Over the past few years, Appalachian production has followed a seasonal pattern where supply increases during the winter season and winds down slightly during the shoulder months. Appalachian producers even publicly announced production curtailments last year to avoid weak summer prices and capture higher prices during the winter. A large winter-summer spread and lackluster spot prices made it economical to delay production. This winter, production growth will likely be limited by a lack of spare capacity additions that become vital during shoulder season.

So far in September, Appalachian dry gas production is averaging around 34.5 Bcf/d, a seasonal record, and just shy of December 2020’s high of 34.6 Bcf/d, according to PointLogic. This would be a year-over-year increase of 2 Bcf/d. Remember, last year’s curtailments made the Summer 2020 number artificially low. However, it seems supply gains have primarily made their way onto outbound pipes. PointLogic data shows flows down the Southern, Midwest, and Atlantic corridors are up by 1.34, 0.2, 0.35 Bcf/d, respectively (1.89 Bcf/d in total).

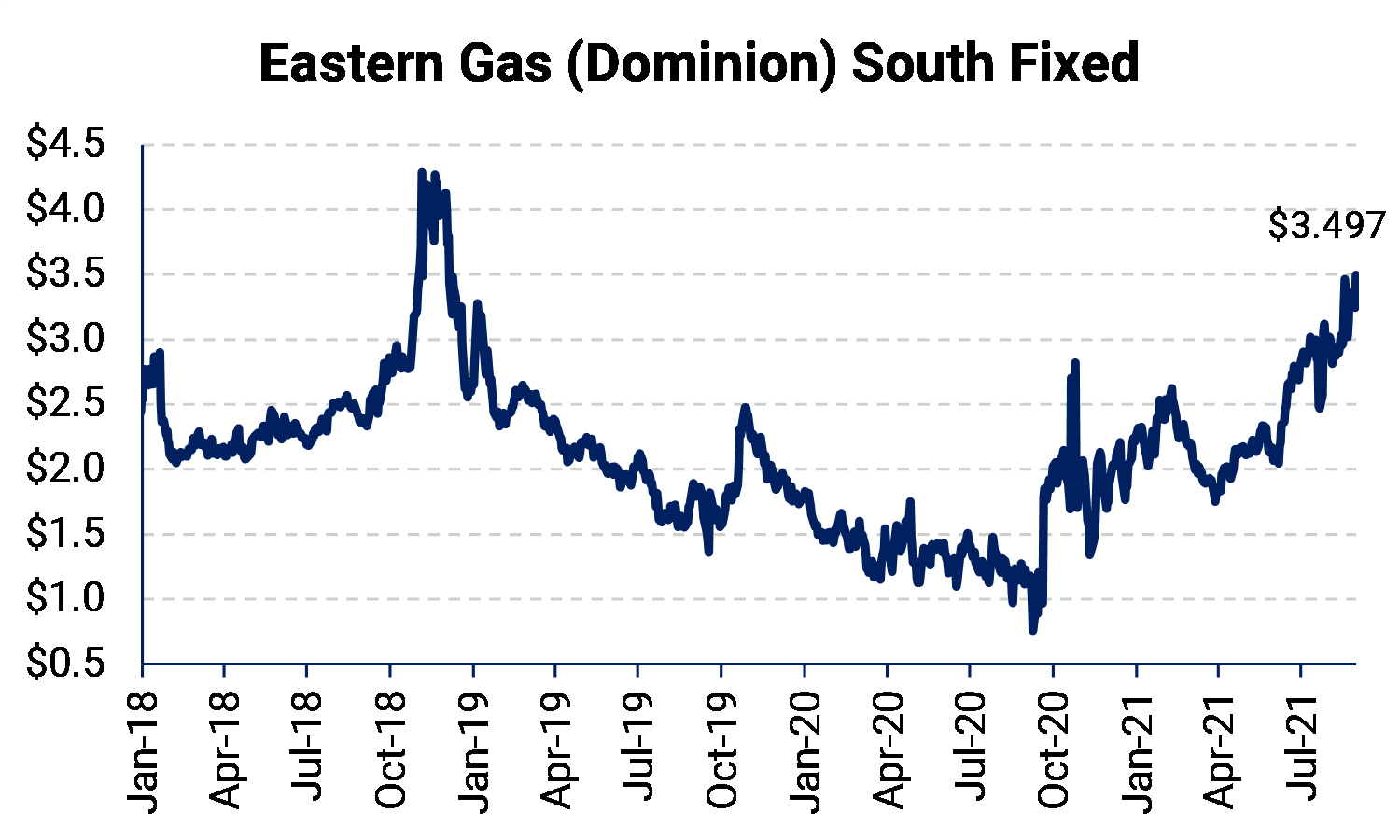

This year we are in a very different gas market. There is a global supply crunch underway which has led prices at Henry Hub to rise to a seven-year high, and widespread low inventory levels will likely keep gas prices high for the foreseeable future. While Eastern Gas South basis (formerly Dominion South basis) has worsened, fixed prices at Eastern Gas South are trading 3x higher than during the same time last year. The prompt-month Eastern Gas South contract was trading at $3.497/MMBtu on September 8, 2021, much better than the $1.16 settle on September 8, 2020.

Pipeline flows to other regions have set several records in 2021. Utilization has been in the high 90% through most of the summer for pipes flowing through the Southeast/USGC, Midwest, and Atlantic corridors. Flows through the NY/NJ corridor are below capacity. However, this is seasonal, and during the winter, flows increase by an average of 4-5 Bcf/d to help serve Northeast residential and commercial heating demand.

AEGIS believes outbound capacity will limit how much production can grow. The only large near-term project that may bring more transportation capacity is Transco’s Leidy South expansion, which is expected to come online in 4Q2021 and bring another (457 MMcf/d) of egress capacity. What about MVP? The 2 Bcf/d Mountain Valley Pipeline is forecast to come in-service next summer. However, this pipeline is already three years late, and it wouldn’t be surprising if there were another delay.

Outbound pipeline capacity is important for the Appalachian region because the gas needs somewhere to go during the shoulder season when local and NY/NJ heating and residential/commercial demand subsides. With most outbound pipelines already running near capacity, the room for growth will be limited. Therefore, we remain concerned that 2022 Appalachia basis could repeat the weakness of 2021.

In conclusion, the gas market will be tight this winter, and the U.S. will need more supply. The Appalachia basin has room to grow, but only slightly. The additional 457 MMcf/d of capacity from Transco’s Leidy South Expansion will help but there are no other infrastructure projects that will provide capacity through the end of 2021.