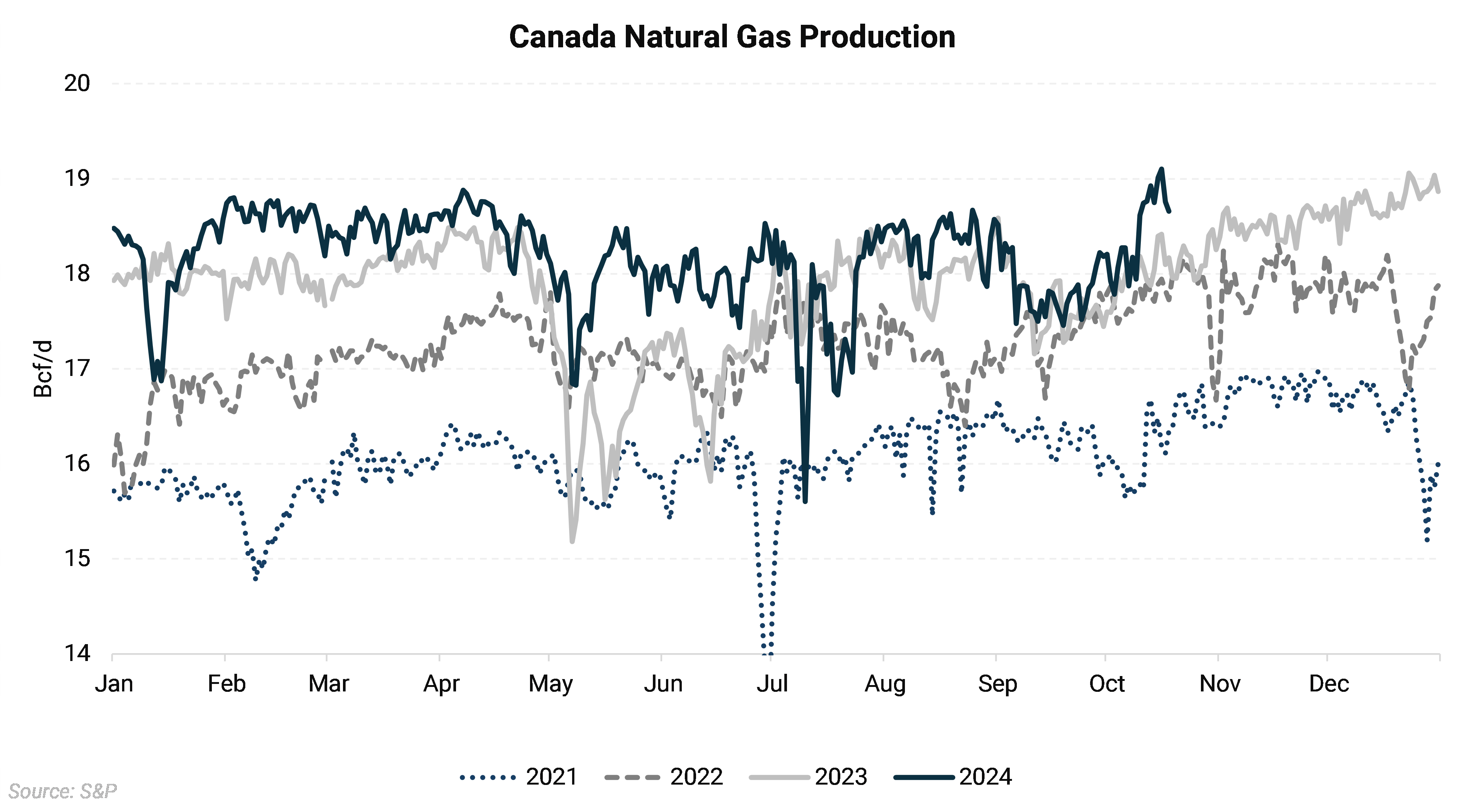

Canadian gas prices have trended lower over the past two years, driven by exceptionally high storage and persistently high supply, despite the weak price environment. While weak pricing in the US led to production curtailments, Canadian production has remained high. A series of mild winters exacerbated this weakness. The question for gas prices heading into 2025 is whether new demand in the form of LNG exports will be enough to lift prices and tighten the supply-demand balance.

Dry gas production reached a new all-time high recently, at a time when US production is still materially lower. This has kept persistent selling pressure on AECO and other Canadian basis locations. The reason for this strength in supply may come down to breakeven pricing, which is often driven by high NGL content in Canada. Many producers may also be hedged at higher prices and exposed to downstream markets within the US, leading to a better netback than one would receive selling into the domestic Canadian market.

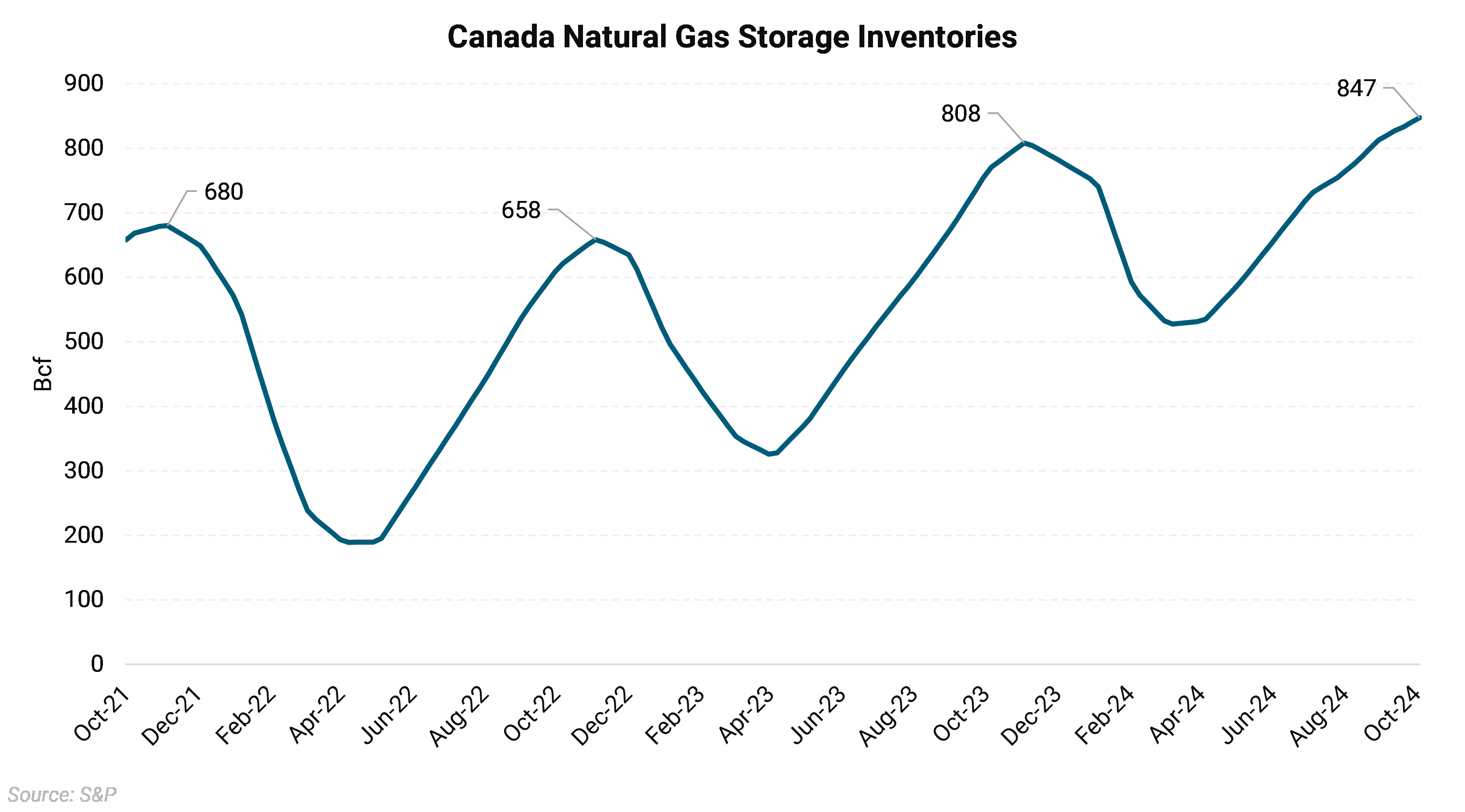

High Canadian supply and lower US supply this year led to some of the strongest US import numbers in recent years. Canadian gas imports into the US Midcontinent for example remained near their maximum capacity for much of this summer, driven by wide spreads between AECO and downstream markets such as Chicago City Gate. As long as Canadian supply remains strong, this trend in exports is likely to continue. Even if producers begin throttling output, high storage levels could mean exports continue at a similar rate. While higher exports to the US likely helped to some degree, storage levels have still trended toward maximum capacity.

With only about two weeks remaining in the injection season, underground gas storage is set to start winter at a record high. This level of gas in storage is unprecedented and has certainly contributed to the exceptionally weak price environment.

A notable change is, however, coming to the Canadian gas market as the county’s first LNG export facility starts up. The 2 Bcf/d LNG Canada facility has begun receiving small volumes of gas as it moves towards its anticipated startup date in 2025. The first cargo is expected to ship in January 2025, and full capacity should be reached later in the year. While on the surface, this would appear to be a substantial bullish factor, the reality may be underwhelming. The project developers will be providing their own supply and already have gas production ready to flow to the facility. While 2 Bcf/d would represent a substantial increase in demand, it may merely offer producers the ability to grow production further, offsetting any demand growth. Later in the decade, two more facilities will start up, further increasing demand. While much smaller, the Woodfibre LNG export plant and the Cedar FLNG facility are expected to source their supply from the local pipeline grids.

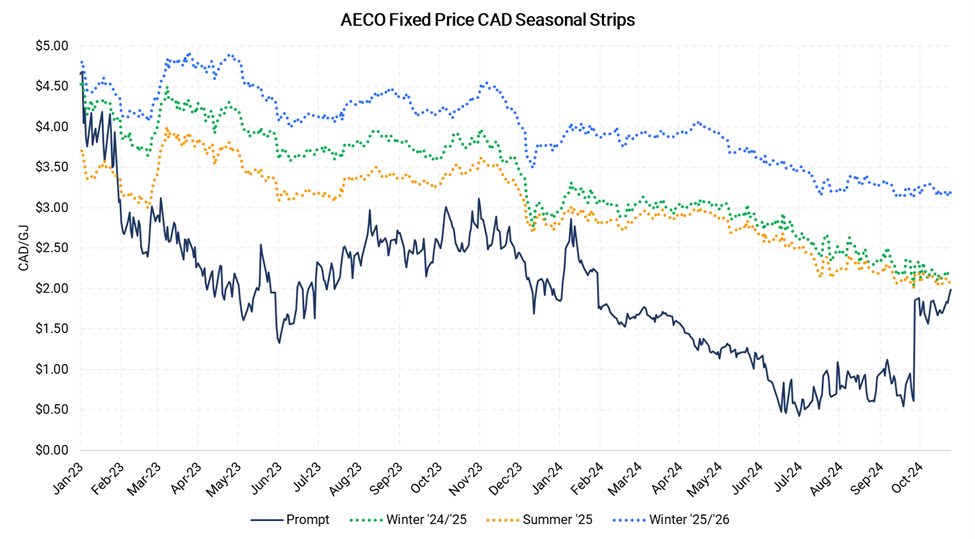

While demand growth from LNG exports will not be a bearish factor, it may not be enough to lead to a bullish shift in fundamentals. Winter ‘25/’26 AECO fixed price is currently around C$3.20/Gj, likely supported by the idea of higher demand. We currently hold a bullish outlook on Henry Hub pricing for this period, which if this pans out should support fixed price AECO. The mechanism behind this being that if locations in the US downstream from Canada, such as Chicago City Gate rally, it should pull AECO prices higher. Typically, AECO will be priced at a discount to Chicago and will be capped at the downstream price. However, despite any potential strength in fixed price, AECO basis may remain weak if supply stays strong.