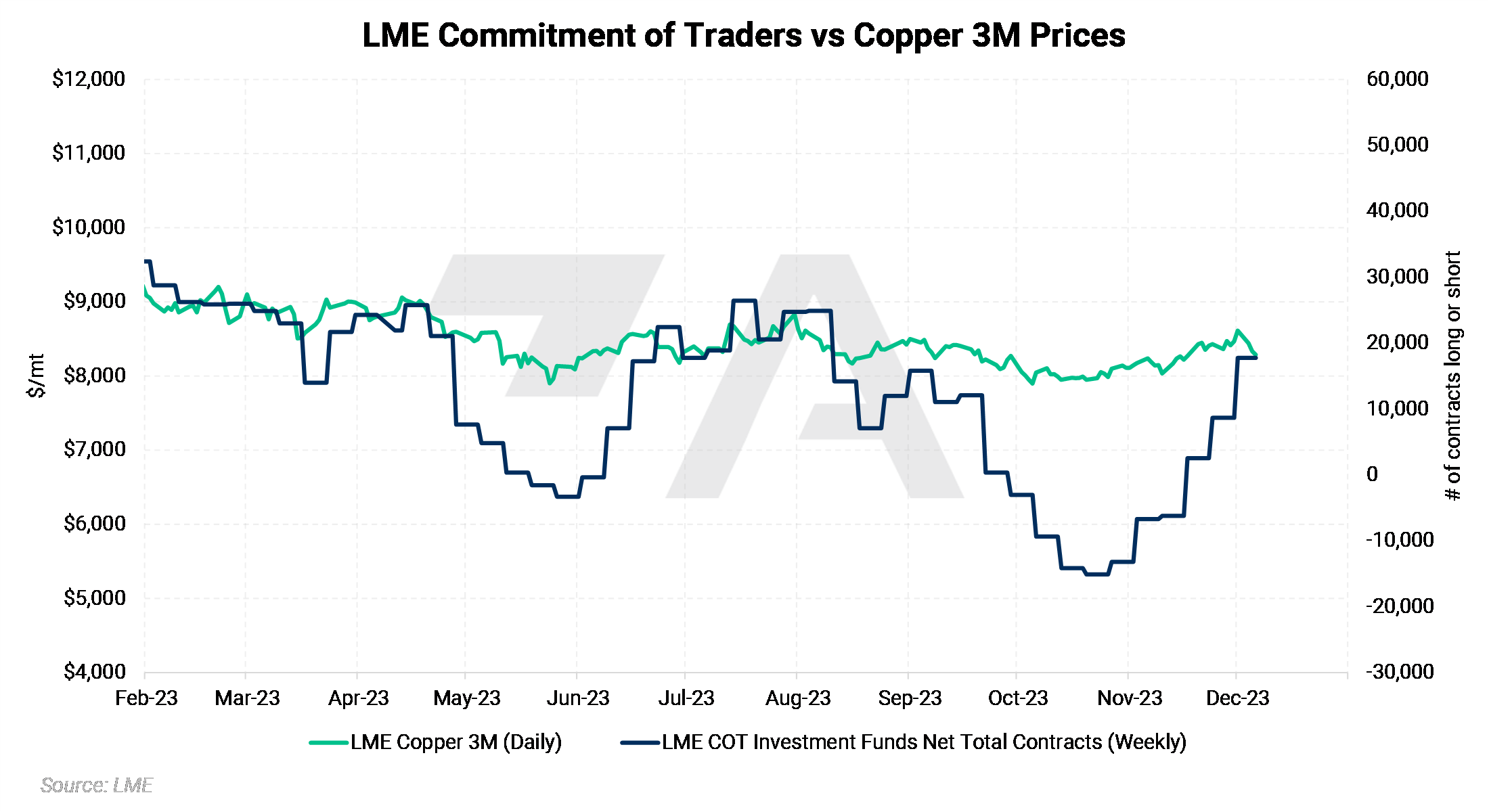

Investment funds buy copper and sell aluminum.The following two charts show how investment funds, who are purely speculators in metals markets, can influence the aluminum and copper markets. The copper and aluminum markets are extremely price-sensitive to fund positioning. While the aluminum market hasn’t fundamentally changed, copper is going through major supply concerns, which could be leading investment funds to make bullish bets on copper while aluminum is moving sideways to lower. |

|

|

|

Copper becomes expensive relative to aluminum.Regarding the relationship between copper and aluminum, the price ratio between the two has reached an unusually high level. Historically, a price ratio of 4 or greater is rare, and 3.9 has typically been a turning point. A ratio near 4 (or greater) suggests that copper has become overvalued relative to aluminum. Given the recent copper rally while aluminum has fallen, it appears aluminum is undervalued relative to copper, thus providing an excellent hedging opportunity for aluminum consumers. |

|

|

Why are aluminum prices down?Aluminum prices are down approximately 11% on the year. This is mainly due to slumping manufacturing sectors in the West as well as China. For example, the US manufacturing sector has been contracting since November 2022, and the Eurozone has been contracting for 17 consecutive months. Meanwhile, China’s manufacturing sector has been essentially flat throughout 2023. (In the charts below, a reading below 50 suggests that the sector is contracting, while a reading above 50 suggests expansion). |

|

|

Are there any bright spots?Despite the negativity, China’s rising import demand in recent months has been a “bright spot” for the global aluminum market. This is mainly because LME aluminum prices have fallen while China’s domestic market has remained stable, thereby leading to improving import arbitrage. Although LME prices have yet to prove a bottom, we think that China’s import demand will keep prices from falling dramatically. |

|

|

What about copper?As for copper, supply concerns from Central and South America have taken center stage in recent months, leading to higher prices. For example, Codelco, Chile’s state-owned copper miner and the world’s largest, has seen its production fall to a 25-year low. In late November, the Panamanian government effectively shut down the First Quantum Minerals’ Cobre Panama copper project, removing 1.5% of global supply from the market. With supply concerns mounting, investment funds and other market participants have turned bullish in Q4. |

|

|

This price risk can be hedged!Even though these markets have diverged in price and fundamentals, end-users should consider hedging against further price increases via LME swaps or options. Below we detail several ways this can be done for both aluminum and copper. Please reach out to AEGIS for further details and specifics. |

|

|

|

|

AEGIS can build your hedging program.AEGIS can help aluminum and copper buyers develop specific strategies that fit their operations. We are also happy to introduce new clients to more counterparties, therefore ensuring that you are receiving the best possible price. Please contact us for details. |

Important Disclosure: Indicative prices are provided for information purposes only and do not represent a commitment from AEGIS Hedging Solutions LLC ("Aegis") to assist any client to transact at those prices, or at any price, in the future. Aegis makes no guarantee of the accuracy or completeness of such information. Aegis and/or its trading principals do not offer a trading program to clients, nor do they propose guiding or directing a commodity interest account for any client based on any such trading program. Certain information in this presentation may constitute forward-looking statements, which can be identified by the use of forward-looking terminology such as "edge," "advantage," "opportunity," "believe," or other variations thereon or comparable terminology. Such statements are not guarantees of future performance or activities.