Canada's unprecedented rail shutdown is poised to rattle a broad spectrum of commodities with implications throughout North America.

The country’s two railroads—Canadian National and Canadian Pacific Kansas City— locked out nearly 10,000 workers on August 22, 2024, at 12:01 a.m. ET, sparking an immediate halt of Canada’s entire rail service for the first time ever.

Past rail strikes have been resolved within 10 days, while a protracted strike would put Canada and its trading partners in uncharted territory.

Roughly 70% of the nation’s goods and commodities move by rail, setting the stage for a disastrous quagmire that could cost more than USD$250MM per day, according to estimates from Moody’s.

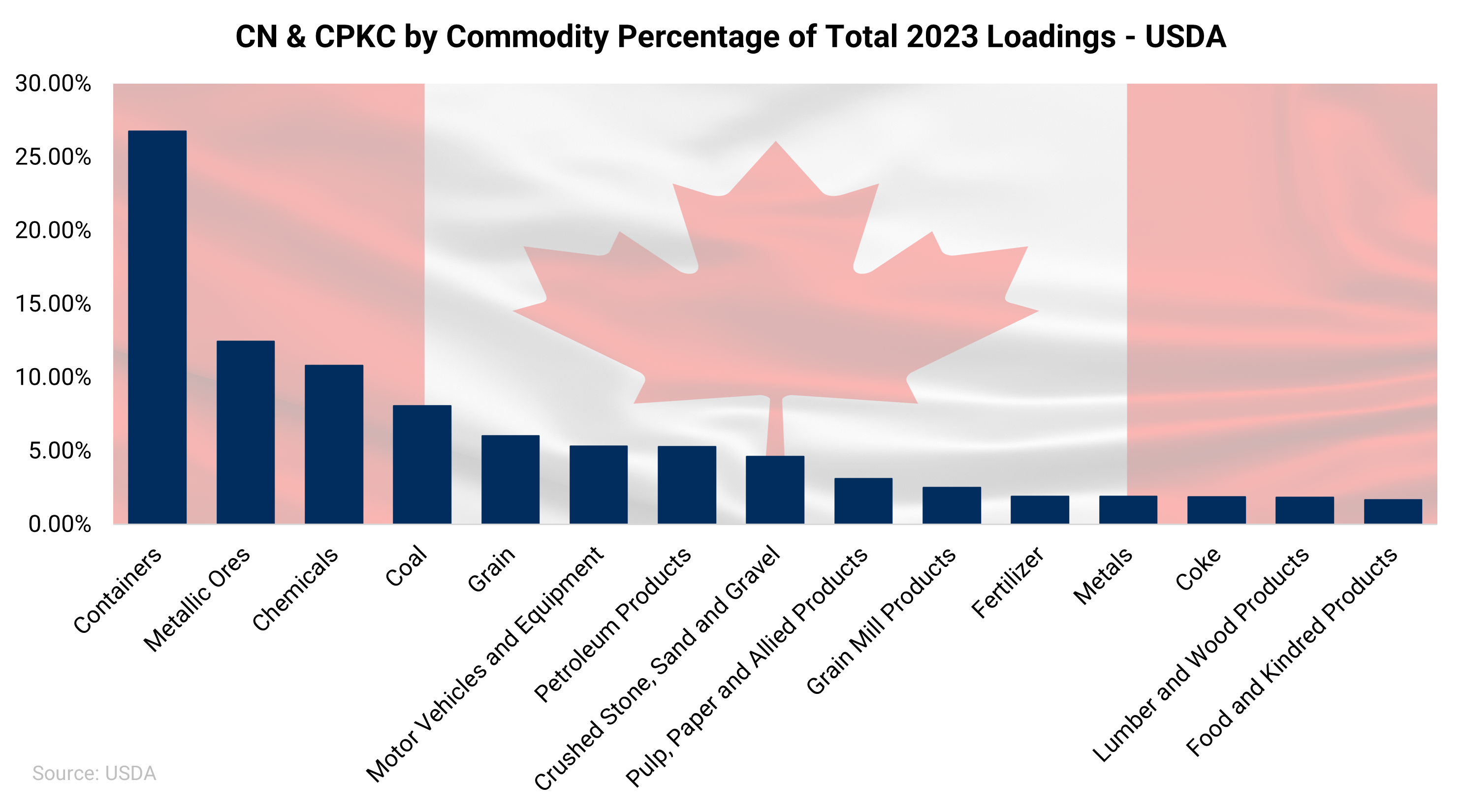

Industries like grains, coal, chemicals, iron ore, and renewable fuels rely heavily on uninterrupted rail service. AEGIS estimates each day of the rail strike will equate to at least a week of backlogs in the initial days, with compounding and exponential impacts should the strike persist beyond a week.

Many traders with cross-border exposure experienced disruptions to service weeks ahead of the deadline as operations wound down.

Shipments for certain products slowed to the point that some companies have run out of product before the strike even took effect. Railcars carrying hazardous materials such as chemicals were removed from rail lines ahead of the strike, while others saw badly needed loads of renewable fuels, grains, fertilizers, iron ore, and other key commodities halted at the border.

Companies took proactive measures in recent weeks to divert shipments to barge delivery, yet this solution is constrained as approximately 50-60% of the volumes at ports are cleared by rail.

Trucking provides the most immediate solution but can handle a small fraction of rail volume—there is simply no alternative solution to a logistics halt of this magnitude. The average train carries approximately 275 truck loads to give a sense of scale to the challenges presented.

Trucking freight rates have already shot up nearly 30% since traders on both sides of the border braced for the strike.

AEGIS expects more outsized impacts for certain commodities, while we have identified specific regions that are more vulnerable. Certain regions will see stranded product desperately seeking export outlets, given very little on-site storage available in many of the impacted industries. Other regions lacking key infrastructure are prone to commodity-specific outages. AEGIS estimates material impacts to emerge within five days of a formal strike with compounding implications past a week.

We'll be sharing additional updates as this situation unfolds.

Concerned about disruptions from the rail shutdown? Connect with our team.