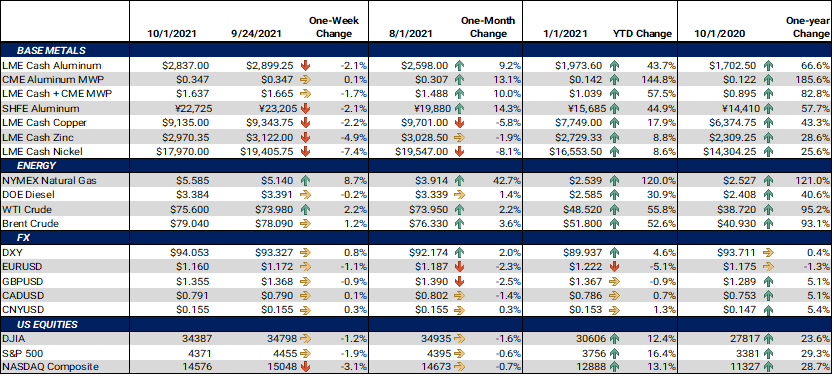

Base metals were largely lower this week as a stock market selloff likely weighed on metals prices. Likewise, metals markets also pushed lower on reports that the Chinese government implemented new electricity cuts on parts suppliers to Apple and Tesla.The US Dollar’s inverse relationship to metals prices could have weighed on metals trade as well. After trading in a tight range over the past several months, the US Dollar Index surged and set new highs for the year on Wednesday and Thursday. This might have accelerated the selloff, which began on Monday.U.S. government action (or inaction) had a mixed influence. Jitters over a potential government shutdown likely weighed on prices early in the week. Friday’s trade seemed to shrug off the US House of Representatives’ failure to vote on the $1.2 trillion infrastructure bill Thursday night. LME copper, nickel and aluminum closed higher on that day. |

Notable Metals News

Potentially bearish aluminum supply-side news occurred in Canada. A deal was finally struck to potentially end the workers strike at Rio Tinto’s Kitimat aluminum smelter in British Columbia. In a joint statement released last weekend, the parties stated the labor union “will present the proposed Agreement to their members, with a vote to seek its ratification planned in the coming days.” The strike began in late July 2021 after discussions over grievances broke down.

Potentially bearish aluminum supply-side news occurred in Canada. A deal was finally struck to potentially end the workers strike at Rio Tinto’s Kitimat aluminum smelter in British Columbia. In a joint statement released last weekend, the parties stated the labor union “will present the proposed Agreement to their members, with a vote to seek its ratification planned in the coming days.” The strike began in late July 2021 after discussions over grievances broke down.

US aluminum tariffs should be eliminated, not replaced with tariff-rate quotas, said the US Aluminum Association at its September 30 annual meeting. A tariff-rate quota is a two-tiered tariff mechanism in which a pre-determined quantity of a good is set at one tariff, and any quantity above that number has a higher tariff. US aluminum industry professionals have been examining ways to resolve issues regarding the Section 232 tariffs. The association also suggests that the tariffs should be phased out over a three-year period.

The US House of Representatives failed to vote on the infrastructure bill Thursday night. House members were set to reconvene Friday for further debate. Of interest to metals processors are the $66 billion for trains, $65 billion to high-speed internet and $73 billion for clean energy.

Finally, in China, electricity-consumption restrictions are now being put upon metals end users. Unimicron Technology, a semiconductor supplier to Apple, halted production at three subsidiaries for three days this week. Other semiconductor suppliers to Apple and Tesla implemented similar production cutbacks this week. These measures comply with national and local mandates as the country looks to reduce the carbon footprint of its manufacturing base.

| Bottom Line: | |||||

|

Base metals pushed lower this as outside markets seemed to outweigh supply concerns. The USD had decoupled from metals prices over the past several weeks, as metals prices pushed higher while the USD traded in a very tight range. However, it seems the old inverse relationship has rekindled. If the USD rally continues, it may weigh metals prices. However, changes in demand should not be ignored. Power supply crunches in China have changed from a largely bullish factor to a now neutral factor. Metals production cuts due to electricity are bullish as supply decreases. However, electricity cuts on metals end users are bearish as such cuts curtail demand. HRC Steel, aluminum, copper markets remain severely backwardated, meaning deferred contracts are cheaper than nearby contracts. This gives end users the opportunity to hedge forward purchases at a sizable discount to the cash markets. As for tactics, zero-cost collars (selling put options to offset the cost of call options) could be a logical strategy. We also suggest using limit orders along with reasonable stop-loss targets to add incremental protection if prices trend higher. |

|||||

|

|

|||||

LME Aluminum |

|||||

|

Aluminum prices slid this week. The last trade on the LME 3M Select was $2,873/mt, with trade ranging from $2,825/mt to $2,949.50/mt. Cash-3M last traded at a $20/mt contango (where cash is lower than 3M), widening from last week’s trade of $16.25/mt contango. The nearby forward curve has flattened, and volatility has slowed dramatically in the past several weeks. However, the latter half of 2022 and beyond is still quite backwardated. Thus, longer-term consumers can still hedge at discount to the cash and nearby market. |

|||||

|

|||||

|

The CME MWP contract for October ‘21 had a last settlement of 34.250¢/lb at time of this writing. The MWP has stalled for the past several weeks, as demand in the US seems to be slowing. However, supply-chain issues such as high freight costs and related trucking shortages are still supportive. The MWP forward curve remains relatively flat, compared to LME aluminum. |

|||||

|

|

|||||

|

|||||

|

Last trade for the LME Copper 3M Select was $9,154/mt, and trade ranging from $8,876.50/mt to $9,431/mt. From a chartists’ perspective, resistance may be the late-July high trade of $9,924/mt. Copper pushed lower this week, closing at its lowest weekly level since mid-August. A stronger US Dollar likely aided in pushing copper prices lower. We should also continue to watch the evolving situation in China’s real estate sector, as the Evergrande crisis has not faded from the headlines.

|

|||||

|

|

|||||

|

|||||

|

Nickel was down for the week. Last trade on the LME 3M Select contract was $18,040/mt, with a trade range of $17,705/mt to $19,375/mt for the week. |

|||||

|

|

|||||

|

|

|||||

|

|||||

|

HRC steel futures traded slightly higher this week. As of this writing, the CME HRC futures contract for October ‘21 last traded at $1,916/T, up $51/T for the week. Trade range was from $1,855/T to $1,916/T. Deferred, or longer-dated, contracts through the remainder of the year and into 2022 continue to be backwardated. Opportunities remain open for HRC consumers to hedge future prices below the current spot price. For both producers and those carrying inventory, zero or low-cost collars or swaps are currently the best structure to achieve protection against a major market correction. |

|||||

|

|

|||||

|

|

|||||

Notable News |

|||||

|

Nickel, tin fall extend losses on China demand worries Nickel falls with most metals as China power crunch spreads S&P 500 books worst daily slump in about 4 months as bond yields climb PBOC promises to protect consumers as China Evergrande teeters Evergrande's electric car company is having trouble paying its suppliers Deal reached to end 2-month Kitimat smelter strike Tentative deal reached in 2-month-old Kitimat aluminum strike Agreement in principle reached by Rio Tinto and Unifor Local 2301 China rocked by power crunch as Apple and Tesla suppliers suspend work Alcoa To Restart Alumar Aluminium Refinery In Brazil After Six Year Shutdown China’s cuts again affect global steel output Pelosi delays a vote on infrastructure as Democrats haggle over larger spending bill

|

|||||