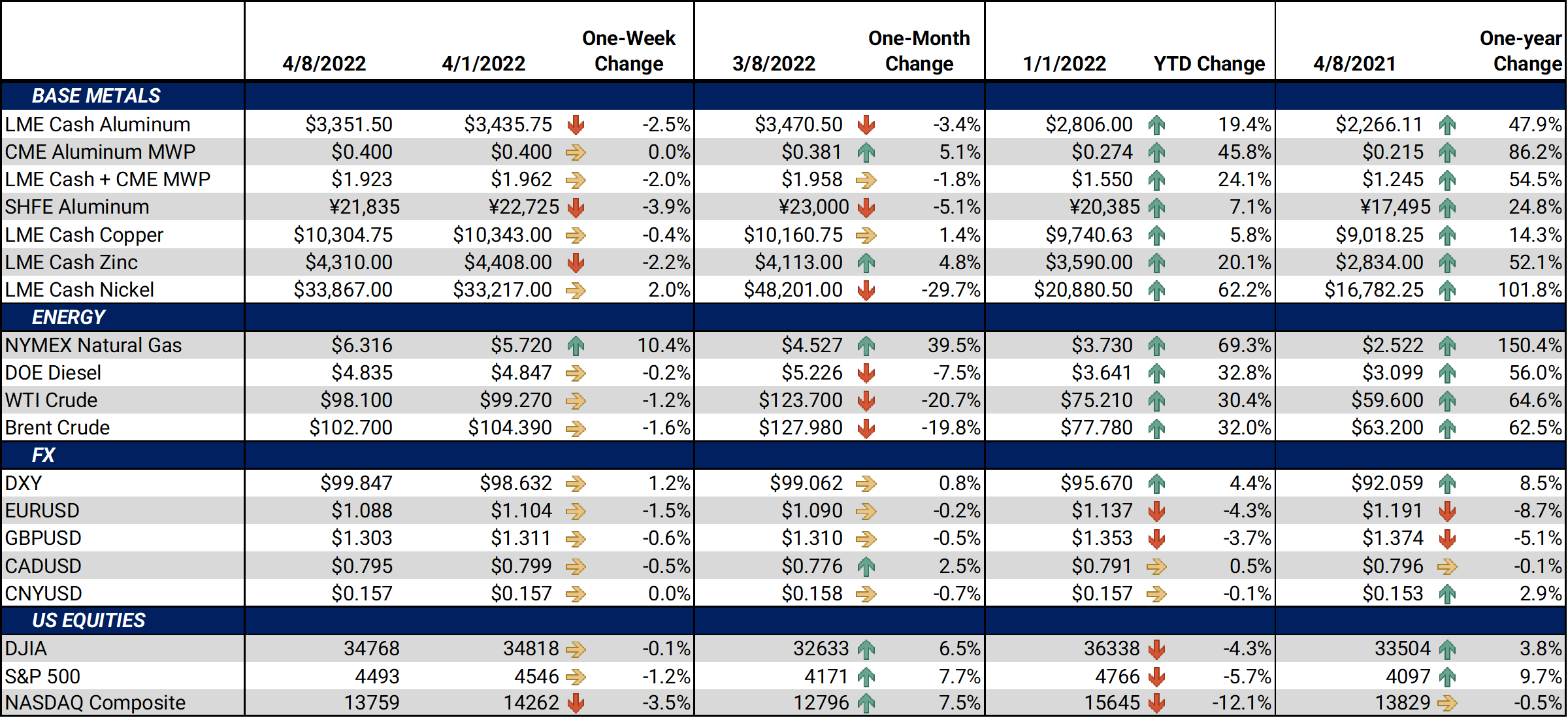

Bottom Line:Metals prices are mostly down this week as an extensive COVID lockdown in China has tempered demand, especially for the automotive sector. Tesla’s factory in Shanghai has been closed since March 28, and Volkswagen’s Shanghai factory was shuttered on April 1, according to Automotive News Europe. VW’s and BMW’s factories elsewhere in China have also temporarily ceased production due to government pandemic controls. Shanghai, which at 25 million people is China’s largest city and an important industrial hub, entered a lockdown in March to repel a rapid rise in COVID cases. The lockdown was supposed to end this week Tuesday; however, on Monday authorities extended the lockdown “indefinitely,” according to Reuters. |

|

|

Notable Metals News

Zinc prices rallied nearly 25% in Q1 2022, as some European zinc production has been curtailed due to soaring electricity prices. Late last year, Nyrstar, one the world’s largest zinc smelters, cut production by 50% at its Belgium and Netherlands operations. Its French operations also cut production by half late last year and briefly ceased production this year. However, Nyrstar recently announced that is restarting its French operations on a limited scale. Nyrstar normally has 720,000 mt of annual zinc production in Europe, according to Reuters. Global zinc supplies last year were estimated at around 14 million mt.

European natural gas futures show prices declining into 2023, but AEGIS notes this backwardation may not represent the reality of economics. Low inventories, few prospects for increased supply, and at-risk imports from Russia could continue to keep energy prices elevated. We believe metals producers in Europe will continue to face high energy prices.

Aluminum end users in Japan are reducing bids due to a predicted slowdown in automotive demand, per Bloomberg. The premium for aluminum imports to Japanese buyers for April through June was set at $172/mt, down from $177/mt the previous quarter. This is the premium over the London Metal Exchange (LME) cash price that Japanese importers agree to for primary aluminum shipments. The country imported approximately 2.793 million mt of aluminum in 2021, or about 4% of global production, according to the Japan Ministry of Finance and USGS data. Japan is Asia's largest aluminum importer.

Rusal may be resuming aluminum raw-materials imports from Guinea. The shipments had been stopped after Russia invaded Ukraine. Refinitiv shipping data indicated that Rusal’s first bauxite shipment from Guinea since Saturday, March 12 left the Kamsar port on Tuesday, April 5, according to Reuters. Bauxite is the ore from which aluminum is produced. Bauxite ore shipments from the Kamsar port are mainly shipped to Rusal’s alumina plant in Ireland. Rusal’s mining operations in Guinea represented approximately 50% of the company’s bauxite production, according to the 2021 operating results released last week.

Finally, in Iran, raw steel production has jumped in recent months. Compared to 2021, raw steel production in Iran was up 11.8% for the first two months of 2022, with a two-month total of 5.33 million mt, according to the World Steel Association (WSA). Iran had the largest expansion rate of any nation surveyed by the WSA, and currently ranks tenth in global steel production. Iran is normally a large steel exporter, shipping mainly to Southeast Asia and the Middle East, according to the US Department of Commerce. At 297.7 million mt, year-over-year global steel production was down 5.5% during the first two months of 2022.

|

|

|||||

|

|

|||||

LME Aluminum |

|||||

|

LME Aluminum 3M settled at $3,374.50/mt, down $75.50/mt on the week. The forward curve for LME Aluminum is currently quite backwardated, meaning that spot prices are higher than futures prices. A backwardated forward curve favors the consumer hedger. The aluminum market has sufficient liquidity to use swaps and options. Consumers might consider strategies that use only swaps or options or a combination of both, depending upon your risk tolerance. Please contact AEGIS for specific strategies that fit your operations. |

|||||

|

|||||

|

Prompt month CME MWP last settled at 40¢/lb this week. The CME Midwest Premium swap market is thinly traded, and there is no options market. Hedging in this market is tricky, so we recommend using strategically placed limit orders. Please contact AEGIS for specific strategies that fit your operations.

|

|||||

LME Copper |

|||||

|

LME Copper 3M settled at $10,323.50/mt, down $30/mt on the week. The forward curve for LME Copper is currently quite backwardated, meaning that spot prices are higher than futures prices. A backwardated forward curve favors the consumer hedger. The copper market has sufficient liquidity to use swaps and options. Consumers might consider strategies that use only swaps or options or a combination of both, depending upon your risk tolerance. Please contact AEGIS for specific strategies that fit your operations.

|

|||||

|

|||||

|

LME Nickel 3M settled at $33,855/mt, up $632/mt on the week. Like LME copper and aluminum, the forward curve for LME Nickel is currently backwardated, meaning that spot prices are higher than futures prices. A backwardated forward curve favors the consumer hedger. The nickel market has sufficient liquidity to use swaps and options. Consumers might consider strategies that use only swaps or options or a combination of both, depending upon your risk tolerance. Please contact AEGIS for specific strategies that fit your operations. |

|||||

|

|

|||||

|

|

|||||

CME Hot Rolled Coil (HRC) Steel |

|||||

|

Prompt month HRC Steel last settled at $1,514/T. For CME HRC Steel, liquidity is low for swaps, but hedging can still be done with strategically placed limit orders. The same is true for options. Similar to other metals, a combination of both swaps and options might work in certain cases, depending upon your risk tolerance. Please contact AEGIS for specific strategies that fit your operations. |

|||||

|

|

|||||

AEGIS Insights |

|||||

|

04/06/2022: AEGIS Factor Matrices: Most important variables affecting metals prices 04/05/2022: Russian Metals Production and Related News: Most Recent Developments (AEGIS Reference) |

|||||

Notable News |

|||||

|

4/8/2022: London blocks sale of new platinum and palladium from Russian refineries 4/8/2022: LPPM GOOD DELIVERY PLATINUM AND PALLADIUM UPDATE 4/6/2022: Tesla, BMW, VW shutdowns in China drag on; microchips pile up as lockdowns continue 4/6/2022: Rusal exports first Guinea bauxite in nearly a month, data shows 4/5/2022: Global nickel smelting up in March despite Ukraine, satellite data shows 4/5/2022: Column-Mass exit from nickel market opens up a volatility trap: Andy Home |

|||||