|

|

|

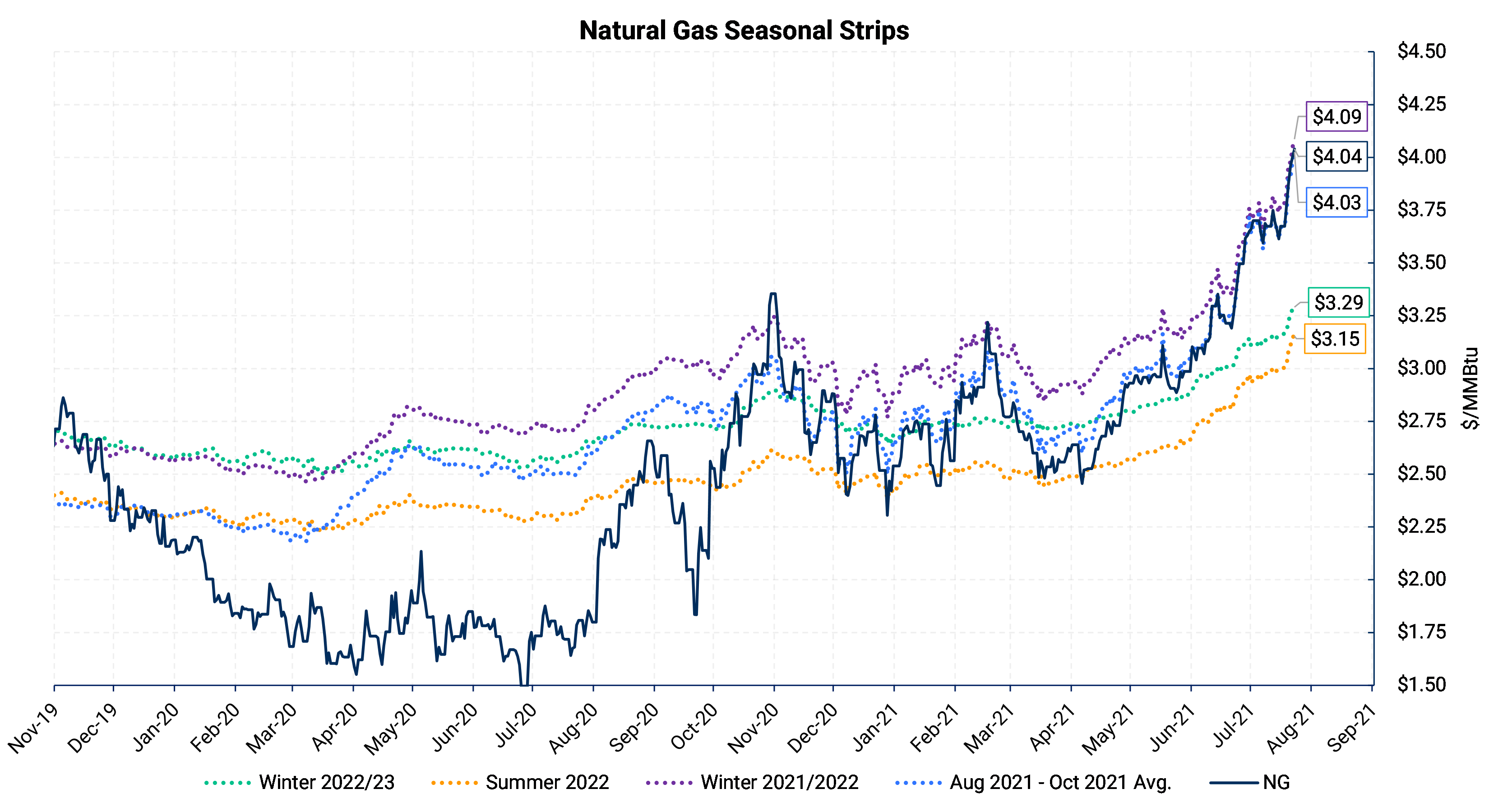

The natural gas price rally that began in mid-June led the whole forward curve higher, but near-term gas benefited much, much more than even next summer’s strip. While Summer 2022 did rise from $2.75 to $3.15, Winter 2021/2022 rocketed to about $4.08, compared to $3.35. That’s a this-winter rally of almost 80c, compared to a next-summer rally of 40c. The result is a larger discrepancy between winter and summer prices, a discrepancy that was already large by historical standards. Let’s compare January versus April, to compare peak-winter market pricing versus the first month of the summer strip. In other words, we compare the usual highest-price tenor versus the lowest. |

|

|

|

|

|

That Jan-Apr price spread was at $1.00 during the day Friday, July 23. This time of year, this spread is typically in the range of $0.20 to $0.50. In well-supplied years that have production rising faster than demand, the spread tends to be small; there is little winter premium (see 2016, 2019). In years where demand is outpacing supply, the winter expectations are usually more bullish and the spread is wide (see 2017). But this year is extreme, and it got worse in mid-June as gas prices began moving higher. In the chart, our study of the previous seven years shows that Winter-Summer usually collapses to the “average” range during summer. It has happened in two ways: Winter can decrease in value, or next Summer can increase. In this case, we expect next summer is more likely to rally to rein-in that spread, rather than expecting weakness in winter pricing. We observe that the market is tight right now. On multiple measures, we quantify supply lagging behind demand. Cooperative weather this summer is part of the explanation, but part is structural, meaning we expect supply-demand tightness will tend to be persistent without the help of weather. And, we do not expect it to change meaningfully next summer. Yes, there are signs that gas production is growing in the Haynesville play (including adjacent plays in East Texas), and oil prices are high enough to encourage associated-gas growth in the Permian basin. However, demand is growing, too. Exports of LNG and some smaller increased volumes to Mexico are likely to keep the gas market tight next summer. The demand growth is in the range of 2 Bcf/d, and our low estimate would be near 1.2 Bcf/d. And this point-to-point comparison does not even consider the possibility that next summer may start with low gas inventories, depending on this winter's demand. If, like us, you think gas supply isn’t likely to rise much faster than demand will, then the logical conclusion is that next summer’s contracts are likely to draw the attention from utilities and marketers soon. They would be interested in securing 2022 supply, in what could be a market with similar scarcity to this year. The result would be that Summer 2022 would rise more, or fall less, than Winter 2021/2022, thereby shrinking the price spread. |

|