|

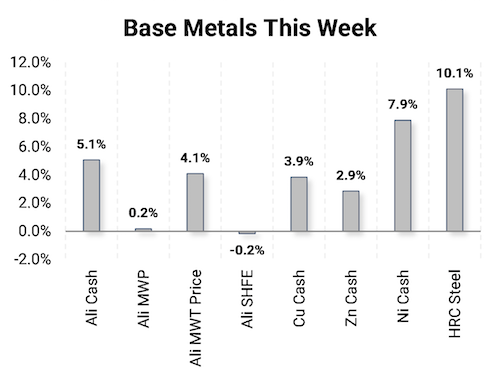

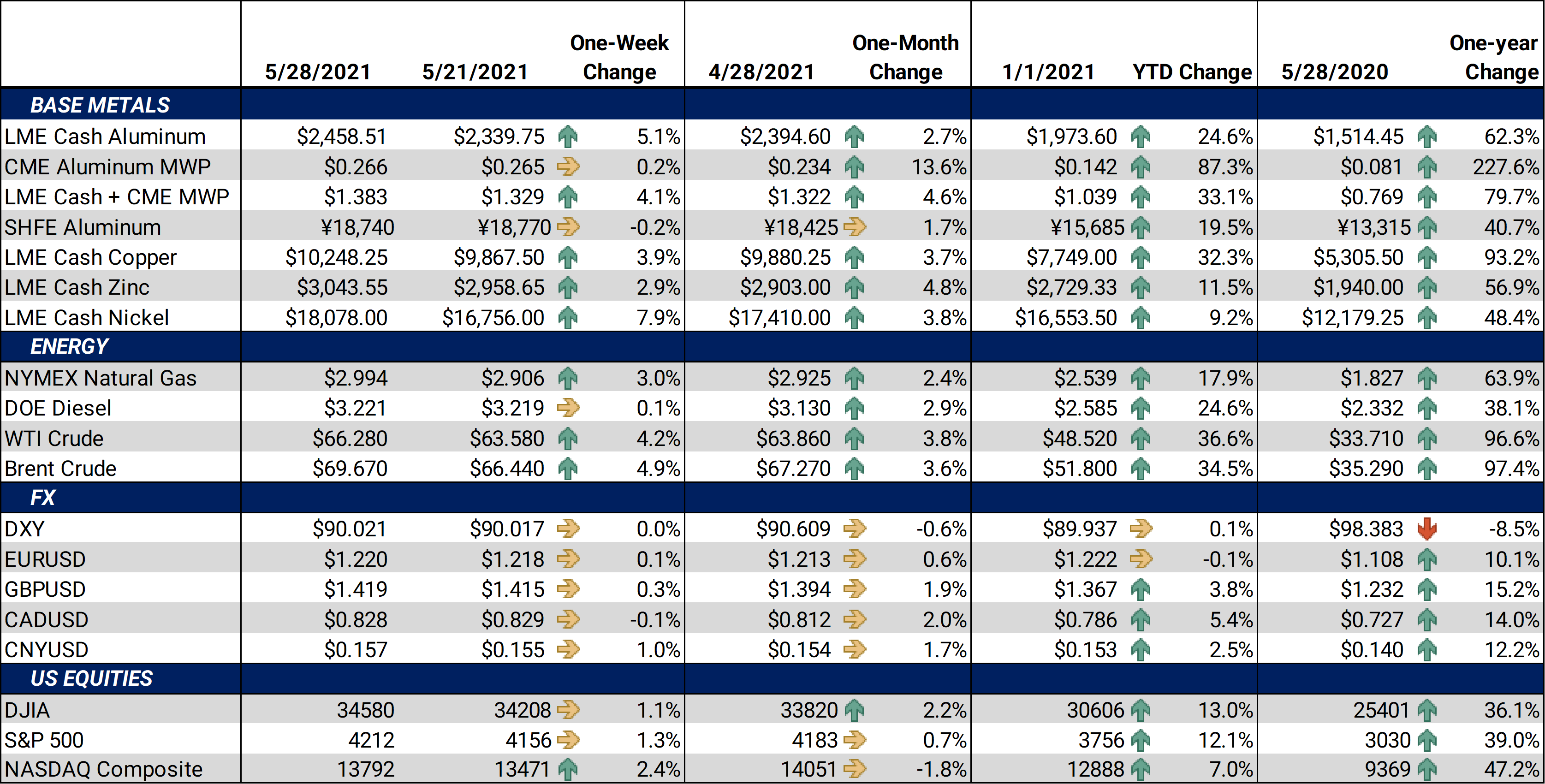

Industrial metals made an about-face this week but saw volatility on the trip back into positive territory week over week. All eyes were on China as the Xi administration seeks to contain bull commodity market momentum as rising prices continue to hinder the industrial manufacturing sector. China’s official stance on speculation and market manipulation has continued to toughen regarding not only commodity prices, but they are also attempting to clamp down on cryptocurrency, big technology, and property markets. |

|

|

|

|

|

The Biden administration released its proposed budget for next year at a reported price tag of $6 trillion, ramping up spending on education, infrastructure, and climate change. The proposed budget would increase the nation’s debt load to levels not seen since World War II when compared as a percentage of GDP. Officials have been quoted describing the spending as opportunistic at current interest rates and as an investment in future prosperity.

|

|

|

Bottom Line: In 2Q 2021, the market has not provided any meaningful relief for unhedged consumers of metal. In addition, many manufacturing companies are struggling to find employees and obtain the raw materials needed to keep up with order books. It has been a painful learning curve for those who may have held off on hedging, waiting for a return to lower prices. Ideally, industrial hedgers were able to take advantage of the brief two-week pullback. If volatility increases and we see additional price consolidation in the future, consider layering in more hedges to narrow the range of possible outcomes and ensure that damage to margins is contained. You may want to consider a trailing stop-loss strategy to add discipline to your hedging approach. It is also important to make sure you understand when margin compression will impact overall company performance. The cost of buying call options or zero cost collars has increased, but if markets remain calm for a few weeks, options may once again be an attractive way to provide protection while allowing participation in lower prices if the rally finally eases. Base metals overall continue to find support from increased consumer demand, physical market imbalances, low short-term interest rates, high freight and logistics costs, continued global stimulus, and a relatively weak U.S. dollar. At the same time, investors have become wary and have been one factor in the recent consolidation.

|

|

|

|

|

|

|

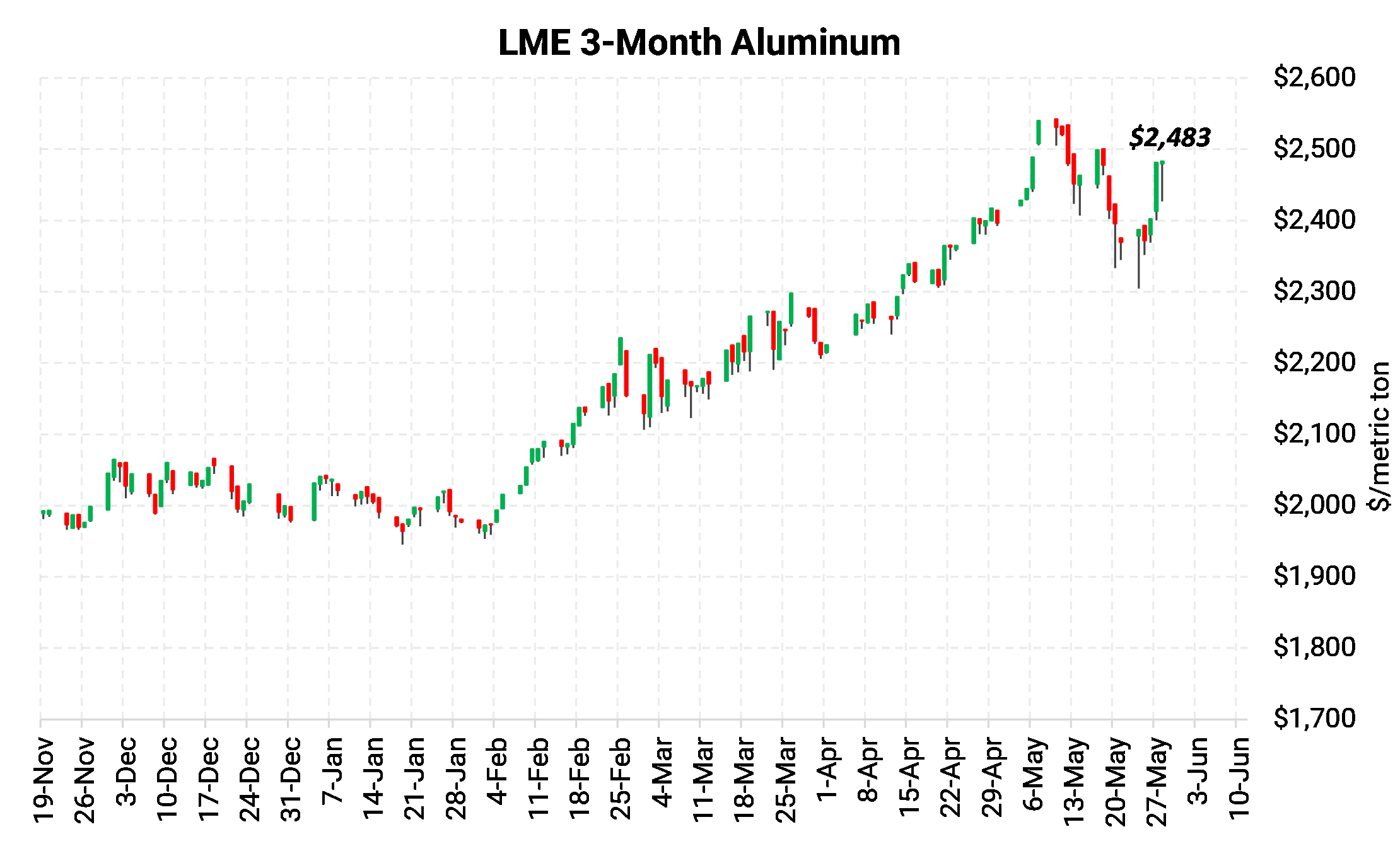

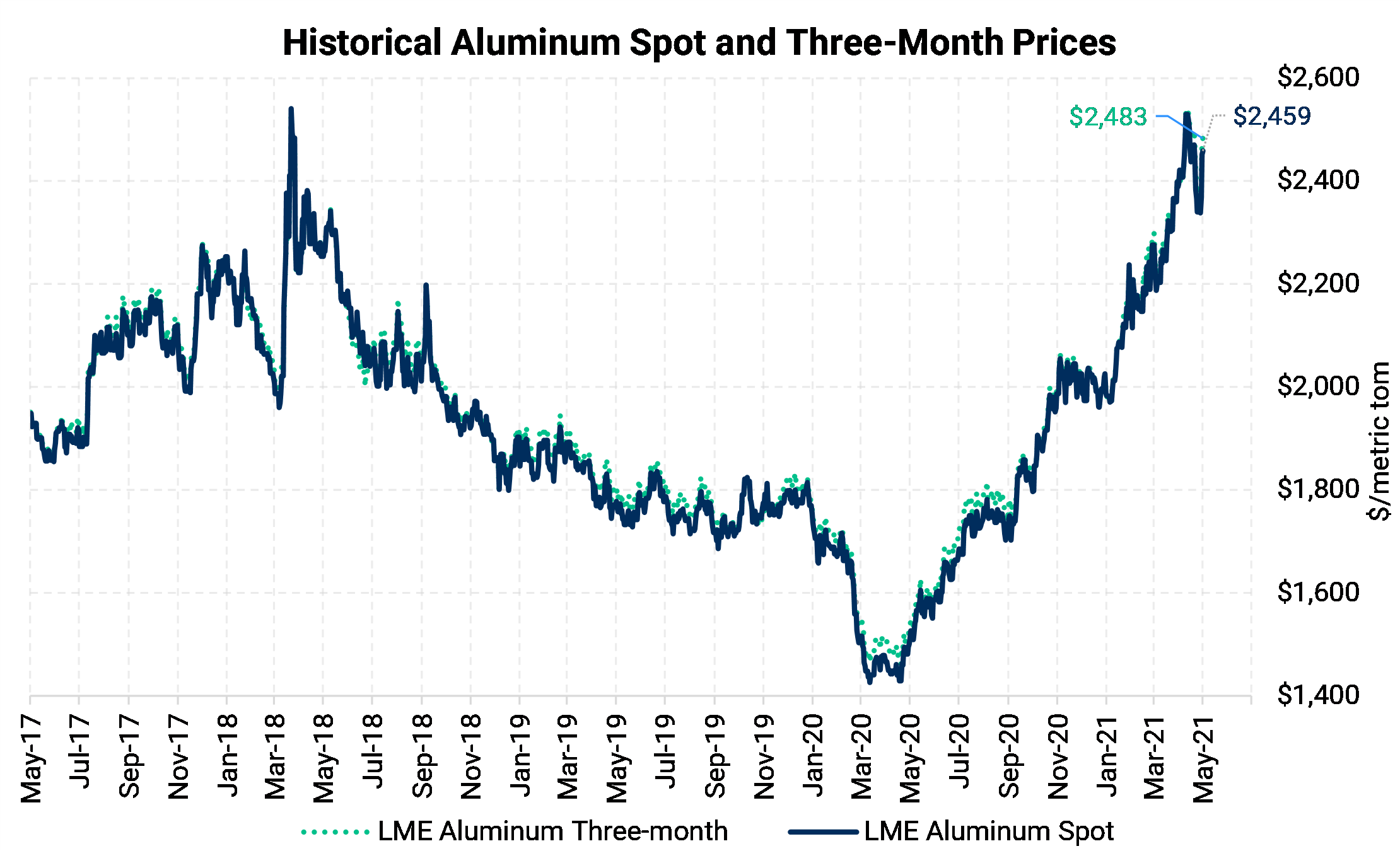

LME Aluminum |

|

|

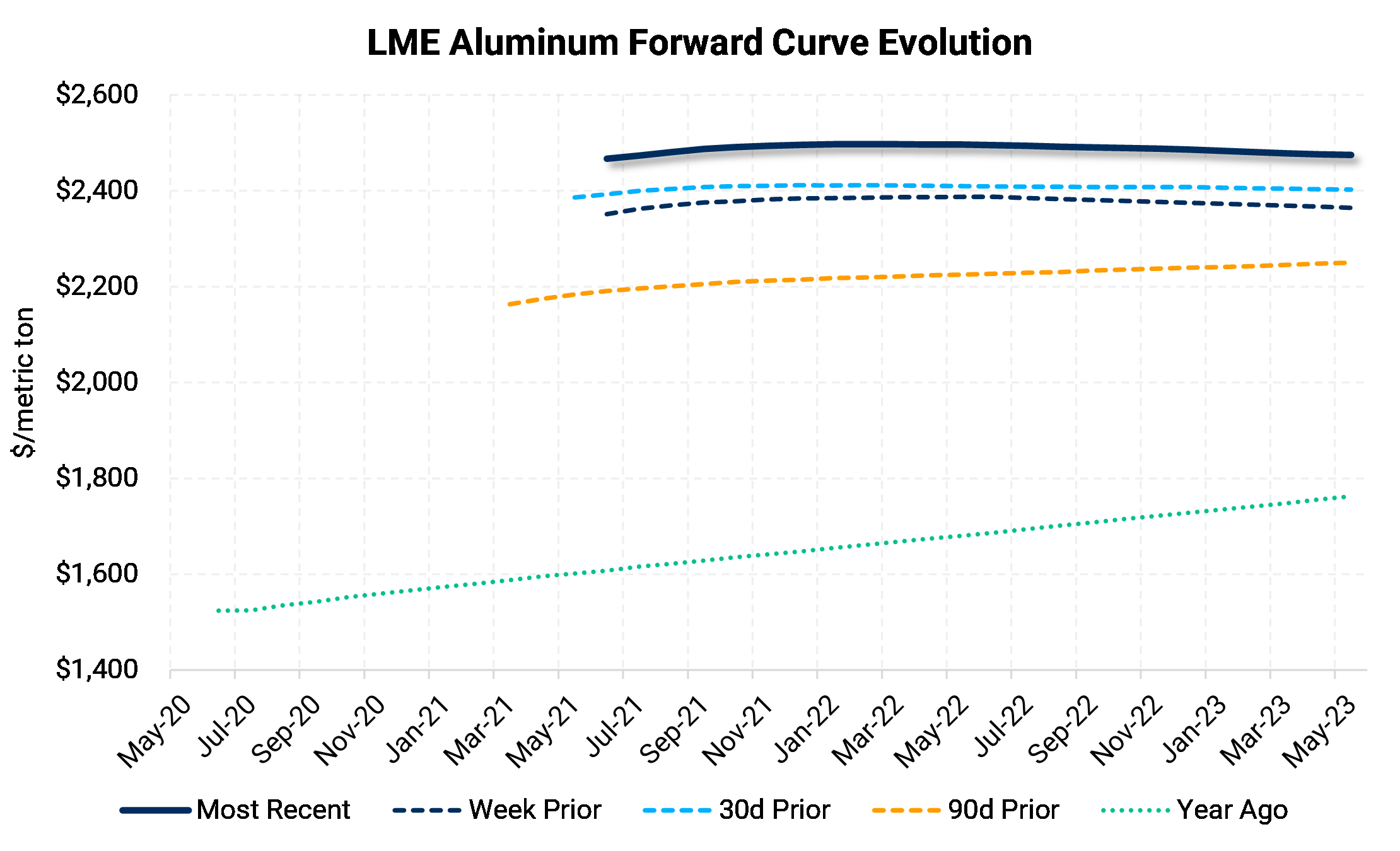

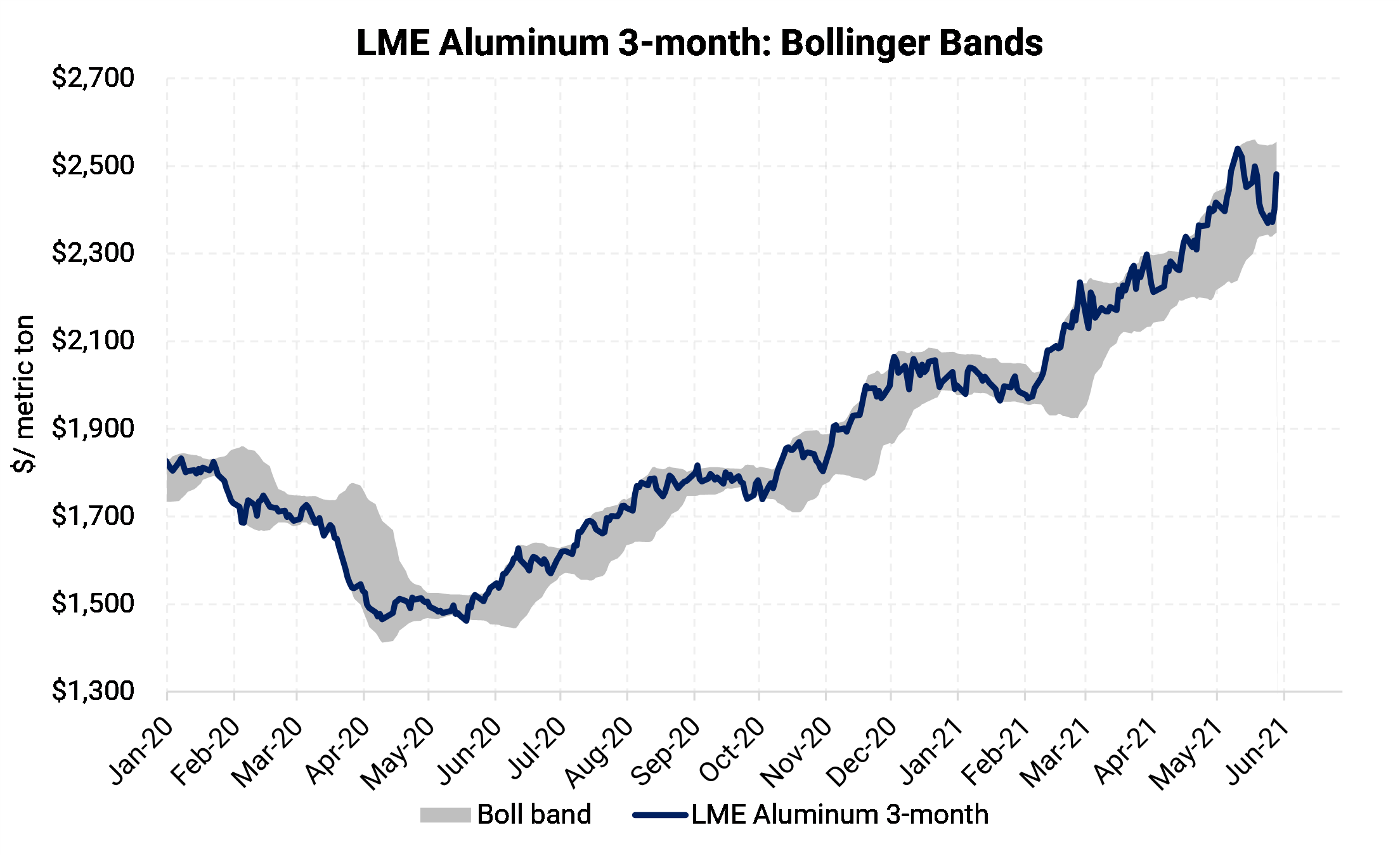

After dropping by 4% and 3.6% the past two weeks, LME cash returned to its long bull run, leaping by 5.1% this week to close at $2,458.51. One does not even have to look at the latest historical volatility data to realize the market is getting choppier with intraday and week-long moves up or down increasing in size. Meanwhile, our month-end look at current cash price vs. 50-day moving average cash prices continues to tell the same old bullish story. The momentum view continues to point to higher prices. However, beware that the moving average look isn’t always very good at picking reversals on the front end. We continue to recommend that consumers layer in hedges in a disciplined manner and select between swaps or call options. Those who have done this over the past year have reaped significant benefits. With the overall price increase, Cash-3mo flattened slightly from $30 contango to $25. This significant contango incentivizes cash and carry inventory financing strategies. Despite the runup in prices this week, Dec’21/Dec’22 backwardation was modestly stable, now standing at $10. The persistent backwardation indicates there are still few buyers for long-dated contracts as producer buying has slowed. Reuters published a couple of aluminum articles late this week that give reason to believe high LME and geographic premiums will stay with us for a while. See links below for your reading interest.

|

|

Midwest Premium |

|

|

LME aluminum has seemed to bounce up and down on its path to higher prices while the aluminum Midwest Premium in the US continues to grind ever higher with no sign of any pullbacks. The CME MWP contract for May will settle today somewhere near 26.55¢/lb, an increase of 0.19¢/lb from last week. With the May contract expiring, the June contract on CME screens now stands at 26.5¢/27.0¢. Meanwhile, the cash market for MWP continues to print at new all-time highs. The backwardation in the forward curve remains significant and makes inventory hedging expensive. What was good on the way up for those who pass through pricing to their customers will likely be just as painful on the way down, at least for premiums. For consumers, CME showed a slight uptick in forwards with Jan’22 at 18.5¢/20.25¢. Some modest consumer flow may be starting to pressure those lower prices for longer-dated maturities. Keep in mind the backwardation can quickly go away with relatively modest trading volumes. If prices look attractive now, it is better to get in quickly rather than be remorseful after the curve steepens. The Biden administration does not seem to be giving any indication that they will remove Section 232 tariffs. In addition, US aluminum demand is strong, and LME warehouse queues in Port Klang are in half-year territory. These factors are supporting current levels and make the backwardation look even more attractive.

|

|

|

|

|

|

|

|

|

|

|

|

LME Copper |

|

|

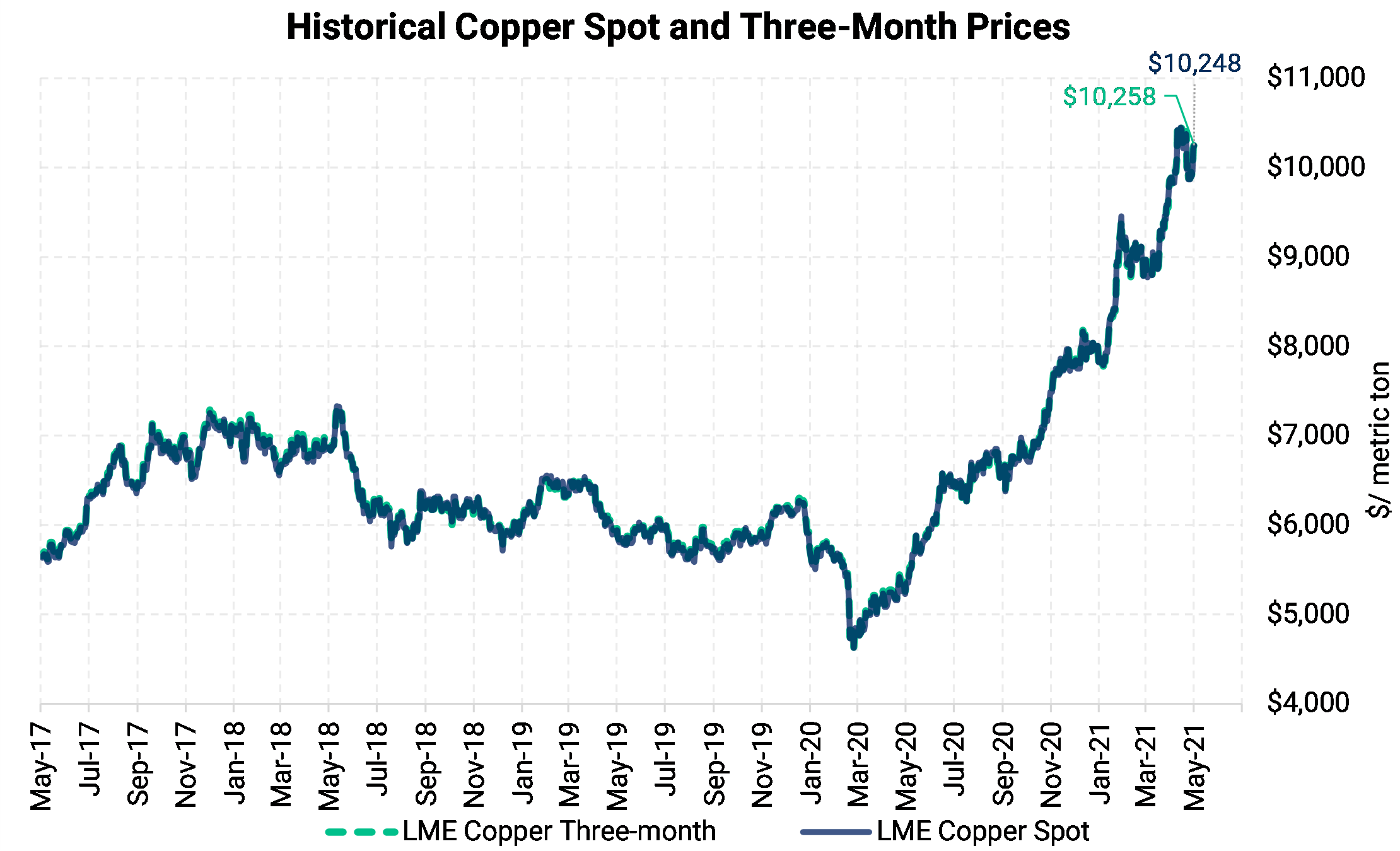

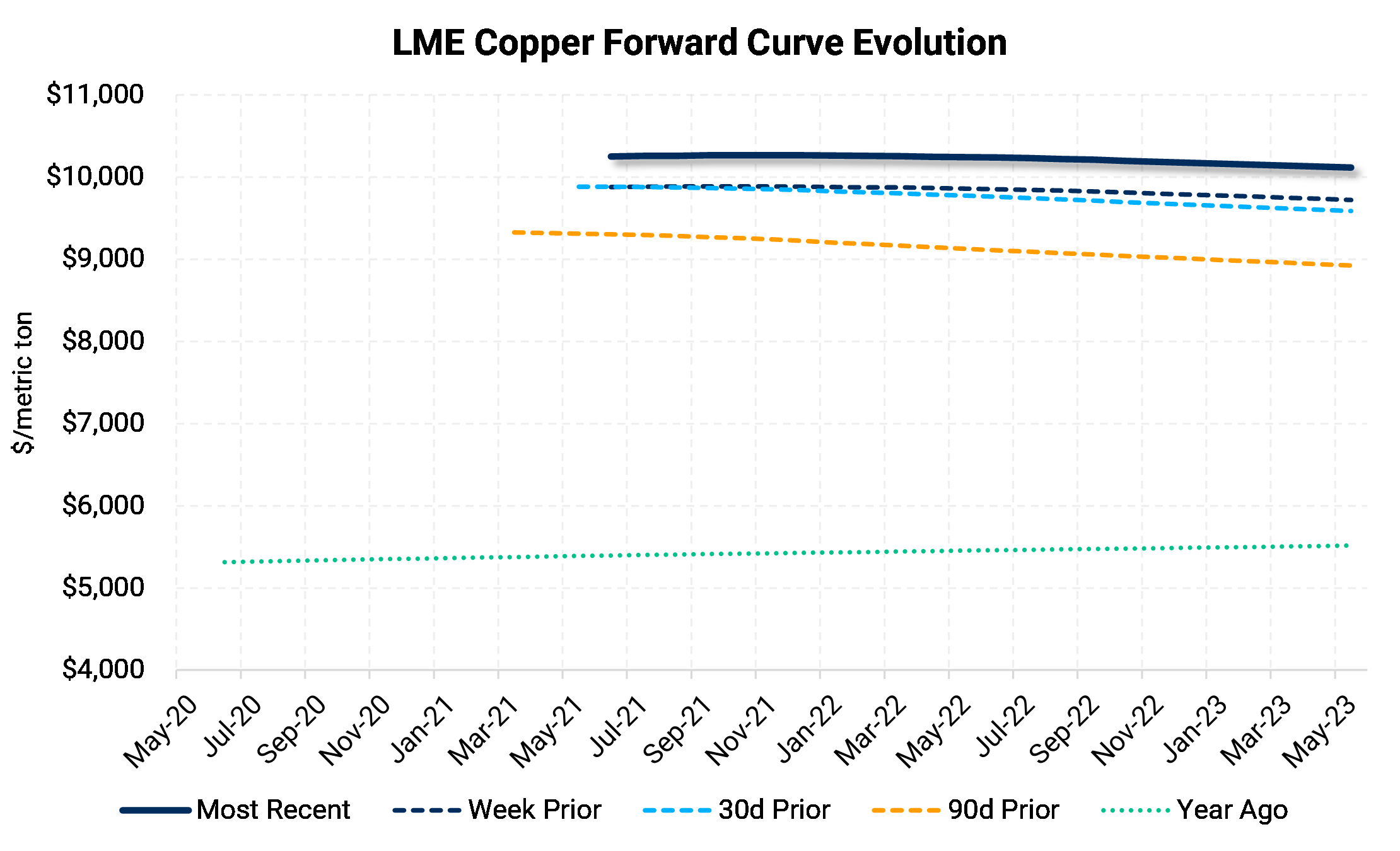

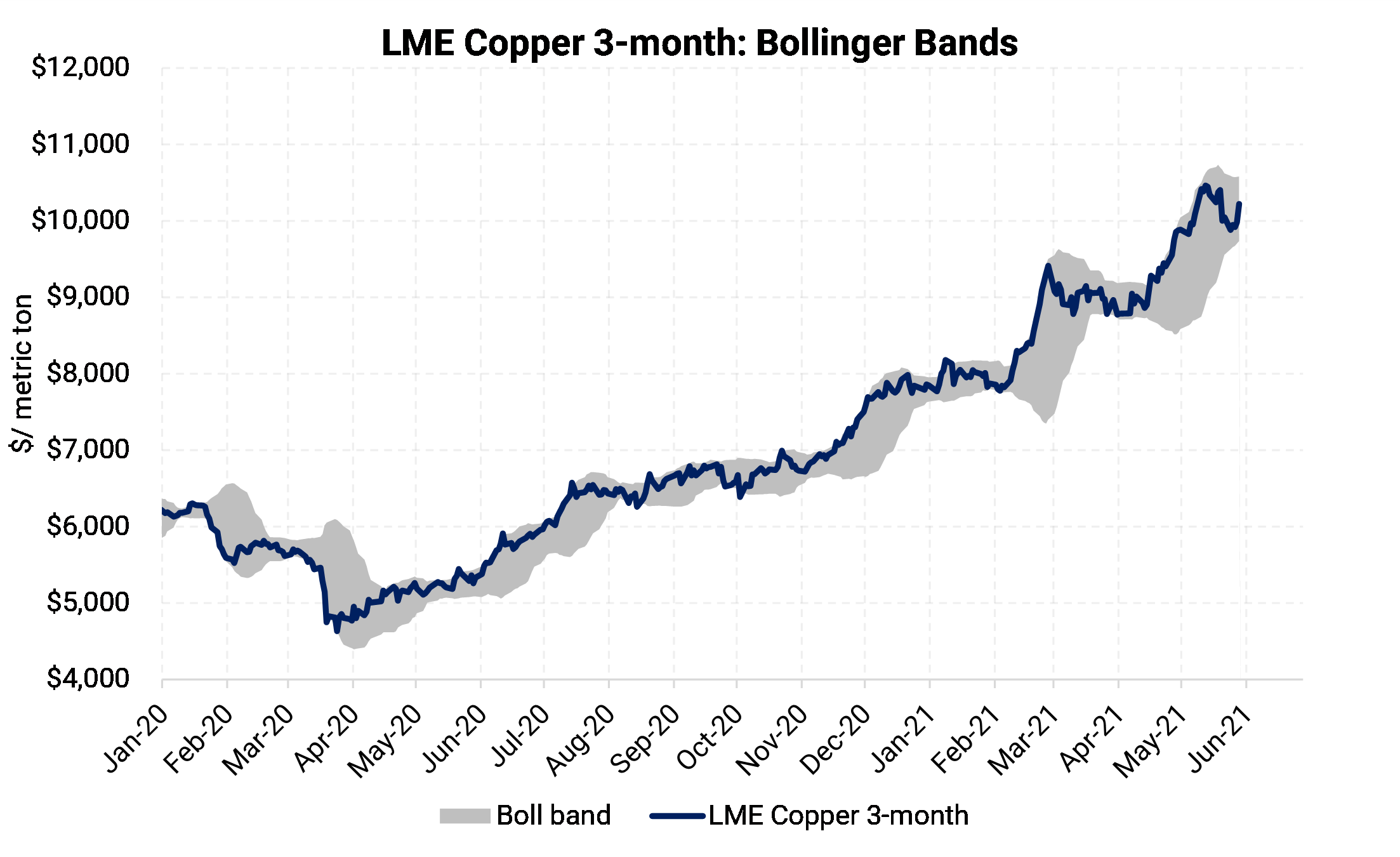

LME 3-month copper price climbed back above the symbolic $10,000/mt level closing at $10,258.00, up $376.50 from the prior week. Official LME Cash prices ended the week up 3.9% after a 3.4% drop last week. The red metal is up by 93.2% over the past year. Goldman Sachs released a note today highlighting that China is losing their ability to rein in commodity price surges, most notably copper. Copper market participants, such as Freeport-McMoRan, continue to note that physical metal scarcity and strengthening demand will likely trump any efforts by China to curb prices. As many market participants remain bullish and since fundamentals have not significantly changed, price pullbacks should be used as an opportunity to layer additional hedges either through swaps, options, or collars. |

|

|

|

|

|

|

|

|

LME Nickel |

|

|

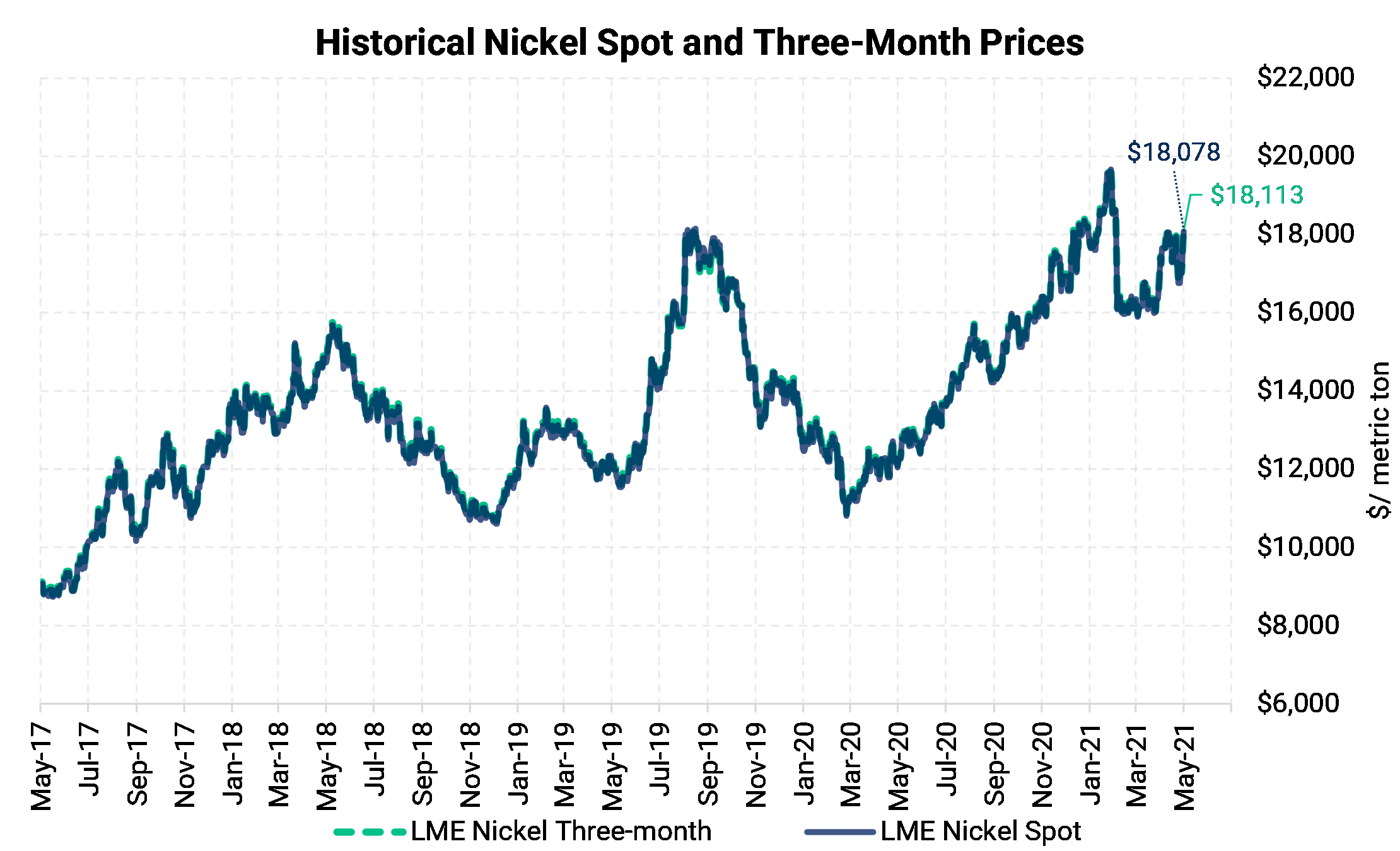

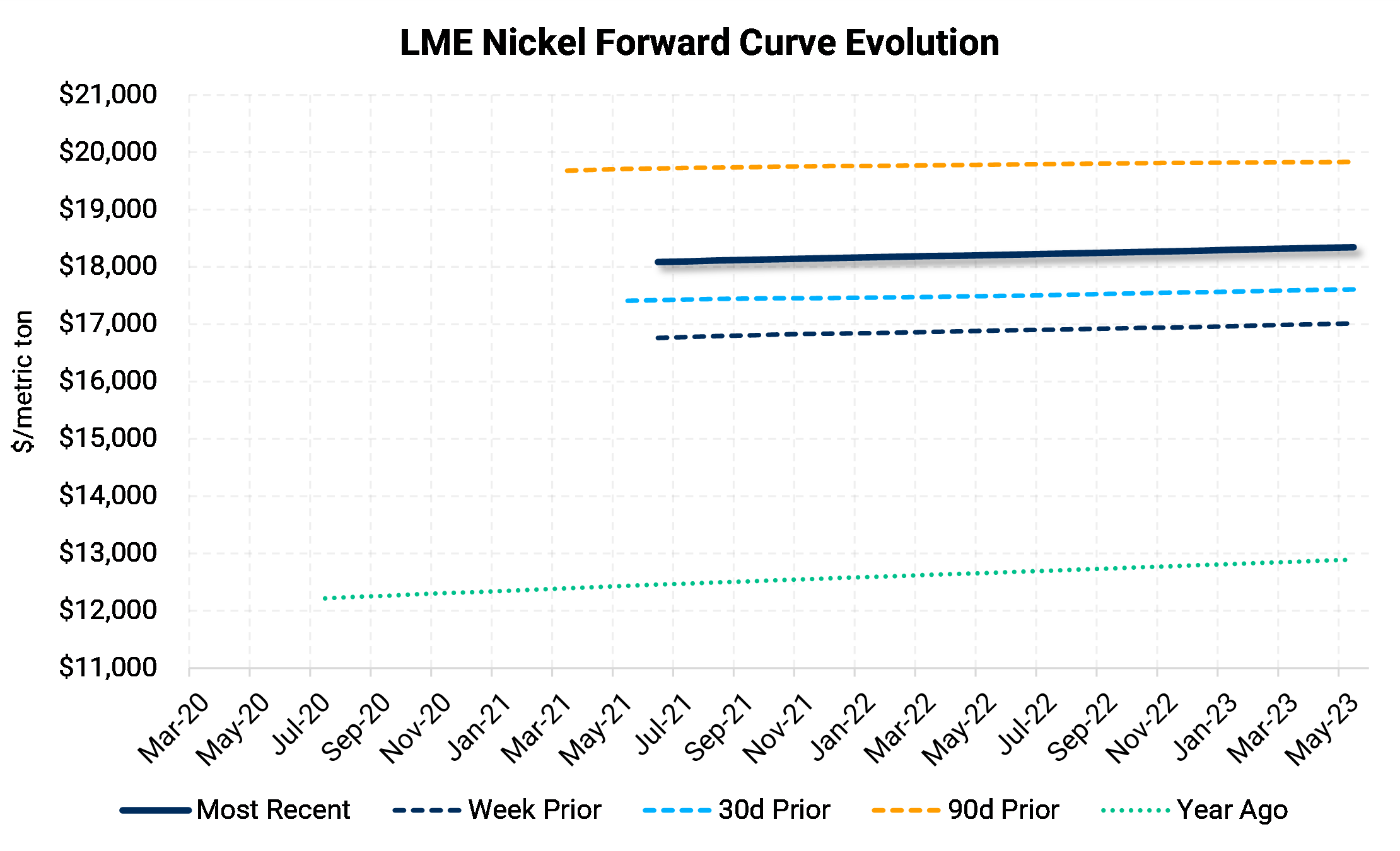

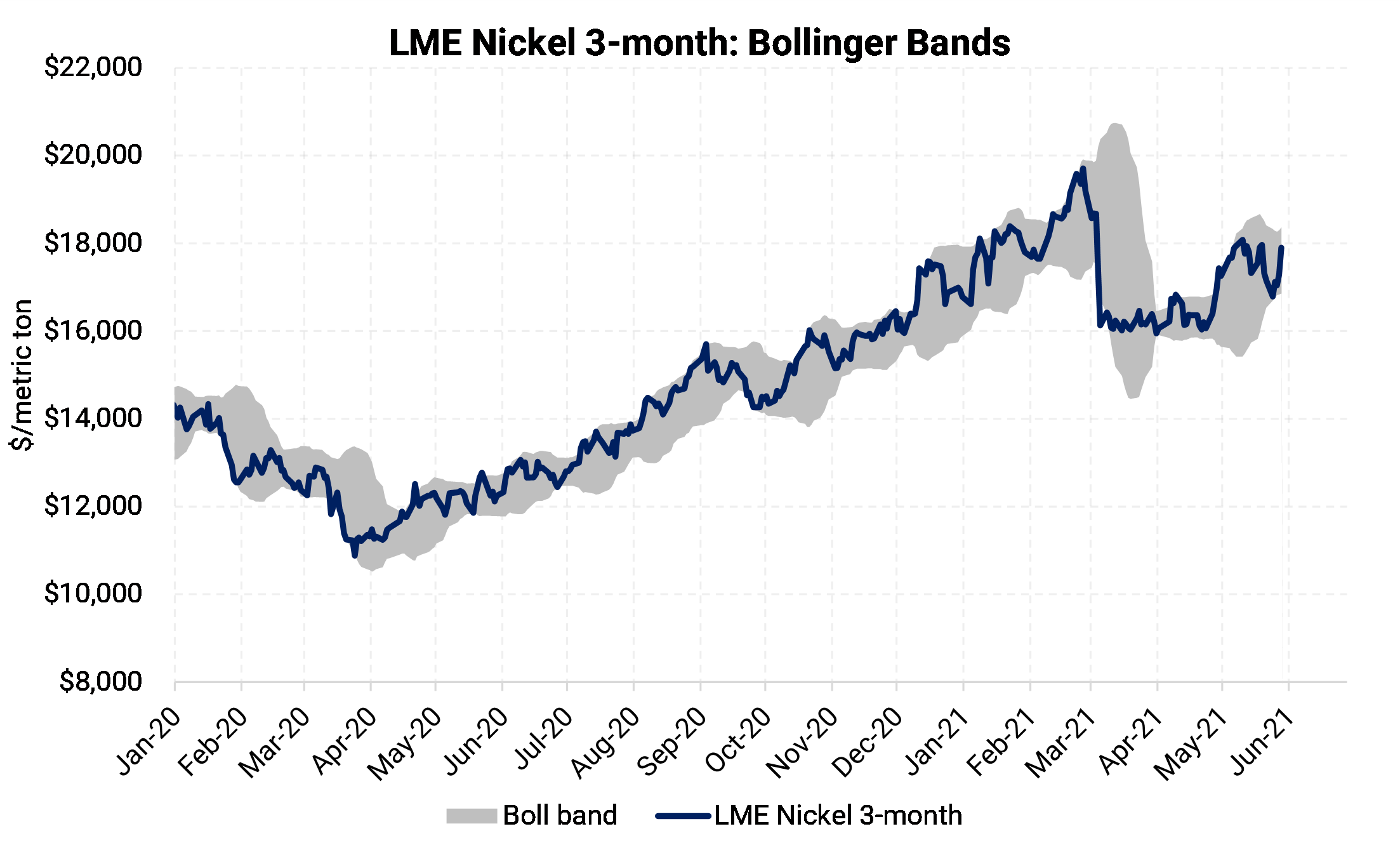

Nickel prices reversed this week, returning to positive territory after last week’s sell-off. LME official cash prices climbed by 7.9% to $18,078. As reported last week, data from the International Nickel Study Group showed the nickel market deficit increasing to 16,100 metric tons. Macquarie Bank, in a note released today, commented that sturdy demand for refined metal and stainless steel should not be discounted. |

|

|

|

|

|

|

|

|

|

|

|

CME Hot Rolled Coil (HRC) |

|

|

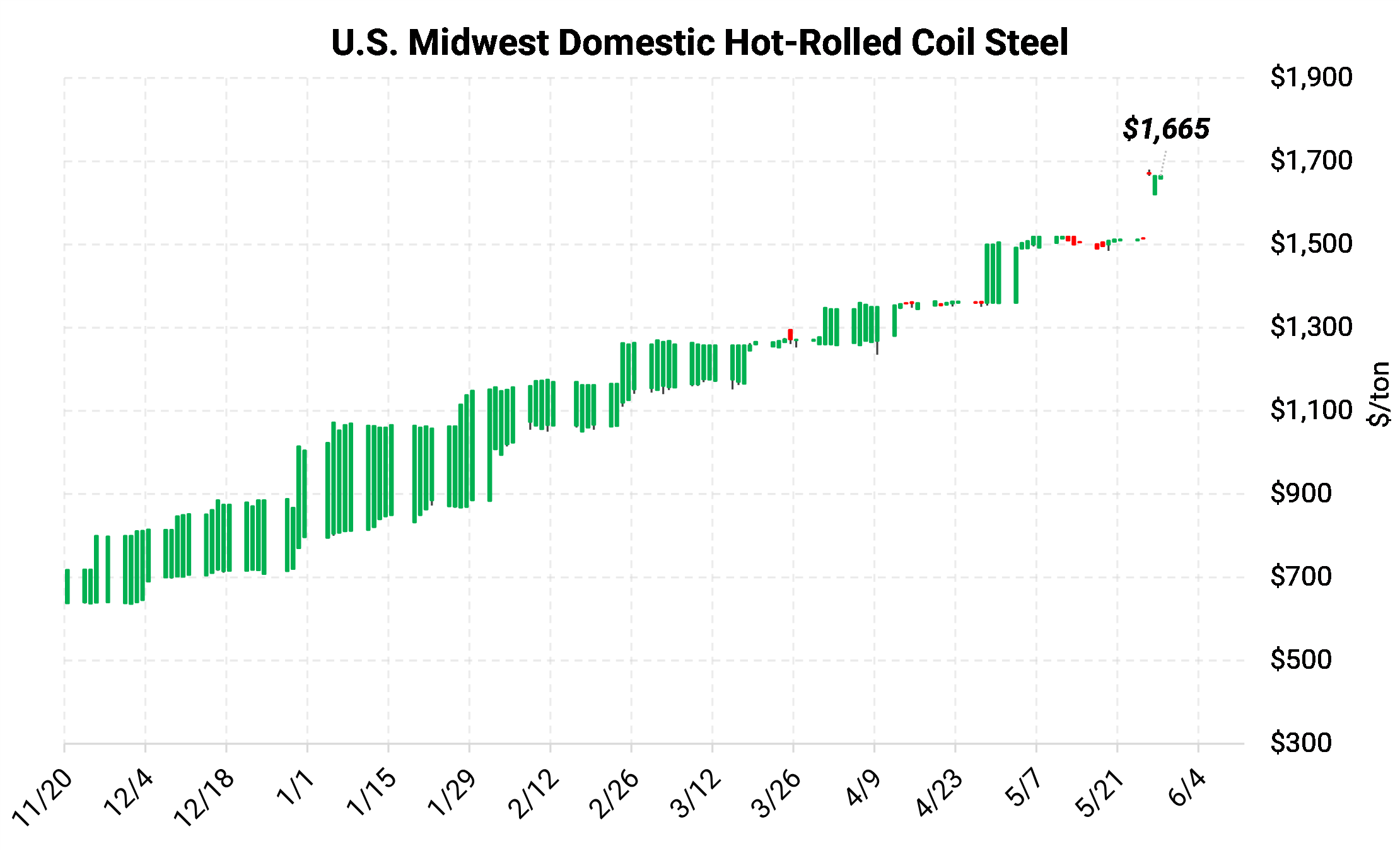

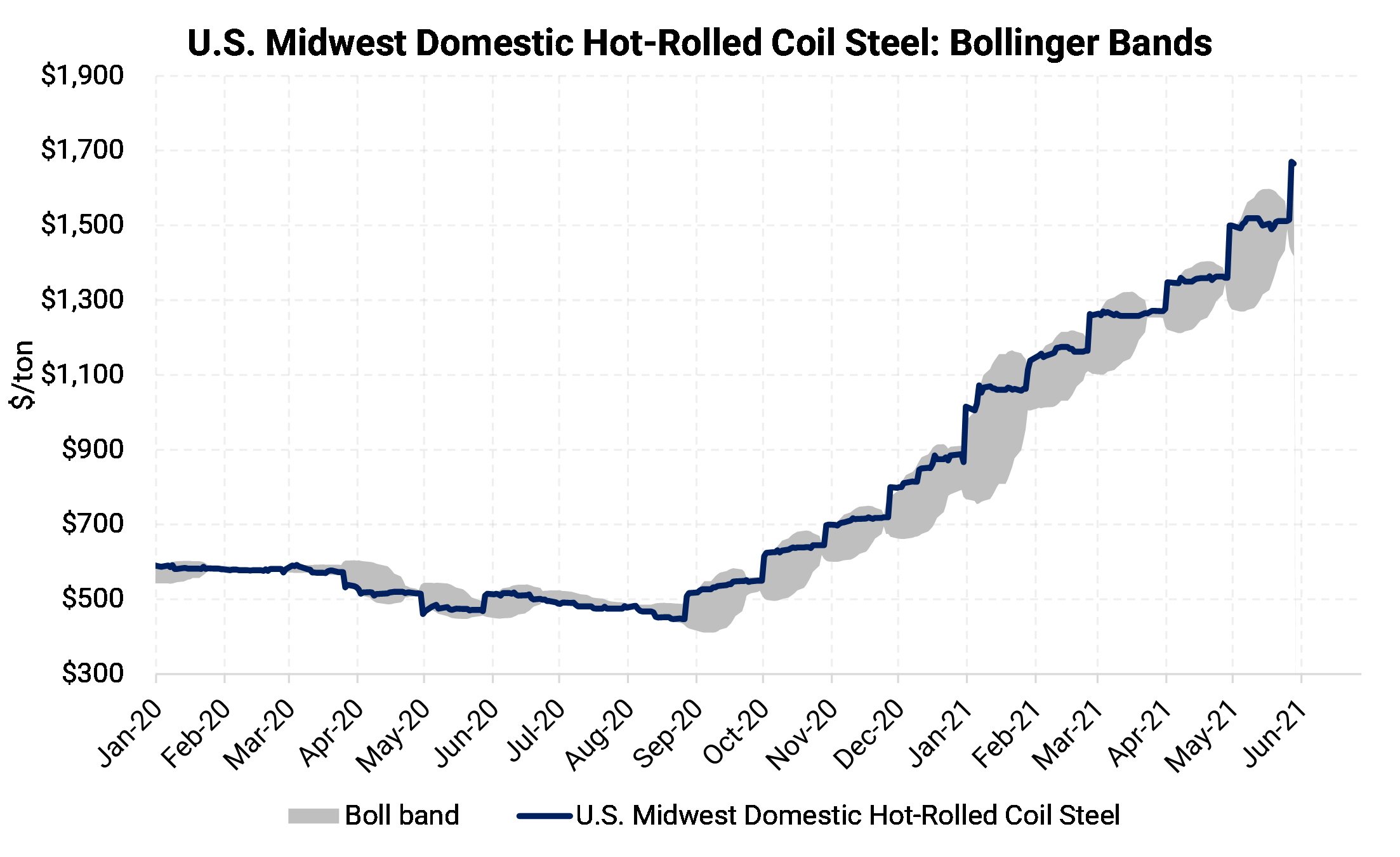

US domestic HRC prices broke through $1,600/short ton this week according to at least one leading price reporting agency, as the record steel rally thunders on. The CME HRC futures contract for May ’21 is currently offered at $1,544/ton, up by $32 from last week’s report. The nearby forward curve continues to show strength with the Jun’21 CME contract last priced at $1,665. The contract for Dec ’21 is currently offered at $1,325/ton, up $100 from a week ago, continuing to signal that market participants are expecting a fall in prices in 2H21. Like the aluminum MWP backwardation, there also could be wary eyes watching for potential changes to Section 232 tariffs. Opportunities remain open for HRC consumers to hedge future prices below the current spot price. The opportunity to hedge inventory or HRC sales continues to improve, and we continue to believe that buying put options remains the best structure to achieve protection against a major market correction. From a consumer perspective, buying calls can be used to protect against a continued rally, with strike prices that are favorable considering the spot market prices. Utilizing options will also allow for participation in a downward price correction. |

|

|

|

|

|

|

|

|

|

Notable News |

|

|

Rusal Carbon Split Heralds Bigger Aluminum Market Rupture UK Considering All Options for Liberty Steel, Nationalisation Unlikely No Commodities Super-Cycle but Copper Demand from Economy Bright Commodity Prices Have Soared, but Miners Aren’t Investing Lumber Prices Are Through the Roof, Punishing Apartment Builders China, India Lead Gains in 2021 Steel Production US New Home Sales Drop in April; March Sales Revised Sharply Lower Alcoa to trial new alumina process that uses renewables instead of fossil fuels GOP to Offer Biden Near $1 Trillion of Infrastructure Spending Thursday Jobs Picture Shows More Improvement as Unemployment Claims Slide Trump Era Aluminum Tariffs Have Revived US Industry – Think Tank Logjams at Malaysian Warehouses Exacerbate Aluminum Shortages |

|