Updated April 17, 2025

|

|

|

For more discussion on basis price moves and the current forward curves:JUMP TO OUR OUTLOOK AND CHART PACKFor more discussion and charts, jump to our outlook and chart pack. Remember, the local market is influenced by the broader gas market. Consult our Gas Macro Outlook for more. |

Recent Market-Relevant Events

|

Infrastructure Outlook |

The basin suffers from persistent oversupply compared to the amount of egress pipeline capacity. This affects the gas market more than it does crude oil, mostly because of aggressive additions in oil takeaway due to oil’s larger revenue share for almost all operators in the area. |

|

As of 4/21/2025 |

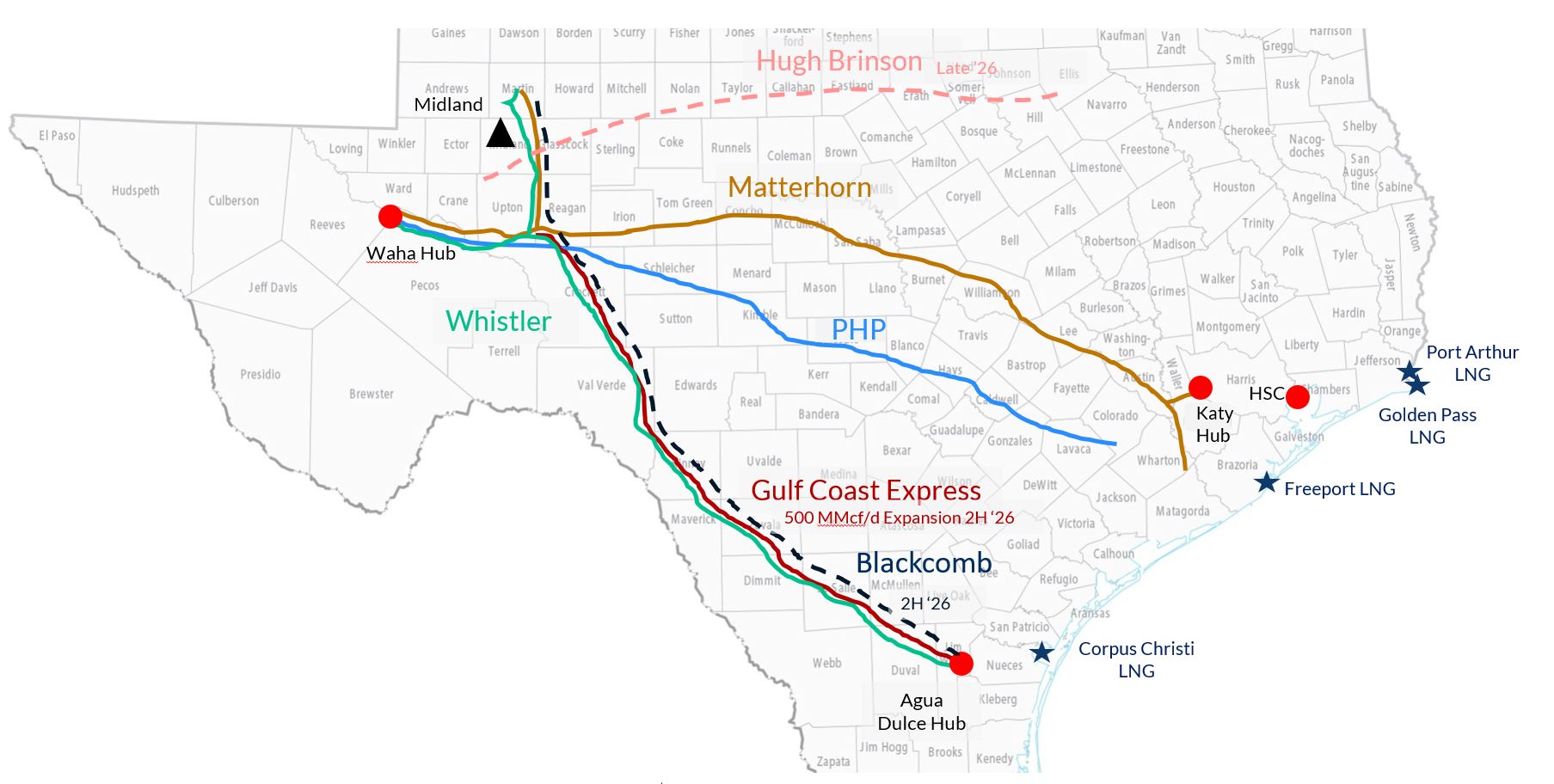

For a discussion of production outlook:JUMP TO LOCAL SUPPLYBelow are the most market-relevant infrastructure projects that appear to be funded and going forward. The projects that offer intra-region capacity (egress) are also shown in the chart above.Note: Deeper discussion included below the map. |

|

|

Matterhorn Pipeline - Whitewater Midstream's 2.5 Bcf/d pipeline entered service in the fall of 2024. The pipe originates in Waha and moves gas toward Katy, Texas. |

|

|

Blackcomb - WhiteWater Midstream and Targa are moving ahead with building a new 42-inch, 365-mile natural gas pipeline from the Permian Basin in West Texas to the Agua Dulce hub in South Texas. The startup timeline is 2H 2026 and will transport up to 2.5 Bcf/d.Shippers include Devon, Diamondback Energy, Marathon Petroleum, and Targa. Will source in the Midland Basin and the 3 Bcf/d Agua Blanca pipeline system in the Delaware Basin owned by WhiteWater and MPLX. |

|

|

Gulf Coast Express Expansion - Kinder Morgan announced the start of an open season for the Gulf Coast Express expansion on May 16, 2022. The project entails adding compressors to the GCX pipeline to enhance its capacity from the Permian Basin to South Texas markets by 570 MMcf/d. The project is expected to be operational in May 2026, subject to additional customer agreements. |

|

|

Hugh Brinson - Formally known as Warrior. The Hugh Brinson Pipeline is expected to be constructed in two phases with the first phase including the construction of approximately 400 miles of 42-inch pipeline with a capacity of 1.5 billion cubic feet per day (Bcf/d). It will extend from Waha to Maypearl, Texas located south of the Dallas/Ft. Worth Metroplex, where it will then connect to Energy Transfer’s vast pipeline and storage infrastructure. Phase I is expected to be in service by the end of 2026. As part of Phase I, Energy Transfer will also construct the Midland Lateral, which is expected to be a 42-mile, 36-inch lateral to connect Energy Transfer and third-party processing plants in Martin and Midland Counties to the Hugh Brinson Pipeline. Phase II of the project would include the addition of compression to increase the capacity of the new pipeline to approximately 2.2 Bcf/d. Depending on shipper demand, Phase II could be constructed concurrently with Phase I. |

Other Projects |

|

Saguaro Pipeline (2028 no FID) - The pipeline is proposed to run from the Waha Gas Hub in the Permian Basin in West Texas, U.S. to the Mexican border in Hudspeth County, Texas. The pipe would be 2.8 Bcf/d at 48" diameter, owned by ONEOK. This pipe's future depends on whether Mexico's Pacific LNG reaches FID (expected 2025). If this is built, the Permian has more of a chance to be overbuilt with takeaway pipe through 2030. Northbound Pipeline Expansions Natural Gas Pipeline of America (NGPL) - Added compression to increase northbound capacity by 50 MMcf/d. Planned in-service of October 2025. Northern Natural Gas - Expansion of 87 MMcf/d. In-service by November 2025. Transwestern - Expansion of 80 MMcf/d. In-service by November 2026. |

Production |

|

|

Operator Guidance

|

|||||||||||||||||||||||||

|

Rig Count

|

Local Demand |

The Permian Basin is a supply zone with limited local demand relative to other areas in the US. Local gas demand can range from 400 MMcf/d and 700 MMcf/d depending on the season. |

|

|

|||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||

|

|

|||||||||||||||||||||||||||||||