|

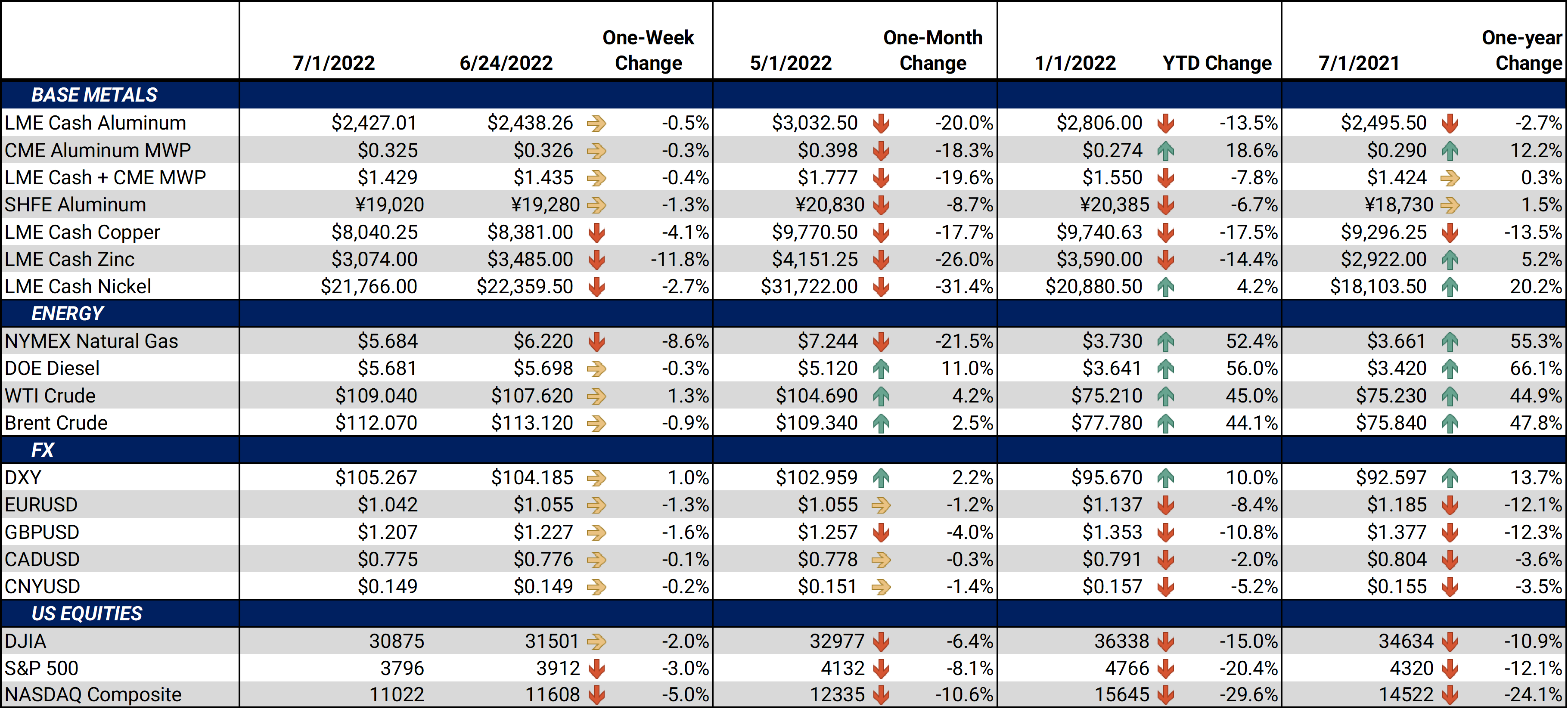

*Please note that our offices will be closed on Monday, July 4 due to the Independence Day holiday. We will not produce a Metals First Look that morning. However, the trading desk will provide LME coverage, and current clients can contact metals@aegis-hedging.com for indications. * LME Copper 3M Select plunged by 20.5% in 2Q, the biggest drawdown since 2011, as slumping demand due to COVID lockdowns in China and fears over a potential global recession weighed on prices. This percentage drop in 2Q beats the 19.8% tumble in 1Q 2020 during the onset of the pandemic. Some industry analysts are concerned that metals prices still have further to fall. For example, yesterday, Commerzbank analyst Daniel Briesemann stated "We still see metals falling as a recession in the U.S. is fully priced in." This is an about-face from bullish estimates earlier this year, as analysts quoted by mining-journal.com in January predicted copper prices at $10,500/mt or higher due to a forecasted pre-Beijing Olympics demand boom and supply-chain bottlenecks that would impact supply. |

Europe’s stainless-steel market should recover to near the pre-COVID level of 1.2 million mt of finished long products this year, up from 1.05 million mt in 2021, Italian producer Cogne Acciai Speciali (CAS) told S&P Global late last week. Stainless-steel demand is increasing in the automotive, aerospace, oil and gas, medical and food sectors, per CAS. Regarding raw material costs, CAS’s director of sales said they " went up, but like most of our competitors we managed to transfer the costs into our final products," later adding that high energy and nickel prices were also partially covered by flexibility in the company's long-term contracts.

Another potentially bullish catalyst for the nickel market also occurred this week. The UK government sanctioned Norilsk Nickel PJSC president Vladimir Potanin on Wednesday, sparking fears that refined nickel supplies from Russia could plunge. According to Bloomberg, UK government sanctions on individuals automatically extend to any company that individual owns or controls, including companies where an individual owns more than 50% of the shares, or has the right to appoint a majority of the board of directors. However, Norilsk Nickel wasn’t directly mentioned in yesterday’s press release UK’s Foreign, Commonwealth & Development Office. Following the government announcement, the LME stated that they “are looking into the detail of the sanctions and what it may mean for the LME, its participants, and Norilsk brands.” Norilsk Nickel is the world’s largest producer of refined nickel, according to Reuters.

As for aluminum production, China’s exports of alumina have increased dramatically this year; however, increasing production costs could hurt margins and lead to lower export volumes, according to S&P Global. This could further squeeze Russian aluminum production profitability. China exported 188,768 mt of alumina in May, up 3,903.9% on the year, with 153,362 mt, or nearly 81% going to Russia, according to customs data released late last week. Last Friday, one anonymous trader cited S&P Global claimed “The main risk to Russia's supply from China is if high-cost refineries are forced to curtail output due to rising production costs…. Refineries could need to keep long-standing relations with existing customers and prioritize them, even if Russia is able to pay slightly more." Sources also told S&P Global that higher bauxite, coal and caustic soda prices and decreasing domestic alumina prices could also lead to more curtailments.

Finally, regarding American scrap steel prices, the Russian invasion of Ukraine shut off American imports of pig iron from the region, causing US electric arc furnace (EAF) operators to scramble to secure domestic ferrous scrap as an alternate feedstock, according to S&P Global. However, American steelmakers have found new suppliers or adjusted production to use less pig iron in steel production. Also, transportation issues in the US are starting to subside. Bob Broom, vice president of trading at Houston-based Tri Coastal Trading recently stated “We are starting to see some improvements. For a price, you can get a truck or you can get a vessel." Spot scrap prices have tumbled as supply-chain issues have lessened. On June 27, S&P Global set its price assessment for domestic US shredded scrap at $480/lt, down from a record $610/lt in March and April 2022.

|

|

|||||

|

|

|||||

LME Aluminum |

|||||

|

LME Aluminum 3M settled at $2,444.00/mt, down $12.00/mt on the week. With this week’s selloff the forward curve for LME Aluminum from July 2022 through September 2023 has shifted lower; however, past September 2023 prices are higher than last Friday. The forward curve remains in contango, meaning that spot prices are lower than futures prices. This allows aluminum producers to hedge future sales at prices higher than that of spot prices. The aluminum market has sufficient liquidity to use swaps and options. If you are a consumer of aluminum, you might consider strategies that use only swaps or options or a combination of both, depending upon your risk tolerance. Please contact AEGIS for specific strategies that fit your operations. |

|||||

|

|||||

|

Prompt month CME MWP last settled at 31.07¢/lb this week. The CME Midwest Premium contract continued lower this week and remains in backwardation. The CME Midwest Premium swap market is thinly traded, and there is no options market. Hedging in this thinly traded market is challenging, so we recommend using strategically placed limit orders. Please contact AEGIS for specific strategies that fit your operations.

|

|||||

LME Copper |

|||||

|

LME Copper 3M settled at $8,048.00/mt, down $333.00/mt on the week. LME Copper's forward curve continues to shift vertically lower. However, this week’s shift is only approximately $300/mt, compared to approximately $500/mt last week. It is essentially flat through December 2026. The copper market has sufficient liquidity to use swaps and options. Consumers might consider strategies that use only swaps or options or a combination of both, depending upon your risk tolerance. Please contact AEGIS for specific strategies that fit your operations.

|

|||||

|

|||||

|

LME Nickel 3M settled at $21,824/mt, down $576/mt on the week. Nickel’s forward curve continues to shift lower, and is in contango, meaning that spot prices are lower than futures prices. The nickel market has sufficient liquidity to use swaps and options. Consumers might consider strategies that use only swaps or options or a combination of both, depending upon your risk tolerance. Please contact AEGIS for specific strategies that fit your operations. |

|||||

|

|

|||||

|

|

|||||

CME Hot Rolled Coil (HRC) Steel |

|||||

|

Prompt month HRC Steel last traded at $930/T, down $1/T on the week. For CME HRC Steel, liquidity is low for swaps, but hedging can still be done with strategically placed limit orders. The same is true for options. Similar to other metals, a combination of both swaps and options might work in certain cases, depending upon your risk tolerance. Please contact AEGIS for specific strategies that fit your operations. |

|||||

|

|

|||||

AEGIS Insights |

|||||

|

06/29/2022: AEGIS Factor Matrices: Most important variables affecting metals prices 06/23/2022: What is Green Steel Anyways? |

|||||

Notable News |

|||||

|

6/30/2022: Copper heads for its biggest quarterly plunge since 2011 6/30/2022: Recession fears creep into ECB thinking at summer conference 6/29/2022: Britain sanctions Russian oligarch Vladimir Potanin 6/29/2022: UK sanctions Russia’s second richest man 6/28/2022: US to raise to 35% tariffs on certain steel, aluminum imports from Russia 6/27/2022: FEATURE: Pandemic fades, recession looms for H2 US ferrous scrap market 6/27/2022: Copper steadies, but recession fears dominate mood 6/24/2022: Copper heads for worst weekly loss in a year, nickel and tin plunge 6/24/2022: China's May bauxite imports hit record high; alumina exports soar on Russian demand 6/23/2022: European stainless steel longs demand to rebound to 1.2 million mt in 2022: CAS |

|||||