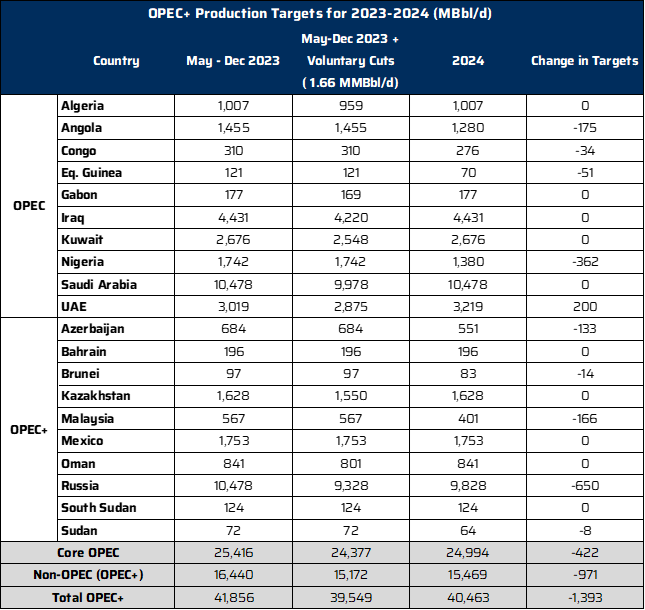

Source: OPEC, Bloomberg

NOTE: Russia's 2023 target factors in a 0.5 MMBbl/d cut from its Feb '23 output level of 9.83 MMBbl/d

June 8, 2023 – On Sunday, June 4, OPEC+ agreed to uphold current production cuts through 2024, while Saudi Arabia pledged voluntarily to cut its output by 1 MMBbl/d in July.

The table above shows the revised 2024 production quotas for OPEC+ members. For the remainder of 2023, the only change is a unilateral cut by Saudi Arabia, which will reduce its output by a further 1 MMBbl/d just for the month of July.

The production targets for several countries have been adjusted for 2024. Only the UAE is set to see an increase in its target by about 0.2 MMBbl/d, while nations including Angola, Gabon, Nigeria, etc., all saw cuts to their quotas to align their targets with their actual production levels.

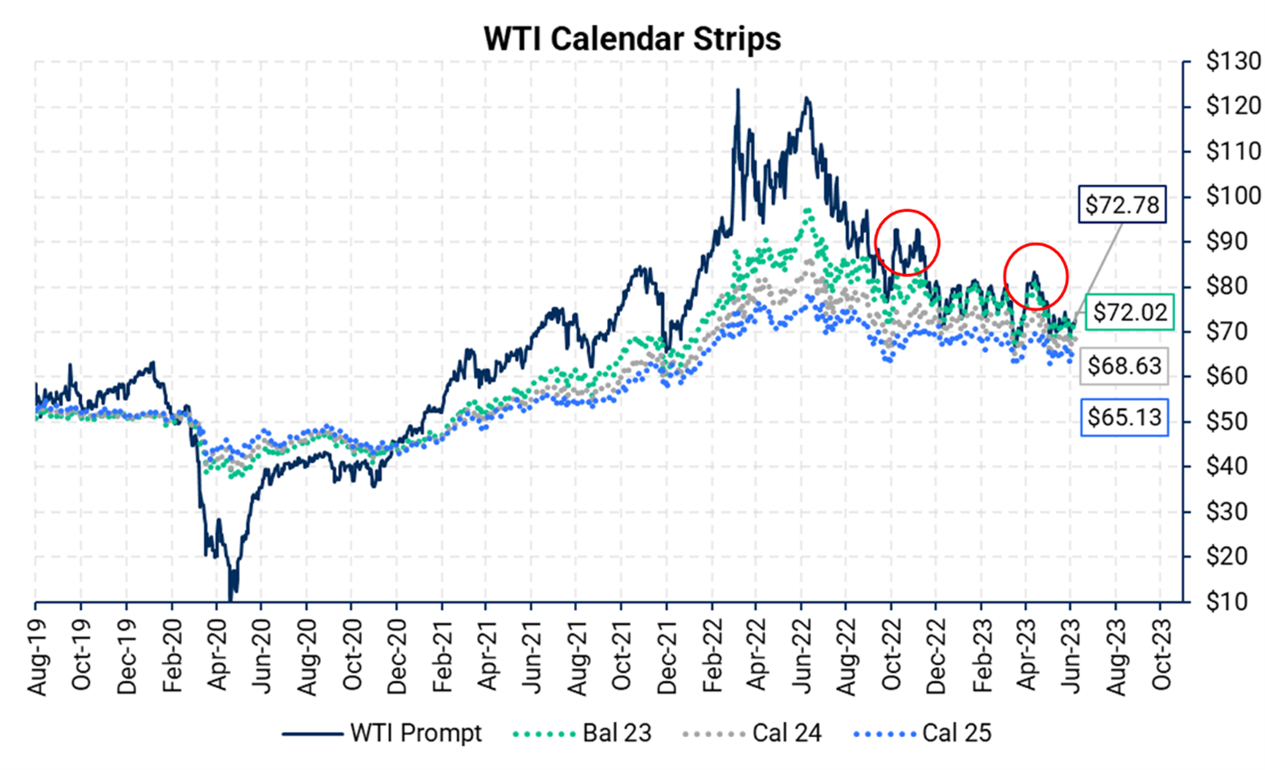

The OPEC+ cartel made an initial cut of 2 MMBbl/d in October 2022. In April 2023, key members like Saudi Arabia, Russia, and others voluntarily pledged to cut an extra 1.7 MMBbl/d, a measure extended until the end of 2024. The physical impact of OPEC's April cuts has not yet become evident, likely due to the opaque nature of the market. It's possible that the effects have begun to take place, but they are expected to become more visible later this month.

Despite Saudi Arabia hinting that the move was precautionary, the nation raised its July OSPs for its benchmark Arab light crude for Asia, Northwest Europe, the U.S., and the Mediterranean region. The price that Aramco sets is seen as a barometer for how Saudi Arabia views the outlook for oil demand in China, the largest crude consumer. Raising prices is typically taken as an indication that it is optimistic about demand.

Expectations were already that the oil market would see an imbalance (deficit) in the second half of 2023 mainly due to China’s demand growth; now, the supply-demand imbalance is expected to worsen. IEA and OPEC’s forecast for 2023 indicate at least a 300 MMBbl decline in global inventories as the “cuts” could prompt outsized withdrawals.

Global demand is forecast to hit a record high of 102 MMBbl/d, thanks to China's post-Covid economic recovery, leading to an increase in industrial activity and air travel. However, China's demand growth fell short, and amid U.S. bank failures, rising interest rates, resilient Russian exports, and potential recession risks, the market remains wary.

Prices have been moving sideways since OPEC’s October 2022 cut, mostly on the back of near-term bearish movers. However, AEGIS sees the recent cut as OPEC+'s and Saudi Arabia's dedication to uphold certain price levels, and even though the market hasn't rallied to the early-2023 expected price range of $80-$100/Bbl, it doesn't imply it won't in the future. The substantial supply deficit could set the stage for a bullish market in 2H2023, even if demand picks up modestly.