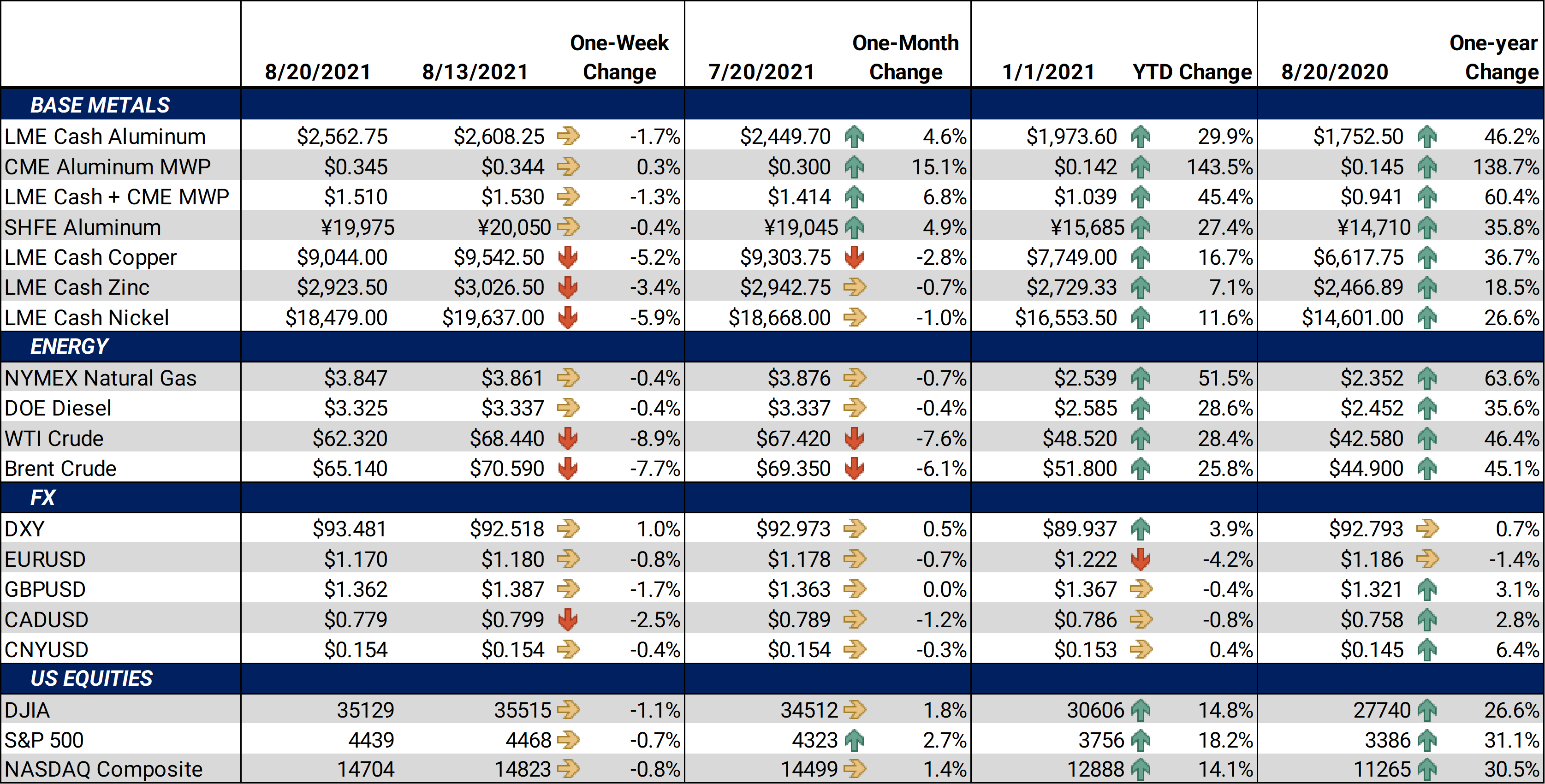

The aluminum Midwest Premium (MWP) reached another new all-time high of 34.75¢/lb on Wednesday. The MWP continues to find strength from a variety of “old” news, including sky-high demand, logistical issues, and worker strike at Rio Tinto’s Kitimat aluminum smelter in British Columbia. This proved to be the only bullish move forward for base metals this week, as disappointing economic data from China and the US combined in a broad selloff in energies and most base metals prices. |

Notable Metals News

Aluminum production regions in China are currently experiencing severe electricity supply crunches, due to an overwhelmed summertime power grid. Authorities have demanded that primary aluminum producers cut electricity consumption, thereby reducing production. Perhaps aided by this decreased utilization, domestic aluminum prices have held firm despite an economic slowdown.

Also in China, more partial port shutdowns are occurring due to port workers testing positive for COVID-19. Last week, the country’s third-busiest (Ningbo-Zhoushan) port reduced throughput because one worker tested positive. This week, three positive cases of COVID-19 affected the Alashankou port. Both shutdowns could affect metals shipments, specifically copper.

In Canada, Teck Resources has temporarily halted copper and molybdenum mining operations in south-central British Columbia due to wildfires in the area. The company was expecting copper production in this area to be between 128,000-133,000 mt in 2021. According to the company, no infrastructure is in danger; this is merely being done out of an abundance of caution.

Notable Economic Data

This week’s economic data for China and the US showed that both economies are slowing, which could weigh on metals prices. China data came first, with the Sunday night releases of industrial production and retail sales. Year-over-year July industrial production was 6.4%, down from 8.3% in June. Year-over-year retail sales was 8.5%, down from 12.1% in June.

On Tuesday, negative US data followed. Month-over-month retail sales for July were down 1.1% from June at 0.7%. Industrial production, also released Tuesday, was +0.9%, up from June’s read of -0.2%. Housing starts, released Wednesday, were 1.534M, but barely below analysts’ median estimate of 1.6M.

The US dollar index rallied this week, which correlated to lower metals prices. With the move this week, the USD finally broke through the upside technical resistance between 93.15 and 93.45 and is now trading at levels not seen since November 2020. The USD typically has an inverse relationship to metals prices. A strengthening dollar makes our goods more expensive for foreign buyers.

A new wrinkle in the Asian demand saga is the lack of arbitrage opportunities. For instance, selling from Southeast Asia into the US is largely unfeasible due to sky-high freight costs and container shortages. Thus, excess supplies could remain in Southeast Asia even with elevated demand and premiums (specifically the aluminum MWP) in the US.

| Bottom Line: | |||||

|

The bears won this week, as demand concerns overwhelmed production outages and supply-chain disruptions. Despite the production slowdowns and flooding issues in aluminum-producing areas of China, metals prices were pressured lower. New COVID lockdowns throughout southeast Asia have cooled metals demand and have created worsening logistical issues. This includes partial shutdowns at several of China’s busiest ports. We continue to recommend that metal consumers layer in hedges in a disciplined manner and select between swaps or call options depending on their risk-management objectives. Option structures are generally preferred due to the recent rise in volatility. However, call options premiums have increased during this rally, so collars (selling put options to offset the cost of call options) are a logical strategy. We also suggest using limit orders along with reasonable stop-loss targets to add incremental protection if prices trend higher. |

|||||

|

|

|||||

LME Aluminum |

|||||

|

This week’s trade wiped away last week’s gains. The LME 3M Select finished lower for the week, with last trade at $2,555/mt, and trade ranging from $2,516/mt to $2,638/mt. Cash-3M last traded at a $16.25/mt backwardation (where cash is higher than 3M), switching from $8.25/mt backwardation at last week’s closing trade. Farther down the curve, Dec ‘21/Dec ‘22 continued to show backwardation, suggesting that there are still few buyers for long-dated contracts. In general, we have seen less long-dated consumer hedging with both premiums and LME at high levels. |

|||||

|

|||||

|

The Midwest Premium set another high-water mark on Wednesday before stabilizing into Friday’s close. The CME MWP contract for August ‘21 had a last trade of 33.5¢/lb at time of this writing. There is plenty of “old” news such as the worker strike at Rio Tinto’s Kitimat aluminum smelter, sky-high freight costs and other logistical issues to keep the MWP elevated. Similar to the past several weeks, there was little MWP trading activity in Cal ‘22; the backwardation in the forward curve remains significant and makes inventory hedging expensive. |

|||||

|

|

|||||

|

|||||

|

LME Copper 3M Select traded lower this week, with last trade at $9,051.50/mt. The LME 3M contract traded in a wider range than last week, from $8,740/mt to $9,554.50/mt. From a chartists’ perspective, copper broke through the $9,000 support, and now trading at levels not seen since April. Copper seems to be trading off the same pieces of recent news, just with refreshed headlines. Strikes and resolutions at Chilean copper mines have had minimal impact on the market. Likewise, economic data for the US and China, flooding in China’s Henan province, and other issues have done little to move prices higher or lower.

|

|||||

|

|

|||||

|

|||||

|

Nickel traded lower this week, closing below last week’s low price. Last trade on the LME 3M Select contract was $18,425/mt, with a trade range of $18,345/mt to $19,695/mt for the week. Nickel is now trading at levels not seen since mid-July. Like other base metals, nickel tends to benefit from industrial demand. However, like February’s trade, we seem to run into resistance at or slightly above the $19,900/mt level. New, positive fundamental news will likely need to occur to have a breakout above the $20,000/mt level.

|

|||||

|

|

|||||

|

|

|||||

|

|||||

|

HRC steel traded in a narrow band this week. As of this writing, the CME HRC futures contract for August ’21 last traded at $1,880/T. Trade range was from $1,880/T to $1,895/T. Deferred, or longer-dated, contracts through the remainder of the year and into 2022 continue to show signs of backwardation. Opportunities remain open for HRC consumers to hedge future prices below the current spot price. For both producers and those carrying inventory, we continue to believe that buying put options remains the best structure to achieve protection against a major market correction. From a consumer perspective, buying calls can be used to protect against a continued rally. Using options with staggered strike prices allows for participation in a downward price correction. |

|||||

|

|

|||||

|

|

|||||

Notable News |

|||||

|

UPDATE 1-China aluminium output falls in July for third month on power squeeze China's power supply crunch seen hitting aluminum output, propping prices MJP aluminium spot premium slips on fall in demand, lower deals Tencent warns investors that China’s tech regulation will intensify China seeks to tighten rules on unfair internet competition, sending tech shares lower China Cuts Steel Production. How That Hurts Iron-Ore Prices. Analysis: Green-push dilemma: China's steel curbs could cripple price control efforts Commodity Slump Accelerates Amid Growth Fears and Fed Taper Talk

|

|||||