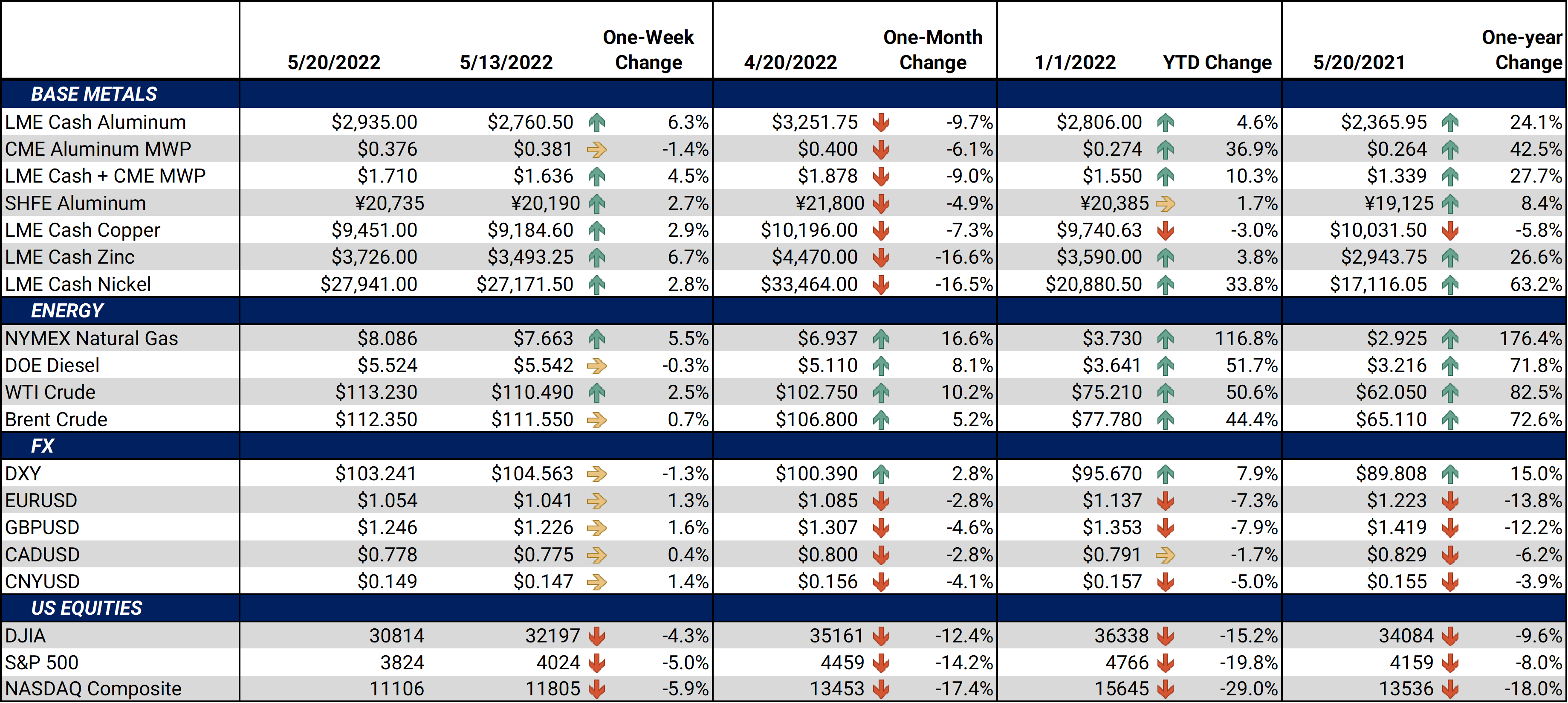

Bottom Line:Aluminum prices rallied this week. The 3M Aluminum Select contract last traded at $2,969.50/mt, up $141.50/mt on the week, or 5%, its first weekly gain since March 21. The US Dollar has backed away from six-year highs this week and could be aiding aluminum’s price gains. Dollar-denominated metals such as aluminum are normally negatively correlated to the dollar. Production issues in Europe remain, forcing consumers to pull supplies from the LME warehouses. LME aluminum warehouse stocks, which are considered a measure of the balance of supply and demand, have dropped precipitously. As of this morning, “on-warrant” LME warehouse aluminum stocks, which are available to trade, totaled 194,175 mt, down 515,450 mt, or 72.6%, from 709,625 mt on January 1. |

|

Still, COVID lockdowns in China have tempered the country’s aluminum demand and could continue to do so. Based on data from S&P Global, business activity in China has dropped to the lowest level since February 2020. The lockdowns in Shanghai, a city with over 25 million residents, are beginning to ease; however, others, including Beijing, are increasing lockdowns, according to Reuters and Bloomberg. |

Notable Metals News

China’s extensive COVID lockdowns, which started in March, have crippled demand for copper, leading to higher exports. The country exported 116,461 mt of unwrought copper, and copper products in April, nearly double the pre-lockdown volume of 58,710 mt in February, according to customs data released on Wednesday. April’s volumes were the highest since May 2016, and 53% greater than April 2021. Data released earlier this month by China’s National Bureau of Statistics shows that manufacturing activity in April slowed due to lockdowns, weighing on copper demand and prices. Compared to March, refined copper production was down 37,000 mt in April, as the country produced 935,000 mt in March and 898,000 mt in April, according to the National Bureau of Statistics.

On the supply side, COVID lockdowns have not slowed China’s primary aluminum production. The country produced 3.36 million mt of primary aluminum in April, the highest monthly volume since 2002, according to data released earlier this week by the National Bureau of Statistics. Some producers have restarted smelters that were idled during last year’s government controls on emissions and power consumption, according to Bloomberg. Analysts cited by Bloomberg believe that production could continue to rise as margins remain high, leading to a further drop in prices. Based on customs data, China was a net exporter of aluminum in February.

High energy costs have forced several European aluminum smelters to shut down, leading to supply shortages across the region. Global LME aluminum stocks were 504,275 mt this morning, the lowest level since November 2005. Europe’s production shortfall has driven end-users to pull inventories from Asian LME warehouses (specifically Malaysia), according to Reuters and LME data. Canceled warrants, which is metal that is scheduled to leave the warehouse, in Malaysia totaled 240,725 mt this morning, representing nearly 78% of the LME’s total canceled warrants.

Barring any changes, the EU will implement new steel import protections on July 1, according to their statements from last week. Specific details on how the new regime will differ from the current system have not been released yet. The current system, which involves tariff-rate quotas and is now in its fourth review, was implemented in 2018 and was meant to counterbalance the effects of the US’ 25% Section 232 import tariff on EU-produced steel. The most recent occurred after Russia’s invasion of Ukraine. After that review, product quotas of Russia and Belarus were reallocated among other exporting countries. EU steel consumers' associations now feel the European Union safeguards are unnecessary and contributed to high prices and product scarcity in the EU market, according to S&P Global.

|

|

|||||

|

|

|||||

LME Aluminum |

|||||

|

LME Aluminum 3M settled at $2,946.00/mt, up $158.00/mt on the week. With this week’s bounce in prices, the forward curve for LME Aluminum has shifted higher compared to last Friday. Similar to last week, the forward curve is backwardated beyond October 2022. The aluminum market has sufficient liquidity to use swaps and options. Consumers might consider strategies that use only swaps or options or a combination of both, depending upon your risk tolerance. Please contact AEGIS for specific strategies that fit your operations. |

|||||

|

|||||

|

Prompt month CME MWP last settled at 37.6¢/lb this week. The CME Midwest Premium swap market is thinly traded, and there is no options market. Hedging in this market is tricky, so we recommend using strategically placed limit orders. Please contact AEGIS for specific strategies that fit your operations.

|

|||||

LME Copper |

|||||

|

LME Copper 3M settled at $9,422.00/mt, up $263/mt on the week. LME Copper’s forward curve has shifted higher compared to last Friday, as prices have rallied. The forward curve is backwardated throughout its entirety. A backwardated forward curve favors copper consumers. The copper market has sufficient liquidity to use swaps and options. Consumers might consider strategies that use only swaps or options or a combination of both, depending upon your risk tolerance. Please contact AEGIS for specific strategies that fit your operations.

|

|||||

|

|||||

|

LME Nickel 3M settled at $27,973/mt, up $711/mt on the week. Nickel’s forward curve has shifted higher, and remains in a slight contango, meaning that spot prices are lower than futures prices. The nickel market has sufficient liquidity to use swaps and options. Consumers might consider strategies that use only swaps or options or a combination of both, depending upon your risk tolerance. Please contact AEGIS for specific strategies that fit your operations. |

|||||

|

|

|||||

|

|

|||||

CME Hot Rolled Coil (HRC) Steel |

|||||

|

Prompt month HRC Steel last traded at $1,385/T, up $3/T on the week. For CME HRC Steel, liquidity is low for swaps, but hedging can still be done with strategically placed limit orders. The same is true for options. Similar to other metals, a combination of both swaps and options might work in certain cases, depending upon your risk tolerance. Please contact AEGIS for specific strategies that fit your operations. |

|||||

|

|

|||||

AEGIS Insights |

|||||

|

05/18/2022: AEGIS Factor Matrices: Most important variables affecting metals prices 05/11/2022: China's Metals Exports are on the Rise |

|||||

Notable News |

|||||

|

5/19/2022: Some in Shanghai allowed out to shop; end of COVID lockdown in sight 5/18/2022: China's Xiaomi, Vivo and Oppo trim smartphone orders by 20% 5/16/2022: Shanghai targets June COVID lockdown exit as China economy slumps 5/16/2022: Column: European smelter hits mean another year of zinc shortfall 5/16/2022: Europe's aluminium deficit triggers further large LME stock draw |

|||||