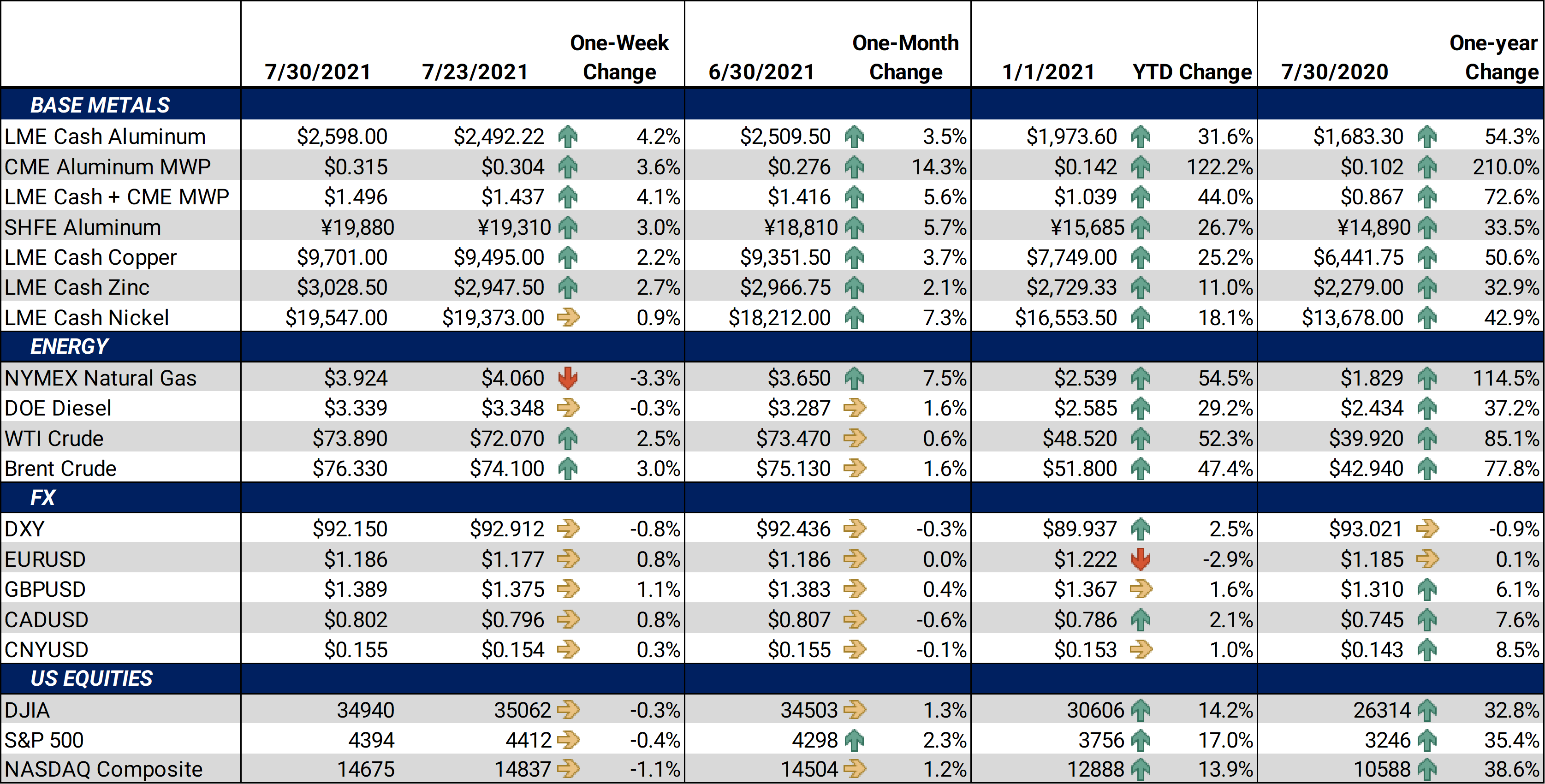

This Week’s Price ActionThe most exciting news to occur were the three new all-time highs set by the aluminum MW Premium. At the beginning of the week, base metals’ prices rose, despite a selloff in Chinese equities, which slid in early Monday trade after their government officials announced plans for capital investment restrictions in the education technology sector. However, Monday’s gains were largely wiped away on Tuesday by a broad selloff across most US asset classes. Some are blaming a sour turn in diplomatic negotiations between the US and China for Tuesday’s push lower, along with delayed reaction to China’s crackdown on its tech sector. Federal Reserve comments came out after the LME close on Wednesday, but weakened the US Dollar, lifting precious metals. The reaction to the Fed comments spilled into Thursday as base metals traded higher, aided by a continually weakening US Dollar.

|

|

||||

|

Notable Metals News Flooding has caused disruptions to aluminum production in Henan province in eastern China, which is second-largest aluminum fabricating province in the country. A flood-related explosion at the 50,000 mt/year Dengfeng Power Group aluminum plant caused a production halt early last week. Likewise, the 420,000 mt/year Jiaozuo Wanfang Aluminum plant halted production last Thursday, and the Yunnan Shenhuo Aluminum plant shuttered about 200,000 mt/year in capacity this Thursday. In South Africa, the violent protests and political crisis which started early this month have largely faded from the headlines for metal markets. However, other issues have flared up, including a cyberattack on Transnet, a major state-owned rail, port and pipeline company. This cyberattack led to the company halting operations at four ports, causing it to declare force majeure. The company’s Durban port is the main container port on the South African coastline, handling approximately 60% of South Africa’s container traffic, according to the US Department of Commerce. Although there have been no reports of delayed metals shipments yet, the Durban port is a major hub for cobalt and copper shipments. In Canada’s British Columbia, the anticipated worker strike at Rio Tinto’s 432,000 mt/year Kitimat aluminum smelter began over the weekend. On Monday, the company announced that it will be running at 35% production capacity. The aluminum MWP responded by jumping 1¢/lb to a new all-time high of 32¢/lb on Monday, and kept rising during the week (see the MWP section below). And in Chile, workers at the Escondida mine appear to be one step closer to a strike, as the union has asked their members to reject BHP’s latest wage and benefit proposal. After the unionized miners, who operate the mine remotely, walked off the job in late May BHP hired non-union replacement miners, so production has been unaffected. Escondida is the world’s largest copper mine, producing approximately 1.1 million mt/year. In Russia, exports tariffs on metals sales kick in on August 1, and market participants are fretting about how much export volumes will be impacted and the potential for more upside in both European and Midwest premiums. Last, in the US, the Senate voted 67-32 on Wednesday to move forward with President Biden’s $1.2T infrastructure bill. The next stage includes further debate and amendments. In its current form, the bill is about half of the amount the president proposed in an earlier version. The funding sources of the bill are still not known. This bill is likely supportive to metals prices, but the final bill will determine which metals markets are supported most. Notable Economic Data Perhaps the most important economic data of the week was the Federal Reserve interest rate decision, which kept short-term rates at a target range between zero and 0.25%. The news pushed the USD lower late Wednesday afternoon and Thursday, helping to lift metals prices. Also this week were New Home Sales, announced Monday, which were 676K, a disappointing read considering the 800K trade estimate. Consumer confidence, announced Tuesday morning, ticked higher to 129.1, up from 128.9 last month and beating trade estimate of 123.9 |

|||||

|

Bottom Line: Metals seemed to have been driven by outside factors this week, as Chinese crackdown on tech firms, hostile diplomatic talks between the US and China, flooding in Henan province, all played a part to keep metals pushing higher. On the macro front, the dollar index has maintained a very tight range over the past several weeks, but it continues to show little weakness, despite the Fed’s interest rate policy. However, this was the largest selloff in the USD since early May, and further weakness in the dollar could boost metal prices. A weakening dollar makes our products cheaper to foreign buyers. Exports of finished goods could bounce if the dollar continues to weaken. As always, COVID fears continue to dominate headlines, as the coronavirus delta variant is creating havoc in Asia and certain areas of the US. New shutdowns could slow the demand for base metals. We continue to recommend that metal consumers layer in hedges in a disciplined manner and select between swaps or call options depending on their risk-management objectives. Option structures are generally preferred due to the recent rise in volatility. However, call options premiums have increased during this rally, so collars (selling put options to offset the cost of call options) are a logical strategy. We also suggest using limit orders along with reasonable stop-loss targets to add incremental protection if prices trend higher.

|

|||||

|

|||||

|

|

|||||

|

|||||

|

The LME 3M Select finished higher for the week, with last trade at $2,597.50/mt, and trade ranging from $2,476/mt to $2,642/mt. This was the highest close since early May. Chartists would note that trade continues to find upward resistance at the $2,580/mt to $2,600/mt levels. Perhaps we need a new catalyst to break above that area. Cash-3M last traded at a $9.20/mt backwardation (where cash is higher than 3M), switching from $10.50/mt contango during last week’s closing trade. Farther down the curve, Dec ‘21/Dec ‘22 continued to show backwardation, suggesting that there are still few buyers for long-dated contracts. In general, we have seen less long-dated consumer hedging with both premiums and LME at high levels.

|

|||||

|

|||||

|

The CME MWP contract for July had a last trade of 31.5¢/lb at time of this writing. Market participants cite a pending worker strike at Rio Tinto’s Kitimat aluminum smelter for these recent ticks higher in MWP. Sky-high freight costs and other logistical issues have caused the movement of metal to slow to a crawl. Market sources are stating that most end users have purchased their short-term needs. However, some are still scrambling for metal, with little to be found. Mimicking the activity we have seen over the past several weeks, there was little MWP trading activity in Cal ‘22; the backwardation in the forward curve remains significant and makes inventory hedging expensive.

|

|||||

|

|

|||||

|

|||||

|

LME Copper 3M Select traded slightly higher this week, with last trade at $9,714/mt. The LME 3M contract traded in a narrower range than last week, from $9,562.50/mt to $9,924/mt. We have bounced off the $9,011/mt low set during the week of June 21, but it appears that trade needs a new catalyst to break us out of the $9,000/mt to $10,000/mt range. Likewise, the market has been bouncing indecisively between $9000/mt to $9,500mt for the past five weeks. Some analysts are blaming the logistical issues due to flooding in China’s Henan province and likewise supposedly dwindling Chinese stocks for the rise in prices this week. Although the floods are likely partially to blame, we note that the market is well aware of China’s ambitions to curb inflation by selling metals reserves. The pending strike by Escondida miners should be watched closely, as well as the USD.

|

|||||

|

|

|||||

|

|||||

|

Nickel inched higher this week, touching levels not seen since mid-February 2021. Last trade on the LME 3M Select contract was $19,570/mt, with a trade range of $19,215/mt to $19,960/mt for the week. Like other base metals, nickel tends to benefit from industrial demand. However, like February’s trade, we seem to run into resistance at or slightly above the $19,900/mt level. New, positive fundamental news will likely need to occur to have a breakout above the $20,000/mt level. |

|||||

|

|

|||||

|

|

|||||

|

|||||

|

This week HRC steel traded in a wider and higher band than in previous weeks. As of this writing, the CME HRC futures contract for August ’21 last traded at $1,878/T. Trade range was from $1,839/T to $1,900/T. Deferred, or longer-dated, contracts through the remainder of the year and into 2022 continue to show signs of backwardation. As we mentioned in the opening comments, let’s keep a close eye on the situation in South Africa. Opportunities remain open for HRC consumers to hedge future prices below the current spot price. For both producers and those carrying inventory, we continue to believe that buying put options remains the best structure to achieve protection against a major market correction. From a consumer perspective, buying calls can be used to protect against a continued rally. Using options with staggered strike prices allows for participation in a downward price correction. |

|||||

|

|

|||||

|

|

|||||

Notable News |

|||||

|

Flooding at Aluminum Plant Causes It to Suddenly Explode in Dramatic Videos Copper hits multi-week highs on weaker dollar Key South African ports declare ‘force majeure’ after cyberattack South Africa port operations halted and workers reportedly put on leave after major cyberattack Unrest in South Africa: Pig sector suffers losses South Africa Country Commercial Guide (US Dept of Commerce) Cyberattack disrupts main African cobalt, copper export hub Union calls for strike vote at Chile’s Escondida, world’s largest private copper mine READ: Bipartisan infrastructure plan 57-page summary Republicans opposing massive infrastructure bill ask: Where’s full text? |

|||||