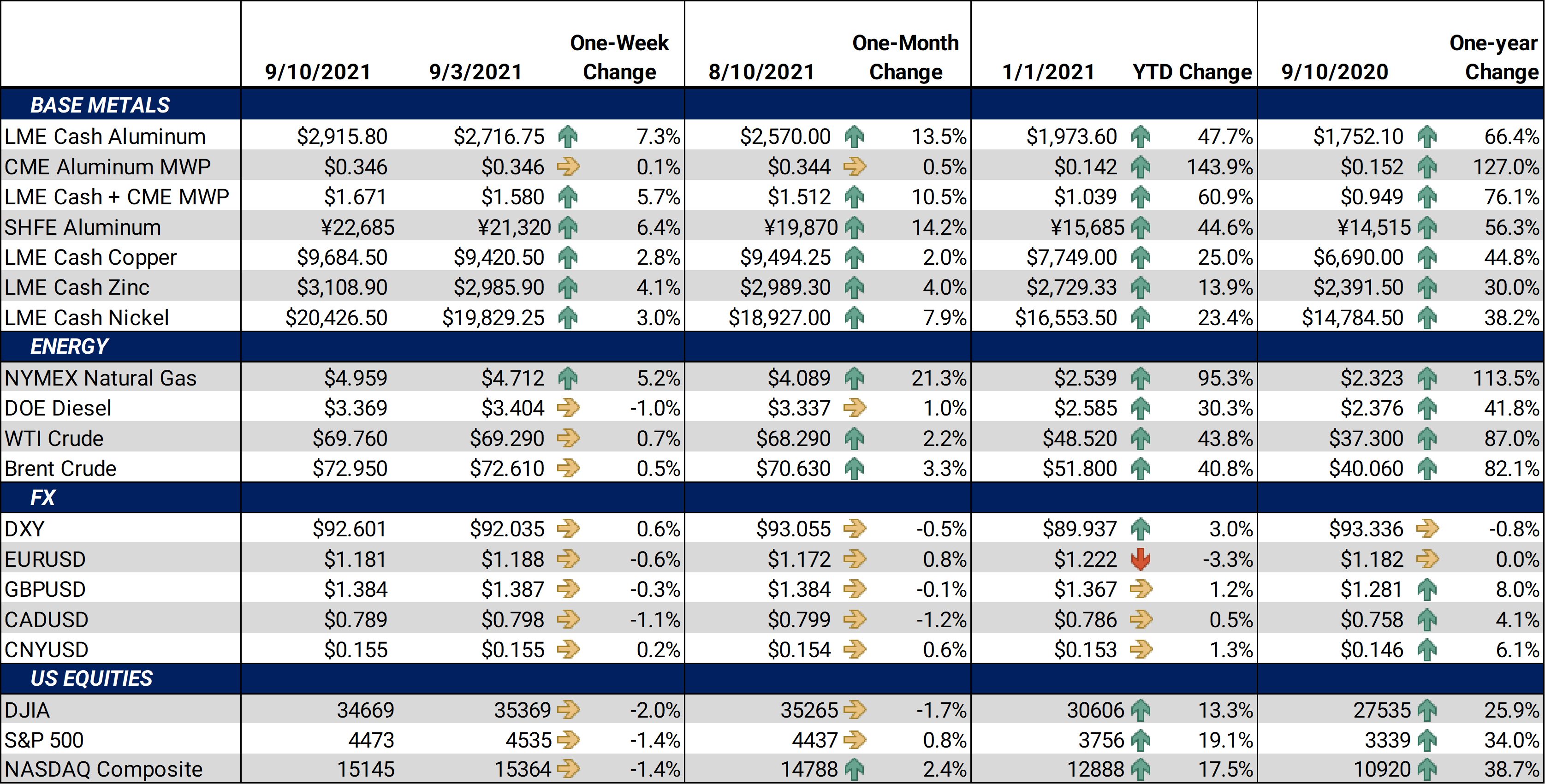

Both nickel and aluminum set new highs for the year this week. “Old” news such freight costs and logistical issues continue to dominate the headlines and direction of trade. LME aluminum, alarmed by the political coup in Guinea, rallied to new highs for the year on Monday during the US Labor Day holiday. This strength continued throughout the week, as economic data from China showed bright spots in their economy. Likewise, metals bulls cheered the news of a diplomatic phone call between President Biden and China President Xi Jinping, which could signal an easing of tensions between the two nations. |

Notable Metals News

A political coup occurred in Guinea last weekend, which market participants initially feared could disrupt bauxite supplies to China. Bauxite, an important ore from which aluminum is produced, is a major export of Guinea. The country produced 84 million metric tons of the ore in 2020, making it the world’s largest producer of the ore. Likewise, historically over half of China’s bauxite imports come from Guinea. However, leaders of the coup ensured mining companies that contracts with the state will be honored. Leadership has also asked miners to keep operating as normal, saying seaborne exports will not be disrupted.

The European Union (EU) is pushing for the US to end some Section 232 tariffs by the end of 2021. The current 25% import tariff was set in place in 2018, implemented by then-President Trump. The EU hopes to convince US authorities to replace this tariff with a tariff-rate quota. (A tariff-rate quota is a two-tiered tariff mechanism in which a pre-determined quantity of a good is set at one tariff, and any quantity above that number has a higher tariff.) This is potentially bearish for HRC Steel, as additional imports from Europe could ease supply constraints.

Automobile production in the US has dipped in September, due to ongoing chip shortages. Toyota said its Blue Springs, Mississippi plant will be shutting down for three weeks this month. Likewise, General Motors said it will idle production at several plants for two weeks this month. Prolonged shutdowns could be bearish for HRC Steel and aluminum.

Lastly, in the US, several calcined petcoke producers and related suppliers have restarted production. These plants were initially shut down due to damage from Hurricane Ida. Calcined petcoke is a key input for aluminum production. If the outages persist, they could further strain an already-tight aluminum market and support prices. .

Notable Economic Data

This week’s Chinese economic indicators were mixed. Total exports, released Monday evening, were up 25.6% year-over-year, up from 19.3% last month. It was the largest export figure ever announced for the country. Imports were also up, 33.1% year-over-year, up from 28.1% last month.

Chinese prices surged. The Producer Price Index (PPI) jumped by 9.5% year over year, and up from 9.0% last month. The prices apparently did not get passed on to the consumer yet, as year-over-year CPI was up 0.8%, but down from 1% last month.

This week’s US economic indicators were positive. Year-over-year PPI was up 8.3%, higher than the 8.2% analysts’ estimate. Likewise, month-over-month PPI was up 0.7%, also higher than the 0.6% analysts’ estimate

The US dollar index rallied this week; however, metals seemed be unfazed by the rally. The short-term support level is now 92.00, with resistance at 93.50 and 93.75. The USD typically has an inverse relationship to metals prices. A strengthening dollar makes dollar-denominated commodities more expensive for foreign buyers.

| Bottom Line: | |||||

|

A bullish charge out of the gate during our holiday on Monday persisted through the week. Positive economic news from China likely held the most sway. Since bauxite shipments will continue as Guinea transitions to a new government, aluminum production in China and elsewhere should not be affected by this alone. However, recent aluminum production cuts in China due to electricity supply crunches seem to be a key driver on keeping their domestic metals prices elevated. That said, China’s efforts to cool inflation and speculation could be a catalyst to pause or reverse the recent rally. We continue to recommend that metal consumers layer in hedges in a disciplined manner and select between swaps or call options depending on their risk-management objectives. Option structures are generally preferred due to the recent rise in volatility. However, call options premiums have increased during this rally, so collars (selling put options to offset the cost of call options) are a logical strategy. We also suggest using limit orders along with reasonable stop-loss targets to add incremental protection if prices trend higher. |

|||||

|

|

|||||

LME Aluminum |

|||||

|

This week’s trade set new highs for 2021, including a new high weekly close. The last trade on the LME 3M Select was $2,927.50/mt, with trade ranging from $2,734/mt to $2,937/mt. Cash-3M last traded at a $8.20/mt contango (where cash is lower than 3M), narrowing from last week’s trade of $10.25/mt contango. The forward curve has been quite volatile recently, as it has had an over $35 swing from backwardation to contango since August 27. Short-term consumer hedges could be affected, so contact AEGIS to discuss the details. Farther down the curve, Dec 2021/Dec 2022 continued to show backwardation, so the longer-term consumer hedge discount is still available. |

|||||

|

|||||

|

The CME MWP contract for September 21 had a last settlement of 34.5¢/lb at time of this writing, which is unchanged on the week. Bottlenecks such as sky-high freight costs, lack of trucking and recent calciner outages keep the MWP elevated. Similar to the past several weeks, there was little MWP trading activity in Cal ‘22; the backwardation in the forward curve remains significant and makes inventory hedging expensive. |

|||||

|

|

|||||

|

|||||

|

Last trade for the LME 3M Select was $9,687.50/mt, and trade ranging from $9,208/mt to $9,738/mt. From a chartists’ perspective, resistance is now the late-July high trade of $9,924/mt. The supply-demand picture for copper has not changed a great deal in recent weeks despite production cuts in China and continued price strength in other base metals. Price action has been essentially sideways for the past several weeks. Perhaps a new catalyst is needed to break out of the recent range.

|

|||||

|

|

|||||

|

|||||

|

Similar to aluminum, this week’s nickel trade set a new high weekly close for 2021. Last trade on the LME 3M Select contract was $20,390/mt, with a trade range of $19,415/mt to $20,705/mt for the week. Chartists will note that we finally breached February’s high of $20,110/mt. |

|||||

|

|

|||||

|

|

|||||

|

|||||

|

HRC steel futures were down slightly this week. As of this writing, the CME HRC futures contract for September ‘21 last traded at $1,927/T, down $14 for the week. Trade range was from $1,920/T to $1,935/T. Deferred, or longer-dated, contracts through the remainder of the year and into 2022 continue to be backwardated. Opportunities remain open for HRC consumers to hedge future prices below the current spot price. For both producers and those carrying inventory, we continue to believe that buying put options remains the best structure to achieve protection against a major market correction. From a consumer perspective, buying calls can be used to protect against a continued rally. Using options with staggered strike prices allows for participation in a downward price correction. |

|||||

|

|

|||||

|

|

|||||

Notable News |

|||||

|

Guinea junta plans unity government, reassures mining firms China's economy gets welcome boost from surprisingly strong Aug exports China’s August exports growth unexpectedly picks up speed in boost to economy Record Chinese coal futures signal need to boost output: Kemp Factbox: China takes contingency measures to shore up generation fuel supply Latin American furnaces burning brighter in 2021 Major automakers fear the global chip shortage could persist for some time GM temporarily shuts down North American factories because of chip shortage Toyota plant in Mississippi begins 3-week production break GM to halt production at nearly all North America assembly plants due to new chip problem

|

|||||