|

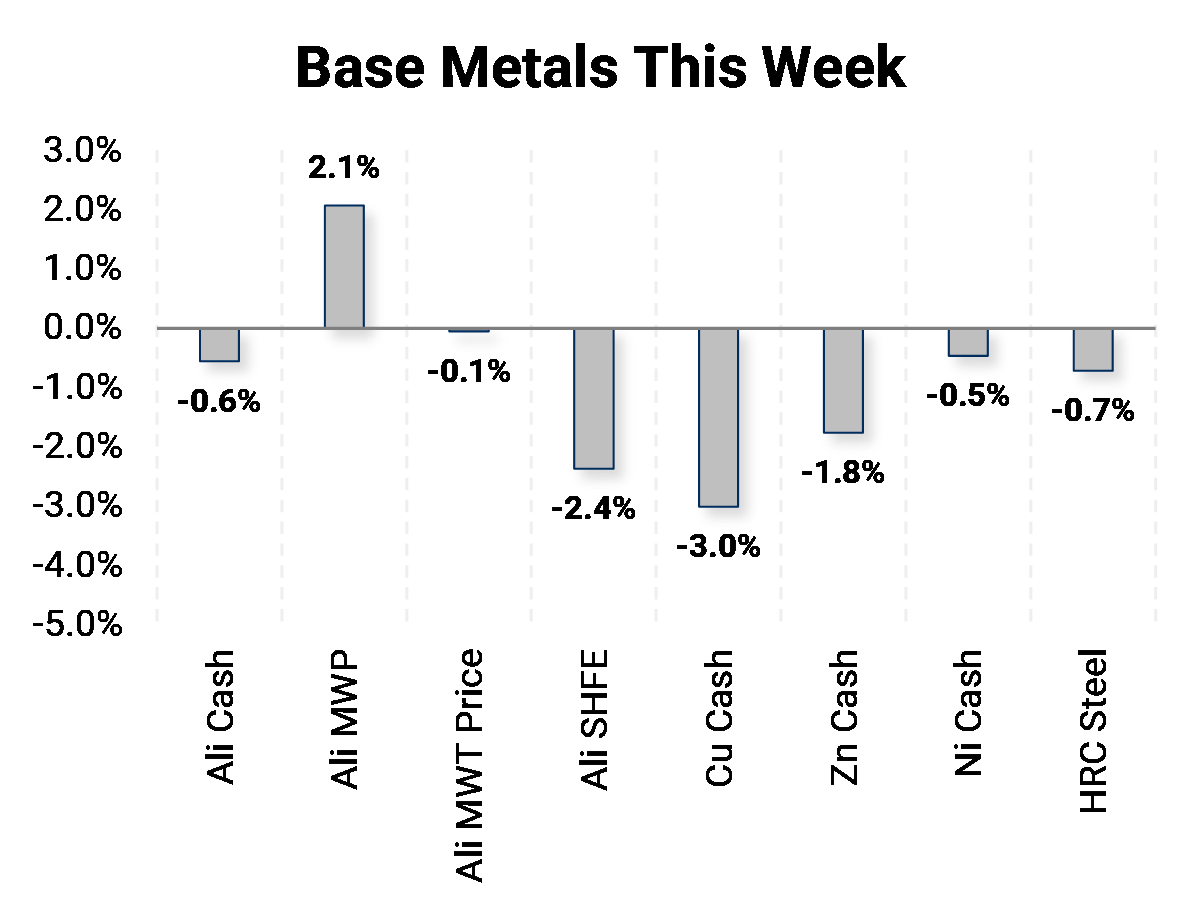

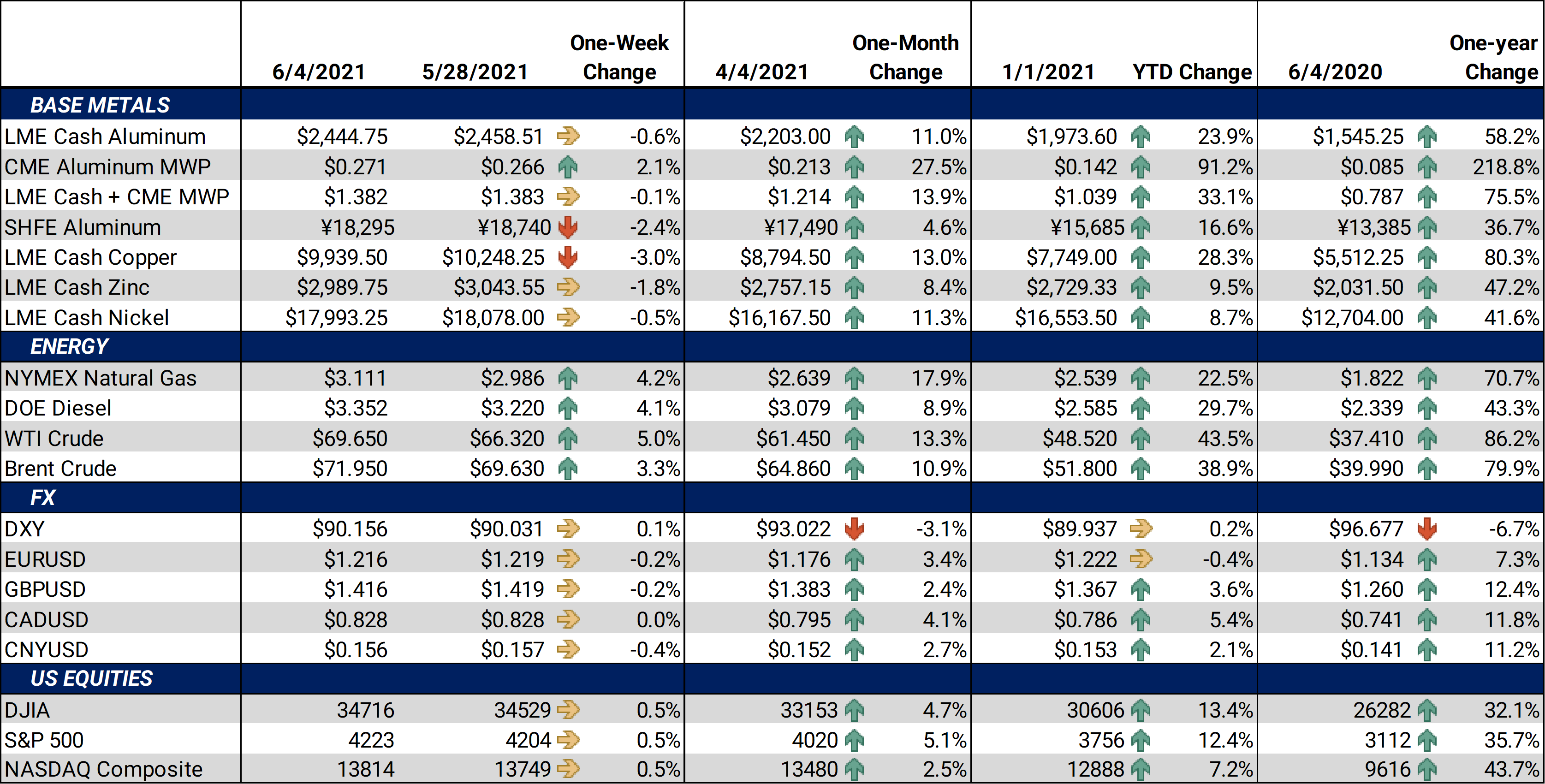

Industrial metals finished the week mixed to flat, although the base metals complex showed upward momentum into Friday’s close. The US jobs report released today showed 559k workers added to payrolls in May, however, the tally missed the median estimate of 675k jobs. Today’s announced additions leave the workforce 7.6 million jobs short of pre-Covid levels. After the announcement, the dollar fell from a three-week high, longer dated treasuries fell, and stock market indices gained on the news. |

|

|

|

|

|

The Biden administration continued to negotiate across the aisle on the proposed infrastructure package today, with reports of Biden planning to continue meeting directly with Republican Senator Capito of West Virginia next Monday. Senate Republicans rejected the latest proposal on Friday and are expected to make a revised offer in the coming days as both sides seek to come to terms before next week’s deadline for a bipartisan proposal.

|

|

|

Bottom Line: In 2Q 2021, the market has not provided any meaningful relief for unhedged consumers of metal. In addition, many manufacturing companies are struggling to find employees and obtain the raw materials needed to keep up with order books. It has been a painful learning curve for those who may have held off on hedging, waiting for a return to lower prices. Ideally, industrial hedgers were able to take advantage of the brief two-week pullback. If volatility increases and we see additional price consolidation in the future, consider layering in more hedges to narrow the range of possible outcomes and ensure that damage to margins is contained. You may want to consider a trailing stop-loss strategy to add discipline to your hedging approach. It is also important to make sure you understand when margin compression will impact overall company performance. The cost of buying call options or zero cost collars has increased, but if markets remain calm for a few weeks, options may once again be an attractive way to provide protection while allowing participation in lower prices if the rally finally eases. Base metals overall continue to find support from increased consumer demand, physical market imbalances, low short-term interest rates, high freight, logistics costs, continued global stimulus, and a relatively weak U.S. dollar. At the same time, investors have become wary and have been one factor in the recent consolidation.

|

|

|

|

|

|

|

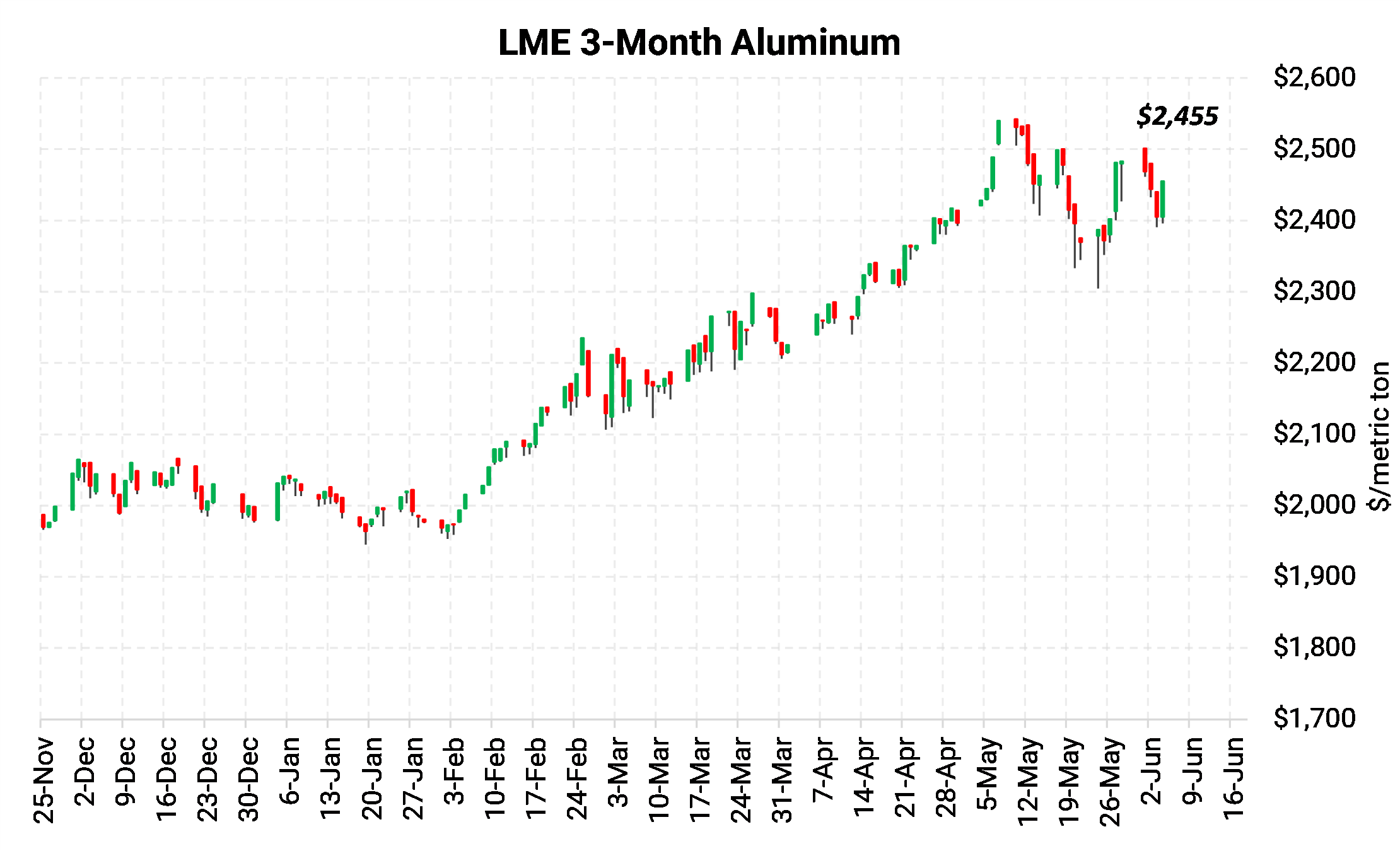

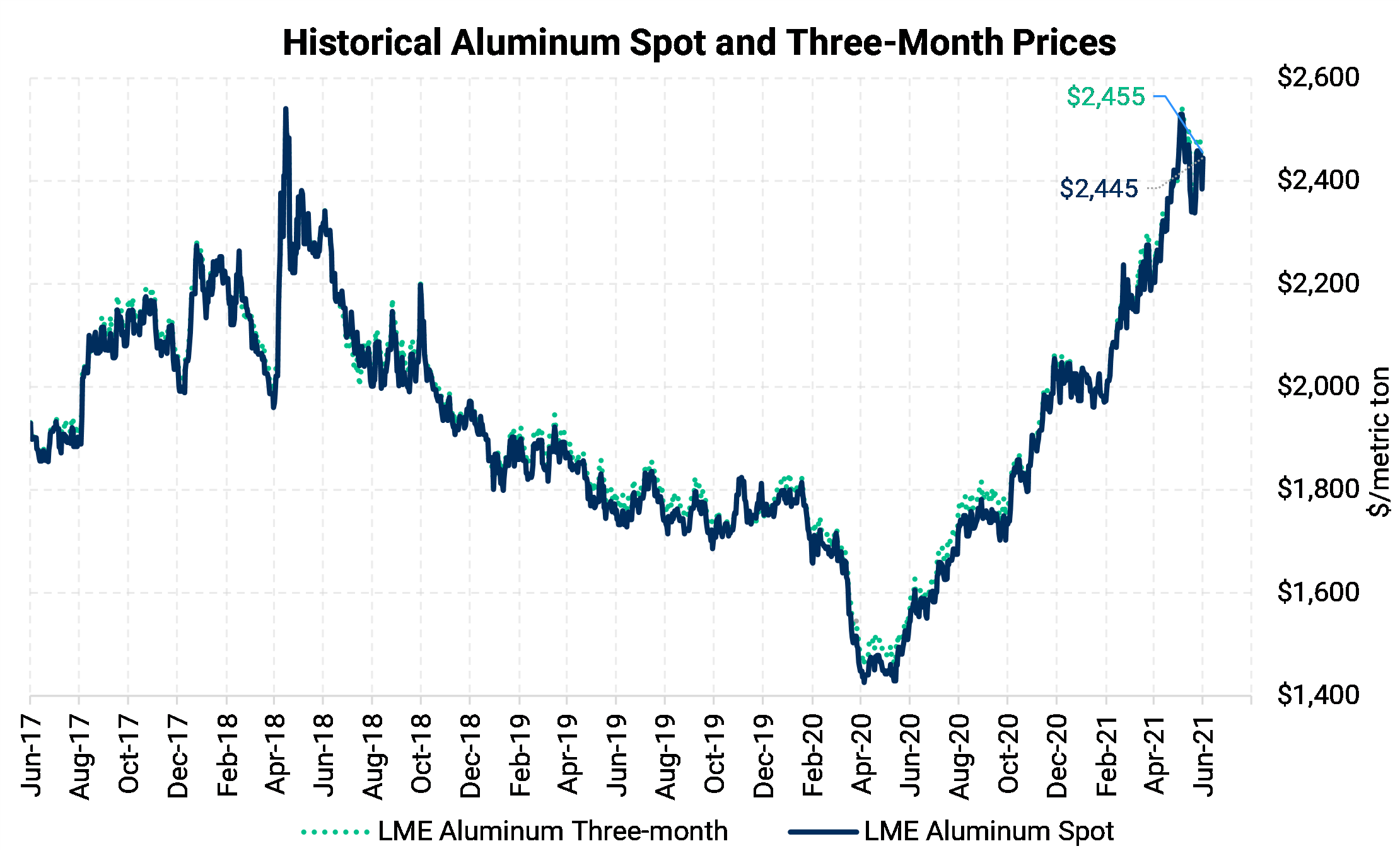

LME Aluminum |

|

|

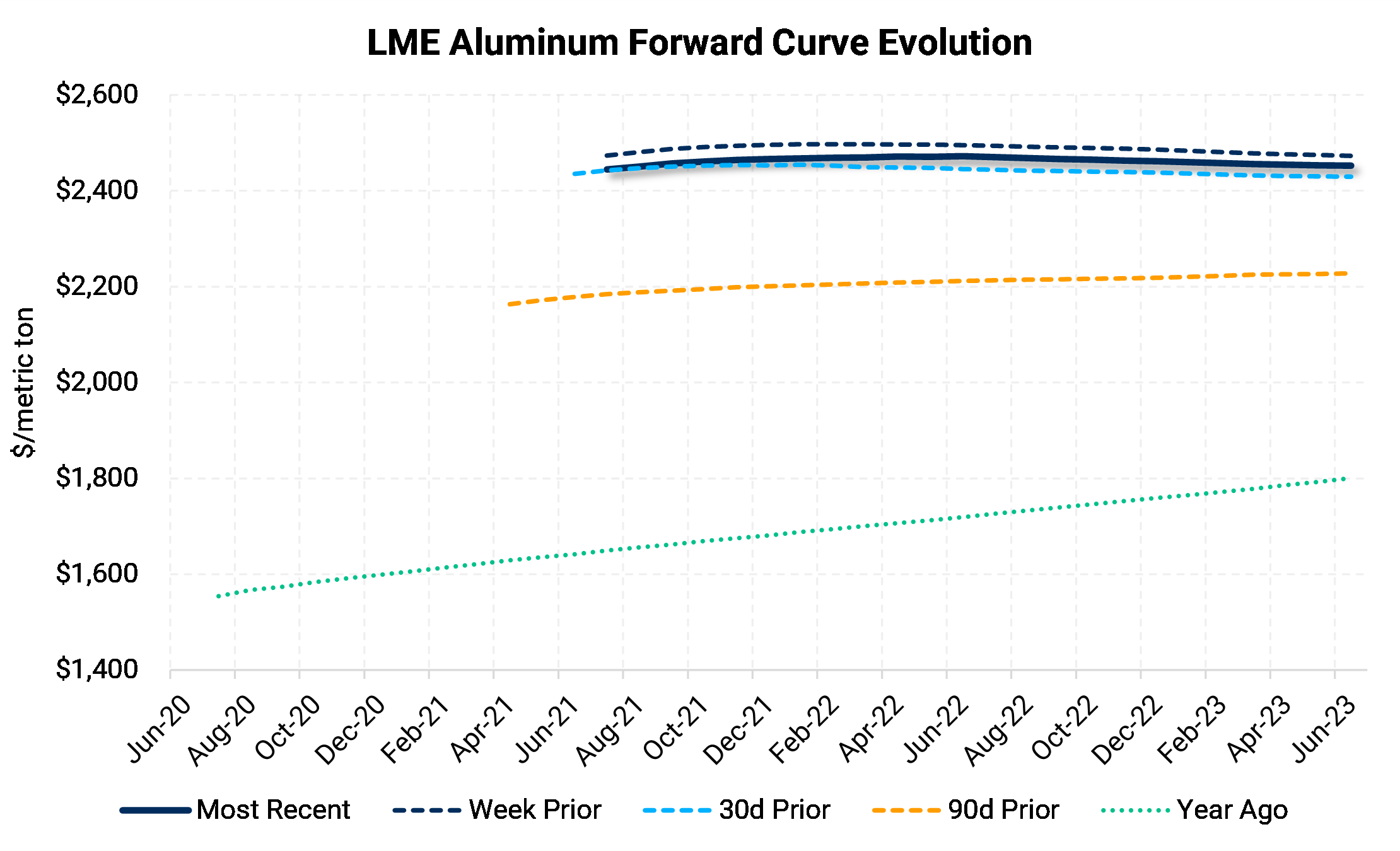

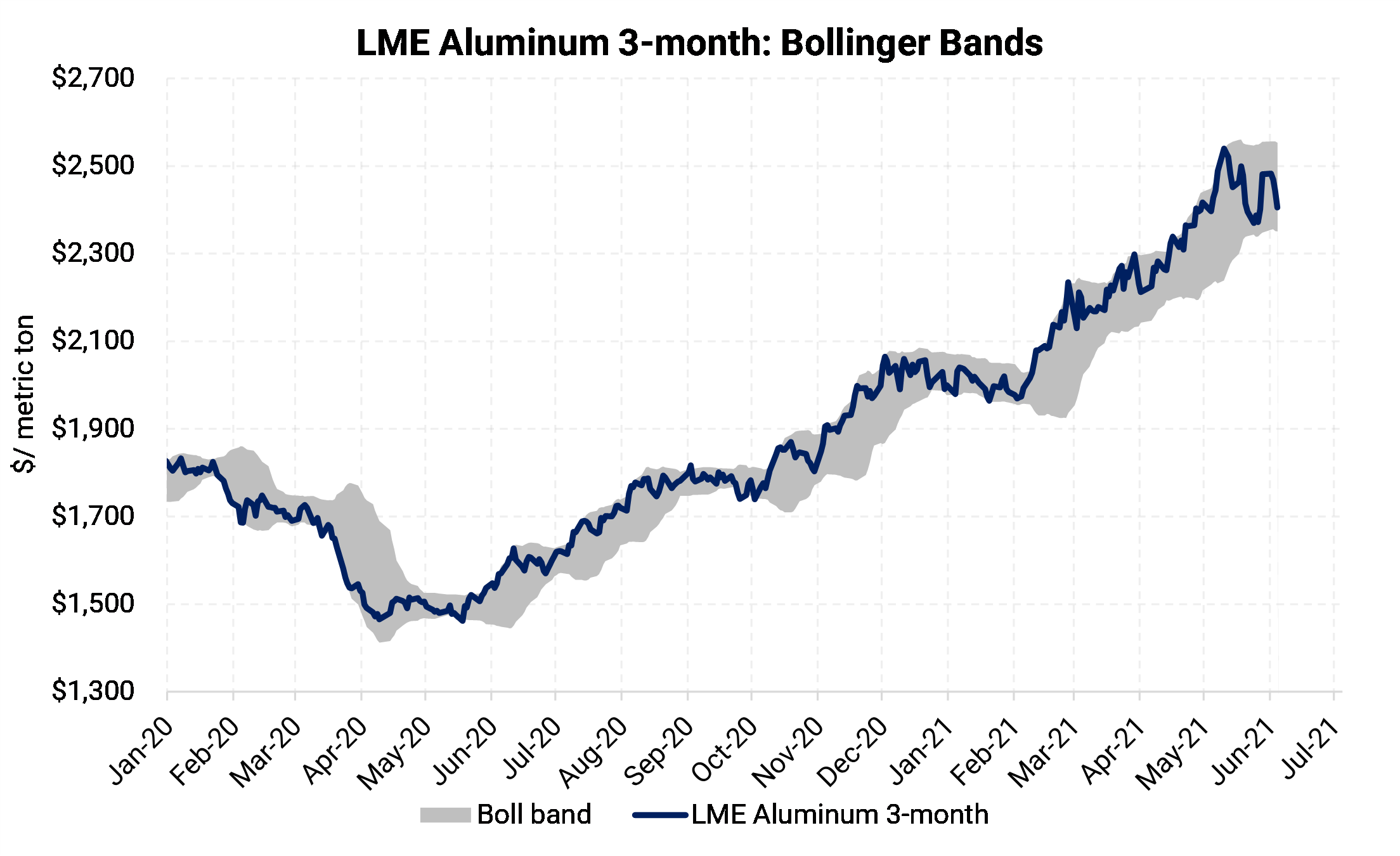

Despite substantial intraday swings on the latest news headlines, LME aluminum cash price ended the week down by only 0.6% at $2,444.75/mt. Meanwhile, the 3mo price ranged from $2,390 to $2,508 as bullish and bearish sentiments shone through. We continue to recommend that consumers layer in hedges in a disciplined manner and select between swaps or call options depending on their risk management objectives. Consumers who have layered in their hedges over the past year continue to receive benefit significant benefits. With a slowdown in the overall rally, Cash-3mo flattened once again from $25 to $15. If the flattening continues or holds, cash and carry inventory financing strategies will become less attractive. Dec’21/Dec’22 backwardation eased ever so slightly, now standing at $5. The persistent backwardation indicates there are still few buyers for long-dated contracts. In general, we have seen less long-dated consumer hedging with both premiums and LME at high levels. As leisure travel picks up and business travel starts to show signs of life, it will be interesting to see if total aluminum demand increases, or if the return of office workers slows down consumer demand and offsets the travel-related boost.

|

|

Midwest Premium |

|

|

The aluminum Midwest Premium in the US hit a modest plateau this week as CME MWP contract for June settled at 27.1¢/lb. This is a 0.55¢/lb increase from last week, but solely due to June contract becoming prompt month. Current published cash MWP levels remain at an all-time high. With little MWP trading activity in Cal22, the backwardation in the forward curve remains significant and makes inventory hedging expensive. For the nearby curve, 3Q2021 appears to be pricing in a greater likelihood of Section 232 tariffs remaining in place for an extended period as well as demand continuing to surpass demand. Just a month ago CME contract settled at 21¢/lb for 3Q while it is now closer to 24.5¢/lb. Keep in mind if you choose not to hedge any portion of your price exposure that you have made a decision. Back-traders can look at the 21¢/lb and say, could have, would have, should have.

|

|

|

|

|

|

|

|

|

|

|

|

LME Copper |

|

|

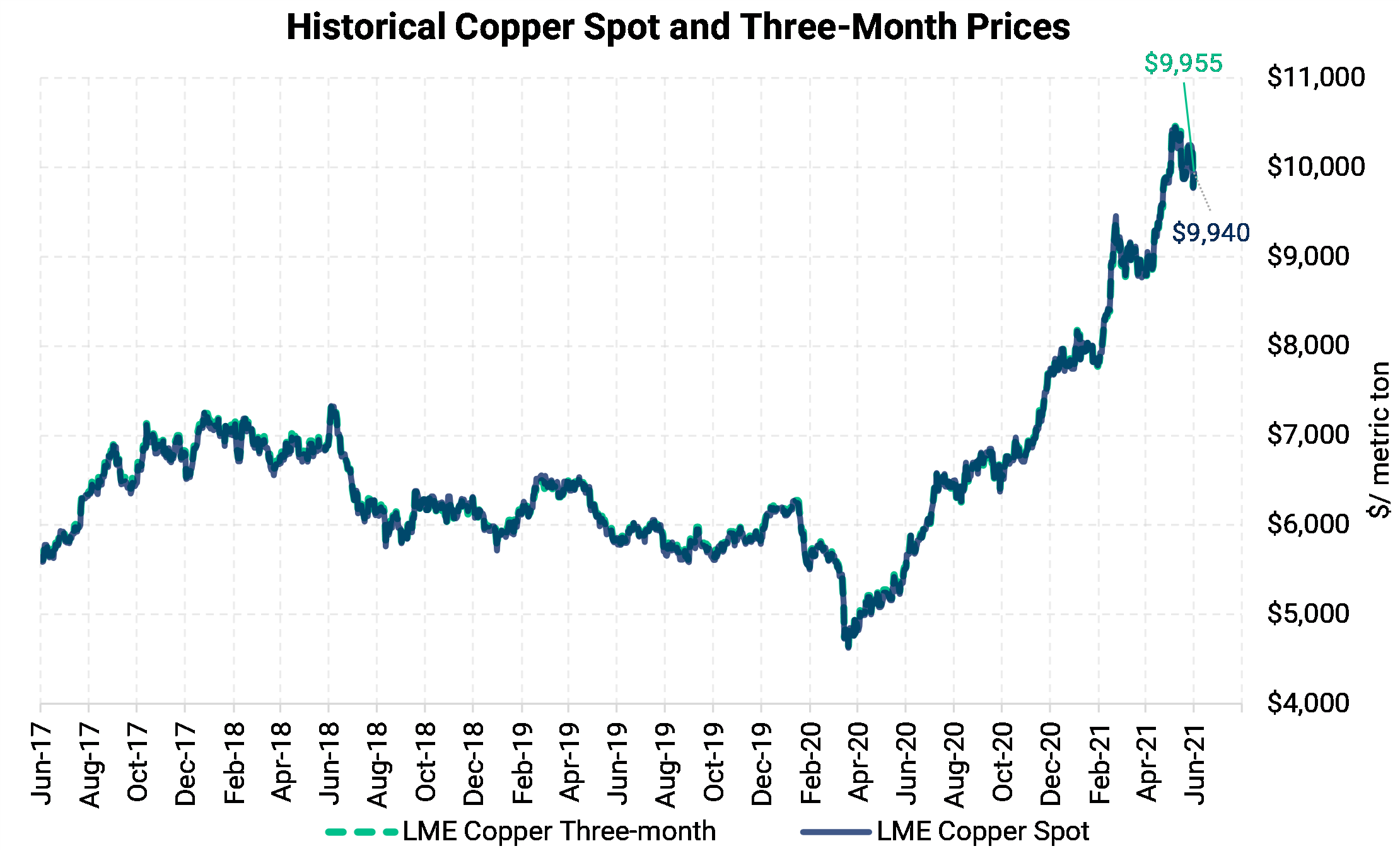

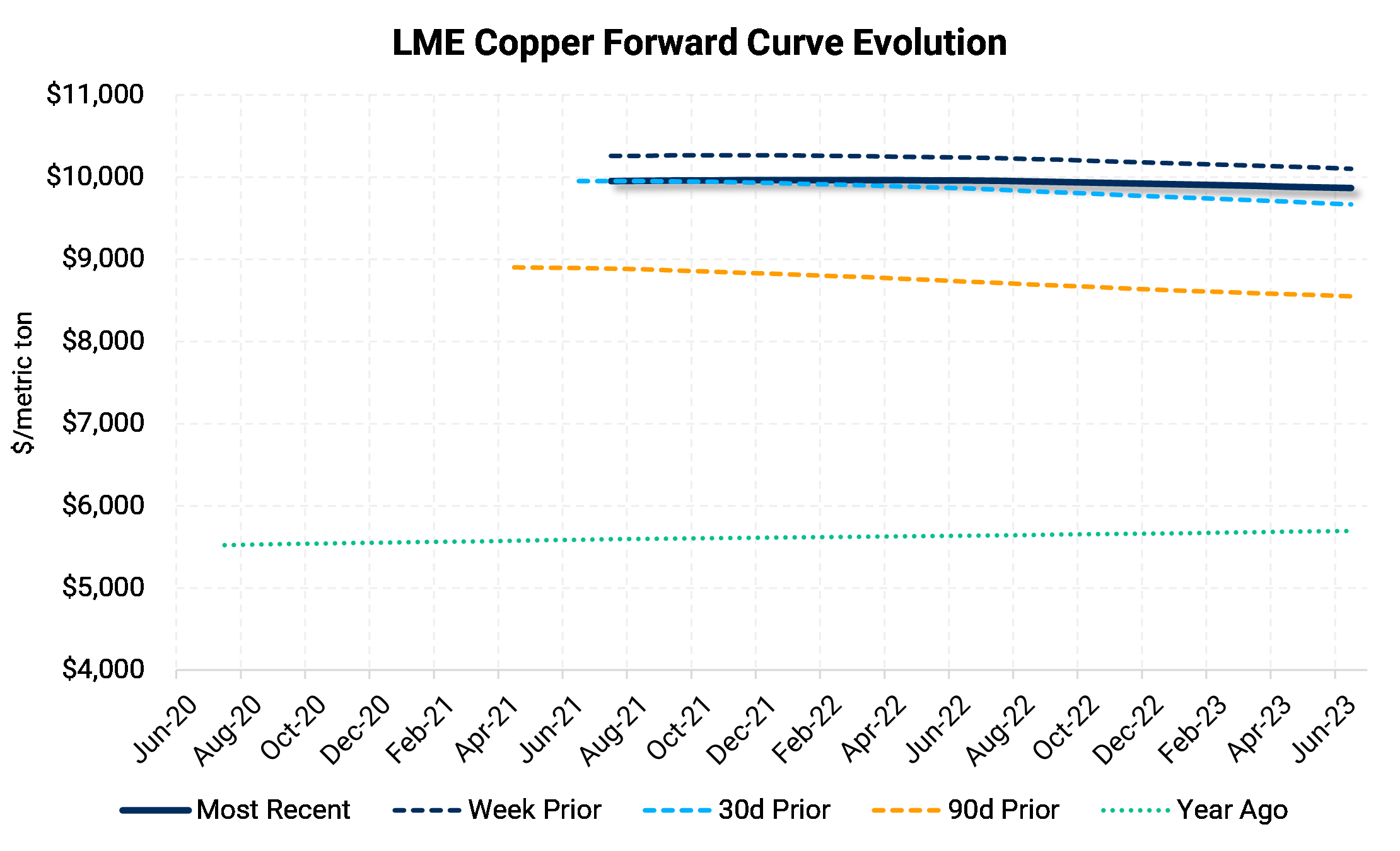

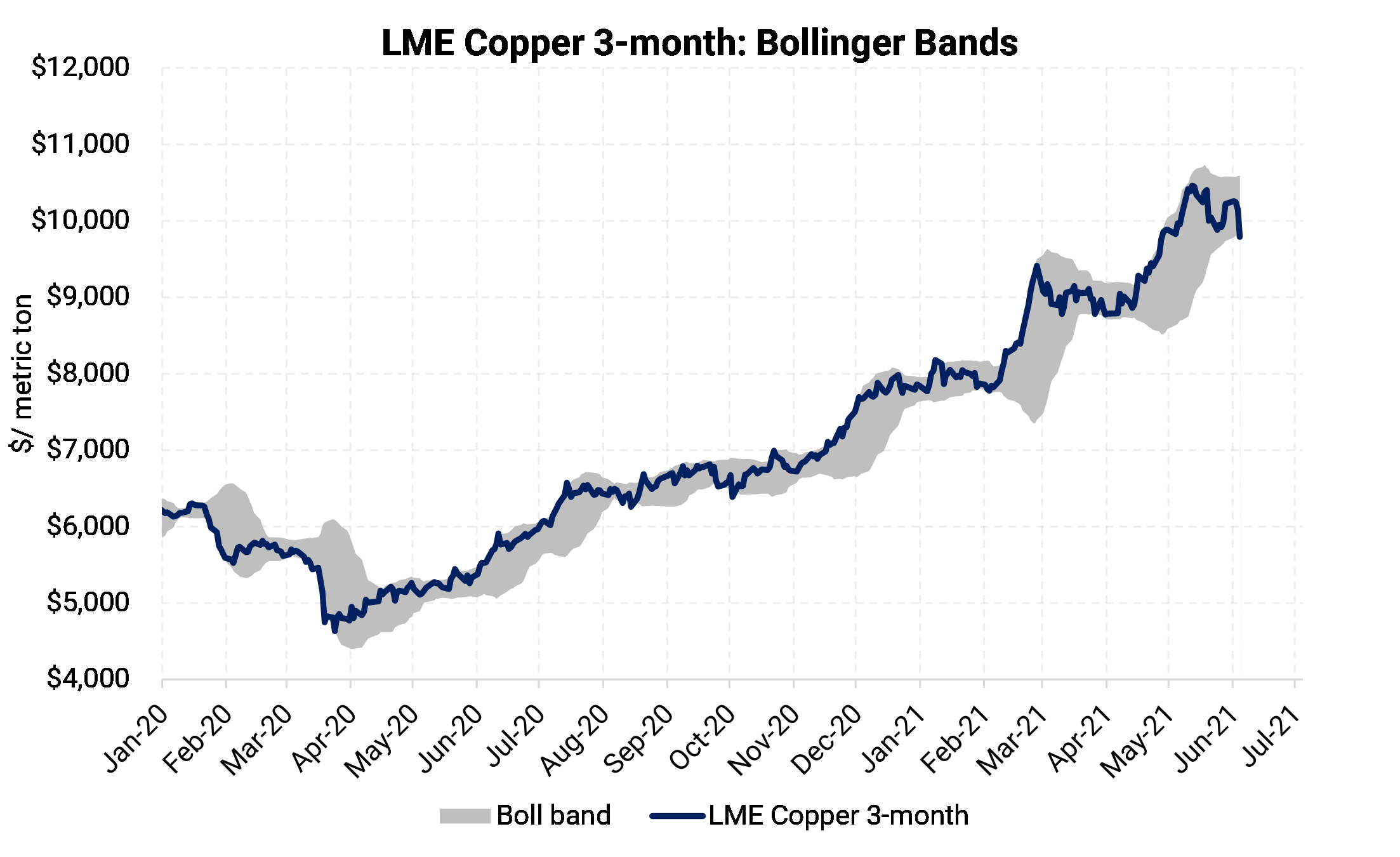

LME 3-month copper price has once again slipped below the symbolic $10,000/mt level closing at $9,955.00, down $303.00 from last week. LME Cash Evaluation prices ended the week down 3% after a 3.9% rise last week. The red metal is up by 80.3% over the past year. Marex and Savant, a geospatial analytics product launched in 2019, reported that smelting activity for copper has reached a year-to-date high in May due to continued strength in copper prices. They reported that every copper-producing region worldwide saw a month-over-month smelting increase, with North America being the laggard.

|

|

|

|

|

|

|

|

|

LME Nickel |

|

|

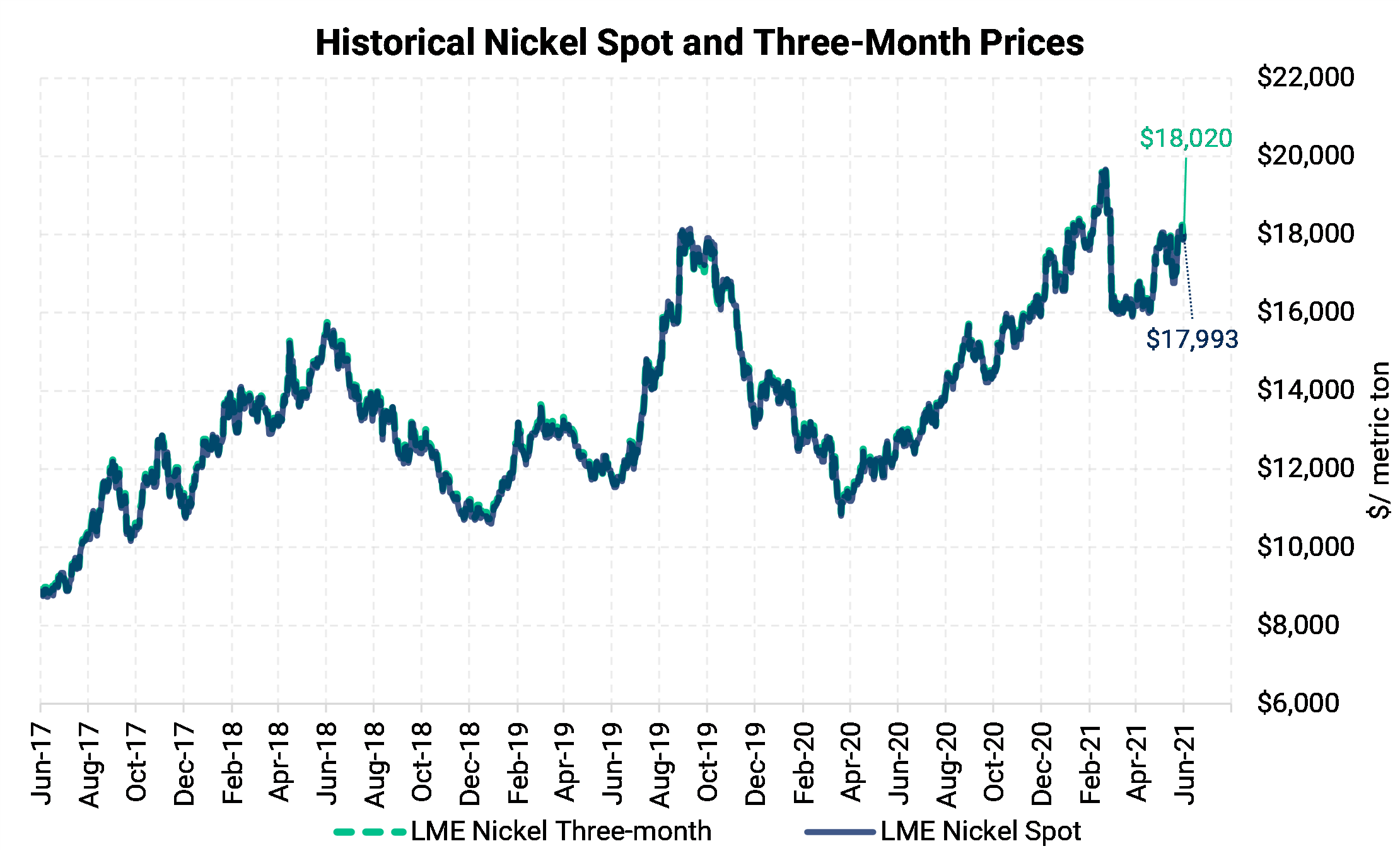

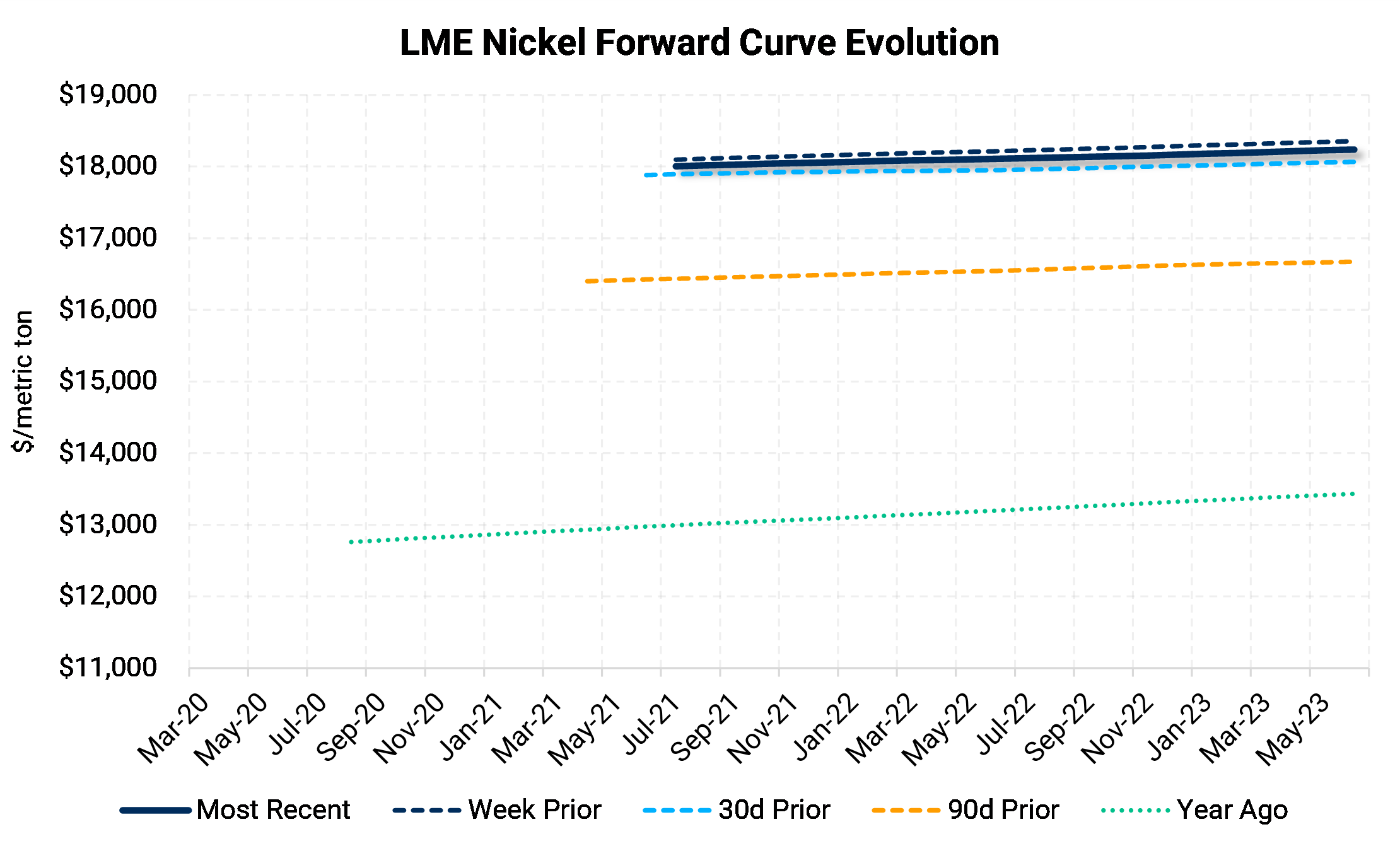

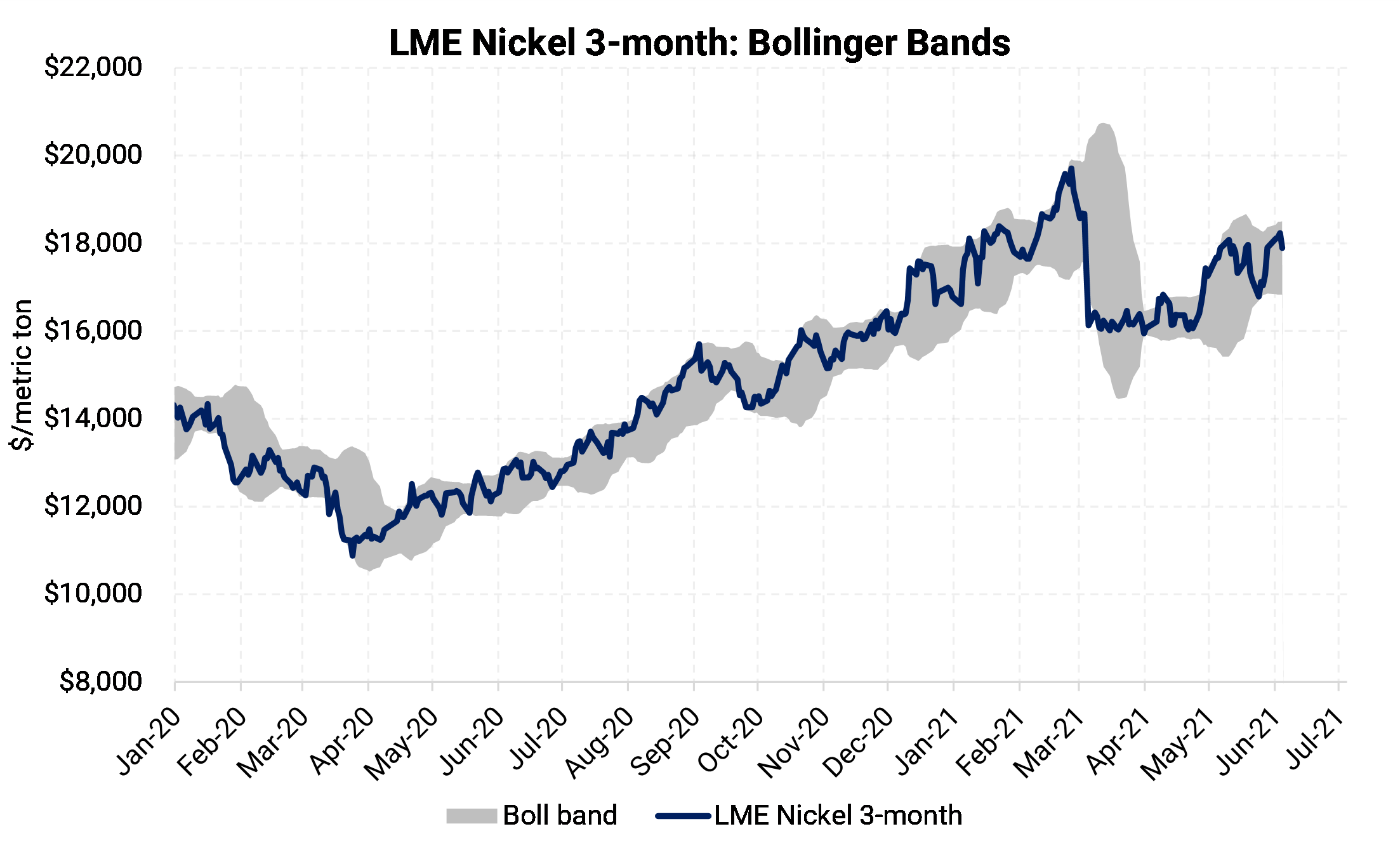

Nickel prices were largely flat this week, after returning to positive territory last week. LME end-of-day evaluation prices fell this week by 0.5% or $84.75/mt to $17,993.25 on Friday. Norilsk Nickel announced on Friday that they have begun to resume mining at the Taimyrsky mine, after flooding curtailed operations earlier this year. |

|

|

|

|

|

|

|

|

|

|

|

CME Hot Rolled Coil (HRC) |

|

|

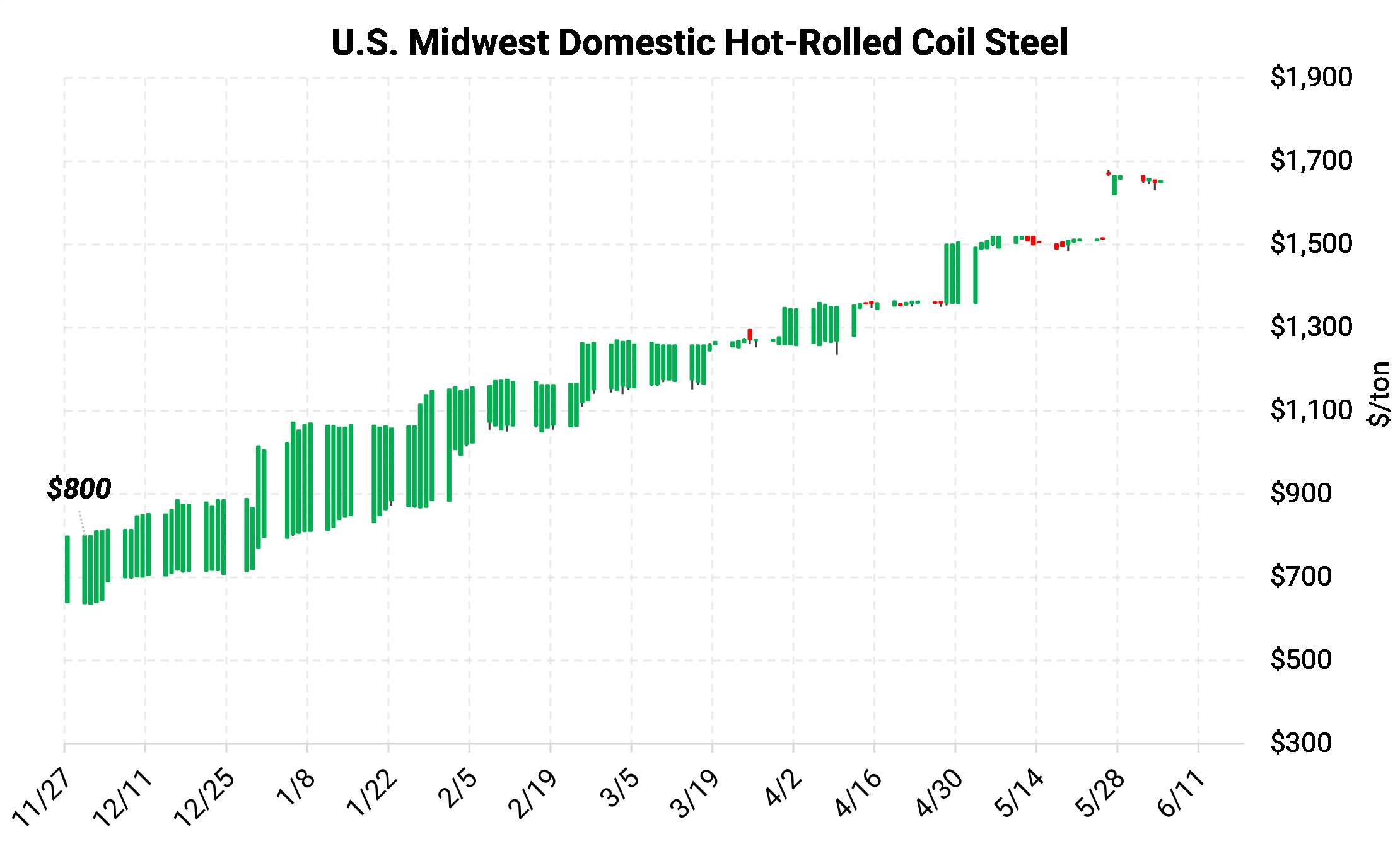

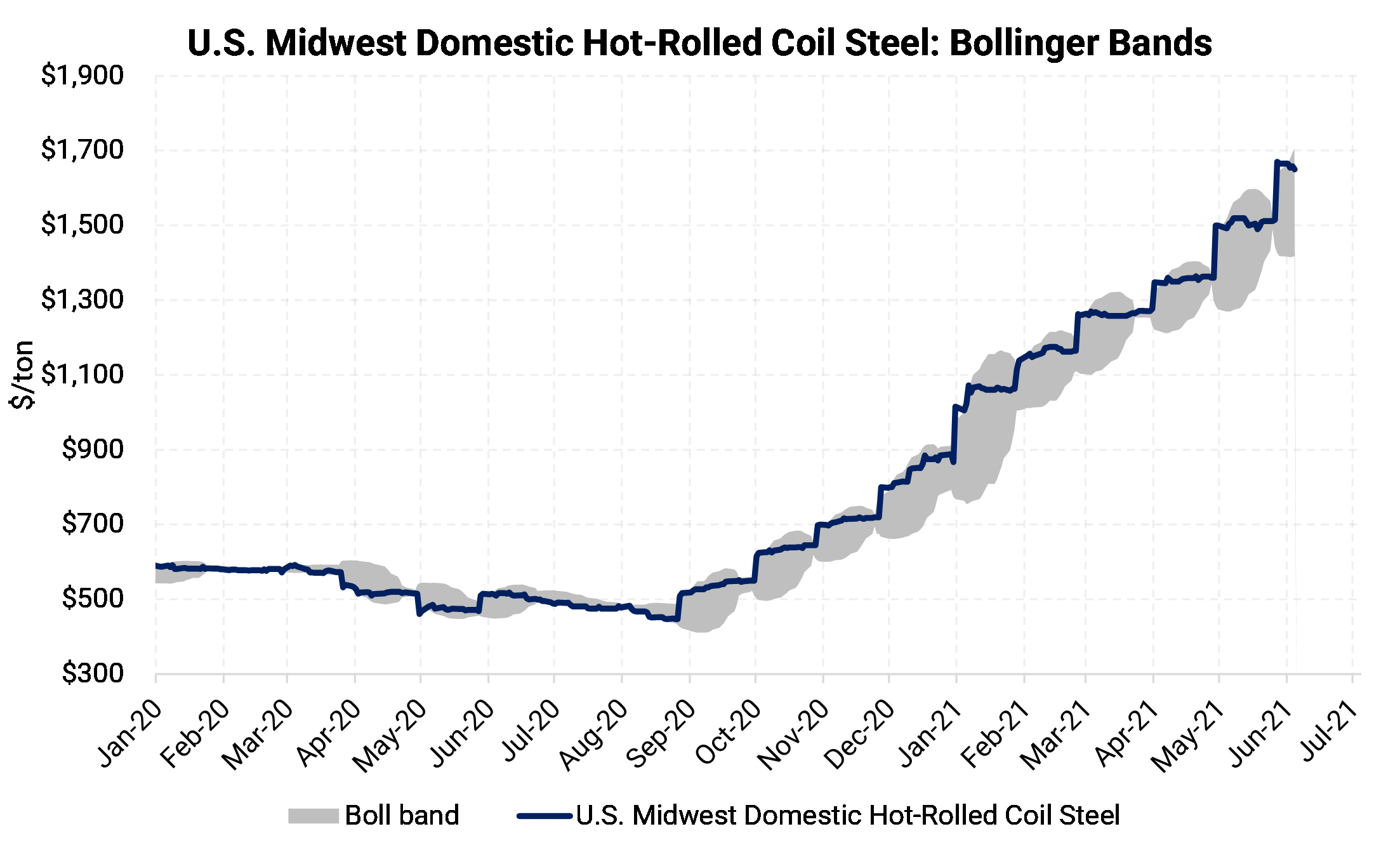

US domestic HRC prices remain above $1,600/short ton this week, as the record steel rally continues unabashed. The CME HRC futures contract for Jun ’21 is currently offered at $1,668/ton, $3 higher than last week’s report. The nearby forward curve began to flatten this week, with the Jul’21 CME contract last priced at $1,660. The contract for Dec ’21 is currently offered at $1,380/ton, up another $55 from a week ago and $155 higher than two weeks ago, continuing to signal that market participants are expecting a fall in prices in 2H21. Like the aluminum MWP backwardation, there also could be wary eyes watching for potential changes to Section 232 tariffs. Opportunities remain open for HRC consumers to hedge future prices below the current spot price. The opportunity to hedge inventory or HRC sales near spot are still available but have tightened this week. We continue to believe that buying put options remains the best structure to achieve protection against a major market correction. From a consumer perspective, buying calls can be used to protect against a continued rally, with strike prices that are favorable considering the spot market prices, utilizing options will also allow for participation in a downward price correction. |

|

|

|

|

|

|

|

|

|

Notable News |

|

|

China to Tighten Environmental Approval for Polluting Projects Funds Cut Copper Exposure and Chinese Impetus Fades Wieland to Expand Copper Recycling Capacity in North America Canada Nickel Announces Industry Leading Low Carbon Footprint Vale Workers in Sudbury Reject Contract Offer and Go On Strike Visualizing All the Metals for Renewable Tech U.S. manufacturing gains steam; raw material, labor shortages mounting Building a Home in the US Has Never Been More Expensive METALS-Copper rises on supply worries in Chile U.S. Manufacturers Blame Tariffs for Swelling Inflation Ball Corp’s Aluminium Cups Now Available Throughout United States How the World Ran Out of Everything The Race For Copper, The Metal Of The Future

|

|