Oil is a crucial global commodity that influences geopolitics and economies. In recent years, the refining industry has become a bottleneck, causing the costs of processing crude oil into products like gasoline, diesel, jet fuel, and petrochemicals to skyrocket. This has translated into high prices for transportation fuels. The question is, as oil demand continues its upward trajectory, can the refining industry keep up?

Demand vs. Capacity: The Widening Gap

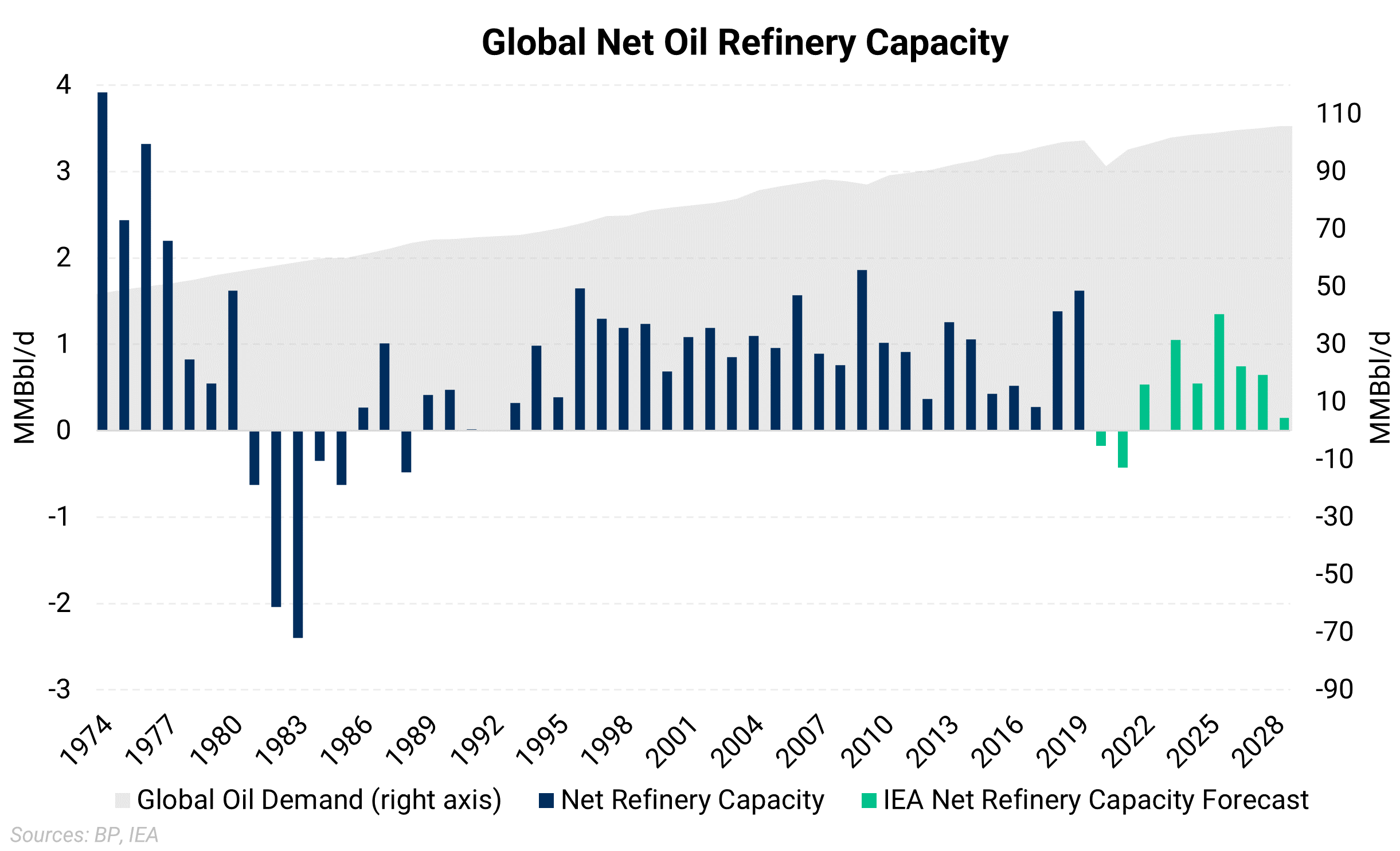

Recent data indicates a concerning trend: since 2021, the growth in oil demand has consistently outstripped refinery capacity additions. Global oil demand is expected to grow by 2.2 MMBbl/d and 1 MMBbl/d in 2023 and 2024, respectively (IEA). Unless there’s an economic recession, an energy crisis, or global events like the pandemic, the long-term trend over the past century has been a general increase in global oil demand due to economic growth.

There could be an impending risk of severe market shocks from refinery operational disruptions if this trend persists. To support this further, data from FGE forecasts this trend of oil demand surpassing refinery capacity will persist until at least 2027. New refineries take a long time and capital to build. Even if any company considered constructing a refinery today, it would only affect the market in five to seven years, if not more.

Although there's been a considerable investment in refinery construction recently, largely due to pandemic-related delays, this might not be enough. JPMorgan projects a global increase of 1.9 MMBbl/d in refining capacity this year, offset by shutdowns amounting to 0.6 MMBbl/d. Net capacity narrows even further by 2025, with an anticipated addition of just 1.4 MMBbl/d and shutdowns reaching 0.9 MMBbl/d.

The Bottleneck Begins to Ease, But Is It Enough?

The current construction boom in refineries, partly due to pandemic-related delays, has resulted in multiple projects coming online simultaneously in nations such as Kuwait, Nigeria, Mexico, and China. Global net refinery capacity is set to rise by 4.4 MMBbl/d from 2023 through 2028, while global oil demand is expected to grow by 6.1 MMBbl/d over the same period to 105.7 MMBbl/d, according to IEA.

However, even this expansion might fall short. Plant closures and conversions of existing refineries to produce renewable fuel due to regulatory reasons continue to bite into the existing capacity.

Refining Margins Reflect the Strain

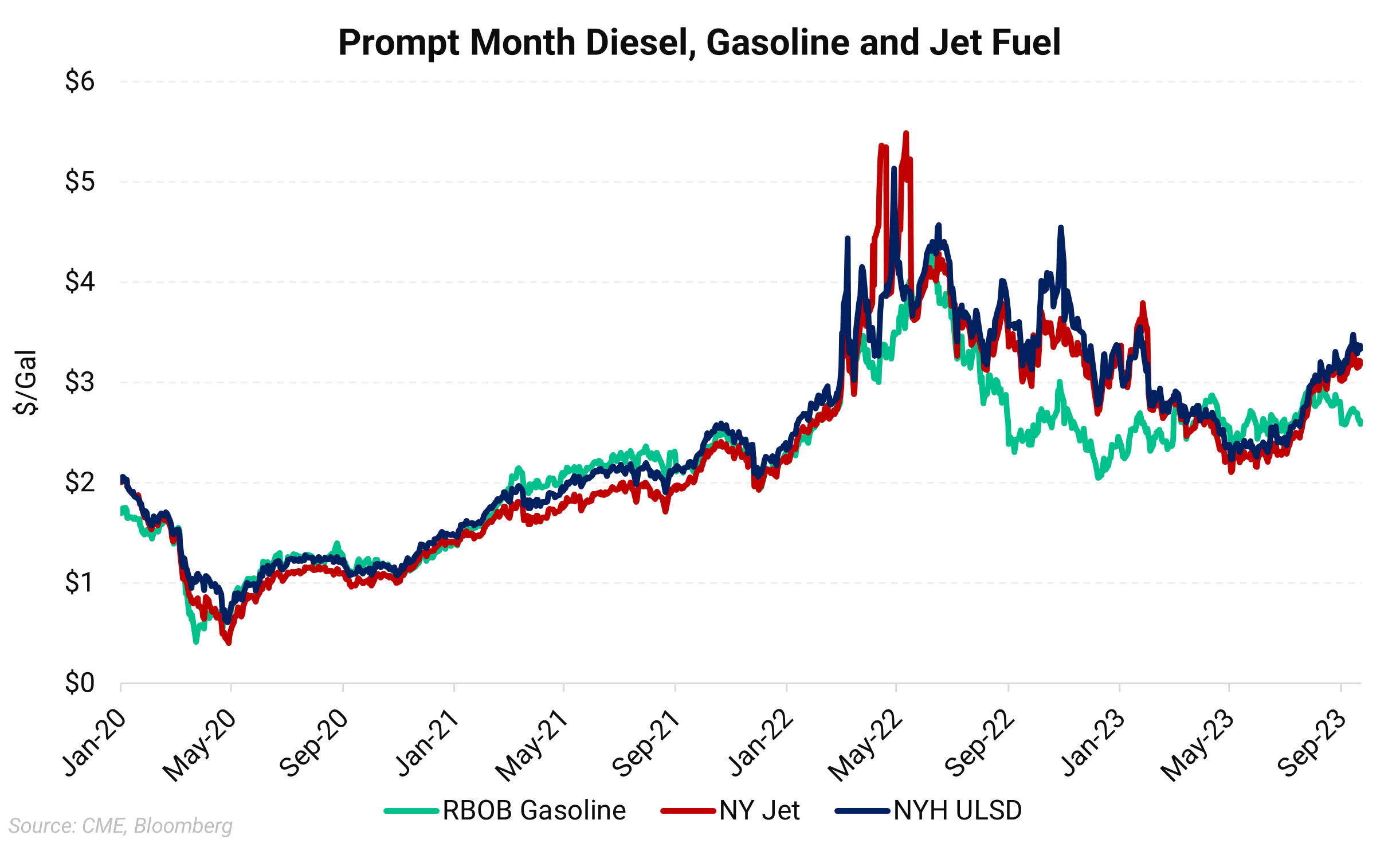

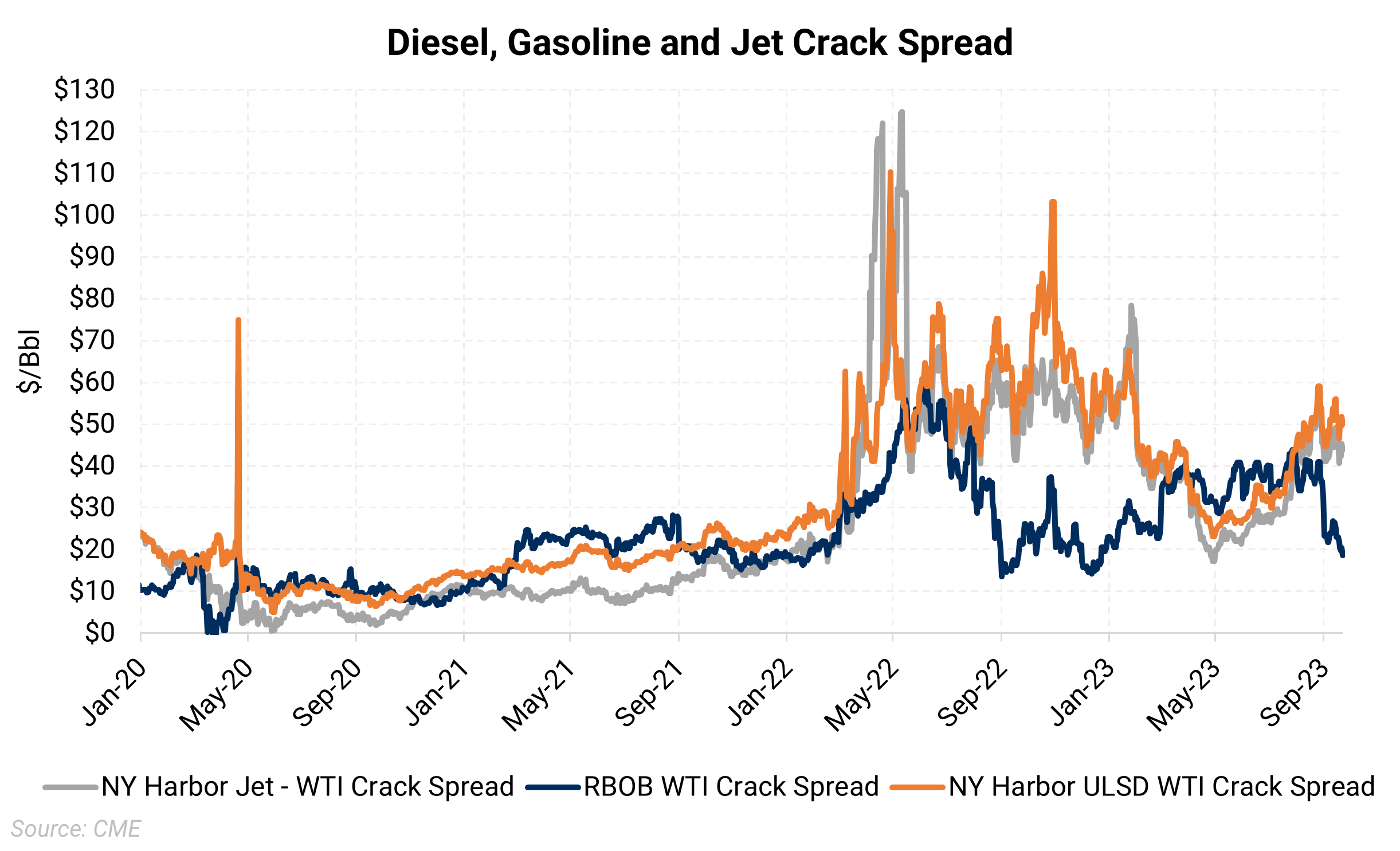

Oil refineries can process various crude types into many products. As seen in the chart above, the refining margins for distillates such as diesel and jet fuel are at multi-month highs.

Despite seasonally high gasoline prices, the gasoline crack spread is weaker. This is attributed to reduced demand following the summer driving season, the switch to a transitional period for winter-blend gasoline, and refiners prioritizing the production of more profitable distillates.

With diesel, however, the situation is grimmer. Global stocks of middle distillates, including diesel, heating oil, and gasoil, are notably below seasonal levels for this period. Compounding the issue is the lack of refining capacity and an insufficient supply of high-distillate-yielding sour crude.

As the global energy landscape undergoes a transition, the growing disconnect between oil demand and refining capacity cannot be ignored. While efforts are underway to expand refining capabilities, it remains to be seen whether they can match the pace of rising oil demand, especially considering the closures and conversions.