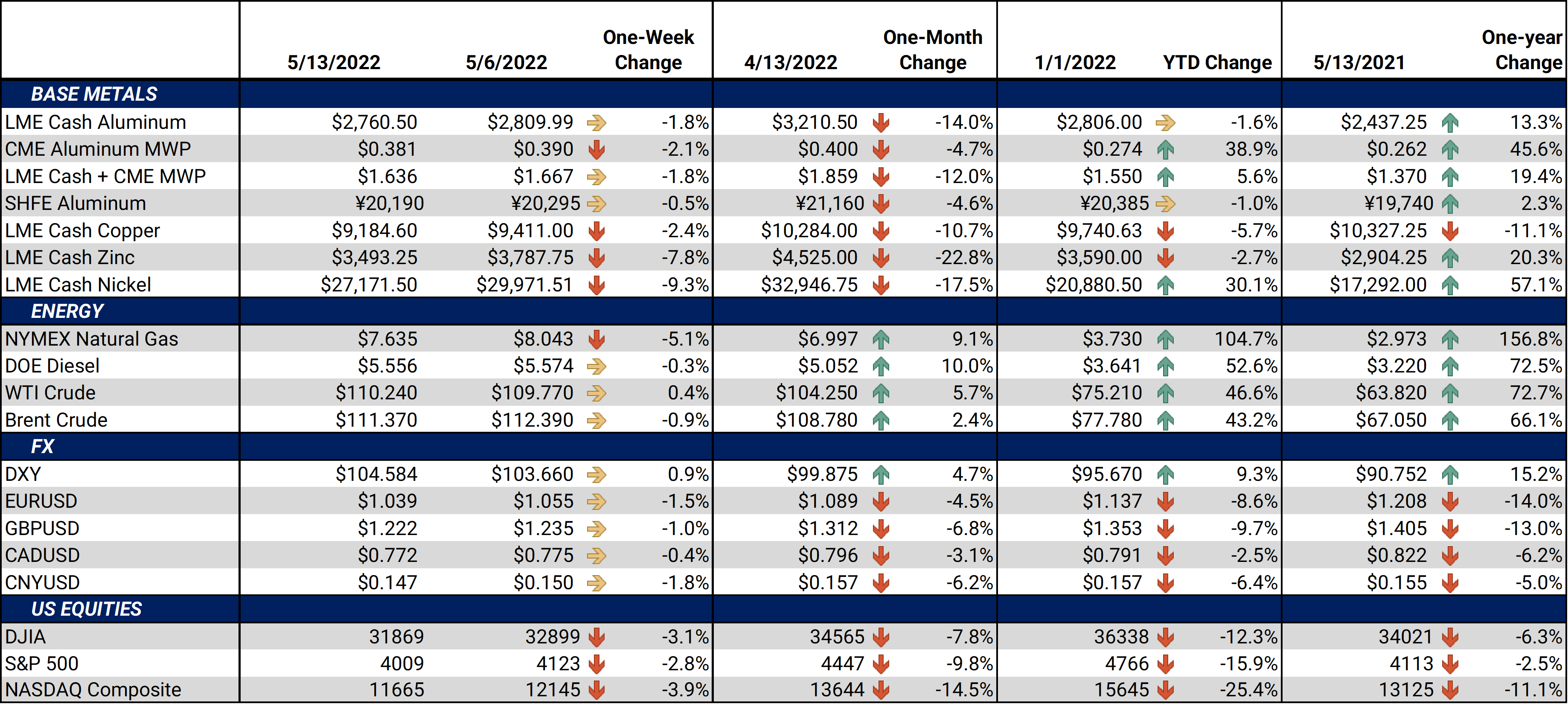

Bottom Line:Aluminum prices rallied until early March; however, the 3M Select contract has tumbled from a high of $4,073/mt on March 7 to $2,828/mt at today’s close. That contract plunged 12.5% in April alone, making it the worst month since 2008, and another 6% in May so far. It is now down about 30% from the March highs. Prices have fallen as China’s aluminum demand has dropped due to COVID lockdowns. Approximately 327.9 million people in over 40 cities, accounting for nearly 31% of the country’s GDP, are under full or partial lockdown, according to Nomura International, a Japanese financial company. With demand lagging, the country exported 597,000 mt of unwrought aluminum in April, its second-largest-ever monthly volume, according to Bloomberg and Chinese Customs data. |

|

Also, fears of Russian supply issues have subsided. Russia’s aluminum producer, Rusal, which is the largest producer outside of China and a major exporter, lost its Ukrainian and Australian alumina supplies due to logistical issues and sanctions. However, China has helped to partially fill the void, as the country will export 200,000 mt of alumina in April and May, with most going to Russia, according to anonymous traders cited by Bloomberg. Shipments of alumina from China to Russia began in late March when exporters sent several test cargoes. At that time, anonymous traders quoted by Bloomberg stated those initial shipments were to test “whether the cargoes face any logistics issues or problems with sanctions, with more ready to ship if all goes well.” |

Notable Metals News

Supply shortages and China’s slowing economy could weigh on global steel demand, according to Nippon Steel Company. These fears come despite the company’s record $7.2 billion profit in the fiscal year ending March 31, 2022, according to their earnings summary released on Tuesday. Nippon’s president stated, “At this moment, we can’t find any positive factors…. [and] there are no signs of a reversal” in the global steel demand downtrend. As a net importer of steel, the US may find more cargoes -- even if bearing a tariff cost -- on its shores, depressing local steel index prices.

Public hearings on the economic impact of Section 232 import tariffs on steel and aluminum will begin in July 2022. The US International Trade Commission is seeking input from consumers and producers of those metals, which have been tariffed since 2018 by the Trump administration. Section 232 tariffs are at the discretion of the executive branch and are allowed for reasons of national security. Current tariffs are 25% on steel and 10% on aluminum. These tariffs were meant to reduce the flow of metals imports, thereby preventing foreign exporters from dumping cheap steel and aluminum onto the US market. AEGIS notes the cost of the tariffs has supported Midwest Transaction Price (Aluminum) and US-based steel tariffs (e.g. CRU Hot Rolled Coil). Reducing or eliminating those tariffs would likely reduce costs and perhaps prices in the U.S. The ITC will release findings in 2023.

|

|

|||||

|

|

|||||

LME Aluminum |

|||||

|

LME Aluminum 3M settled at $2,788.00/mt, down $54.00/mt on the week. Due to this week’s selloff, the forward curve for LME Aluminum has shifted lower compared to last Friday; however, its shape remains the same. It has a slight contango through summer 2022, meaning that spot prices are lower than futures prices. Starting with the October 2022 contract and beyond, it becomes backwardated, with those contracts trading below summer 2022. The backwardated curve from October 2022 onwards favors aluminum consumers. The aluminum market has sufficient liquidity to use swaps and options. Consumers might consider strategies that use only swaps or options or a combination of both, depending upon your risk tolerance. Please contact AEGIS for specific strategies that fit your operations. |

|||||

|

|||||

|

Prompt month CME MWP last settled at 38.1¢/lb this week. The CME Midwest Premium swap market is thinly traded, and there is no options market. Hedging in this market is tricky, so we recommend using strategically placed limit orders. Please contact AEGIS for specific strategies that fit your operations.

|

|||||

LME Copper |

|||||

|

LME Copper 3M settled at $9,159.00/mt, down $255.50/mt on the week. LME Copper’s forward curve has shifted lower compared to last Friday and is now backwardated throughout the entire curve. A backwardated forward curve favors the consumer hedger. The copper market has sufficient liquidity to use swaps and options. Consumers might consider strategies that use only swaps or options or a combination of both, depending upon your risk tolerance. Please contact AEGIS for specific strategies that fit your operations.

|

|||||

|

|||||

|

LME Nickel 3M settled at $27,262/mt, down $2,814/mt on the week. Nickel’s forward curve remains in a slight contango, meaning that spot prices are lower than futures prices. The nickel market has sufficient liquidity to use swaps and options. Consumers might consider strategies that use only swaps or options or a combination of both, depending upon your risk tolerance. Please contact AEGIS for specific strategies that fit your operations. |

|||||

|

|

|||||

|

|

|||||

CME Hot Rolled Coil (HRC) Steel |

|||||

|

Prompt month HRC Steel last traded at $1,378/T, up$4/T on the week. For CME HRC Steel, liquidity is low for swaps, but hedging can still be done with strategically placed limit orders. The same is true for options. Similar to other metals, a combination of both swaps and options might work in certain cases, depending upon your risk tolerance. Please contact AEGIS for specific strategies that fit your operations. |

|||||

|

|

|||||

AEGIS Insights |

|||||

|

05/11/2022: AEGIS Factor Matrices: Most important variables affecting metals prices 05/11/2022: China's Metals Exports are on the Rise |

|||||

Notable News |

|||||

|

5/11/2022: EC to propose potential steel import safeguard changes late May, following review 5/11/2022: Shares of Spanish steelmaker Acerinox soar after record profit 5/10/2022: COVID-19 outbreak hobbles Chinese demand for cobalt, nickel, lithium 5/10/2022: Nippon Steel reveals plans to deliver 'carbon neutral' steel 5/6/2022: CME explores nickel contract after LME trade chaos 5/6/2022: China’s Covid lockdowns are hitting more than just Shanghai and Beijing |

|||||