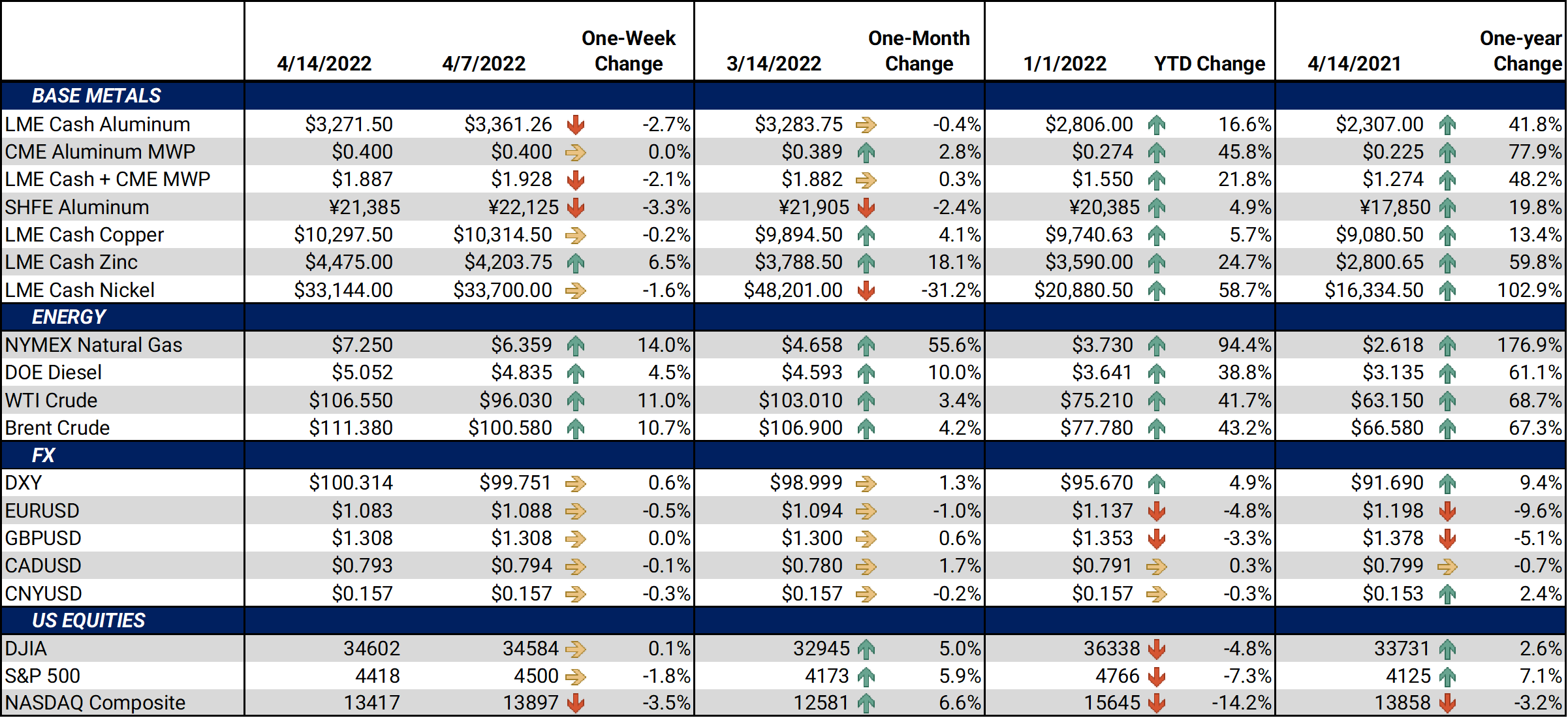

Bottom Line:** Please note that due to the Good Friday and Easter Monday holidays, the LME will be closed on Friday, April 15 and Monday, April 18. AEGIS will not produce a First Look those mornings; our office will be closed on Friday only. ** China exported a record quarterly volume of unwrought aluminum and aluminum products, taking advantage of a nearly 25% rally in global prices in 1Q2022. The country exported 1.63 million mt in 1Q2022, up from 1.29 million mt in 1Q2021, according to China customs data.

|

|

Global aluminum production has dropped; high energy costs have forced several European smelters to shut down, contributing to record LME prices. China is the world’s largest aluminum producer, but itnormally exports only a small amount of aluminum. |

Notable Metals News

A recent COVID outbreak led to a decrease in China’s refined zinc volumes in March, both month-over-month and year-over-year. LME Zinc 3M rallied nearly 14% in March while China was experiencing production issues. Antaike, the Chinese state-backed research company, says refined zinc output in March was 423,000 tonnes, down 0.7% year on year; month-over-month production was off 3%. Transportation issues due to COVID in three important zinc-producing provinces (Yunnan, Shaanxi and Gansu) caused most of the setback in production. China is the world's largest zinc smelter.

Continuing in China, COVID lockdowns have forced electric-vehicle manufacturer Nio to stop production at three Chinese factories, according to marketwatch.com. The company stated “Since March, due to reasons to do with the epidemic, the company’s supplier partners in several places including Jilin, Shanghai and Jiangsu suspended production one after the other and have yet to recover. Due to the impact of this Nio has had to halt car production.” Other auto manufacturers, including Tesla, VW, and BMW have closed plants in Shanghai and elsewhere in China due to lockdowns, according to Reuters and Bloomberg. Shanghai, which at 25 million people is China’s largest city and an important industrial hub, entered a lockdown in March to repel a rapid rise in COVID cases. Other areas have also entered full or partial lockdowns, leading to a drop in demand for aluminum and other base metals.

Finally, late last week the London Platinum and Palladium Market (LPPM) barred two Russian state-owned platinum and palladium producers, Krastsvetmet and Prioksky Plant of Non-Ferrous Metals from the exchange. This move blocks those producers from delivering to the world’s largest platinum and palladium market. Roughly 25% of the global palladium supply to the London market, or approximately 102 mt, will be affected by this decision, according to market participants cited by Reuters. London is the world’s largest platinum and palladium market. In 2020, Russia was the world’s largest palladium miner, and the second-largest platinum producer.

|

|

|||||

|

|

|||||

LME Aluminum |

|||||

|

LME Aluminum 3M settled at $3,285.50/mt, down $89/mt on the week. The forward curve for LME Aluminum is currently quite backwardated, meaning that spot prices are higher than futures prices. A backwardated forward curve favors the consumer hedger. The aluminum market has sufficient liquidity to use swaps and options. Consumers might consider strategies that use only swaps or options or a combination of both, depending upon your risk tolerance. Please contact AEGIS for specific strategies that fit your operations. |

|||||

|

|||||

|

Prompt month CME MWP last settled at 40¢/lb this week. The CME Midwest Premium swap market is thinly traded, and there is no options market. Hedging in this market is tricky, so we recommend using strategically placed limit orders. Please contact AEGIS for specific strategies that fit your operations.

|

|||||

LME Copper |

|||||

|

LME Copper 3M settled at $10,315/mt, down $8.50/mt on the week. The forward curve for LME Copper is currently quite backwardated, meaning that spot prices are higher than futures prices. A backwardated forward curve favors the consumer hedger. The copper market has sufficient liquidity to use swaps and options. Consumers might consider strategies that use only swaps or options or a combination of both, depending upon your risk tolerance. Please contact AEGIS for specific strategies that fit your operations.

|

|||||

|

|||||

|

LME Nickel 3M settled at $33,175/mt, down $680/mt on the week. Like LME copper and aluminum, the forward curve for LME Nickel is currently backwardated, meaning that spot prices are higher than futures prices. A backwardated forward curve favors the consumer hedger. The nickel market has sufficient liquidity to use swaps and options. Consumers might consider strategies that use only swaps or options or a combination of both, depending upon your risk tolerance. Please contact AEGIS for specific strategies that fit your operations. |

|||||

|

|

|||||

|

|

|||||

CME Hot Rolled Coil (HRC) Steel |

|||||

|

Prompt month HRC Steel last traded at $1,479/T, down $11/T on the week. For CME HRC Steel, liquidity is low for swaps, but hedging can still be done with strategically placed limit orders. The same is true for options. Similar to other metals, a combination of both swaps and options might work in certain cases, depending upon your risk tolerance. Please contact AEGIS for specific strategies that fit your operations. |

|||||

|

|

|||||

AEGIS Insights |

|||||

|

04/13/2022: AEGIS Factor Matrices: Most important variables affecting metals prices 04/05/2022: Russian Metals Production and Related News: Most Recent Developments (AEGIS Reference) |

|||||

Notable News |

|||||

|

4/12/2022: China's March zinc output falls in face of COVID disruption, says Antaike 4/11/2022: METALS-Industrial metals fall as firmer dollar, China's COVID woes weigh 4/11/2022: China’s Nio halts EV production as COVID lockdowns disrupt its supply chain |

|||||