|

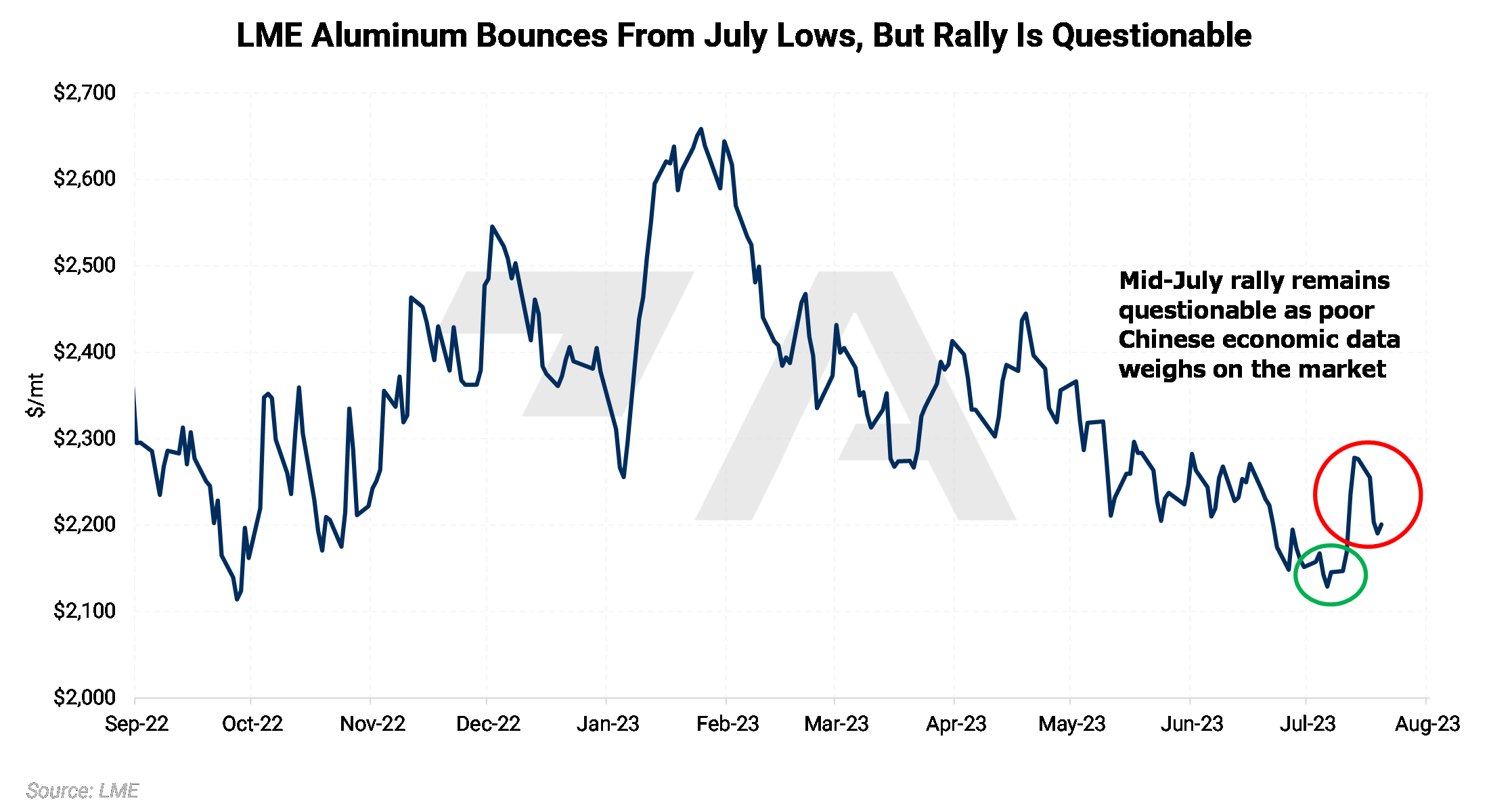

As of this writing (July 20), the market has appeared to reach a bottom on July 6. Falling inflation data and a declining US dollar proved to be positive catalysts, albeit short-term. Poor economic data soon followed, and aluminum prices quickly coughed up these brief gains. |

|

|

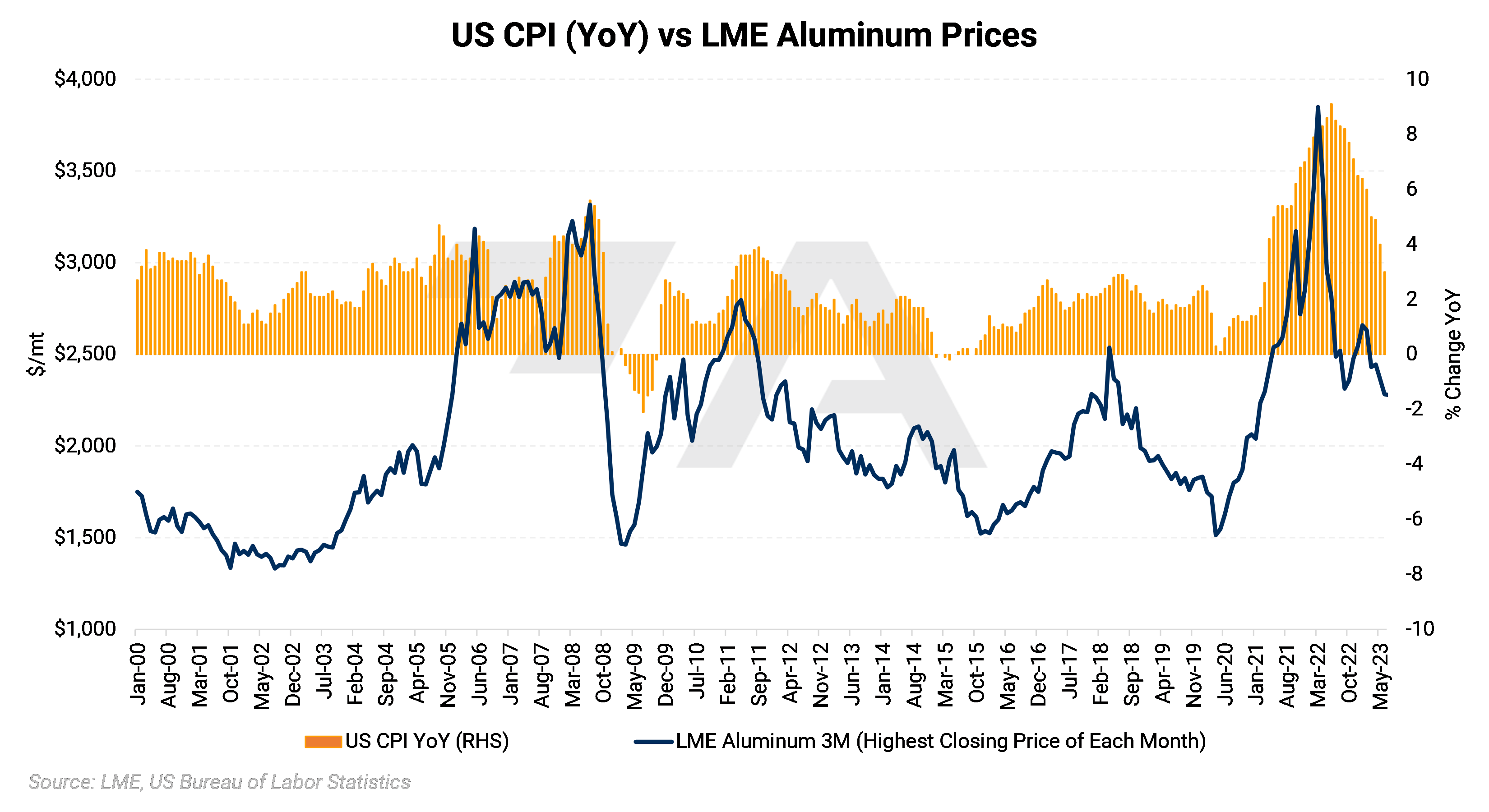

Aluminum prices seem to be a leading indicator of inflation in the US. The US Consumer Price Index, a widely watched gauge of inflation, has fallen tremendously in 2023. If aluminum prices continue to fall, it is likely that inflation will drop further. |

|

|

China’s manufacturing sector can have an oversized influence on aluminum prices. Peaks and troughs in manufacturing activity usually precede a corresponding turn in the global aluminum market. If Chinese manufacturing starts to recover, the aluminum market will likely respond in kind. |

|

|

|

In general, China’s aluminum export volumes rise alongside prices. This was especially true in early 2022 when prices spiked to nearly $4,000/mt due to the Russia-Ukraine conflict. Prior to the conflict and the pandemic, exports tended to increase when prices exceeded the $2,700/mt (blue line) and $3,300/mt (gray line) levels. Although volumes have fallen slightly from the extraordinary levels of early 2022, exports remain at a historically high level. |

|

|

|

Despite falling end-user demand, China’s aluminum imports also remain at a historically high level. Imports tend to increase when prices are near the $1,500/mt level. If we reach the $1,500/mt level, will imports increase further? |

|

|

|

As a final note on China, the country’s aluminum smelters keep producing at a blistering pace. Since June 2020, the country’s average daily production has never fallen below 100,000 mt. As demand remains subpar, this could also be contributing to the recent slide in global prices. |

|

|

|

If you are an aluminum producer or hold aluminum inventory and are worried that prices could fall further, AEGIS can help you mitigate such risk via LME swaps or options. Below we detail several strategies. Please contact us for further details. |

|

|

Important Disclosure: Indicative prices are provided for information purposes only and do not represent a commitment from AEGIS Hedging Solutions LLC ("Aegis") to assist any client to transact at those prices, or at any price, in the future. Aegis makes no guarantee of the accuracy or completeness of such information. Aegis and/or its trading principals do not offer a trading program to clients, nor do they propose guiding or directing a commodity interest account for any client based on any such trading program. Certain information in this presentation may constitute forward-looking statements, which can be identified by the use of forward-looking terminology such as "edge," "advantage," "opportunity," "believe," or other variations thereon or comparable terminology. Such statements are not guarantees of future performance or activities.