|

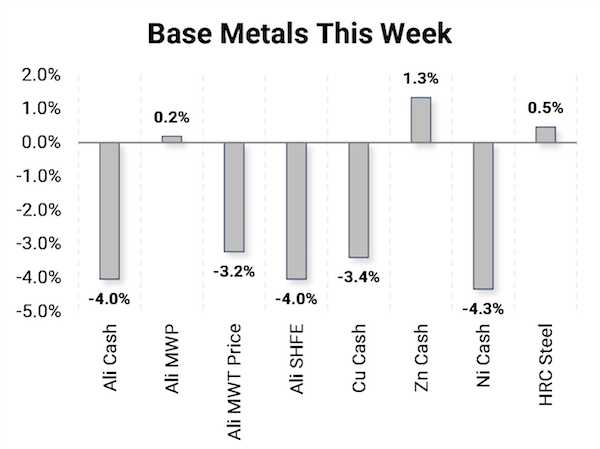

In what has been a rarity nowadays, industrial metals had a second straight down week with only zinc and HRC steel nudging upwards. As life in the US slowly returns to a post-pandemic normal, equities, commodities, and cryptocurrency prices all hesitated, perhaps deciding if all the good news is already priced in, or if we are just at the forefront of sustained, longer-term growth. Late in the week with fear of inflation on the minds of many, the Biden administration proposed a reduced infrastructure package of ONLY $1.7 trillion versus the previous $2.3 trillion proposal. However, bipartisan support is still unlikely. |

|

|

|

|

|

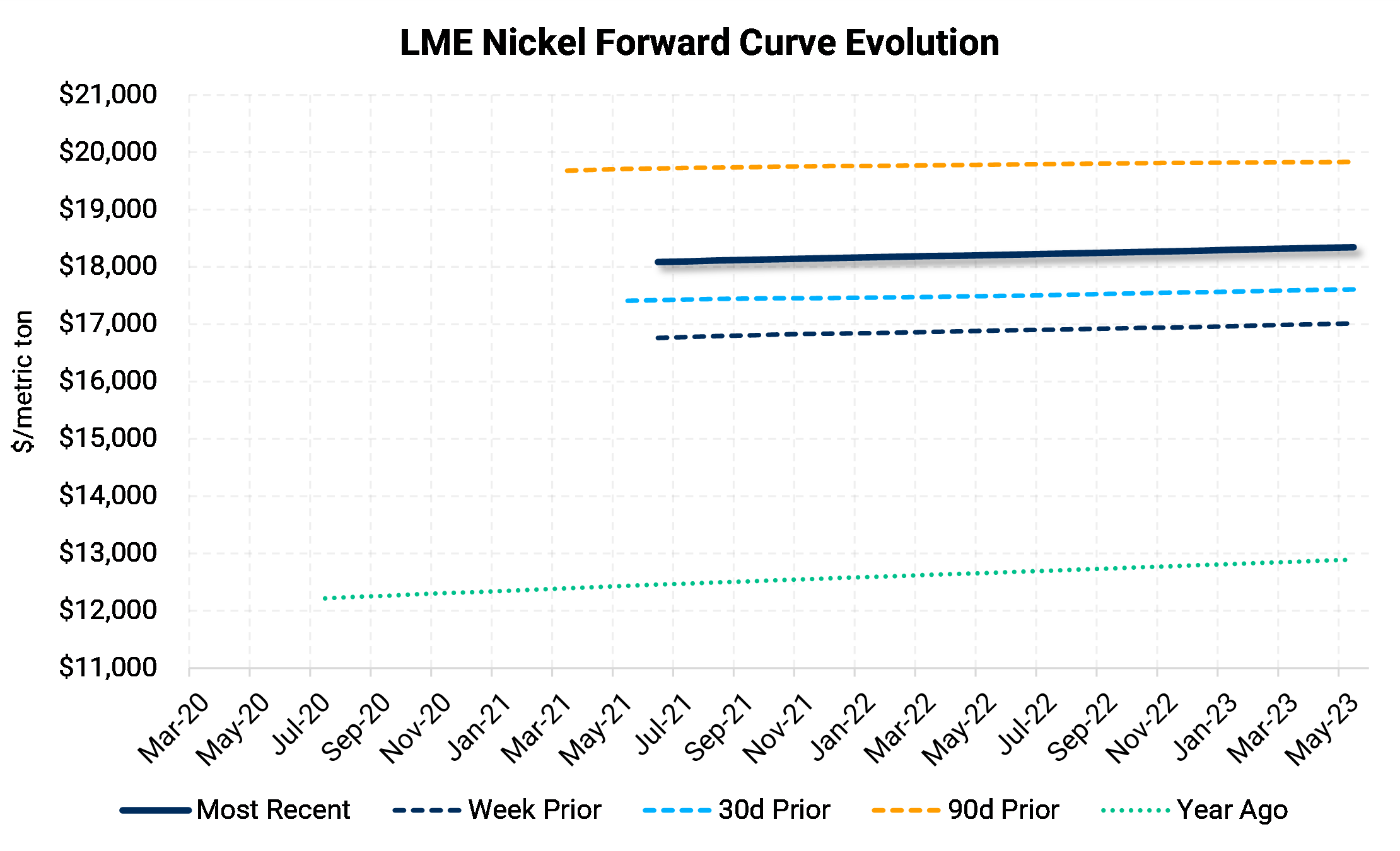

This reduction in proposed spending as well as China’s recent actions to combat higher prices have weighed heavily on metals prices. The markets have whipsawed recently and are ripe for short-term volatility. Corporates should take this into account while planning for the remainder of 2021 and into 2022. Higher volatility will increase the cost of options but may also provide an opportunity to layer in swaps when prices retreat. AEGIS can discuss methods to layer in hedges using a systematic, analytical process rather than trying to predict future prices. Hedging should be used to prevent runaway costs and ensure forecasted profit margins remain achievable.

|

|

|

Bottom Line: In 2Q2021, the market has not provided any relief for unhedged consumers of metal. In addition, many manufacturing companies are struggling to find employees and obtain the raw materials needed to keep up with order books. It has been a painful learning curve for those who may have held off on hedging, waiting for a return to lower prices. With the brief two-week pullback, consider layering in more hedges to narrow the range of possible outcomes and ensure that damage to margins is contained. You may want to consider a trailing stop-loss strategy to add discipline to your hedging approach. It is also important to make sure you understand when margin compression will impact overall company performance. As the markets take a pause, keep an eye on volatility. The cost of buying call options or zero cost collars has increased, but if markets remain calm for a few weeks, options may once again be an attractive way to provide protection while allowing participation in lower prices if the rally finally eases. Base metals overall continue to find support from increased consumer demand, physical market imbalances, low short-term interest rates, high freight and logistics costs, continued global stimulus, and a relatively weak U.S. dollar. At the same time, investors have become wary and have been one factor in the recent consolidation

|

|

|

|

|

|

|

LME Aluminum |

|

|

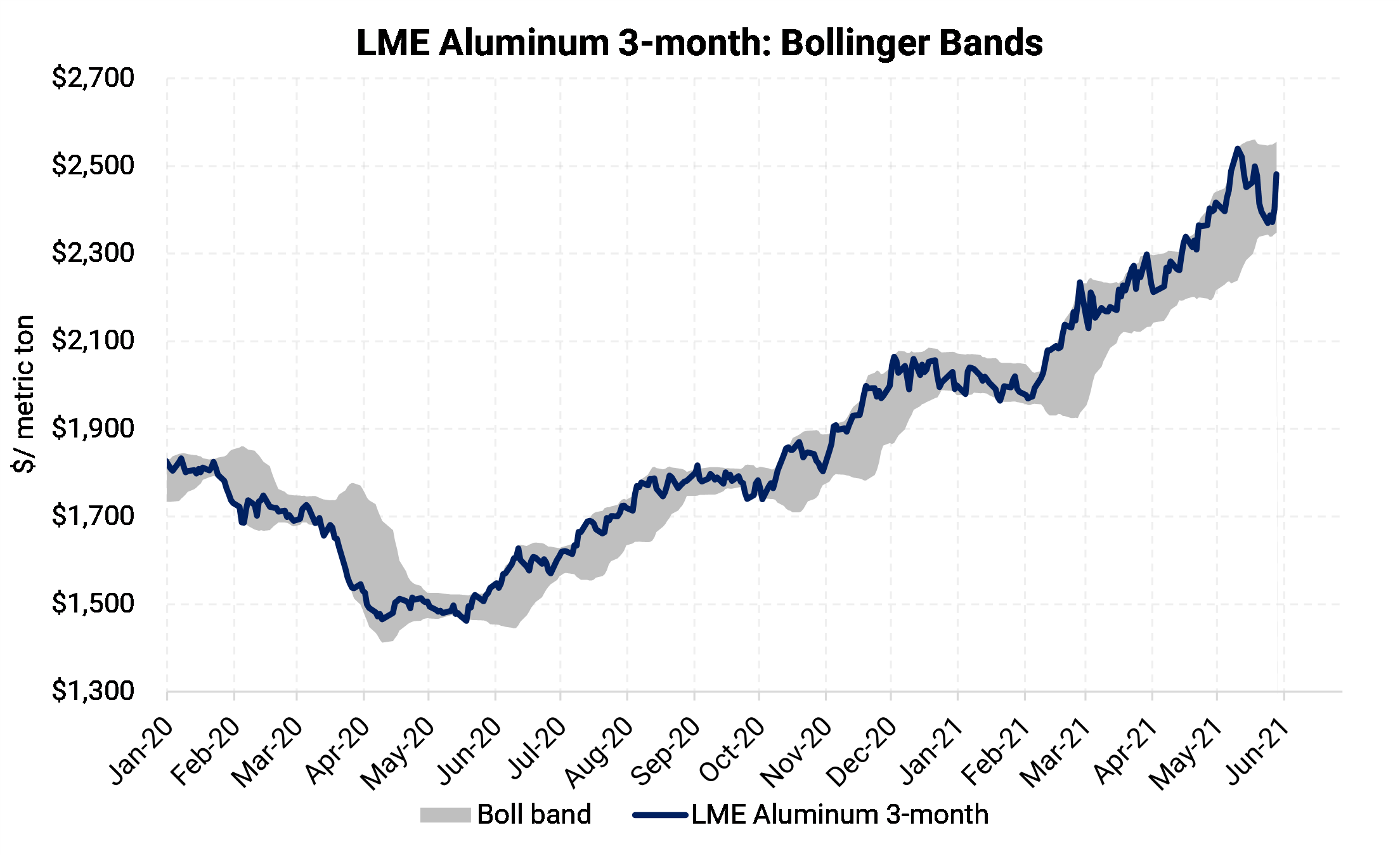

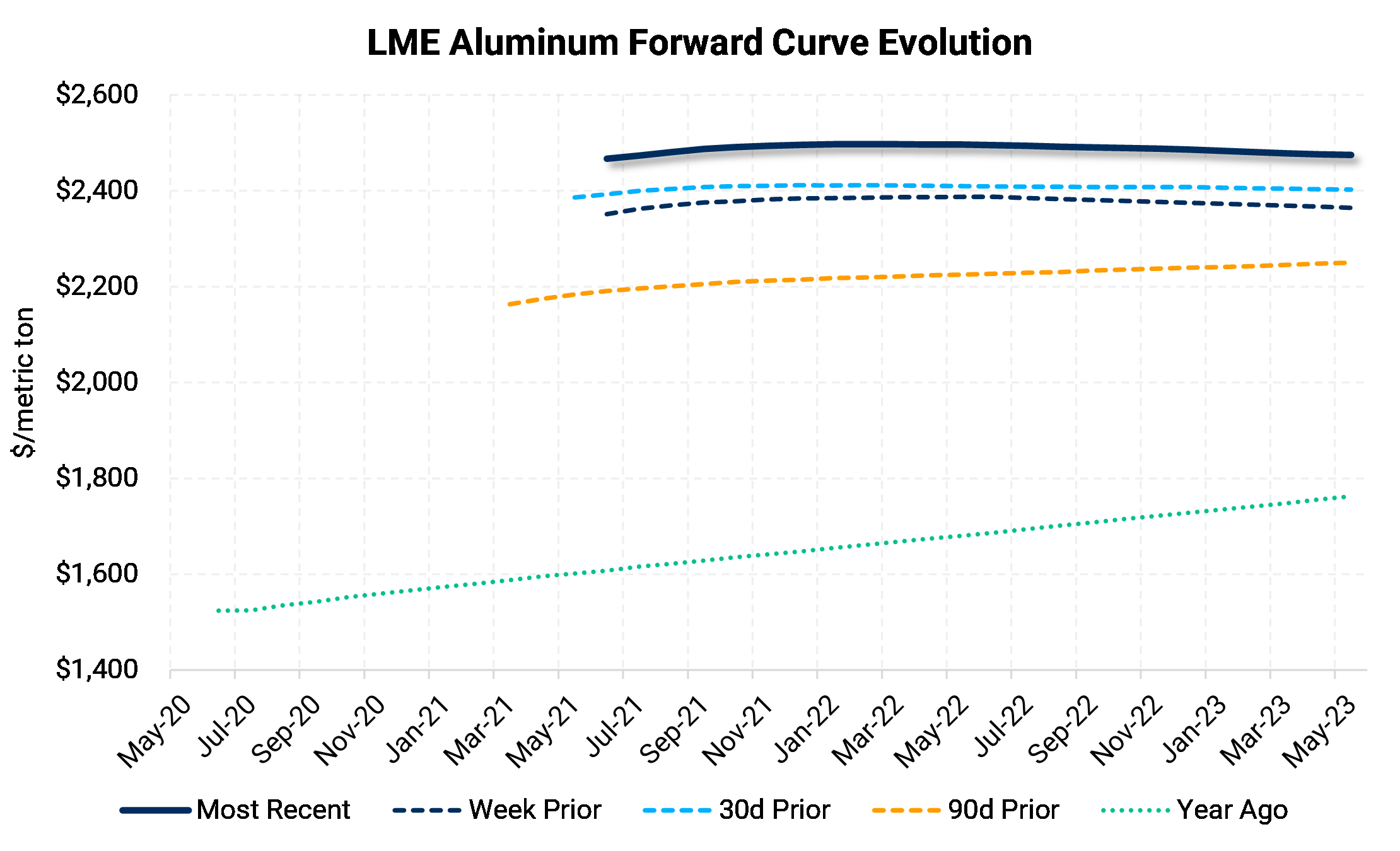

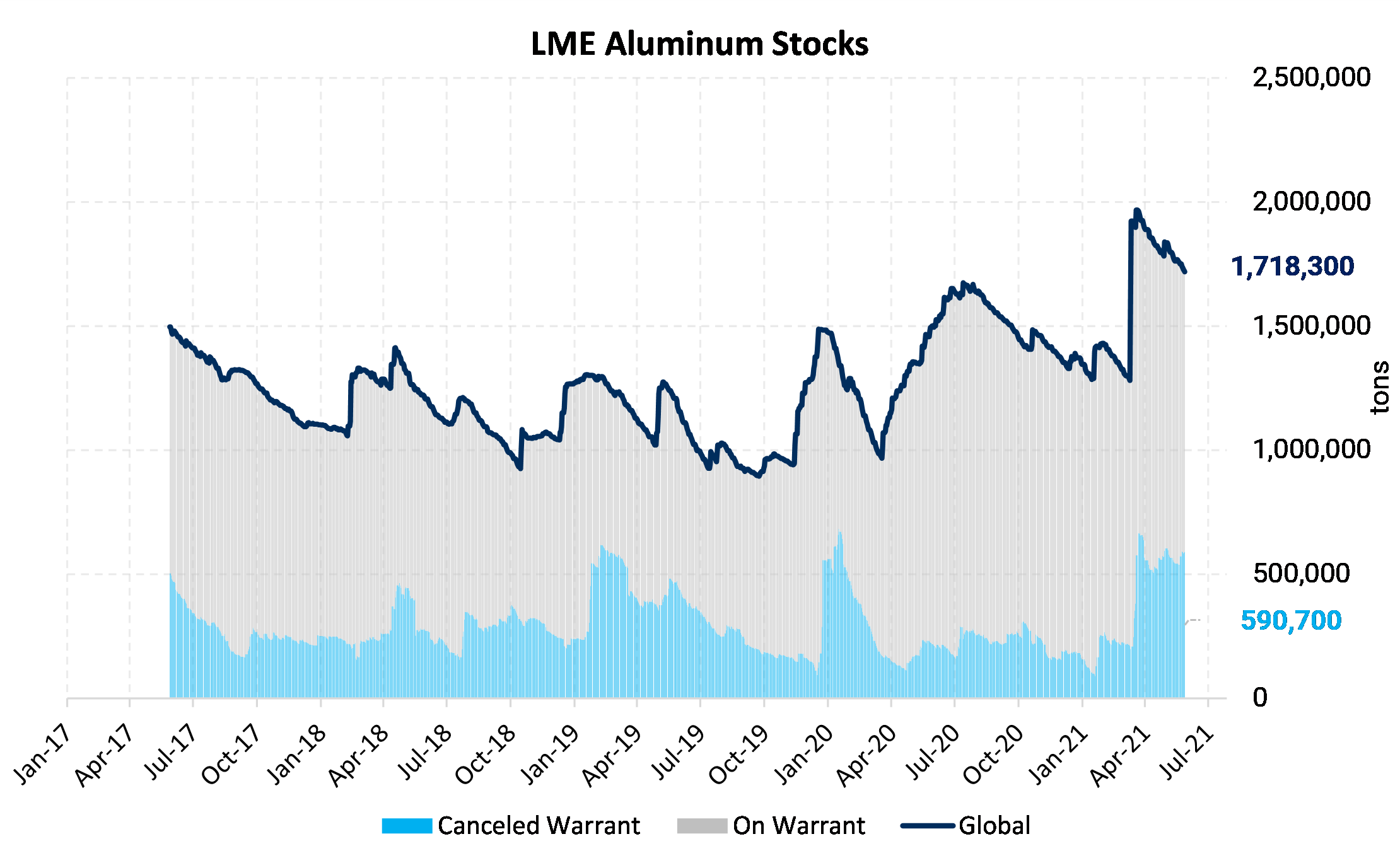

After a 3.6% drop last week, LME cash aluminum fell by another 4% this week to $2,339.75. The current price is not far above the 50-day moving average, one of the numbers we follow to track market momentum. For most of the past year, the current price has been above the 50-day MA indicating bullish momentum. If prices remain at the current level or drop more, technical indicators could shift toward a bearish view. Before panicking about the two-week drop in prices, don’t forget that aluminum prices did increase by 5.1% and 2% the prior two weeks. With the drop in prices, Cash-3mo continues to steepen, now standing at $30. This is only three weeks after being in a $10.50 backwardation. Contango in the forward curve incentivizes cash and carry inventory financing strategies while backwardations can force deliveries of LME short positions. Not surprisingly, further out the curve, Dec’21/Dec’22 backwardation eased from $29 two weeks ago to $8 this week. The persistent backwardation indicates there are still few buyers for long-dated contracts as producer buying has slowed. Keep an eye on “green” aluminum’s impact on prices in the future. UC Rusal has decided to “demerge” their carbon assets and will keep their assets produced using hydropower and that use inert anodes.

|

|

Midwest Premium |

|

|

While the year-long rally has stalled for most metals, the aluminum Midwest Premium in the US continues to grind ever higher. The CME MWP contract for May stands at 26.36¢/lb, an increase of 0.06¢/lb from last week. Keep in mind though as we get later in the month, it takes bigger cash moves to change this month-average number. Meanwhile, the cash market for MWP continues to print at new all-time highs. At least on the consumer side, we have started hearing talk of current prices (LME + MWP) being unsustainable, causing many to also take a closer look at their inventory levels. Unfortunately, the backwardation in the forward curve has intensified and makes inventory hedging expensive. What was good on the way up for those who pass through pricing to their customers will likely be just as painful on the way down, at least for premiums. For consumers, we have seen Oct’21 – Mar’22 trade under 20 cents/lb. However, there has been little appetite even at these levels due to Section 232 uncertainty and the likelihood of improvements in supply chain constraints in the future. Consumers with little flexibility in downstream pricing to their customers may want to layer in some 1H2022 swaps at this point.

|

|

|

|

|

|

|

|

|

|

|

|

LME Copper |

|

|

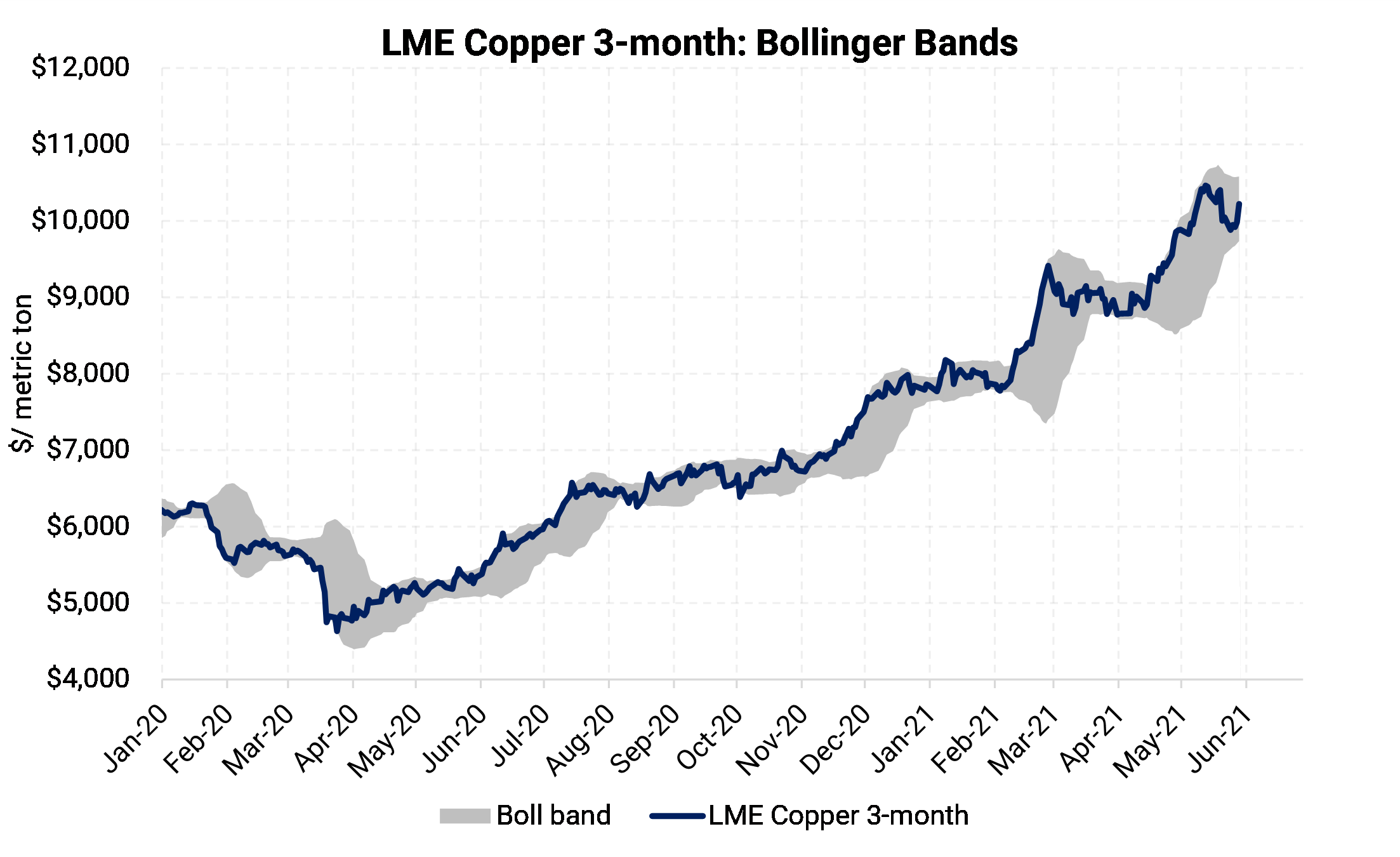

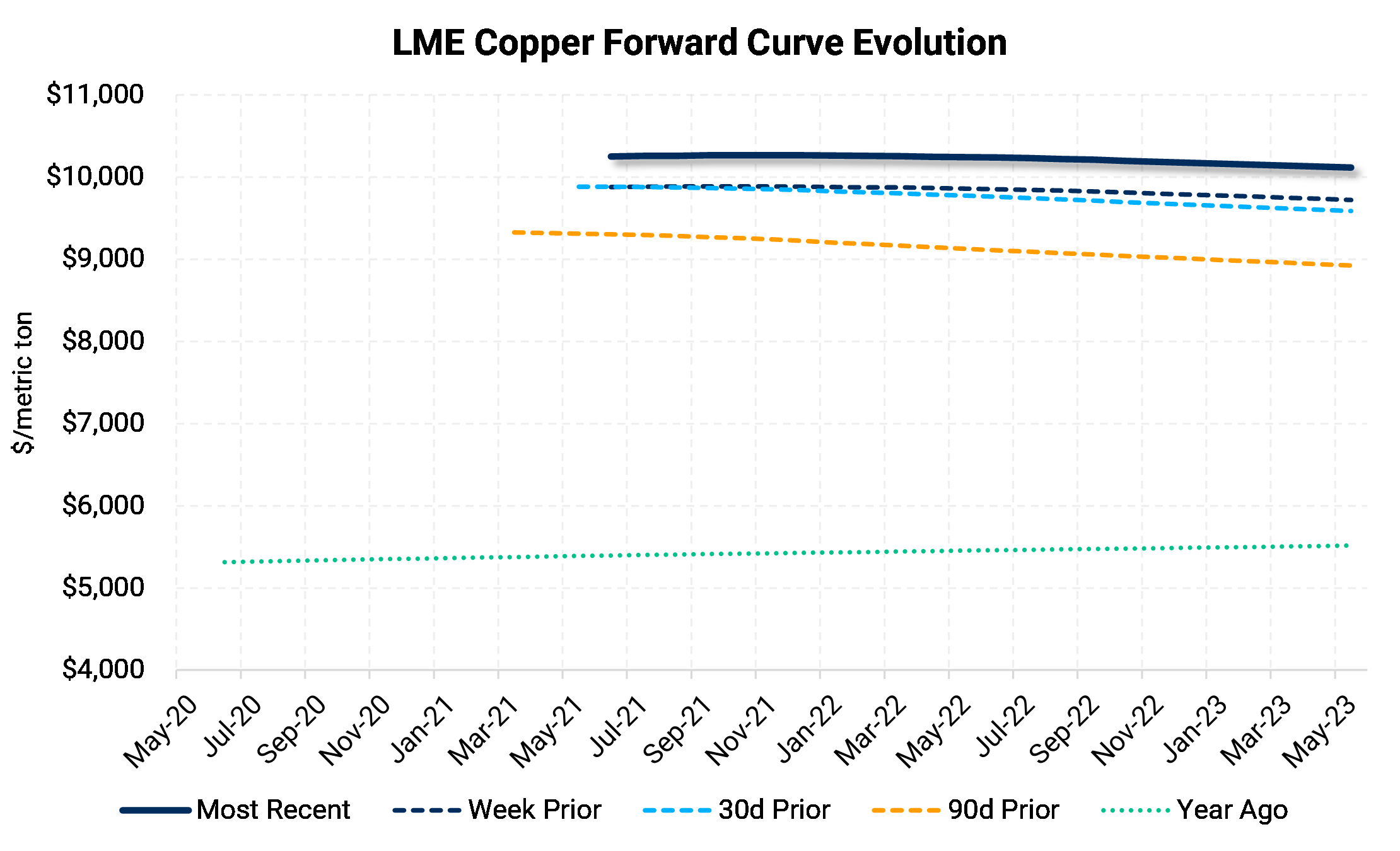

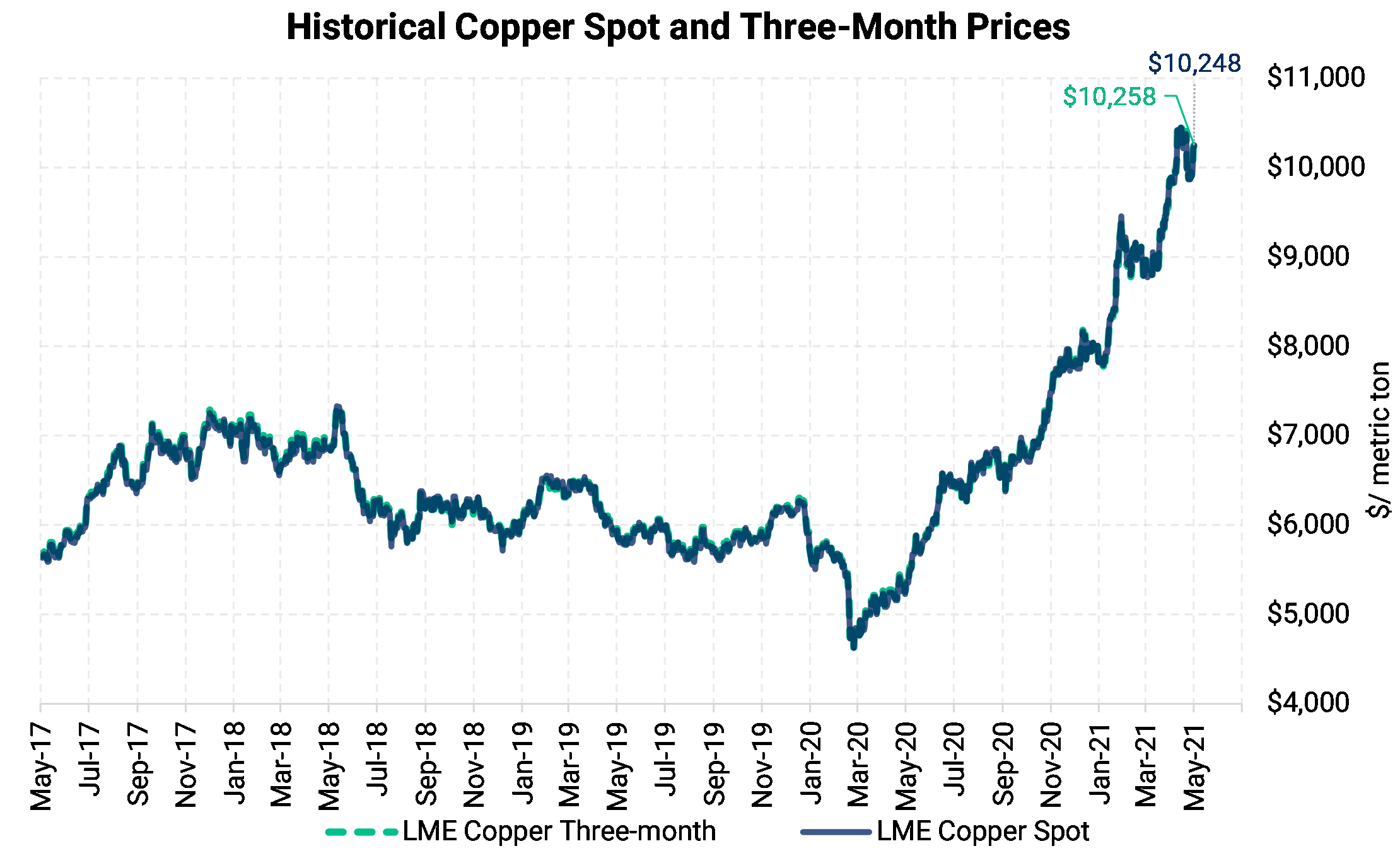

LME 3-month copper price dropped below the symbolic $10,000/mt level closing at $9,881.50, a $440 drop from the prior week. Official LME Cash prices ended the week down 3.4% after a 2% drop last week. Putting this retreat in perspective, the red metal is still up by 84% over the past year. The government in China has called for more efforts to “curb unreasonable” gains and prevent any impact on consumer prices. Copper imports in April also declined by 12.2% m/m as we keep an eye on demand in China. In addition, investors trimmed their long copper position to the lowest level in four weeks. As many market participants remain bullish despite these factors and since fundamentals have not significantly changed, price pullbacks should be used as an opportunity to layer additional hedges either through swaps, options, or collars. |

|

|

|

|

|

|

|

|

LME Nickel |

|

|

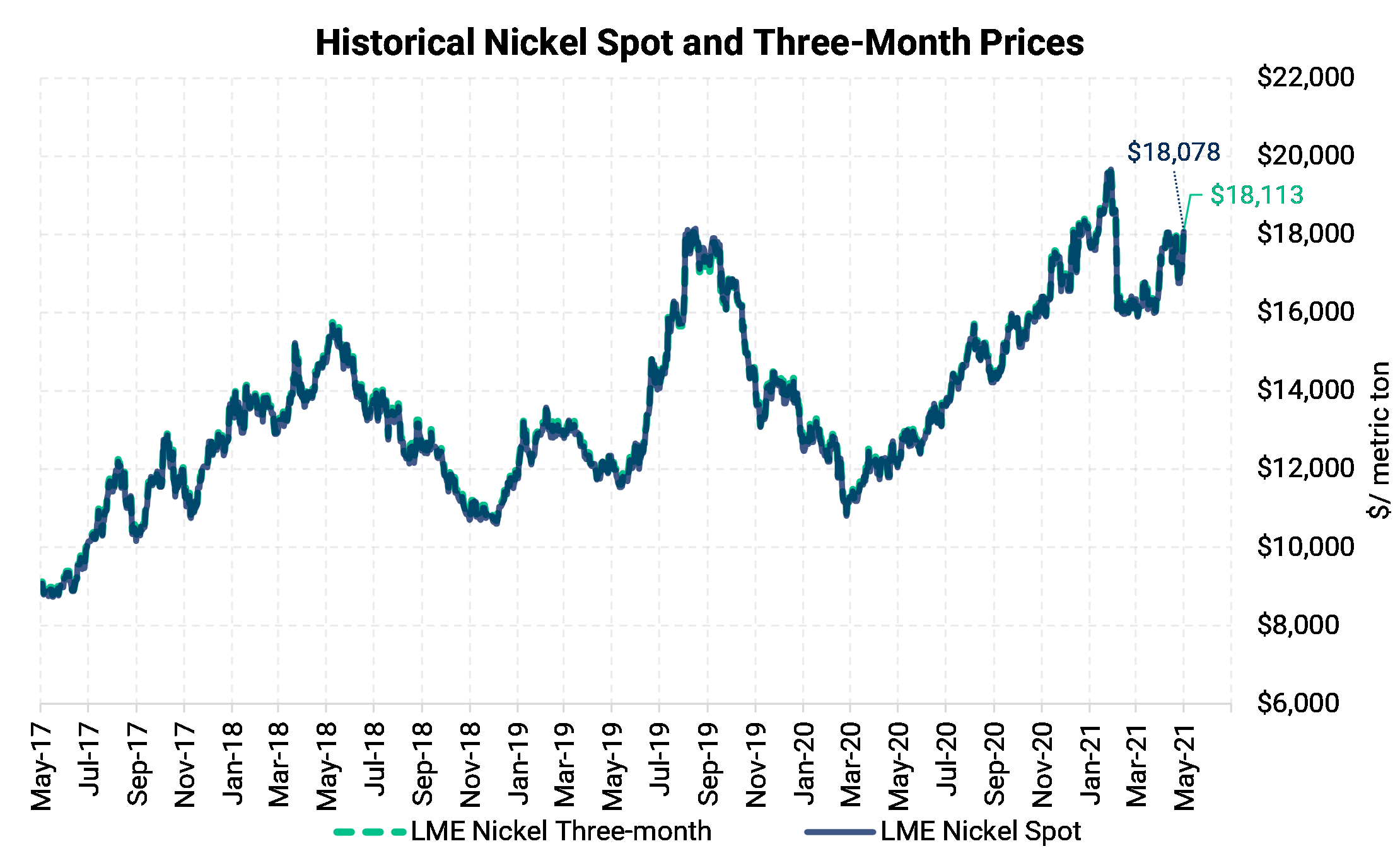

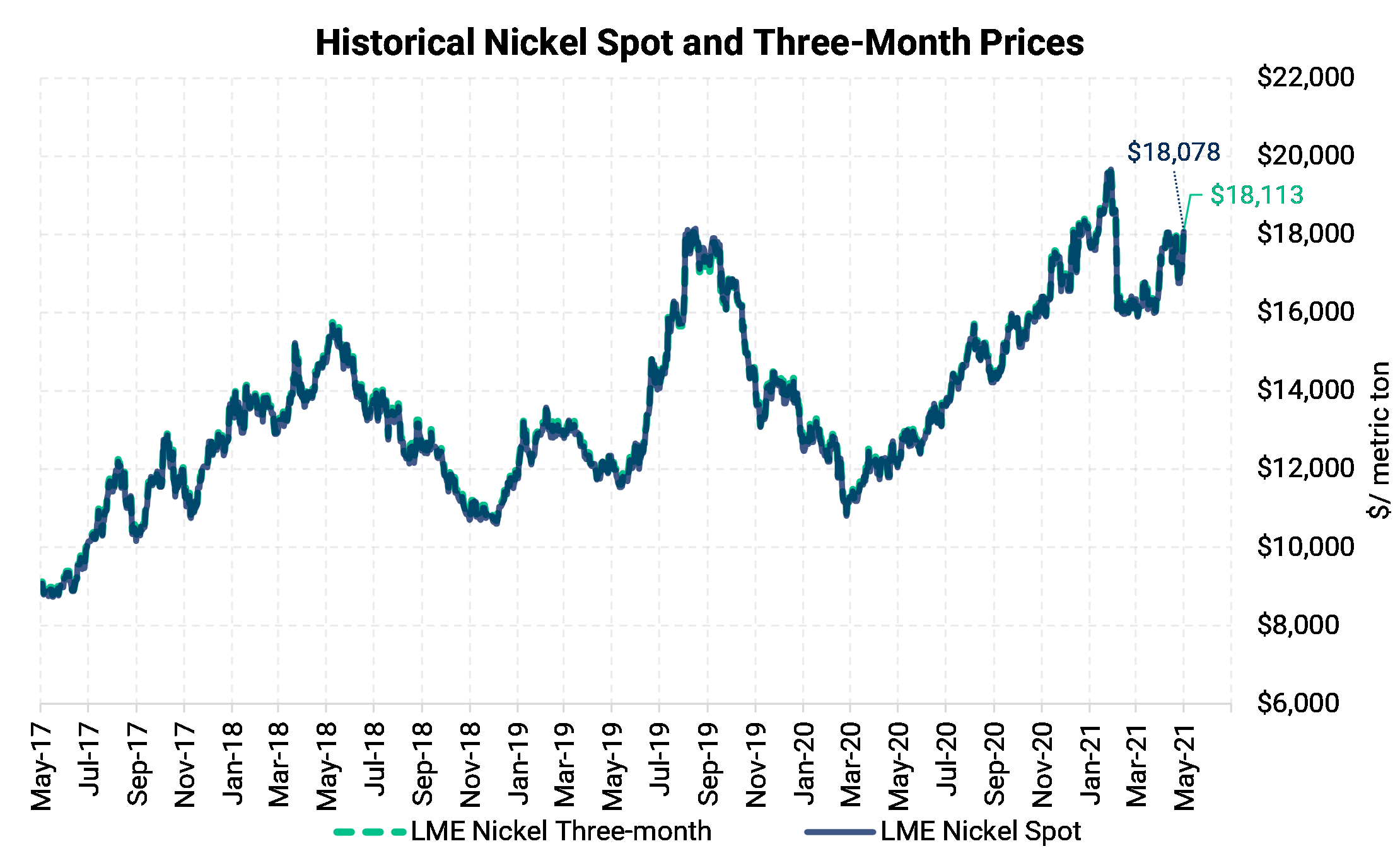

Nickel prices continued round two of their setback, remaining in negative territory this week after only a few weeks of recovering from the late February sell-off. Cash prices dropped by another 4.3% to $16,756. Counter to the price drop, data from the International Nickel Study Group showed the nickel market deficit increasing to 16,100 metric tons. LME nickel inventory dropped slightly to 250,842 mt. |

|

|

|

|

|

|

|

|

|

|

|

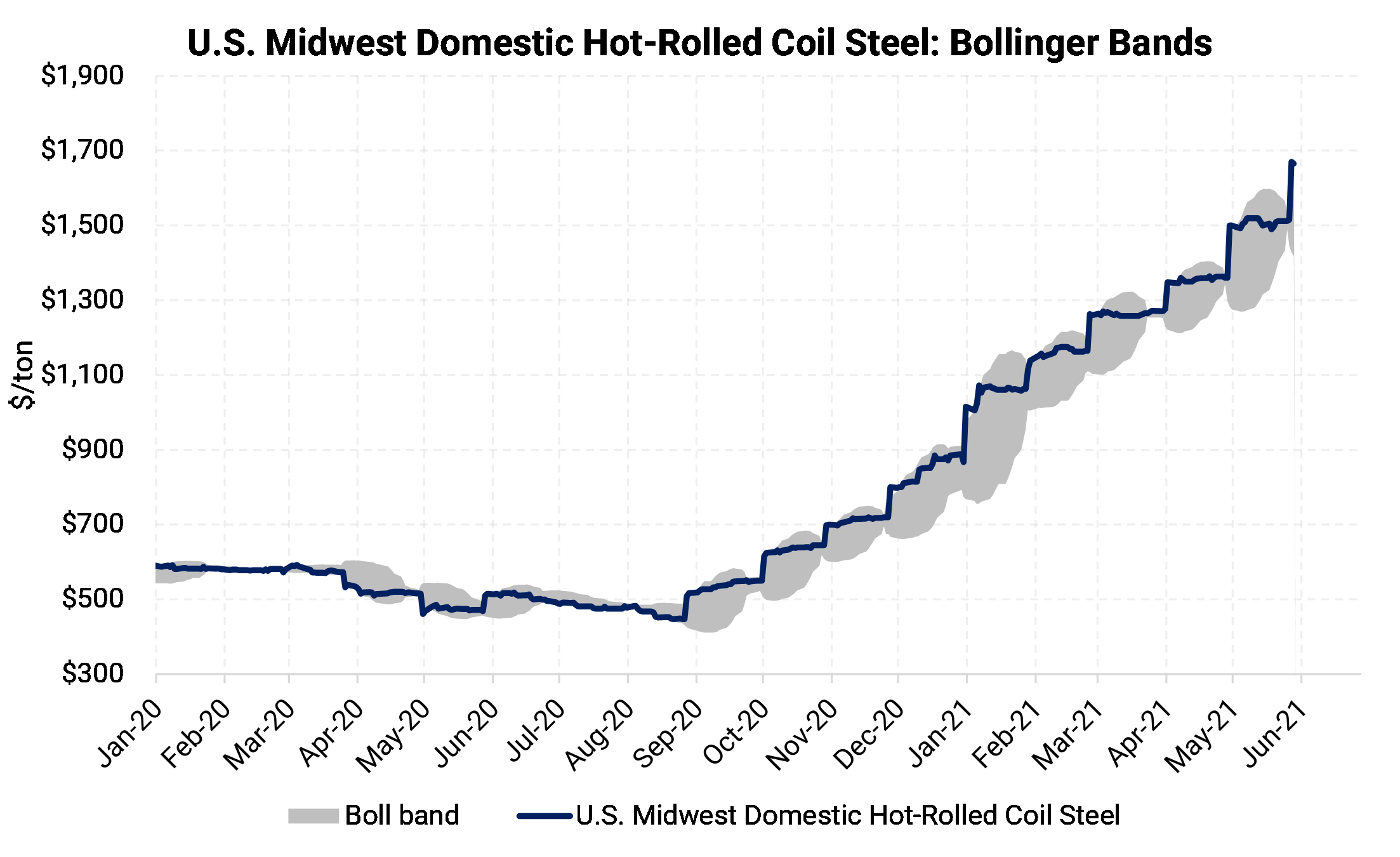

CME Hot Rolled Coil (HRC) |

|

|

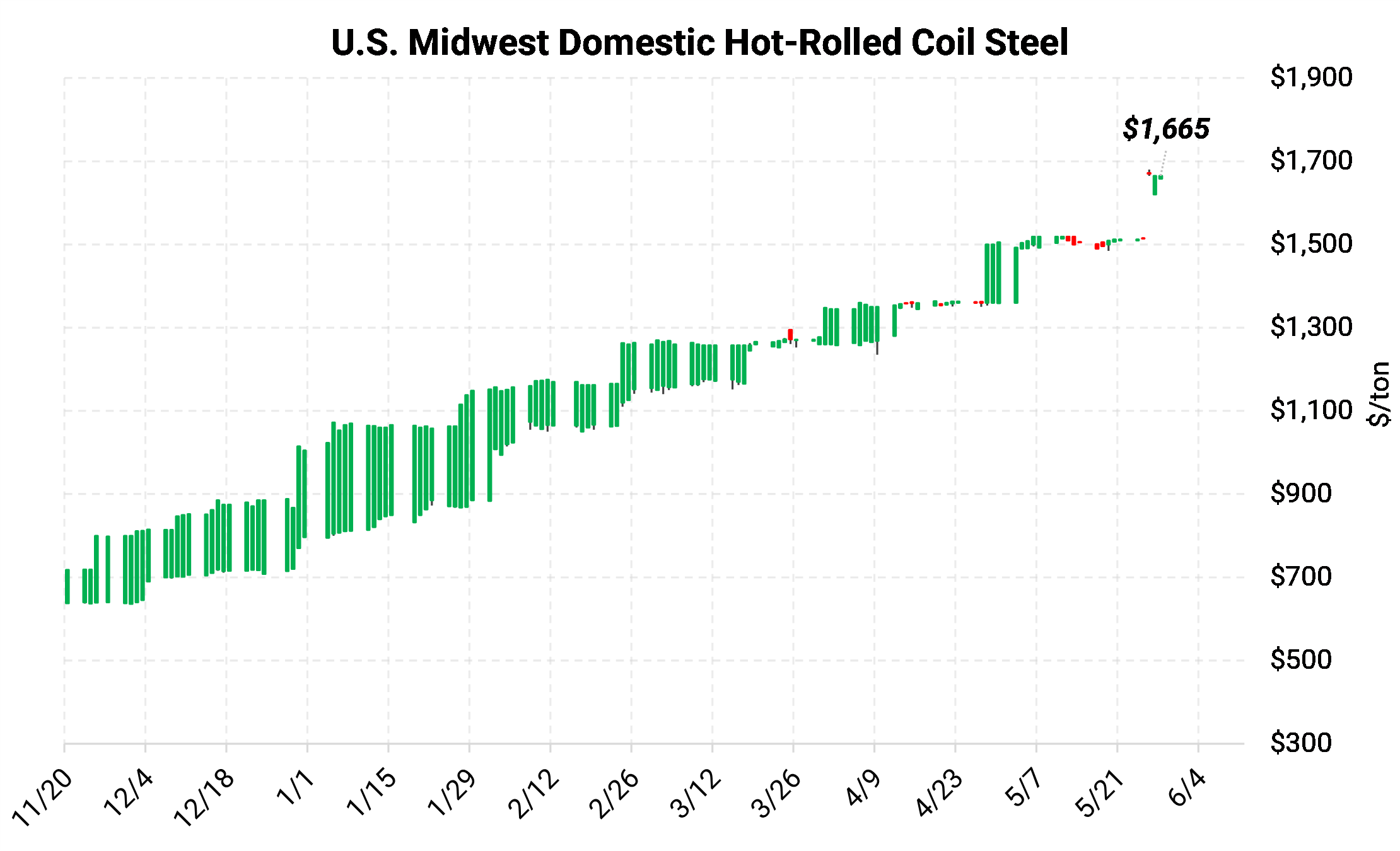

US domestic HRC prices broke through $1,500/short ton two weeks ago as the record steel rally thundered on. The CME HRC futures contract for May ’21 is currently offered at $1,512/ton, up by $2 from last week’s report. The nearby forward curve continues to show strength, with the Jun’21 CME contract last priced at $1,610. The contract for Dec ’21 is currently offered at $1,225/ton, down $70 from a week ago and down $185/ton from just two weeks ago, signaling that market participants are expecting a fall in prices in 2H21. Like the aluminum MWP backwardation, there also could be wary eyes watching for potential changes to Section 232 tariffs. LME traded volume Friday was concentrated in September and October while open positions fall off after the end of the year. Opportunities remain open for HRC consumers to hedge future prices below the current spot price. The opportunity to hedge inventory or HRC sales continues to improve, and we continue to believe that buying put options remains the best structure to achieve protection against a major market correction. From a consumer perspective, buying calls can be used to protect against a continued rally, with strike prices that are favorable considering the spot market prices, Utilizing options will also allow for participation in a price correction downward. |

|

|

|

|

|

|

|

|

|

Notable News |

|

|

Aluminum Producers Request Subsidy Investigations US Chamber of Commerce: The Clock is Ticking on the Steel and Aluminum Tariffs China April Aluminum Output Hits Record High As Output Curbs Ease The World Economy Is Suddenly Running Low on Everything WSJ Opinion: How Trump’s Steel Tariffs Failed Housing Starts Fall as Builders Contend with Shortage of Materials and Labor Chongqing Shunbo Plans 900 Thousand MTPA Aluminum Plant In Anhui Province Aluminum Trade Groups Call On G7 To Combat Beijing’s Subsidies China Bans Financial, Payment Institutions from Cryptocurrency Business Russia’s Rusal to Demerge its Higher Carbon Assets and Change Name Copper Price Tanks After China Said It Will Stabilize Commodity Market China April Copper Imports Fall 12.2% on Month as High Prices Deter Purchases White House Makes $1.7 Trillion Infrastructure Counteroffer to Senate Republicans

|

|