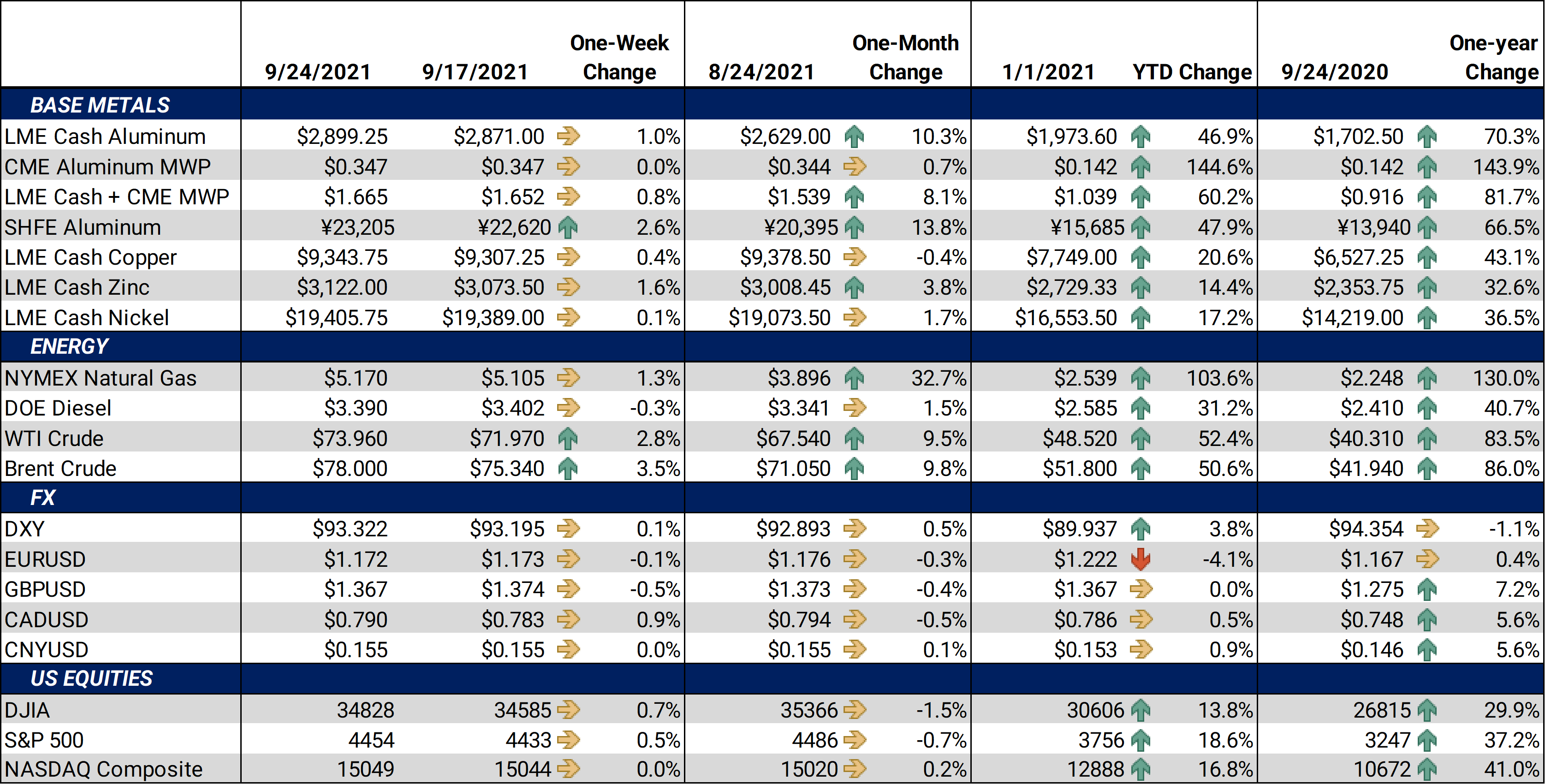

Base metals were volatile this week as most of the news centered around the potential bankruptcy and defaults of Evergrande, a Chinese real estate firm, which has $300 billion in liabilities. Base metals slid on Monday and Tuesday over concerns of a potential bond interest payment default. Then, news that Evergrande agreed on terms for one of its bond interest payments sent copper and aluminum soaring on Wednesday. Both were up 3% on the day.In its Wednesday afternoon statements on interest rate and monetary policies, the Federal Reserve was very vague regarding the tapering of its bond-buying program. Short-term rates were left unchanged, which was widely expected. Metals, unlike equities, had little reaction to the news. |

Notable Metals News

There was bullish aluminum supply-side news out of China. Yunnan Aluminum said it will not make its 2021 production goals, and volumes will be lower last year. The company has taken nearly 770,000 mt/yr of primary aluminum smelting capacity offline this year. Other aluminum smelters have made similar production cut announcements. Electricity consumption restrictions in China have forced aluminum smelters to dramatically reduce production. China is looking to restrict emissions from metals manufacturing.

But production is still up this year compared to last year. The International Aluminum Institute’s (IAI) monthly bulletin stated that global aluminum production for August was 5.699 million metric tonnes, up 3.14% year-over-year. The daily average production was 183,000 metric tonnes. Chinese production was nearly 58% of the global total, at 3.299 million metric tonnes.

Elsewhere, a freight train derailment in Guinea’s capital early Monday might affect some bauxite shipments. Both trains were owned and operated by Rusal, a large Russian aluminum producer. One train is known to have been carrying bauxite at the time. Bauxite is a main ore from which aluminum is produced. The accident has not affected mining operations, according to Rusal. Local authorities are currently investigating the cause of the accident.

| Bottom Line: | |||||

|

Base metals were mixed this week as the markets grapple with potential fallout of the Evergrande situation. China’s real estate sector is a large end user of base metals, so metals demand could be affected if real estate prices or demand begins to wane. Likewise, any negative affect on the larger economy could also metals demand and prices. There is a bright spot for end users who are staring at much higher steel, aluminum, and copper prices recently. Those markets are severely backwardated, meaning future prices are much less expensive than near-term prices. Therefore, end users can hedge forward purchases at a sizable discount to the cash markets. As for tactics, zero-cost collars (selling put options to offset the cost of call options) could be a logical strategy. We also suggest using limit orders along with reasonable stop-loss targets to add incremental protection if prices trend higher. |

|||||

|

|

|||||

LME Aluminum |

|||||

|

Aluminum prices keep moving up. The LME 3M Select set a new high close for the year on Thursday, closing at $2,956. The last trade on the LME 3M Select was $2,929/mt, with trade ranging from $2,831/mt to $2,977.50/mt. Cash-3M last traded at a $16.25/mt contango (where cash is lower than 3M), widening from last week’s trade of $13.50/mt contango. Volatility in the nearby forward curve has slowed in the past two to three weeks. The forward curve is relatively flat in the short-term, but the latter half of 2022 and beyond is still quite backwardated. Thus, longer-term consumers can still hedge at discount to the cash and nearby market. |

|||||

|

|||||

|

The CME MWP contract for September ‘21 had a last settlement of 34.675¢/lb at time of this writing, which is unchanged on the week. Frictions in the aluminum supply chain tend to raise MWP prices. End-users are still plagued with the same issues such as sky-high freight costs, but demand, especially for the automotive sector, seems to be waning. The MWP forward curve is relatively flat, compared to LME aluminum. |

|||||

|

|

|||||

|

|||||

|

Last trade for the LME 3M Select was $9,355/mt, and trade ranging from $8,810/mt to $9,407/mt. From a chartists’ perspective, resistance may be the late-July high trade of $9,924/mt. Copper had a volatile week but ultimately neither gained nor lost much ground. It has largely traded sideways since late-July. News from China seems to be mixed. Overall, copper seems to have little fundamental reason to advance or decline.

|

|||||

|

|

|||||

|

|||||

|

Nickel was down slightly for the week. Last trade on the LME 3M Select contract was $19,205/mt, with a trade range of $18,395/mt to $19,545/mt for the week. |

|||||

|

|

|||||

|

|

|||||

|

|||||

|

HRC steel futures traded slightly higher this week. As of this writing, the CME HRC futures contract for September ‘21 last traded at $1,933/T, down $3 for the week. Trade range was from $1,915/T to $1,937/T. Deferred, or longer-dated, contracts through the remainder of the year and into 2022 continue to be backwardated. Opportunities remain open for HRC consumers to hedge future prices below the current spot price. For both producers and those carrying inventory, zero or low-cost collars or swaps are currently the best structure to achieve protection against a major market correction. |

|||||

|

|

|||||

|

|

|||||

Notable News |

|||||

|

Evergrande's debt crisis is wreaking havoc on Hong Kong's stock market $US90 iron ore sinks ASX with no sign of stability High-Pressure Week for Global Markets Starts With Steep Losses Iron ore price collapses below $100 as China extends environment curbs Evergrande begins repaying wealth product investors with property Evergrande unit to make $35.9M onshore coupon payment on Sept 23 Beijing unlikely to save Evergrande, report says China's Evergrande meets crucial debt deadline but another looms Imminent China Evergrande deal will see CCP take control Federal Reserve holds interest rates steady, says tapering of bond buying coming ‘soon’ Steelmakers Capitalize Record Prices to Spend Big on New Mills One dead as bauxite trains collide in Guinea Chip shortage expected to cost auto industry $210 billion in revenue in 2021

|

|||||