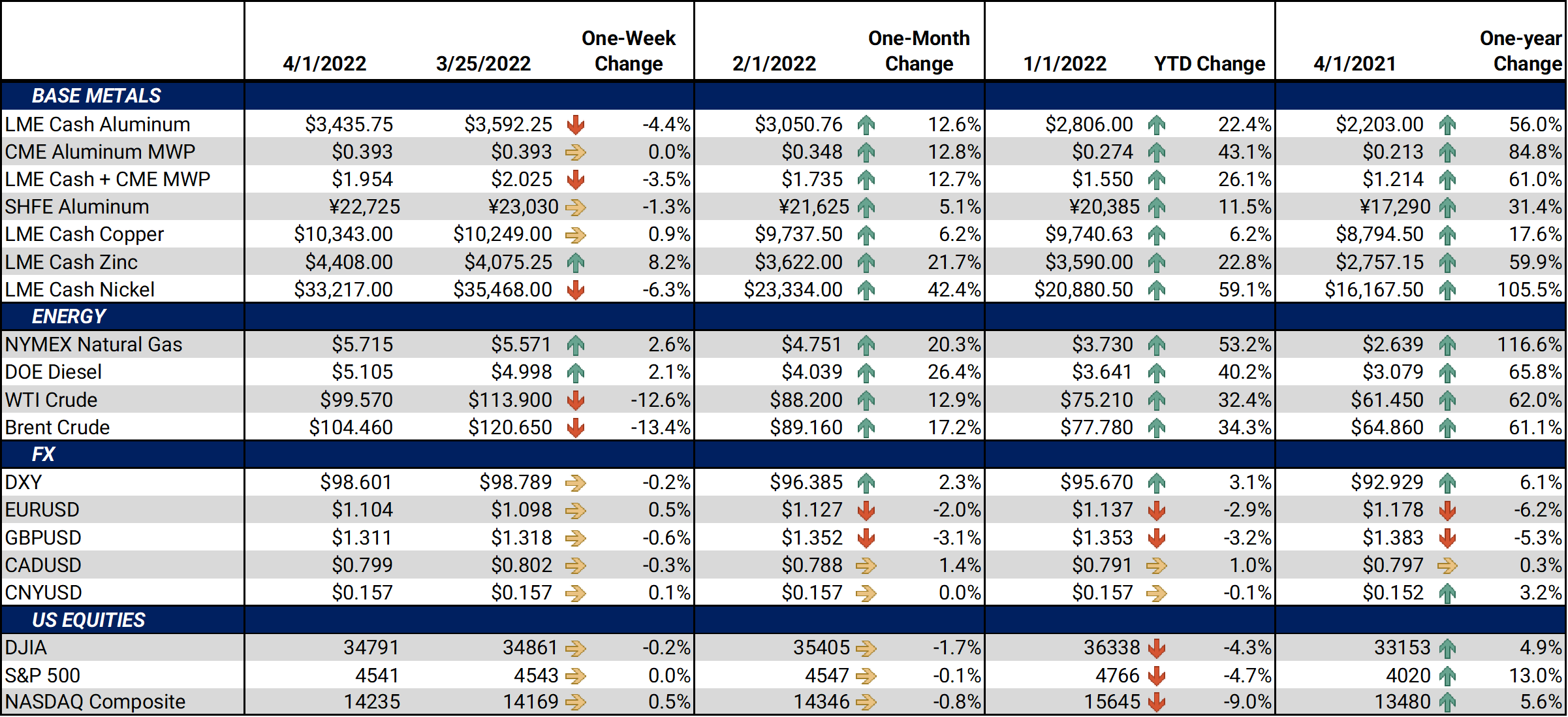

Bottom Line:Aluminum just had its biggest quarterly price gain since 1988, finishing up nearly 25% in Q1. This price gain is largely due to the Russia-Ukraine conflict. Rusal, the Russian aluminum producer which is the largest producer outside of China, is experiencing logistical issues and Western sanctions that have hampered its ability to source bauxite and alumina. Bauxite is the ore that is refined into alumina, and alumina is then processed into aluminum. |

|

|

|

|

|

|

Notable Metals News

Rusal has had problems with sourcing bauxite in recent weeks. Ore shipments from Rusal’s three bauxite mines in Guinea have “ground to a halt,” according to Reuters. Rusal has not commented on why shipments from the West African country have slowed. Some bauxite produced in Guinea is shipped to Rusal’s alumina plant in southern Ukraine; however, that plant is closed due to the ongoing conflict. No bauxite mines have been shut down, so ore is being stockpiled. The operations in Guinea represented approximately 50% of the company’s bauxite production, according to the 2021 operating results released this week. This slowdown in bauxite shipments compounds the problems Rusal is facing with sourcing input materials.

The company is having similar problems with obtaining alumina. Early last week Australia banned exports of alumina to Russia, according to Reuters. At that time, it was unclear if the Rusal could access alumina produced from their Australian joint venture with Rio Tinto. However, anonymous sources cited by Bloomberg reported that Rusal cannot source alumina from the JV, nor ship or sell it elsewhere. It is currently unclear what will happen to Rusal’s portion of production. In 2020, Rusal’s portion of production was 740,000 mt, according to their annual report. This moves hurts both Rusal’s revenue potential and could also tighten the global aluminum supply chain.

However, Rusal is forging new relationships to source aluminum inputs. Chinese traders have sold 30,000 mt of alumina to Rusal in recent weeks, according to Bloomberg. China rarely exports Alumina, as it is more profitable to use in domestic aluminum production. This modest tonnage was meant to “test whether the cargoes face any logistics issues or problems with sanctions, with more ready to ship if all goes well,” according to anonymous traders cited by Bloomberg.

|

|

|||||

|

|

|||||

LME Aluminum |

|||||

|

LME Aluminum 3M settled at $3,450/mt, down $155/mt on the week. The forward curve for LME Aluminum is currently quite backwardated, meaning that spot prices are higher than futures prices. A backwardated forward curve favors the consumer hedger. The aluminum market has sufficient liquidity to use swaps and options. Consumers might consider strategies that use only swaps or options or a combination of both, depending upon your risk tolerance. Please contact AEGIS for specific strategies that fit your operations. |

|||||

|

|||||

|

The prompt month (March) last settled at 40¢/lb this week. The CME Midwest Premium swap market is thinly traded, and there is no options market. Hedging in this market is tricky, so we recommend using strategically placed limit orders. Please contact AEGIS for specific strategies that fit your operations.

|

|||||

LME Copper |

|||||

|

LME Copper 3M settled at $10,353.5/mt, up $86.50/mt on the week. The forward curve for LME Copper is currently quite backwardated, meaning that spot prices are higher than futures prices. A backwardated forward curve favors the consumer hedger. The copper market has sufficient liquidity to use swaps and options. Consumers might consider strategies that use only swaps or options or a combination of both, depending upon your risk tolerance. Please contact AEGIS for specific strategies that fit your operations.

|

|||||

|

|||||

|

LME Nickel 3M settled at $33,223/mt, down $2,268/mt on the week. Like LME copper and aluminum, the forward curve for LME Nickel is currently backwardated, meaning that spot prices are higher than futures prices. A backwardated forward curve favors the consumer hedger. The nickel market has sufficient liquidity to use swaps and options. Consumers might consider strategies that use only swaps or options or a combination of both, depending upon your risk tolerance. Please contact AEGIS for specific strategies that fit your operations. |

|||||

|

|

|||||

|

|

|||||

CME Hot Rolled Coil (HRC) Steel |

|||||

|

The prompt month (March) last traded at $1,540/T, up $42/T on the week. For CME HRC Steel, liquidity is low for swaps, but hedging can still be done with strategically placed limit orders. The same is true for options. Similar to other metals, a combination of both swaps and options might work in certain cases, depending upon your risk tolerance. Please contact AEGIS for specific strategies that fit your operations. |

|||||

|

|

|||||

AEGIS Insights |

|||||

|

03/23/2022: AEGIS Factor Matrices: Most important variables affecting metals prices 03/23/2022: Russian Metals Production and Related News: Most Recent Developments (AEGIS Reference) |

|||||

Notable News |

|||||

|

3/24/2022: Nickel turmoil is back as prices spike 15% again to hit limit 3/24/2022: LME benchmark nickel jumps 15%, hits price limit in thin market 3/23/2022: U.S. not looking to renegotiate Trump-era steel quotas with South Korea, says Raimondo 3/23/2022: LME benchmark nickel spikes 15% to hit limit up 3/22/2022: METALS-Supply fears lift aluminium, nickel shows signs of normalising 3/22/2022: LME says it has no current plans to ban Russian metal from its system 3/20/2022: Australia bans alumina exports to Russia, sources coal for Ukraine 3/18/2022: LME’s copper industry group recommends banning Russian metal |

|||||