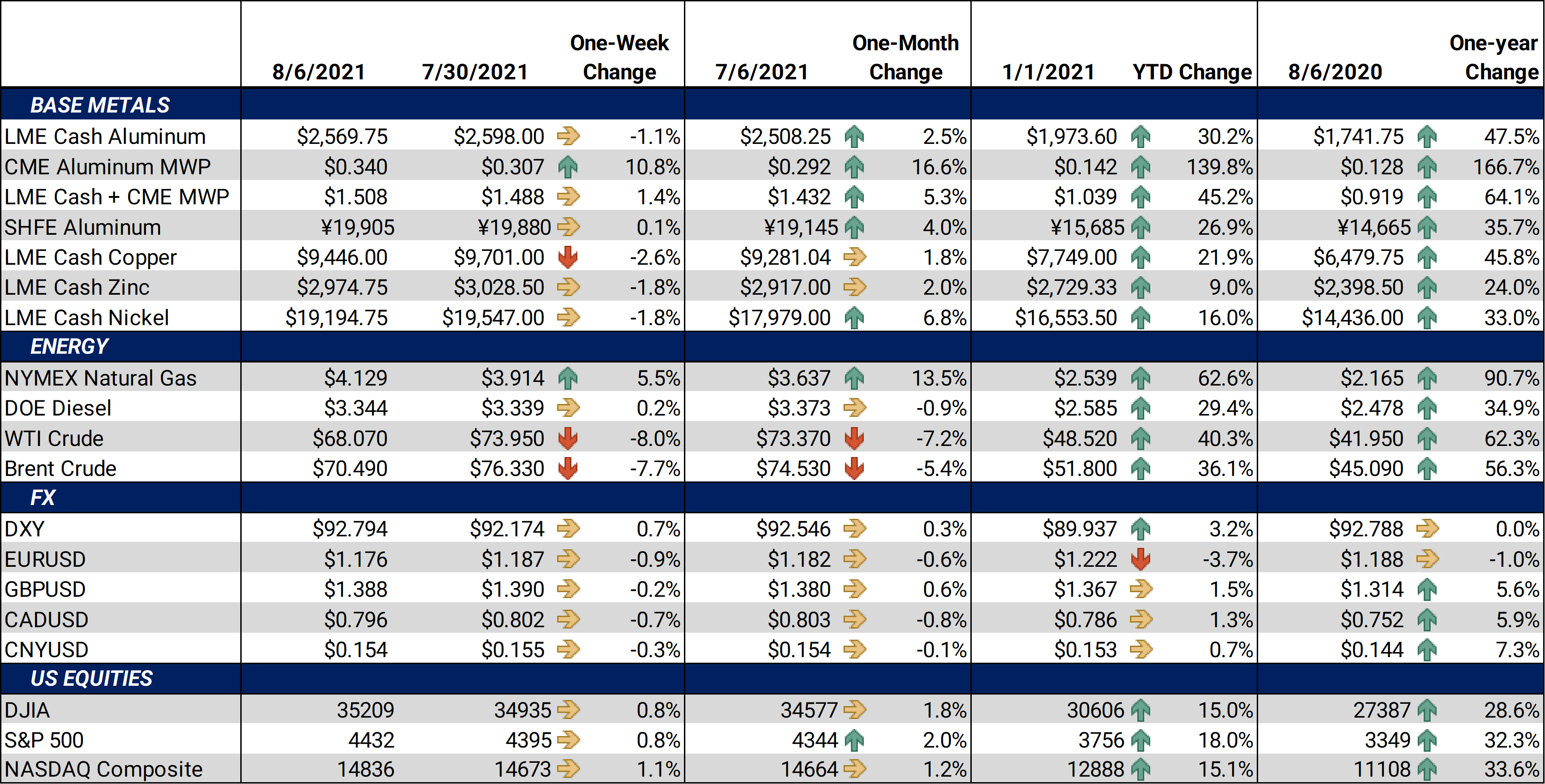

The most exciting news to occur since our last Metals Weekly Dashboard was the new all-time high set by the aluminum MW Premium last Friday. Sky-high demand, supply constraints, Russian export tariffs, and now workers strikes in Canada have fueled the rally in MWP that began last summer. This rally has eclipsed previous highs by over 10 ¢/lb.At the beginning of the week, most base metal prices rose on hopes of Chinese stimulus measures and reports that the country and its regional governments will be setting up relief funds to help state-owned businesses against defaults. However, copper, which is often tied to the health of the Chinese economy, failed to hold early gains during Monday’s session.Tuesday’s trade took cues from a selloff in Chinese equities, which led to further losses for not only copper, but also aluminum and nickel. Market participants are blaming a new crackdown on their video-game industry for the Chinese equities selloff, which bled into metals markets. The Chinese video-game sector has been under fire since a prominent, state-owned newspaper called video games “spiritual opium” and “electronic drugs.”Finally, a higher-than-expected increase in US non-farm payrolls pushed the dollar higher, which sent metals prices lower on Friday. |

Notable Metals News

In its half-year earnings report, released late last week, auto manufacturer Volkswagen stated that the shortage in semiconductors will continue in Q3, which could slow production. Ford and GM have made similar statements during recent earnings calls. A continued lack of semiconductors could further slow auto production and new car sales, thereby weighing on steel and aluminum prices.

In eastern China, flooding concerns remain for aluminum production in the Henan province, which is the second-largest aluminum fabricating province in the country. Three major aluminum plants (Dengfeng Power Group, Jiaozuo Wanfang and Yunnan Shenhuo) have halted all or part of their respective production in the past several weeks. We have seen no updates or progress on when these facilities might be back online. This should be supportive to both aluminum and copper.

In South Africa, Transnet, a major state-owned rail, port and pipeline company, has lifted a force majeure declaration after a cyberattack halted operations several weeks ago. The initial cyberattack led to the company halting operations at four ports. The company’s Durban port is the main container port on the South African coastline, handling approximately 60% of South Africa’s container traffic, according to the US Department of Commerce. Durban port is a major hub for cobalt and copper shipments;, luckily there were no reports of delayed metals shipments.

In Canada, border guards and customs officials are threatening to strike, which could compound the logistical nightmare that is already afflicting that country’s metals exporters. The labor groups are expected to vote on August 6. Also in Canada, the worker strike at Rio Tinto’s Kitimat aluminum smelter has slowed metals shipments. The strike began in late July. These factors should keep a bid under the aluminum MW premium.

And in Chile, union miners at Codelco and Caserones copper mines are also threatening to strike, joining alongside workers from the Escondida copper mine. All three groups had voted last weekend to begin striking procedures. The next step includes mediated talks, which can be requested under Chilean law. Pandemic related restrictions have slowed production at the Escondida mine, as it just recorded its 11th consecutive month of production declines.

In Russia, exports tariffs on metals sales kicked in on August 1, and market participants are fretting about how much export volumes will be impacted and the potential for more upside in both European and Midwest premiums. More information from the Russian ministry on this tariff scheme is expected in August.

Last, in the US, the Senate has made little progress on the infrastructure bill, as nearly 300 amendments have been added to the legislation. Some senators are contemplating that the next vote will be Saturday August 7. In its current form, the bill is about half of the amount the president proposed in an earlier version. This bill is likely supportive to metals prices, but the final bill will determine which metals markets are supported most.

Notable Economic Data

The most economic data this week was nonfarm payrolls, which were 943,000, well above trade estimates of 875,000. This week’s economic data started in China with the Sunday night release of the Caixin Manufacturing PMI, which had a read at 50.3 for July, down from 51.3 in June and below the 51.0 analysts estimate. A reading below 50.0 suggests the industry is contracting, above 50.0 suggests expansion. US Factory Orders, released Tuesday morning, were up 1.5%, slightly above expectations of 1.0%. China’s July Caixin Services PMI, released Tuesday night, was 54.9 VS 50.3 in June.

| Bottom Line: | |||||

|

China’s new stimulus efforts and safeguards against defaults should support an economy that is continuing to slow. However, the markets (especially metals) seem to need more clarity on what protocols China is looking to implement. Any positive measures should be supportive to metals. Besides China, we must also keep an eye on any workers strikes, whether from miners in Chile or border agents in Canada. These strikes have the potential to further strain supply chains, reduce near-term supply, and keep a bid under metals prices, especially the aluminum MW premium. On the macro front, the dollar index has maintained a very tight range over the past several weeks. It continues to show little weakness, despite the Fed’s interest rate policy. However, it seems like greater forces than the USD are driving metals prices. Even a brief selloff on the USD during the week of July 26, did little to support metals prices. As always, COVID fears continue to dominate headlines, as the coronavirus delta variant is creating havoc in Asia and certain areas of the US. New shutdowns could slow the demand for base metals. We continue to recommend that metal consumers layer in hedges in a disciplined manner and select between swaps or call options depending on their risk-management objectives. Option structures are generally preferred due to the recent rise in volatility. However, call options premiums have increased during this rally, so collars (selling put options to offset the cost of call options) are a logical strategy. We also suggest using limit orders along with reasonable stop-loss targets to add incremental protection if prices trend higher. |

|||||

|

|

|||||

LME Aluminum |

|||||

|

The LME 3M Select finished higher for the week, with last trade at $2,583.50/mt, and trade ranging from $2,562/mt to $2,632/mt. Chartists would note that trade continues to find upward resistance at the $2,580/mt to $2,600/mt levels. Perhaps we need a new catalyst to break above that area. Cash-3M last traded at a $8.25/mt contango (where cash is cheaper than 3M), switching from $9.20/mt backwardation last week’s closing trade. Farther down the curve, Dec ‘21/Dec ‘22 continued to show backwardation, suggesting that there are still few buyers for long-dated contracts. In general, we have seen less long-dated consumer hedging with both premiums and LME at high levels. |

|||||

|

|||||

|

The MW US Transaction premium set another all-time high by jumping to 34¢/lb last Friday. The CME MWP contract for August had a last trade of 33.5¢/lb at time of this writing. Market participants cite a worker strike at Rio Tinto’s Kitimat aluminum smelter for these recent ticks higher in MWP. Sky-high freight costs and other logistical issues have apparently caused the movement of metal to slow to a crawl. There are industry reports stating that most end users have purchased their short-term needs, but also that some are still scrambling for metal, with little to be found. Similar to the past several weeks, there was little MWP trading activity in Cal ‘22; the backwardation in the forward curve remains significant and makes inventory hedging expensive.

|

|||||

|

|

|||||

|

|||||

|

LME Copper 3M Select traded slightly lower this week, with last trade at $9,470/mt. The LME 3M contract traded in a similar range to last week, from $9,410/mt to $9,810/mt. We have bounced off the $9,011/mt low set during the week of June 21, but it appears that trade needs a new catalyst to break us out of the $9,000/mt to $10,000/mt range. Likewise, the market has been bouncing indecisively between $9,000/mt to $9,500/mt for the past five weeks. Some analysts are blaming the logistical issues due to flooding in China’s Henan province and supposedly dwindling Chinese stocks for the rise in prices this week. However, renewed hopes over stimulus efforts have failed to satisfy the market. The continued downtrend in Chinese equities, which normally has a correlated trade to copper, has also weighed on the red metal. Thus, copper has seen limited upside recently. The pending strike by Chilean copper miners should be watched closely, as well as the USD.

|

|||||

|

|

|||||

|

|||||

|

Nickel traded lower this week, closing below last week’s low price. Last trade on the LME 3M Select contract was $19,210/mt, with a trade range of $19,125/mt to $19,760/mt for the week. Like other base metals, nickel tends to benefit from industrial demand. However, like February’s trade, we seem to run into resistance at or slightly above the $19,900/mt level. New, positive fundamental news will likely need to occur to have a breakout above the $20,000/mt level. |

|||||

|

|

|||||

|

|

|||||

|

|||||

|

HRC steel traded in a wide band this week. As of this writing, the CME HRC futures contract for August ’21 last traded at $1885/T. Trade range was from $1,829/T to $1,888/T. Deferred, or longer-dated, contracts through the remainder of the year and into 2022 continue to show signs of backwardation. As we mentioned in the opening comments, let’s keep a close eye on the situation in South Africa. Opportunities remain open for HRC consumers to hedge future prices below the current spot price. For both producers and those carrying inventory, we continue to believe that buying put options remains the best structure to achieve protection against a major market correction. From a consumer perspective, buying calls can be used to protect against a continued rally. Using options with staggered strike prices allows for participation in a downward price correction. |

|||||

|

|

|||||

|

|

|||||

Notable News |

|||||

|

Volkswagen's top brands flag chip risk in months ahead Tesla-chaser Volkswagen lifts margin outlook again after record profit Asian Stock Market: China leads bulls amid stimulus hopes Steel output stays on growth track Copper price down as Chinese imports fall New hurdle slows $1 trillion infrastructure bill $1T infrastructure bill gets first action as senator dig in EMERGING MARKETS-Chile's peso jolted by Escondida strike fears Codelco ups production 14.9% in June, Escondida marks 11th month of drops South Africa Will Lift Force Majeure at Ports as Operations Resume |

|||||