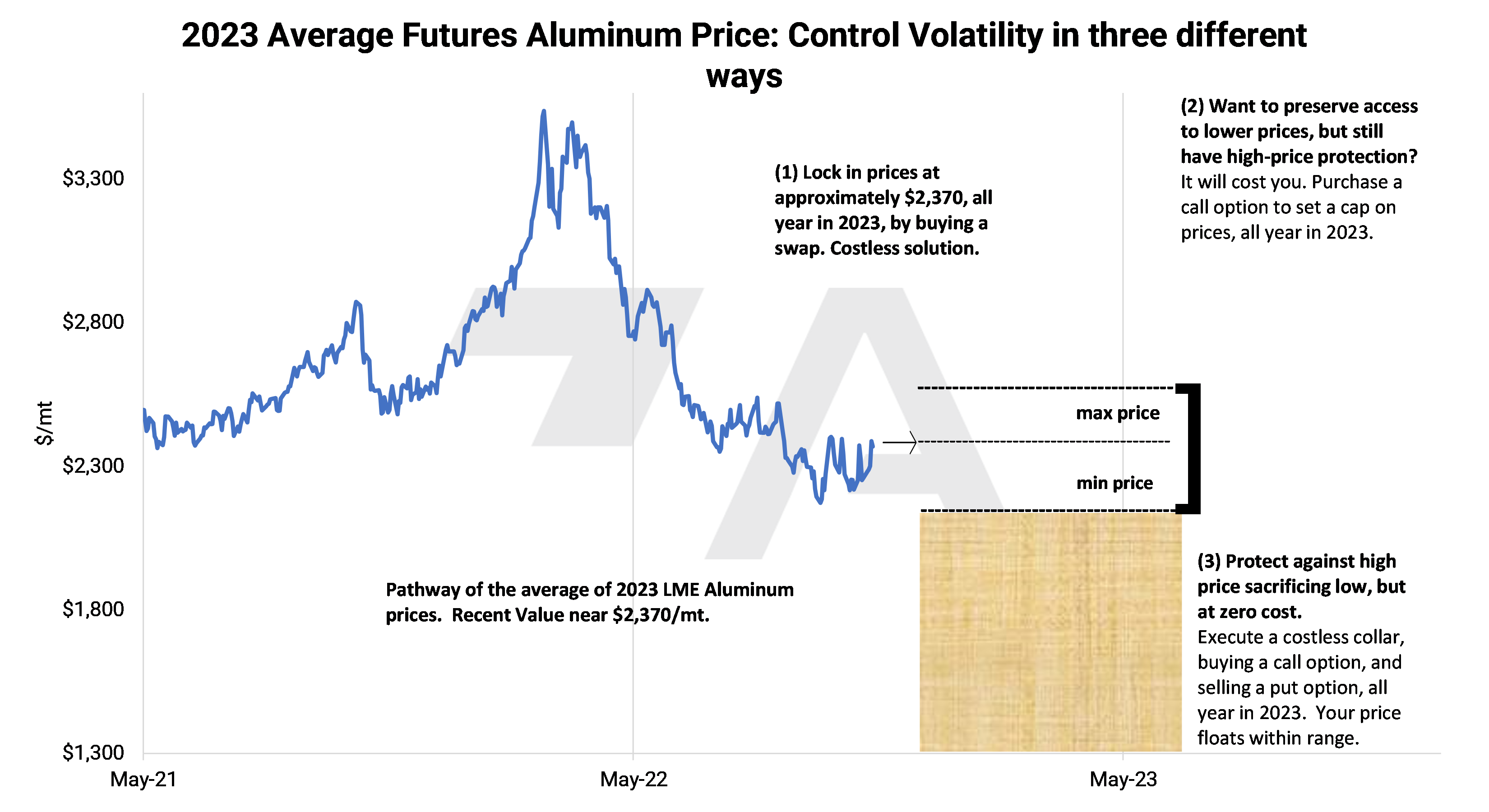

Aluminum end-users looking to hedge future needs may want to review the various hedge programs detailed below. Buying swaps or call options are viable strategies, as either would establish a maximum aluminum price. Such positions are standard for consumer hedging; however, they can result in opportunity costs or cash costs if metal prices decrease. Please get in touch with AEGIS for specific strategies that fit your operations. |

|