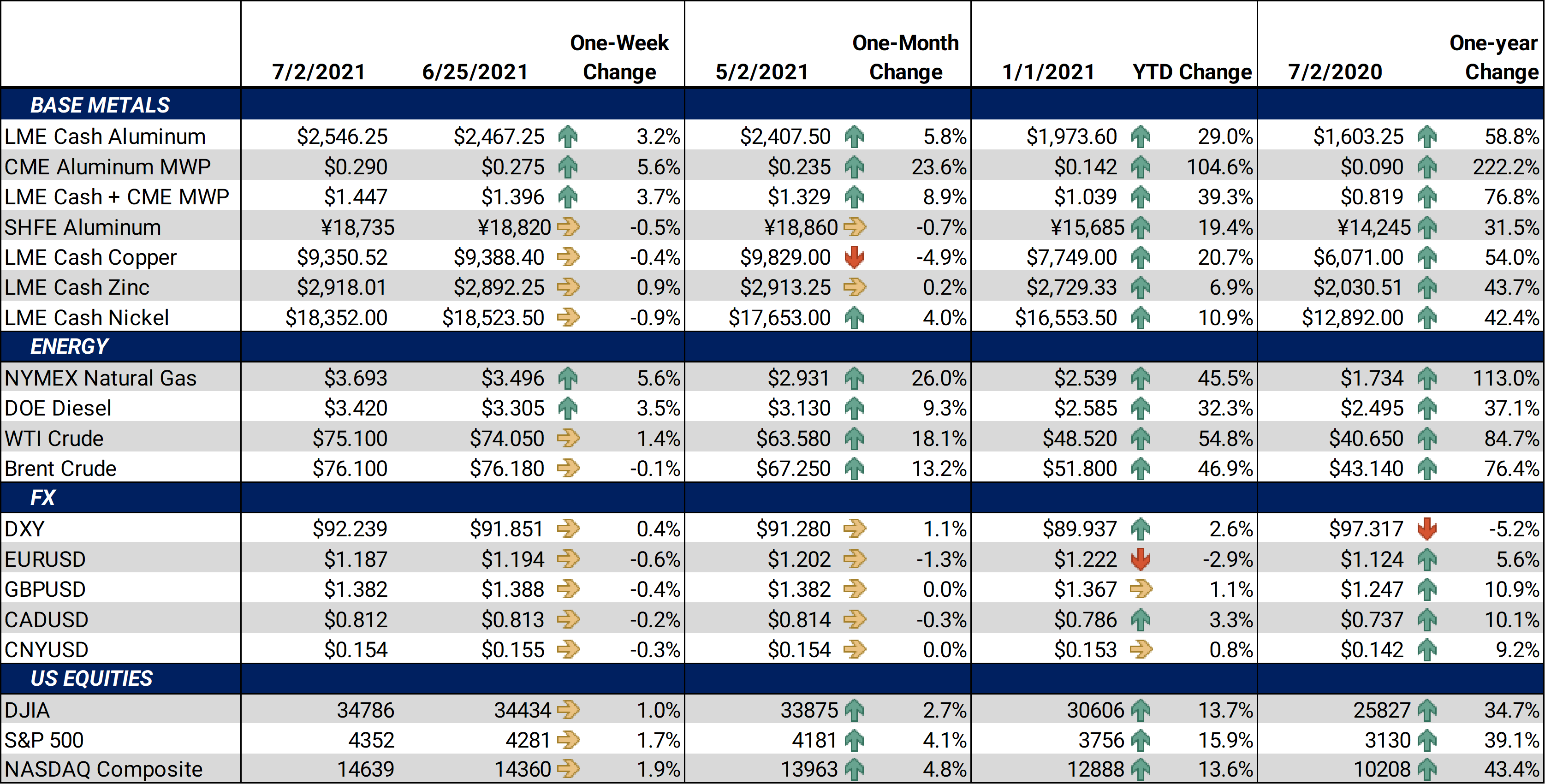

Metals markets were mixed this week, as news from China and Russia provided fodder for both bulls and bears. Late last week, China stated it will auction 20,000 mt of copper, 30,000 mt of zinc and 50,000 mt of aluminum on July 5-6. Market participants shrugged off these numbers, stating that they were too low to make a meaningful impact. However, state officials claim they are only testing the waters with this initial sale. It will be interesting to see the results of this sale, both on demand and pricing. |

|||||

|

On a similar tone, the market initially shrugged off news from late last Thursday that Russia will be implementing a new round of tariffs on metals exports. However, the aluminum MW US Transaction premium did eke out a new all-time high on Monday, suggesting a delayed reaction to the news. Strength on the MWP continued throughout the week as traders digested the Russia news and its longer-term implications. The new tariffs kick in on August 1; American end users are scrambling to source aluminum before tariffs go into effect. Even before this new round of tariffs, Russian exports volumes have been red hot. Increased production costs due to tariffs likely will not cool demand if those costs are not passed through to the consumer. However, some believe that if the tariffs become too burdensome, Russian production and sales could slow, making the aluminum market even tighter. (For more info on this, please check out our recent blog post here.) |

|||||

|

Bottom Line: Given the mixed action this week, it’s really hard to know if this week’s trade was merely a “breather,” or if the market is “exhausted.” Chinese economic data released over the weekend suggest that consumers and industrial firms are seeing the pinch from high commodity prices. By no means have profits evaporated, nor have consumers put away their wallets, but it will be interesting to see if China has finally reached the point where high prices lead to lower demand. On a more macro note, precious metals continued their slide, with front-month gold finishing down nearly $150 (nearly 6%) off late-May highs. Conversely, the dollar index is up nearly $2.50 (nearly 3%) since the late May lows and is sitting at levels not seen since early April. Further strength in the dollar and selling in the precious metals complex could keep speculators on the sidelines in more physically driven markets like aluminum and steel. A strengthening dollar makes our products more expensive for foreigners to purchase, so exports of finished goods could stall should the dollar strengthen beyond the appetite of foreign demand. Payrolls in the US were up 850,000, substantially higher than the 720,000 average estimate. Stock market futures immediately jumped on the news, however, trade, after the cash market opened, was muted. An improving job market is positive for base metals, hence metals firmed on the news. Traders should also keep an eye on renewed COVID fears, as the delta variant is creating havoc in Asia and certain areas of the US. Any ramp-up in delta variant shutdowns could slow the demand for base metals. We remain steadfast in our thoughts on disciplined hedging such as with long calls or zero-cost collars. Having limit orders working along with reasonable stop-losses is also sensible.

|

|||||

|

|||||

|

|

|||||

LME Aluminum |

|||||

|

With the news of Russian export tariffs acting as a supportive backdrop, the LME 3M Select finished higher for the week, with the last trade at $2,561, and trades ranging from $2471.00/mt to $2,564.50/mt. However, we starting to hear of a slowdown in aluminum demand in both China and Japan, which could keep a cap on prices. The US Department of Commerce began requiring import licenses for aluminum importers, effective June 28. According to the Department of Commerce, this is purely meant for informational purposes, tracking volumes, prices, etc. Although there is some debate in the trade as to whether or not this bullish or bearish, we believe this shouldn’t be viewed as a market-moving event. We continue to recommend that metal consumers layer in hedges in a disciplined manner and select between swaps or call options depending on their risk-management objectives. However, option structures are generally preferred due to the recent rise in volatility. Call option premiums have increased during this rally, so collars are a logical strategy. Cash-3M last traded at $15.75/mt contango (where cash is cheaper than 3mo), narrowing in from $19.00/mt contango during last week’s trade. Dec ‘21/Dec ‘22 continued to show backwardation, suggesting that there are still few buyers for long-dated contracts. In general, we have seen less long-dated consumer hedging with both premiums and LME at high levels.

|

|||||

Midwest Premium |

|||||

|

The aluminum Midwest Premium did some of the heavy lifting in the metals complex this week, as the CME MWP contract for July had a last trade of 29.2¢/lb at the time of writing, up nearly 2¢/lb for the week. The much-discussed Russian export tariffs buoyed prices this week, as American end-users, unsure of future supply, struggle to source metal. Likewise, high freight costs, shipping delays, and increasing European demand are adding fuel to the fire. Mimicking the activity we have seen over the past several weeks, there was little MWP trading activity in Cal ‘22; the backwardation in the forward curve remains significant and makes inventory hedging expensive. |

|||||

|

|

|||||

LME Copper |

|||||

|

LME Copper 3M Select traded sideways this week, with the last trade at $9,374.00/mt. Keep an eye on the $10,000/mt level as it is still nearby resistance. The LME 3M contract traded in a narrower range than last week, from $9236.00/mt to $9,496.50/mt. Copper is digesting the same news we discussed in detail above, mainly economic news and data from China. Likewise, keep an eye on the dollar, as it will likely be a major influence on the price direction of the red metal. A weaker dollar usually supports higher metals prices.

|

|||||

|

|

|||||

LME Nickel |

|||||

|

Nickel was among the weakest in the metals complex this week, wiping away half of last week’s gains. Last trade on the LME 3M Select contract was $18,310/mt, with a trade range of $17,930/mt to $18,600/mt for the week. Like other base metals, nickel tends to benefit from industrial demand. However, the dollar’s recent rally and lower trade in copper has kept the price of nickel range bound. New, positive fundamental news will likely need to occur to break nickel out of the narrow range we have seen since late April.

|

|||||

|

|

|||||

|

|

|||||

CME Hot Rolled Coil (HRC) |

|||||

|

The CME HRC futures contract for July ’21 last traded at $1,789/T, about $14/T higher than last week. Deferred, or longer-dated, contracts through the remainder of the year and into 2022 continue to show signs of backwardation, and there is little reason for this to change in the near term. Opportunities remain open for HRC consumers to hedge future prices below the current spot price. For both producers and those carrying inventory, we continue to believe that buying put options remains the best structure to achieve protection against a major market correction. From a consumer perspective, buying calls can be used to protect against a continued rally, with strike prices that are favorable considering the spot market prices, utilizing options will also allow for participation in a downward price correction. |

|||||

|

|

|||||

|

|

|||||

Notable News |

|||||

|

Column: China's first round of copper, zinc, aluminum auctions fails to impress Americans’ Hunger for the World’s Goods Drives Global Recovery European Aluminium Praises United Kingdom’s Move To Penalize Chinese Aluminium Extrusion Imports China’s Industrial Profits Grow at Slower Pace as Costs Rise - Bloomberg US Dept of Commerce Aluminum Import License Page

|

|||||