|

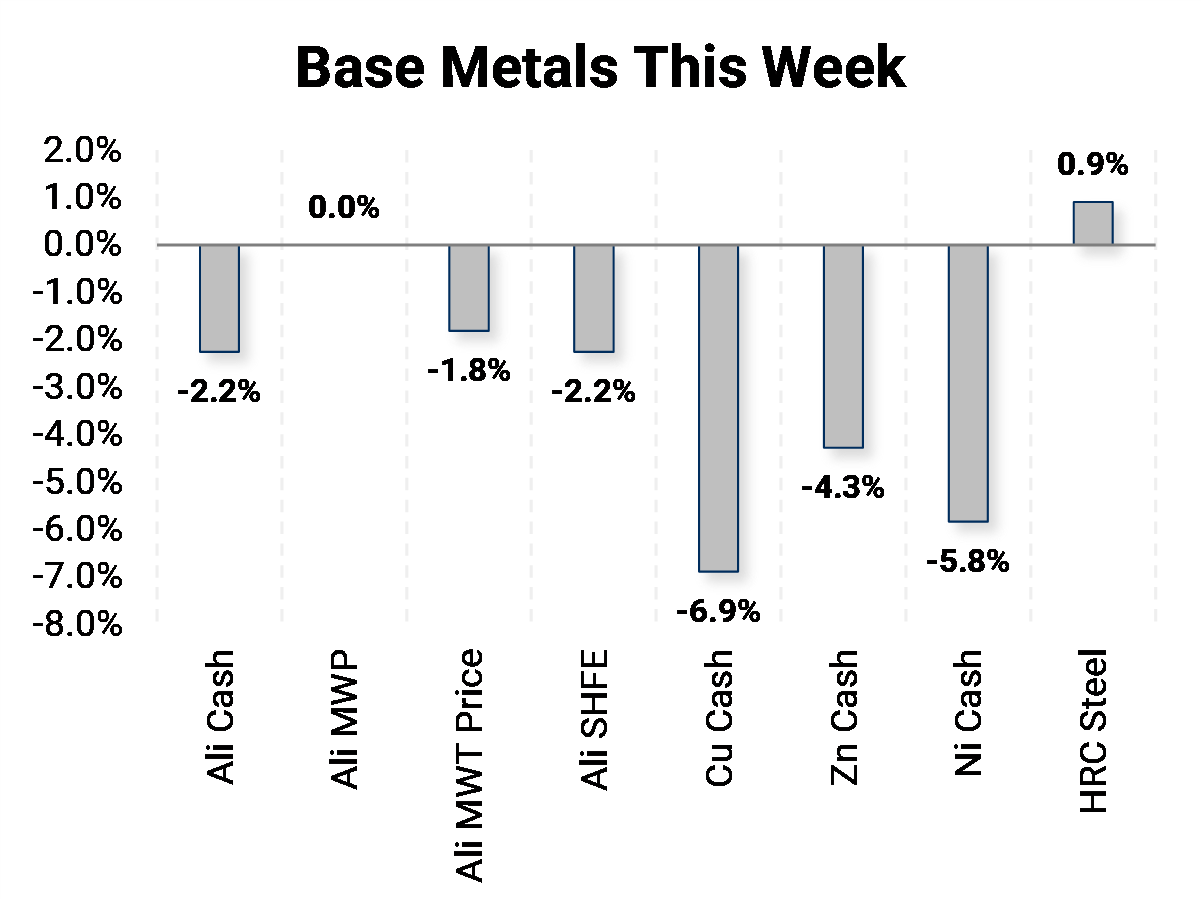

Metals this week took cues from the Fed and China, as both signaled that inflation needs to cool. On early Tuesday morning, rumors swirled of a Chinese crackdown on speculation and subsequent opening of their state copper, aluminum and zinc reserves. No numbers were given on how much will be sold or when; trade had only a handful of recent analyst estimates. China's pricing mechanism will be key, as the last time they sold aluminum from state coffers they did so at below market prices. Interestingly, copper took the news the hardest, closing at lows not seen since late April. |

|

|

Not to be outdone, late Wednesday, Federal Reserve chairman Jay Powell signaled that two-quarter point interest rate hikes might implemented by end of 2023, thereby easing away from their heretofore accommodative stance. Commodities normally trade inversely to the dollar, and Wednesday was no exception. The dollar index spiked almost 1%, closing at highs not since late April. COMEX copper had a muted response; however, precious metals took the news on the chin. No major news occurred on Thursday or Friday, but the selloff continued for most industrial metals. |

|

|

Bottom Line: We will only know in hindsight whether or not there were any teeth to comments by the Fed or chatter about China. Cheap money has helped fuel commodity speculation, and any hint of higher interest rates could ease the throttle on such speculation. To use “econspeak,” they are taking away the punch bowl just as the party is getting started. A strong dollar policy could keep a cap on prices and inflation in the short-term, but the Fed has little control of the intricacies of physical commodity markets. Likewise, any “dumping” of metals reserves by China will likely be quickly absorbed by the market. Unhedged consumers of metal have had some painful lessons this year and betting the ranch on a Fed or China induced pullback could prove to be just as painful. As always, these markets will require discipline, and hedging with long calls or zero-cost collars are examples of educated hedging. Having limit orders working along with reasonable stop-losses is also sensible as well.

|

|

|

|

|

|

|

LME Aluminum |

|

|

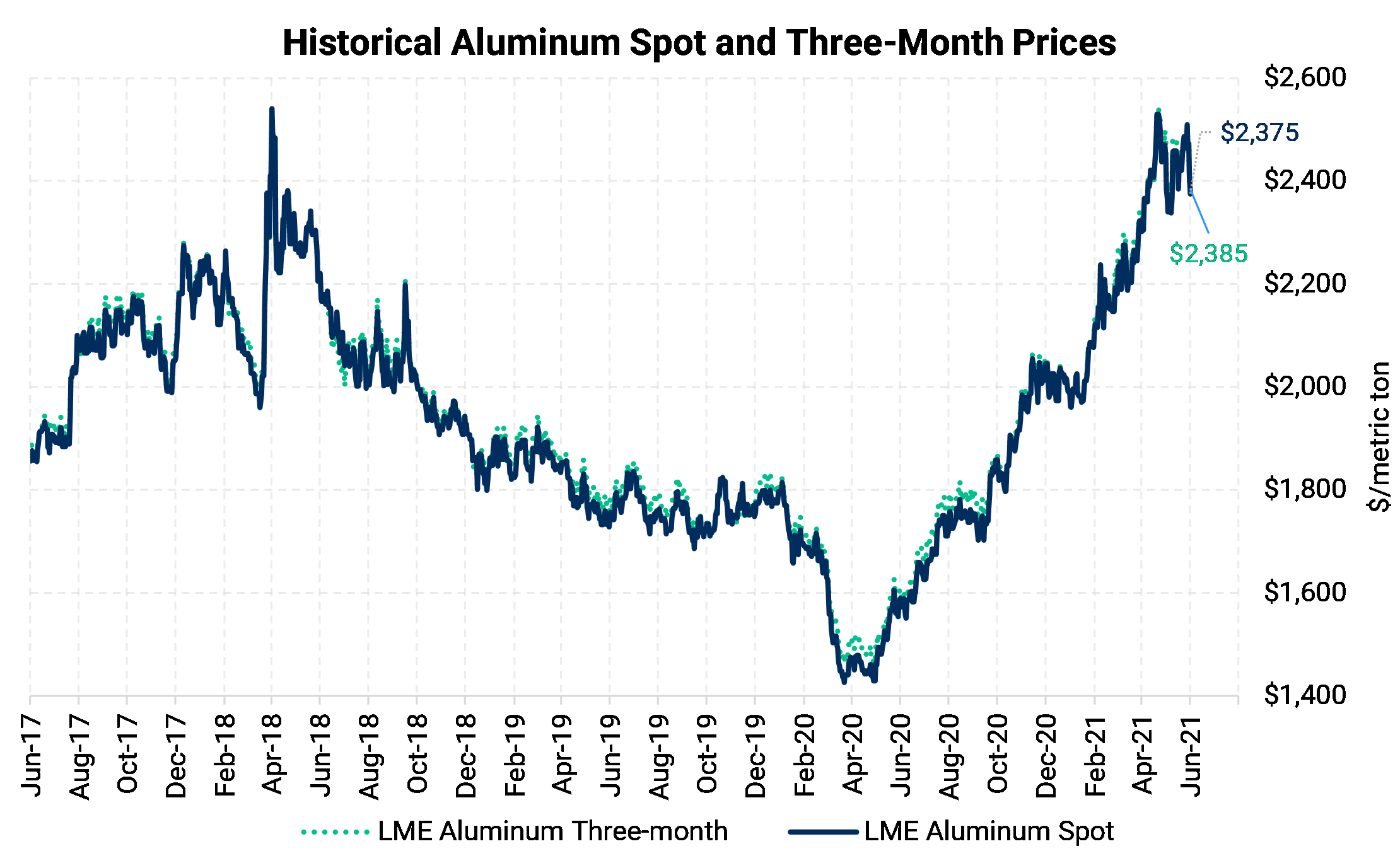

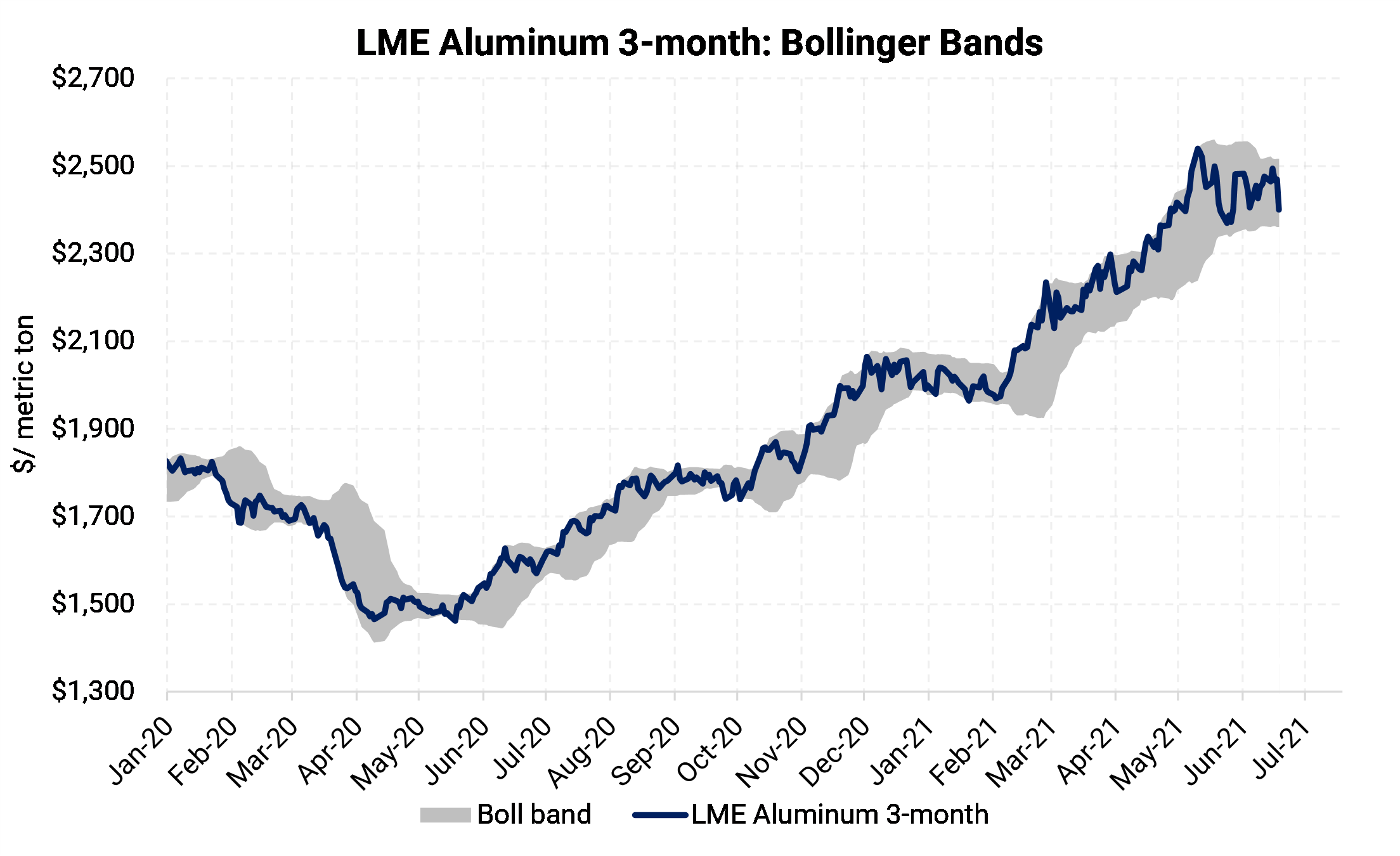

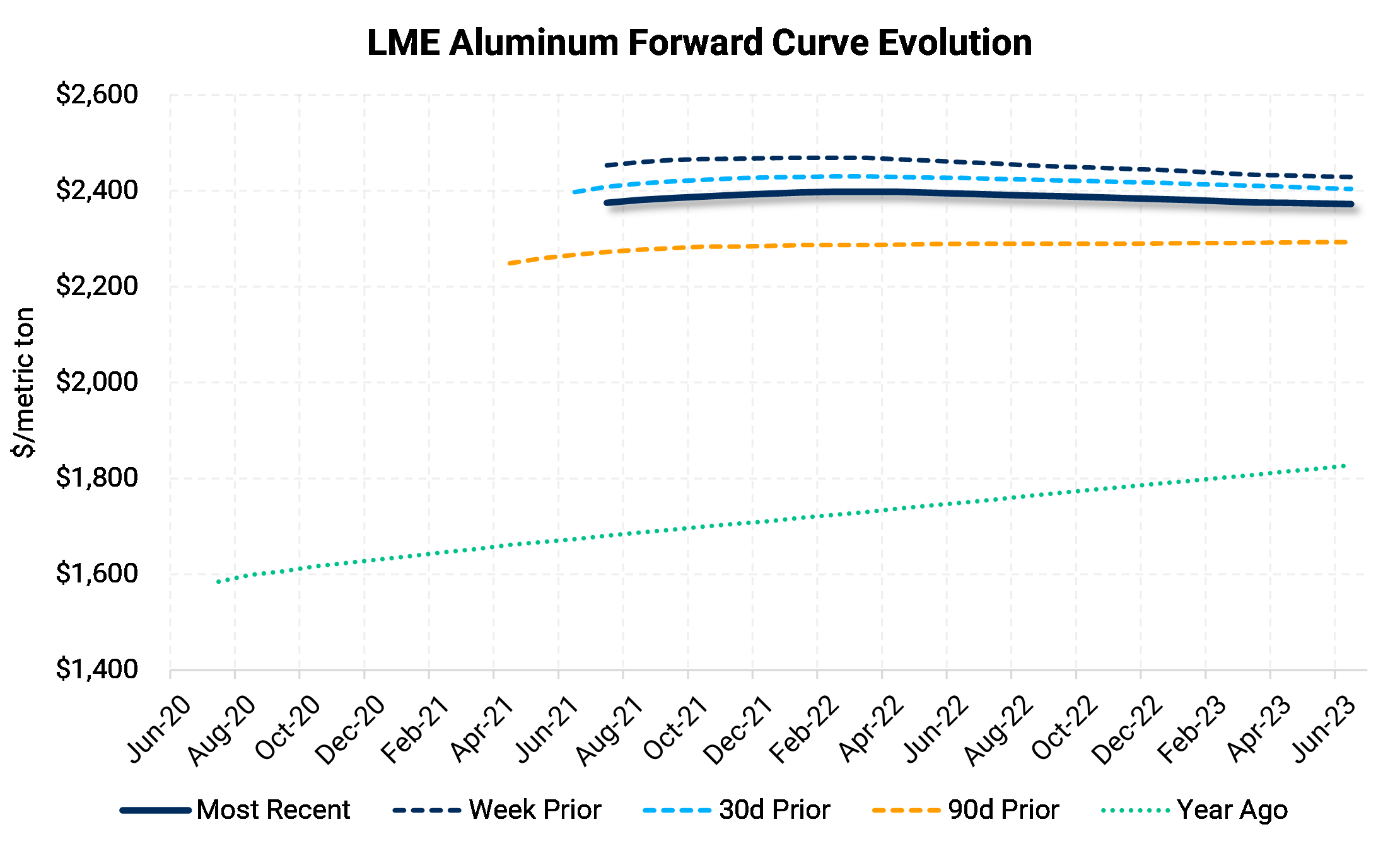

LME aluminum cash price ended the week down by 2.2% at $2,409.50/mt. Meanwhile, the 3mo price ranged from $2,352.00 to $2,505.00, ending the week on a bearish tone near the bottom of the range. We continue to recommend that consumers layer in hedges in a disciplined manner and select between swaps or call options depending on their risk-management objectives. However, option structures are currently preferred due to the recent rise in volatility. Cash-3mo reversed from $0.45 backwardation to $10.00 contango this week. Dec’21/Dec’22 backwardation decreased this week, now standing at $10. The persistent backwardation indicates there are still few buyers for long-dated contracts. In general, we have seen less long-dated consumer hedging with both premiums and LME at high levels. Keep an eye for any news on China opening up their state metals reserves. This could market moving news depending on how much is being sold and when.

|

|

Midwest Premium |

|

|

The aluminum Midwest Premium in the US continued to show signs of a plateau this week as CME MWP contract for June was trading at 27.1¢/lb at time of writing, largely flat on the week. Current published cash MWP levels continue to remain at all-time highs. With little MWP trading activity in Cal22, the backwardation in the forward curve remains significant and makes inventory hedging expensive. For the nearby curve, 3Q2021 appears to be pricing in a greater likelihood of Section 232 tariffs remaining in place for an extended period as well as demand continuing to surpass demand.

|

|

|

|

|

|

|

|

|

|

|

|

LME Copper |

|

|

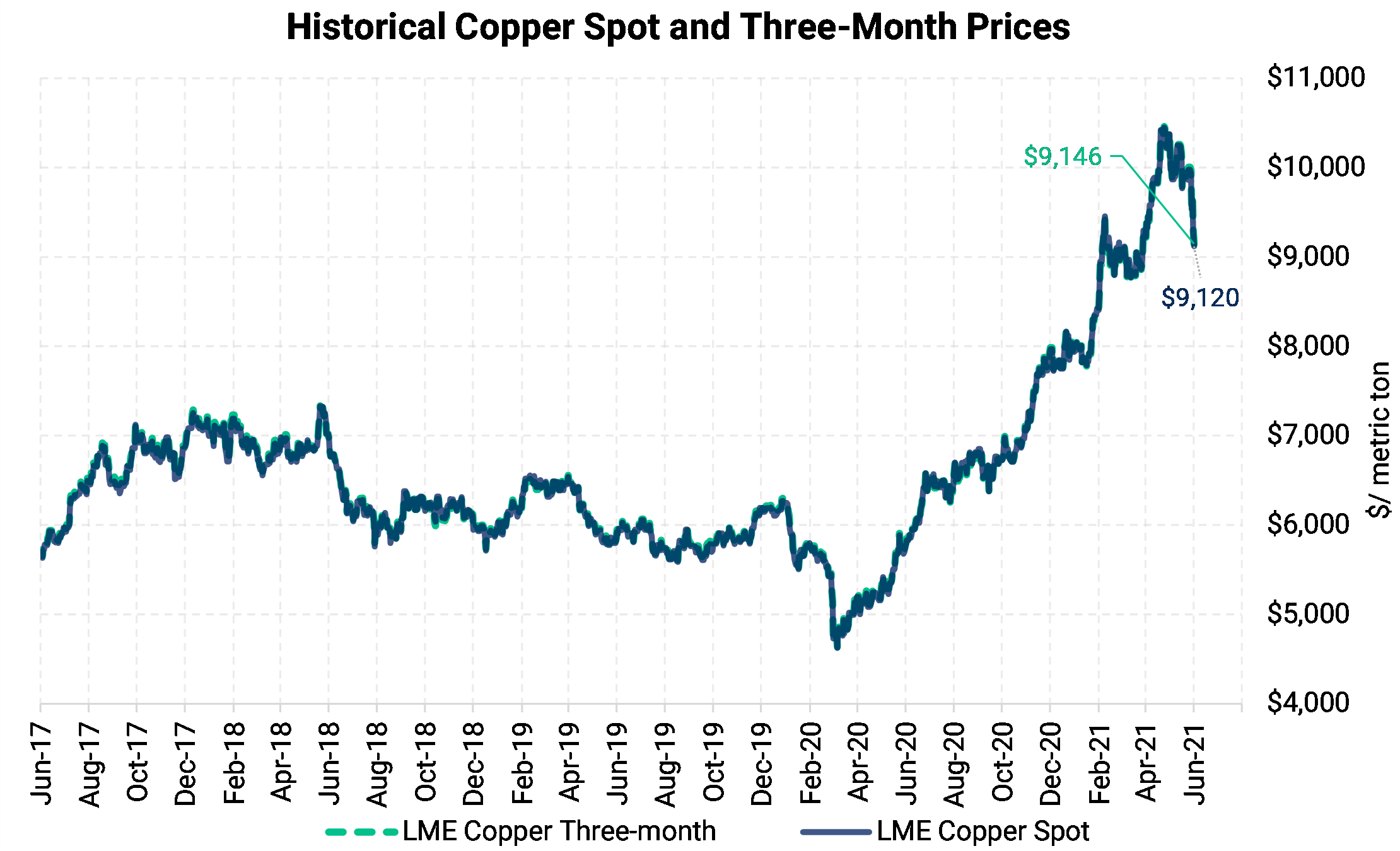

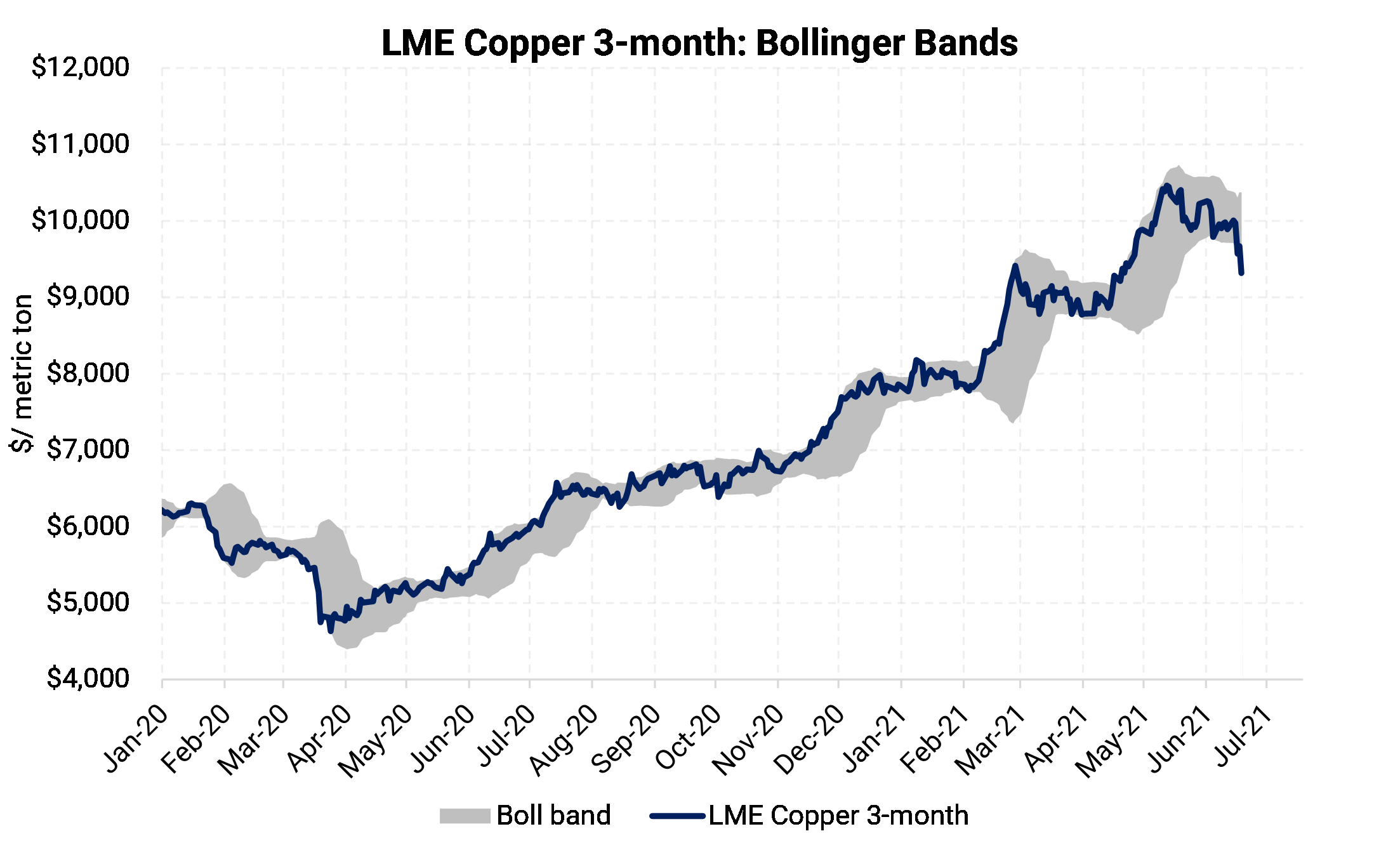

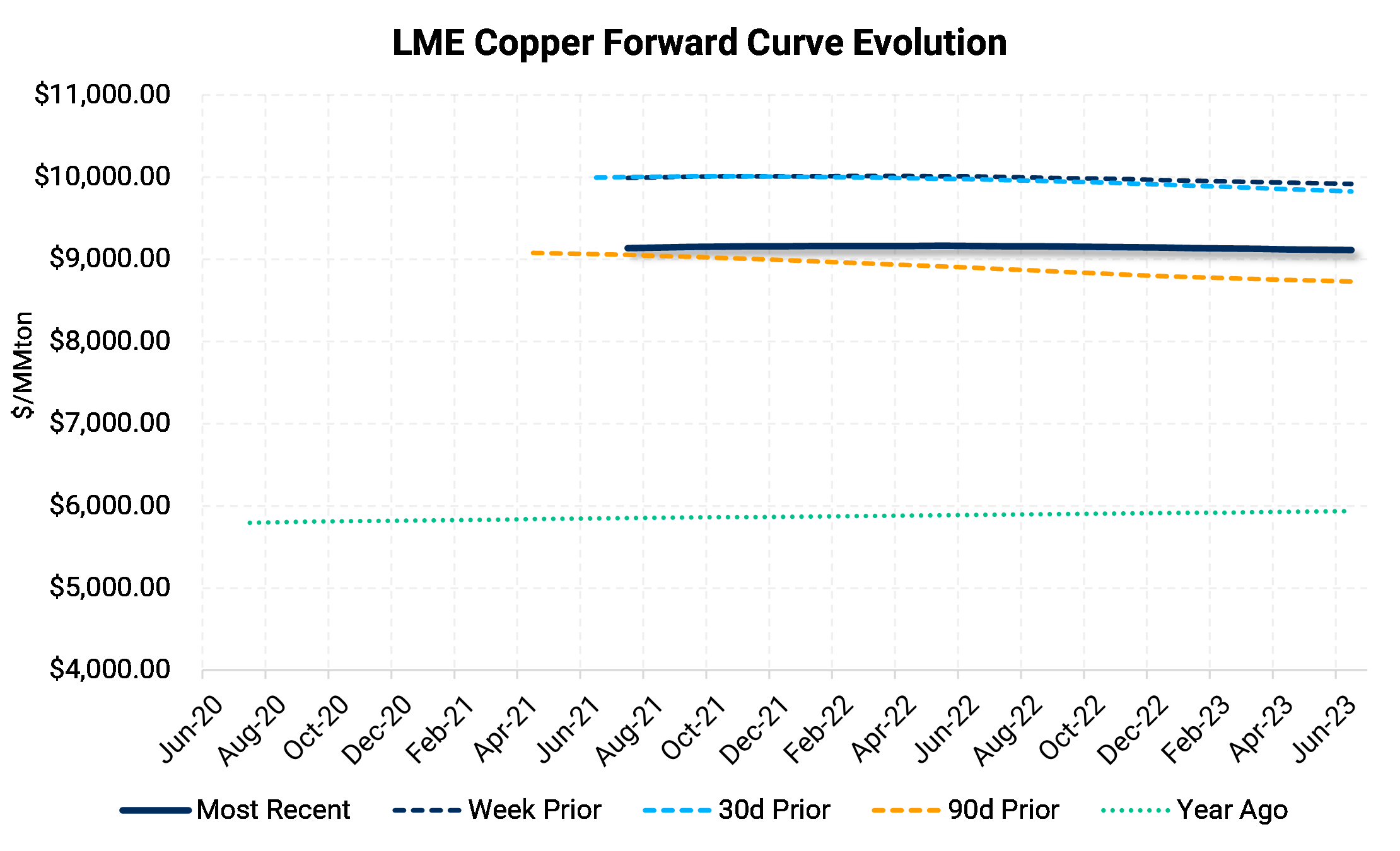

This week LME Copper saw its largest weekly fall since March of 2020. LME Cash prices were down 6.9%, coming in at $9,289/mt. As we seem to have materially broken through the $10,000/mt levels, next week should be telling on whether the metals bull run will continue to have legs. The LME 3m contract traded in a wide 9% range of $9,161 to $10,120 this week. Some analysts are already beginning to call a peak, perhaps prematurely, as consensus estimates continue to put the red metal in a physical deficit for 2021. Copper has historically been a bellwether for the base metals complex. One recent strike at a large Chilean copper mine (Spence) was resolved this week; however, negotiations are ongoing with Escondida’s on-site workers. Any prolonged strike at the giant Chilean Escondida mine could keep a bid under copper.

|

|

|

|

|

|

|

|

|

LME Nickel |

|

|

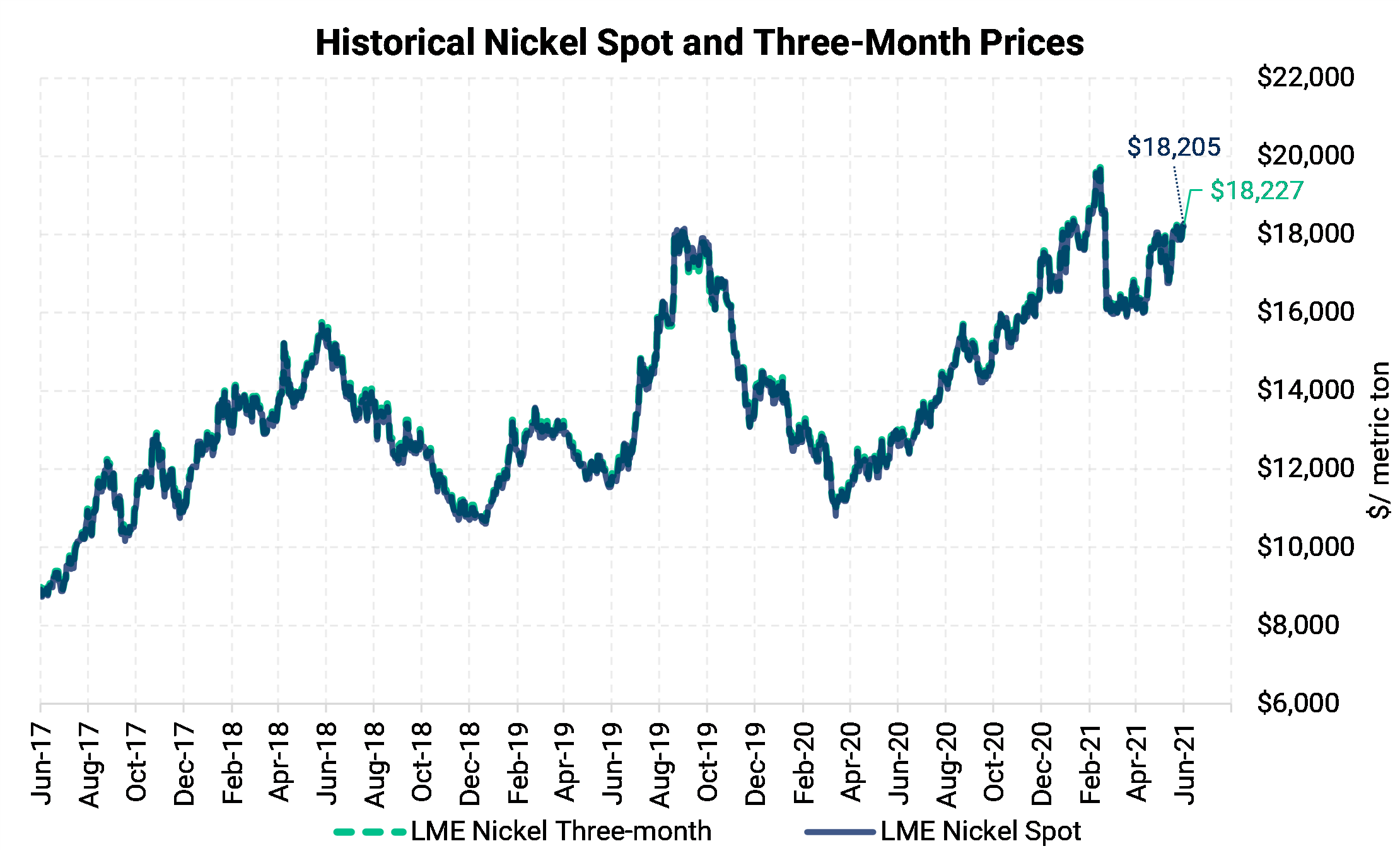

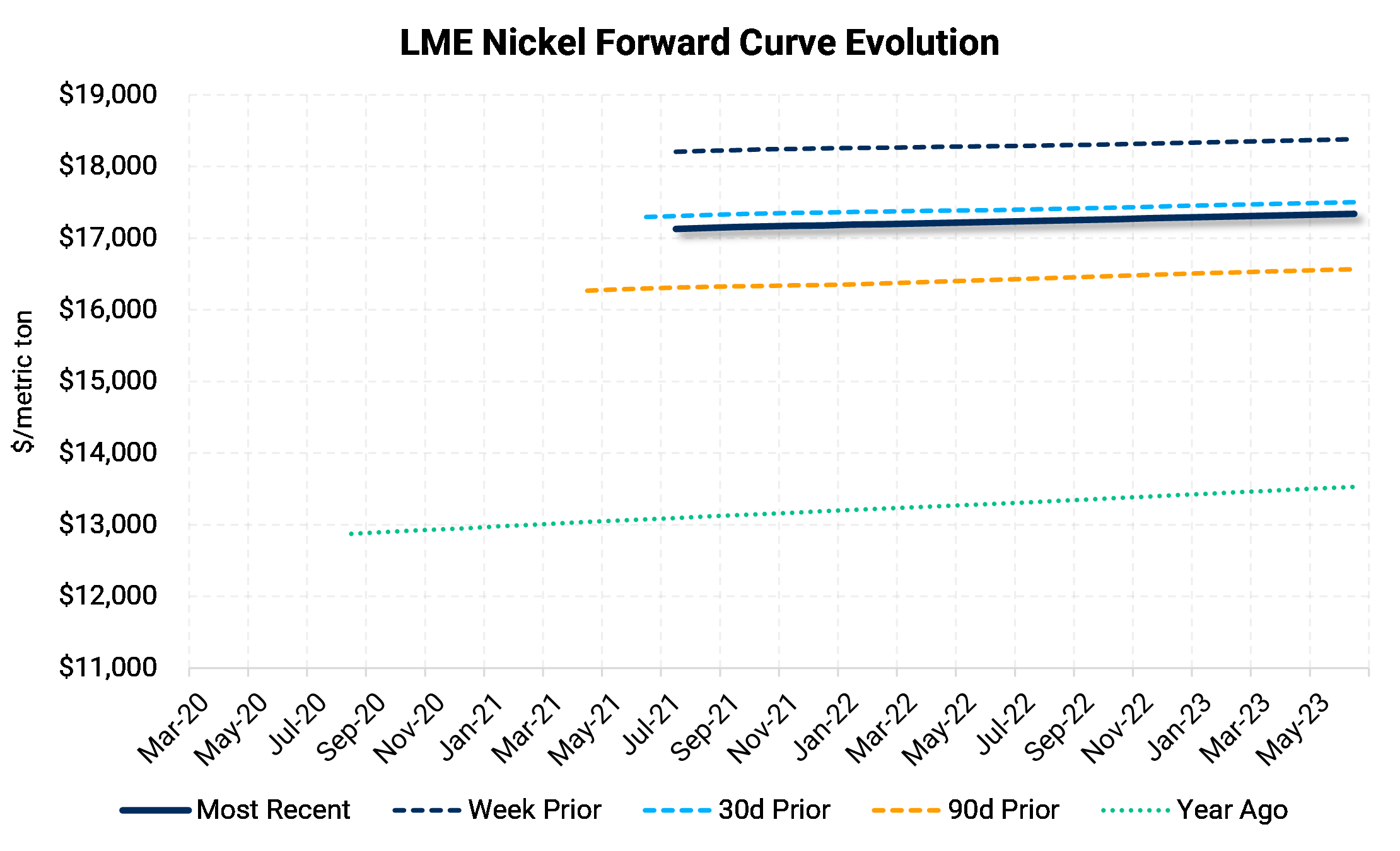

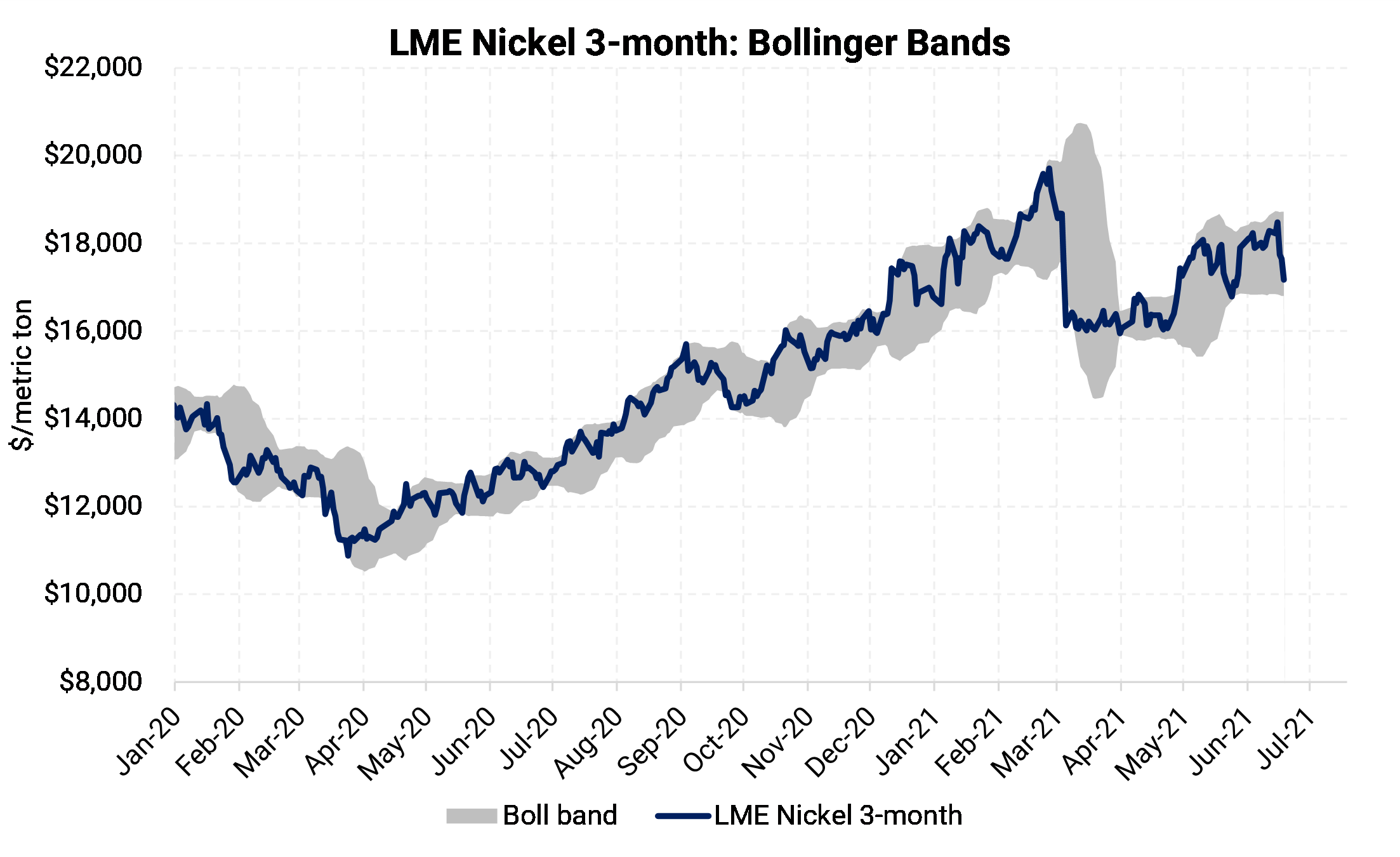

Nickel, the metal laggard of the year, continues to underperform relative to the industrial metals complex. LME Cash was 5.8% lower this week, with Friday’s closing price settling at $17,143/mt. The LME 3m contract traded in a range of $17,085 to $18,495. Like other base metals, nickel tends to benefit from industrial demand and a weaker U.S. dollar. As reported last week, Indonesia may have three new smelters operational this year, although the country did not disclose the capacities.

|

|

|

|

|

|

|

|

|

|

|

|

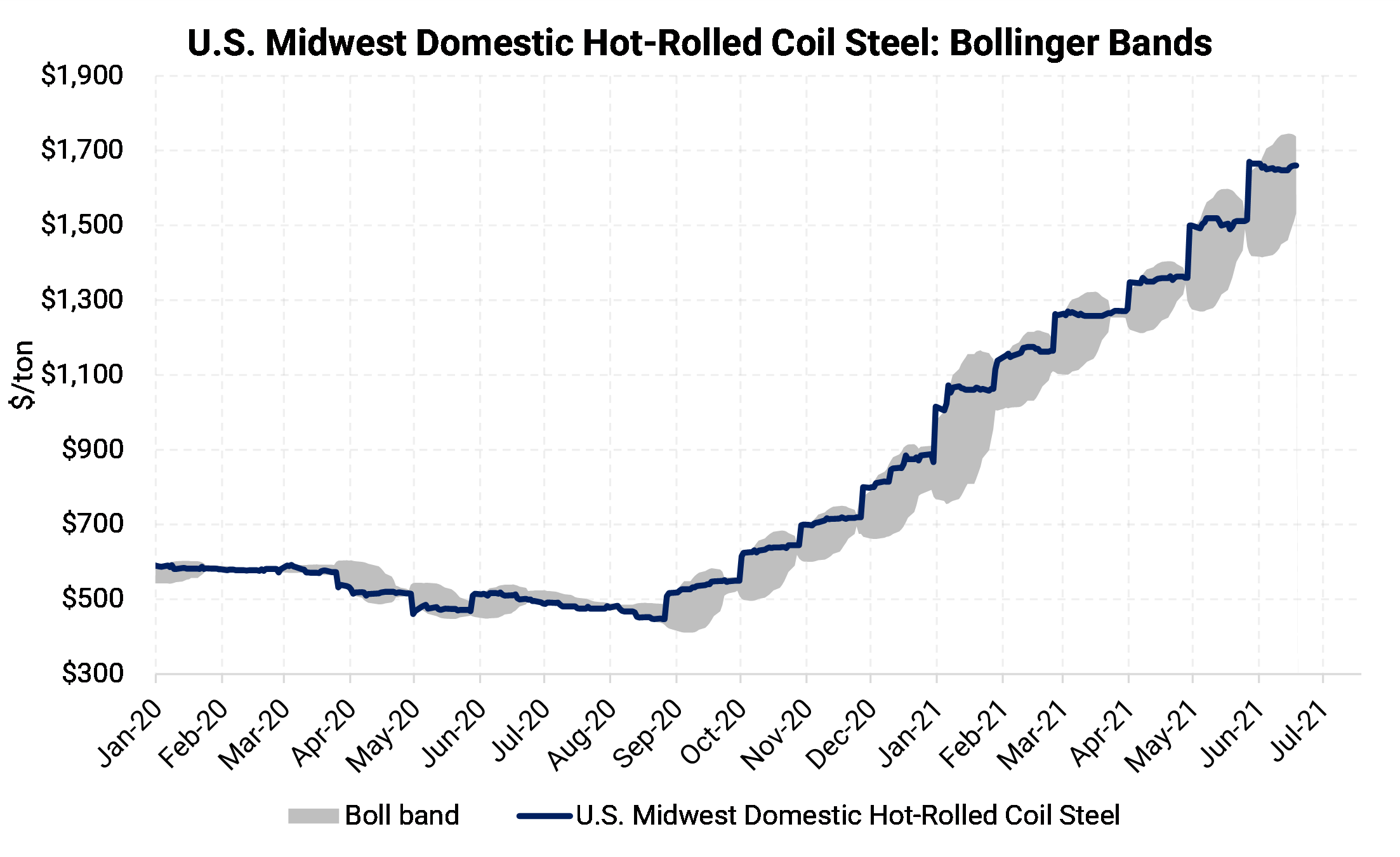

CME Hot Rolled Coil (HRC) |

|

|

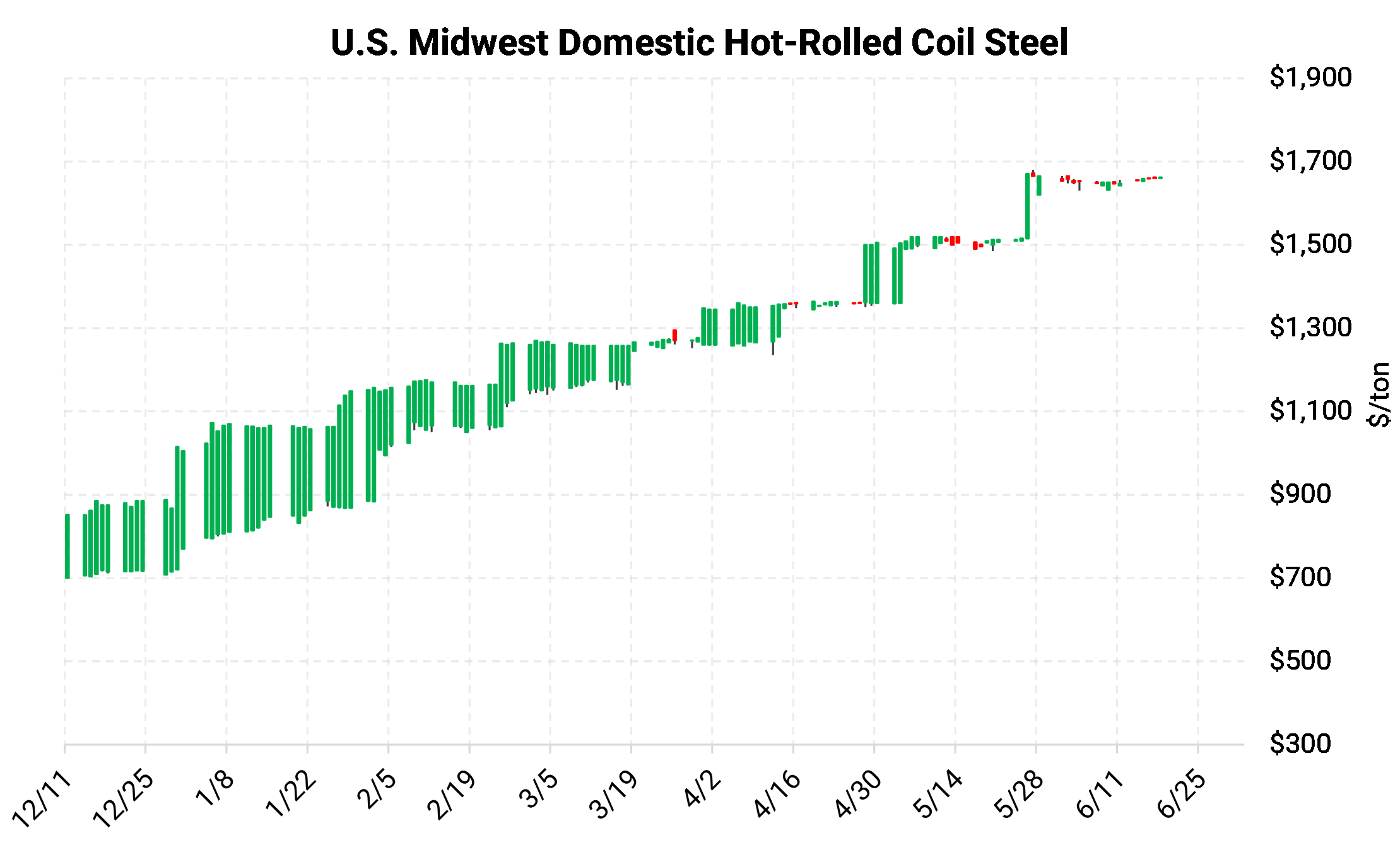

US domestic HRC prices continue to set records with physical market indications showing prices above $1,700/short ton this week. The record rally continues to show very little signs of weakness. AMM has reported that downstream consumers are preparing to invoke force majeure clauses due to domestic physical market unavailability. The CME HRC futures contract for Jun ’21 is currently offered at $1,676/Ton, only $1 higher than last week’s report. The nearby forward curve steepened this week, with the Jul’21 CME contract last priced at $1,745/Ton. The contract for Dec ’21 is currently offered at $1,427/ton, continuing to signal that market participants are expecting a fall in prices in 2H21. Like the aluminum MWP backwardation, there also could be wary eyes watching for potential changes to Section 232 tariffs. Opportunities remain open for HRC consumers to hedge future prices below the current spot price. The opportunity to hedge inventory or HRC sales has reopened this week, albeit on a short dated basis. We continue to believe that buying put options remains the best structure to achieve protection against a major market correction. From a consumer perspective, buying calls can be used to protect against a continued rally, with strike prices that are favorable considering the spot market prices, utilizing options will also allow for participation in a downward price correction. |

|

|

|

|

|

|

|

|

|

Notable News |

|

|

Treasury Yields Leap as Fed Officials Signal Speedier Hikes BHP Dodges Chile Copper Strike With Eleventh-Hour Wage Deal Lockdowns, plant closures hit wholesale auto sales Column: World's largest aluminium producer still short of metal: Andy Home Behind Fed Confidence on Inflation, Some Anxiety Creeps In US and EU Agree to Suspend Airbus-Boeing Trade Fight EAF Steelmakers Ratchet Up Profit Forecasts https://www.recyclingtoday.com/article/nucor-sdi-earnings-steel-recycling-profits-2021/ Solving EU-US Dispute Over Steel, Aluminum No Easy Task China May Aluminum Output Slips From Record High on Electricity Curbs China to Release Copper, Aluminum, and Zinc Reserves to Stabilize Prices (Steel) Supply to Catch Demand by Year-End: Tata’s Adam These 25 Projects Will Set the Copper Price for Decades https://www.mining.com/mapped-these-25-projects-will-set-the-copper-price-for-decades/ |

|