|

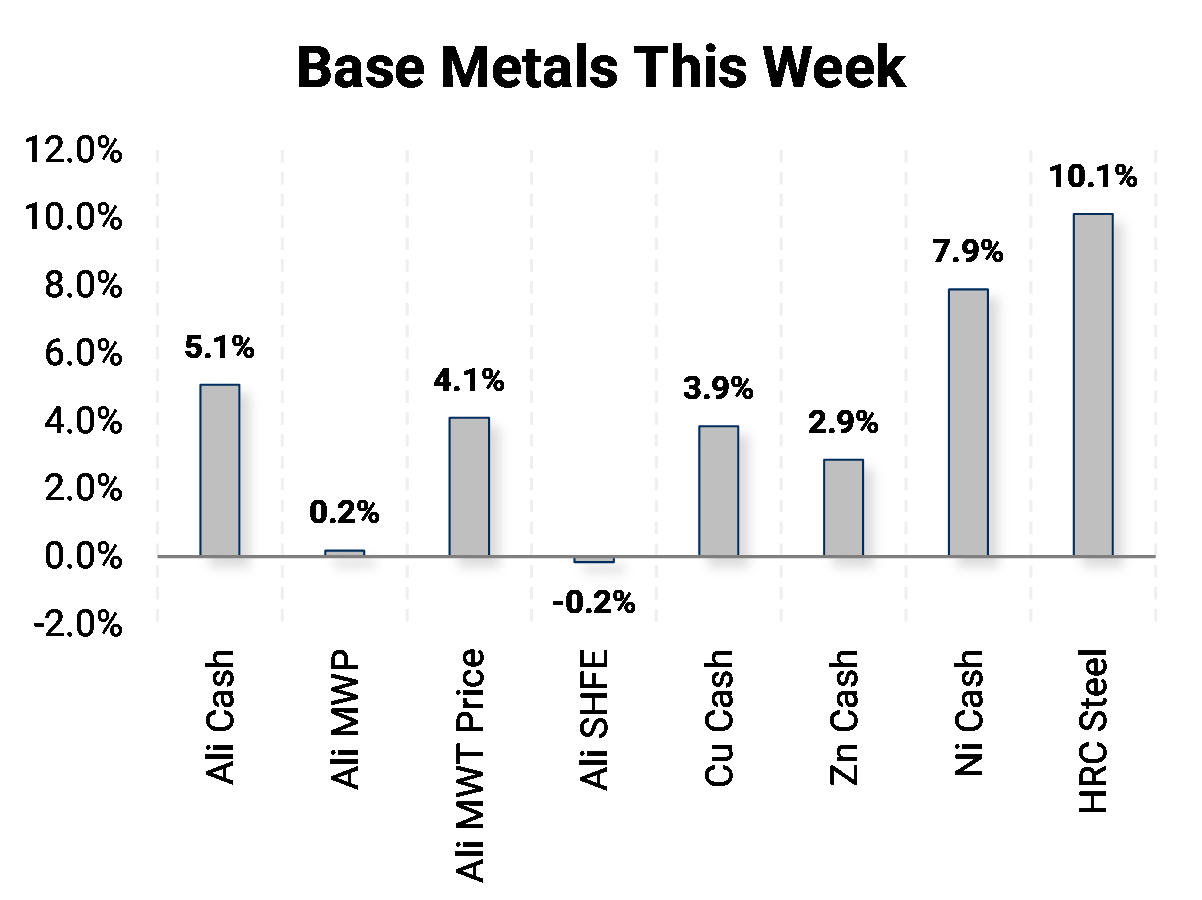

Our weekly summary chart flipped on its axis this week with prices down across the board. Considering the selloff of the past few days, the LME index of base metals is still up by an astounding 80% in the past year. Should this week’s pause be interpreted as a hint of an upcoming correction, or is it just a buying opportunity on the way to a commodities multi-year bull market? |

|

|

Amazingly, the ongoing surge in metals prices has taken place while headlines include the following: · Chip shortage is expected to cost the automotive industry $110 billion in revenue in 2021 · Axis Partners is forecasting 3.9 million vehicles will not be built this year as a result of the chip shortage · China officials take action targeting steel sector including restrictions to control emissions · Air travel demand is not expected to return to pre-Covid levels before 2024 · Halt to 737 MAX deliveries stymies Boeing’s recovery effort

Will consumer demand continue to drive demand for commodities and outweigh lesser need by industries still saddled with covid demand and supply chain interruptions? The markets are ripe for volatility so corporates should take this into account while planning for the remainder of 2021 and into 2022. Should companies be concerned with protecting high inventory values or preventing further runup of future input costs? It is a dicey game for which clear targets are needed and disciplined hedging strategies implemented to ensure the appropriate goals are met.

|

|

|

Bottom Line: In 2Q2021, the market has not provided any meaningful relief for unhedged consumers of metal. In addition, many manufacturing companies are struggling to find employees and obtain the raw materials needed to keep up with order books. It has been a painful learning curve for those who may have held off on hedging, waiting for a return to lower prices. With the brief dip this week and despite prices at their highest level since 2011, consider layering in more hedges to narrow the range of possible outcomes and ensure that damage to margins is contained. You may also consider a trailing stop-loss strategy to add discipline to your hedging approach. It is also important to make sure you understand when margin compression will impact overall company performance. As the seemingly never-ending rally thunders on, buying call options or zero cost collars may be an attractive way to provide protection while allowing participation in lower prices if the rally finally eases. Base metals overall continue to find support from increased consumer demand, physical market imbalances, low short-term interest rates, high freight, and logistics costs, continued global stimulus, and a relatively weak U.S. dollar.

|

|

|

|

|

|

|

LME Aluminum |

|

|

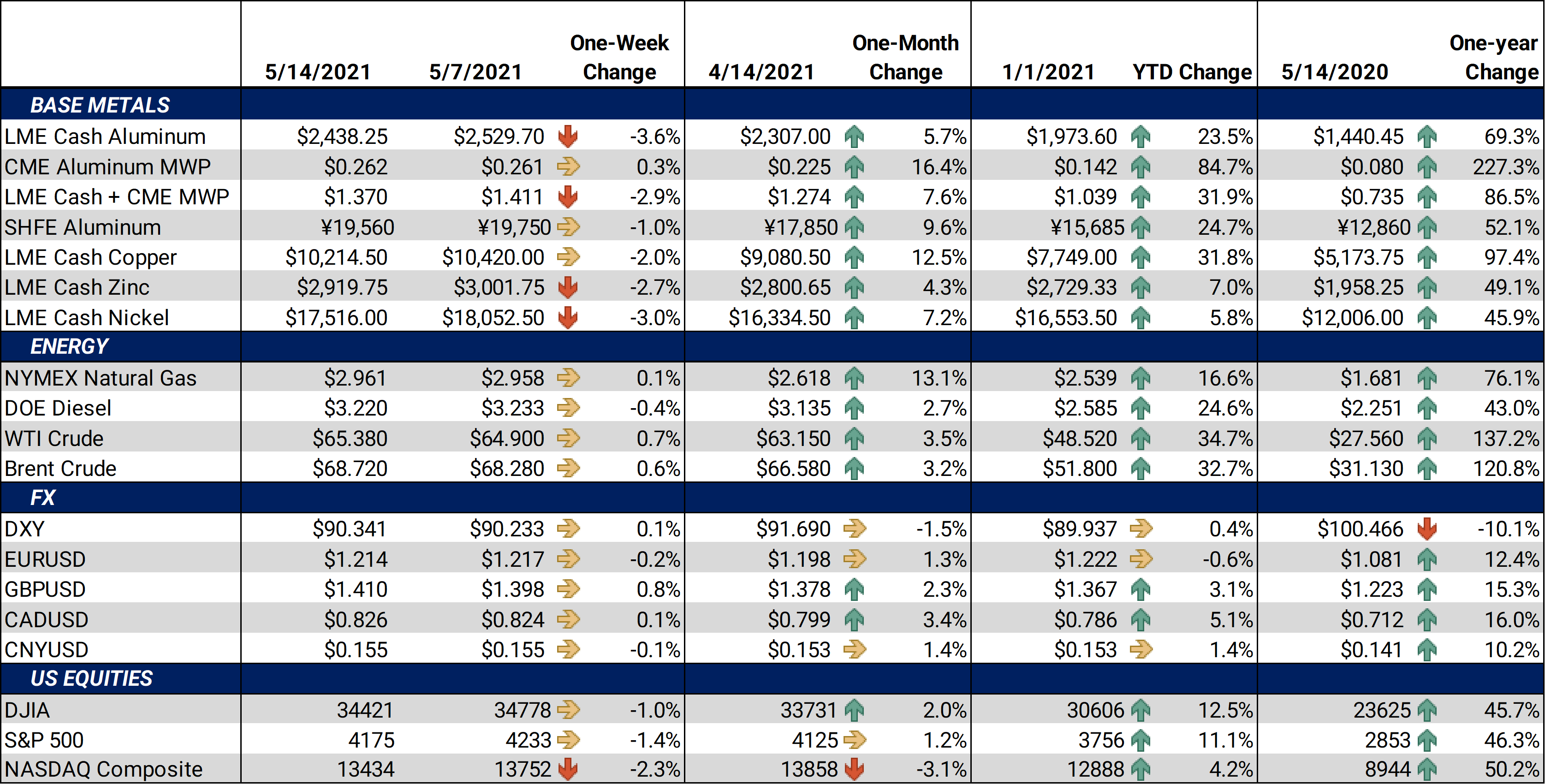

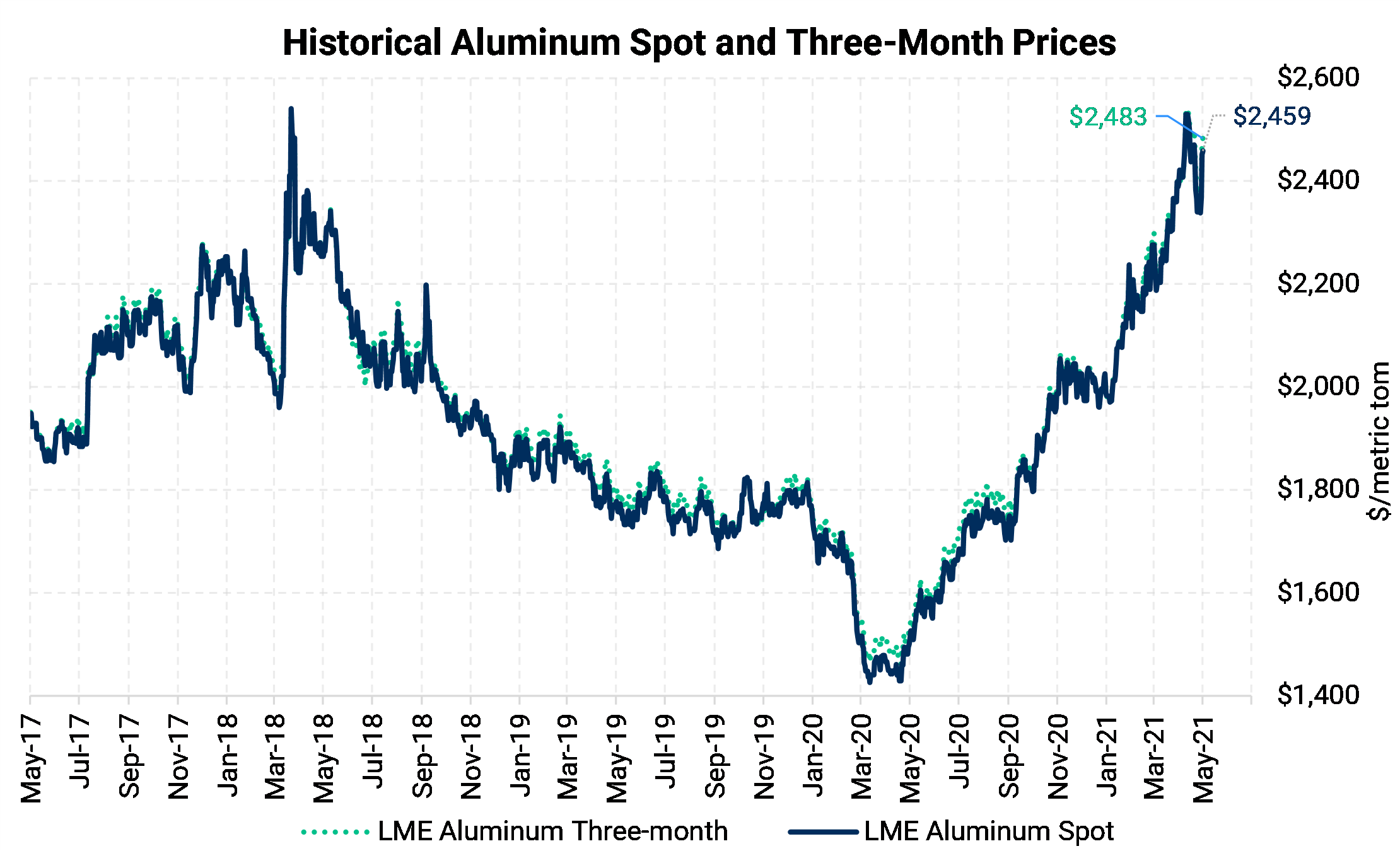

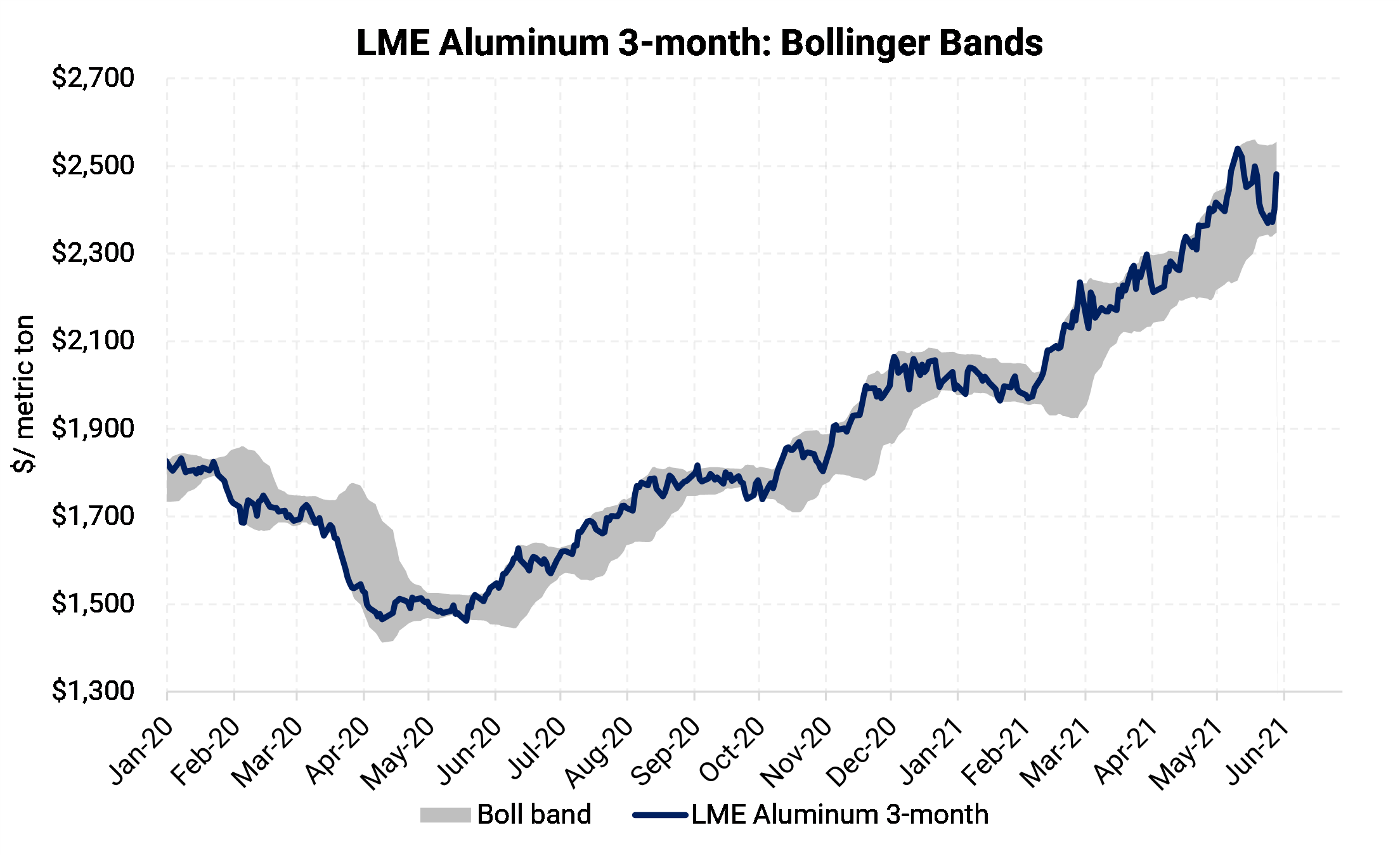

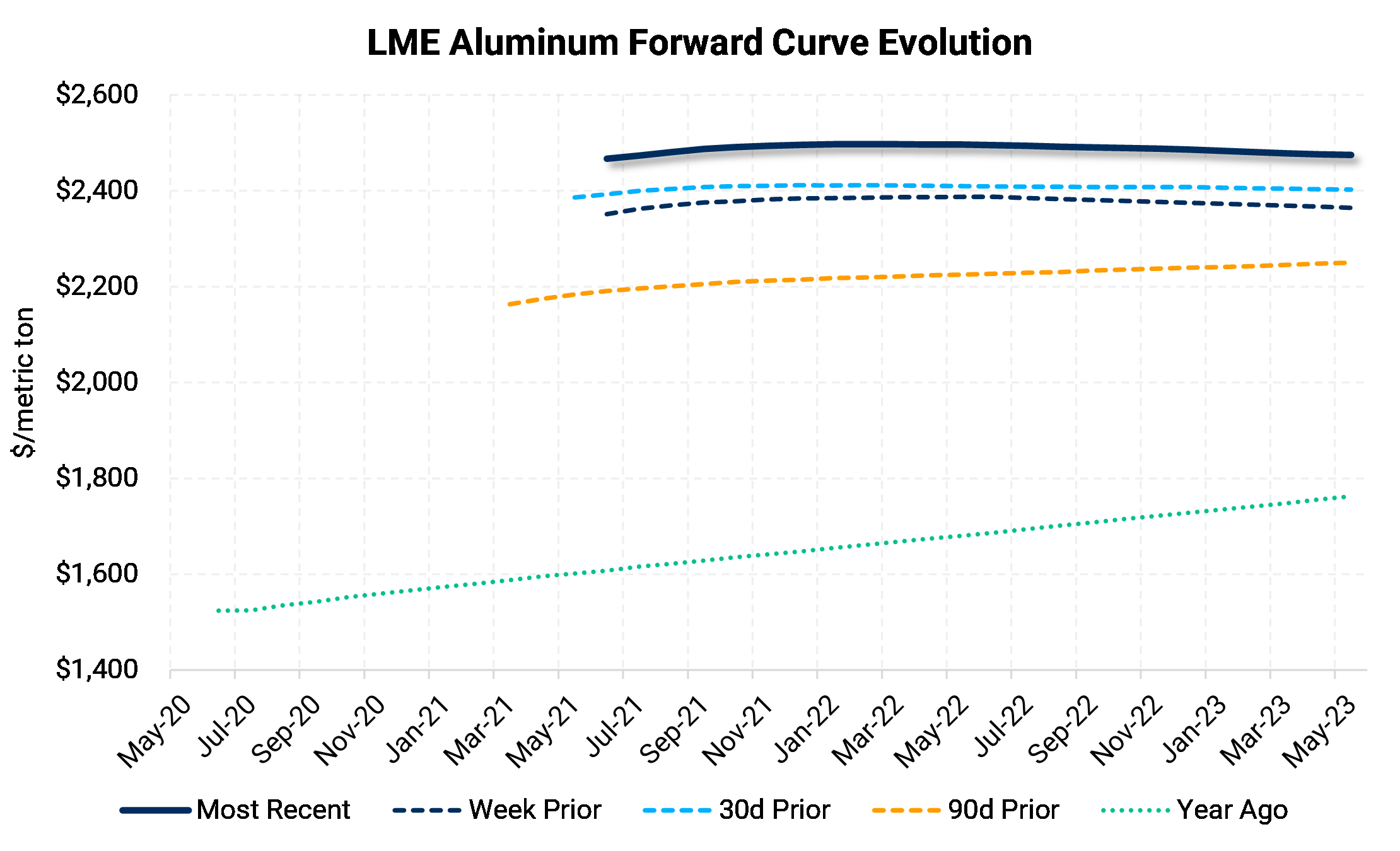

After $122/mt and $105/mt increases the past two weeks, LME Aluminum cash price retreated by 3.6% to close the week at $2,438.25. With the drop in prices, Cash-3mo steepened significantly from a $10 contango to $25 contango. The strong contango comes just two weeks after a $10.50 backwardation. Contango in the forward curve incentivizes cash and carry inventory financing strategies while backwardations can force deliveries of short positions. Further out the curve, Dec’21/Dec’22 backwardation eased from $29 last week to $20 this week. The backwardation indicates there are more sellers than buyers for the long-dated contracts. Despite the downward sloping forward curve, producers can continue selling forward at levels well above anticipated input costs. The current forward curve may also provide an opportunity for consumers to roll forward long positions in certain situations.

|

|

Midwest Premium |

|

|

CME MWP for May stands at 26.3¢/lb, an increase of only 0.2¢/lb. At the risk of sounding like a broken record, the cash market printed once again at an all-time high. The backwardation in the forward curve makes inventory hedging expensive and the availability of options trading is almost non-existent. For inventory with a three-month turnover, a processor could sell forward the premium at 22.3¢/lb. On just one million pounds, the processor would be ensuring a $40,000 metal lag loss. At the same time, consumers and processors should take notice that 1Q2022 is offered at 20¢/lb and has even traded below that level recently. We would be happy to discuss alternative strategies for pricing to your customers or for hedging your premium exposures.

|

|

|

|

|

|

|

|

|

|

|

|

LME Copper |

|

|

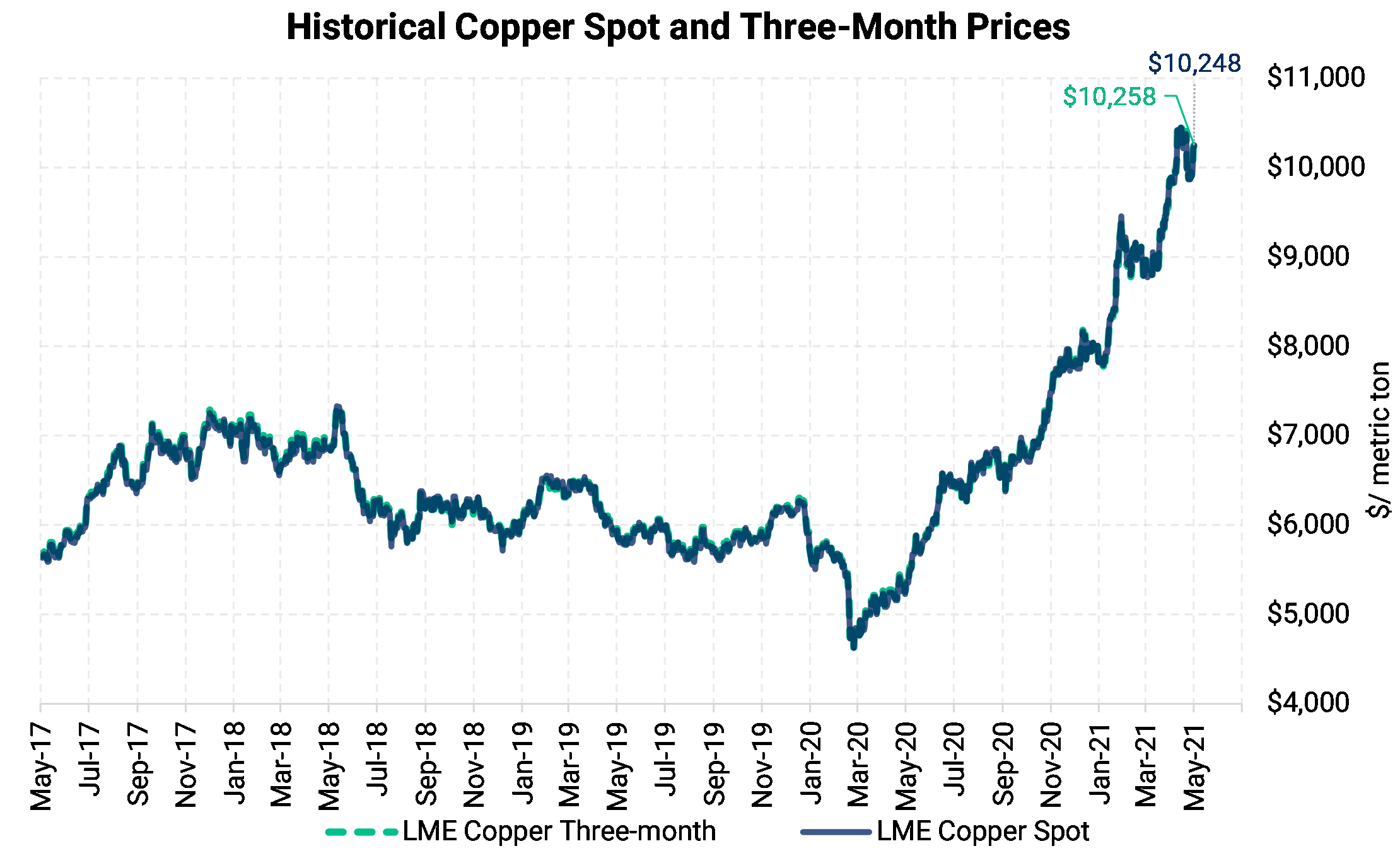

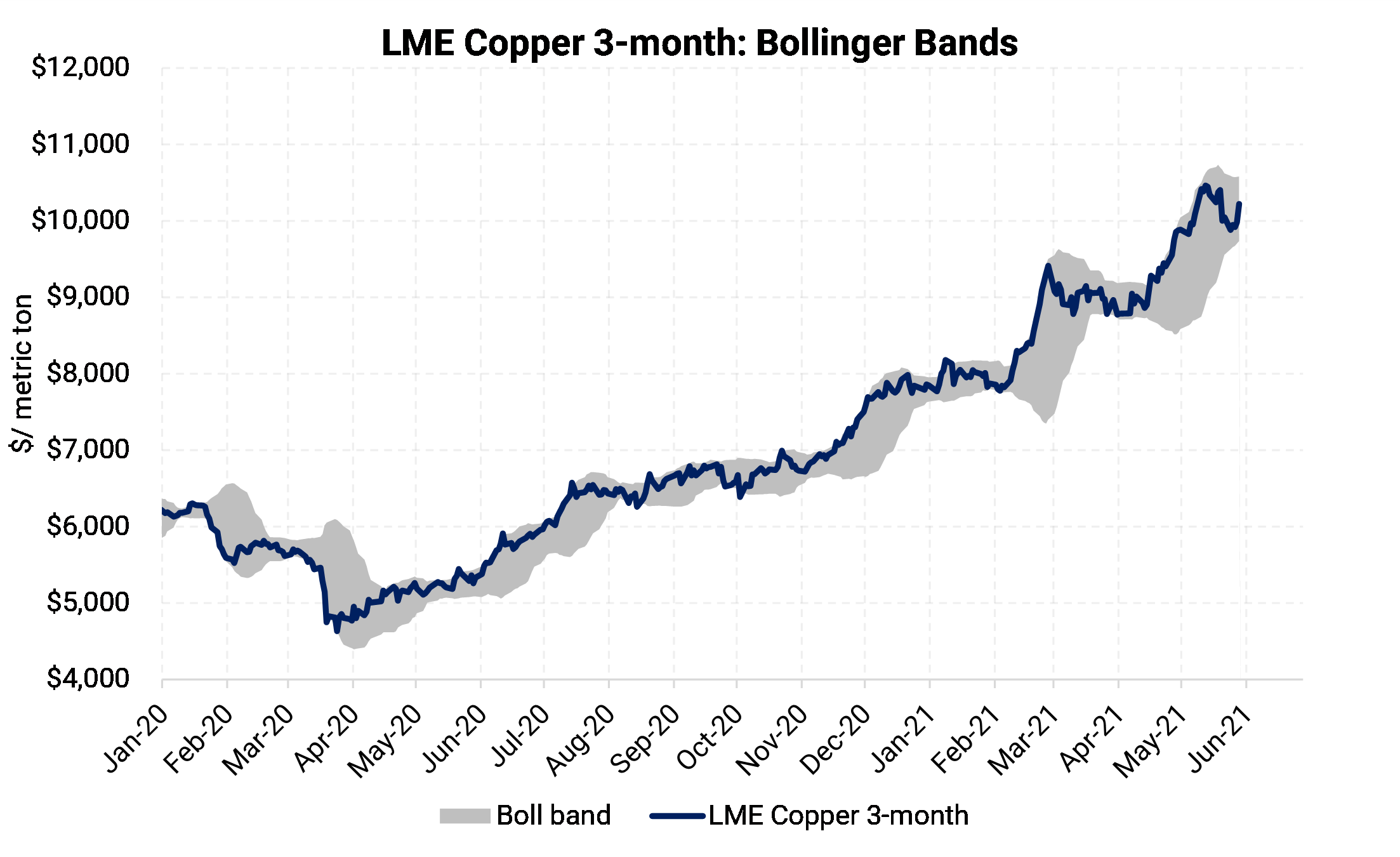

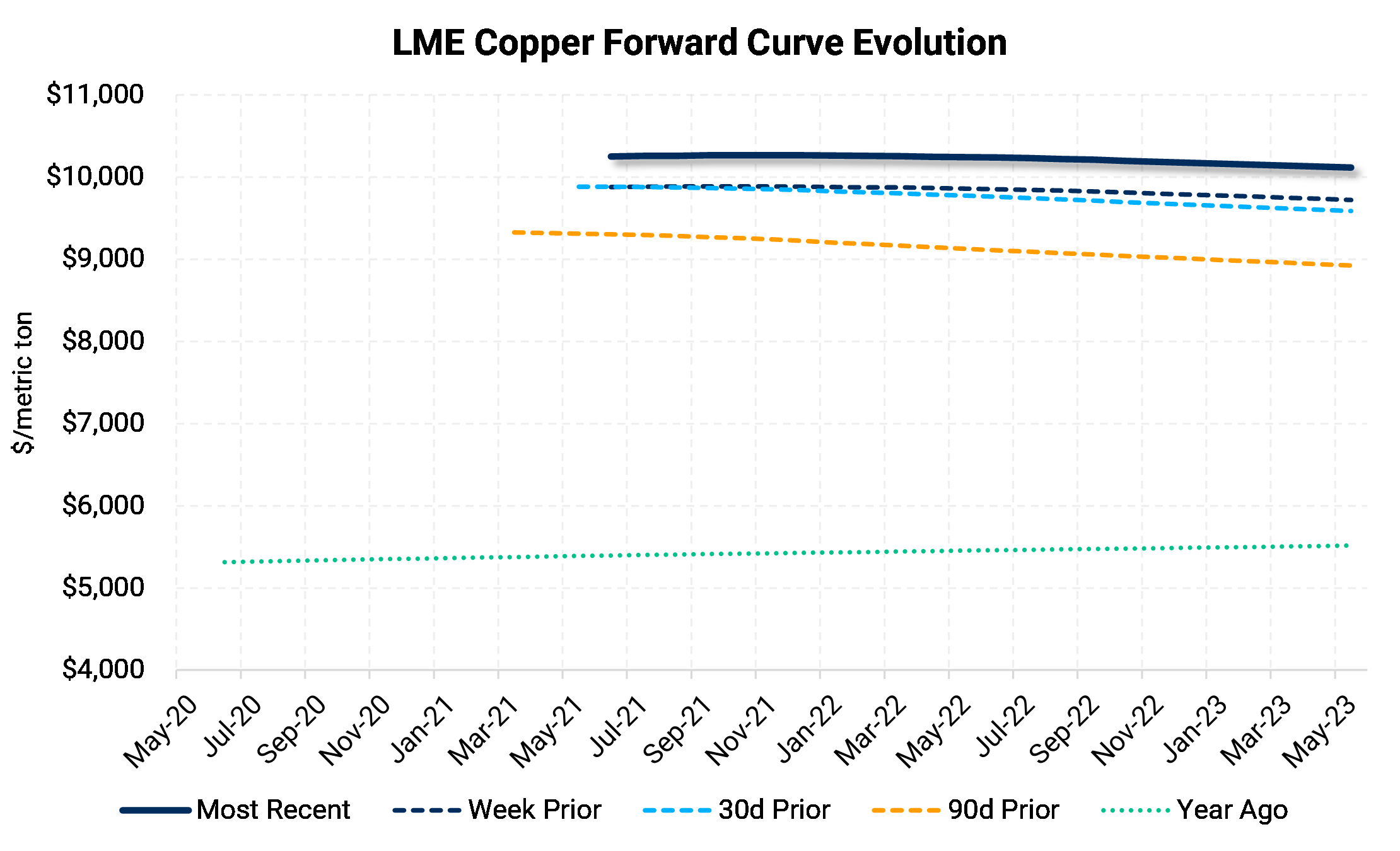

LME 3 month copper price remains above $10,000/mt level but came under pressure this week, ending the week at $10,241/MT. Official LME Cash prices ended the week down 2% this week. Copper prices recorded a new all-time record high before pulling back and ending the week in negative territory. The Chile Copper royalty bill advanced to the nation’s Senate this week, increasing the chances of a copper tax becoming law. The bill is seen by the market as bearish copper supply because if passed would likely make new mining investment in Chile economically difficult. As many market participants remain bullish and fundamentals have not significantly changed, price pullbacks should be used as an opportunity to layer additional hedges either through swaps, options, or collars. |

|

|

|

|

|

|

|

|

LME Nickel |

|

|

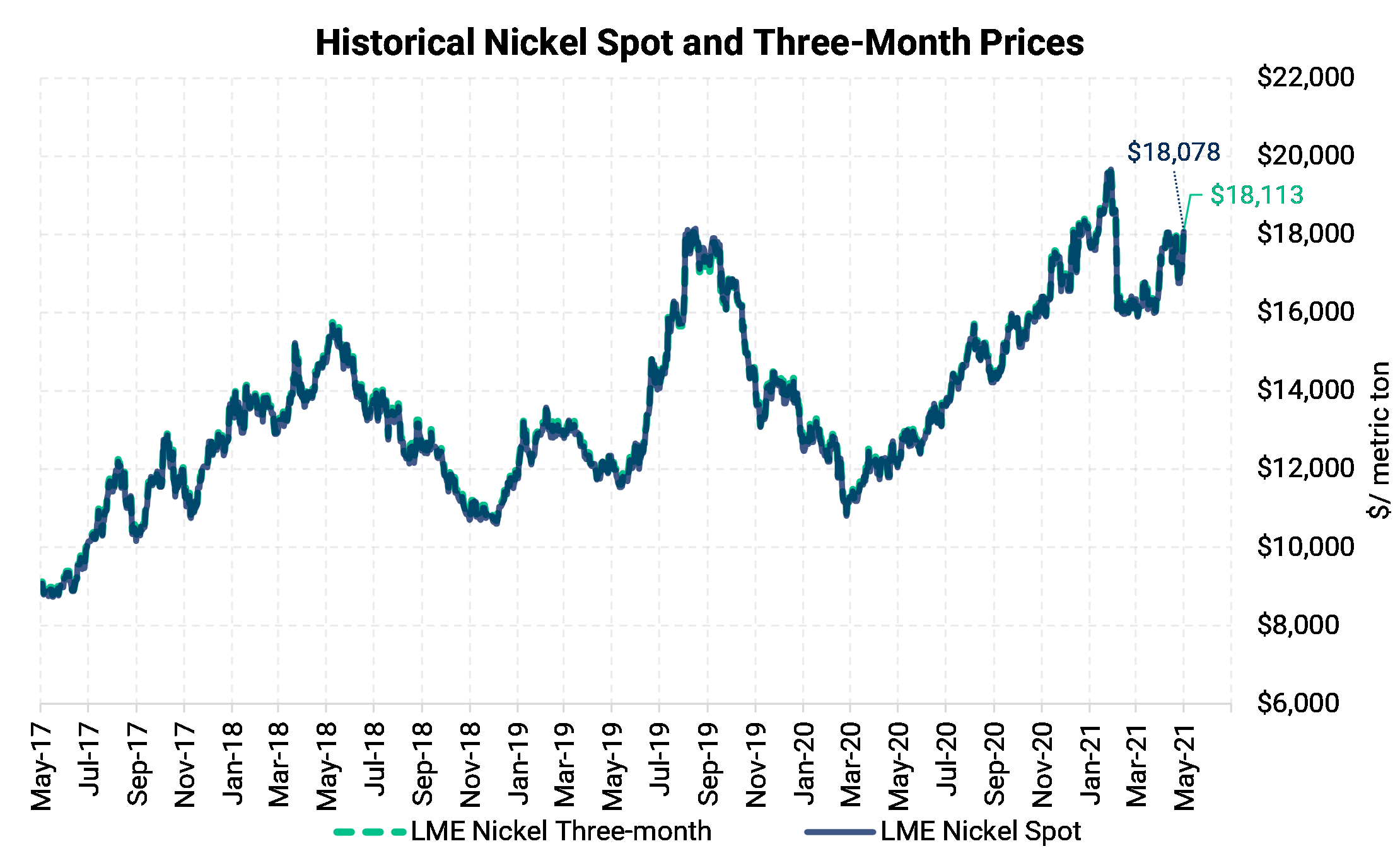

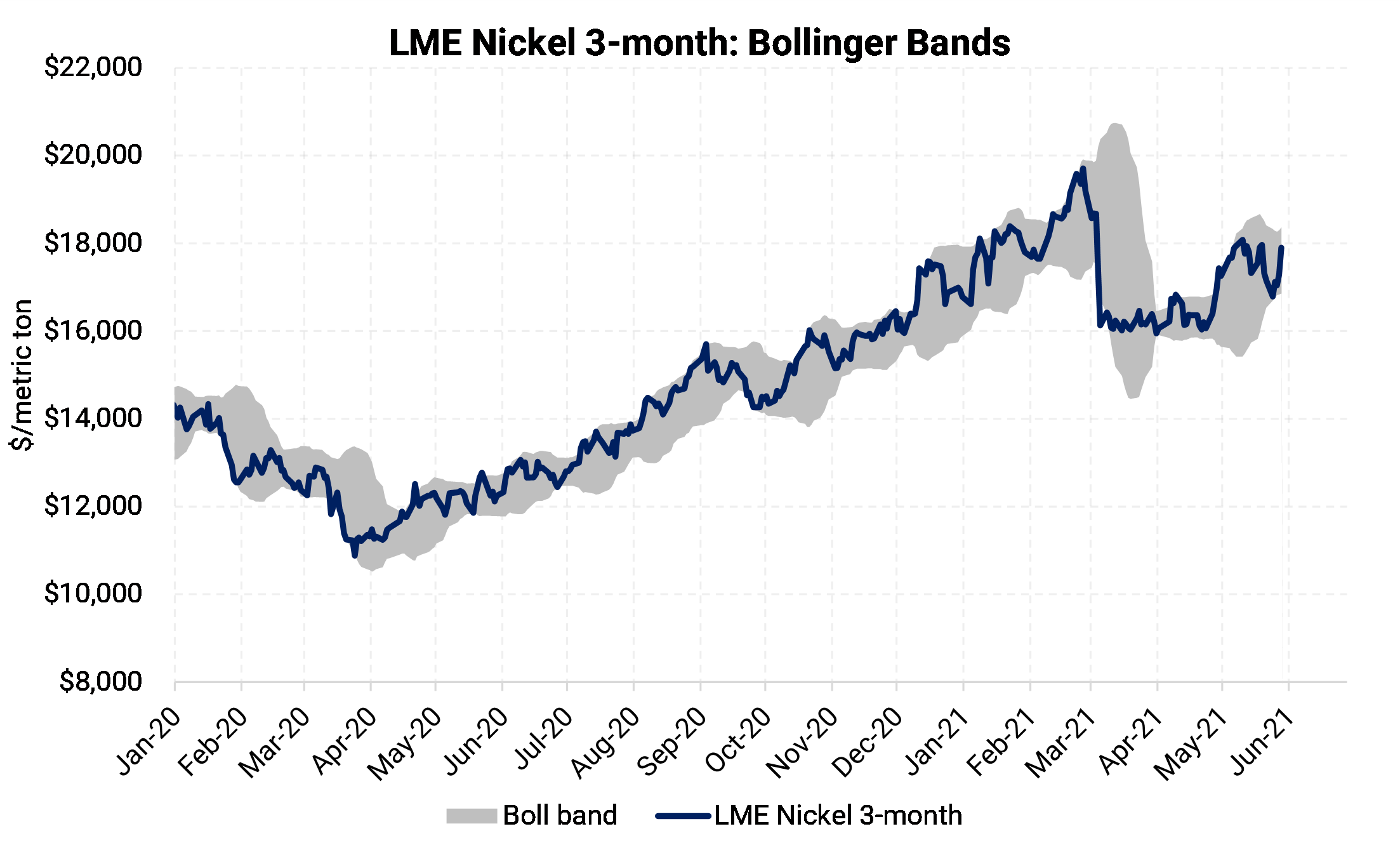

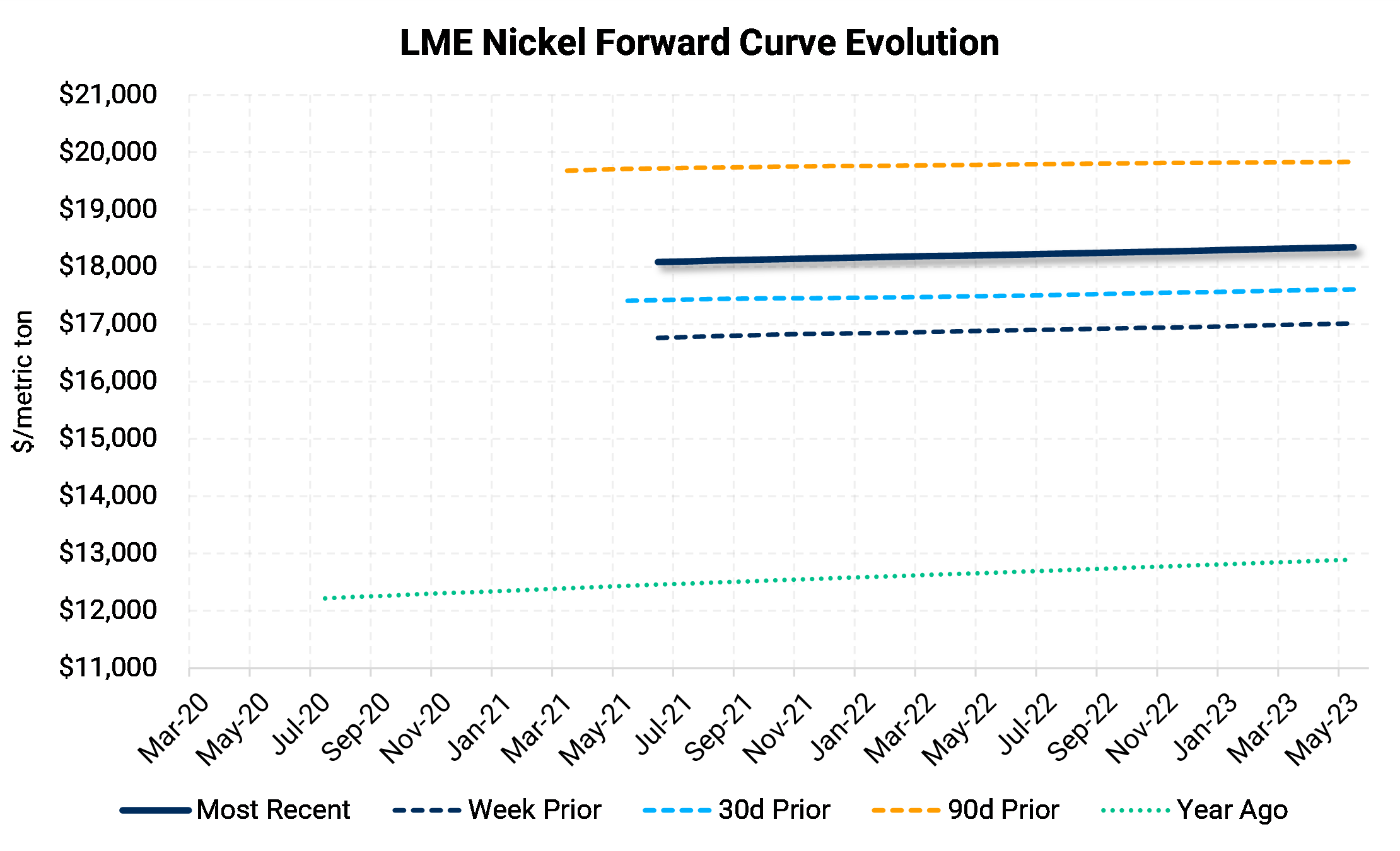

Nickel prices returned to negative territory this week after only a few weeks of recovering from the late February sell-off, cash prices dropped 3% to $17,516.00. Nornickel announced that the Oktyabrsky mine is again at full capacity and the Taimyrsky mine is on schedule to return after flooding earlier this year caused both mines to temporarily curtail operations. |

|

|

|

|

|

|

|

|

|

|

|

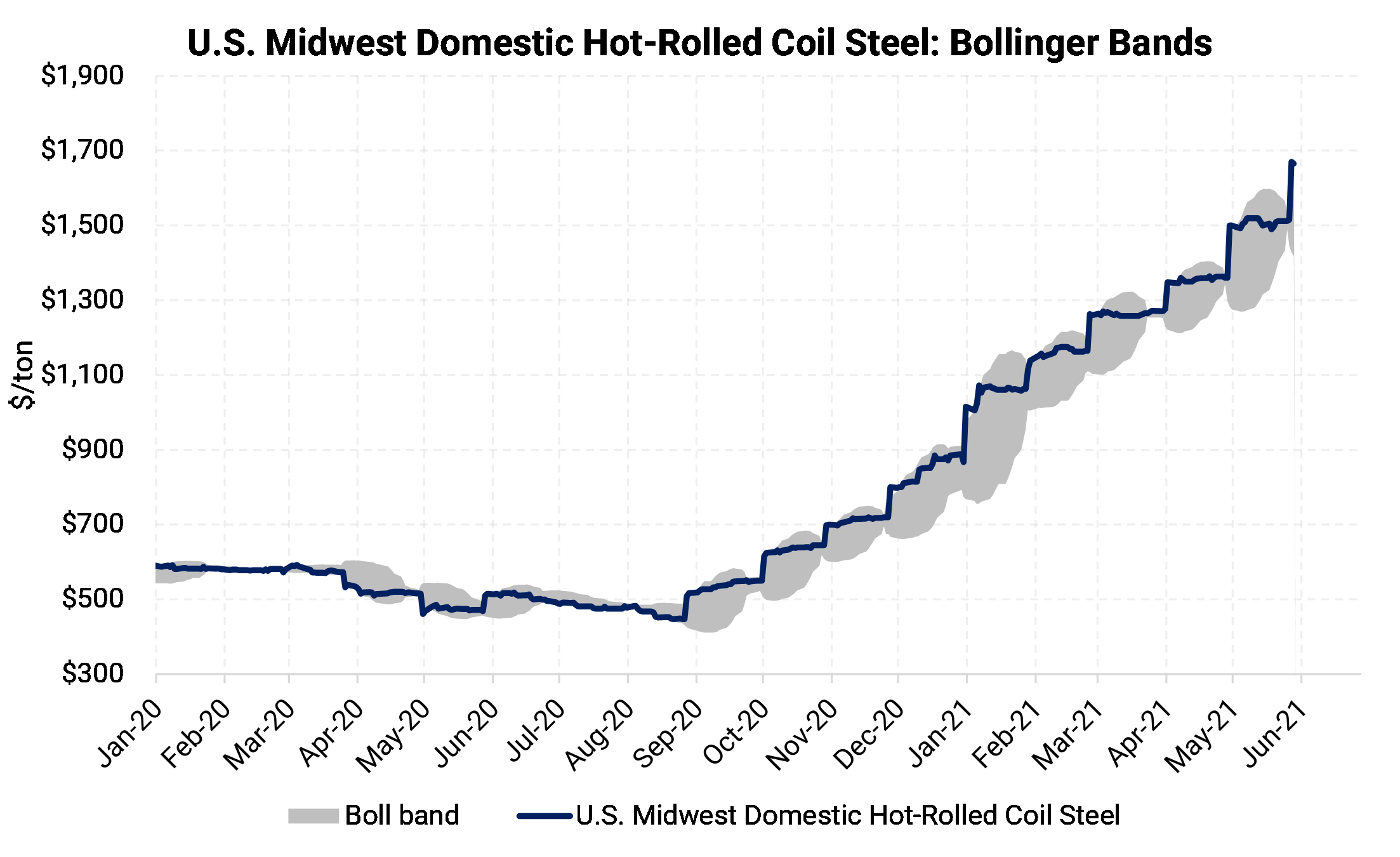

CME Hot Rolled Coil (HRC) |

|

|

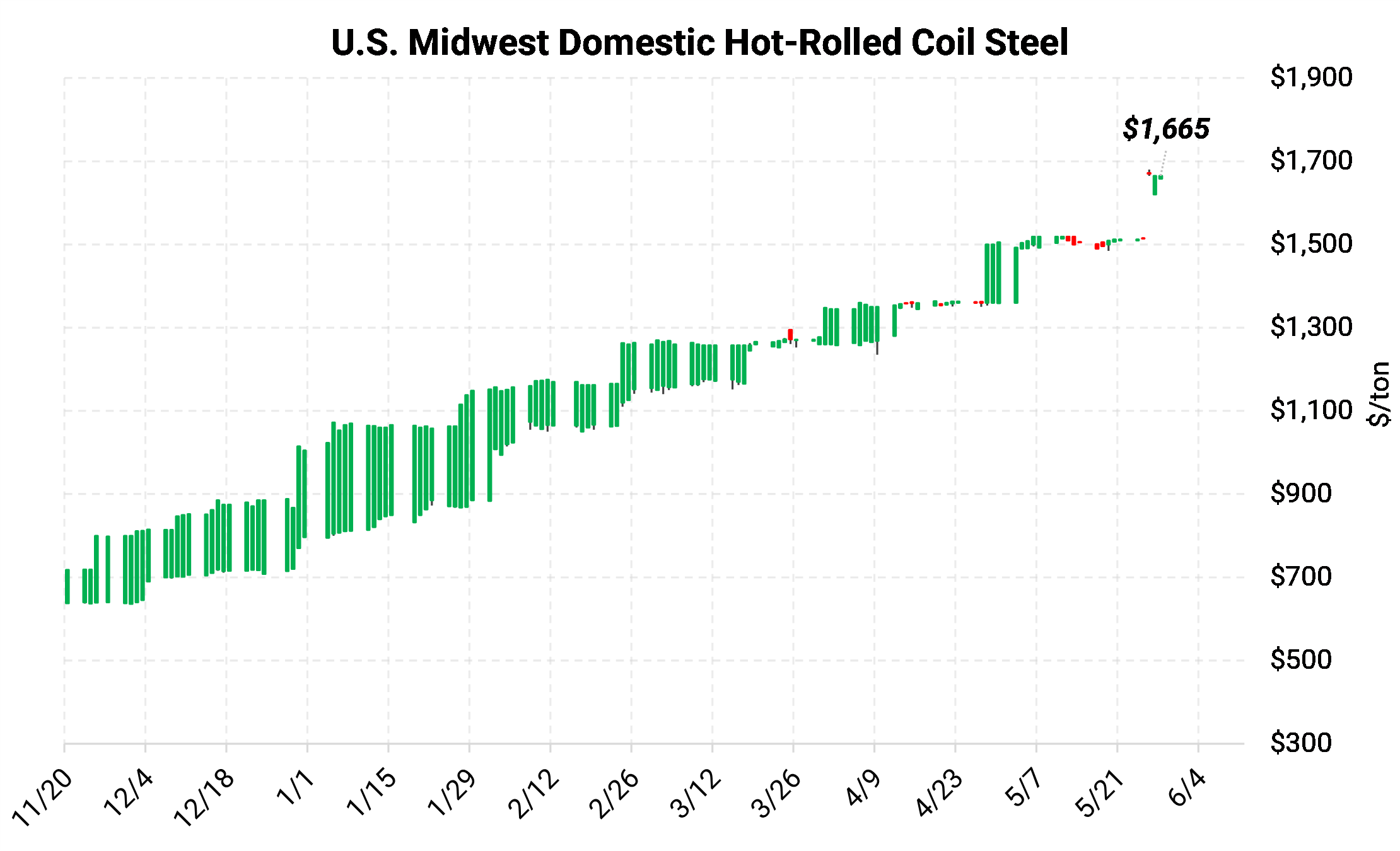

US domestic HRC prices broke through $1,500/short ton this week as the record steel rally thunders on. The CME HRC futures contract for May ’21 is currently offered at $1,510/ton, down $25 from last week’s report. The shorter-dated forward curve continues to show strength, with the Jun-Aug ’21 strip remaining upward sloping (contango). The contract for Dec ’21 is currently offered at $1,295/ton, down $115/ton from this time last week, signaling that market participants are currently back to expecting a fall in prices in 2H21. Opportunities remain open for HRC consumers to hedge future prices below the current spot price. The opportunity to hedge inventory or HRC sales continues to improve, and we continue to believe that buying put options remains the best structure to achieve protection against a major market correction. From a consumer perspective, buying calls can be used to protect against a continued rally, with strike prices that are favorable considering the spot market prices, and also allowing for participation in a price correction downward. |

|

|

|

|

|

|

|

|

|

Notable News |

|

|

ISRI 2021: A Tale of Two Hemispheres Low Carbon World Needs $1.7 Trillion in Mining Investment Signs of Investor Vertigo as Copper Hits Record Highs Century Aluminum Reports Q1 Net Loss Despite 14% Sales Jump Beyond Colonial Pipeline, Ransomware Cyberattacks Are a Growing Threat U.S. Tariffs Drive Drop in Chinese Imports China Exchange Considers Accepting Lower-Grade Iron Ore Amid Price Rally Counting on a Rebound (Ferrous Scrap Recycling) Minnesota Copper Project in Limbo as Officials Launch Permits Review An Acid Squeeze is the Latest Obstacle Facing Giant Copper Mines Ark’s Cathie Wood Predicts ‘Serious Correction’ in Commodities Inflation Speeds Up In April As Consumer Prices Leap 4.2%, Fastest Since 2008 Consumer Prices Jumped as Economic Recovery Picked Up Commodities Boost Economic Recoveries, Mirroring Aftermath of Financial Crisis Cobalt, Congo, and a Mass Artisanal Mining Experiment Chip Shortage Expected to Cost Auto Industry $110 Billion in Revenue in 2021 Mining Stocks Gleam as Copper, the Red Metal, Becomes the ‘Green Metal’ Copper Heads for Weekly Loss, Retreating from Record High $953 Million Fund Ensnared by Alleged Nickel Fraud U.K. Launches Fraud Probe Into Greensill-Linked Steel Firm GFG Metals Rally Falters with China Cracking Down on Steel Sector

|

|