LME aluminum trades sideways in early 2024.Aluminum has been quite rangebound for the past several months. Over the past year, resistance is approximately the $2,400/mt level, while $2,100/mt has been support. Despite the reports of new sanctions on Russia, there is little reason for prices to break out of the recent range. |

|

|

Russia finds a willing buyer in China.One key reason why any new sanctions won’t materially impact US imports of Russian aluminum is that the US imports little from Russia. In late February 2023, the Biden administration imposed a 200% import tariff on Russian aluminum. This move effectively shut out Russia from US markets. While Russia’s exports to the US have slumped, China has become a top buyer of Russian aluminum. Last year, China imported 1.175 million mt of Russian primary aluminum, up from approximately 462,000 mt in 2022. In 2023, about 76% of China’s primary aluminum imports came from Russia. Reports from Bloomberg, Reuters, and other sources suggest that Russia sells aluminum at a significant discount, but the specific prices are unknown. |

|

|

Low global prices help.Although steep discounts led to China importing a record amount of Russian aluminum last year, an improving import arbitrage also aided in driving shipments to China. The spread between China’s domestic (SHFE) prices and global (LME) prices widened significantly throughout 2023. This strengthening spread led to a significant uptick in imports last year. So far in 2024, this spread has remained strong and hovers near $400/mt. If this spread remains strong in 2024, then we should expect imports to continue at a brisk pace. Steady import demand from China should support global (LME) prices. |

|

|

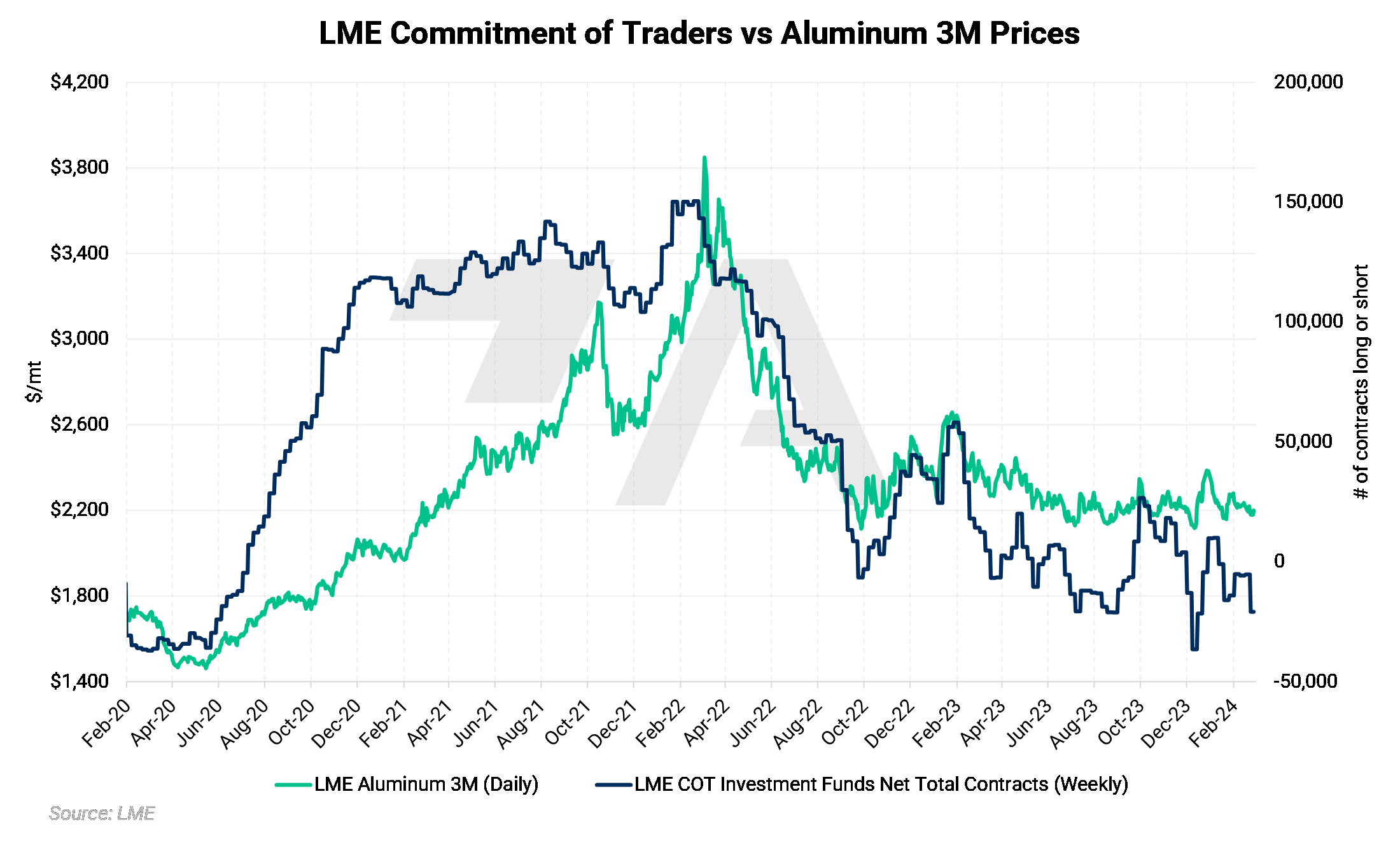

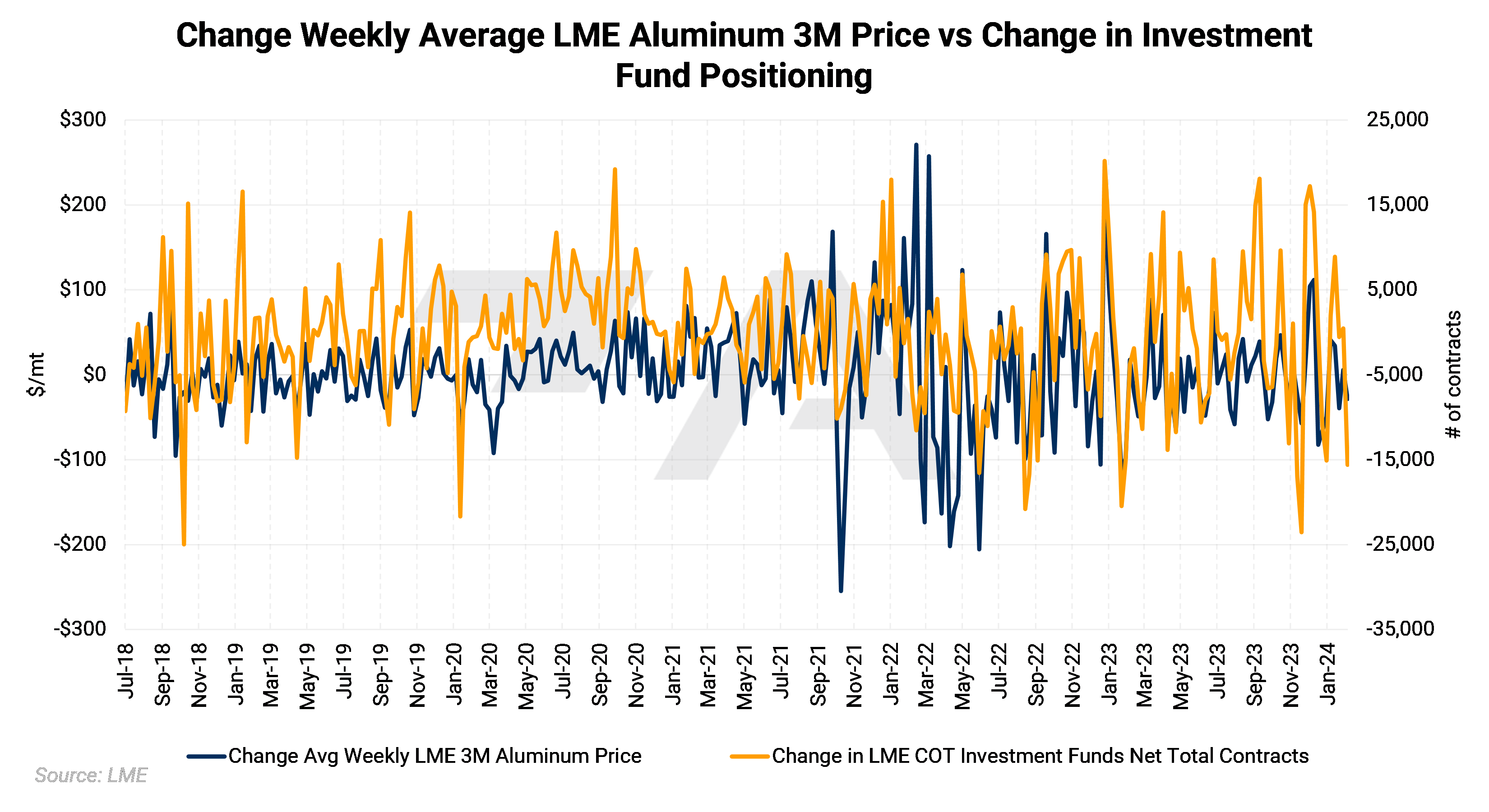

Speculators are still selling.Although it is outside traditional supply and demand dynamics, AEGIS also keeps a close eye on the actions of investment funds. These funds, generally speculators in metals markets, can have an oversized influence on LME prices. The charts below clearly illustrate the impact these funds can have on prices. |

|

|

End users should consider hedging though!As of this writing, LME aluminum is down about 8% on the year. As suggested above, LME aluminum remains rangebound, but aluminum end-users should consider doing long-term hedging while prices are near the lower half of the recent trading range. Below, we detail several strategies that end-users could implement. Please get in touch with us for more information and specific strategies. |

|

|

AEGIS can build your hedging program.AEGIS can help aluminum buyers develop specific strategies that fit their operations. We are also happy to introduce new clients to more counterparties, therefore ensuring that you are receiving the best possible price. Please contact us for details. |

Important Disclosure: Indicative prices are provided for information purposes only and do not represent a commitment from AEGIS Hedging Solutions LLC ("Aegis") to assist any client to transact at those prices, or at any price, in the future. Aegis makes no guarantee of the accuracy or completeness of such information. Aegis and/or its trading principals do not offer a trading program to clients, nor do they propose guiding or directing a commodity interest account for any client based on any such trading program. Certain information in this presentation may constitute forward-looking statements, which can be identified by the use of forward-looking terminology such as "edge," "advantage," "opportunity," "believe," or other variations thereon or comparable terminology. Such statements are not guarantees of future performance or activities.