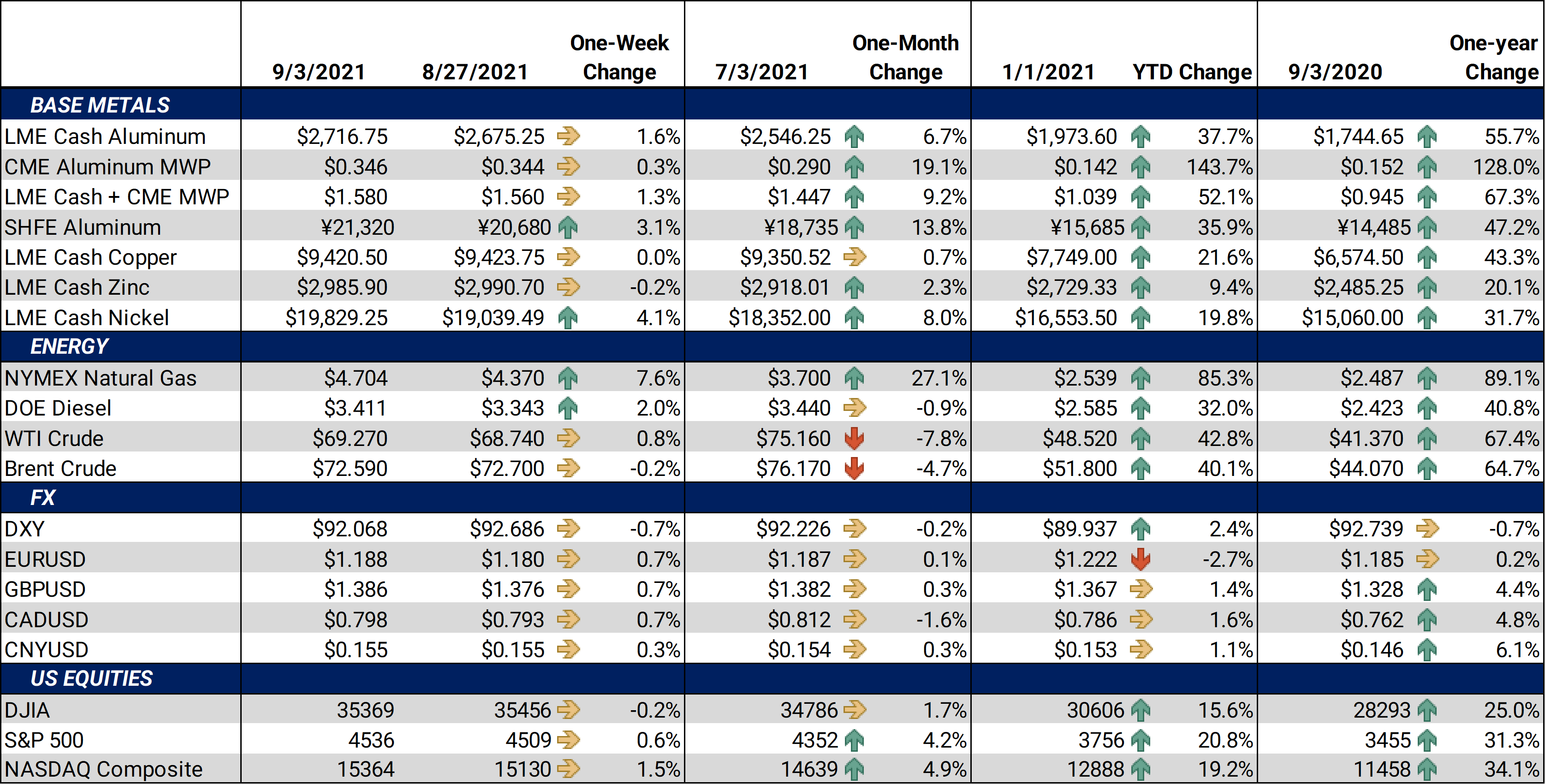

LME aluminum rallied to new highs for the year on Tuesday after the UK bank holiday on Monday. LME aluminum took cues from Monday’s trade on Shanghai (SHFE) aluminum futures, which rallied due to ongoing supply and logistical concerns. However, base metals prices fell on Wednesday as poor economic data from China continues to show their economy is slowing. Likewise, comments from the China Nonferrous Industry Association and Russia’s Industry and Trade deputy minister this week could cool future expectations of metal prices, especially aluminum and the MWP. Despite a weaker-than-expected US non-farm payrolls report on Friday morning, base metals rallied into the weekend. |

Notable Metals News

Chinese authorities continue to apply electricity-consumption restrictions on aluminum production regions, thereby hampering production. Aluminum production areas are currently experiencing severe electricity supply crunches, as the country looks reduce the carbon footprint of metals manufacturing. Similarly, some firms have cut production due to high electricity costs, which resulted from high LNG import prices.

|

Late last Friday, China’s National Food and Strategic Reserves Administration announced they will be selling 70,000 mt aluminum, 50,000 mt zinc, 30,000 mt copper in a series of auctions on September 1. This was the third such auction since early July 2021.

Finally, on September 1, the China Nonferrous Industry Association (CNIA) commented that they are concerned about speculation in aluminum, adding that the supply situation is not as tight as the market believes. Without getting specific, CNIA stated that the government can implement certain policies to stabilize commodity prices.

Russia's Industry and Trade deputy minister, Victor Evtukhov, stated earlier this week that Russia’s15% tariffs on metals exports will not be extended into 2022. He said metals prices have cooled, making a tariff extension unnecessary. We believe this export tariff has been a key catalyst for the rally in aluminum and MWP prices in recent months.

Lastly, in the US, several calcined petcoke producers and related suppliers have stopped or slowed production due to damage from Hurricane Ida. Calcined petcoke is a key input for aluminum production. If they persist, these outages could further strain an already tight aluminum market and support prices.

Notable Economic Data

This week’s economic data for the US was mixed; consumer confidence slipped, and payrolls disappointed, but a manufacturing indicator was optimistic. On Tuesday, consumer confidence was pegged at 113.8, down from last month’s reading 129.1. On Wednesday, the ISM Manufacturing Purchasing Managers Index, was 59.9, which is up from 59.5 last month. Lastly, on Friday, non-farm payrolls were 235,000, well below the forecasted 750,000 increase.

Chinese economic indicators were disappointing, too. In China, the Caixin Manufacturing Purchasing Managers Index (PMI), out Tuesday evening, was 49.2, which is down from 50.3 last month. Below 50.0 for the PMIs signal contraction for that sector. On Thursday evening, the Caixin Services PMI, was 46.7, down from 54.9 last month.

The US dollar index fell this week, which slightly aided the rally in base metals. The short-term support level 92.50 was breached this week, but longer-term support remains at 91.50. The USD typically has an inverse relationship to metals prices.

| Bottom Line: | |||||

|

A bullish charge out of the gate on Tuesday fizzled later in the week as economic data from China continues to show signs of weakening. However, a rally on Friday and subsequent high closes for the year on aluminum and nickel show that the bulls are still in charge. However, China’s efforts to cool inflation and speculation could be a catalyst to pause or reverse the recent rally. That said, supply imbalances continue to be a driver in the markets. Covid-19 lockdowns, which have cooled metals demand and created worsening logistical issues, remain prevalent throughout Southeast Asia. The issues of Southeast Asia have had the opposite effect in the US, as our markets continue to be tight. High freight costs have driven away arbitrage opportunities, hence supply imbalances persist. We continue to recommend that metal consumers layer in hedges in a disciplined manner and select between swaps or call options depending on their risk-management objectives. Option structures are generally preferred due to the recent rise in volatility. However, call options premiums have increased during this rally, so collars (selling put options to offset the cost of call options) are a logical strategy. We also suggest using limit orders along with reasonable stop-loss targets to add incremental protection if prices trend higher. |

|||||

|

|

|||||

LME Aluminum |

|||||

|

This week’s trade set new highs for 2021, including a new high weekly close. The last trade on the LME 3M Select was $2,733/mt, with trade ranging from $2,661/mt to $2,734.50/mt. Cash-3M last traded at a $10.25/mt contango (where cash is lower than 3M). This was a big shift in the forward curve; last Friday, there was $25.75/mt of backwardation. Short-term consumer hedges could be affected, so contact AEGIS to discuss the details. Farther down the curve, Dec 2021/Dec 2022 continued to show backwardation, so the longer-term consumer hedge discount is still available. |

|||||

|

|||||

|

The CME MWP contract for September 21 had a last trade of 34¢/lb at time of this writing, which is unchanged on the week. Reminiscent of the past several weeks, the market continues to be driven by “old” news. This includes the worker strike at Rio Tinto’s Kitimat aluminum smelter, sky-high freight costs and other logistical issues, which keep the MWP elevated. Similar to the past several weeks, there was little MWP trading activity in Cal ‘22; the backwardation in the forward curve remains significant and makes inventory hedging expensive. |

|||||

|

|

|||||

|

|||||

|

Last trade for the LME 3M Select was $9,470/mt, and trade ranging from $9,275/mt to $9,546.50/mt. From a chartists’ perspective, resistance continues to be the mid-August high trade of $9,554.50/mt. The supply-demand picture for copper has not changed a great deal in recent weeks as economic data for the US and China show that both economies are slowing, which could hinder metals prices.

|

|||||

|

|

|||||

|

|||||

|

Similar to aluminum, this week’s nickel trade set a new high weekly close for 2021. Last trade on the LME 3M Select contract was $19,875/mt, with a trade range of $19,155/mt to $19,940/mt for the week. Like other base metals, nickel tends to benefit from industrial demand. Chartists will look at February’s high of $20,110/mt as the next key resistance level. New, positive fundamental news will likely need to occur to have a breakout above the $20,000/mt level. |

|||||

|

|

|||||

|

|

|||||

|

|||||

|

HRC steel rallied this week. As of this writing, the CME HRC futures contract for September ‘21 last traded at $1,944/T, up $3 for the week. Trade range was from $1,916/T to $1,945/T. Deferred, or longer-dated, contracts through the remainder of the year and into 2022 continue to be backwardated. Opportunities remain open for HRC consumers to hedge future prices below the current spot price. For both producers and those carrying inventory, we continue to believe that buying put options remains the best structure to achieve protection against a major market correction. From a consumer perspective, buying calls can be used to protect against a continued rally. Using options with staggered strike prices allows for participation in a downward price correction. |

|||||

|

|

|||||

|

|

|||||

Notable News |

|||||

|

'Power up' for China's energy storage sector The Crypto Craze: China’s Ban Came None Too Soon U.S. begins detaining solar panel imports over concerns about forced labor in China Shanghai aluminum price hits 13-year high on supply worries in China UPDATE 2-China to auction 150,000 T of metal from state reserves on Sept 1 China to auction more copper, zinc, aluminium reserves Aluminum Hurtles Toward Decade High as Supply Concerns Mount Russia does not plan to apply elevated export duty on metals in 2022: official Analysis: High LNG prices trigger gas demand destruction in China's downstream sectors Copper price down as China factory activity slows

|

|||||