|

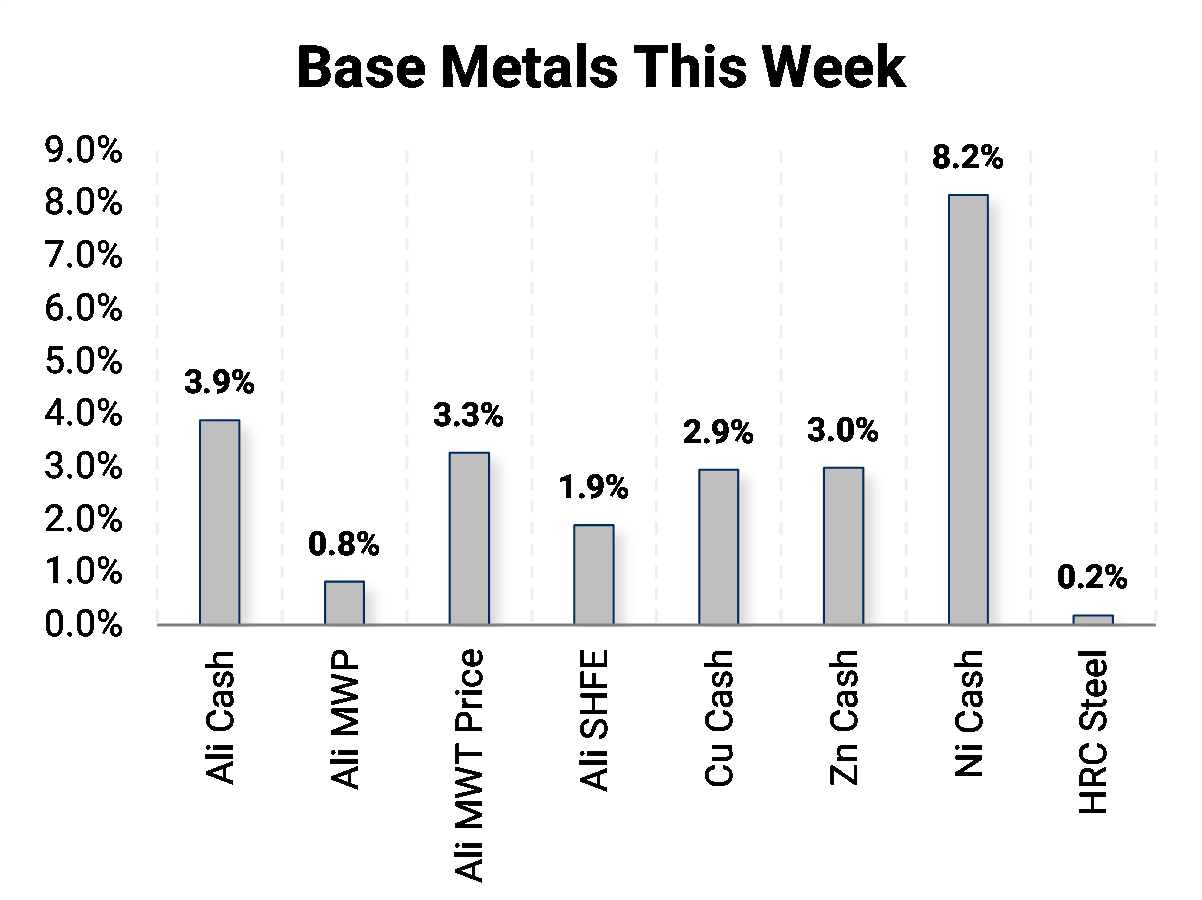

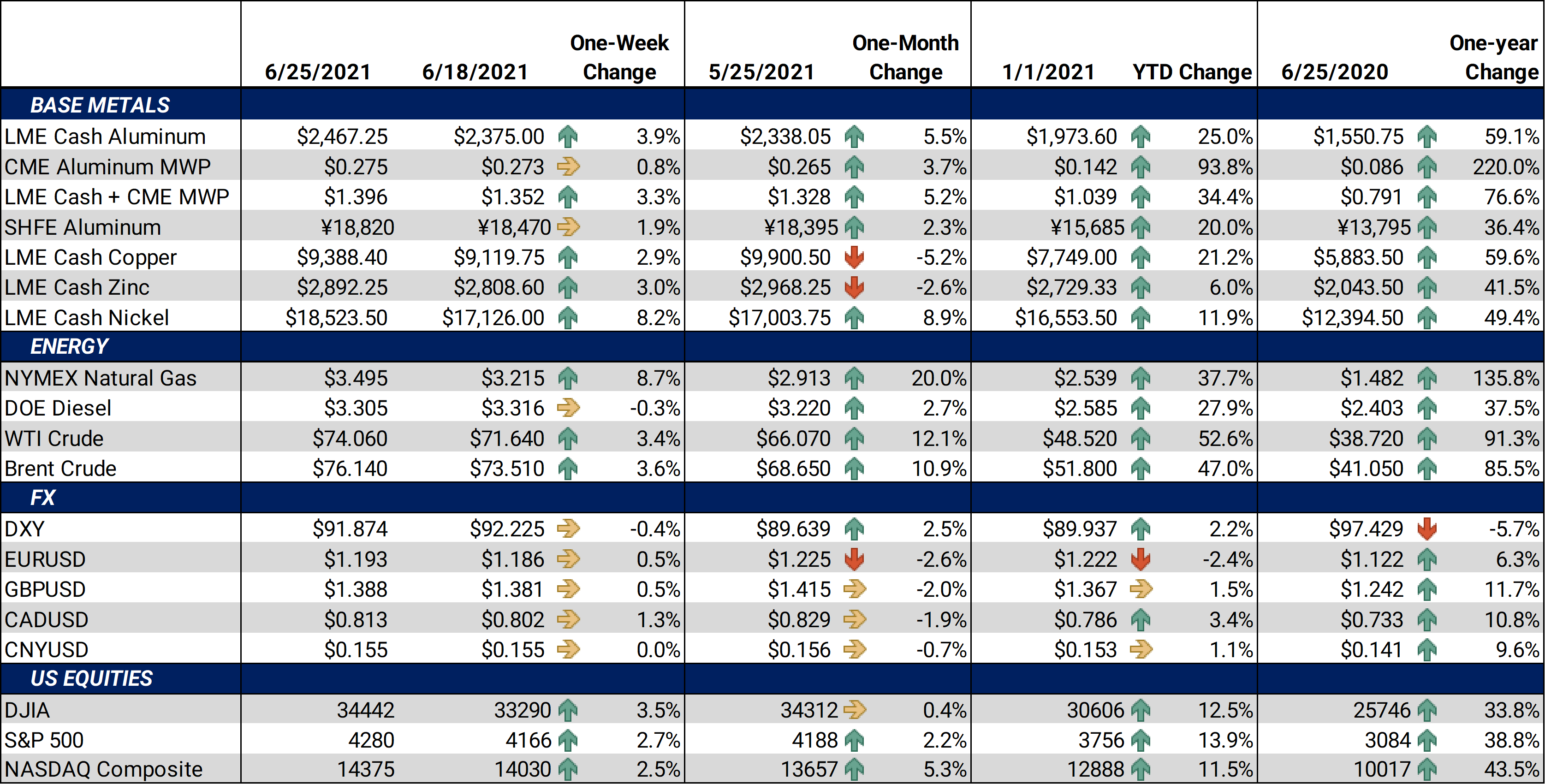

Metals markets firmed this week, regaining ground lost after last week’s China and Fed-induced sell-off. Details were finally revealed on China’s potential releases from its metals reserves. Estimates for sales through the end of the year total 500 kmt of aluminum, 200 kmt of copper, and 150 kmt of zinc. Questions remain on how much might be sold per month, as sales might not be linear. Ditto that regarding pricing as well. |

|

|

Federal Reserve chairman Jerome Powell, feeling the backlash of last week’s hawkish interest rate comments, backtracked during his testimony before the House Select Subcommittee on the Coronavirus crisis on Tuesday. In a nutshell, interest rate hikes will likely be based on broader economic data, rather than controlling inflation. This is based on the Fed’s belief that inflation brought on by recent spikes in commodities such as copper and lumber will likely be temporary. On a very positive note, President Biden was able to pass his much-hyped and debated infrastructure bill. Early indications claim that this will equate to $600B over the next eight years. This is supportive to the metals complex, however, thoughts that it will lead to bullish shortages seem unlikely. |

|

|

Bottom Line: In our comments last week, we stated “We will only know in hindsight whether or not there were any teeth to comments by the Fed or chatter about China.” These comments only aged a few days before we had some clarity on how China will likely release from reserves. However, these numbers should not be chipped in stone. If history is any guide, we know the Chinese government is rather skilled at creating inflation or deflation by selling off or hoarding reserves, depending on what current market conditions dictate. Thus, we should keep an eye out for actual sales and changes in estimates, as both are likely to be volatile. To parlay our earlier comments, it seems the Fed’s comments have “baby teeth.” By backing off earlier statements, Powell and the Fed seem to be chained to the stock market, thereby keeping the cheap money flowing. This should keep a bid under speculative commodities, and conversely a lid on the dollar. However, we should pay close attention to signs of overproduction in metals, cooling of demand, or renewed talks of interest rate hikes. We remain steadfast in our thoughts on disciplined hedging such as with long calls or zero-cost collars. Having limit orders working along with reasonable stop-losses is also sensible. |

|

|

|

|

|

|

LME Aluminum |

|

|

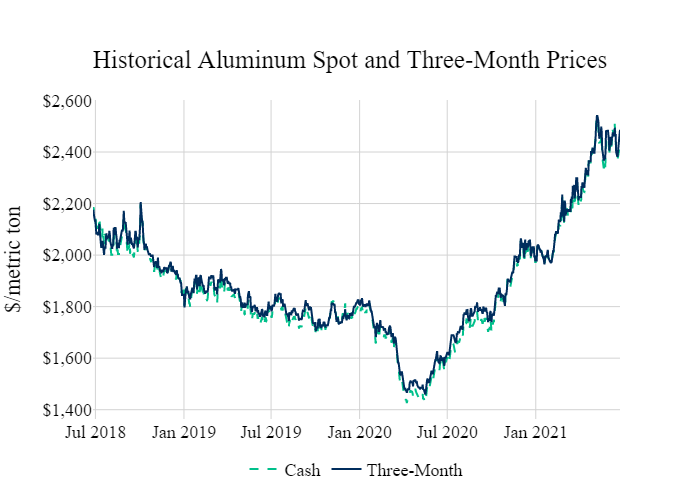

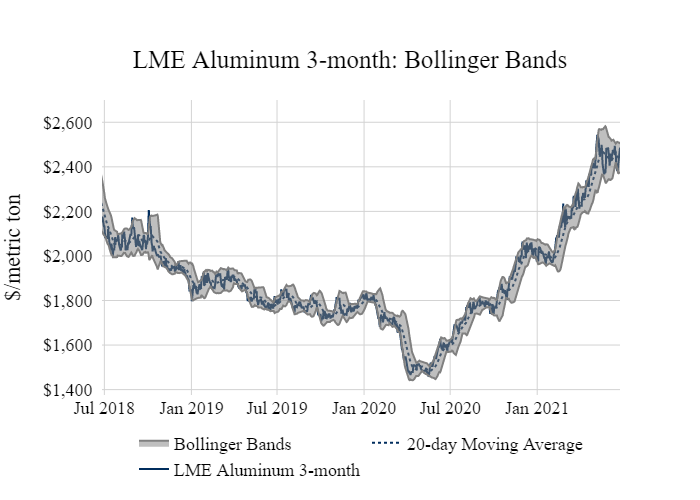

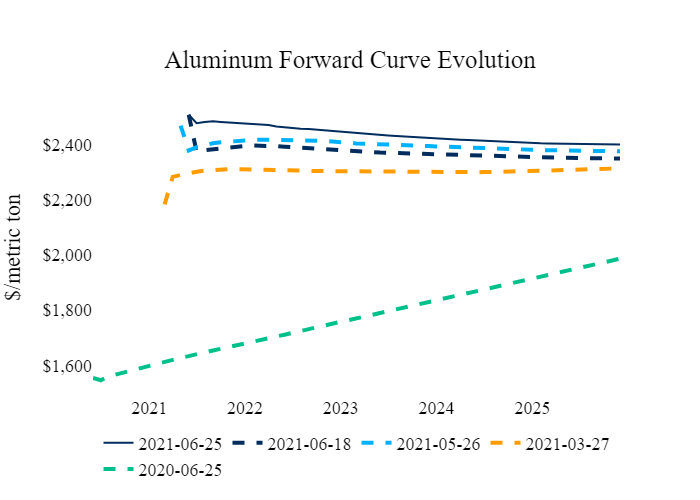

The LME 3mo Select price ranged from $2,355 to $2,498, ending the week near the highs and on a supportive tone. We continue to recommend that consumers layer in hedges in a disciplined manner and select between swaps or call options depending on their risk-management objectives. However, option structures are currently preferred due to the recent rise in volatility. In the news cycle this week, Russia announced plans to tariff Russian aluminum production exports. The market seems to be split between how and if this may affect underlying aluminum prices, regional premiums, and product premiums. Cash-3mo settled at $25.10 contango (where cash is cheaper than 3mo), widening from $10.00 contango last week. Dec ‘21/Dec ‘22 continued to show backwardation, suggesting that there are still few buyers for long-dated contracts. In general, we have seen less long-dated consumer hedging with both premiums and LME at high levels.

|

|

Midwest Premium |

|

|

The aluminum Midwest Premium in the US continues to show signs of a plateau this week as CME MWP contract for June was trading at 27.4¢/lb at the time of writing, up slightly on the week. Mimicking last week, there was little MWP trading activity in Cal ‘22; the backwardation in the forward curve remains significant and makes inventory hedging expensive. For the nearby curve, 3Q2021 appears to be pricing in a greater likelihood of Section 232 tariffs (Biden’s discretionary tariffs) remaining in place for an extended period.

|

|

|

|

|

|

|

|

|

|

|

|

LME Copper |

|

|

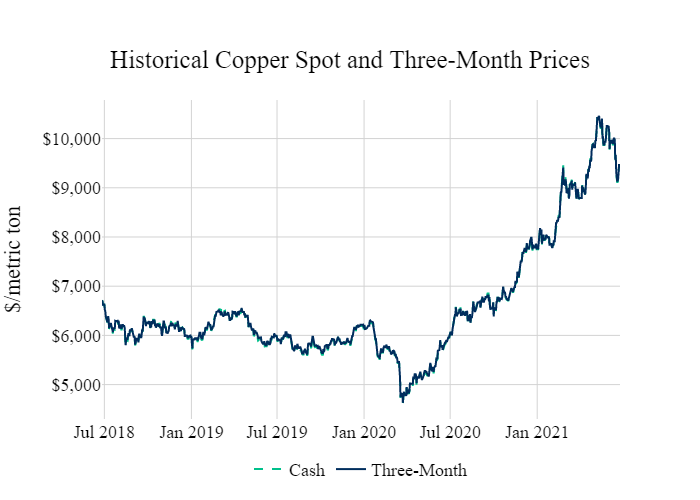

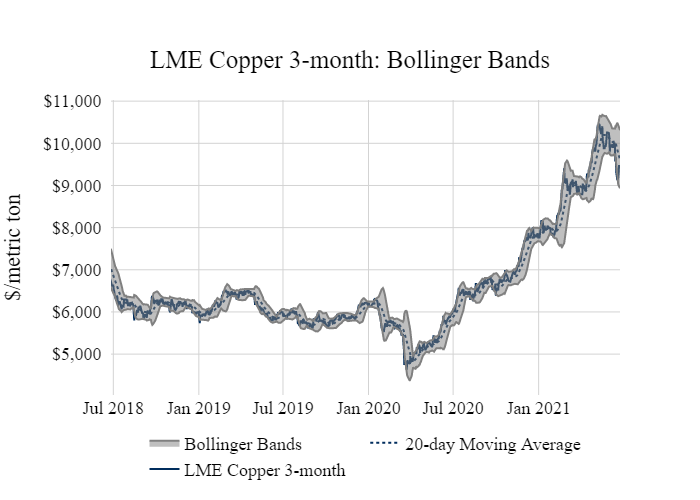

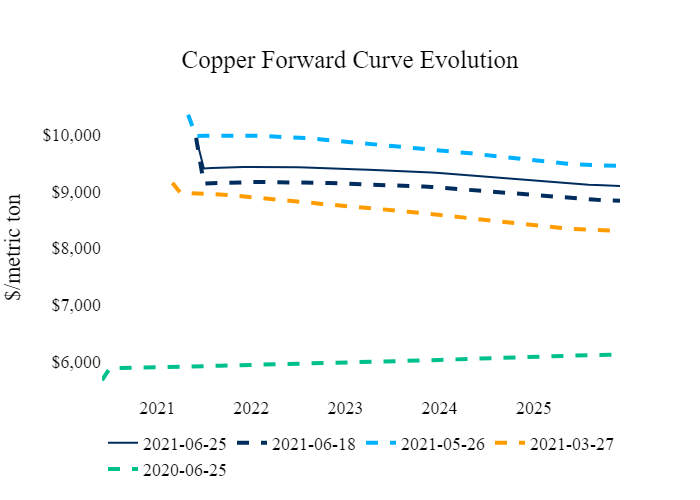

LME Copper 3M Select firmed this week, settling at $9435/MT. As we seem to have materially broken back below the $10,000/MT levels, and with no significant retest this week, we should consider the $10,000/MT level nearby resistance. The LME 3m contract traded in a narrower range than last week, from $9,011/MT to $9,517/MT. Some analysts are already beginning to call a peak, perhaps prematurely, as consensus estimates continue to put the red metal in a physical deficit for 2021. Copper has historically been a bellwether for the base metals complex. No news has occurred in relation to the ongoing strike by on-site workers at the Escondida mine in Chile. Any prolonged strike at the Escondida mine could keep a bid under copper

|

|

|

|

|

|

|

|

|

LME Nickel |

|

|

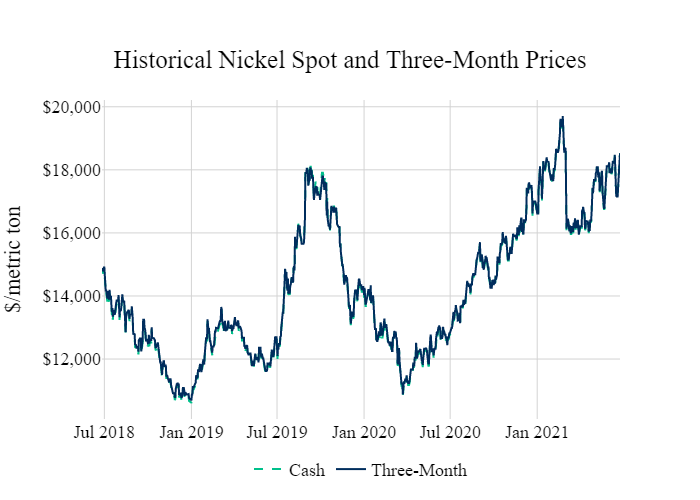

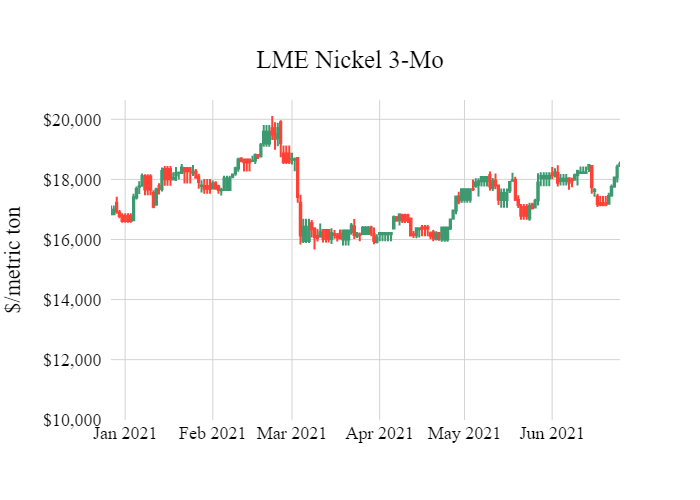

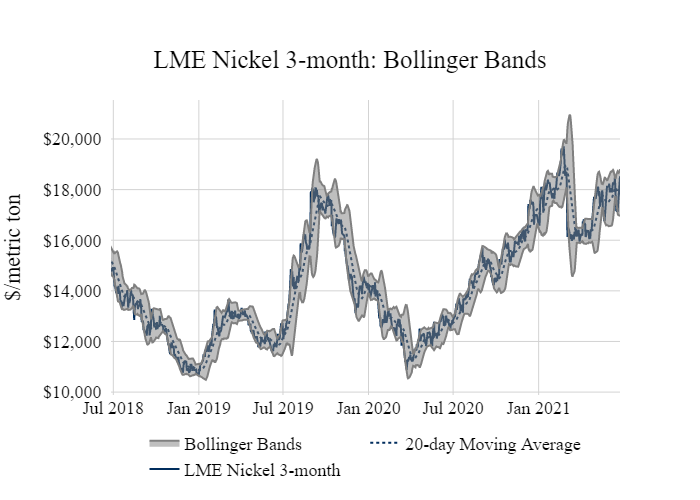

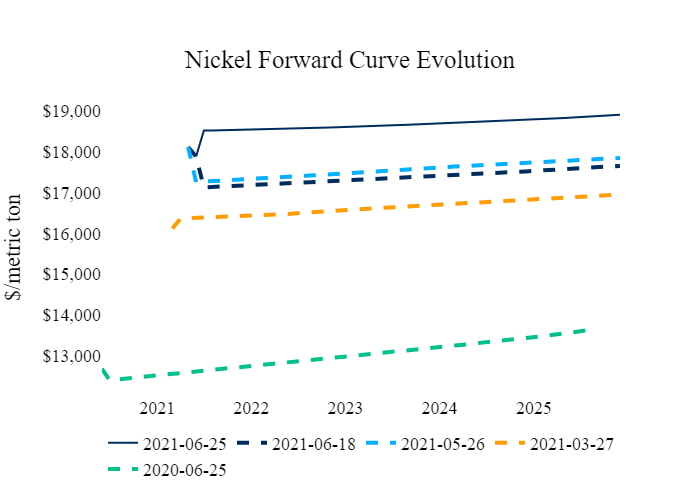

Nickel, despite being the metal laggard of the year, firmed this week, regaining the losses set last week. LME Cash was higher this week, with Friday’s closing price settling at $18612/MT. The LME 3M Select contract traded in a range of $17,085/MT to $18,495/MT. Like other base metals, nickel tends to benefit from industrial demand and a weaker U.S. dollar. However, the dollar this week saw only minor profit-taking from last week’s Fed-induced rally. Thus, nickel continues to trade within the narrow range we have seen since late April.

|

|

|

|

|

|

|

|

|

|

|

|

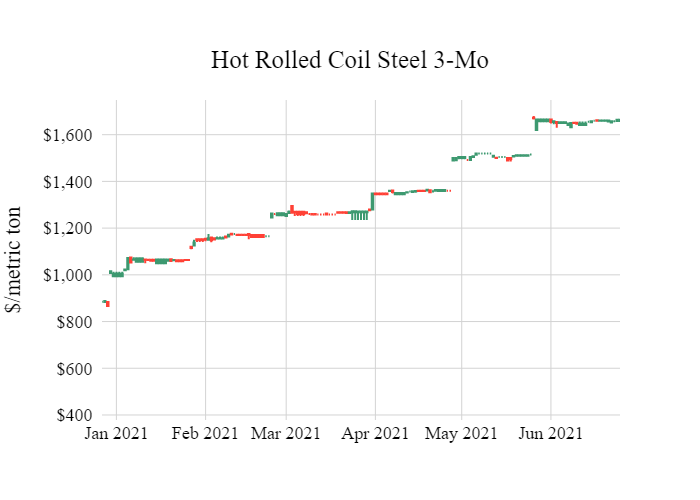

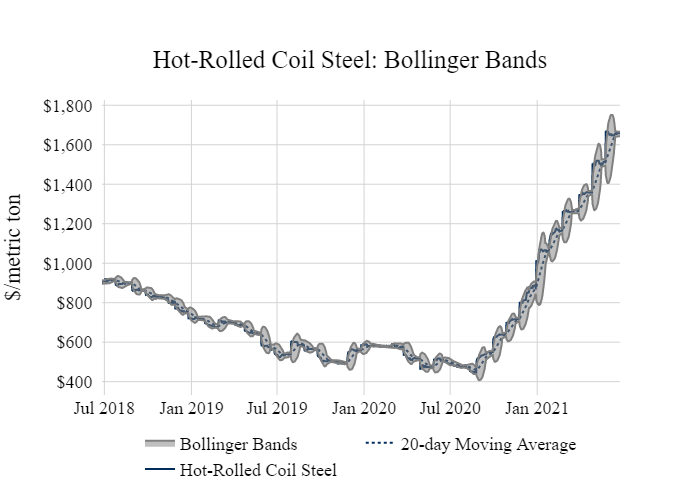

CME Hot Rolled Coil (HRC) |

|

|

The CME HRC futures contract for Jun ’21 is closed at $1,664/Ton, only $2 higher than last week. Deferred contracts through the remainder of the year and into ’22 continue to show signs of backwardation, and there is little reason for this to change in the near term. Opportunities remain open for HRC consumers to hedge future prices below the current spot price. We continue to believe that buying put options remains the best structure to achieve protection against a major market correction. From a consumer perspective, buying calls can be used to protect against a continued rally, with strike prices that are favorable considering the spot market prices, utilizing options will also allow for participation in a downward price correction. |

|

|

|

|

|

|

|

|

|

Notable News |

|

|

Aluminum Deficit May Swing to Surplus Later This Year Rusal Earning a Small Premium for Low Carbon Aluminum Metals Boom Sees the Return of Physically-Backed Funds Europe’s Economy Is Booming as Nations Cast Off Crisis Shackles Deripaska’s Ex-Wife Is Said Nar En+ Stake Sale to Mubadala Funds Flee Cyclically Confused Copper Market Tariff Alchemy: Turning Aluminum Tariffs Into Gold?

|

|