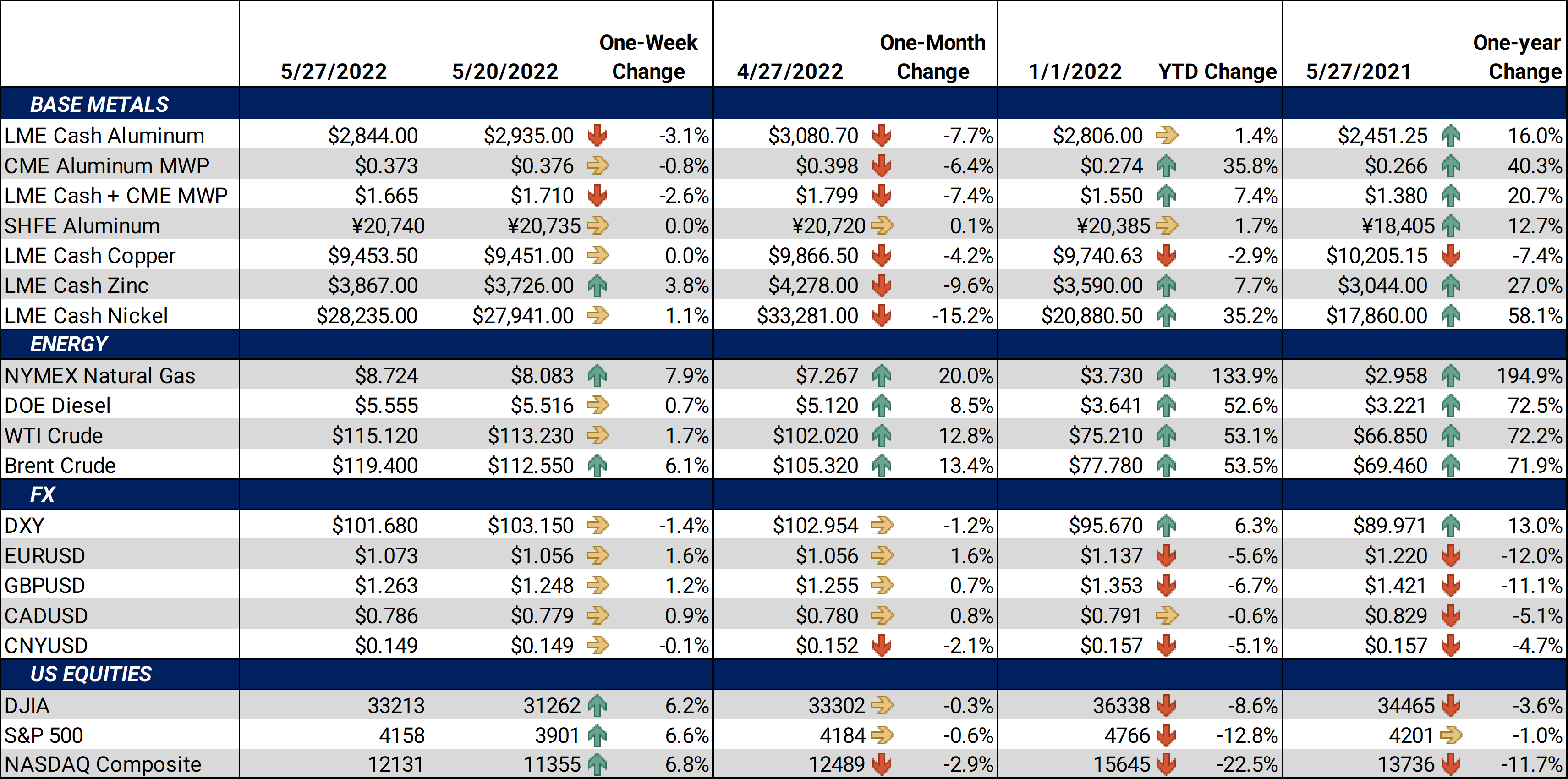

Bottom Line:Aluminum prices fell this week. The 3M Aluminum Select contract last traded at $2,871.50/mt, down $74.50/mt on the week, or 2.5%. The US Dollar has continued its retreat this week, exacerbating the weakness in price. Dollar-denominated metals such as aluminum are normally negatively correlated to the dollar. |

Notable Metals News

Is a glut of nickel coming? Global nickel production could reach 3.21 million mt in 2022, up 19% year-over-year, according to Russian producer Nornickel. They believe that demand will reach 3.17 million mt, leading to a surplus of 40,000 mt. Nornickel cites Indonesian production growth for the increase in supply, as they expect the country’s nickel-pig-iron production to grow by 33% year-over-year to 1.1 million mt. Nickel pig iron is used in stainless steel production and is a low-grade, cheaper alternative to pure nickel, according to S&P Global. Nornickel, which is the world's largest refined-nickel producer, produced 190,000 mt in 2021, according to their 2021 annual report.

The India steel market received a shock that could limit production and exports. Without warning, India implemented a 15% export tariff, effective Sunday, May 22, on HRC and CRC steel. One large domestic producer, alarmed by the government’s sudden move, told Reuters “They should have given us at least two-to-three months of time, we did not know about such a substantial policy.” Indian producers cited by Reuters fear it could close off export markets, specifically to Europe. Prior to its invasion of Ukraine, Russia had been a major steel exporter to the European Union. European buyers have since shunned Russian steel, and Indian exporters were looking to fill the void. India exported 13.5 million mt of finished steel in 2021, up from 10.8 million mt in 2021, according to the Ministry of Steel. (For a more detailed overview, please see our latest post: India's Steel Exports Tariffs Shock Producers)

Indonesia, which is the world’s largest tin exporter, shipped 9,243 mt in April, up from 6,674 mt in March, according to its Ministry of Trade. April’s volume was the highest since September 2018. Total shipments in 2022 are 23,919.65 mt, which is up 11.2% compared to the same period in 2021. Nearly 71% of their March shipments went to China. Last November, Indonesian President Joko Widodo announced that the country might ban the export of tin starting in 2024. Indonesia is the world’s second-largest tin producer, bested only by China.

|

|

|||||

|

|

|||||

LME Aluminum |

|||||

|

LME Aluminum 3M settled at $2,871.00/mt, down $74.50.00/mt on the week. With this week’s bounce in prices, the forward curve for LME Aluminum has shifted higher compared to last Friday. Similar to last week, the forward curve is backwardated beyond October 2022. The aluminum market has sufficient liquidity to use swaps and options. Consumers might consider strategies that use only swaps or options or a combination of both, depending upon your risk tolerance. Please contact AEGIS for specific strategies that fit your operations. |

|||||

|

|||||

|

Prompt month CME MWP last settled at 37.3¢/lb this week. The CME Midwest Premium swap market is thinly traded, and there is no options market. Hedging in this market is tricky, so we recommend using strategically placed limit orders. Please contact AEGIS for specific strategies that fit your operations.

|

|||||

LME Copper |

|||||

|

LME Copper 3M settled at $9,459.00/mt, up $37/mt on the week. LME Copper’s forward curve has shifted higher compared to last Friday, as prices have rallied. There is now contango through September 2022, but the forward curve reverts to backwardation past that contract. A backwardated forward curve favors the copper consumers. The copper market has sufficient liquidity to use swaps and options. Consumers might consider strategies that use only swaps or options or a combination of both, depending upon your risk tolerance. Please contact AEGIS for specific strategies that fit your operations.

|

|||||

|

|||||

|

LME Nickel 3M settled at $28,284/mt, up $311/mt on the week. Nickel’s forward curve has shifted higher, and remains in a slight contango, meaning that spot prices are lower than futures prices. The nickel market has sufficient liquidity to use swaps and options. Consumers might consider strategies that use only swaps or options or a combination of both, depending upon your risk tolerance. Please contact AEGIS for specific strategies that fit your operations. |

|||||

|

|

|||||

|

|

|||||

CME Hot Rolled Coil (HRC) Steel |

|||||

|

Prompt month HRC Steel last traded at $1,195/T, down $183/T on the week. For CME HRC Steel, liquidity is low for swaps, but hedging can still be done with strategically placed limit orders. The same is true for options. Similar to other metals, a combination of both swaps and options might work in certain cases, depending upon your risk tolerance. Please contact AEGIS for specific strategies that fit your operations. |

|||||

|

|

|||||

AEGIS Insights |

|||||

|

05/18/2022: AEGIS Factor Matrices: Most important variables affecting metals prices 05/11/2022: China's Metals Exports are on the Rise |

|||||

Notable News |

|||||

|

5/19/2022: Some in Shanghai allowed out to shop; end of COVID lockdown in sight 5/18/2022: China's Xiaomi, Vivo and Oppo trim smartphone orders by 20% 5/16/2022: Shanghai targets June COVID lockdown exit as China economy slumps 5/16/2022: Column: European smelter hits mean another year of zinc shortfall 5/16/2022: Europe's aluminium deficit triggers further large LME stock draw |

|||||