|

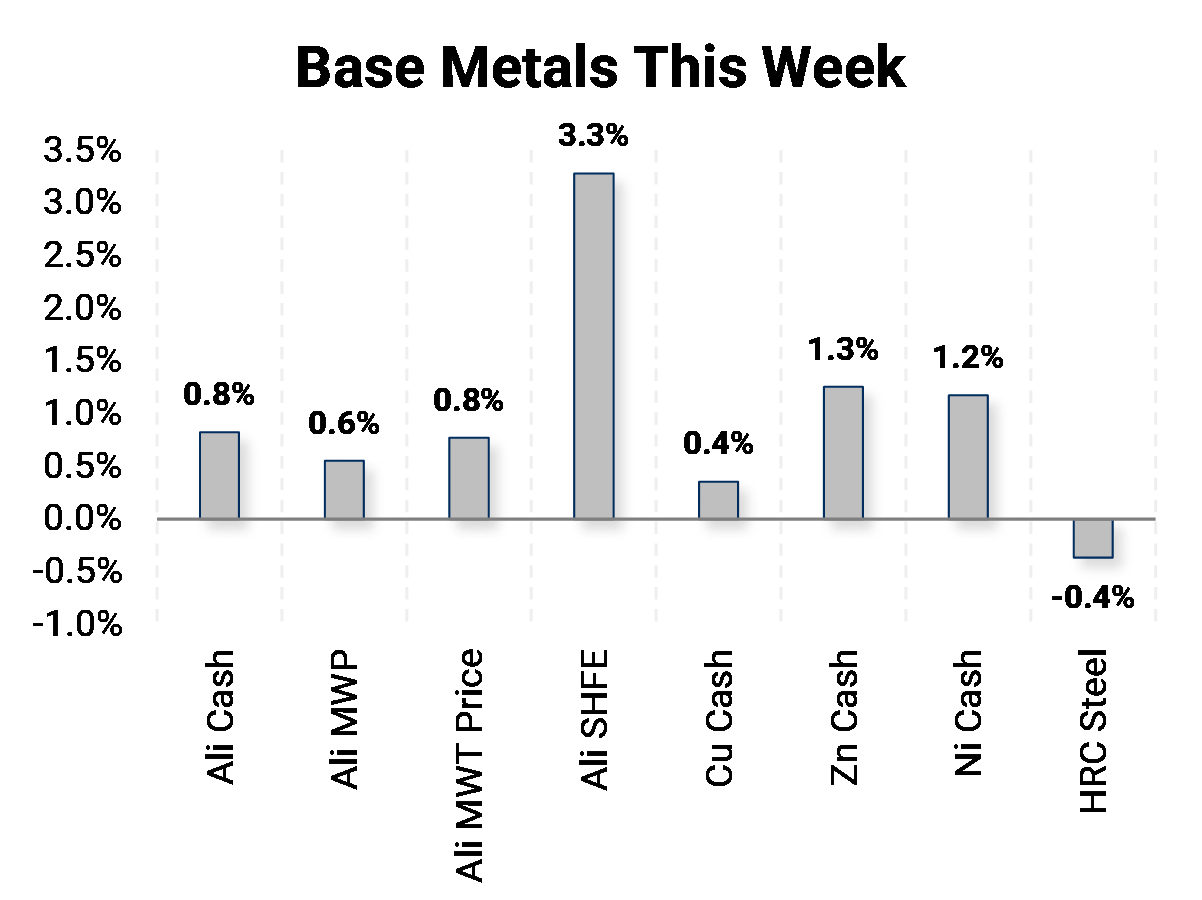

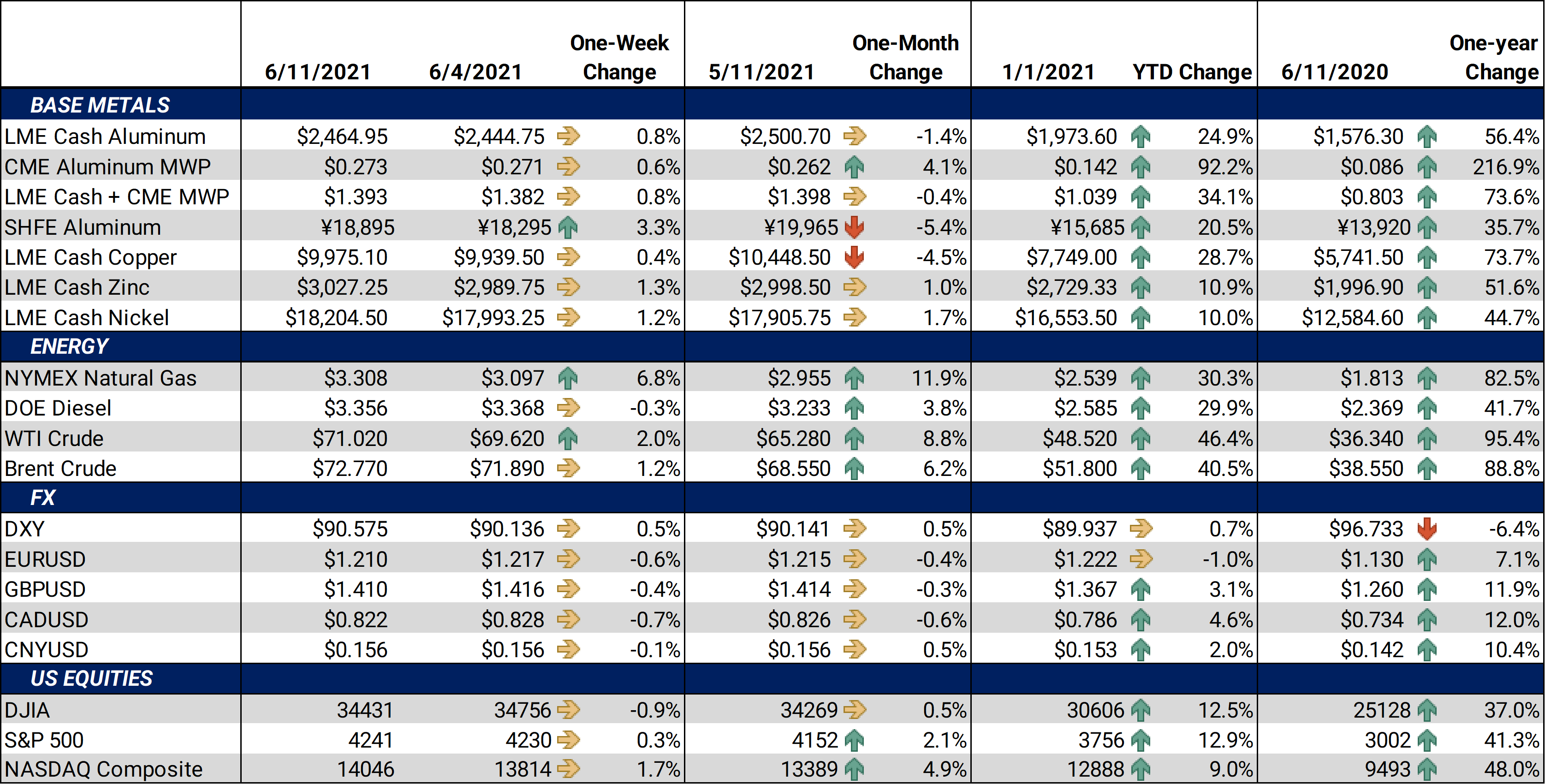

The industrial metals markets did almost nothing to help assuage broader market worries about inflation this week. Again, they were almost universally higher, with HRC steel being the only outlier. SHFE aluminum really took off, while its peers were merely firm. |

|

|

Want to make a quick buck? Start riding your bike to work. The CPI numbers for May showed that inflation, for the second month in a row, has mostly been higher because of vehicle prices. If there were a curve, we expect it would be backwardated. Sell that truck; buy it back later. While inflation indicators are still very low compared to historical standards, more and more surveys show that firms are expecting to raise prices in the future. Raw materials costs are catching up buyers down the chain. |

|

|

Bottom Line: In 2Q 2021, the market has not provided any meaningful relief for unhedged consumers of metal. In addition, many manufacturing companies are struggling to find employees and obtain the raw materials needed to keep up with order books. It has been a painful learning curve for those who may have held off on hedging, waiting for a return to lower prices. Ideally, industrial hedgers were able to take advantage of the brief two-week pullback. If volatility increases and we see additional price consolidation in the future, consider layering in more hedges to narrow the range of possible outcomes and ensure that damage to margins is contained. You may want to consider a trailing stop-loss strategy to add discipline to your hedging approach. It is also important to make sure you understand when margin compression will impact overall company performance. The cost of buying call options or zero cost collars has increased, but if markets remain calm for a few weeks, options may once again be an attractive way to provide protection while allowing participation in lower prices if the rally finally eases. Base metals overall continue to find support from increased consumer demand, physical market imbalances, low short-term interest rates, high freight, logistics costs, continued global stimulus, and a relatively weak U.S. dollar. At the same time, investors have become wary and have been one factor in the recent consolidation.

|

|

|

|

|

|

|

LME Aluminum |

|

|

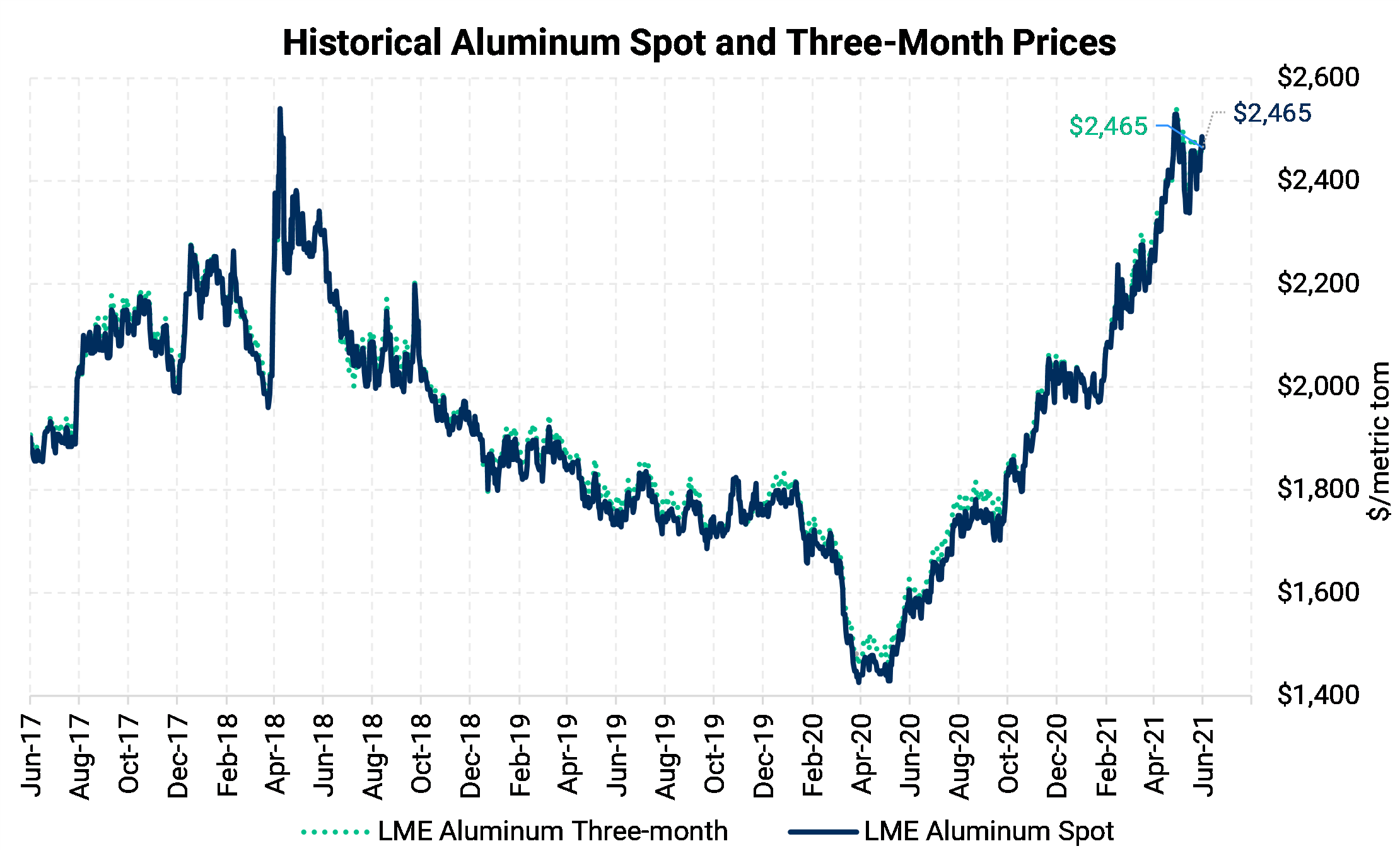

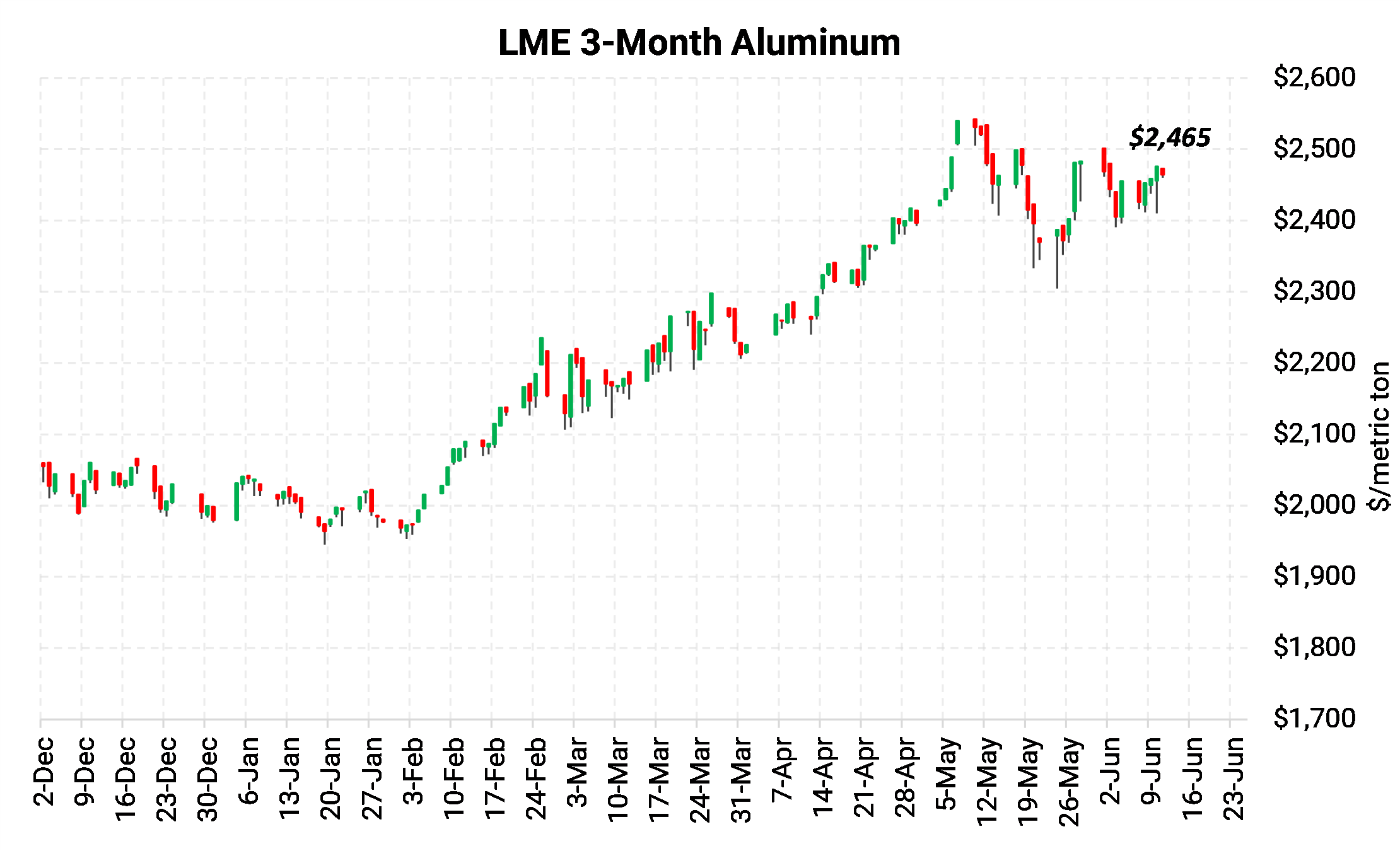

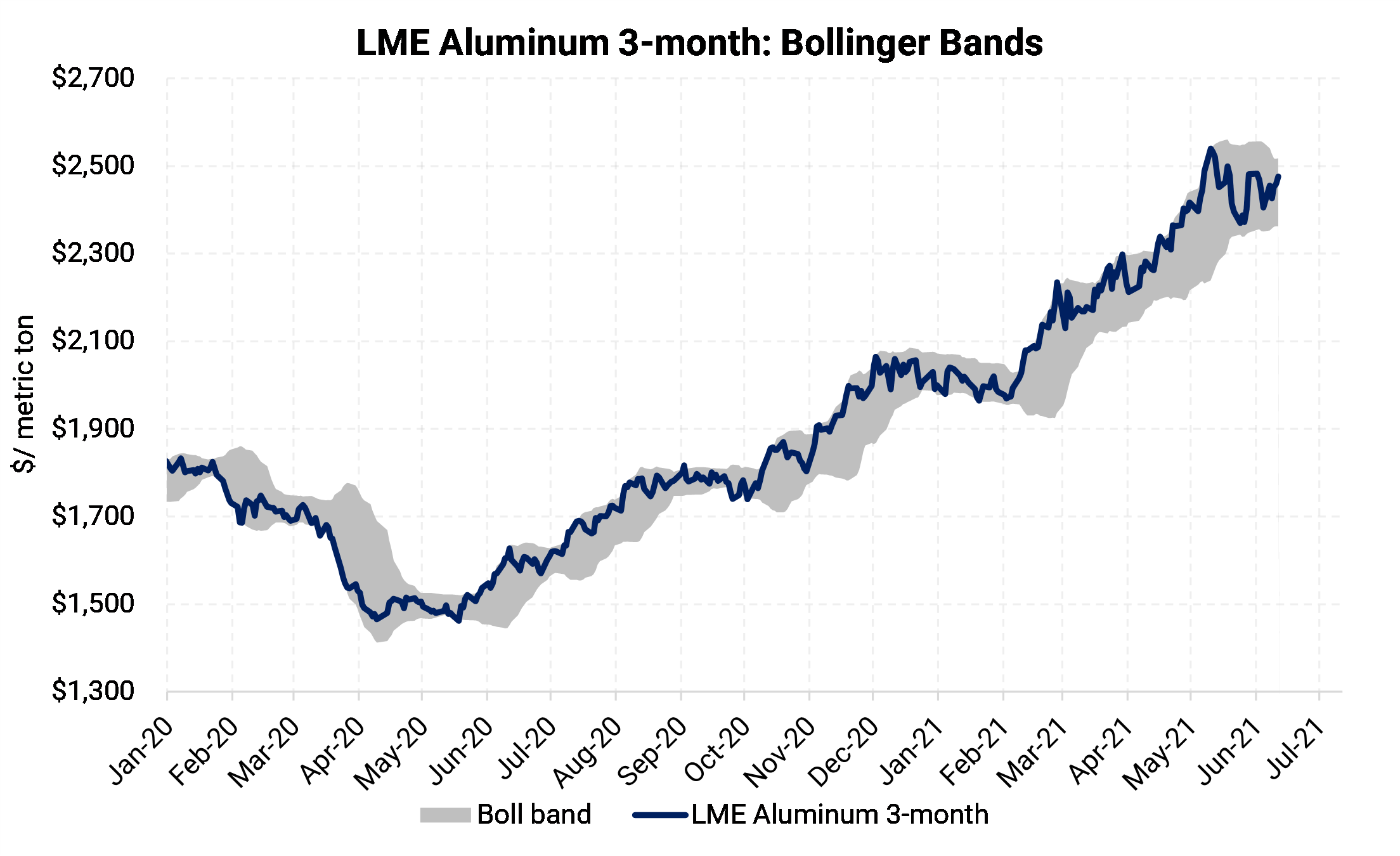

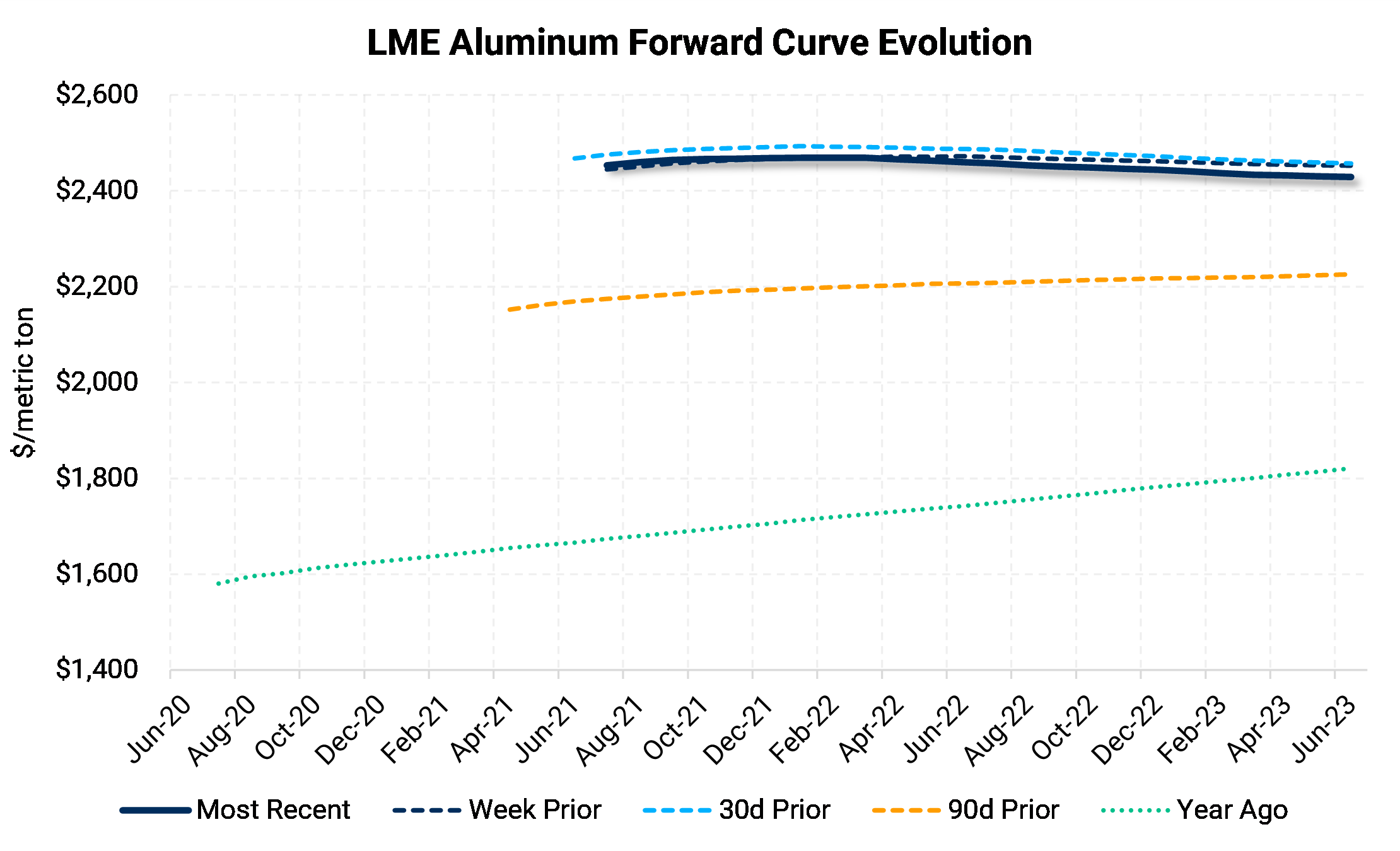

In a somewhat calmer week compared to recent reports, LME aluminum cash price ended the week up by a mere 0.8% at $2,464.95/mt. Meanwhile, the 3mo price ranged from $2,396.00 to $2,478.50, somewhat rangebound, but showing some upward momentum. We continue to recommend that consumers layer in hedges in a disciplined manner and select between swaps or call options depending on their risk management objectives. Consumers who have layered in hedges over the past year continue to receive significant benefits. With the continued slowdown in the overall rally, Cash-3mo collapsed from $25 contango to $0.45 backwardation. Cash and carry inventory financing strategies have become less attractive. Dec’21/Dec’22 backwardation increased this week, now standing at $30. The persistent backwardation indicates there are still few buyers for long-dated contracts. In general, we have seen less long-dated consumer hedging with both premiums and LME at high levels.

|

|

Midwest Premium |

|

|

The aluminum Midwest Premium in the US continued to show signs of a plateau this week as CME MWP contract for June was trading at 27.3¢/lb at the time of writing, largely flat on the week. Current published cash MWP levels continue to remain at all-time highs. With little MWP trading activity in Cal22, the backwardation in the forward curve remains significant and makes inventory hedging expensive. For the nearby curve, 3Q2021 appears to be pricing in a greater likelihood of Section 232 tariffs remaining in place for an extended period as well as demand continuing to surpass supply.

|

|

|

|

|

|

|

|

|

|

|

|

LME Copper |

|

|

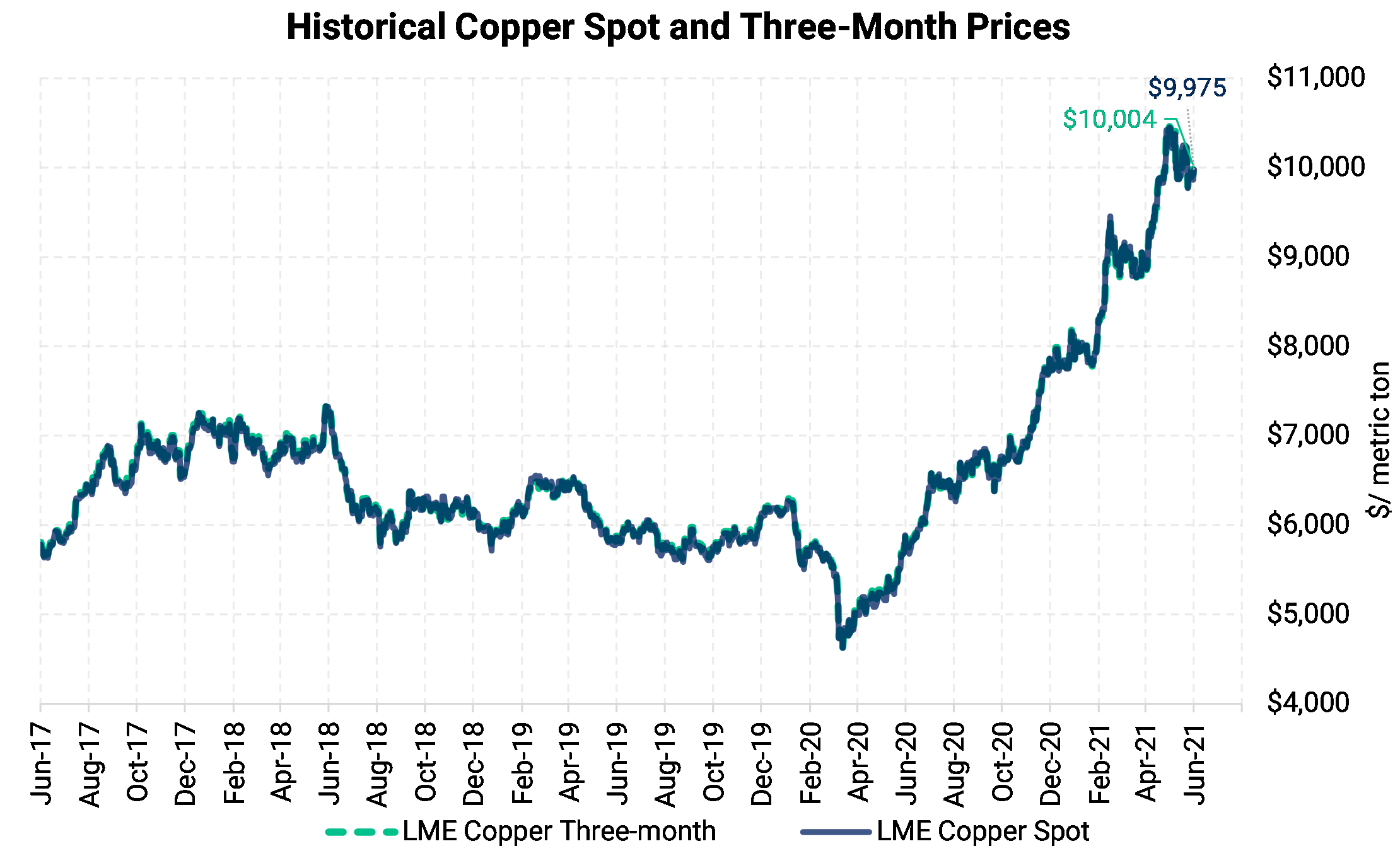

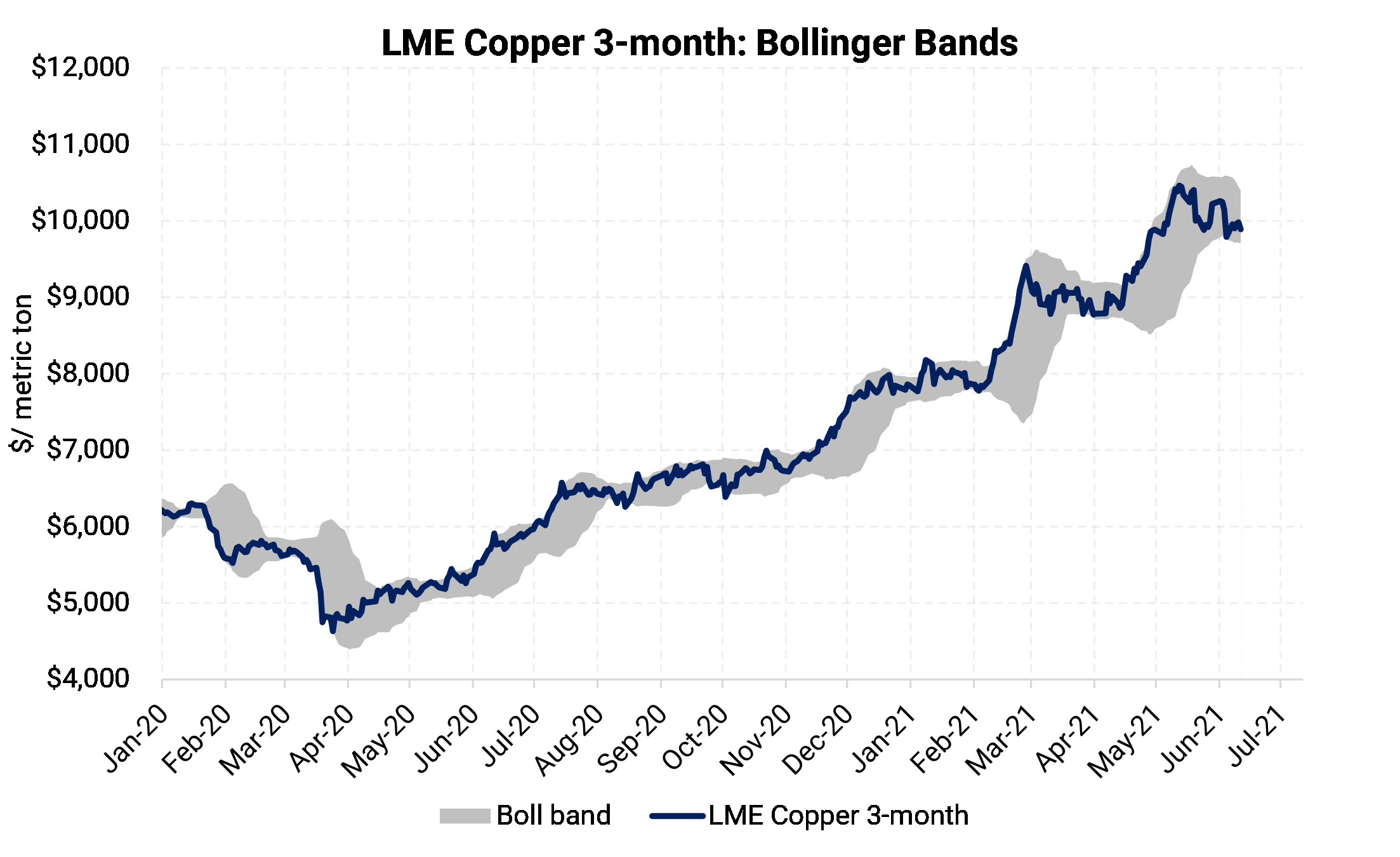

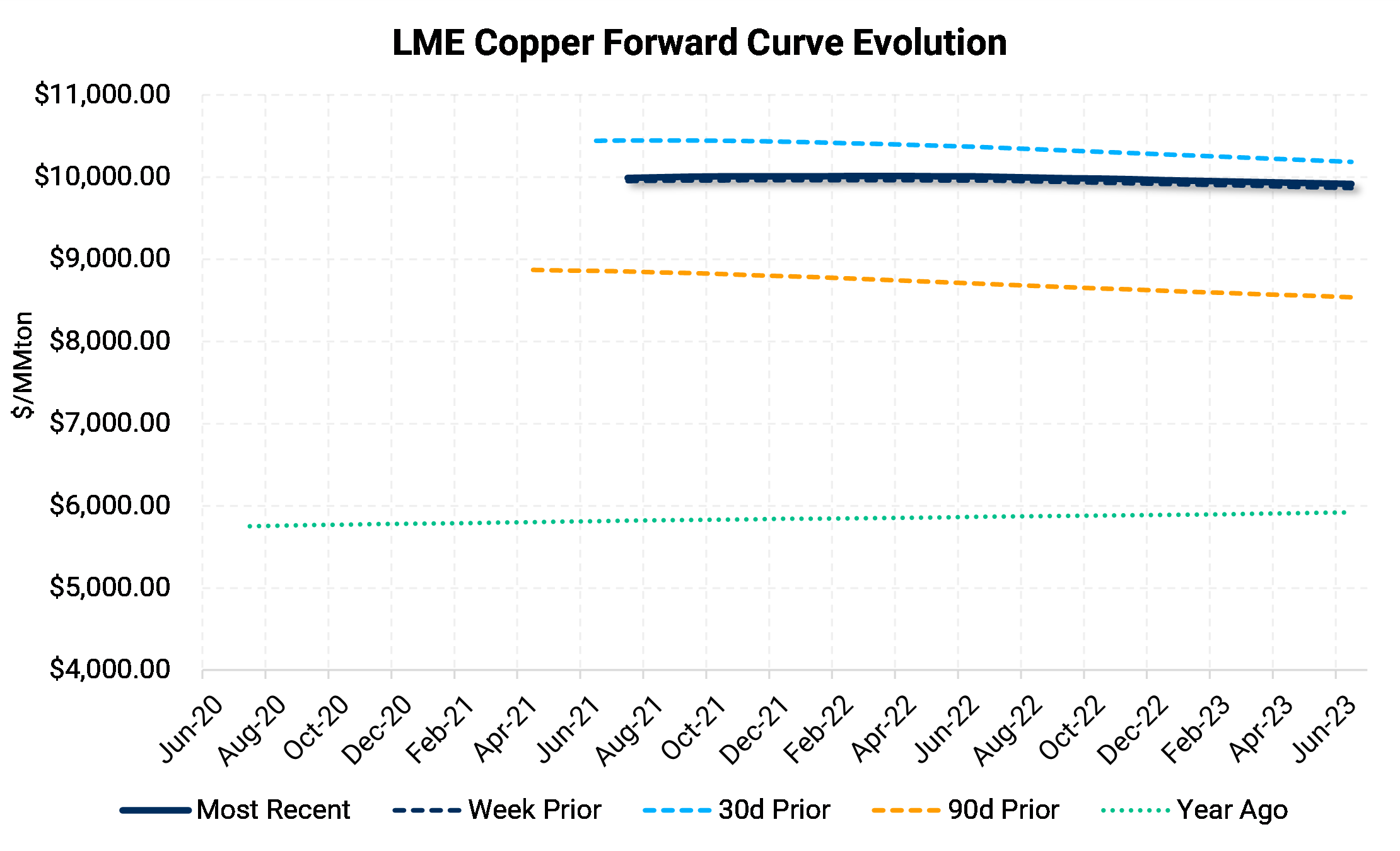

A month ago, LME Copper tried to hold at $10,500, but it has retreated, still barely keeping its five digits, at $10,004. Some mild backwardation (downward slope) emerged in the curve in late winter, presenting a fleeting opportunity for some consumers to hedge at a discount. But the curve has flattened out and maintained a high price. By many analyst reports, copper supply is likely to respond to price and a bright outlook for demand. However, demand is currently at the helm. Near-term supply threats add on to the surging demand and weakening USD. The world's largest copper mine, Escondida in Chile, has been dealing with labor (strikes) and regulatory issues regarding water use. Forbes reports it is also at peak production. All in all, despite prices already being higher, there remains a relative scarcity of copper without a near-term likelihood of increased supply.

|

|

|

|

|

|

|

|

|

LME Nickel |

|

|

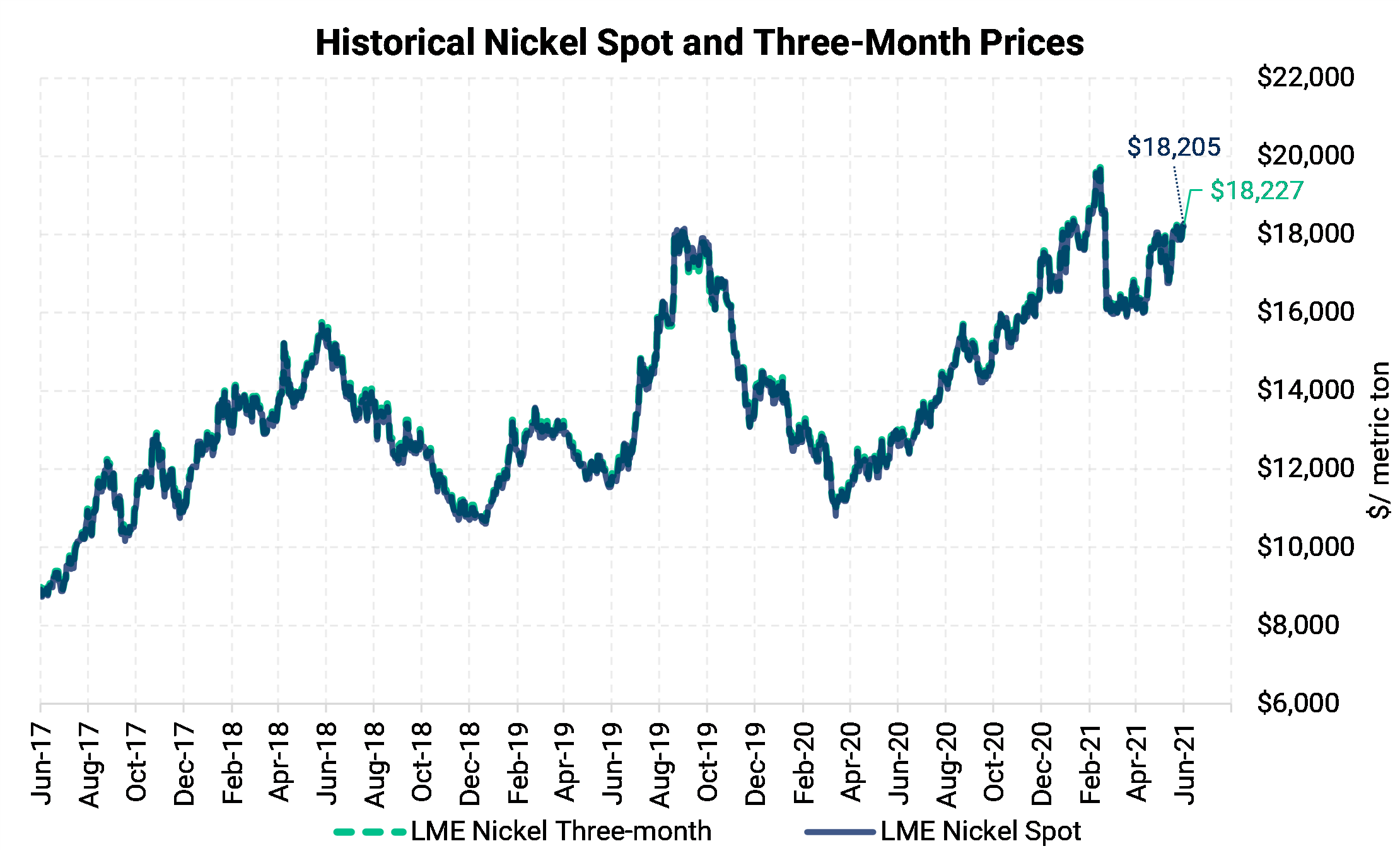

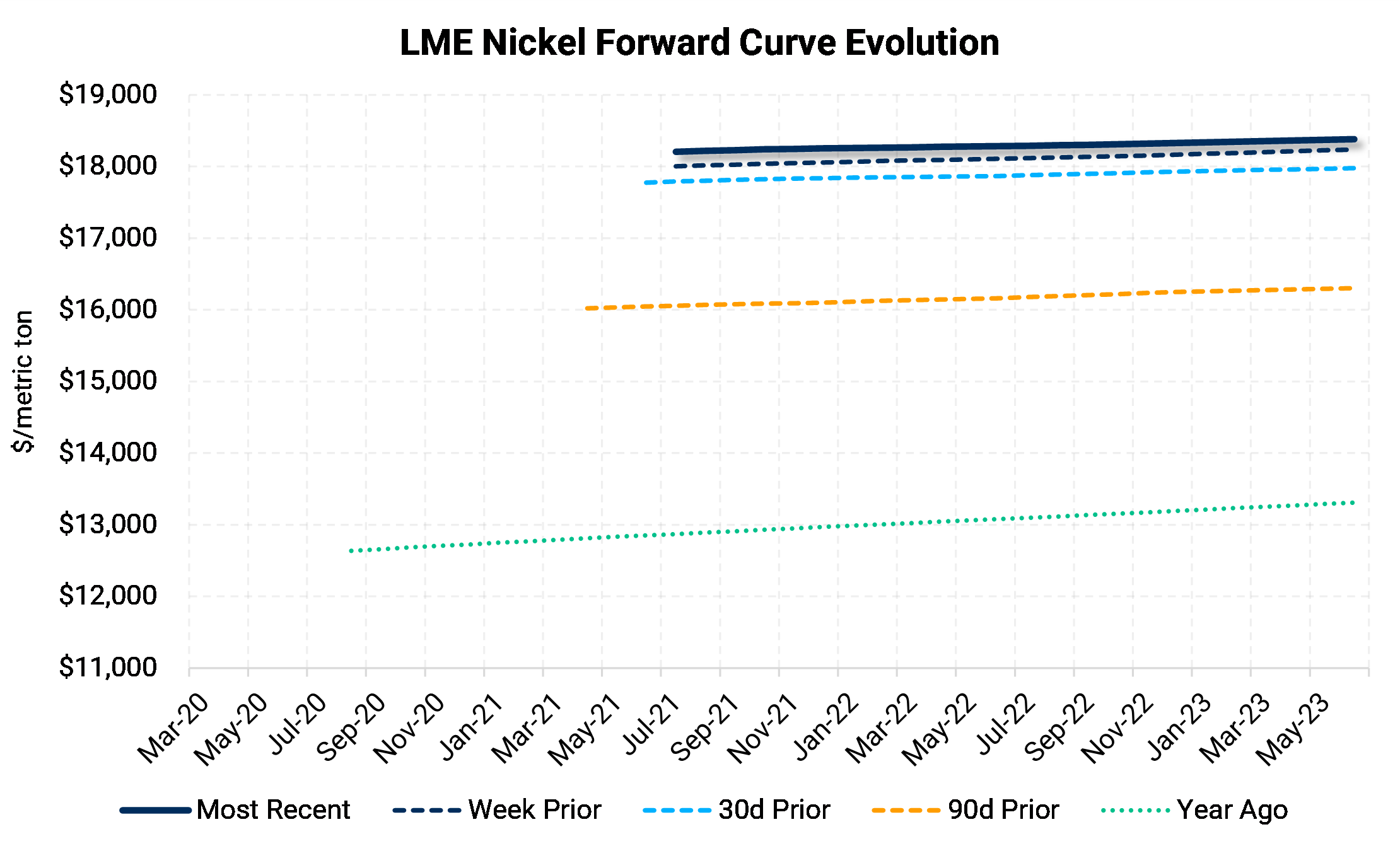

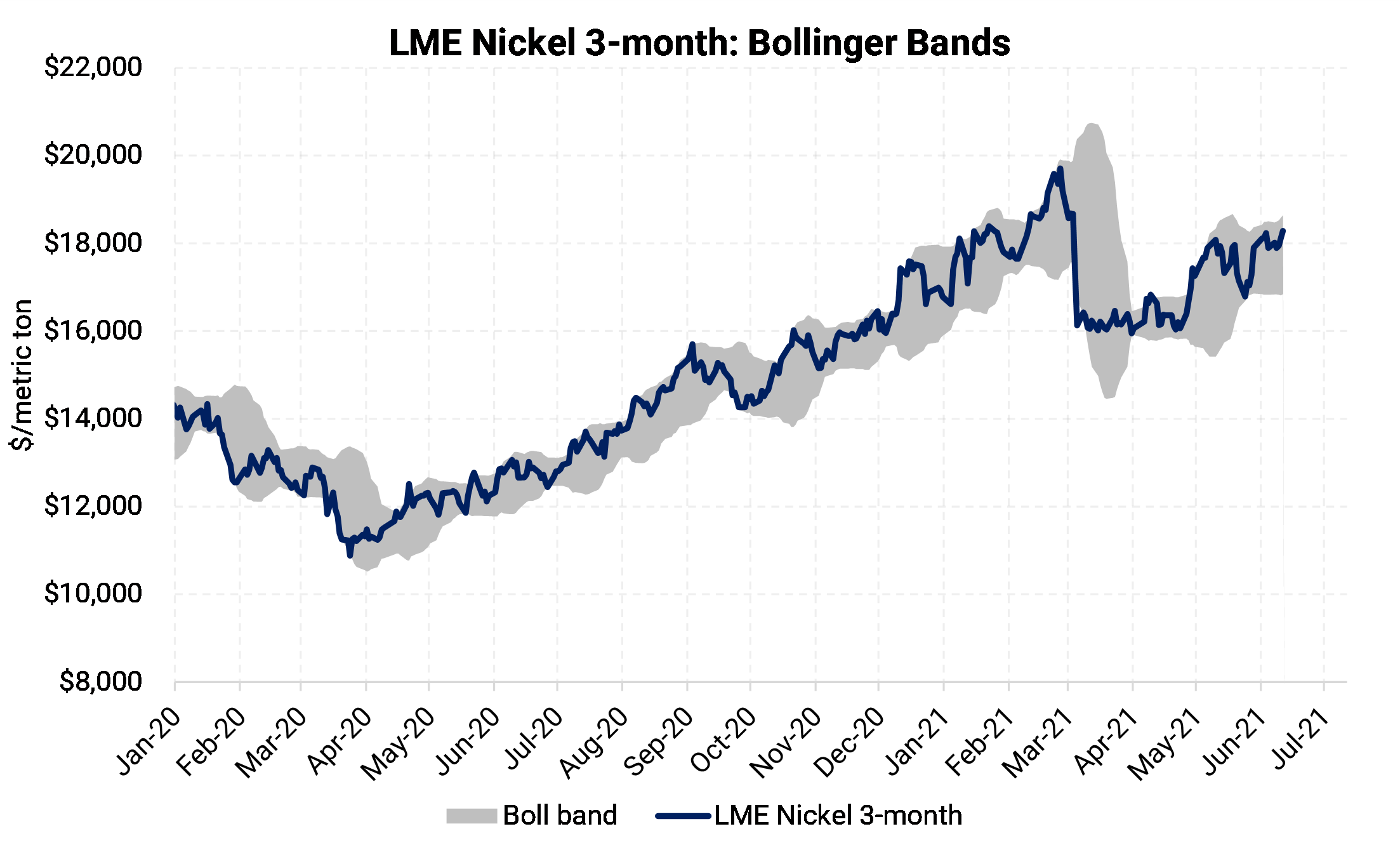

Nickel still hasn't caught up to its high in February, when it fetched nearly $20,000 per ton. Like other base metals, nickel has benefited from the return of industrial demand and a weaker U.S. dollar. This week, there was also news that Indonesia may have three new smelters operational this year, although the country did not disclose the capacities.

|

|

|

|

|

|

|

|

|

|

|

|

CME Hot Rolled Coil (HRC) |

|

|

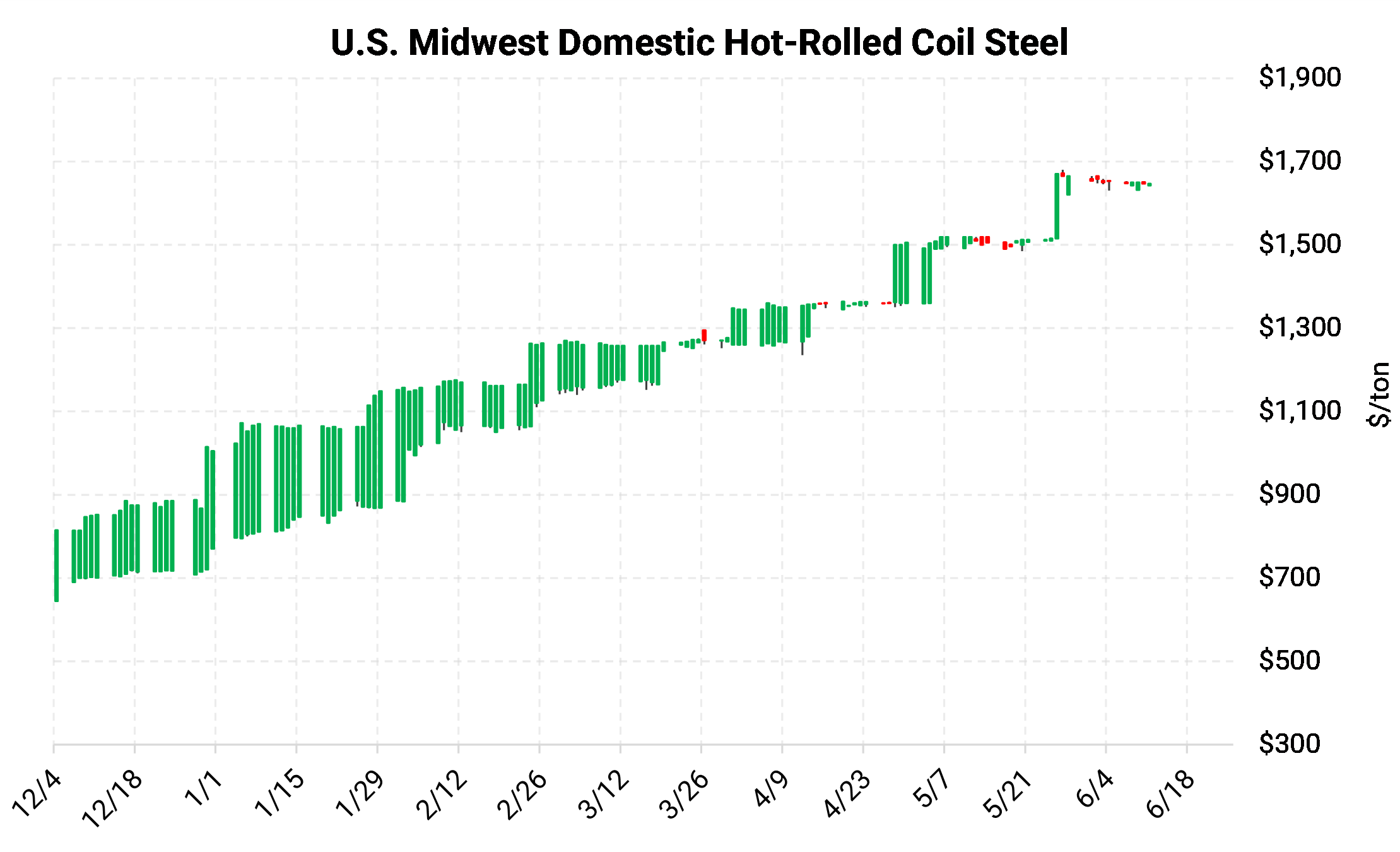

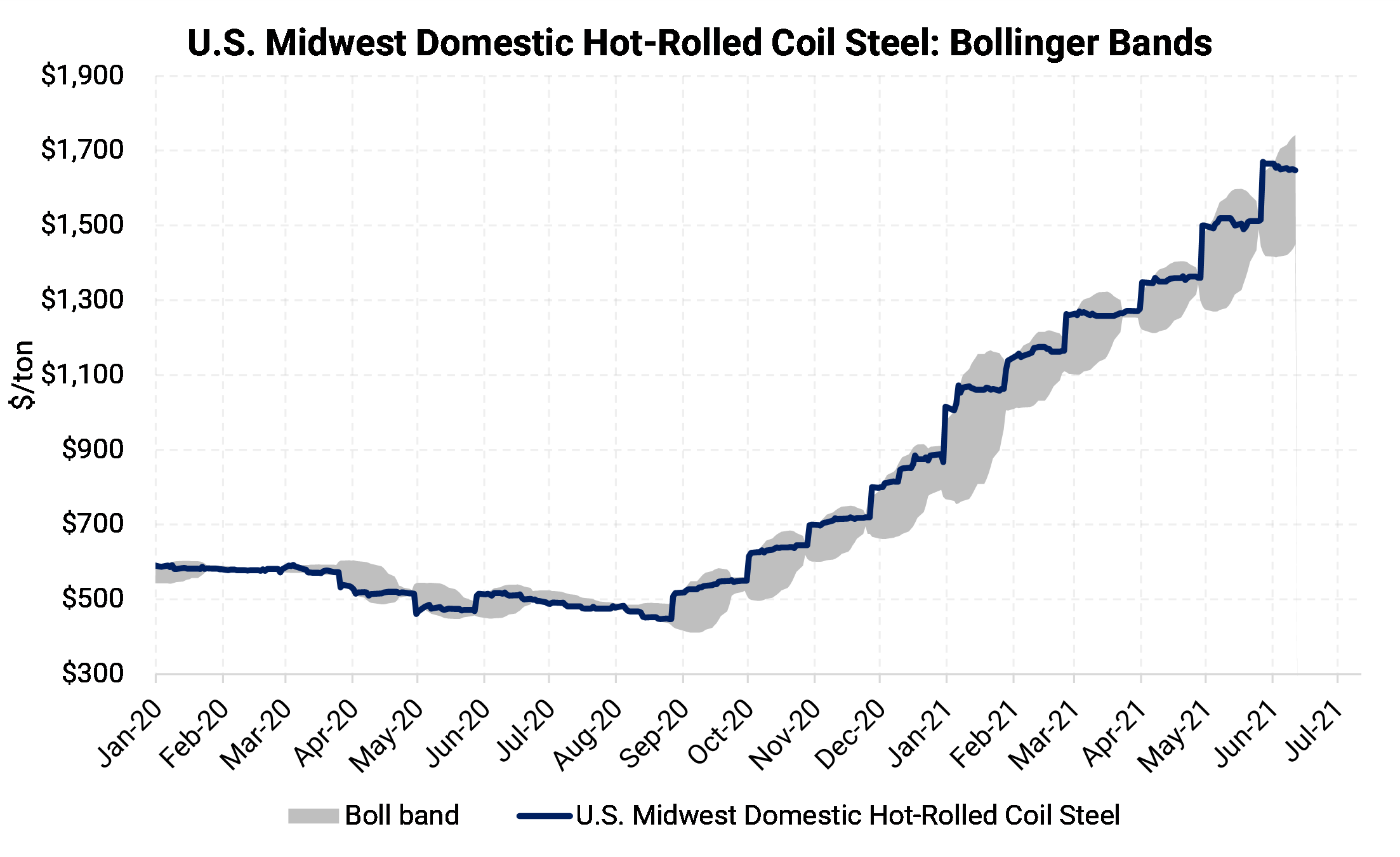

US domestic HRC prices climbed above $1,650/short ton this week, as the record steel rally currently shows no signs of weakness. The CME HRC futures contract for Jun ’21 is currently offered at $1,675/ton. The nearby forward curve remains flat, with the Jul’21 CME contract last priced at $1,675. The contract for Dec ’21 is currently offered at $1,387/ton, up another $7 from a week ago, continuing to signal that market participants are expecting a fall in prices in 2H21. Like the aluminum MWP backwardation, there also could be wary eyes watching for potential changes to Section 232 tariffs. Opportunities remain open for HRC consumers to hedge future prices below the current spot price. The opportunity to hedge inventory or HRC sales near spot is still available but has tightened this week. We continue to believe that buying put options remains the best structure to achieve protection against a major market correction. From a consumer perspective, buying calls can be used to protect against a continued rally, with strike prices that are favorable considering the spot market prices. Utilizing options will also allow for participation in a downward price correction. |

|

|

|

|

|

|

|

|

|

Notable News |

|

|

Rusal to Complete Demerger of Higher Carbon Assets in Early 2022 A G-7 Deal on Global Minimum Tax for Companies Faces Hurdles Future of Low Carbon Metals Pricing Far From Settled Nucor to Acquire Insulated Metal Panels Business From Cornerstone Building Brands China’s Unwrought Copper Imports Fall M/M in May on Record High Prices LME Announces Outcomes of Discussion Paper on Market Structure World’s Largest Aluminum Producer Still Short of Metal London Metal Exchange Ring Will Return, but for How Long? Copper Rises on Supply Disruption Fears in Peru, Chile |

|