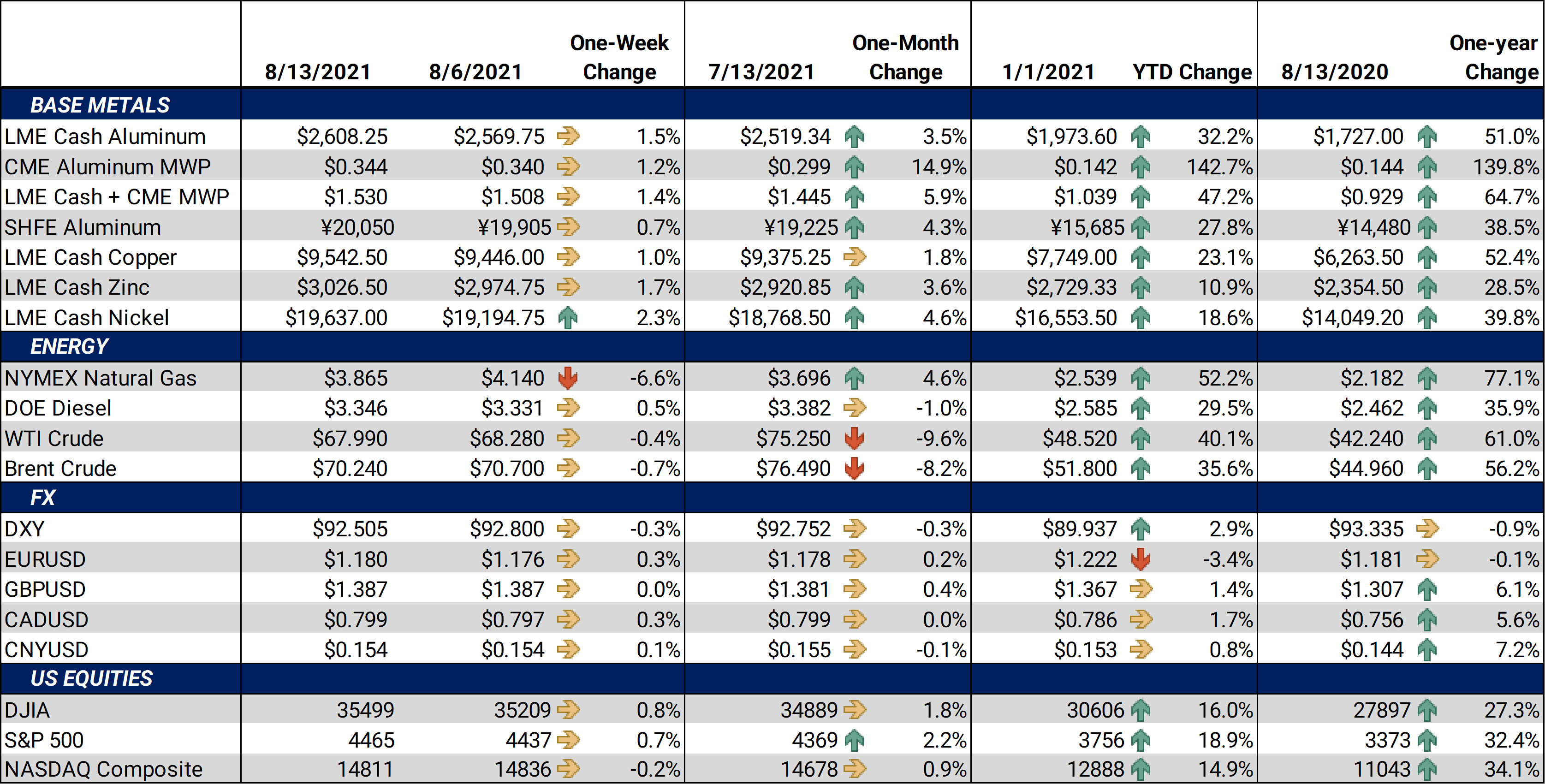

The aluminum Midwest Premium (MWP) set a new all-time high of 34.5¢/lb last Friday. Sky-high demand, supply constraints, Russian export tariffs, and workers strikes in Canada have fueled the rally in MWP that began last summer. This rally has eclipsed previous highs from 2015 by over 10¢/lb.At the beginning of the week, renewed fears over the Delta variant and a broad selloff in other commodities correlated in lower base metals prices. New strikes and resolutions at Chilean copper mines keep both LME and CME copper futures volatile on Tuesday through the remainder of the week. Despite the volatility, copper prices did not break out of the range they have had in the past two months.As for other base metals, LME Aluminum 3M Select surged on Friday to close at the highest weekly level in over 10 years! Nickel also gained traction this week, setting highs not seen mid-February 2021. |

Notable Metals News

In Canada, last week’s strike by border guards and customs officials lasted mere hours. Likewise, traffic jams and delays caused by the strike quickly dissipated. However, the worker strike which began in late July at Rio Tinto’s Kitimat aluminum smelter continues to impede metals shipments. The Kitimat strike, if left unresolved, should keep a bid under the aluminum MW premium.

And in Chile, union miners at the Caserones copper mine began a strike on Tuesday. Later that day, workers at BHP’s Escondida mine stated they had reached a tentative deal with the company on a new contract. On Thursday, the union for BHP’s miners formally agreed to and ratified a new contract. Also on Thursday, workers at Codelco’s Andina mine began a strike.

Last, in the US, the Senate passed the $1.2T infrastructure bill on Tuesday with a 69-30 vote. Of interest to metals processors are the $66 billion for trains, $65 billion to high-speed internet and $73 billion for clean energy. The bill now goes to the House of Representatives for debate. However, House Democrats are threatening to shelve the bill until the Senate can pass a budget.

Notable Economic Data

This week’s economic data started in China with the Sunday night releases of the Producer Price Index (PPI) and Consumer Price Index (CPI). Year-over-year July CPI was 1.0%, down from 1.1% in June. Year-over-year July PPI was 9.0%, up from 8.8% in June.

In the US, the year-over-year CPI for July, released on Wednesday, was unchanged from June at 5.4%. Released on Thursday, the year-over-year PPI for July was 7.8%, up from 7.2% in June. Consumer confidence, released on Friday, was 70.2, down from 81.2 last month.

| Bottom Line: | |||||

|

It seems that most metals markets (save for LME Aluminum and MWP) have run into upside resistance as summer begins to wind down. Worker strikes at Chilean copper mines and the Rio Tinto aluminum smelter in Canada, production slowdowns in China, worldwide logistical bottlenecks, and other “old news” are playing a part to keep aluminum, the MWP, and copper prices elevated. As for “new” news, one of China’s busiest ports partially shutdown late this week after a worker was found to be positive for COVID-19. This shutdown has already affected some metals shipments (specifically manganese flake). Market participants are worried about the potential for more shutdowns. On the macro front, although the dollar index has maintained a very tight range over the past several weeks, it is inching closer to the March 2021 high of 93.44. Even though it seems like greater forces than the USD are driving metals prices, a breakout to the upside could keep a cap on metals prices. The USD typically has an inverse relationship to metals prices. A strengthening dollar makes our goods more expensive for foreign buyers.

As always, COVID fears continue to dominate headlines, as the coronavirus delta variant continues to create havoc in Asia and certain areas of the US. New shutdowns could slow the demand for base metals. We continue to recommend that metal consumers layer in hedges in a disciplined manner and select between swaps or call options depending on their risk-management objectives. Option structures are generally preferred due to the recent rise in volatility. However, call options premiums have increased during this rally, so collars (selling put options to offset the cost of call options) are a logical strategy. We also suggest using limit orders along with reasonable stop-loss targets to add incremental protection if prices trend higher. |

|||||

|

|

|||||

LME Aluminum |

|||||

|

The LME 3M Select finished higher for the week, with last trade at $2,611/mt, and trade ranging from $2,538/mt to $2,622.50/mt. Cash-3M last traded at a $8.25/mt backwardation (where cash is higher than 3M), switching from $8.25/mt contango last week’s closing trade. Farther down the curve, Dec ‘21/Dec ‘22 continued to show backwardation, suggesting that there are still few buyers for long-dated contracts. In general, we have seen less long-dated consumer hedging with both premiums and LME at high levels. |

|||||

|

|||||

|

The MW US Transaction premium set another all-time high by jumping to 34.5¢/lb last Friday. The CME MWP contract for August ‘21 had a last trade of 33.5¢/lb at time of this writing. Market participants cite a worker strike at Rio Tinto’s Kitimat aluminum smelter for these recent ticks higher in MWP. Sky-high freight costs and other logistical issues have apparently caused the movement of metal to slow to a crawl. There are industry reports stating that most end users have purchased their short-term needs, but also that some are still scrambling for metal, with little to be found. Similar to the past several weeks, there was little MWP trading activity in Cal ‘22; the backwardation in the forward curve remains significant and makes inventory hedging expensive. |

|||||

|

|

|||||

|

|||||

|

LME Copper 3M Select traded higher this week, with last trade at $9,520/mt. The LME 3M contract traded in a narrower range than last week, from $9,273/mt to $9,620/mt. We have bounced off the $9,011/mt low set during the week of June 21, but it appears that trade needs a new catalyst to break us out of the $9,000/mt to $10,000/mt range. Copper seems to be trading off the same pieces of recent news, just with refreshed headlines. Strikes and resolutions at Chilean copper mines have had minimal impact on the market. Likewise, economic data for the US and China, flooding in China’s Henan province and other issues have done little to move prices higher or lower.

|

|||||

|

|

|||||

|

|||||

|

Nickel traded higher this week, closing below last week’s low price. Last trade on the LME 3M Select contract was $19,685/mt, with a trade range of $18,540/mt to $19,765/mt for the week. Like other base metals, nickel tends to benefit from industrial demand. However, like February’s trade, we seem to run into resistance at or slightly above the $19,900/mt level. New, positive fundamental news will likely need to occur to have a breakout above the $20,000/mt level. |

|||||

|

|

|||||

|

|

|||||

|

|||||

|

HRC steel traded in a narrow band this week. As of this writing, the CME HRC futures contract for August ’21 last traded at $1,880/T. Trade range was from $1,880/T to $1,892/T. Deferred, or longer-dated, contracts through the remainder of the year and into 2022 continue to show signs of backwardation. As we mentioned in the opening comments, let’s keep a close eye on the situation in South Africa. Opportunities remain open for HRC consumers to hedge future prices below the current spot price. For both producers and those carrying inventory, we continue to believe that buying put options remains the best structure to achieve protection against a major market correction. From a consumer perspective, buying calls can be used to protect against a continued rally. Using options with staggered strike prices allows for participation in a downward price correction. |

|||||

|

|

|||||

|

|

|||||

Notable News |

|||||

|

Canadian government, border staff reach deal, ending strike Global decarbonisation drive to challenge steel producers - Woodmac Column: China's imports are reshaping the global aluminium market Aluminium prices melt up on booming recovery in global economy Nonferrous scrap markets contend with volatility Union at Caserones copper mine in Chile to strike after talks collapse Copper price down as BHP and workers reach tentative wage deal at Escondida Power curbs in China's Guangxi seen shutting more aluminium capacity It's time to end the US steel and aluminum tariffs Unions at Codelco’s Andina mine set to walk off job on Thursday China Cu: Concentrate TC/RCs edge higher in slow trade China’s Ningbo port scrambles to limit Covid disruption Workers at Chile's Escondida mine approve new contract - company |

|||||