|

Aluminum Aluminum prices jumped by over 8% on Thursday morning on reports that the LME might ban Russian aluminum and other metals from being delivered against LME contracts, according to Reuters and Bloomberg. Although likely a coincidence, the LME news happened almost simultaneously with the supposed sabotage of Nord Stream pipeline, a major natural-gas conduit between Russia and Germany. The two events show that EU-Russia tensions have heightened, and both news items could have influenced aluminum prices. Any move by the LME to block Russian aluminum supplies could have significant ramifications. One anonymous source cited by Reuters stated, "the discussions are about the possibility of banning new deliveries." This same source told Reuters that trying to ban Rusal-produced aluminum that is already in LME warehouses "would be madness." In a brief statement, LME stated they will “take the required action to ensure market stability in response to sanctions,” later adding it will continually review the situation as they prioritize an “orderly market.” |

Europe’s aluminum supply and production issues continue. With Norsk Hydro's announcement late Tuesday afternoon that two of their Norway plants will soon cut production, AEGIS now estimates that approximately 1.14 million mt, or 25.4% of Europe’s annual smelter capacity has gone offline since late 2021 due to falling demand or high electricity prices. We have yet to see news of any of these facilities resuming production. The two Norsk plants, Karmøy and Husnes, will curtail production by a combined total of 110,000 to 130,000 mt due to falling European aluminum demand. According to the press release, the two plants will begin production cuts “shortly,” and the company expects the plants will settle at their new production levels by the end of 2022.

Finally, regarding global aluminum demand, due to “negative metals demand momentum,” Goldman Sachs has set its 2023 average aluminum price to $2,563/mt, a 25% price drop from its prior estimate. However, this is still about $350/mt higher than the current average price for the 2023 LME aluminum futures forward curve. This could mean that Goldman believes the aluminum futures forward curve is undervalued for 2023. The bank fears that global stockpiles could build until Russia finds alternative buyers for excess inventory. However, aluminum prices could stabilize if Europe’s supply chain issues dissipate or Chinese demand returns.

Copper

Could Chinese copper imports drop over the coming months? Maike Metals, which is responsible for nearly 25% of China’s copper imports and one of the country’s largest trading houses, is restructuring and selling assets as it fends off a liquidity crisis, according to the Financial Times and Reuters. Maike and other trading firms rely upon short-term financing, using its metals inventory as collateral. However, the company is currently experiencing a liquidity crisis as banks have stepped away from financing physical metals trading. Maike is not only alone in this situation, at least two other major Chinese metals trading companies have had credit lines frozen in recent weeks, according to Bloomberg reports from earlier this month. Maike also has substantial real-estate assets that have deteriorated in value due to China’s ongoing real-estate demand crisis, further exacerbating the company’s dire financial situation. The company said it is meeting with various banks and seeking government investment as it restructures and sells assets.

Steel

Finally, regarding steel demand, the research firm AutoForecast Solutions says North American vehicle production is worse than thought, and there are implications for steel. Units produced will number 573,000 less in 2022 than in 2021, while a previous estimate from July had been only a 348,000 unit decrease year-over-year. It might be worse than that, though; another 450,000 vehicles are “at risk” of not being produced, per AutoForecast Solutions. Based on AutoForecast’s “at risk” volume, AEGIS estimates 445,000 short tons of steel demand could be lost or deferred until later. According to the American Iron and Steel Institute's (AISI) Automotive Program, the average North American vehicle contains 1,980 lbs of steel, of which approximately 1,480 lbs are flat-rolled products. Approximately 486 lbs of aluminum are used in each vehicle as well. The slowdown in vehicle production is primarily the result of an ongoing semiconductor outage. (Source: Argus)

|

|

|||||

|

|

|||||

LME Aluminum |

|||||

|

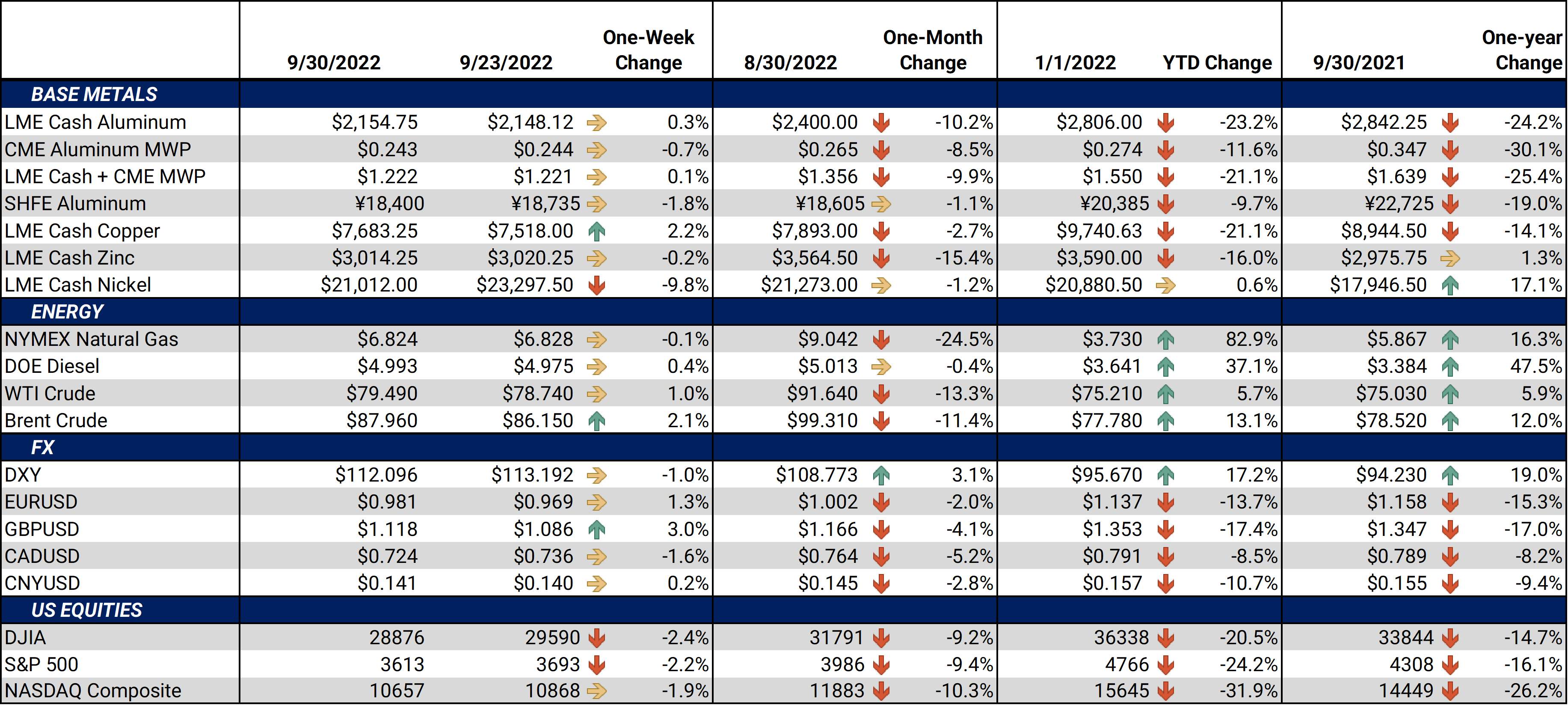

LME Aluminum 3M settled at $2,162.00/mt, down $3.00/mt on the week. Aluminum prices were volatile this week but finished nearly unchanged. Compared to last Friday, both the position of the forward curve and its shape look essentially the same. It remains in contango, meaning that spot prices are lower than futures prices. Aluminum producers that are concerned about decreasing prices might consider hedging future sales by selling swaps or buying put options. The aluminum market has sufficient liquidity to use swaps and options. Please contact AEGIS for specific strategies that fit your operations. |

|||||

|

|||||

|

Prompt month CME MWP last settled at 24.3¢/lb this week. The CME Midwest Premium contract was steady this week and remains in backwardation. The CME Midwest Premium swap market is thinly traded, and there is no options market. Hedging in this thinly traded market is challenging, so we recommend using strategically placed limit orders. Please contact AEGIS for specific strategies that fit your operations. * Please note all these charts are for desktop only.* |

|||||

LME Copper |

|||||

|

LME Copper 3M settled at $7,560.00/mt, up $127.00/mt on the week. Compared to last Friday, LME Copper's forward curve has shifted slightly higher, by about $100/mt. Prices throughout the curve are relatively flat. The copper market has sufficient liquidity to use swaps and options. Consumers might consider strategies that use only swaps or options or a combination of both, depending upon your risk tolerance. Please contact AEGIS for specific strategies that fit your operations.

|

|||||

|

|||||

|

LME Nickel 3M settled at $21,107/mt, down $2,304/mt on the week. Nickel’s forward curve shifted slightly lower this week, by about $2,300/mt. It remains in contango, meaning that spot prices are lower than futures prices. The nickel market has sufficient liquidity to use swaps and options. Consumers might consider strategies that use only swaps or options or a combination of both, depending upon your risk tolerance. Please contact AEGIS for specific strategies that fit your operations. |

|||||

|

|

|||||

|

|

|||||

CME Hot Rolled Coil (HRC) Steel |

|||||

|

Prompt month HRC Steel last traded at $776/T, up $11/T on the week. For CME HRC Steel, liquidity is low for swaps, but hedging can still be done with limit orders. The same is true for options. Similar to other metals, a combination of both swaps and options might work in certain cases, depending upon your risk tolerance. Please contact AEGIS for specific strategies that fit your operations. |

|||||

|

|

|||||

AEGIS Insights |

|||||

|

9/28/2022: AEGIS Factor Matrices: Most important variables affecting metals prices 8/31/2022: Will Chilean Production Issues Drive Copper Prices Higher? 8/24/2022: Chinese Aluminum Supply Issues Could Rally Prices 8/16/2022: Zinc Prices Are On The Rebound Due To Supply Issues 8/9/2022: Aluminum prices are finding support: Consumers can lock in lower costs in 2023 and beyond |

|||||

Notable News |

|||||

|

9/30/2022: EU edges towards more sanctions on Russia 9/29/2022: LME to discuss banning Russian metal, sources say 9/28/2022: Nippon Steel says India JV with ArcelorMittal to spend $5 bln to boost capacity 9/27/2022: Hydro responds to reduced aluminium demand, partially curtails production 9/26/2022: NorthAm auto cut estimates continue to rise 9/26/2022: Grim demand outlook pushes copper prices to 2-month low 9/25/2022: Chinese copper trader Maike will sell assets and restructure, Financial Times reports 9/25/2022: China’s Maike Metals will sell assets and restructure, says chair 9/23/2022: China's manufacturing steel demand rebounds in August, further improvement to be modest 9/23/2022: Steel makers fear deepening crisis from energy crunch as output halted |

|||||